市场资讯及洞察

2025 年,拉丁美洲的加密货币交易量创下了 7300 亿美元。在整个地区,现在有5,770万人拥有某种形式的数字货币 rankingslatam,这一基础的增长速度比世界上其他任何地方都要快

随着机构资本的到来和监管的成熟,这些是投资者最关注的上市股票。

值得关注的拉丁美洲顶级加密股票

1。Nu Holdings(纽约证券交易所代码:NU)

数字银行·巴西、墨西哥和哥伦比亚有1.27亿用户

Nubank可能是拉美金融科技和加密繁荣中最直接的上市代理之一。该公司将加密货币交易直接集成到其Nu应用程序中,并与Lightspark合作嵌入了 比特币 闪电网络可实现更快、更具成本效益的比特币交易。

2025年第三季度,收入同比增长42%,达到41.7亿美元,客户存款增长37%,达到388亿美元,毛利增长35%,达到18.1亿美元。

在过去的一年中,该股的回报率约为36%,在过去三年中,标准普尔500指数的回报率增长了三倍。该公司在巴西占据主导地位,超过60%的成年人使用Nubank。

Nu Holdings最近还获得了有条件的批准,可以推出美国国家数字银行Nubank N.A.。 但是,该公告引发了回调,投资者对资本部署时间表和扩张成本持谨慎态度。

瑞银已将目标股价下调至17.20美元,理由是尽管运营发生了积极的变化,但市场仍持谨慎态度。

要看什么

- 巴西和墨西哥的信贷质量趋势。

- 通过Nubank奖励加快采用USDC的速度。

- 美国银行章程时间表和早期成本披露。

2。MercadoLibre(纳斯达克股票代码:MELI)

电子商务/金融科技·拉丁美洲18个国家

MercadoLibre并不是纯粹的加密游戏,但Mercado Pago(其金融科技部门)已成为拉美最重要的金融领域之一。该公司在其资产负债表上持有约570个比特币,以对冲地区通货膨胀,并发行了自己的与美元挂钩的稳定币Meli Dólar。

Mercado Pago的2025年全年净收入达到126亿美元,同比增长46%,而总支付额达到2780亿美元,增长41%。金融科技月活用户连续十个季度增长近30%,信贷组合同比增长近一倍,达到125亿美元。

MercadoLibre 面临的问题是盈利能力。总体利润率压缩了5-6%,这归因于对免费送货、信用卡扩张、第一方商务和跨境贸易的持续投资。

该股在过去六个月中下跌了约14.5%,市场对该股的定价围绕管理层设定的进入2026年的深思熟虑的投资阶段进行了重新定价。

长期的理由仍然令人信服。Mercado Pago已在其核心市场推出了加密资产管理和保险产品,将其定位为与其说是电子商务公司,不如说是内置加密基础设施的全面数字银行。

要看什么

- Mercado Pago贷款损失趋势和信贷组合质量。

- 通过其支付网络进行稳定币整合和加密交易量。

- 阿根廷信用卡的推出能否实现盈利。

3.Méliuz (B3: CASH3.SA)

金融科技/比特币国库·巴西第一家上市的比特币财资公司

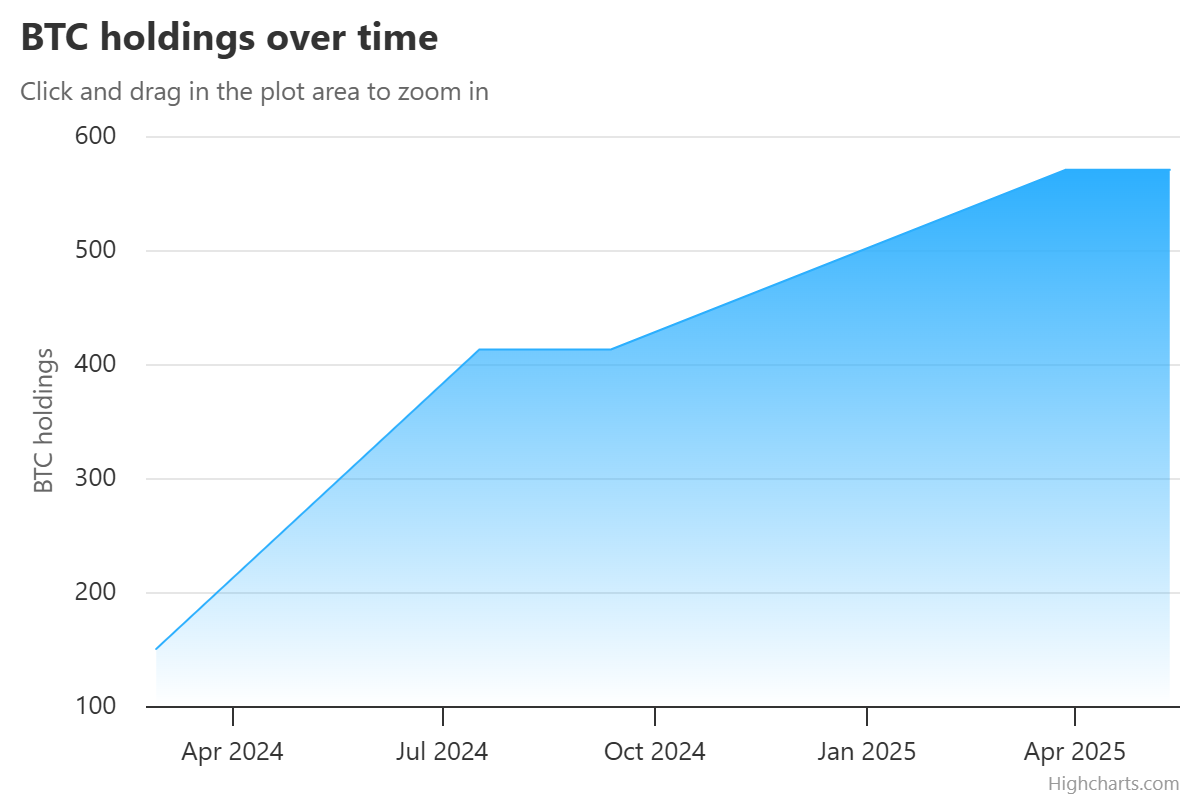

Méliuz是拉美企业比特币资金趋势的最直接股票表现形式。2025年初,Méliuz成为拉丁美洲第一家正式采用比特币国库战略的上市公司,获得股东批准,将现金储备分配给比特币积累。

Méliuz没有发行以美元计价的廉价债务来购买比特币,而是使用股票发行和运营现金流。该公司还出售比特币的现金担保看跌期权以产生收益,这是一本从日本比特币财资公司Metaplanet借来的剧本,将80%的比特币持有量保存在冷库中

CASH3 本质上是比特币敞口的杠杆工具,在牛市周期中大量捕捉上行空间,但在下跌过程中会产生更大的波动性,尤其是在涉及债务的情况下。

比特币战略宣布后,该股在2025年5月飙升了约170%。 但是,此后它已回落至2025年4月的水平,广泛追踪了比特币的价格走势并强调了该股的波动性。

要看什么

- 比特币的价格方向。

- 比特币每股指标。

- 扩大产量生成策略

- 任何国际股票上市的举措。

4。oranjeBTC (B3: OBTC3.SA)

Pure-Play 比特币宝库·拉美最大的企业比特币持有者

Méliuz是一家同时持有比特币的金融科技企业,而OranjeBTC恰恰相反:一家以比特币积累为宗旨的公司。

该公司通过与教育公司Intergraus的反向合并,于2025年10月在B3上市,这标志着一家商业模式完全以比特币积累为中心的公司首次公开亮相。

OranjeBTC目前持有超过3650个比特币,并筹集了近3.85亿美元的比特币,这得到了包括温克莱沃斯兄弟、亚当·巴克、FalconX和里卡多·萨利纳斯在内的知名投资者的支持。

其2.1亿美元的一轮融资由巴西最大银行的投资部门Itaü BBA牵头,这是一项重要的机构信任投票。

2026年,OBTC3 今年迄今已下跌约32%,是两只巴西比特币库存股中受打击最严重的股票。 该股在上市日(2025年10月7日)创下29.00巴西雷亚尔的历史新高,在2026年2月创下6.06巴西雷亚尔的历史新低。

它目前的交易价格约为7.06巴西雷亚尔,与首次亮相相相比有大幅折扣,但与比特币自身从峰值水平回调的情况非常相似。

OranjeBTC是这份清单上最不稳定的名字,应被视为高贝塔值的比特币工具。流动性比既定公司更少。

要看什么

- 比特币每股走势。

- 任何筹集资金或购买新的比特币。

- 潜在的国际上市野心。

- 市值净资产价值(mNav)折扣/溢价相对于比特币的价格如何演变。

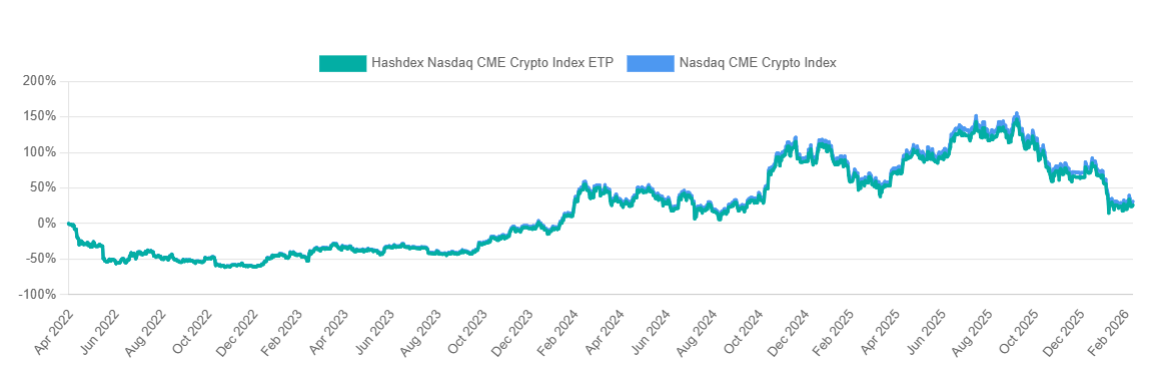

5。Hashdex — HASH11 (B3: HASH11)

加密资产管理·巴西领先的加密ETF发行商

Hashdex 提供了一种不同的加密货币敞口。HASH11 不是单一公司的资产负债表或业务战略,而是一揽子多元化的加密资产,封装在受监管的巴西 ETF 结构中。

巴西拥有22只提供全部或部分加密资产敞口的ETF,其中Hashdex基金吸引了18万名投资者,日交易量平均为5000万雷亚尔。

2025年4月,Hashdex在巴西B3上推出了世界上第一个现货XRPETF(XRPH11),追踪纳斯达克XRP参考价格指数,并将至少95%的净资产分配给XRP。

该公司还经营比特币(BITH11)、以太坊(ETHE11)和索拉纳(SOLH11)的单一资产交易所买卖基金,以及旗舰 HASH11 多资产指数基金。

2025年中期,Hashdex推出了混合比特币/黄金ETF(GBTC11),可动态调整两种资产之间的配置。

对于想要分散加密市场敞口而不是单一资产风险的投资者来说,HASH11 是巴西受监管的股票基础设施最容易进入的入口。

但是,作为一种多资产加密指数,HASH11 仍受数字资产市场的广泛表现的影响。而且,与该清单上的股票名称不同,没有任何运营企业可以创造独立价值。

要看什么

- 加密市场情绪广泛。

- Hashdex产品有可能向美国市场扩张。

- 随着巴西机构采用率的加快,资产管理规模的增长。

- HASH11 与单一资产替代品的相对表现。

接下来要看什么

机构基础设施仍处于早期阶段——德意志交易所的加密金融集团于2026年初进入拉美,自2024年以来,当地交易所已经开设了200多个以巴西雷尔计价的交易对。扩建的节奏将为所有五个名字定下基调。

巴西、墨西哥和智利的监管进展是下一波资本浪潮的关键推动力。任何挫折都会对诸如 OBTC3 和 CASH3 之类的更高测试版本的名字造成最严重的打击。

稳定币交易量是该地区最可靠的实时信号。尽管2025年初全球经济放缓,但拉丁美洲在1月至5月期间的交易量仍为162亿美元,同比增长42%。观察这种势头是否保持不变——重新加速可以提振所有五个势头;逆转同样会给他们带来压力。

热门话题

2023年尾中国股市开始大跌,整个市场进入了至暗时刻。究其原因,首先外商对中国市场失去信心,导致中国外资大量且迅速地撤出是中国股市在2023年底开始大跌的主要原因之一,早在2023年中的时候外国资金便已经陆续开始净流出了,基于对中国经济长期增长放缓担忧,政治局势变幻莫测带来的极大风险,使得外国资本对中国市场失去信心,对指数形成压制,外资不断从A股流出,据统计截至年底外资净流出已达687亿美元,市场的恐慌情绪不断扩大从而引起羊群效应,大家纷纷开始抛售股票。再者,MSCI指数调整带来的不确定性,以及量化产品引发大众纷纷开始集中抛售中小市值股票。

2024年2月中国发布一系列救市政策,各个指数开始回升。自二月伊始,中国政府频繁出击发布一系列举措来挽救股市,2024年2月7日,中国股市监管机构承诺防止 “市场异常波动” ,中国于2月7日意外更换证监会主席为吴清。吴清,一位素来有 ‘券商屠夫’之称的新任掌门人。证监系统出身的他,有着十分丰富的金融监管经验,在其任职证监会监管相关工作期间作风十分强硬,处置过多家违规证券公司。这是一个很有意思的举措,不难看出中国政府在向市场参与者传达一个十分明确且强烈的意愿:“金融市场监管改革,我是认真的。”那么现在我们回归k线图来看,日线级别上在当天最终以一根大阳线收盘,期间最大涨幅甚至超过1%。并且在除息日当天就处置了63位招商证券员工并合计处罚8173万元,行动之迅速可见其大刀阔斧改革之决心,可以说是完全没有辜负他这令金融界闻风丧胆的名声了。但效果也十分显著,这些举措的确有效稳定了市场的情绪,股民开始对中国股市重拾信心。

与此同时中金发布公告肯定目前A股的市场配置价值并且扩大ETF的增持范围,适时传递出了稳定市场的信号。自开年以来整体ETF市场已经迎来高达3698. 68亿元的资金净流入。基于自2010年至2023年的历史数据来看,五大指数走势基本一致,均在春节前后有不同程度的涨幅,再加上本次春节期间利好消息不断发布,新年伊始自2月20日起,证监会新任主席吴清就已经针对加强资本市场监管、防范化解风险、推动资本市场高质量发展等问题与各级市场参与者展开了会谈,证监会所传达出的未来工作重点将会是:1.提高上市公司质量,2.加强上市公司的全过程监管,3. 加强证券公司和公募基金监管,4. 加强对融券业务的监管以打击恶意做空。同时在座谈会之后一大明显的变化是证监会允许微信用户在其公众号下方发表评论。这些举措对市场产生了较为积极明显的信号,证监会广开言路的态度,以及强烈的维护市场稳定和坚守监管主责的决心非常成功地稳定了广大投资人的信心。可以说新官上任这三把火烧的还是很深得人心的,2月23日,上证指数持续反弹态势,沪深指数重新守在3000点上方并且实现了8个交易日连续收阳。打击融券业务方面也初见成效,融券余额目前已下降24%至637亿元。同时A50与HK50也连续三天收阳足以说明市场情绪得到了有效的稳定。新年前后A股市场初步显露回升迹象,并呈现出了外资回流加仓A股的变化,截至2月28日收盘,北向资金2月净买入额已达到441.41亿元,已实现连续8个交易日净买入。MSCI指数调整方面并没有太大的变化,A股依旧保持着20%的纳入因子比例,总市值占比也并没有过大变化。技术形态分析目前看来这一系列的举措对目前的市场产生了较为积极的影响,China50和HK50逐渐迎来修复行情,各项政策的发布,经济渐趋稳定复苏,以及市场情绪在中国政府的救市努力下已逐渐恢复积极态度,市场对金融市场监管政策改革的积极响应以及对经济回升预期的逐渐升温,投资情绪日渐恢复,大家可以持续关注开始寻找入场机会了。同时现在市场上的积极情绪也可在k线图中有所印证,技术形态上恒生指数目前已逐渐显露出形成底部形态的节奏,在16427是一个非常重要的支撑阻力互换位,可静待时机待其守住颈线之后适时寻找交易机会。

(Source: TradingView)CHINA50技术形态与恒生指数走势相似,11645为其关键支阻互换位,需要关注其拉回该位置时是否能够站住再择机布局建仓。

(Source: TradingView)免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Olivia Huang | GO Markets 悉尼中文部

热门话题

我承认,每天早上睡觉起来,打开手机,看到钱又多了,多了一套首付,在2024年的这2个多月,很多人做到了。甚至,一天醒来多了套悉尼豪宅的人,我也见到了。2024年,金融市场注定充满神话。因为,我们在新旧交替的尾声。旧世界,还在运转,新世界的财富,已经以几何倍速增加。

新世界,链接全球的人,也连接了全球的数据。连接了过去数十年的数据,这些数据包含了全人类在几千年留下来的所有资料。这就是新世界,跨越时空,跨越种群。农业社会,价值靠人们的劳动,汗水,靠着粒粒皆辛苦,创造出来。工业社会,价值靠燃油机的推动,通过机器放大了力量,将一个人的劳动,变成了一个可以使用物理工具的工业行为价值。信息社会,价值靠信息快速传递,通过互联网和物联网自动化,将一个人的劳动或行为,快速传递到每一个终端,人类第一次跨越了物理障碍,第一次触碰到了空间。

AI社会,人类第一次触碰到了时空。那是过去千年文明的精华与糟粕,是所有互联网记忆的结果。最终,价值由数据和逻辑自行生成,演变,我们成为了“造物主”,在虚拟的世界里,产生了一个又一个生态。这种生态不一定是碳基,也不一定是硅基,但是他们可以自行分裂,成长,就像细胞一样,在电磁与量子的世界里,绽放出世界的未来。

就如同2000年互联网泡沫一样,大家对今天的AI,也是充满了好奇,与谨慎。而互联网真正腾飞的时间,并不是在2000年。正如当下的资本市场,对AI充满热情,但是群众还在忧郁。新旧的交替,很快会随着下一代人长大,成年,而在几年间迅速更迭。我们清楚的知道,2000年互联网成为了泡沫,是因为当时30岁的人,出生于1970年,世界上最强有力的劳动和智慧群体,并没有从小接触过电脑。对他们来说,互联网,很虚幻,很陌生。正如2024年的AI,1994年的人们,小时候刚刚知道扫雷,纸牌游戏。而我们看2000年出生的孩子们,从小是抱着iPad长大,刚出生就可以拍抖音,帮家里分担经济问题,创收能力远超父母。对他们来说,二次元是正常的,元宇宙是和全世界聊天交朋友的地方,就和我们现在使用微信一样。对他们来说,AI,太正常了,虚拟现实,那就是这个世界的真理。

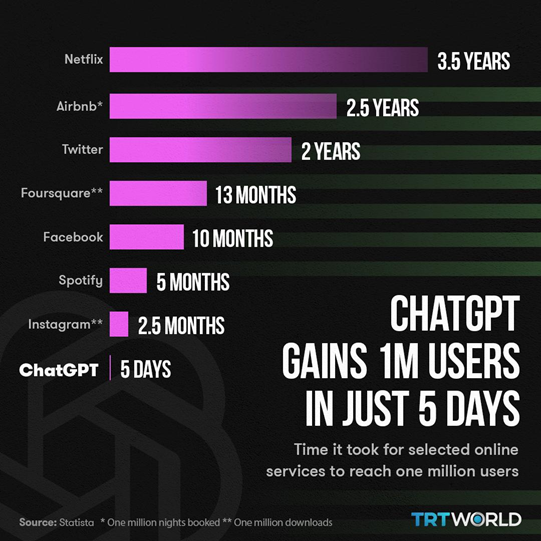

2023年,Threads产品5天使用人数破亿,超越ChatGPT史上用户增长速度最快的消费级应用程序。曾经,破亿,iTunes 用了 6 年半、Twitter 用了 5 年、Meta(Facebook)用了 4 年半、WhatsApp 用了 3 年半,Instagram 则花了 2 年半,TikTok 用了 9 个月。ChatGPT用了2个月。这就是新世界的速度。5天,相当于旧世界(互联网时代)的5年。希望能够震撼到你,无论你30,40,50,60,70,80,90,100岁,你很幸运,我很幸运,我们站在时代的拐点,已经搭上了新时代的速度,那不是马车,不是火车,不是飞机,不是高铁,也不是互联网的速度。正如过去历次的更迭,这一次的超越,就好比火车替代了马车。

你还觉得AI远么,在去年的今天,全球已经有1亿人使用了ChatGPT。而我在去年的2月份网课中,询问ChatGPT,未来涨势最好的股票是谁,ChatGPT回答说是英特尔。而从去年至今,英特尔股价上涨6倍。如果我们拿出来1000澳币零花钱,用个3倍杠杆,目前是1.8万澳币。这就是AI的力量。

资本市场的狂欢,是押注全人类新时代的革命,终将胜利。3年后,比特币的价格,英伟达的价格,AI各类股票的价格,会将亚马逊,苹果30年的价格走势,浓缩到3年,这就是新时代的速度。这是一个遍地黄金的时代,是属于下一代的时代,我们都只是时代的引路人。真正的百家争鸣,是我们的下一代带来的,是那些从小拍抖音,从小用ChatGPT的孩子们带来的。某特/币的价格从2024年1月1日的42,265美元飙升至2024年3月4日68,537美元,涨幅接近 62%。纳斯达克指数在上周四创历史新高。科技盛宴,还没有结束。

对于普通投资者,最好的方法,就是定投纳斯达克。既然不懂,就用最简单的方法,交给全世界最优秀的100家公司,让他们卷去,我们躺赚。还在投澳股的朋友,还不配置美股资产么?配置不是All In,定投全世界最好的。除非你认为澳洲在全世界会有竞争力。高昂的人工成本,税率,高昂的创业试错成本,无法批量产生规模效应的人口数量,没有交通优势的独立大陆,势必在科技领域难有作为。所以,我建议大家,配置一些纳斯达克指数。定投,不要All In。担心美股太高的,那都是伪命题。美股代表的,是全世界人类的科技和生产力。价格高高低低很正常,但是长期看,只要人类不内战,美股最终都会创出新高。免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题

最近几周,随着AMD, 英伟达,以及微软等科技股再次引领股市,加上比特币重新冲上6万美元大关,全球投资者的热情再次被点燃,此时此刻,几乎所有的投资者都不再顾虑目前依然在高峰的美元利率,也不再去关心什么时候降息。相比较降息那可怜的0.25%, 在芯片股一天20%上涨的疯狂下,什么高利息,什么降不降息,都不再重要。

英伟达12个月走势图*我本人在去年多次和周围朋友说,如果2024年你担心害怕,就存银行3年定期,澳元5%一年的利率,3年也可以给你带来15%的回报。而如果你愿意承担一定的风险,那绝对就应该考虑美股,如果你不知道选什么,那就直接买美股指数基金。目前仅仅只是第一季度,美股的疯狂走势已经开始,似乎预示着2024年注定是一个不平静的年份。

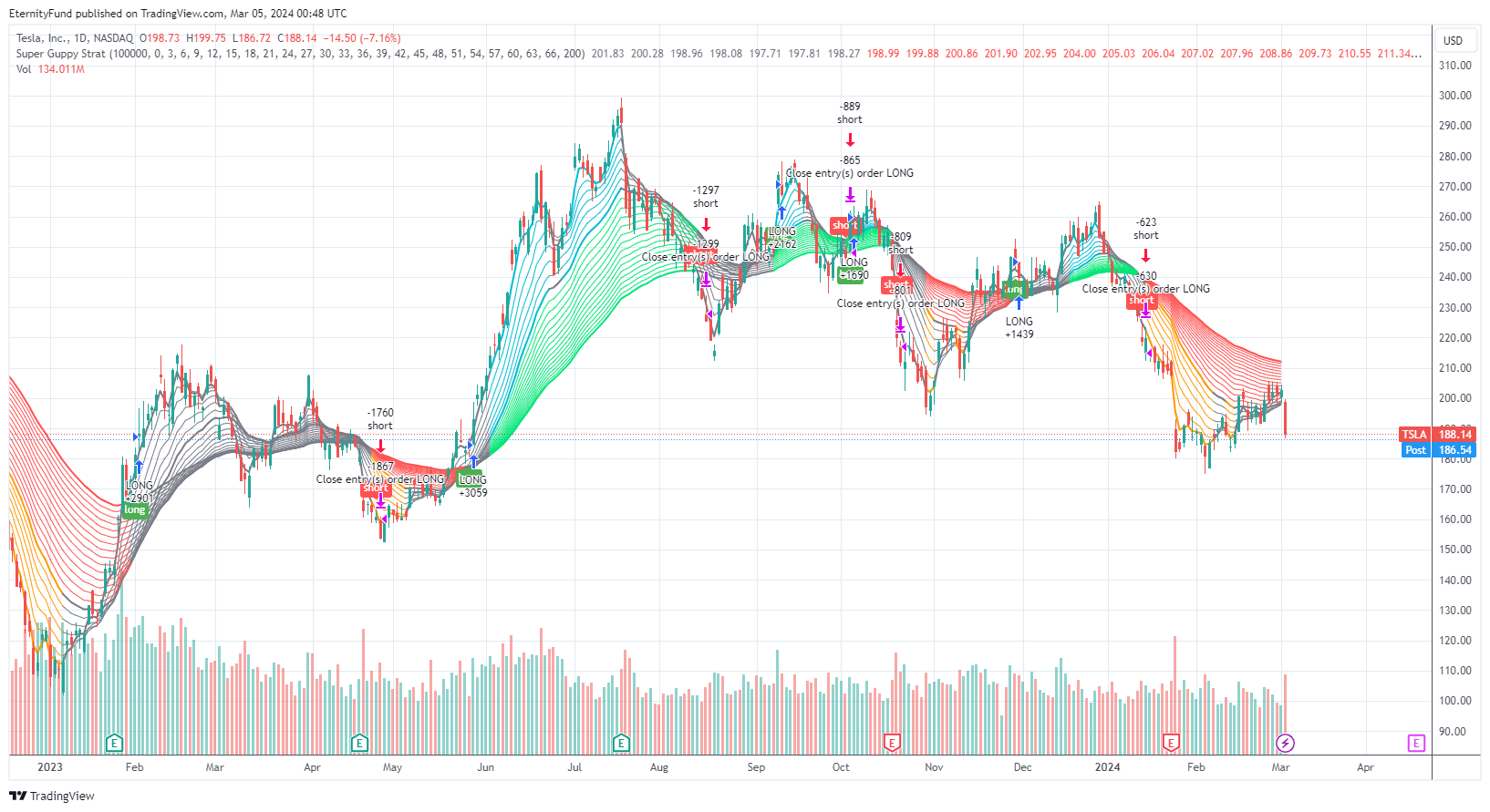

纳斯达克12个月走势图*但是,我得和大家泼一盆凉水。巴菲特名言我得再用一下:别人恐惧我贪婪,别人贪婪我恐惧。当人人都陷入疯狂,觉得现在不杀进去对不起祖宗的教诲时,这时你就得好好考虑一下,如果连身边卖菜的大妈,看门的大叔,或者开出租车的小哥都准备杀进某一个产品时,那是不是就快要到庄家考虑收网的时候了?当然我并不是说大跌马上要开始,但是我得提醒大家,越是市场火热的时候,我们越需要有一颗冷静的心。好了,前言说完了。今天我们再来说说特斯拉,但是这次的角度有些不同。我们都知道过去一年最火的产业就是AI和人工智能。从OpenAI的股东微软,到AI芯片厂AMD, 英伟达和台积电,甚至到专业流量蹭王META,都达到或者几乎达到自己股价的新高。于此同时,曾经作为金融市场里流量一哥的特斯拉,在过去一年股价却疯狂下跌了30%,这是因为特斯拉不行了?

在我看来,也许特斯拉销量会有所起伏,但是我们要明白一点,特斯拉并不是一个简单的电动车企业,于其说它是一个新能源汽车品牌,到不如说是一个表面上卖汽车的AI企业。

特斯拉12个月走势图*我在去年和前年针对特斯拉的分析里已经明确说到,特斯拉的盈利除了来自目前的电动车销售以外,另一个其核心卖点就是车载软件不断的自我学习以适应更好的自动驾驶或者仅仅只是变速跟踪巡航。只要使用过特斯拉Autopilot 的朋友们应该有很强的感受,即便是免费没有升级的版本,也远远比宝马奔驰的定速巡航保持车道功能更顺滑和准确。其实这就是因为特斯拉的车载电脑从所有特斯拉摄像头拍到的数据里在不断学习和进化。

而特斯拉未来随着车辆的不断普及和不断自我学习,其实可以几乎长期在汽车软件的智能级别里保持领先。并且更为重要的是,如果未来特斯拉需要借助外部电脑来运算某一个方程,那其全世界几百万辆汽车,都是它几百万台可以远程计算的电脑。目前AI上市公司很大程度上衡量股价的一个重要因素就是这个公司的AI总算力。而大家似乎忽略了特斯拉惊人的总销售量,和其总算力是在不断增加的。在最近马斯克说到随着AI的不断提升,其所计算需要的电力也会随之增加。因此未来谁掌握了AI的算力,谁就可以影响这个行业。

我们暂且不谈这是不是最大的因素,但是最少是一个主要因素。而按照目前特斯拉的销量,在全世界范围内依然没有其他品牌可以在电动车领域于其抗衡。也许比亚迪在中国已经超越特斯拉,但是要在主要的美国和欧洲市场超越特斯拉,目前短期内还不太可能。我对特斯拉的长远看好,并不是仅仅是因为其在电动车领域里的占有率,更重要的一点,就是未来特斯拉凭借车载电脑以及云联网能力所积累下来的恐怖的AI总计算能力,如果把特斯拉的AI属性这一点也计算在其股票价值里,那特斯拉的未来的股价还有很大潜力。免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

热门话题

去年上半年,我们就开始谈论布局核能相关的股票。其中最重要的原因之一是在新能源转型过程中,唯一能够满足过度能源需求的是核能。而ChatGPT的出现,则彻底掀起了AI火爆热潮。虽然表面上看,AI与能源似乎没有直接关系,但仔细分析后,我们会发现能源可能成为AI的终极利好。文明的划分也是以对能源的掌握为基准的。

在上周,戴尔透露了英伟达B200将于明年发布的消息,其功耗将高达1000W。马斯克也曾表示,目前美国存在芯片短缺,一年后可能会出现变压器短缺,大约两年内可能会出现电力短缺。无论是电动车的普及所需的新能源转型,还是AI发展所需的高效能源,都彰显了能源利用方式的进化。而在芯片短缺之后,人工智能市场也即将面临电力荒。

受益于AI服务器需求的激增,全球最大的服务器制造商之一戴尔在最新财季实现了超预期的营收,股价在过去12个月内上涨了一倍以上。据戴尔公司首席运营官Jeff Clarke透露,英伟达将于2025年推出搭载“Blackwell”架构的B200产品,其功耗可能高达1000W。此外,戴尔的旗舰产品PowerEdge XE9680机架服务器采用了英伟达GPU,是该公司历史上速度最快的解决方案。目前,英伟达尚未透露Blackwell架构的详细信息。从芯片制造的角度出发,参考散热的基本经验法则(每mm²芯片面积最高散热量为1W),英伟达的H100功耗约为700W(包括HBM内存功率在内)。考虑到芯片裸片的面积大小为814mm²,每平方毫米的功耗实际低于1W。这意味着,B200的功耗将比H100增加40%以上。有分析认为,H200可能会采用另一种性能增强的工艺技术,比如3nm级的工艺技术。并且考虑到芯片消耗的功率以及所需的散热量,B100可能会成为英伟达的第一个双芯片设计的GPU,从而具有更大的表面积用于散热。

除了芯片设计对能源的要求外,AI和高性能计算应用还需要平衡FLOPS的高功率需求和释放的热能。FLOPS是每秒浮点运算次数的缩写,通常用于衡量硬件性能。这正是戴尔Blackwell处理器的优势所在。Clarke表示,英伟达下一代AI将在明年的B200上实现。然而,B200并未出现在英伟达去年10月份发布的技术路线图中。目前,英伟达也还未公布B100的详细信息,但可能会在本月晚些时候即将举行的开发者大会上释出相关细节。

随着人工智能技术的发展,市场对芯片的需求激增,但随之而来的是电力需求的增加。人工智能领域的蓬勃发展几乎重塑了数据中心市场。据相关数据显示,十年前全球数据中心市场的耗电量为100亿瓦,而如今1000亿瓦已经十分常见。尽管人工智能目前只占全球数据中心规模的一小部分,但根据美国Uptime Institute的预测,到2025年,人工智能业务在全球数据中心用电量中的占比将从2%增至10%。有策略师分析认为,AI技术发展利好能源股。越来越多的人开始意识到,大型人工智能服务器群将需要大量能源,这引起了一些投资者将投资范围扩大至电力、油气等相关领域的兴趣,甚至开始关注核能。马斯克此前也对未来能源前景表示担忧。去年年底,他在一档播客节目中表示,美国目前存在芯片短缺,一年后可能会出现变压器短缺,大约两年内可能会出现电力短缺。有媒体报道称,美国目前的变压器需求主要依赖进口。随着向更清洁的电力系统转型,电网不断扩容,对变压器的需求将激增。如果不采取进一步行动,到2030年美国将面临一道难以逾越的国内供应缺口。

综上所述,能源争夺战将推动能源板块的上涨。然而,传统能源如煤炭、天然气和原油短期内难以大幅上涨。由于国际局势的不确定性,传统能源在控制通胀道路上并未呈现一边倒的趋势。无论是油价还是煤炭,更不用说天然气的价格,都已明显回落。未来可能会广泛应用的清洁能源如氢能源距离低成本商业化生产尚有距离,而被压制了十几年的核能,正可作为最完美的过渡能源清洁能源。免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师

热门话题

Meta Platforms 正在筹划于7月推出其人工智能技术的最新迭代——Llama 3,这个模型主要提升对敏感话题的回应质量,使其能够提供更加精准的解答。这一步骤标志着 Meta 在其大型语言模型(LLMs)上将迈出的重要一步,力图让这些模型能够更加灵活地处理各种问题,包括那些目前可能被视为有争议或不恰当的问题。正当谷歌因其 Gemini AI 生成的历史图片存在准确性问题而暂停此功能时,Meta 加速推出 Llama 3 的决定展现了其在市场有着很强的竞争性。

Meta 目前使用的 Llama 2 模型在其社交平台的聊天机器人上运行时,展现出了一定的局限性,比如它会回避对某些较不敏感问题的回答,例如如何执行恶作剧或如何破坏汽车引擎。然而,Llama 3 旨在突破这些限制,通过在适当的语境中理解并回应此类查询。此外,Meta 还计划通过建立一个专门负责语气和安全培训的内部团队,来增强模型的管理,确保 AI 提供的回应既负责任又具有细腻度。Meta 对其 Llama 模型的开放性策略,与某些专有模型相比,表现得格外明显。Llama 1 免费提供给研究机构仅限非商业使用,而 Llama 2 则在开放许可下发布,允许不超过7亿月活跃用户的组织进行商业使用。这种做法与首席执行官马克·扎克伯格关于通过开放获取来防止 AI 技术高度集中的愿景相吻合。尽管尚未有具体说明,但预期 Llama 3 也将遵循这种开放和易于获取的策略。扎克伯格还提到,通过开发 Llama 等 AI 项目,Meta 致力于实现人工通用智能(AGI)的长期目标。尽管 Llama 3 不被期待即刻实现 AGI,但其开发是向创造具备全面智能模型迈出的关键一步。Meta 对多模态 AI 功能的重视也预示着 Llama 3 可能集成视听数据处理,进一步提升其功能,为构建更全面的 AI 系统铺平道路。

Meta 在 NVIDIA H100 GPU 上的巨额投资显示了其对推动 AI 技术发展的坚定承诺。这一投资有望显著提高 Llama 3 与其前身 Llama 2 相比的性能,通过加强预训练并可能提高模型规模和上下文处理能力。与此同时,虽然 Llama 2 已展现出与更大模型(如 GPT-3 竞争)的能力,Meta 计划将 Llama 3 定位为 AI 技术的领先者,预计在某些领域超越 OpenAI 的 GPT-4。这表明 Meta 致力于向开源 AI 社区提供先进技术,并推动 AI 模型能力的拓展。随着 AI 领域持续进步,Llama 3 的发布为各类应用提供了新的创新和竞争机会,从提高聊天机器人的智能到开发更复杂的 AI 驱动解决方案。Meta 与 Hugging Face 及 IBM Watson 等机构的合作强化了 AI 社区内部的合作,其目的是提高和扩展 AI 技术的能力,以确保企业能够利用这些进步优化客户体验和提高运营效率。

(Source:TradingView)目前Meta的股价处于一个高位震荡的阶段,今年年初实现了36%左右的上涨。而新的模型即将问世,也会对其股价可能有着推动作用。目前看来,上方仍有空间,投资者们适合适当回调入场。AI模型百花齐放的现在,哪一款是你的菜呢?免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 悉尼中文部

The largest financial services company in the world, Visa Inc. (NYSE: V), released the latest earnings results for Q1 of fiscal 2024 after the market closed in Wall Street on Thursday. The US company reported revenue of $8.634 billion (up by 9% year-over-year) vs. $8.554 billion expected. Earnings per share reported at $2.41 (up by 11% year-over-year) vs. $2.339 per share estimate.

Company overview Founded: 1958 Headquarters: One Market Plaza, San Francisco, California, United States Number of employees: 26,500 (2022) Industry: Payment cards services Key people: Ryan McInerney (CEO), Alfred F. Kelly Jr. (Executive Chairman), Oliver Jenkyn (Group President & Global Markets), Kelly Mahon Tullier (Vice Chair & CPO), Chris Suh (CFO) CEO commentary "Our 2024 fiscal year is off to a solid start. In our first quarter, net revenues grew 9% and GAAP EPS grew 20%, driven by relatively stable growth in overall payments volume and processed transactions, plus strong growth in cross-border volume.

Consumer spending remained resilient. Looking ahead, we continue to see significant opportunities across consumer payments, new flows and value added services," CEO of Visa, Ryan McInerney, said in a press release to investors. Stock reaction Shares of Visa ended Thursday up by 0.35% at $272.61 a share.

The stock dipped in the after-hours by around 3% after the latest financial results were released. Stock performance 5 day: +1.67% 1 month: +4.69% 3 months: +17.87% Year-to-date: +4.71% 1 year: +21.32% Visa stock price targets Citigroup: $306 Mizuho: $265 KeyCorp: $300 UBS Group: $305 Jefferies Financial Group: $295 BMO Capital Markets: $280 Barclays: $278 Raymond James: $287 Wedbush: $270 Oppenheimer: $252 HSBC: $266 JP Morgan Chase & Co.: $293 Wells Fargo & Company: $270 Credit Suisse Group: $275 Visa Inc. is the 13th largest company in the world with a market cap of $560.26 billion. You can trade Visa Inc. (NYSE: V) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform.

To find out more, go to ''Trading'' then select ''Share CFDs''. GO Markets offers pre-market and after-market trading on popular US Share CFDs. Why trade during extended hours?

Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Visa Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap