市场资讯及洞察

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

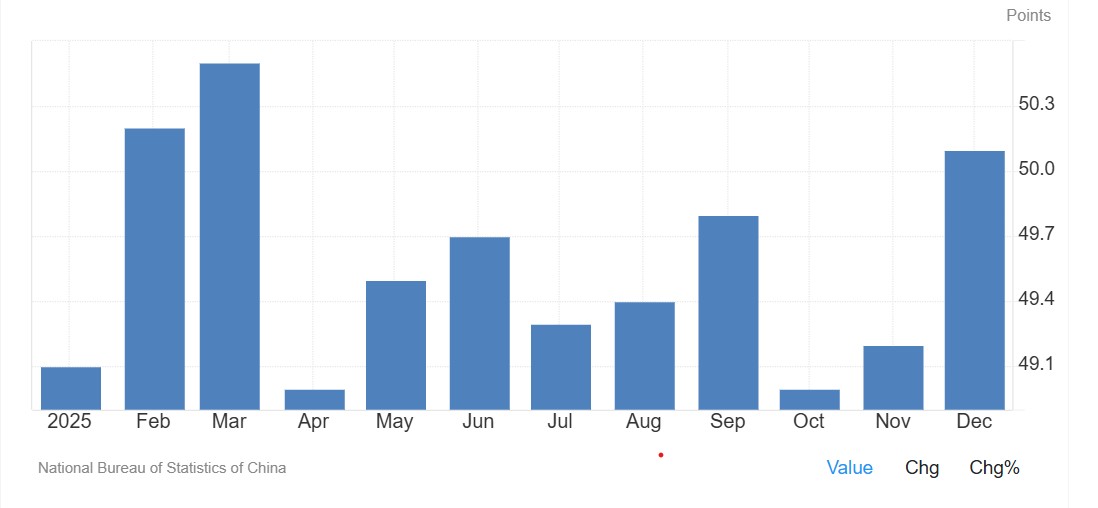

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

USD was firmer on Thursday, largely due to a rally in treasury yields with the DXY tracking the 10 year yield higher to a peak of 102.470 after bouncing off the psychological 102 support level. US data was mixed with Unemployment claims and current account figures coming in worse than expected, but this was offset by a beat in Existing home sales. There was a selection of Fed speakers, with the Chair Powell headlining.

Little new was revealed with Chair Powell re-iterating the FOMC broadly feels it will be appropriate to raise rates again this year which surprised no-one. GBP was volatile after the BoE somewhat surprised markets with a larger than expected 50bp hike, going into the meeting a 25bp was the favoured outcome by economists, but a 50bp was partially priced in so not a totally unexpected move from the BoE. The bank also maintained guidance further tightening would be required if there was more evidence of persistent inflation.

Post decision GBPUSD hit a high of 1.2838 in a knee jerk reaction before reversing the move and eventually hitting lows of 1.2728 in similar price action we saw after Wednesdays hotter than expected CPI figure. GBP price action is indicating the market feels further hawkish re-pricing of BoE action is limited, with fears that the current projected path will lead to recession in the UK weighing on the Pound and Cable will struggle to breach the major resistance at 1.28. CHF was lower vs the USD after seeing weakness in the aftermath of the SNB rate decision where the SNB hiked by 25bps disappointing some market participants who were looking for a 50bp move.

The SNB did note however that additional rate hikes will be necessary. After an initial spike lower to test the 0.8900 support zone, USDCH reversed course, hitting a high of 0.8973 before finding some selling. JPY was the G10 underperformer with USDJPY printing a fresh 2023 high of 143.22 after breaching the key 142.50 level, with a CPI report coming up today, another close above this level could see a technical continuance to test the 145 level.

Recent Fed speak has also raised the issue that US treasury yields are likely to continue to rally, increasing the rate differential between US10Y and JGBs which will also be a major tailwind to get the pair to 145, which is where the BoJ's November USDJPY intervention was launched. Todays calendar of major risk events below:

A raging US equity market fuelled by soft data, a drop in treasury yields and blowout earnings from NVDA (which saw its stock price hit an all-time high) saw risk-on trading through Wednesdays session. USD was choppy on Wednesday with an initial rally in DXY, which saw it briefly pierce the major resistance at 103.60, dramatically reversing course on big misses in US Manufacturing and Services PMIs which showed the US economy contracting faster than forecast. DXY hovering just above lows of 103.30 at the close after the earlier rally (driven by EUR weakness after their own PMIs disappointed) saw a high of 103.980.

AUD and NZD were among G10 outperformers, with AUD benefitting more from the risk-on sentiment outperforming the NZD to see AUDNZD hit a 10 day high of 1.0846. Rallies in iron ore and gold prices also helping the AUD. AUDUSD continued its bounce from the 0.6400 support level to highs of 0.6482, the next key level is the big figure at 0.6500 which until recently had been major support and now likely to be the next resistance level and certainly a key level to watch.

GBP was the G10 underperformer as dire PMI readings saw the Sterling Bears in charge. Services and Manufacturing figures all sharply declined, slipping into contractionary territory. GBPUSD printed a low of 1.2616 after the figures after hitting a high of 1.2717 earlier in the session.

GBPUSD did bounce back to regain the key 1.2700 level in the US session though, recouping most of its losses on positive risk sentiment and the USD slide on its own weak PMI figures. JPY outperformed with tumbling US treasury yields saw rate differentials tighten, taking the pressure off the USDJPY. USDJPY crashed below the key “intervention” level at 145 after printing an earlier high of 145.89.

The Yen was also supported by a beat in Japanese PMI data. The next big data point for Yen watchers will be the Tokyo CPI figure released tomorrow, with the 145 level key to the next move in USDJPY. Gold blasted higher in Wednesday’s session, blowing through the 1902 resistance level and not finding any real selling until 1920, the high set back on 11 th of August.

A weak USD and more importantly catering US Treasury Yields lending a big tailwind to the precious metal. In today’s economic announcements, not much in the way of tier one releases with Jackson Hole looming on Friday. US unemployment claims being the headline.

Global markets were buffeted by a risk-off catalysts in Tuesdays session. Weak Chinese trade data, hawkish Fed-speak and a Moody’s downgrade of US regional banks saw stocks and yields tumble FX Markets USD was firmer Tuesday in a session that was firmly risk-off following the Chinese trade data and Moody’s downgrade. Later in the session we also had the Fed’s Harker who said barring any "alarming" new data by mid-September he believed "we may be at the point where we can be patient and hold rates steady", dashing traders hops of a Fed pivot anytime soon.

DXY printed a high of 102.800, falling just short of the July 3rd high of 102.84 where it found resistance just under the round 103 figure and it’s June/July trendline. Risk sensitive AUD and NZD were the G10 underperformers, with NZD performing mildly worse than its AUD counterpart. Both NZD and AUD were weighed on by the aforementioned risk-off tone and dismal Chinese trade data.

AUDUSD hit a low of 0.6497, briefly breaking the major support at the 0.65 big figure before finding some bids, 0.6500 looking to be a key level. NZDUSD bottomed out at 0.6035 ahead of the closely watched New Zealand inflationary forecasts today. EUR, CAD, and GBP were all weaker to varying degrees against the USD due to the risk-averse trading conditions and the general USD strength as opposed to anything currency specific.

USDCAD traded up to 1.3501 until paring gains as a rally in crude oil lent the CAD some support. EUR saw little reaction to the ECB June Consumer Inflation Expectations survey which downgraded the 12-month and 3-year inflation forecasts. EURUSD losing hold of the psychological 1.10 handle, hitting a low of 1.0930 before recovering modestly.

JPY weakened with USDJPY continuing its march to the 145 “intervention” zone. JPY’s haven demand offset by BoJ doubts after Japanese wage data suggested the BoJ has less scope to reduce its easy policies. USDJPY trading to a high of 143.49, testing its August highs.

Today’s calendar:

US equity markets snapped a record-breaking run of up sessions in Thursdays trading, with the Dow Jones looking set to close in the green for a 14 th straight session (for the first time since the Dow’s inception), before seeing a sell-off on rising yields after a report that the BoJ is looking to tweak their YCC at their meeting today. FX Markets USD bounced back from its post-FOMC weakness with the Dollar supported by rising US Treasury yields after beats in US GDP and employment data and the aforementioned hawkish report regarding the BoJ. US 10yr yields surged over the 4% level, an area recently that has marked the top in yields.

With Powell stressing that the Fed would be “data dependent” going forward as to rate increases the hot US data saw traders shifting hawkishly on rates, this saw the US Dollar Index surge through the 101 level, hitting 2-week highs and looking to test the major resistance at 102. Todays PCE Index figure will be another piece in the Fed puzzle, and is likely to move the USD and yields on it’s release. EUR pushed higher early in the session until the ECB meeting where the market took comments from President Lagarde as dovish, seeing EURUSD hit a low of 1.0967, breaking through the support at 1.10, holding below with 1.10 now looking like resistance..

The ECB did hike rates 25bp as expected but it was Lagarde’s comments that she does not believe that more work needs to be done, given the current data, implying future meetings could be a hike or a hold, that saw EUR moving. Later today, some key German inflation figures will be released, EUR volatility should be expected. JPY saw big gains on Thursday, with USDJPY sliding from highs of 141.31 to hit a low of 138.75 after reports in Nikkei that the BoJ are to discuss a YCC tweak at today’s pivotal monetary policy meeting.

Noted however, similar rumours have been reported on in the recent past, so really nothing new. The overreaction in JPY shows how jittery FX traders are going into today’s meeting, it is likely we’ll see some big moves in the Yen in today’s session as well, whichever way the BoJ goes. Calendar:

USD was mostly firmer in Tuesday’s session as a mixed equity markets saw some slight risk-off conditions. Also support USD was rates markets shifting hawkishly (September meeting now pricing a 16% chance of a hike) ahead of Jackson Hole and Fed Chair Powell speaking on Friday. Fed member Barkin spoke but added little new, as he noted consumer spending and economic strength make it possible the US economy could reaccelerate before inflation cools.

DXY hit a high of 103.710, pushing slightly above July and last week’s high and resistance area after testing support at 103.00 earlier in the session. EUR and GBP were both lower against the USD to varying degrees, EUR was the G10 underperformer with EURUSD hitting a low of 1.0834 and EURGBP testing the bottom of its recent range and major support at 0.8500. Both EUR and GBP traders have key PMI figures to navigate today, with readings in manufacturing and services for both currencies.

AUD, NZD and JPY were all firmer against the USD, with NZD outperforming, seeing AUDNZD dip below the psychological 1.0800 level briefly. Both NZDUSD and AUDUSD managed to hold their major support levels at 0.5900 and 0.6400 respectively. With Kiwi and Aussie traders having NZ retail sales and Australian flash PMIs to look forward to today.

USDJPY dropped 146.00, trading in a range between 146.39-145.50 ahead of Japan’s preliminary PMIs, JPY supported by a double top and forming in USDJPY. Despite overall USD strength, with some help from a soured risk sentiment, XAUUSD attempted to retake the 1902 resistance/support level. The move however was strongly rebuked as sellers entered the market at that key level, holding XAUUSD in its 2-week range.

Todays Calendar:

USD was marginally lower in Tuesdays session, trading in a tight range amid thin newsflow and market participants awaiting the key June CPI reading released later today. After breaking the psychological 102 level in Mondays session, DXY tested a re-entry into the range but found the previous support at 102 acting as stiff resistance, seeing DXY finish at the session lows around 101.65. NZD was the G10 underperformer with NZDUSD hitting a low of 0.6168 where it found support at Mondays lows as the currency traded defensively ahead of the RBNZ rate decision today.

Futures markets are expecting rates will be held at 5.5%, confirming the RBNZ as being the first developed Central Bank to reach the end of its tightening cycle. AUD was marginally firmer against the USD, after initially struggling in tandem with the Kiwi before later reversing losses on a USD pull-back. AUDNZD moving higher, back above the mid-price of it’s 2023 range.

Safe-havens, JPY and CHF, saw gains despite risk-on equity markets on some defensive positioning ahead of big data releases later in the week. USDCHF retraced from a peak of 0.8863 to a low of 0.8791 with the cross pair hitting its lowest level since January 2021. USDJPY traded between 141.46-140.17, continuing its strong down move after testing the 145 “intervention” zone last week.

USDJPY appears one of those most at risk of any upside surprises in the US CPI data given its sharp decline over recent sessions. GBPUSD saw gains with Cable breaking it’s 1.2850 resistance level, surpassing 1.2900 to a peak of 1.2934, its highest level in over a year. A strong UK Labour market figure saw futures markets re-price a 50bp hike as the favoured outcome of the BoE policy meeting on August 3 rd, driving gains in the Pound.

EUR was flat with EURUSD just about clawing back above 1.10 at the US session end amid a USD pullback, with EURUSD trading in a narrow range despite a weak German ZEW survey. CAD saw slight gains against the USD, bolstered by the continued upward momentum in crude oil with WTI crude settling at 10-week highs and seeing USDCAD break its 4h trendline. CAD traders have the BoC rate decision later today to look forward to, where after a five-month ‘pause’, the consensus looks for rates to be lifted by 25bps for the second straight meeting, taking its key rate to 5.00%