Investors globally and domestically are stuck in this weird holding pattern. We are all clearly waiting for more definitive signals on the direction of tariffs and broader policy settings, and despite US-China trade talks, we would argue this is news for news' sake – it is not fact. This uncertainty is casting a long shadow over the market, but you wouldn’t know it; the recent volatility has all but reversed equity losses.Beneath the surface, several important trends are shaping the outlook, particularly around the movement of prices for both commodities and consumer goods. For example, look at how local retailers respond with their own pricing strategies to deal with the ‘new trade order’. At the same time, expectations around index rebalancing are adding another layer of complexity, with market participants closely watching which companies might move in or out of major indices in the coming months as geopolitics and the digital age move weightings around.Investors are acutely aware that the next major move will likely be dictated by policy announcements, which could come at any moment and in any form, and so are scrutinising every development for clues.First - In this environment, we are very mindful of oil, any second-order effects that lower oil prices as a traded commodity and at the petrol pump, could have on the broader economy for Australia and, by extension, our China-linked economy. A deal between the US and China, but also Russia and Ukraine, would be huge for oil.Second, there is also an ongoing debate about whether the Australian economy and local equity markets will see any real benefit from a period of goods disinflation, or whether the impact will be more limited than some expect.Looking ahead to the June 2025 index review, expectations are that the level of change will be more subdued compared to what was seen in March. The most significant adjustment on the horizon is the likely addition of REA Group to the S&P/ASX 50 Index, replacing Pilbara Metals. Beyond that, Viva Energy is currently positioned within the 100–200 range and could move up if conditions are right, while Nick Scali is well placed to enter the 200 should a spot become available, and in a rate-cutting environment, consumer discretionary is going to be interesting. The June rebalance is due to be announced on June 6 and implemented on June 20, so there’s plenty of anticipation building as investors position themselves ahead of these changes.Zooming out to the macroeconomic front, several catalysts are likely to shape the market narrative in the weeks ahead.Consumer and business sentiment, first-quarter wage growth, and the April labour force data are all in sharp focus this week and next. The expectation is that consumer sentiment will have continued to decline in May, extending the broader deterioration that’s been in place since the US tariff announcements. Business surveys for April show that both confidence and conditions are holding steady, tracking above their long-run averages.Turning to Wednesdays, Wage index growth is expected to have accelerated in the first quarter, with forecasts pointing to a 0.8% increase quarter-on-quarter and a 3.9% rise year-on-year. This acceleration is being driven by a combination of ongoing tightness in the labour market, stronger enterprise bargaining agreements, and legislated increases in childcare wages.Thursday’s labour force data for April is expected to show 40,000 jobs added, with the unemployment rate holding steady at 4.1%. A slight uptick in participation to 66.9% is also anticipated, reflecting the ongoing strength of the jobs market.In the housing sector, the latest data is less encouraging. Building approvals fell by 8.8% in March, with a 13.4% drop in house approvals. These figures are weaker than both market and consensus expectations, and the annualised rate has now fallen to 160,000. This points to ongoing challenges in the construction sector and raises questions about the sustainability of the housing market recovery. This will bring the RBA and the newly elected Federal government into sharp focus – action is needed, but what that looks like is hard to define.Commodities markets have also seen significant movement, with oil prices dropping below US$60 per barrel, the lowest point since early 2021. This has brought OPEC into sharp focus. The crux question is whether OPEC will attempt to chase prices lower or instead move to stabilise the market. So far, they have pushed prices with deliberate oversupply to punish certain nations – this, however, is unsustainable and will have to change soonCouple this with weaker demand from Asia, and a volatile US dollar is also playing a role, with Brent crude now trading at $55 per barrel. These developments are feeding into broader concerns about global growth and the outlook for commodity exporters.Looking at the local currency and AUD has shown remarkable resilience, supported by a meaningful improvement in the country’s energy trade balance and a weaker US dollar. However, the next major test for the currency will come with the release of the US CPI data on Wednesday, which could set the tone for global markets in the near term – is the Fed out of the market in 2025? This will impact the USD.Looking at the globe, the market and financial landscape is still navigating a complex web of challenges, with persistent inflation, potential tariff implementations, and evolving economic dynamics all in play.Market participants are increasingly focused on how these factors interact and influence everything from consumer pricing to investment strategies. Central bank decisions, especially from the Federal Reserve, have been pivotal in moderating market sentiment, while ongoing discussions about trade policy continue to reshape the global economic environment. Tariffs, in particular, are forcing companies to rethink their supply chains. You only must look at the US reporting season and the likes of Ford, GM, Nike and the like, all scrapping forward guidance and highlighting the impact tariffs are having on cost. The second event that is now becoming ‘actual is that the higher input costs are often now being passed on to consumers. The broader issue here is that this can reduce household disposable income and slow broader economic growth.So, although the excitement of early April has subsided, it's only a social media release away. That means that we as investors are navigating a period of heightened uncertainty, with every policy announcement, economic data release, and market move being scrutinised harder than normal as we look for what it might signal about the path ahead.The interplay between inflation, tariffs, and shifting economic dynamics means that flexibility and vigilance will be essential for anyone looking to make sense of the current environment and position themselves for what comes next.

Where did all the excitement go? And where does it leave us?

Related Articles

Recent Articles

市场将进入未来一周,澳大利亚和日本的通货膨胀数据,以及地缘政治紧张局势的加剧,继续影响能源价格和更广泛的风险情绪。

- 澳大利亚居民消费价格指数(CPI): 通货膨胀数据可能会影响 澳大利亚储备银行(RBA))政策路径,澳元(AUD)和当地收益率对任何意外都很敏感。

- 日本数据集群: 东京消费者价格指数(初值)加上工业生产和零售销售提供了通货膨胀和活动脉冲,可能会影响日本银行(BoJ)的正常化预期。

- 欧元区和德国居民消费价格指数: 通胀速率数据将考验反通货膨胀的说法,并影响欧洲央行的降息时机预期。

- 石油和地缘政治: 由于中东紧张局势再起,布伦特原油创下2025年8月8日以来的最高收盘价,这加剧了能源驱动的通胀风险。

澳大利亚消费者价格指数:澳大利亚央行的预期会发生变化吗?

澳大利亚即将发布的消费者价格指数将受到密切关注,以了解通货膨胀是否稳定或超过预期的持续性。

随着利率预期的调整,强于预期的印刷量可能与更高的收益率和更高的澳元走强有关。较软的结果可能会支持人们对更稳定的政策立场的预期。

关键日期

- 通货膨胀率(MoM): 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

- CPI: 2月25日星期三上午 11:30(澳大利亚东部夏令时间)

监视器

- 澳元在发布前后波动。

- 地方债券收益率反应。

- 利率定价变化。

日本通货膨胀和增长数据

日本周末发布的公告将东京消费者价格指数(初值)与工业生产和零售销售相结合,为价格压力和国内需求提供了更广泛的解读。

东京消费者价格指数通常被视为全国通胀动态和日本央行辩论的及时信号。工业产出和零售支出增加了活动的背景。

整个集群的意外情况可能会推动日元的急剧波动,特别是如果结果改变了人们对日本央行正常化步伐和持续性的看法。

关键日期

- 东京居民消费价格指数: 2月27日星期五上午 10:30(澳大利亚东部夏令时间)

- 工业生产: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

- 零售销售: 2月27日星期五上午 10:50(澳大利亚东部夏令时间)

监视器

- 日元对通胀意外敏感度

- 债券收益率因活动数据而变动

- 如果增长势头预期发生变化,股市的反应

能源和避险流动

在中东紧张局势再次爆发的情况下,油价已攀升至2025年8月8日以来的最高收盘价。

最近关于霍尔木兹海峡附近地区军事活动加剧和航运风险头条的报道加强了能源安全作为市场关注的焦点。霍尔木兹海峡仍然是全球能源流动受到广泛关注的阻塞点。

油价上涨会刺激通胀预期并影响债券收益率。同时,地缘政治的不确定性可以通过避险需求和相对利率定位来支撑美元。

监视器

- 布伦特原油价格水平

- 美元兑主要货币走强

- 随着通货膨胀风险溢价的调整,收益率变动

欧元区和德国的通货膨胀

德国和整个欧元区(HICP)的快速通胀数据将测试该地区的反通货膨胀趋势是否保持不变。

德国的发布可能会影响欧元区总体数据之前的预期。如果核心通胀被证明是棘手的,那么对欧洲央行可能放松政策的时机和步伐的预期可能会发生变化。

关键日期

- 德国通货膨胀率: 2月28日星期六上午12点(澳大利亚东部夏令时间)

监视器

- 欧元围绕通胀数据波动

- 欧洲主权债券收益率

- 降息概率调整

关键经济事件

从科技颠覆者到国防承包商,一些市场上最受关注的公司开始了首次公开募股(IPO)的公开征程。对于交易者来说,这些首次公开上市可能代表一个独特的交易环境,但也是一个不确定性加剧的时期。

事实速览

- 首次公开募股是指私人公司首次在公共证券交易所上市其股票。

- 首次公开募股可以让交易者尽早进入高增长的公司,但波动性较大,价格历史有限。

- 上市后,交易者可以通过直接购买股票或衍生品获得对IPO股票的敞口,例如 差价合约(CFD)。

什么是首次公开募股(IPO)?

首次公开募股是指公司首次向公众发行股票。

在进行首次公开募股之前,公司的股票通常仅由创始人、早期员工和私人投资者持有。上市使任何人都可以购买股票。

根据公司的规模,它通常会在当地证券交易所上市其公开股票(例如 ASX 在澳大利亚)。但是,一些大估值公司选择只在纳斯达克等全球证券交易所上市,无论其主要总部位于何处。

对于交易者而言,首次公开募股通常是获得公司股票敞口的第一个机会。鉴于价格历史的有限和对情绪波动的敏感性,它们可以创造一个波动性和流动性增加的独特环境,但也会带来更高的风险。

公司为什么要上市?

进行首次公开募股的最大推动力是获得更多资金。在公共交易所上市意味着公司可以通过出售股票筹集大量资金。

它还为现有股东提供流动性。创始人、早期员工和私人投资者经常在公开市场上出售其现有资产的一部分,从而实现他们多年支持的回报。

除了金钱收益外,上市还意味着公司可以使用股票作为收购的货币,并提供股权薪酬以吸引人才。公开估值提供了透明的基准,这对于战略定位和未来筹资很有用。

但是,它确实需要权衡取舍。上市公司必须遵守持续的披露和报告义务,如果许多公司专注于短期业绩,来自公众股东的压力可能会成为长期进展的障碍。

首次公开募股流程如何运作?

虽然具体情况因司法管辖区而异,但从私营公司到公开上市通常涉及以下阶段:

1。准备

公司首先选择承销商(通常是投资银行)来管理此次发行。他们共同评估公司的财务状况、公司结构和市场定位,以确定最佳的上市方法。这是确保公司真正做好上市准备的繁重规划阶段。

2。注册

一切准备就绪后,承销商将进行彻底的尽职调查,然后向相关监管机构提交所需的披露文件。这些文件向监管机构详细披露了该公司、其管理层及其拟议的发行情况。在澳大利亚,这通常是向澳大利亚证券投资委员会提交的招股说明书;在美国,这是向美国证券交易委员会提交的注册声明。

3.路演

然后,公司的高管和承销商将在 “路演” 中向机构投资者和市场分析师介绍投资案例。该展示旨在评估对股票的需求并帮助激发兴趣。机构投资者可以登记首次公开募股的利息和估值,这有助于为初始定价提供信息。

4。定价

根据路演的反馈和当前的市场状况,承销商设定了最终股价并确定了要发行的股票数量。股票在 “初级市场” 上分配给参与要约的投资者(股票在二级市场公开上市之前)。该过程设定了上市前价格,这有效地决定了公司的初始公开估值。

5。清单

上市当天,该公司的股票开始在所选证券交易所交易,正式开放二级市场。对于大多数交易者来说,这是他们可以直接或通过衍生品交易股票的第一点,例如 股票差价合约。

6。首次公开募股后

上市后,公司将受到严格的报告和披露要求的约束。它必须定期与股东沟通,公布其财务业绩,并遵守其上市交易所的治理标准。

交易者的首次公开募股风险和收益

交易者如何参与首次公开募股?

对于大多数交易者来说,一旦股票上市并开始在二级市场上交易,就可以参与首次公开募股。

股票在交易所上线后,投资者可以直接通过经纪人或在线交易所购买实物股票,也可以使用衍生品,例如 股票差价合约 在不拥有标的资产的情况下持有价格头寸。

首次公开募股交易的前几天往往波动很大。交易者应确保他们已采取适当的风险管理措施,以帮助防范潜在的价格剧烈波动。

底线

首次公开募股标志着一家公司可以向公众投资。他们可以为高增长公司的早期准入提供机会,并在波动性和市场兴趣的增加的推动下创造独特的交易环境。

对于交易者而言,在持仓之前,了解流程是如何运作的,是什么推动了定价和首次公开募股后的表现,以及如何权衡潜在回报和交易新上市股票的风险。

.jpg)

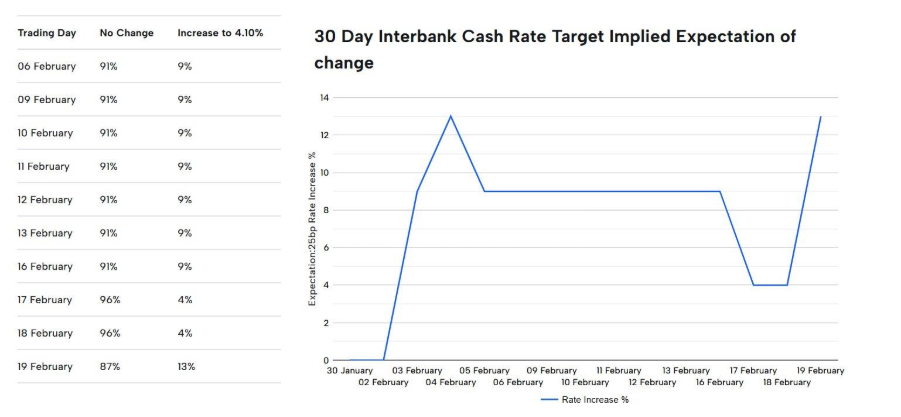

澳洲 联储在2月的货币政策会议上 一致同意将现金利率提高 25 个基点至 3.85%,这是自 2023 年以来的首次加息,并反转了此前 2025 年的几次降息。

1会议核心判断:通胀风险显著加大

会议纪要显示,与此前判断相比,官员们认为 通胀风险已经“实质性改变”,并且比预期更为持久。虽然部分价格压力可能暂时性,但更大范围的通胀已从临时性转向较结构性,推高了通胀预期。

2 决定加息 25 个基点

委员会一致 将官方现金利率上调0.25 个百分点至3.85%,认为如果维持在会上次水平(3.60%),经济中 过度需求和通胀压力可能持续存在,难以回落至目标水平。

3经济活动和需求超出供应能力

纪要指出,国内需求增长明显领先于供应扩充,产能紧张情况加剧。委员们普遍认为这种需求与供给失衡是通胀持续性更强的关键因素之一。

4劳动力市场仍然紧俏

会议强调劳动力市场仍显紧张,失业率较低,这进一步增强了工资和价格压力,从而对通胀带来持续向上推动力。虽然紧俏程度较前期有所缓和,但整体仍支撑价格维持在高位。

5金融状况不再足够收紧

纪要讨论中提到 金融条件已明显放松而不再具有足够的抑制作用,即使市场预期利率上行、澳元走强,但整体资金环境及信贷活动仍被认为对通胀形成刺激,这也是加息理由之一。

6未来路径依赖数据、无固定预设路径

会议明确指出 没有对未来利率路径的固定设定,未来政策决定将高度依赖最新经济数据,尤其是通胀和就业表现。纪要强调需要评估即将公布的CPI、就业等关键指标再决定下一步行动。

7对未来政策的观点分歧与不确定性

虽然大多数委员支持加息,但会议纪要还显示存在对保持利率或未来进一步加息 观点上的讨论与谨慎。部分委员认为在观望更多数据后再行动或更为适当;整体对未来经济走势仍存在不确定性。