市场资讯及洞察

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

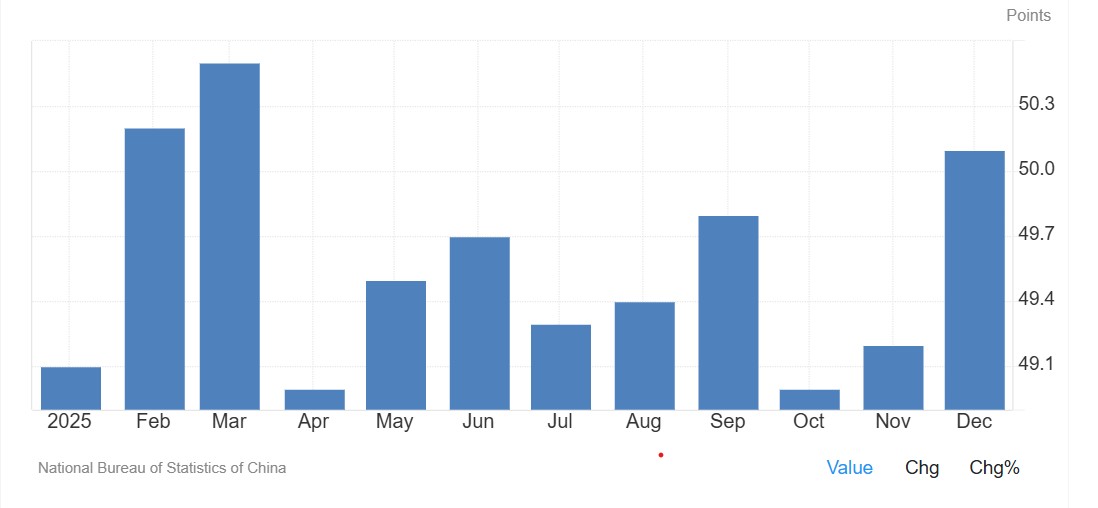

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

USD was higher on Thursday, with The Dollar Index bouncing back strongly from Wednesdays decline, breaking through the resistance level of 103.60 to touch on the weekly highs at the big 104 level and hitting overbought levels on the daily RSI. Market risk-off, rising yields and a lower than forecast jobless claims figure giving the USD a boost as good news is bad news for equities which in turn is good news for the USD (if that makes sense!) Looking ahead to Friday’s session, all attention will be on Fed Chair Powell speaking at Jackson Hole 14:05 GMT, we are sure to see some volatility in USD as traders look for hawkish or dovish clues from the Fed chair. AUD, NZD, and CAD all saw losses to varying degrees against the USD on broad risk-off sentiment resulting in haven flows to the USD.

CAD was the “least worst” with a rally in oil prices supporting CAD somewhat. Risk sensitive AUD and NZD were the underperformers with both AUDUSD and NZDUSD giving back all their Wednesday gains and then some. AUDUSD and NZDUSD both sliding to test their major support levels at 0.6400 and 0.5900 respectively.

Again, these will be key levels to watch as we head into Jackson Hole. EUR and JPY both also saw losses against the USD, but not as deep as the more risk sensitive cyclical currencies above. EURUSD managing to defend the psychological 1.0800 level, which was the support level set in Wednesday’s session and also the 200 Day MA level.

USDJPY held beneath 146.00, but still well above the key 145 level, rising US yields pushing this pair higher, but held back somewhat by the safe haven status of the Yen. In risk events for today and the weekend, all eyes will be on the Jackson Hole Symposium, where the main event will be comments from Fed Chair Jerome Powell, also on the docket will be other Fed speakers and ECB President Lagarde.

The US Dollar was firmer Thursday, continuing its bounce from extreme oversold levels, the DXY peaking at 100.97, just short of the major resistance at the big 101 figure. A much lower than expected initial jobless claims figure saw a jump in US treasury yields, propelling the USD higher with the DXY having it biggest up day since May. AUD was the G10 outperformer, holding its own against the resurgent USD and easily outperforming its peers.

A hot jobs report where employment increased 32.6k vs an expected 15.4k and an unexpected fall in the unemployment rate, saw odds of a RBA rate hike next month jump to 43%, pushing the AUD higher. NZD underperformed on general risk aversion, seeing AUDNZD push higher into the overvalued “sell zone”. JPY saw losses, with USDJPY continuing it’s bounce off the 50% fib retracement at 137.30, pushing briefly through the psychological 140 level.

USD saw highs of 140.49 before finding selling at the 50-day SMA, pulling back to find support at its previous bullish trend line. Japanese CPI was released earlier today where a reading 0f 3.3% came in right as expected, JPY traders will be eyeing next weeks pivotal BoJ meeting where tweaks to their yield curve control policy are expected. EUR and GBP saw similar losses vs the USD, EUR initially boosted by a not as weak as anticipated flash Eurozone consumer confidence figure which coincided with a miss in US existing home sales.

Though it soon reversed to the downside with EURUSD hitting a low of 1.1119, managing to hold the key 1.1100 level. GBP continued to feel the effects of a softer UK CPI reading on Wednesday, with GBPUSD testing buyers around the key 1.2850 level, after losing sight of a Fib retracement level that helped contain declines on Wednesday. Today’s economic calendar is very light ahead of pivotal Central Bank meetings next week, with the only tier one release being only UK Retail Sales.

USD rallied modestly into month end with DXY pushing to the top of its recent range to again test the big 102 resistance level. The data highlight out of the US was the Chicago PMI figure which rose from the prior 41.5 to 42.8, but missing expectations of 43.3. in FedSpeak, Governor Goolsbee added little new from the FOMC statement last week stating he is “not sure when the Fed will be done raising rates and they are making good progress but will let the data guide them” and they may or may not hike in September. EUR was weighed on by the Dollar strength with EURUSD dipping below the psychological 1.10 level early in the session before finding support at the lower trend line.

A bounce on hot inflation data and a strong GDP out of the Eurozone saw EURUSD reclaim the 1.10 level, albeit unconvincingly. Currently, markets are pricing in around a 25-30% probability of a 25bp hike in September, with the ECB being “data dependant” any and all news regarding inflation out of the EU should see an impact on EUR. JPY was markedly weaker to start the week following on from the BoJ meeting on Friday.

During the Asian session yesterday, the BoJ offered to buy an unlimited amount of JGBs at a fixed rate in an unscheduled announcement in an effort to defend their new “flexible” yield control limits, a feeling of panic at the Japanese Central Bank saw selling in JPY, with USDJPY heading above 142, looking likely to test the BoJ resolve at the “intervention” zone of 145 in the near future. AUD and NZD predominantly outperformed, with AUD bring the clear winner on more talk from China regarding future stimulus, with AUDUSD rising through and holding the big figure at 0.6700. AUD traders also positioning for the RBA policy decision due today at 14:30 AEST, markets are currently split between a hike or hold following the lower than expected Aussie CPI data last week, with futures showing a 15.5% of a hike, but economists polled have it as much closer odds so could be an exciting meeting.

Todays Calendar below:

FX WRAP USD was choppy with the US Dollar Index ending the session flat in range bound trade. Unemployment claims dropped to 239k from 250k the prior week which was in line with consensus and having little effect on the USD, though Philly Fed Manufacturing figures did have a big beat coming in at +12.0 vs an expected -9.8, which was the highest print since April 2022. This, along with stubbornly high yields and a general risk-off background, saw the USD reverse some early weakness on Yuan intervention headlines.

DXY pushing its head above the resistance at July’s highs before stalling. JPY was the G10 outperformer against the USD. USDJPY now having eight straight days printing higher highs and higher lows, its longest streak since October's BoJ intervention-driven collapse from 32-year highs.

USDJPY hit a high in APAC trading of 146.56 on weak Japanese data, before fading to hit a low of 145.62. Not a peep out of the Japanese MoF yet but desks put the recovery down to yield differentials as US Treasury yields plateaued, while a poorly received Japanese JBG bond auction saw Japanese yields spike on the 30 years. Another currency on the intervention watchlist is the Chinese Yuan.

Bloomberg reports of Chinese authorities reportedly telling state banks to escalate Yuan intervention saw USDCNH have its largest drop of the month, breaking a 5-day rally. There is also theories floating around that China is funding Yuan intervention through selling US Treasuries, which would explain US treasury weakness (keeping yields elevated), which is unusual in an equity market risk off environment. AUD and NZD were the G10 underperformers again, AUD underperforming the NZD after a big miss in the Aussie employment report, where unemployment unexpectedly rose to 3.7% and jobs fell by 14.6k vs a 15k rise expected.

AUDUSD printed a low of 0.6366, but moved higher on the back of Yuan strength as the session went on. AUDNZD recovered the losses after the Aussie jobs report to move back above the key 1.080 level. Gold again moved lower, with XAUUSD breaking key support at 1892, after a test of the 1902 resistance early in the session was forcefully rejected.

The economic calendar is very light today, with only UK retail Sales being of any significance.

The long-awaited July FOMC meeting is finally upon us where rates markets are pricing in a sure thing for a 25bp hike (even a small chance of a 50bp), the question that traders will be looking for to be answered is “is this it?”. With a growing number of economists calling this the top in rates, butting up against the FOMC June statement and unwavering Fed speak since, giving guidance that there will be two more this year (including July if it happens). This sets traders up with an intriguing FOMC meeting, with the accompanying statement and Powell Presser sure to see some volatility as traders look for clues as to what’s to come.

With the background of recently cooling inflation, any language around the previously released June dot plots and whether they are still a reasonable estimate of future rate movements will likely be key. Fed Futures odds: Source: CME Fedwatch tool Tis seta traders up with some unique opportunities as the battle between the Market and the Fed should see some real volatility in both direction as market participants digest the statement and then Powell’s presser, which in the past, has contradicted somewhat traders perception of the statement. Charts to watch: DXY – The US Dollar Index It’s been straight up since mid-July after DXY bounced from extreme oversold levels, breaking through and holding the key S/R (and psychological) 101 level, which has held as support in the last couple of sessions.

Despite this recent rally DXY is still in the oversold half of it’s daily RSI, a hawkish Fed pushing back against the market today would likely see DXY push to test the next major S/R level at 102. A dovish Fed could see the recently established support at 101 seriously tested. In my opinion there is more chance of an upside surprise, given the market seems to be leaning towards pricing in a Powell capitulation.

US 10-year government bonds Government bonds are an asset. I think a lot of CFD traders are missing great opportunities in, in the current climate of rates and inflation taking center stage they are one of my favourite markets to trade with some great range trading opportunities. Looking at the chart of the US 10-year with the yields superimposed to see the negative correlation between the two (when you trade bonds, you trade the price, not yield) Over the last twelve months the yield on the 10-year has tested and subsequently struggled to stay above 4%, this turn lower in yields at this level gives a bond trader an opportunity by buying the bond price.

Todays FOMC should see some volatility in yields, I recommend keeping an eye on these over the coming days for some good trading opportunities as yields hit pivotal levels. Today’s FOMC decision is due out at 18:30 GMT

After surging close to 4% since early July off the back of a weakening USD, the EURUSD pair has stabilised around $1.123. With very little volatility seen this week in the pair, eyes now turn to the euro, as the European inflation data is set to be released today. Analysts are predicting a continued downward trend in inflation, with a Year-on-Year forecast of 5.50%, which is below May’s figure of 6.1%.

If the inflation data comes in above forecasts, we may see a further increase in the EUR as investors move towards the potentially higher yields. On the technical front, the tightening of Bollinger Bands on the 4-hour chart is something to watch. The lack of movement in the EURUSD pair throughout this week has led to exceptionally tight Bollinger Bands, with levels not observed on this timeframe since 2021.

When Bollinger Bands contract significantly, it typically signifies a period of low volatility and suggests that a breakout or significant price movement may be on the horizon. The Relative Strength Index (RSI) is also in overbought territory on multiple timeframes, including the daily. This might suggest there is room for a cool-off before a further continuation higher.

However, with the European inflation data due today, the fundamental data might cancel out any technical signals.