市场资讯及洞察

2025 年,拉丁美洲的加密货币交易量创下了 7300 亿美元。在整个地区,现在有5,770万人拥有某种形式的数字货币 rankingslatam,这一基础的增长速度比世界上其他任何地方都要快

随着机构资本的到来和监管的成熟,这些是投资者最关注的上市股票。

值得关注的拉丁美洲顶级加密股票

1。Nu Holdings(纽约证券交易所代码:NU)

数字银行·巴西、墨西哥和哥伦比亚有1.27亿用户

Nubank可能是拉美金融科技和加密繁荣中最直接的上市代理之一。该公司将加密货币交易直接集成到其Nu应用程序中,并与Lightspark合作嵌入了 比特币 闪电网络可实现更快、更具成本效益的比特币交易。

2025年第三季度,收入同比增长42%,达到41.7亿美元,客户存款增长37%,达到388亿美元,毛利增长35%,达到18.1亿美元。

在过去的一年中,该股的回报率约为36%,在过去三年中,标准普尔500指数的回报率增长了三倍。该公司在巴西占据主导地位,超过60%的成年人使用Nubank。

Nu Holdings最近还获得了有条件的批准,可以推出美国国家数字银行Nubank N.A.。 但是,该公告引发了回调,投资者对资本部署时间表和扩张成本持谨慎态度。

瑞银已将目标股价下调至17.20美元,理由是尽管运营发生了积极的变化,但市场仍持谨慎态度。

要看什么

- 巴西和墨西哥的信贷质量趋势。

- 通过Nubank奖励加快采用USDC的速度。

- 美国银行章程时间表和早期成本披露。

2。MercadoLibre(纳斯达克股票代码:MELI)

电子商务/金融科技·拉丁美洲18个国家

MercadoLibre并不是纯粹的加密游戏,但Mercado Pago(其金融科技部门)已成为拉美最重要的金融领域之一。该公司在其资产负债表上持有约570个比特币,以对冲地区通货膨胀,并发行了自己的与美元挂钩的稳定币Meli Dólar。

Mercado Pago的2025年全年净收入达到126亿美元,同比增长46%,而总支付额达到2780亿美元,增长41%。金融科技月活用户连续十个季度增长近30%,信贷组合同比增长近一倍,达到125亿美元。

MercadoLibre 面临的问题是盈利能力。总体利润率压缩了5-6%,这归因于对免费送货、信用卡扩张、第一方商务和跨境贸易的持续投资。

该股在过去六个月中下跌了约14.5%,市场对该股的定价围绕管理层设定的进入2026年的深思熟虑的投资阶段进行了重新定价。

长期的理由仍然令人信服。Mercado Pago已在其核心市场推出了加密资产管理和保险产品,将其定位为与其说是电子商务公司,不如说是内置加密基础设施的全面数字银行。

要看什么

- Mercado Pago贷款损失趋势和信贷组合质量。

- 通过其支付网络进行稳定币整合和加密交易量。

- 阿根廷信用卡的推出能否实现盈利。

3.Méliuz (B3: CASH3.SA)

金融科技/比特币国库·巴西第一家上市的比特币财资公司

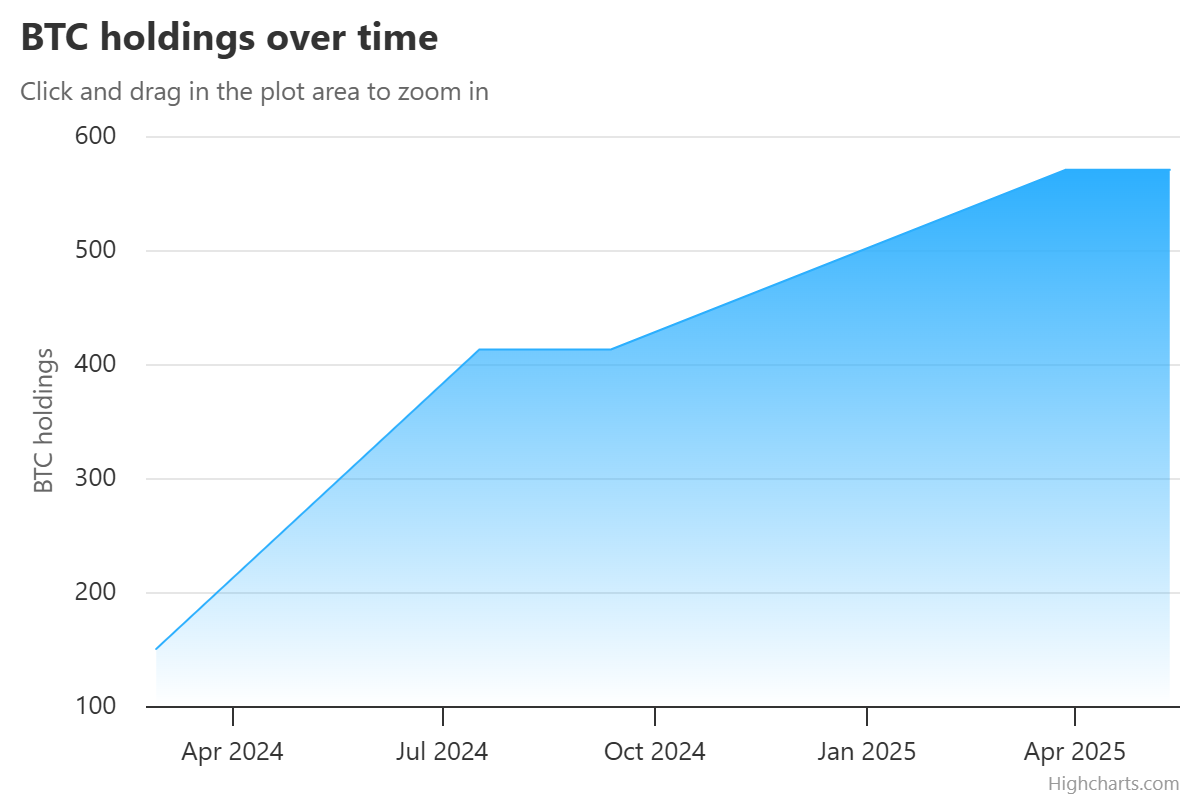

Méliuz是拉美企业比特币资金趋势的最直接股票表现形式。2025年初,Méliuz成为拉丁美洲第一家正式采用比特币国库战略的上市公司,获得股东批准,将现金储备分配给比特币积累。

Méliuz没有发行以美元计价的廉价债务来购买比特币,而是使用股票发行和运营现金流。该公司还出售比特币的现金担保看跌期权以产生收益,这是一本从日本比特币财资公司Metaplanet借来的剧本,将80%的比特币持有量保存在冷库中

CASH3 本质上是比特币敞口的杠杆工具,在牛市周期中大量捕捉上行空间,但在下跌过程中会产生更大的波动性,尤其是在涉及债务的情况下。

比特币战略宣布后,该股在2025年5月飙升了约170%。 但是,此后它已回落至2025年4月的水平,广泛追踪了比特币的价格走势并强调了该股的波动性。

要看什么

- 比特币的价格方向。

- 比特币每股指标。

- 扩大产量生成策略

- 任何国际股票上市的举措。

4。oranjeBTC (B3: OBTC3.SA)

Pure-Play 比特币宝库·拉美最大的企业比特币持有者

Méliuz是一家同时持有比特币的金融科技企业,而OranjeBTC恰恰相反:一家以比特币积累为宗旨的公司。

该公司通过与教育公司Intergraus的反向合并,于2025年10月在B3上市,这标志着一家商业模式完全以比特币积累为中心的公司首次公开亮相。

OranjeBTC目前持有超过3650个比特币,并筹集了近3.85亿美元的比特币,这得到了包括温克莱沃斯兄弟、亚当·巴克、FalconX和里卡多·萨利纳斯在内的知名投资者的支持。

其2.1亿美元的一轮融资由巴西最大银行的投资部门Itaü BBA牵头,这是一项重要的机构信任投票。

2026年,OBTC3 今年迄今已下跌约32%,是两只巴西比特币库存股中受打击最严重的股票。 该股在上市日(2025年10月7日)创下29.00巴西雷亚尔的历史新高,在2026年2月创下6.06巴西雷亚尔的历史新低。

它目前的交易价格约为7.06巴西雷亚尔,与首次亮相相相比有大幅折扣,但与比特币自身从峰值水平回调的情况非常相似。

OranjeBTC是这份清单上最不稳定的名字,应被视为高贝塔值的比特币工具。流动性比既定公司更少。

要看什么

- 比特币每股走势。

- 任何筹集资金或购买新的比特币。

- 潜在的国际上市野心。

- 市值净资产价值(mNav)折扣/溢价相对于比特币的价格如何演变。

5。Hashdex — HASH11 (B3: HASH11)

加密资产管理·巴西领先的加密ETF发行商

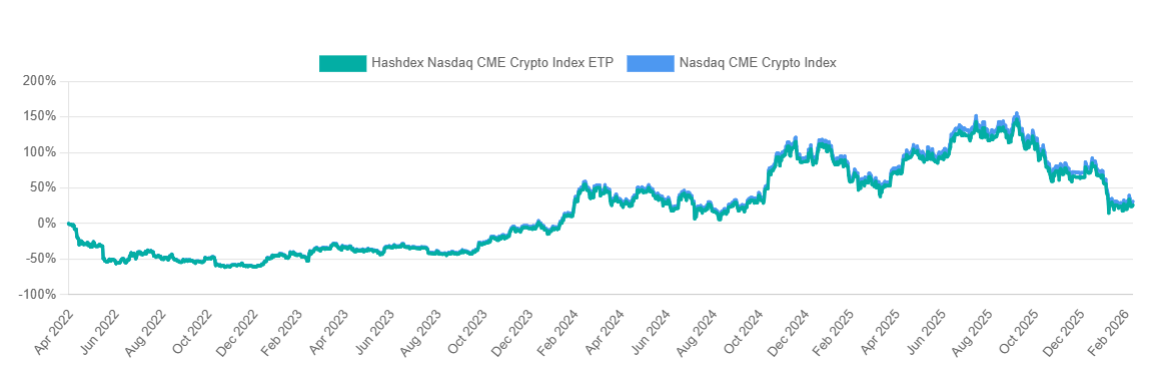

Hashdex 提供了一种不同的加密货币敞口。HASH11 不是单一公司的资产负债表或业务战略,而是一揽子多元化的加密资产,封装在受监管的巴西 ETF 结构中。

巴西拥有22只提供全部或部分加密资产敞口的ETF,其中Hashdex基金吸引了18万名投资者,日交易量平均为5000万雷亚尔。

2025年4月,Hashdex在巴西B3上推出了世界上第一个现货XRPETF(XRPH11),追踪纳斯达克XRP参考价格指数,并将至少95%的净资产分配给XRP。

该公司还经营比特币(BITH11)、以太坊(ETHE11)和索拉纳(SOLH11)的单一资产交易所买卖基金,以及旗舰 HASH11 多资产指数基金。

2025年中期,Hashdex推出了混合比特币/黄金ETF(GBTC11),可动态调整两种资产之间的配置。

对于想要分散加密市场敞口而不是单一资产风险的投资者来说,HASH11 是巴西受监管的股票基础设施最容易进入的入口。

但是,作为一种多资产加密指数,HASH11 仍受数字资产市场的广泛表现的影响。而且,与该清单上的股票名称不同,没有任何运营企业可以创造独立价值。

要看什么

- 加密市场情绪广泛。

- Hashdex产品有可能向美国市场扩张。

- 随着巴西机构采用率的加快,资产管理规模的增长。

- HASH11 与单一资产替代品的相对表现。

接下来要看什么

机构基础设施仍处于早期阶段——德意志交易所的加密金融集团于2026年初进入拉美,自2024年以来,当地交易所已经开设了200多个以巴西雷尔计价的交易对。扩建的节奏将为所有五个名字定下基调。

巴西、墨西哥和智利的监管进展是下一波资本浪潮的关键推动力。任何挫折都会对诸如 OBTC3 和 CASH3 之类的更高测试版本的名字造成最严重的打击。

稳定币交易量是该地区最可靠的实时信号。尽管2025年初全球经济放缓,但拉丁美洲在1月至5月期间的交易量仍为162亿美元,同比增长42%。观察这种势头是否保持不变——重新加速可以提振所有五个势头;逆转同样会给他们带来压力。

USD Dollar saw mild strength in Monday’s session, DXY trading either side of the psychological 104.00 level but again being capped to the upside by the 100-day SMA resistance. The was little in the way of a catalyst with no tier one data released, that will change today with US CPI figures released, which will help market participants and the Fed gauge the timing of the first rate cut. USDJPY was mostly flat for the second straight session, volume was low with Japan away for a holiday.

USDJPY hit a low of 148.94 but failed to stay beneath 149.00 for long as a rise in US yields dragged the pair higher and held it above the key 149 level. AUDUSD rallied through the 0.6525 resistance level, this will be a key level to watch for Aussie traders today to see if it can re-establish itself as support. NZD lagged despite hawkish RBNZ commentary where RBNZ Governor Orr said inflation is still too high, NZDUSD finding resistance at the February highs and dropping to a low of 0.6120.

This also saw AUDNZD have its biggest up day of 2024 hitting a high of 1.0650 and retracing all and then some of Fridays steep drop. Attention turns to the New Zealand inflation expectations and RBA's Kohler both on Tuesday.

USD dipped in Wednesday’s session after the CPI inspired surge on Tuesday. The US dollar index (DXY) hitting resistance at the 105 level and dropping to a low of 104.65. Reports of Fed Chair Powell downplaying Tuesday's hotter than expected CPI along with the Fed's Goolsbee stating US inflation is still consistent with the Fed's path back to target weighing somewhat on yields and the USD.

EURUSD rallied modestly, holding the key 1.07 level where it found support on Tuesday. A soft USD and beats in Q4 employment and industrial production data support the pair. Euro watchers have ECB president Lagarde testifying at the EU parliament later in the session to look forward to.

JPY saw small gains against the USD with lower UST yields across the curve benefitting the Japanese currency. Though with USDJPY still well above the “intervention” level of 150 some jawboning from Japanese officials materialised. Japanese Finance Minister Suzuki saying he is closely watching FX market moves with a strong sense of urgency and currency diplomat Kanda noting he is watching FX moves and will take appropriate actions if needed on FX.

GBP was the G10 underperformer with GBPUSD setting one week lows after cooler than expected UK CPI data. The headline Y/Y maintaining a 4.0% pace, beneath the 4.2% forecast. UK GDP is ahead for Sterling traders where a contraction of -0.2% is expected.

US machine manufacturer Deere & Company (NYSE: DE) announced the latest financial results before the opening bell on Thursday. Deere achieved revenue of $10.486 billion for the three months ending 28/1/24, beating analyst estimate of $10.303 billion. Revenue was down by 8% vs. the same period year prior.

Earnings per share (EPS) reported at $6.23 vs. $5.264 per share estimate. EPS decreased year-over-year by 4.88%. Net income for the quarter reached $1.75 billion.

The company cut net income forecast for fiscal year 2024 from $7.75-$8.25 billion to $7.50-$7.75 billion. Company overview Founded: 1837 Headquarters: Moline, Illinois, United States Number of employees: 82,200 (2022) Industry: Agricultural machinery, heavy equipment Key people: John C. May (Chairman, CEO & President) CEO commentary "Deere's first-quarter performance underscores the effectiveness of our Smart Industrial operating model and the dedication of our workforce, enabling improved performance across economic cycles that surpasses historical benchmarks," John C.

May, CEO of the company commented on the latest results. "Moreover, we remain committed to empowering our customers to improve their productivity and sustainability through ongoing investment in the next generation of solutions, as evidenced by our partnership on satellite communications to expand rural connectivity announced this quarter," May concluded his statement to stockholders. Stock reaction The stock fell by over 5% on Thursday. Shares were trading at around $363.36 a share – the lowest level since 12/12/23.

Stock performance 5 day: -5.49% 1 month: -4.39% 3 months: -3.68% Year-to-date: -8.81% 1 year: -9.51% Deere & Company stock price targets Morgan Stanley: $430 JP Morgan Chase & Co.: $385 Canaccord Genuity Group: $375 TD Cowen: $396 Bank of America: $422.50 HSBC: $486 USB Group: $408 Credit Suisse Group: $551 Stifel Nicolaus: $460 Oppenheimer: $458 Deutsche Bank: $407 DA Davidson: $510 Citigroup: $475 BMO Capital Markets: $425 Wells Fargo & Company: $490 Deere & Company is the 147 th largest company in the world with a market cap of $101.73 billion, according to CompaniesMarketCap. You can trade Deere & Company (NYSE: DE) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs".

GO Markets offers pre-market and after-market trading on popular US Share CFDs. Why trade during extended hours? Volatility never sleeps.

Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Deere & Company, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Cisco Systems Inc. (NASDAQ: CSCO) released the latest earnings results for fiscal Q2 of 2024 after market close in the US on Wednesday. The US telecommunications company achieved revenue of $12.8 billion for the quarter vs. $12.706 billion. Revenue was down by 6% vs. the same period the year prior.

Earnings per share (EPS) reached $0.87, above Wall Street estimate of $0.836 per share. EPS was down by 1% year-over-year. Cisco announced a 3% raise on its quarterly dividend of $0.40 per share for all shareholders on record as of 4/4/24.

For fiscal Q3 of 2024, the company expects revenue in a region of $12.1 to $12.3 billion. EPS expected at between $0.84 to $0.86 per share. Company overview Founded: 1984 Headquarters: San Jose, California, United States Number of employees: 84,900 (2023) Industry: Telecommunications Key people: Chuck Robbins (CEO & Chairman) CEO commentary "We delivered a solid second quarter with strong operating leverage and capital returns," Chuck Robbins, CEO of the company said in a press release. "We continue to align our investments to future growth opportunities.

Our innovation sits at the center of an increasingly connected ecosystem and will play a critical role as our customers adopt AI and secure their organizations," Robbins concluded. Stock reaction Shares were up by 1.29% at the end of Wednesday’s session at $50.28 a share. The stock fell by around 4% in the after-hours trading.

Stock performance 5 day: +0.32% 1 month: -0.74% 3 months: -6.29% Year-to-date: -1.17% 1 year: +3.05% Cisco stock price targets UBS Group: $55 Melius Research: $55 DZ Bank: $50 Rosenblatt Securities: $51 Piper Sandler: $50 Oppenheimer: $54 Tigress Financial: $76 Bank of America: $60 Deutsche Bank: $58 Barclays: $53 Citigroup: $55 Morgan Stanley: $56 Jefferies Financial Group: $59.50 Evercore ISI: $63 BNP Paribas: $45 JP Morgan Chase & Co.: $62 Cisco Systems Inc. is the 54 th largest company in the world with a market cap of $203 billion, according to CompaniesMarketCap. You can trade Cisco Systems Inc. (NASDAQ: CSCO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to ''Trading'' then select ''Share CFDs''.

GO Markets offers pre-market and after-market trading on popular US Share CFDs. Why trade during extended hours? Volatility never sleeps.

Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Cisco Systems Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

American beverage giant The Coca-Cola Company (NYSE: KO) reported the latest financial results before the opening bell on Wall Street on Tuesday. Coca-Cola reported revenue of $10.948 billion (up by 7% year-over-year) for the last three months of 2023 vs. $10.675 billion expected. Earnings per share reached $0.49 (up by 10% year-over-year) vs. $0.489 per share estimate.

The company achieved revenue of $45.8 billion in 2023, up by 6% from 2022. EPS reached at $2.69 per share, up by 8%. Coca-Cola paid a total of $8 billion in dividends in 2023.

Company overview Founded: 1892 Headquarters: Atlanta, Georgia, United States Number of employees: 82,500 (2022) Industry: Beverage Key people: James Quincey (chairman and CEO), Brian Smith (president and COO) CEO commentary "During the year, our people and partners rose to meet new challenges, allowing us to excel globally and deliver in a dynamic world," CEO of the beverage company, James Quincey said in a statement to shareholders. "As we begin a new year, we’re confident that our all-weather strategy, powerful portfolio and harmonized system will continue to create value for our stakeholders in 2024 and for the long term," Quincey looked ahead. Stock reaction Shares were down by 0.87% on Tuesday at $59.18 a share – the lowest since 25/1/24. Stock performance 5 day: -1.55% 1 month: -1.63% 3 months: +3.35% Year-to-date: +0.14% 1 year: -0.97% Coca-Cola stock price targets Citigroup: $68 Barclays: $66 Jefferies Financial Group: $64 Morgan Stanley: $65 JP Morgan Chase & Co.: $62 Bank of America: $60 Royal Bank of Canada: $70 Wedbush: $71 HSBC: $74 Evercore ISI: $70 Deutsche Bank: $63 Wells Fargo & Company: $68 Credit Suisse Group: $70 UBS Group: $70 The Goldman Sachs Group: $62 The Coca-Cola Company is the 39 th largest company in the world with a market cap of $254.80 billion, according to CompaniesMarketCap.

You can trade The Coca-Cola Company (NYSE: KO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: The Coca-Cola Company, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Canadian mining company Barrick Gold Corporation (NYSE: GOLD) reported Q4 2023 financial results before the US market opened on Wednesday. The world's second-largest gold miner achieved revenue of $3.126 billion for Q4 2023, up from $2.943 billion in Q3 2023 vs. $3.128 billion expected. Earnings per share reported at $0.276, exceeding analyst estimate of $0.205.

The company announced a $0.10 per share dividend for all shareholders as of 29/2/24. Company overview Founded: 1983 Headquarters: Toronto, Ontario, Canada Number of employees: 18,421 Industry: Metals and mining Key people: John L. Thornton (Executive Chairman), Mark Bristow (President and Chief Executive Officer) CEO commentary CEO of Barrick Gold, Mark Bristow, had this to say in a letter to shareholders: ''In true Barrick fashion, we kept our focus, dealt with the challenges, progressed our long-term strategic plans and delivered on some of our key objectives.

Most significantly, we have sustained our industry-leading organic growth outlook and are still projecting a 30% increase in gold equivalent3 production by the end of this decade.'' Stock reaction The stock was down by 0.42% during the day on Wednesday after the latest results were announced, trading at $14.09 a share – lowest since 3/11/22. Stock performance 5 day: -5.73% 1 month: -9.54% 3 months: -9.83% Year-to-date: -22.19% 1 year: -18.03% Barrick Gold stock price targets Raymond James: $24 CIBC: $23 BMP Capital Markets: $27 Citigroup: $18 TD Securities: $22 Scotiabank: $25 UBS Group: $23 Jefferies Financial Group: $15 CSFB: $20 Barclays: $28 The Goldman Sachs Group: $22 Fundamental Research: $19.02 Barrick Gold Corporation is the 743 rd largest company in the world with a market cap of $24.77 billion, according to CompaniesMarketCap. You can trade Barrick Gold Corporation (NYSE: GOLD) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform.

To find out more, go to ''Trading'' then select ''Share CFDs''. GO Markets offers pre-market and after-market trading on popular US Share CFDs. Why trade during extended hours?

Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Barrick Gold Corporation, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap