市场资讯及洞察

从人工智能基础设施到宠物护理、半导体和黄金勘探,以下是最有可能上榜的五大候选人 ASX 在 2026 年。

1。Firmus 科技

Firmus Technologies正在塔斯马尼亚州建设人工智能驱动的数据中心基础设施,它可能是澳大利亚目前最具战略地位的科技公司之一。

Firmus是英伟达的云合作伙伴,并已加入这家GPU制造商的Lepton市场。该公司设计了模块化、无处不在的液体AI Factory平台,以适应Nvidia的最新架构,包括Nvidia Spectrum-X以太网网络。

2025年9月,该公司完成了3.3亿澳元的融资,盘后估值为18.5亿澳元。到2025年11月,在又筹集了5亿澳元之后,该估值已增长三倍至大约 60 亿澳元。

马斯集团随后在2026年初进行的1亿澳元投资证实了11月份的估值。据报道,Firmus正在考虑在未来12个月内在澳大利亚证券交易所进行首次公开募股,鉴于60亿澳元的私募估值,任何公开募集的资金预计都将远高于 10亿澳元。

随着澳大利亚对主权人工智能计算能力的需求不断增长,以及塔斯马尼亚州在大型数据中心运营方面的凉爽气候和可再生能源优势,Firmus成为2026年澳大利亚证券交易所规模最大的IPO候选人之一。

但是,尽管市场对Firmus的兴趣似乎在增长,但就首次公开募股而言,时机决定一切。留意确切的首次公开募股时机、人工智能数据中心情绪的确认,以及英伟达在上市后是否表示将深化其作为战略主要投资者的参与。

2。Rokt

悉尼创立的Rokt已悄然成为澳大利亚最有价值的私营科技公司之一。旨在帮助品牌在 “交易时刻” 获利的电子商务广告技术平台现在的估值为 ~79 亿美元。

MA Financial编写的条款表预计退出 股价为72美元 在基本情景下,股票将于 2027 年 11 月从托管中解除。

预计Rokt可能会在2026年在美国和澳大利亚证券交易所双重上市,最快可能在上半年。IG 最广泛讨论的结构是纳斯达克的主要上市,澳大利亚投资者采用澳大利亚证券交易所CDI(CHESS存托权益)结构,而不是全面的双重上市。

截至2025年8月的财年,Rokt的收入预计为7.43亿美元(同比增长48%),息税折旧摊销前利润预计为1亿美元,毛利率约为43%。目前预计到2026年8月,其年收入将突破10亿美元的里程碑。

据报道,亚马逊、Live Nation和Uber都是Rokt的客户,该公司已在北美和欧洲迅速扩张。

无论Rokt选择以澳大利亚证券交易所CDI结构在纳斯达克进行主要上市,还是选择全面双重上市,都可能严重影响流动性和本地投资者准入。

3.格林克罗斯

Petbarn、City Farmers和Greencross Vets背后的企业Greencross在2019年被美国私募股权公司TPG私有化后,正准备在澳大利亚证券交易所重新上市。

TPG目前拥有Greencross55%的股份,而AustralianSuper和安大略省医疗保健养老金计划(HOOPP)持有其余45%的股份。

该公司报告称,2025财年的收入为20亿澳元,较2024年的19.5亿澳元略有增长。TPG在2019年为该业务支付了6.75亿澳元的股权;它在2022年出售了45%的股份,估值超过35亿澳元。拟议的首次公开募股意味着估值超过 4 亿澳元。

TPG的目标是进行至少7亿澳元的首次公开募股。首次公开募股将标志着格林克罗斯在缺席八年后重返澳大利亚证券交易所。TPG的加薪规模相对较小,这表明该公司在完全退出之前寄希望于强劲的售后市场表现。

TPG的退出时间表公告仍在关注2026年的首次公开募股是否即将到来。而且,无论公司是追求传统的首次公开募股还是贸易出售,这仍然是另一种途径。

4。摩尔斯微电子

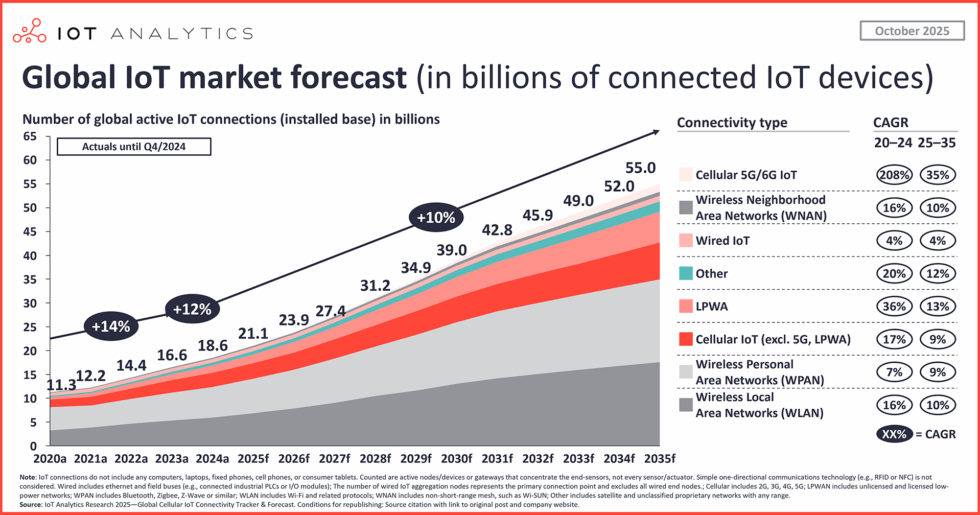

Morse Micro是一家总部位于悉尼的半导体公司,开发Wi-Fi HaLow芯片,专为农业、物流、智慧城市和工业监控领域的物联网应用而设计。

摩尔斯微于2025年9月举行了C轮融资,筹集了8,800万美元,随后在2025年11月进行了3,200万美元的首次公开募股前融资,使融资总额超过3,200万美元 3 亿澳元。

它的目标是在未来12-18个月内在澳大利亚证券交易所上市。C轮融资由日本芯片巨头MegaChips和国家重建基金公司牵头。

预计到2030年,全球物联网设备连接将超过300亿,摩尔斯微将成为一家罕见的在澳大利亚证券交易所上市的纯半导体公司,这可能会吸引专注于科技的基金经理的浓厚兴趣。

摩尔斯微在上市前与一级硬件合作伙伴的收入吸引力值得关注,鉴于美国半导体投资者的胃口深厚,该公司是否寻求同时在美国上市。

5。野牛资源

Bison Resources是一家新成立的专注于美国的黄金和贵金属勘探公司,目前正在澳大利亚证券交易所进行首次公开募股。

该要约将于2026年3月20日结束,目标是在2026年4月中旬在澳大利亚证券交易所上市。按指示性市值计算 1325 万澳元 在全面订阅后,Bison是这份清单上最具投机性的名字。

该公司在内华达州东北部的卡林趋势(世界上最多产的黄金产地带之一)内拥有四个勘探项目,约占美国黄金产量的75%。

首次公开募股旨在筹集450万澳元至550万澳元(2,250万至2750万股,每股0.20澳元)。该团队之前曾在Sun Silver(澳大利亚证券交易所股票代码:SS1)和黑熊矿业公司任职,这使其在内华达州的澳大利亚证券交易所初级矿业上市中创下了良好的记录。

底线

澳大利亚2026年的首次公开募股日历涵盖了全部风险范围。一家由NVIDIA支持的人工智能基础设施公司,一个价值十亿美元的电子商务平台,以及一家正在进行首次公开募股的初级黄金勘探者。

每位候选人反映不同的成熟阶段和不同的投资者概况。他们共同表明,澳大利亚证券交易所可能会有意义地注入近年来当地市场基本上没有上市的行业的新上市。

USD sold off on Monday with DXY failing to hold above 104 after finding some resistance at the 100 DAY SMA and dipping from a high of 104.20 to a low of 103.70 where the 200 Day SMA held as support. The move lower in USD came despite higher UST yields, which would normally support the USD. EURUSD was supported by the weaker USD with EURUSD rising above its 100 Day SMA at 1.0814, the 200 Day SMA at 1.0826 and briefly above the 1.0850 level.

There was little in the way of Euro data although ECB President Lagarde did speak where she stated the ECB is not there yet on inflation and noting wage pressures remain strong, supporting the EUR somewhat. JPY was softer vs the USD keeping USDJPY above the short erm support at the psychological 150 level. Higher UST yields supporting the pair seeing it test resistance at the 2024 high of 150.8.

JPY traders’ attention turning to Japanese inflation data today where the National Core CPI is expected to drop to 1.9% from the previous reading of 2.3%.

USD was notably weaker in Thursday’s session ahead of the pivotal NFP report on Friday. The US Dollar index falling for the fifth straight session and breaking below 103 to touch on the Jan 24 lows before finding some support. Risk-on sentiment, a fall in yields and weak jobless claims data being the main drivers of the Greenback decline.

JPY saw strong gains against the USD on the back of hawkish BoJ Speak from Governor Ueda and Board Member Nakagawa, also helped by a tightening in US10Y-JP10Y yield differential. USDJPY continuing its break below the psychological 150 level to hit a low of 147.59. EUR also outperformed vs. the Greenback with EURUSD breaking through the key 1.09 level and entering APAC at NY session highs at 1.0948.

Thursdays ECB policy meeting saw the central bank maintaining rates, as expected, whilst slashing its inflation forecasts which now sees 2025 headline inflation at the 2% target. This “dovish” tone saw EUR initially being the worst performer, before EURUSD benefitted from the accelerating in USD selling during the US session. Gold continued its steep rally for a seventh straight session, again setting new all-time highs in doing so.

A fall in yields, a weaker USD and a desire for safe havens pushing the precious metal above 2160 USD an ounce.

Risk off returned to the markets in Tuesdays session with US equity markets pulling back sharply led by tech stocks with the NASDAQ being the biggest loser, shedding 1.65%. The big headline for the day in FX was gold touching on all-time highs, rallying for a fifth straight session, buoyed by haven flows and a drop in US treasury yields. XAUUSD RSI reading in extreme overbought territory at over 78, the highest level since the blow off top in March 2022.

JPY was the G10 outperformer with USDJPY pushing briefly below the key 150 level after a hotter the expected Tokyo inflation print. Yen was also helped by more jawboning out of currency diplomat Kanda who said that markets must brace for higher interest rates environment. AUD and NZD saw marginal losses against the greenback, with AUD modestly outperforming the Kiwi.

In the APAC session both currencies were softer amid disappointment out of China which weighed on sentiment before recovering somewhat in the US session. AUDUSD briefly dropped below 0.65 and hit a low of 0.6478 before finding support to head into the APAC session above 0.65. NZDUSD pushing below last week's RBNZ-led low and 200DMA at 0.6076 to make a low at 0.6072 before recovering to trade above the key support at 0.61.

Broadcom Inc. (NASDAQ: AVGO) wasn’t the only company releasing the latest earnings report on Thursday. World’s second largest supermarket chain Costco Wholesale Corporation (NASDAQ: COST) also announced their results after the closing bell on Wall Street. Costco reported revenue of $57.33 billion vs. $59.111 billion expected.

Revenue rose by 5.7% year-over-year. Earnings per share (EPS) was reported at $3.92, which was above Wall Street estimate of $3.64 per share. EPS increased by 18.78% vs. the same period the year prior.

Company overview Founded: September 15, 1983 Headquarters: Issaquah, Washington, United States Number of employees: 316,000 (2023) Industry: Retail Key people: Hamilton E. James (Chairman), W. Craig Jelinek (President and CEO) Stock reaction Broadcome was up by 1.60% before the earnings call, trading at $785.59 a share.

Shares rose to a new all-time high of $787.08 during the session. The stock was down by around 4% post market after the latest results were announced. Stock performance 5 day: +4.99% 1 month: +7.85% 3 months: +27.83% Year-to-date: +18.32% 1 year: +62.87% Costco stock price targets Oppenheimer: $805 Telsey Advisory Group: $785 Wells Fargo & Company: $675 The Goldman Sachs Group: $749 Loop Capital: $755 Tigress Financial: $745 Northcoast Research: $620 Raymond James: $670 UBS Group: $725 BMO Capital Markets: $700 DA Davidson: $600 Stifel Nicolaus: $675 Citigroup: $630 Evercore ISI: $650 JP Morgan Chase & Co.: $605 Costco Wholesale Corporation is the 26 th largest company in the world with a market cap of $346.60 billion, according to CompaniesMarketCap.

You can trade Costco Wholesale Corporation (NASDAQ: COST) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Costco Wholesale Corporation, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Broadcom Inc. (NASDAQ: AVGO) announced its latest financial results after the US market closed on Thursday. The US tech giant achieved revenue of $11.961 billion in the first quarter of fiscal year 2024 (up by 34% year-over-year) vs. $11.759 billion estimate. Earnings per share was reported at $10.99 (up by 6.38% year-over-year) vs. $10.368 per share expected.

The company announced a quarterly dividend of $5.25 a share. Company overview Founded: 1961 Headquarters: San Jose, California, United States Number of employees: 20,000 (2023) Industry: Semiconductor, computer software Key people: Henry Samueli (Chairman), Hock Tan (President and CEO) CEO commentary Hock Tan, CEO of Broadcom had this to say in a letter to investors: "We are pleased to have two strong drivers of revenue growth for Broadcom in the first quarter and fiscal year 2024. First, our acquisition of VMware is accelerating revenue growth in our infrastructure software segment, as customers deploy VMware Cloud Foundation.

Second, strong demand for our networking products in AI data centers, as well as custom AI accelerators from hyperscalers, are driving growth in our semiconductor segment." "We reiterate our fiscal year 2024 guidance for consolidated revenue of $50 billion and adjusted EBITDA of $30 billion," Tan looked at the year ahead. Stock reaction Shares ended Thursday’s session up by 4.22% before the results were announced, trading at $1,407.01 a share. The stock dipped by around 3% in the after-hours trading.

Stock performance 5 day: +7.19% 1 month: +9.35% 3 months: +51.15% Year-to-date: +24.88% 1 year: +123.92% Broadcom stock price targets Mizuho: $1,550 Rosenblatt Securities: $1,500 Cantor Fitzergald: $1,600 Oppenheimer: $1,500 Susquehanna: $1,550 UBS Group: $1,480 The Goldman Sachs Group: $1,325 Citigroup: $1,100 TD Cowen: $1,000 Truist Financial: $1,015 KeyCorp: $1,200 Evercore ISI: $1,050 Robert W. Baird: $1,000 Deutsche Bank: $950 Wells Fargo & Company: $900 Broadcom Inc. is the 11 th largest company in the world with a market cap of $646.85 billion, according to CompaniesMarketCap. You can trade Broadcom Inc. (NASDAQ: AVGO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform.

To find out more, go to "Trading" then select"Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs. Why trade during extended hours?

Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Broadcom Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

AutoZone Inc. (NYSE: AZO) announced Q2 fiscal 2024 results before the US opening bell on Tuesday. The largest US retailer of aftermarket automotive parts and accessories achieved revenue of $3.859 billion in the quarter, which topped analyst estimate of $3.846 billion. Earnings per share (EPS) reached $28.89 vs. $26.296 per share expected.

Both revenue and EPS increased by 4.6% and 17.2% year-over-year respectively. AutoZone opened 29 new stores in the United States (19), Mexico (6) and Brazil (4) during the quarter. 3 stores were closed in the United States. The company has 7,191 stores in the Unites States (6,332), Mexico (751) and Brazil (108) as of 10/2/24.

Company overview Founded: 1979 Headquarters: Memphis, Tennessee, United States Number of employees: 119,000 (2023) Industry: Retail Key people: William C. Rhodes III (Chairman, President, & CEO), Jamere Jackson (CFO) CEO commentary "I want to thank our AutoZoners for delivering solid earnings in our second fiscal quarter. Their commitment to delivering superior customer service again drove our very solid quarterly performance.

While a difficult holiday comparison for both Christmas and New Year’s negatively impacted quarterly sales performance, we continue to be encouraged with our sales initiatives, and believe we are well positioned for future growth. Additionally, we are pleased with our international business as we delivered another quarter of double-digit growth. We remain committed to prudently investing capital in our business, and we will be steadfast in our long-term, disciplined approach to increasing operating earnings and cash flows while utilizing our balance sheet effectively," Phil Daniele, CEO of the US company said in a statement to shareholders.

Stock reaction Shares rose to a new all-time high following the release of the latest results. The stock was up by over 5% at $2,926.32 a share. Stock performance 5 day: +8.67% 1 month: +3.21% 3 months: +12.59% Year-to-date: +13.31% 1 year: +17.83% AutoZone stock price targets Wedbush: $2950 Barclays: $2779 Morgan Stanley: $2900 Raymond James: $3100 Stephens: $3070 Truist Financial: $3027 TD Cowen: $2975 Oppenheimer: $2600 Argus: $2920 JP Morgan Chase & Co.: $2975 Evercore ISI: $2750 DA Davidson: $2500 UBS Group: $2900 Bank of America: $2465 AutoZone Inc. is the 360 th largest company in the world with a market cap of $50.55 billion, according to CompaniesMarketCap.

You can trade AutoZone Inc. (NYSE: AZO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: AutoZone Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap