2026 is not giving investors much breathing room. It seems markets may have largely moved past the idea that rate cuts are just around the corner and into a year where inflation may prove harder to control than many expected.

Goods inflation has picked up, while services inflation remains relatively sticky due to ongoing labour cost pressures. Housing costs, particularly rents, also remain a key source of inflation pressure.

The RBA is trying to stay credible on inflation without pushing the economy too far the other way.

Key data

CPI is still around 3.8 per cent (above target), wages are still rising at about 0.8 per cent over the quarter, and unemployment is around 4.1 per cent.

Based on market-implied pricing, rate hikes are not expected soon, so the way the RBA explains its decision can matter almost as much as the decision itself. If the tone shifts expectations, those expectations can move markets.

What this playbook covers

This is a playbook for RBA-heavy weeks in 2026. It covers what to watch across sectors, lists the key triggers, and explains which indicators may shift sentiment.

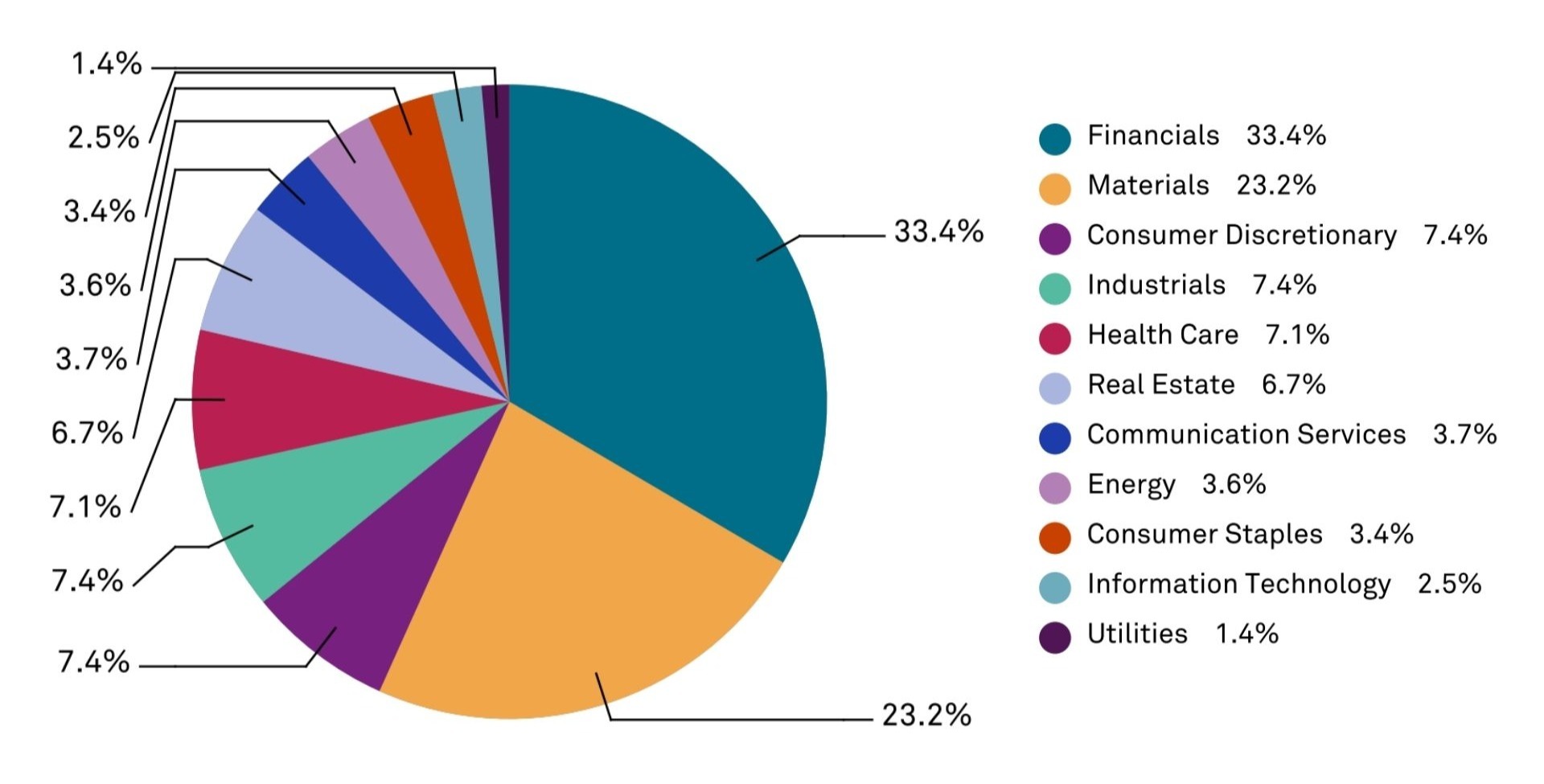

1. Banks and financials: how RBA decisions flow through to lending and borrowers

Banks are where the RBA shows up fastest in the Australian economy. Rates can hit borrowers quickly and feed into funding costs and sentiment.

In tighter phases, margins can improve at first, but that can flip if funding costs rise faster, or if credit quality starts to weaken. The balance between those forces is what matters most.

If banks rally into an RBA decision week, it may mean the market thinks higher for longer supports earnings. If they sell off, it may mean the market thinks higher for longer hurts borrowers. You can get two different readings from the same headline.

What to watch

- The yield curve shape: A steeper curve can help margins, while an inverted curve can signal growth stress.

- Deposit competition: It can quietly squeeze margins even when headline rates look supportive.

- RBA wording on financial stability, household buffers, and resilience. Small phrases can shift the risk story.

Potential trigger

If the RBA sounds more hawkish than expected, banks may react early as markets reassess growth and credit risk expectations. The first move can sometimes set the tone for the session.

Key risks

- Funding costs rising faster than loan yields: May point to margin pressure.

- Clear tightening in credit conditions: Rising arrears or refinancing stress can change the narrative quickly.

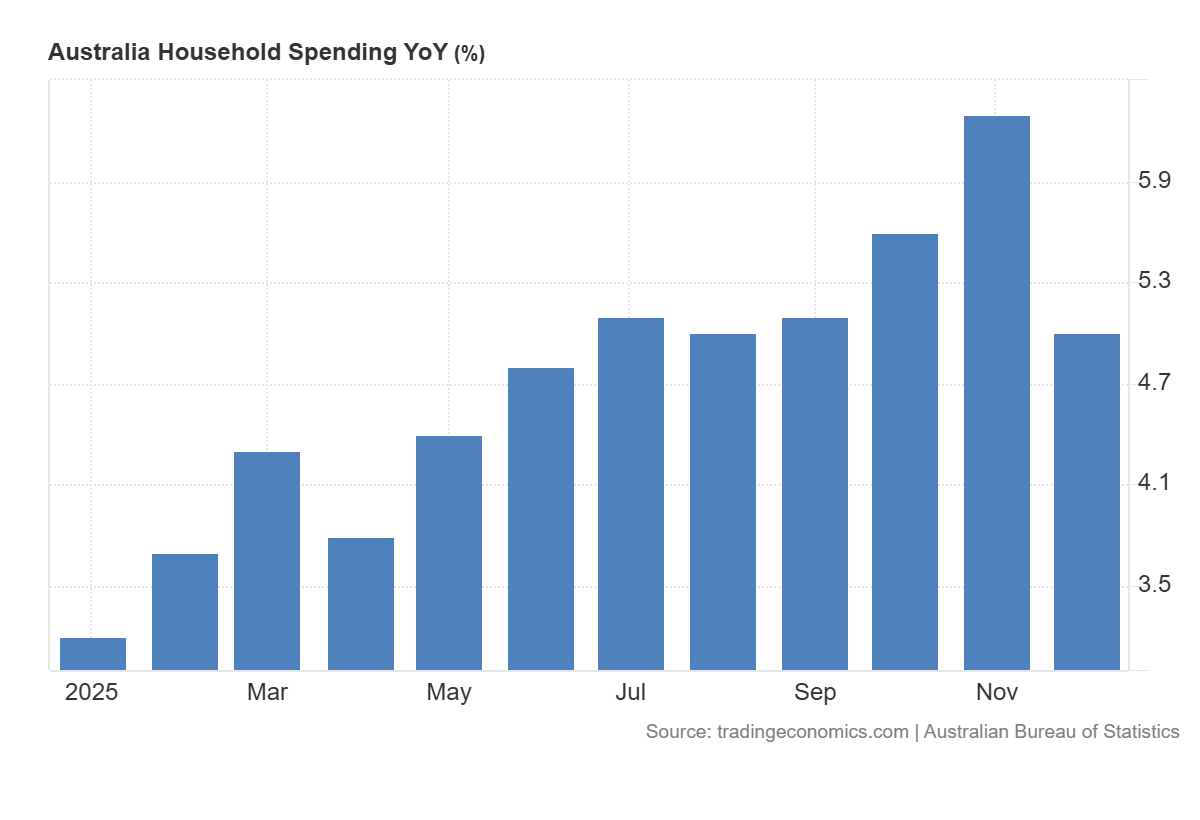

2. Consumer discretionary and retail: where higher rates hit household spending

When policy is tight, consumer discretionary becomes a live test of household resilience. This is where higher everyday costs often show up fastest.

Big calls about the consumer can look obvious until the data stops backing them up. When that happens, the narrative can shift quickly.

What to watch

- Wages versus inflation: The real income push or drag.

- Early labour signals: Hours worked can soften before unemployment rises.

- Reporting season clues: Discounting, cost pass-through, and margin pressure can indicate how stretched demand really is.

Potential trigger

If the tone from the RBA is more hawkish than expected, the sector may be sensitive to rate expectations. Any initial move may not persist, and subsequent price action can depend on incoming data and positioning

Key risks

- A fast turn in the labour market.

- New cost-of-living shocks, especially energy or housing, that hit spending quickly.

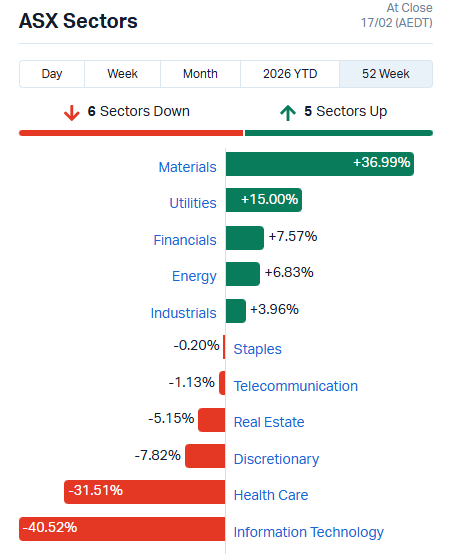

3. Resources: what to watch when tariffs, geopolitics, and policy shift

Resources can act as a read on global growth, but currency moves and central bank tone can change how that story lands in Australia.

In 2026, tariffs and geopolitics could also create sharper headline moves than usual, so gap risk can sit on top of the normal cycle.

The RBA still matters through two channels: the Australian dollar and overall risk appetite. Both can reprice the sector quickly, even when commodity prices have not moved much.

What to watch

- The global growth pulse: Industrial demand expectations and China-linked signals.

- The Australian dollar: The post-decision move can become a second driver for the sector.

- Sector leadership: How resources trade versus the broader market can signal the current regime.

Potential trigger

If the RBA tone turns more restrictive while global growth stays stable, resources may hold up better than other parts of the market. Strong cash flows can matter more, and the real asset angle can attract buyers.

Key risks

- In a real stress event, correlations can jump, and defensive positioning can fail.

- If policy tightens into a growth scare, the cycle can take over, and the sector can fade quickly.

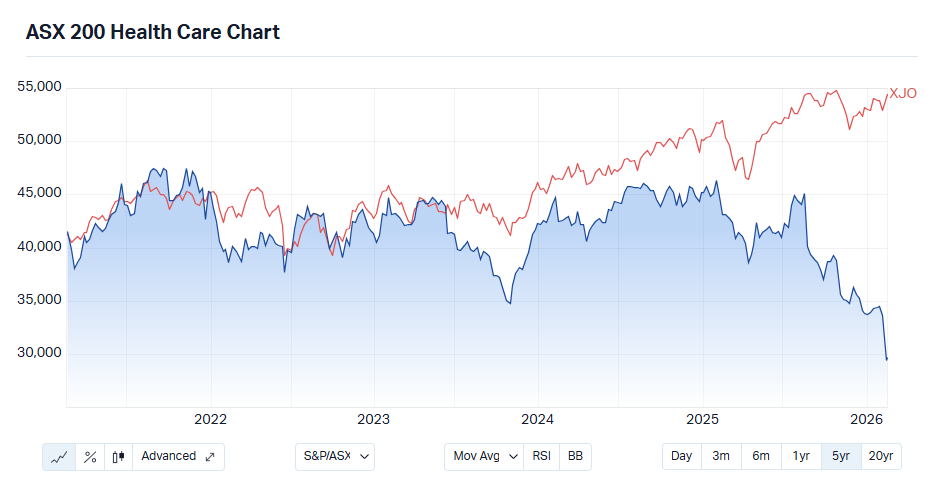

4. Defensives, staples, and quality healthcare

Defensives are meant to be the calmer corner of the market when everything else feels messy. In 2026, they still have one big weakness: discount rates.

Quality defensives can draw inflows when growth looks shaky, but some defensive growth stocks still trade like long-duration assets. They can be hit when yields rise, even if the business looks solid. That means earnings may be steady while valuations still move around.

What to watch

- Relative strength: How defensives perform during RBA weeks versus the broader market.

- Guidance language: Comments on cost pressure, pricing power, and whether volumes are holding up.

- Yield behaviour: Rising yields can overpower the quality bid and push multiples down.

Potential trigger

If the RBA sounds hawkish and cyclicals start to wobble, defensives can attract relative inflows, but that can depend on yields staying contained. If yields rise sharply, long-duration defensives can still de-rate.

Key risks

- Cost inflation that squeezes margins and weakens the defensive story.

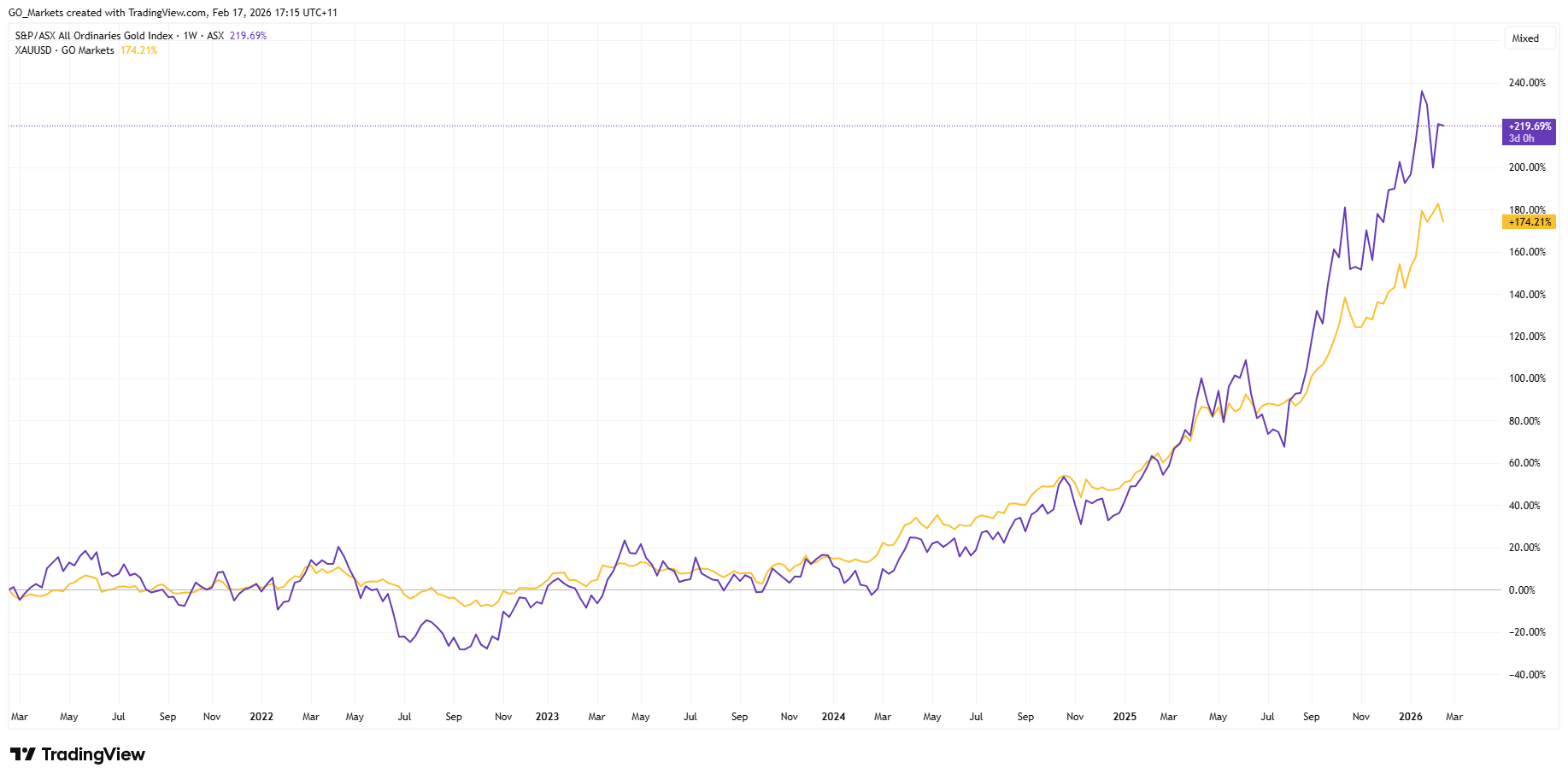

5. Hard assets, gold, and gold equities

In 2026, hard assets may be less about the simple inflation-hedge story and more about tail risk and policy uncertainty.

When confidence weakens, hard assets often receive more attention. They are not driven by one factor, and gold can still fall if the main drivers run against it.

What to watch

- Real yield direction: Shapes the opportunity cost of holding gold.

- US dollar direction: A major pricing channel for gold.

- Gold equities versus spot gold: Miners add operating leverage, and they also add cost risk.

Potential trigger

If the market starts to question inflation control or policy credibility, the hard-asset narrative can strengthen. If the RBA stays restrictive while disinflation continues, gold can lose urgency, and money can rotate into other trades.

Key risks

- Real yields rising significantly, which can pressure gold.

- Crowding and positioning unwinds that can cause sharp pullbacks.

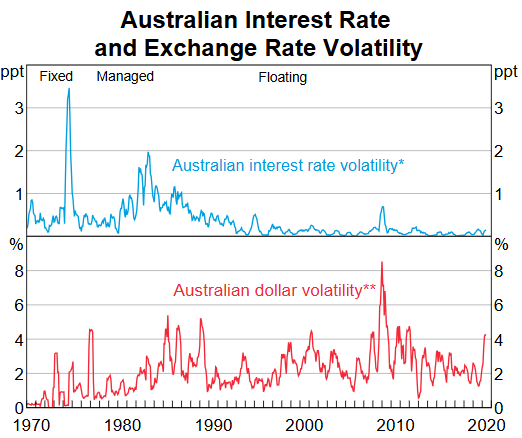

6. Market plumbing, FX, rates volatility, and dispersion

In some RBA weeks, the first move shows up in rates and the Australian dollar, and equities follow later through sector rotation rather than a clean index move.

When guidance shifts, the RBA can change how markets move together. You can end up with a flat index while sectors swing hard in opposite directions.

What to watch

- Front-end rates: Repricing speed right after the decision can reveal the real surprise.

- AUD reaction: Direction and follow-through often shape the next move in equities and resources.

- Implied versus realised volatility: Can show whether the market paid too much or too little for the event.

- Options skew: Can reflect demand for downside protection versus upside chasing.

- Early tape behaviour: The first 5 to 15 minutes can be messy and can mean-revert.

Potential trigger

If the decision is expected but the statement leans hawkish, the front end may reprice first, and the AUD can move with it. Realised volatility can still jump even if the index barely moves, as the market rewrites the path and rotates positions under the surface.

Key risks

- A true surprise that overwhelms what options implied and creates gap moves.

- Competing macro headlines that dominate the tape and drown out the RBA signal.

- Thin liquidity that creates false signals, whipsaw, and worse execution than models assume.

7. Theme baskets

Theme baskets may let traders express a macro regime while reducing single-name risk. They also introduce their own risks, especially around events.

What to watch

- What the basket holds: Methodology, rebalance rules, hidden concentration.

- Liquidity and spreads: Especially around event windows.

- Tracking versus the narrative: Whether the “theme” behaves like the macro driver.

Potential trigger

If RBA language reinforces a “restrictive and uncertain” regime, theme baskets tied to value, quality, or hard assets may attract attention, particularly if broad indices get choppy.

Key risks

- Theme reversal when macro expectations shift.

- Liquidity risk around event windows, where spreads can widen materially.

The point of this playbook is not to predict the exact headline; it is to know where the second-order effects usually land, and to have a short checklist ready before the decision hits.

Keeping these triggers and risks in view may help some traders structure their monitoring around RBA decisions throughout 2026.

FAQs

Why does “tone” matter so much in 2026?

Because markets often pre-price the decision. The incremental information is guidance on whether the RBA sounds comfortable, concerned, or open to moving again.

What are the fastest tells right after a decision?

Some traders look to front-end rates, the AUD, and sector leadership as early indicators, but these signals can be noisy and influenced by positioning and liquidity.

Why are REITs called duration trades?

Because a large part of their valuation can be sensitive to discount rates and funding costs. When yields move, valuations can reprice quickly.

Are defensives always safer around the RBA?

Not always. If yields jump, long-duration defensives can still be repriced lower even with stable earnings.

Why do hard assets keep showing up in 2026 narratives?

Because they can act as a hedge when trust in policy credibility wobbles, but they also carry crowding and real-yield risks.