市场资讯及洞察

波动性不分青红皂白。但它可以惩罚没有做好准备的人。

在几分钟内反向移动时停止被击中。短期期权的溢价攀升。而且日元不再像以前那样作为可靠的对冲工具。

对于亚洲各地的交易者来说,驾驭这种环境意味着就风险、时机以及为市场平静而制定的策略中包含的假设提出更棘手的问题。

1。在地缘政治冲击期间如何交易VIX差价合约?

芝加哥期权交易所波动率指数(VIX)衡量了市场对标准普尔500指数30天隐含波动率的预期。它通常被称为 “恐惧指标”。在地缘政治冲击中,例如当前的伊朗升级、制裁公告和央行出人意料的行动,VIX可能会急剧而迅速地飙升。

是什么让 VIX 差价合约在震惊中与众不同

VIX 本身不可直接交易。VIX差价合约通常按VIX期货定价,这意味着它们在正常条件下具有同价拖累。

在地缘政治冲击期间,可能会同时发生几件事

- 现货VIX可能会立即飙升,而短期期货滞后,从而造成脱节。

- 随着流动性的减少,VIX差价合约的点差可能会显著扩大。

- 随着经纪商风险模型的调整,保证金要求可能会在盘中发生变化。

- VIX 在峰值之后往往会恢复均值,因此时机和持续时间至关重要。

这对亚洲时段交易者意味着什么

亚洲市场交易时间意味着许多地缘政治事件可能会在当地交易者活跃或刚刚开始交易时爆发。

在悉尼开盘之前,东京时段发生的冲击可能已经定价到VIX期货中。

一些交易者使用VIX差价合约头寸作为股票投资组合的短期对冲工具,而不是定向交易。其他人则交易回归(一旦最初的飙升消退,就会回到历史平均水平)。两种方法都有不同的风险,都不能保证特定的结果。

2。为什么我现在的0DTE期权保费这么贵?

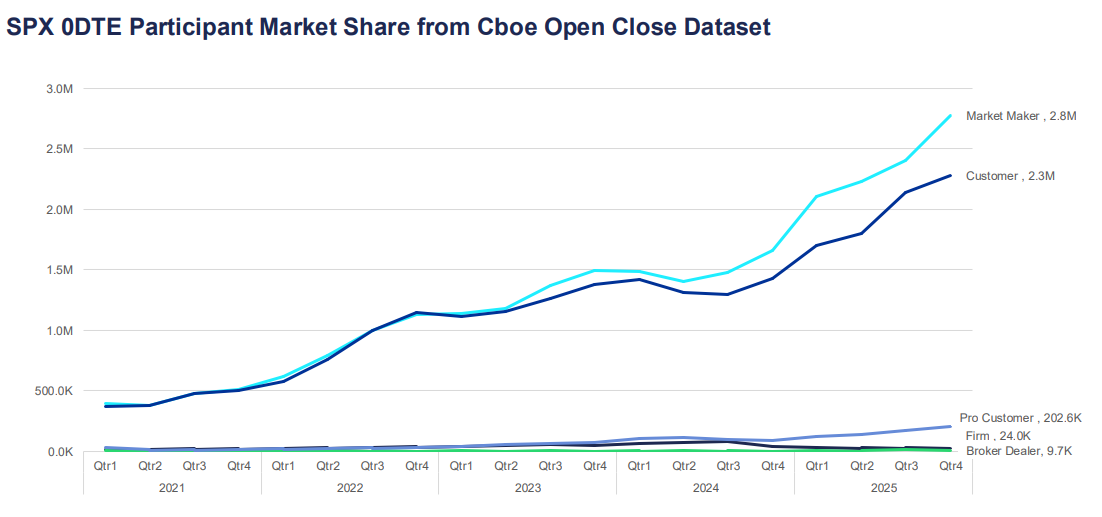

零天到期(0DTE)期权在交易当天到期。根据芝加哥期权交易所全球市场数据,它们已成为期权市场增长最快的细分市场之一,目前占标准普尔500指数期权每日交易量的57%以上。

对于进入美国期权市场的亚洲参与者来说,波动时期的溢价上涨可能感觉像是定价错误,但通常反映了结构性定价因素。

为什么保费飙升

期权定价由内在价值和时间价值驱动。对于0DTE期权,几乎没有剩余的时间价值,这可能表明它们应该便宜,但隐含波动率部分可以弥补这一点。

当不确定性增加时,卖方可能会要求为盘中急剧波动的风险提供更多补偿。

这可以反映在

- 更高的隐含波动率输入。

- 更宽的买卖价差。

- 在 delta 和 gamma 对冲方面进行更快的调整。

在更高的VIX环境中,套期保值流量可能导致标的指数的短期反馈循环。这可能会放大价格波动,尤其是在关键水平附近。

这对亚洲时段交易者意味着什么

许多0DTE期权合约在美国交易时段的定价和套期保值流量最为活跃。在亚洲时段入仓可能意味着面临过时的定价或更大的利差。

如果您看到昂贵的保费,这可能反映出市场对当日大幅波动风险的准确定价。该保费是否值得支付取决于您对可能的盘中区间和风险承受能力的看法,而不仅仅是绝对的美元数字。

3.如何针对高 VIX 环境调整算法交易机器人?

许多算法交易系统都建立在低波动率模式下校准的参数之上。当 VIX 达到峰值时,这些参数很快就会过时。

政权不匹配问题

大多数交易算法使用历史数据来设置头寸规模、止损距离和入场阈值。该数据反映了测试系统的条件。如果 VIX 从 15 升至 35,则支撑这些设置的统计假设可能不再成立。

高 VIX 环境中的常见故障模式包括

- 在预期的定向运动发生之前,由噪声反复触发停止。

- 基于固定美元风险的头寸规模,与实际盘中区间相比,固定美元风险变得相对较小。

- 分解资产之间的相关性假设。

- 执行失误会削弱优势。

一些算法交易者考虑的方法

有些系统没有运行一组固定的参数,而是采用了波动率机制过滤器。这是对VIX或ATR的实时检查,当条件发生变化时,它会触发切换到不同的设置。

一些交易者在高VIX环境中审查的方法调整

- 与 ATR 成比例地扩大停车距离,以减少噪音驱动的出口。

- 缩小头寸规模,以保持相对于更大预期区间的恒定美元风险。

- 添加 VIX 阈值,超过该阈值系统将暂停或进入模拟交易模式。

- 减少同时持仓的数量,因为在市场压力下,相关性往往会上升。

任何调整都无法消除风险。尽管过去的情况并不能作为未来结果的可靠指导,但对历史High-VIX周期的新参数进行回溯测试可以为可能的表现提供一定的指示。

4。日元(JPY)仍然是可靠的避险交易吗?

在全球避险情绪期间,随着投资者放松套利交易并寻求波动率较低的持股,资本历来流入日元。但是,这种动态的可靠性已变得更加有条件了。

为什么日元历来是避风港?

日本历史最低的利率使日元成为套利交易的首选融资货币,当避险情绪来袭时,这些交易会迅速平仓,从而创造对日元的需求。

此外,日本庞大的外国净资产头寸意味着日本投资者倾向于在危机期间汇回资本,进一步支撑日元。

发生了什么变化

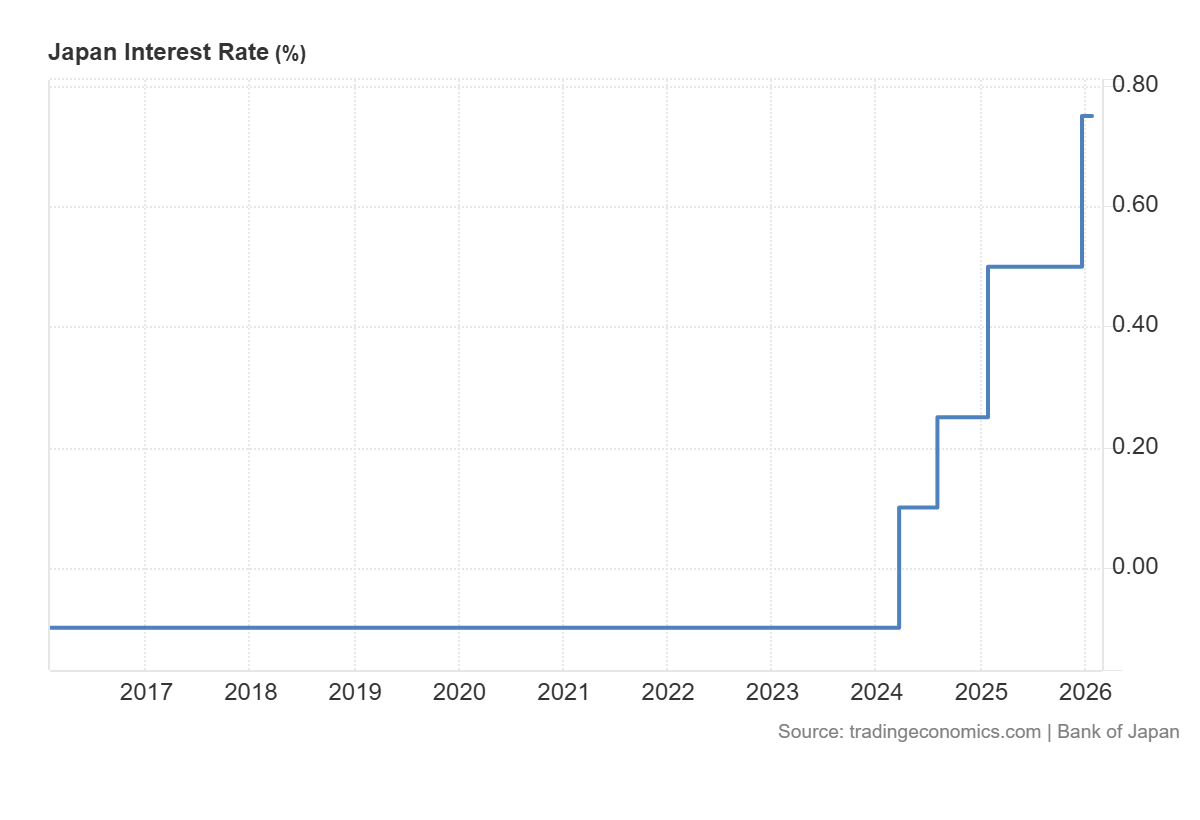

日本央行近年来放弃超宽松的货币政策,这使传统的避险动态变得复杂。

随着日本利率的上升:

- 套利交易头寸的规模可能会发生变化。

- 美元/日元可能对利率利差变得更加敏感。

- 日本央行的通讯和国内通胀数据可能会影响日元,与全球风险偏好无关。

日元仍然可以充当避风港,尤其是在股票大幅抛售期间。但是,与日本与世界其他地区之间的政策分歧更为极端的早期周期相比,它的反应可能更慢或不一致。

要看什么

对于将日元视为避险信号的交易者来说,日本央行的会议日期、日本消费者价格指数的发布以及美日实时利差数据已成为比几年前更重要的输入。

5。如何避免 “炒股” 能源差价合约?

Whipsawing描述了向一个方向进入交易,在价格反转时被强制平仓,然后看着价格向原始方向回移的经历。

能源差价合约,尤其是原油,在动荡的市场中尤其容易出现这种情况。对于亚洲的交易者来说,当地时间流动性薄弱以及对地缘政治头条的敏感性相结合,可能使这变得特别具有挑战性。

为什么能源差价合约大放异彩

原油对各种主要驱动因素很敏感:欧佩克+的生产决策、美国库存数据、地缘政治供应中断和货币走势。

在高波动性的环境中,市场可以对每个标题做出强烈反应,然后在下一个标题到来时逆转。

- 标题价格飙升,空头头寸触发止损。

- 交易者重新进入多头,预计会继续。

- 第二个头条新闻或获利回吐可以逆转这一走势。

- 长途停靠点被击中。循环重复。

交易者可以考虑采用的方法来管理鞭子风险

一些交易者选择在波动条件下更改风险控制(例如,审查与波动率指标相关的止损设置)。但是,这可能会增加损失;在快速市场中,执行和滑点风险可能会急剧上升

一些交易者审查的其他方法:

- 避免在主要预定数据发布前后的30分钟内交易原油差价合约。

- 在进入较短的时间范围之前,使用较长的时间框架图表来确定当前趋势,从而减少与更大的机构资金流进行交易的机会。

- 分阶段扩大仓位,而不是在初次进入时全额投入。

- 监控未平仓合约和交易量,以区分真实参与的走势和低流动性假货。

在动荡的能源市场中,不可能完全消除 Whipsawing。在这种情况下,风险管理的目标不是预测哪些走势将保持不变,而是确保虚假走势的损失小于真正的定向走势时的收益。

亚洲市场波动的实际注意事项

亚洲市场具有结构性特征,与波动的相互作用与美国或欧洲市场不同:

- 当地时段的流动性减少会夸大交易量的波动,尤其是能源和外汇差价合约的走势。

- 中国的事件,包括采购经理人指数的发布、贸易数据和中国人民银行的政策信号,可能会影响区域指数。

- 近年来,日本央行的政策决策已成为日元和日经指数波动的更积极的驱动力。

- 对于无法全天候监控头寸的交易者来说,美国交易日走势产生的隔夜缺口是一种持续的结构性风险。

- 在高VIX时期,杠杆产品的保证金要求可能会在短时间内发生变化。

有关亚洲市场波动的常见问题

高VIX读数对亚洲股票指数意味着什么?

VIX衡量标准普尔500指数的预期波动率,但读数上升通常反映了市场上普遍存在的全球避险情绪。日经225指数、恒生指数和澳大利亚证券交易所200指数等亚洲指数的波动性通常会增加,并且与VIX的急剧上涨呈负相关性。

0DTE 期权可以在亚洲时段交易吗?

访问权限取决于平台和特定工具。美国股票指数0DTE期权在美国交易时段的定价最为活跃。在这些时间以外,亚洲交易者可能会面临更大的点差和更不具代表性的定价。

在高波动性条件下,算法交易策略本质上是否更具风险?

在低波动率时期校准的策略在高 VIX 环境中的表现可能会有所不同。对于任何系统性方法,定期根据当前市场条件审查参数都是明智之举。

日元的避险交易是否发生了永久性变化?

日本央行的政策正常化带来了新的动力,但在一些避险时期,日元继续走强。这可能更多地取决于冲击的性质和日本央行的同步立场。

在高波动性条件下设置能源差价合约止损的最佳方法是什么?

没有普遍的最佳方法。许多交易者参考ATR来根据当前条件调整止损距离,而不是使用固定水平。这并不能保证以期望的价格退出,也不能消除鞭打风险。

.jpg)

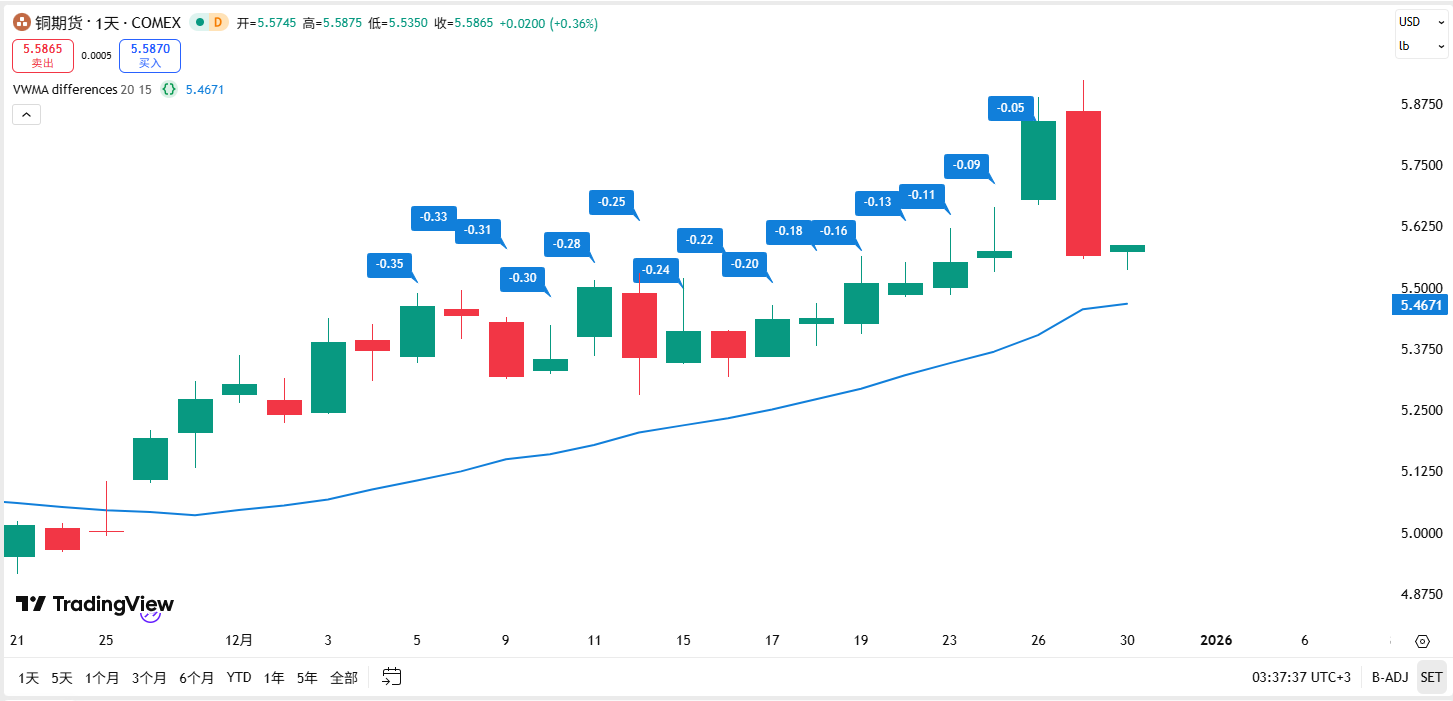

一、保持独立性:

市场的担忧并非空穴来风。如果特朗普真的动摇了外界对美联储抗通胀承诺的信心,其后果可能会十分严重。即便如此,就算下一任美联储主席想迎合特朗普、推动进一步降息,也并非轻而易举。主席仍需说服负责制定政策的联邦公开市场委员会(FOMC),一旦无法达成一致,其个人信誉将面临巨大的损害。如何同时维系FOMC、美联储内部职员、投资者以及总统之间的信任,将成为一项极具挑战性的任务。

二、利率路径:

撇开政治因素不谈,美联储确实有理由选择按兵不动。在去年已三次各降息25个基点之后,鲍威尔认为,目前的货币政策大体处于“对中性利率的合理估算区间内”。随着时间推移,维持劳动力市场稳定与实现2%通胀目标之间的矛盾预计将有所缓解。而要收集到足够证据来证明进一步调整利率是必要且合理的,恐怕仍需要一段不短的时间。

三、资产负债表

预计美联储将继续购买国债,保持投资组合规模足够庞大,以确保银行拥有充足现金储备,并维持短期借贷市场的顺畅运行。然而,一些美联储主席候选人倾向于大幅缩减资产负债表。若付诸实施,这将使货币政策执行更为复杂,不仅可能加剧利率波动,也会增加银行系统内部的风险传染。

四、银行监管:

2023年的地区性银行危机暴露了监管流程和文化中的显著缺陷。美联储理事鲍曼主张,将监管重点放在关系银行安全与稳健的核心问题上,同时简化那些过于复杂且重复的规定。这些目标无疑合理,但如何将其落实到实际操作中仍有待观察。若仅仅放松监管,纳税人和整体经济可能会因此承担不必要的风险。

五、稳定币:

美联储理事沃勒建议,为获得有限银行执照的金融科技公司提供“精简账户”,例如允许稳定币发行方将准备金存放在美联储。然而,与传统美联储账户不同,这类账户不计利息,不提供日间透支,也无法通过贴现窗口获得贷款,这在市场压力时期会限制其实际效用。如何解决这一问题,将在很大程度上影响美国支付系统的未来发展。

六、政策框架

美联储的沟通机制亟需改革。例如,其每季度发布的经济预测摘要过于侧重模态预测,却未充分揭示关于合适利率路径产生分歧的根本原因——是对经济前景的看法不同,还是对货币政策应如何应对存在分歧。一种改进方式是效仿欧洲央行,发布职员预测的同时附上替代方案。这将有助于市场参与者理解:若经济偏离基准预测,美联储可能采取何种应对,从而提升货币政策的透明度与有效性。尽管主席鲍威尔去年5月曾暗示可能推进改革,但迄今仍未取得实质进展。

七、外部经济与全球金融冲击:

全球经济放缓、美元波动、地缘政治冲突以及贸易与关税变动等外生因素,都将对美联储执行货币政策造成压力。

FX markets enter the month influenced by uncertain growth momentum, inflation dynamics and central bank policy, yield sensitivity, and shifts in how markets are pricing geopolitical risk.

Quick facts:

- USD remains primarily responsive to inflation data, and this may have overtaken growth as the main driver.

- JPY sensitivity to potential Bank of Japan (BOJ) action remains high, creating asymmetric responses to global rate moves and policy communication.

- EUR and AUD continue to trade reactively to global events and commodity price moves.

- Volatility may be episodic, clustering around key data releases rather than a single sustained directional trend.

With central bank expectations still evolving into the first quarter (Q1), key releases and policy communication are likely to stay central to near-term FX pricing. In this environment, moves may cluster around scheduled events and headline risk, rather than build into a single dominant trend.

US dollar (USD)

Key data and events:

- Non-farm payrolls (Employment Situation, Dec 2025): 9 January 2026 Bureau of Labor Statistics

- CPI (Dec 2025): 13 January 2026 Bureau of Labor Statistics

- Fed rate decision: 27-28 January 2026 Federal Reserve

- Advance GDP (Q4): rescheduled (date TBA) U.S. Bureau of Economic Analysis

What to watch:

USD performance remains closely tied to inflation data and what it could mean for Federal Reserve policy expectations. Market pricing can shift quickly around CPI and labour-market outcomes, particularly where outcomes affect how investors perceive the timing and pace of any policy changes.

Jobs data and GDP numbers will be watched as gauges of growth momentum. The start of the US earnings season may also influence FX indirectly through its impact on equity performance, risk sentiment, and yield expectations, rather than acting as a direct currency driver.

Key chart: US dollar index (DXY) weekly chart

Periods of market uncertainty can support USD demand around prior support areas near 97, while the 100 region may continue to act as a reference point for resistance, including where it aligns with commonly watched moving averages (noting technical indicators can fail).

A break in either direction may reflect shifting expectations about how different central banks will respond to the next run of inflation and growth data.

Euro (EUR)

Key data and events:

- CPI (Euro area HICP, Dec 2025 reference period): 19 January 2026 European Central Bank

- ECB rate decision: 5 February 2026 European Central Bank

What to watch:

European Central Bank (ECB) messaging on policy direction and inflation remains key. A prolonged hold is one scenario market participants continue to debate, but outcomes are likely to remain data-dependent and sensitive to changes in the growth and inflation backdrop.

The geopolitical situation in Ukraine will also remain in focus.

Key chart: EUR/USD weekly chart

Differences in likely central bank direction could support a test of the top end of the current multi-month range near 1.18. A sustained break above that level would be technically significant.

For now, price may stay range-bound until there is clearer guidance on policy direction on both sides of the Atlantic.

Japanese yen (JPY)

Key data and events:

- BOJ policy decision: 22–23 January 2026 Bank of Japan

- Tokyo core CPI (Ku-area of Tokyo, preliminary; Dec 2025 reference month): 23 January 2026 Statistics Bureau of Japan

What to watch:

Following the BOJ’s December rate rise, markets appear to be weighing the likelihood of further action in Q1. Whether the January meeting delivers another move remains uncertain and may depend on incoming inflation and wage signals, as well as BOJ communication.

Data released ahead of the decision may be important in shaping expectations.

Key chart: GBP/JPY daily chart

As of 7 January 2026, GBPJPY has traded around the 211.50 area, near levels last seen in 2008. Continued consolidation may suggest fresh drivers are needed to extend gains.

If the cross can’t push higher, some traders will start watching for a pullback toward 210.00, where support has shown up before. And if expectations for BOJ action build, selling could accelerate, with price potentially drifting down through those previously tested support zones and toward the more established support near 208.00.

Australian dollar (AUD)

Key data and events:

- CPI (Complete Monthly CPI; Nov 2025 reference month): 7 January 2026 Australian Bureau of Statistics

- Employment (Labour Force; Dec 2025 reference month): 22 January 2026, Australian Bureau of Statistics

- RBA rate decision: 3 February 2026 (Monetary Policy Board meeting 2–3 February) Reserve Bank of Australia

AUD continues to behave as a proxy for global growth sentiment and commodity demand.

Stabilisation in Chinese data, firmer commodity prices, and expectations around the Reserve Bank of Australia (RBA) policy path may be providing relative support for AUD. Sensitivity to broader risk conditions remains high.

Key chart: EUR/AUD daily chart

Moves in commodity prices have coincided with a sharp fall in EURAUD since the 31 December close, breaking down out of the prior range. The next key level to the downside sits at 1.7305.

The area around 1.7305 may help indicate whether selling pressure is continuing or whether momentum is fading for now. Near-term commodity price moves are likely to remain important.

Bottom line

FX conditions this month may remain reactive, with volatility clustering around key data releases rather than a sustained directional trend. With Q1 central bank expectations still forming, price moves may be sharper around the calendar, policy communication, and geopolitical headlines.

.jpg)

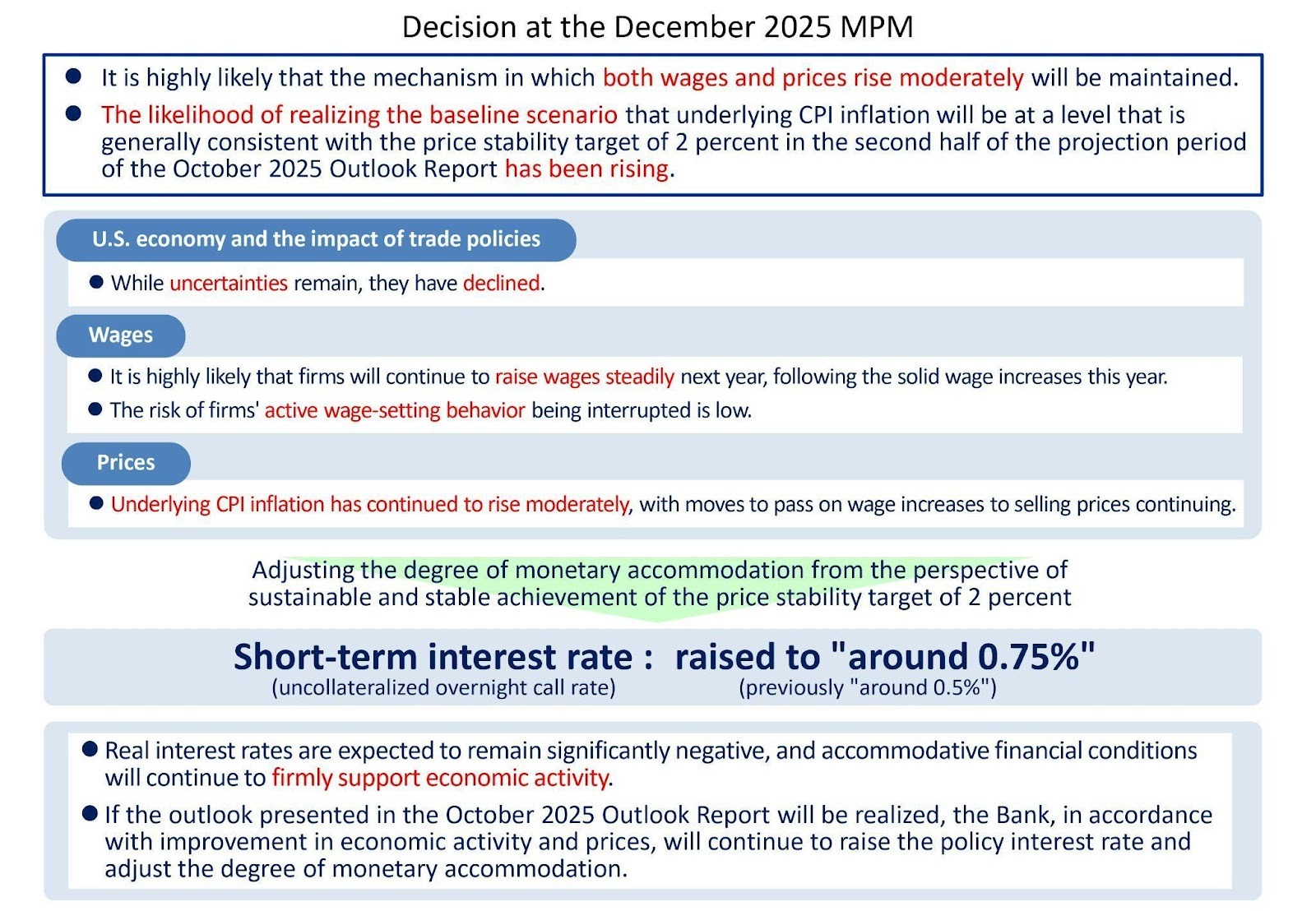

2025年12月19日,东京,日本央行在为期两天的会议后宣布:将政策利率从0.5%上调至0.75%。加息幅度本身并不意外,市场更在意的是:政策利率上行是否会延续为一条路径;日元融资的成本,是否正在被系统性地抬高。

来源:Bank of Japan

如果把过去十多年的日元放在全球资金市场的语境里,它常被视为一种融资成本相对较低、流动性较深的融资货币之一。对不少跨市场资金安排而言,日元融资长期处在“成本可控、流动性充足”的区间,使得相关交易在低波动环境中更容易扩张。但需要强调的是:融资货币的“便宜”并不等同于风险低——当汇率波动、融资条件或流动性发生变化时,相关交易的损益与风险暴露可能迅速反转。

时间轴上,日元加息的“转向”要追溯到2024年3月,日本央行结束负利率,把短端政策利率从-0.1%抬到0–0.1%附近,此后又经历了台阶式上调——到2025年1月来到约0.5%,再到2025年12月来到约0.75%。这条阶梯是一段持续抬升的过程:一格一格上行,市场每隔一段时间就要重新定价一次“借日元这件事”。而当2026年1月5日,日本央行行长植田和男在对日本银行业团体的讲话中又补了一句更具方向性的表态:“如果经济与物价走势符合预测,日本央行将继续加息、调整货币支持力度”。这样的鹰派发言自然会让市场产生一些显而易见的思考,融资成本的边际上行是否会持续?以及波动率/流动性环境是否会改变市场参与者对相关风险暴露的容忍度与对冲需求?这条以日元为燃料的交易链条,还能以多少的成本、在多大的波动下继续跑?

而这条链条,就是日元的 Carry Trade。

什么是日元的 Carry Trade:以为在赚利差,其实在借“安静”

套息交易的定义并不复杂:用低利率货币融资,再把资金投入到更高收益的货币或资产里,获取利差。放在日元身上,最典型的结构就是:借入日元、卖出日元换成美元,去持有美元端的现金类或利率资产;在持有期结束时,卖出美元资产并将美元兑换回日元,用于归还日元融资及利息,从而完成整笔交易的闭环。当然,美日汇率波动、对冲成本等因素也会显著影响最终结果。

不过,“日元Carry”很少是单一、纯粹的一笔交易。它更像一组以日元为融资端的做法:既有高频、可见的投机仓位,也有更慢、更粘的长期配置与结构性融资安排。同样重要的一点是:Carry并不总以“借贷”形态出现。除了表内的跨境贷款与资金划转,市场里还有大量通过掉期等表外工具表达的融资与对冲结构。这也是为什么有时一些人可能会感觉它“平得很快”,又或者“怎么平不完”——很多动作并不在最直观的数据表里。

但如果只把它理解成“赚利差”,就很容易误判它的脆弱性。Carry Trade 的核心假设,利差只是表层,底层更依赖环境:波动率、融资条件与流动性是否维持在可承受区间。这有时会依托于希望市场保持一种可交易的“安静”,这种“安静”意味着波动率不高、融资条件稳定、流动性充足、汇率不会在最需要时间的时候突然反向奔跑。

于是同一笔交易会呈现出两种完全不同的世界:在平静时,它像一台慢速机器,靠时间把利差一点点磨出来;在风暴时,它像一条反向传送带——不是在选择什么时候走,是在被迫和所有人一起走。

日本加息后,Carry Trade会怎么变:不一定会消失,而可能更挑环境以及容错更薄”

日本加息带来的第一层变化很直观:融资成本上升,利差变薄。利差变薄意味着同样的汇率波动、同样的融资摩擦、同样的对冲成本,会更容易把“正Carry”压成“没意义的Carry”。换句话说,策略的门槛更高了。

但市场更敏感的是第二层变化:未来路径的可信度。2025年12月19日本身或许被提前消化,但它让市场更难忽略“阶梯还在向上”这个事实。只要市场开始把“下一格”放进概率分布,Carry 的风险回报就会被整体重估:相关头寸可能会变得更依赖短期风险偏好与波动环境,在外部风险事件出现时更容易出现“降低风险暴露/提高对冲比例/缩短风险敞口时间”的倾向。这类变化也会与市场对日本与美国利率路径的预期联动。

第三层变化是结构性的:拥挤交易的脆弱性上升。Carry 交易常常不是因为逻辑错误而失败,而是因为它在低波动里成功太久、规模太大,最终在某个波动抬头的瞬间,被迫同时收缩。

这里要区分两种力量。

第一种是负反馈:当日元开始走强、或波动率开始抬头时,风险管理会迫使仓位变小——因为同样的利差,已经不够覆盖同样的波动。仓位减少,会让“进一步日元走强的动能”下降,市场因此有机会重新回到可交易的平衡;反之亦然。

但Carry的麻烦在于,它有时在关键时刻从负反馈滑向正反馈。当日元升值幅度足够大、波动足够快、流动性开始变薄时,平仓不再是“选择”,而变成“被迫”: 在某些市场结构下(例如高杠杆参与者占比较高、流动性不足、风险限额收紧等),市场可能出现同步的风险收缩行为,从而带来“买回日元—日元更强—进一步收缩”的自我强化过程。需要注意的是,这并非每次都会发生,但在波动与流动性同时恶化时,发生概率有可能会提高。这也是为什么有时候会看到一种典型的市场语言:Carry不是慢慢死的,Carry经常是被“日元升值 + 波动上升 + 流动性变薄”一起掐死的。日本加息可能并不自动触发正反馈,但它有可能会让市场更早进入一种状态:只要外部风险一来,阈值更容易被触碰。

还有一条经常被忽略的“反身性”:Carry的去杠杆如果来得太急,反过来可能让日本金融条件明显收紧,从而影响日本央行后续加息的节奏与耐心。换句话说,Carry Unwind 有时可能更像是BoJ继续加息路上的一个变量,而不只是加息后的一个结果。

对USDJPY的影响:为什么会出现“加息了,日元反而走弱”的盘面

理论上,日本加息会收窄美日利差,对日元有支撑;但有时候看到的盘面经常更拧巴:加息或降息落地,USDJPY却未必下行,甚至可能上行——也就是日元走弱或走强。

这并不矛盾,因为外汇市场交易逻辑复杂,有时候不是“动作”,而可能是“相对路径与预期差”。如果在这个单一逻辑下思考,当一次加息被市场充分预期,落地那一刻更像结算点:会前押注的仓位开始获利了结、对冲盘调整、流动性瞬间变薄,价格短线走出“卖事实”的姿态。当然,市场变化多端,单一逻辑并不能说明任何现实情况的波动。

更关键的是,USDJPY是美日两端利率路径的合成。如果市场同时在重估美国端的利率路径、或者风险偏好仍偏“risk-on”,那么日本这边的25bp不足以扭转合成结果,USDJPY就可能表现得和直觉相反;反之亦然。另外,有时候短期里看到USDJPY和其他风险资产一起“共振”,也不一定需要立刻把它简化成“某类资产是用日元借出来的”。更常见的情况是:多个原本就拥挤的交易在同一时间各自遇到催化剂,于是走势看起来像因果链,实际更像共振。Carry有时会或不会放大波动,但未必是波动的唯一来源。

为什么大家默认用 USDJPY 来看日元:因为它是“日元风险的主干道”

USDJPY是日元最核心的价格发现场所之一:流动性最深、对冲链条最完整、成交最集中;大量交叉盘(比如 AUDJPY、EURJPY)在实际执行与风控上,往往也会通过 USDJPY 与对应的美元货币对拆分、套算、对冲。换句话说,USDJPY不仅是一个报价,它更像日元风险在全球资本市场的“总开关”。

如果把日元Carry Trade当作一条“资金流的管道”,那它一直都在,只是管道的水压、阀门的松紧、以及市场能承受的震动幅度,会随着利率路径与波动环境变化而改变。2024年3月以来的阶梯式加息,让这条管道从“几乎无感”变成“需要时刻复核成本与风险”的系统。

当听到日本央行的利率与措辞变化时,可以顺着问下去——融资成本会怎么变?波动会不会被抬高?风险暴露是否更容易出现被动收缩的压力?这些问题未必能给出单一答案,但说不定能为理解为什么同样是“加息或降息25bp”,盘面有时顺着走,有时反着走,提供一些思考。

日本央行(BOJ)政策文件与发言入口

- https://www.boj.or.jp/en/mopo/mpmdeci/state_2025/index.htm

- https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240319a.pdf

- https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2025/k250124a.pdf

- https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2025/k251219b.pdf

- https://www.boj.or.jp/en/about/press/index.htm

市场结构/仓位等权威机构与媒体资料(用于理解套息与去杠杆机制)

- https://www.bis.org/publ/bisbull90.pdf

- https://www.bis.org/publ/qtrpdf/r_qt2409a.pdf

- https://www.bis.org/statistics/rpfx22.htm

- https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

- https://www.reuters.com/markets/asia/what-is-yen-carry-trade-2024-08-07/

- https://www.reuters.com/world/asia-pacific/boj-keep-raising-interest-rates-governor-ueda-says-2026-01-05/

免责声明:本文内容仅为一般性建议,未考虑任何个人的具体投资目标、财务状况或特定需求,不构成任何形式的个人财务建议、投资建议、税务建议、法律建议或任何金融产品推荐等。本文陈述的信息基于日本银行(BoJ)等公开渠道资料。本文可能包含对市场机制与潜在情景的讨论,但不构成对未来市场走向、经济表现、投资回报或政策变化的承诺或保证。过往表现和历史数据不代表未来结果。所有投资均涉及风险,包括可能损失全部本金,外汇、差价合约(CFD)、衍生品等杠杆类产品具有高风险特性,可能导致快速且重大的损失,市场价格可能因各种因素剧烈波动。本文引用的信息来源于公开渠道,虽已尽力确保准确性,但不对信息的完全准确性、完整性、及时性或适用性作出任何明示或暗示的保证,信息可能存在延迟、需要更正,或因市场和政策环境快速变化而不再适用于当前情况。在做出任何投资或财务决策前,您应当仔细考虑自身的财务状况、投资目标和风险承受能力,进行适当性评估以确保相关产品或策略符合您的需求,并咨询持有澳大利亚金融服务牌照(AFSL)的财务顾问、税务专业人士或法律顾问,同时了解并遵守您所在司法管辖区的相关法律法规。本文提及的任何第三方机构、产品或服务不构成推荐或认可,相关商标、名称归其合法所有者。在法律允许的最大范围内,作者及相关方对因使用、依赖或无法使用本文信息而导致的任何直接、间接、附带、特殊或后果性损失不承担任何责任。投资有风险,决策需谨慎。

Global markets are calm but alert in response to the US–Venezuela situation, with US and European equities holding near or testing record levels.

Gains in energy, defence and materials suggest selective positioning. Modest strength in gold and lower yields is indicative of hedging rather than market fear, with oil prices remaining muted.

Quick facts

- US and European equity indices are holding near record highs despite geopolitical headlines. Volatility remains low through the trading session.

- Energy and defence stocks are leading gains, with materials stocks responding to mild gains in previous metals, reflecting selective risk positioning.

- Gold is edging higher, and government bond yields have dipped slightly, signalling mild hedging.

- Oil prices remain range-bound, suggesting no immediate supply shock is being priced in.

- Markets could be sensitive to further geopolitical developments, with any escalation a major potential risk to sentiment.

US–Venezuela tensions escalation has prompted heightened geopolitical scrutiny across the globe, not only related to this action itself but other geopolitical longer-term implications.

There has been a muted and measured response across global financial markets so far, with little significant negative impact evident for now.

Some sectors have had noteworthy gains, whilst the impact on other asset classes has again been calm.

US equities

What’s happening:

US equity markets are showing resilience, with the S&P 500 holding near recent highs and the Dow Jones Industrial Average up 1.23%, pushing into fresh record territory.

What to watch:

- If US indices continue to hold above recent breakout levels, then markets are reinforcing the view that geopolitical risk remains manageable.

- Rising volatility, if seen in the VIX index, may indicate that sentiment may be shifting from selective risk-taking to broader caution.

European equities

What’s happening:

European markets are modestly higher, with the DAX trading at record levels and the FTSE 100 closing over 10,000 for the first time.

What to watch:

- For now, European indices appear to be tracking US strength, suggesting investors are viewing the event as externally contained. Similar sectors are performing well, as seen in overnight US equity performance.

- It is unlikely that we will see any specific regional response, though tensions related to the US administration's narrative around Greenland is noteworthy.

Specific sector moves

Energy stocks

What’s happening:

Energy stocks are leading equity gains across the US (e.g. Chevron Corp – CVX up 5.1%), and European markets, with the potential for increased influence in Venezuela of US oil companies.

What to watch:

- While energy equities outperform while oil prices remain range-bound, then markets are pricing geopolitical caution rather than immediate disruption. If this is accompanied by a rise in crude prices rise together, then it may be indicative of supply risk

Defence stocks

What’s happening:

Defence stocks are attracting some investor interest. (E.g. Lockheed Martin – LMT up 2.92%, General Dynamics – GD up 3.54%).

What to watch:

- Continued outperformance with other sector equity drawdowns may be indicative of some escalation concerns.

Materials & miners

What’s happening:

Materials and mining stocks are finding support alongside modest gains in precious metals and record highs in copper. The S&P Metals & Mining ETF – XME closed 3.28% up.

What to watch:

- Ongoing materials strength alongside stable growth indicators, then the current move may reflect real-asset demand rather than simply a hedging approach. If gold accelerates higher while base metals fail to follow, then investor defensive positioning may be overtaking confidence in growth.

Crude oil

What’s happening:

Oil prices remain subdued, with the futures trading at $58.40, within recent ranges, despite the unfolding geopolitical situation.

What to watch:

- Venezuelan influence on global oil production is not substantial enough on its own to create any major issues in the short term with global oil supply at high levels.

- As a result, the impact is more likely to remain muted, but any significant rises in oil price across multiple sessions may be indicative of some market concerns related to increases in geopolitical-influenced supply expectations.

Gold

What’s happening:

Gold prices are currently edging higher towards all-time highs, reflecting a modest safe-haven play. The closing price for Gold futures is $4454, breaching the psychologically important $4400.

What to watch:

- If gold continues to rise gradually while equities remain firm, then the move reflects a standard hedging approach to assets rather than fear.

- A spike in gold price alongside falling equities and rising volatility, maybe a signal that market risk may be increasing.

Treasury yields

What’s happening:

Yields have eased slightly, indicating a potential selective defensive positioning in asset choice by institutional investors. (10-year Treasury yields at 4.153%, down 0.36%)

What to watch:

- If yields should fall sharply alongside equity weakness, then markets may be shifting toward a risk-off approach.

What to watch next

- If asset-class correlations remain contained, then markets are maintaining confidence in the broader macro backdrop.

- If tensions escalate into broader regional instability or prolonged policy responses, Sharp movements across equities, bonds, and commodities may signify a reassessment of risk.

- If geopolitical developments fail to translate into sustained price dislocation, then the current response is likely to fade.

(All prices quoted correct as of 4.30pm NY time after market close).

%20(1).jpg)

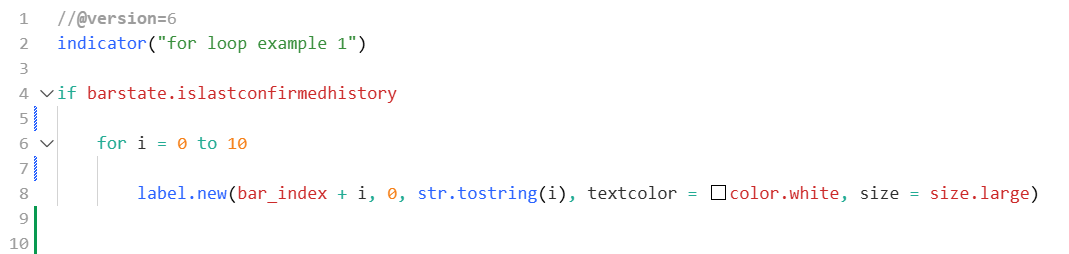

在 Pine Script 中,for 循环是一种非常重要且高频使用的控制结构,主要用于在脚本中执行重复、可控次数的计算或操作。无论是遍历数组、逐项计算指标,还是在指定范围内生成图形元素,for 循环都能让代码更加简洁、高效和可读。与简单的条件判断不同,for 循环通过计数器精确控制迭代次数,使开发者能够清楚地掌握脚本的执行流程。理解 for 循环的语法结构、执行机制以及与 continue、break 等关键字的配合方式,是掌握 Pine Script 进阶编程的关键一步。本文将从基础概念入手,结合示例,系统地介绍 Pine Script 中 for 循环的用法与注意事项。

for 循环语句用于创建一种计数控制型循环,它通过一个计数器变量来管理其局部代码块的重复执行。计数器从预先定义的初始值开始,在每次迭代结束后按固定的步长递增或递减。当计数器达到指定的最终值时,循环停止迭代。

在 Pine Script 中,for 循环使用以下语法来定义:

[variables = | :=] for counter = from_num to to_num [by step_num]

statements | continue | break

return_expression

其中,以下部分共同定义了循环头(loop header):

- counter 表示计数器变量,可以是任何合法的标识符。循环在每次迭代后,都会将该变量的值以固定的步长(step_num)从初始值(from_num)向最终值(to_num)递增或递减。最后一次可能的迭代发生在该变量的值达到 to_num 时。

- from_num 是计数器变量在第一次迭代时的初始值。

- to_num 是循环头允许进行新一次迭代的最终计数器值。循环会按 step_num 的幅度调整计数器的值,直到其达到或越过该值。如果脚本在某次循环迭代中修改了 to_num,循环头会使用新的值来控制后续允许的迭代次数。

- step_num 是一个正数,表示计数器在每次迭代后递增或递减的数值幅度,直到达到或越过 to_num。如果 from_num 大于初始的 to_num,循环会在每次迭代后从计数器中减去该数值;否则,循环会在每次迭代后将该数值加到计数器上。默认值为 1。

下面这个简单的脚本演示了一个 for 循环:在最后一根历史 K 线执行脚本时,循环会在未来的柱索引位置绘制多个标签。该循环的计数器从 0 开始,每次增加 1,直到达到 10,此时执行最后一次迭代。

下面对这段 Pine Script 代码进行逐行解析。

声明这是一个指标脚本,并将指标名称设置为for loop example 1。该名称会显示在 TradingView 的指标列表和图表上。

设置一个条件判断语句,barstate.islastconfirmedhistory 在最后一根已确认的历史 K 线上返回 true。这样可以确保后面的代码只执行一次,避免在每根 K 线上重复创建标签。

定义一个 for 循环。计数器变量 i 从 0 开始,每次递增 1,直到 10 为止,一共执行 11 次迭代。

- bar_index + i:标签绘制在当前 K 线之后第 i 根柱子的位置

- 0:标签在价格轴上的 y 坐标

- str.tostring(i):将当前计数器 i 转换为字符串,作为标签文本

- textcolor = color.white:设置文字颜色为白色

- size = size.large:设置文字大小为大号

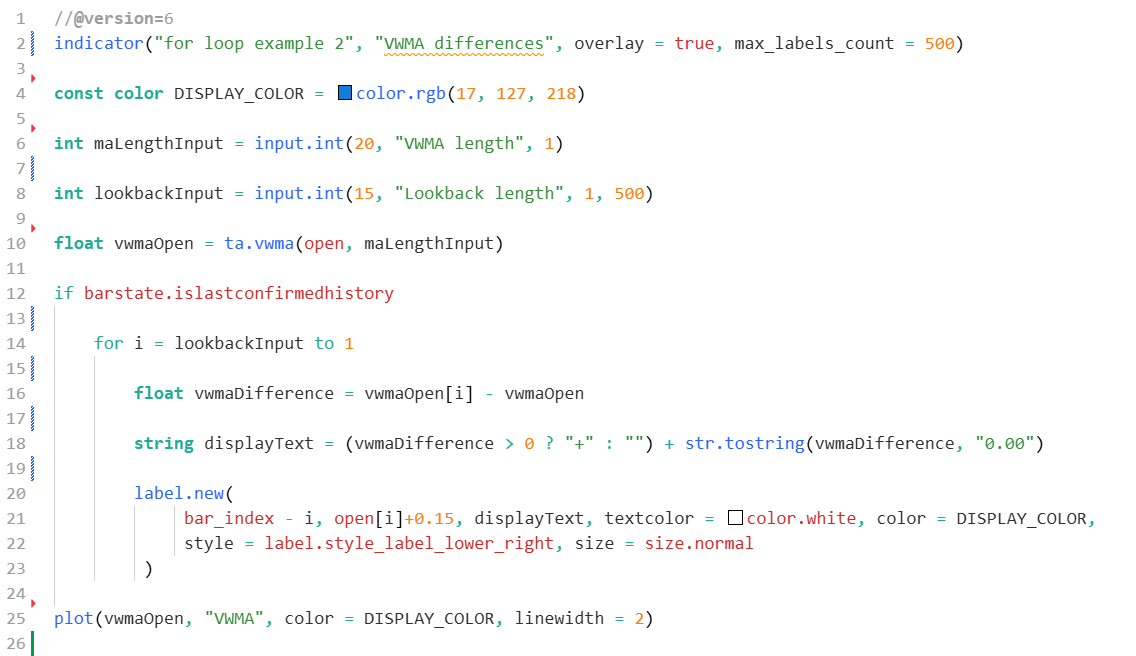

下面再举一个复杂一点的例子,下面的脚本用于计算并绘制 开盘价的成交量加权移动平均线(VWMA),计算范围为指定数量的 K 线。随后,脚本使用一个向下计数的 for 循环,将最后一根历史 K 线的数值与之前各根 K 线的数值进行比较,比较过程从所设定回看窗口中最早的一根 K 线开始。在每一次循环迭代中,脚本都会获取某一根过去 K 线的 vwmaOpen 值,计算它与当前 K 线数值之间的差值,并在该历史 K 线的开盘价位置通过标签显示计算结果。

下面对这段 Pine Script代码进行逐行解析:

第二行,声明这是一个指标脚本:

- "for loop example 2":指标名称

- "VWMA differences":指标的简短标题

- Overlay = true:将指标绘制在主图(价格图)上

- max_labels_count = 500:允许最多绘制 500 个标签,防止标签数量超限报错

第四行,定义一个常量颜色 DISPLAY_COLOR,用于统一设置指标线和标签的显示颜色。const 表示该变量在脚本中不可被修改。

第六行,创建一个整数输入参数 maLengthInput:

- 默认值为 20

- 显示名称为 “VWMA length”

- 最小值为 1

- 该参数用于控制 VWMA 的计算周期长度。

第八行,定义另一个输入参数lookbackInput:

- 默认回看 15 根 K 线

- 最小值 1,最大值 500

- 用于决定向过去比较多少根 K 线的数据。

第十行,计算开盘价的成交量加权移动平均线(VWMA):

- 使用 open 作为数据源

- 计算周期由 maLengthInput 决定

- 结果保存在 vwmaOpen 变量中。

第十二行,判断当前是否为最后一根已确认的历史 K 线。

第十四行,定义一个向下计数的 for 循环:

- 计数器 i 从 lookbackInput 开始

- 每次递减 1

- 直到 i == 1 为止

用于逐根回看历史 K 线。

第十六行,计算差值:

- vwmaOpen[i]:i 根 K 线之前的 VWMA 值

- vwmaOpen:当前 K 线的 VWMA 值

- 两者相减,得到历史值与当前值之间的差。

第十八行,将差值转换为显示文本:

- 如果差值大于 0,在前面加上 “+”

- 使用 str.tostring 将数值保留两位小数

最终生成用于标签显示的字符串。

第二十行,在历史 K 线上绘制标签:

- bar_index - i:定位到 i 根 K 线之前

- open[i]:标签绘制在该 K 线的开盘价位置

- displayText:标签文本内容

- textcolor = color.white:文字颜色

- color = DISPLAY_COLOR:标签背景色

- style 和 size:设置标签样式和大小

第二十五行,将 vwmaOpen 以曲线形式绘制在图表上:

- 线条名称为 “VWMA”

- 使用统一的显示颜色

- 线宽为 2

最终效果如上所示:在主图中,脚本会对过去 15 根 K 线逐一计算其 VWMA 历史值与当前 VWMA 值之间的差异,并将结果以标签形式直接标注在对应的 K 线位置上。

本文围绕 Pine Script 中的 for 循环 展开,介绍了其基本语法、计数方式以及在实际指标中的应用。通过 VWMA 示例,演示了如何利用 for 循环回看历史 K 线、逐一计算并对比数据,并将结果直观地展示在主图上。同时,也指出了 overlay = true、barstate.islastconfirmedhistory 等常见但关键的细节问题。掌握 for 循环的正确用法,有助于编写更高效、清晰且可维护的 Pine Script 指标代码。

.jpg)

January’s market action often matters more than simply marking the opening of the calendar year. Institutional positioning resets, testing of economic assumptions, and early price moves reflect how market participants interpret the first meaningful signals of the year.

While January rarely determines full-year outcomes, it frequently shapes the narratives markets carry into the first quarter (Q1).

Four critical levers: growth, labour, inflation, and policy, can provide an early indication of how markets are processing and prioritising incoming information.

Growth: manufacturing PMIs

January’s first growth test comes from the manufacturing surveys, with markets watching whether signals from S&P Global Manufacturing PMI and ISM Manufacturing PMI tell a consistent story.

Key dates:

- ISM Manufacturing PMI: 5 January, 10:00 AM (ET)/ 6 January, 1:00 AM (AEDT)

What markets look for:

Attention often centres on new orders as a forward-looking indicator of demand, alongside prices paid for early insight into cost pressures.

Broad strength across both surveys would support the narrative that the growth momentum seen toward the end of 2025 may extend into early 2026, easing some concerns about a sharper slowdown. Weaker or conflicting readings would keep the growth outlook uncertain, rather than decisively negative.

How it tends to show up in markets:

Firmer growth signals often appear first in higher short-dated Treasury yields. Rising yields can tighten financial conditions, weigh on equity valuations, and support the USD, with spillover effects across foreign exchange (FX) and commodity markets.

Labour: job openings and payrolls

While early-January Non-Farm Payrolls (NFP) often drive short-term volatility, JOLTS job openings may be more influential in shaping January’s policy narrative.

Key dates:

- JOLTS Job Openings: 7 January, 10:00 AM (ET)/ 8 January, 1:00 AM (AEDT)

- Non-Farm Payrolls (NFP): 9 January, 8:30 AM (ET)/ 10 January, 12:30 AM (AEDT)

What markets look for:

Markets often treat JOLTS as a clearer indicator of underlying labour demand than month-to-month hiring flows.

A continued drift lower in openings would support the view that labour demand is easing in an orderly way, reinforcing confidence that inflation pressures can continue to moderate. A rebound or stalled decline would suggest labour conditions remain firmer than expected.

Market sensitivities:

For markets, easing labour demand typically supports lower short-dated yields and a softer USD, while persistent tightness can push yields higher, strengthen the USD, and increase volatility across rate-sensitive assets.

Inflation: PPI and CPI

Key Dates:

- PPI: 14 January, 8:30 AM (ET)/ 15 January, 12:30 AM (AEDT)

- CPI (December 2025 data): 15 January, 8:30 AM (ET)/ 16 January, 12:30 AM (AEDT)

The inflation signal can be read as a pipeline from producer prices to consumer inflation. Markets are watching whether producer-level cost pressures continue to fade or begin to re-emerge.

What markets look for:

Core PPI, particularly services-linked components, provides an early indication of cost momentum. Core CPI breadth may help determine whether inflation is continuing to cool or showing signs of persistence.

A softer pipeline would reinforce confidence that disinflation can extend into early 2026, increasing the scope for a potential March policy adjustment. Stickier CPI readings above 3% would raise questions about the durability of recent progress.

How rates and the USD often react

Market reaction tends to be led by yields. Cooling inflation pressure usually pulls short-dated yields lower and softens the USD, while persistent inflation risks can push yields higher and tighten financial conditions.

Policy: January FOMC meeting

By the time the Federal Reserve meets at the end of January, markets will have processed the early growth, labour, and inflation signals of the year.

Key Dates:

- FOMC rate decision: 29 January, 2:00 PM (ET)/ 30 January, 6:00 AM (AEDT)

What markets look for:

A policy change is unlikely this month, but how those signals are framed in the statement and press conference still matters. With January cut expectations priced well below 20%, attention is on whether expectations for a March move, currently around 50%, begin to shift.

Confidence that inflation and labour pressures are easing would typically support lower yields and a softer USD. A more cautious tone could lift yields, strengthen the USD, and tighten global financial conditions.

Putting it all together

January’s data acts as condition-setters rather than decision points. The practical takeaway lies in how markets respond as those conditions become clearer:

If growth and labour soften while inflation continues to ease, markets may lean toward a more constructive risk backdrop, with Treasury yields remaining the key guide and expectations for policy easing later in Q1 firming.

If growth holds up and inflation proves sticky, a more cautious posture may be warranted, with heightened sensitivity to Treasury yields, USD strength, and pressure on equity valuations and rate-sensitive commodities.