市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

热门话题

本周开始,另一大科技公司亚马逊也将宣布裁员。

据报道称,亚马逊的管理人员已经开始通知员工,他们有两个月的时间在公司内部寻找另一个职位或接受遣散费并离职。许多员工通过 LinkedIn 等软件承认他们受到了这些举措的影响。同时,这一消息无疑是给予了很多员工巨大的挫败感,一时间整个公司“人心惶惶”。

亚马逊公司,是一家位于美国西雅图的科技公司,专注于电子商务,云计算,数字流媒体,和人工智能开发和研究。在科技公司中,其股价的价值可以排进前五。同时被誉为最有价值的品牌。亚马逊公司的知名度极高,其实在最开始,其野蛮扩张的策略,强行霸占行业份额使得亚马逊公司闻名于世。但是正因如此,才成就了如今的亚马逊。本周早些时候有消息称该公司计划裁员达到10,000 人——约占其公司员工总数的 3%。这一数字如果属实,那么将会意味着这次裁员将是这家电子商务和云计算巨头在其近 30 年的历史中进行的最大规模的裁员。新冠疫情期间,消费者的生活和工作习惯转向了在线端和电子商务,亚马逊和其他科技公司都觉疫情不会那么快过去,或者说,这样线上的生活习惯将会持续很久。因此在过去几年中都大幅增加了招聘。现在,随着人们生活逐渐走向正常,习惯已经慢慢恢复和并且宏观经济状况恶化,许多这些看似不会受到影响的科技公司正在经历“拷问”,并且已经开始解雇数千名员工。

那么在2022年下半年,已经有不少的巨头公司开始了裁员。在新东家埃隆马斯克的领导下,Twitter首当其冲,其解雇了 7,500 名员工中的大约一半,理由是每天损失约 400 万美元不必要花费。而且裁员来的毫无征兆,甚至没有提前给公司管理层发通知。虽然后续马斯克召回了小部分员工,打了一波脸,但是总体上还是裁员了非常多的一部分人。

几天后,Meta宣布将裁员约11,000人,约占其员工总数的13%。该公司上个月报告连续第二个季度销售额下降。加上扎克伯格对于Metaverse 高额赌注,裁员势在必行。还有很多金融公司都陆续开始裁员,例如高盛,黑石等等。另一方面看,种种迹象表明,美国发生经济衰退概率在急剧加大。在每一波裁员潮中,被淘汰的人基本上都有一些特质,1.资历较浅,特别是实习生和新入职员工。其中的价值无法快速体现,就容易被裁退。2.工资特别高,但是创造价值有限的人。在一切向好的时期,高薪人员无所担忧,但是经济衰退来临,公司可能会因为削减预算而裁去部分高薪员工。最后就是裁员成本低的人,其实这就是综合考虑,价格和公司花费不成正比,那么注定将会被淘汰。新一轮的危机过程中,如何才能保证自己不是那个被淘汰的人呢?答案其实是显而易见的,首先就是增强自己的实力。首先就是增强自己的“硬实力”,就是自身工作岗位上的能力。比如提升业务能力,掌握核心技术,提升对于公司的贡献度。在不断创造价值的同时也需要注重自身发展,比如各种执业证书,新的外语,新的技能等等。这个就是所谓的艺多不压身。其次就是“软实力”,需要在公司,甚至行业有一定的知名度和话语权,这样就算被裁也会很快找到新的岗位。最后公司人际关系也会有受到一定影响,如果在公司一直处于“透明人”的阶段,危机来临时候也是十分危险。最后就是发展副业,进行一些适当的投资,有着被动收入,在危机来临是就不会显得“捉襟见肘”。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 助理分析师

Alibaba Group Holding Limited (NYSE: BABA, HKEX: 9988) announced the latest financial results on Thursday. The Chinese e-commerce giant reported revenue of $29.124 billion (up by 3% year-over-year), falling slightly short of $29.288 billion expected. Earnings per share topped analyst estimates for the quarter at $1.816 per share (an increase of 15% year-over-year) vs. $1.683 earnings per share estimate. ''We delivered solid results this past quarter despite ongoing macro environment challenges, which is a testament to our resilient business model and unmatched customer value proposition,'' Daniel Zhang, Chairman and CEO of the company said in a press release. ''The uncertainties of the global landscape have only reinforced our resolve to focus on building capacity that will yield sustainable, high-quality growth for our customers and our own business over the long term.

The trust of our shareholders has enabled Alibaba’s development over the past 23 years, and we are committed to improving shareholder return as we continue to strengthen the foundations for Alibaba’s future,'' Zhang added. Alibaba also announced an increase to its share buyback program: ''We have continued to take a holistic approach to improve operating efficiency and cost optimization throughout the company that resulted in adjusted EBITA growth of 29% year-over-year. With strong net cash position and cash flow generation, as of November 16, 2022, we had repurchased approximately US$18 billion of our shares under our existing US$25 billion share repurchase program.

In addition, our board has approved to upsize the share repurchase program by another US$15 billion and extend the program to the end of fiscal year 2025.'' Shares of Alibaba rose on Thursday – up by around 8% at $84.52 a share. Stock performance 1 month: +18.47% 3 month: -5.97% Year-to-date: -28.18% 1 year: -40.58% Alibaba price targets Truist Securities: $125 Barclays: $114 Morgan Stanley: $110 B of A Securities: $155 Bernstein: $130 Benchmark: $205 JP Morgan: $140 HSBC: $141 Citigroup: $172 Alibaba is the 37 th largest company in the world with a market cap of $227.68 billion. You can trade Alibaba Group Holding Limited (NYSE: BABA, HKEX: 9988) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Alibaba Group Holding Limited, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

NVIDIA Corporation (NASDAQ: NVDA) reported its latest financial results after the market close in the US on Wednesday. The US technology giant beat revenue estimates but fell short of earnings per share (EPS) expectations for the quarter. The company reported revenue of $5.931 billion (down by 17% year-over-year) vs. $5.781 billion estimate.

EPS reported at $0.58 per share (down by 50% year-over-year) vs. $0.70 per share. ''We are quickly adapting to the macro environment, correcting inventory levels, and paving the way for new products,'' founder and CEO of NVIDIA, Jensen Huang said after posting the latest results. ''NVIDIA’s pioneering work in accelerated computing is more vital than ever. Limited by physics, general purpose computing has slowed to a crawl, just as AI demands more computing. Accelerated computing lets companies achieve orders-of-magnitude increases in productivity while saving money and the environment,'' Huang added.

NVIDIA expects revenue of around $6 billion in Q4. The stock was down by 4.54% on Wednesday at $159.09. The share price rose by around 2% in after-hours following the results.

Stock performance 1 month: +33.32% 3 month: -12.37% Year-to-date: -45.37% 1 year: -45.09% NVIDIA price targets Credit Suisse: $210 Oppenheimer: $225 Barclays: $140 Deutsche Bank: $140 Citigroup: $210 BMO Capital: $210 Mizuho: $205 Stifel: $165 Needham: $170 NVIDIA is the 14 th largest company in the world with a market cap of $400.98 billion. You can trade NVIDIA Corporation (NASDAQ: NVDA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: NVIDIA Corporation, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

The EUR has been on a ‘recovery rally’ since it fell below parity level with USD earlier this year. With inflationary pressures potentially easing across the world the USD has finally taken a breath. The currency which has been haven for many market participants in dealing with the high volatility finally saw a dip after weaker than expected US CPI figures last week.

Since this time the USD Index or DXY has fallen by nearly 4.5% which is a significant drop. This has had an overall positive impact on currencies that were struggling such as the AUD, JPY and of course the EUR. Whilst the EUR has provided a positive move in recent weeks and days there is still some geopolitical concerns especially with the news of a missile killing two citizens in Poland earlier this week.

Technical Analysis The weekly chart shows that price is currently testing a long terms resistance level at 1.0352. This level acted as support for almost 7 years prior to being broken and therefore has become a significant level. In addition, the price is also fighting against the 50-week moving average which is at 1.0588.

The 50 week moving averages is also a short-term long target for long trades. Looking more closely at the daily chart, the price is showing an important signal that it has not done since May 2020. The price is testing the 200-day moving average.

If it can break through it may represent a bullish signal. The last time the price broke through this level it managed to go from 1.10 to 1.23. This time around, the currency pair is having to fight inflationary pressures which may create a headwind.

The price action is still showing a potential price target of 1.06 in the near term and if it can break through the 200-day moving average and a longer-term target of 1.15.

热门话题

美元指数强势突破110 关口,新兴经济体主权债务风险上升,股市波动风险增加,部分国家地区股市大幅回落。澳洲房产价格也开始下跌。未来的衰退是否会演变成经济危机呢?

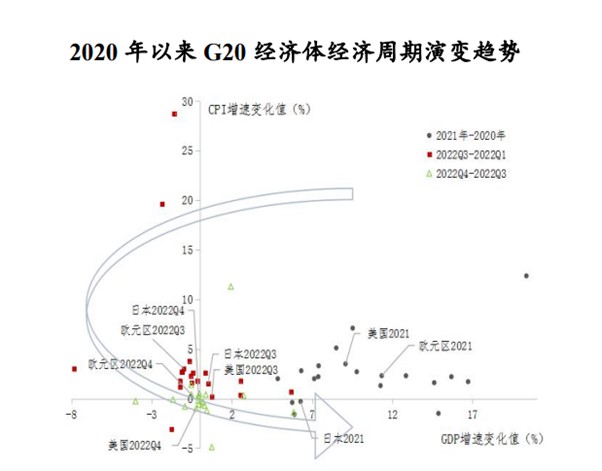

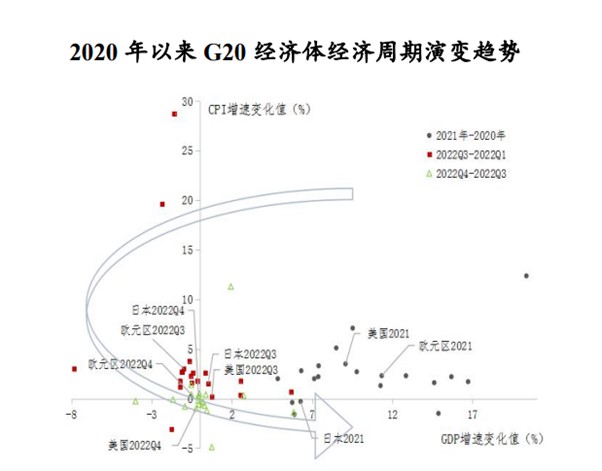

由于新冠疫情、地缘冲突、能源短缺、通胀高企、货币政策紧缩、需求回落等多重因素相互叠加的影响,全球经济不断衰退。8月份全球制造业和服务业PMI 指数分别为50.3%和49.2%,分别较年内高点回落3.4 和 4.8 个百分点。本文从空间、时间、结构和价格来简单解读上述现象的结果。从空间来看,美联储连续多次大幅加息,发达和新兴经济体均面临下行风险。欧元区面临的衰退压力大于美国。澳洲衰退的压力在发达国家中最低。从时间维度看,2020年疫情以来,全球主要经济体经历了“衰退—复苏—再衰退”的经济周期。未来面对着通胀回落和经济衰退的矛盾。若2023年美联储结束加息,则经济周期重新恢复预计为2023年下半年。

从结构维度看,全球经济面临供给和需求的不平衡,部分国家需求增加但供给减少。而部分行业也面临着供求失衡的情况。比如此前芯片紧缺造成的手机和汽车断货。全球供应链压力有所缓解,但行业和国家间的短缺仍然存在。少数行业供给过剩。大部分发达国家当前处于“工资—通胀”螺旋上升的局面,尤其是欧洲受到乌克兰局势影响,制造业能力持续下滑。从价格维度看,进入四季度后,全球通胀压力将有所缓解,天然气等能源价格有所回落。美联储继续加息进程,部分商品价格出现回落,资产价格下跌。若国家依赖于进口,则有可能在美元升值的过程中,本币贬值,国内资金流出,资产价格下跌,汇率下跌,进口材料上涨,工业成本上涨,进而陷入经济衰退。相反,若国家依赖于出口,例如澳洲,则有可能趁机加大出口额度,国内经济压力较低,陷入经济衰退的风险就会降低。

从11月各国经济数据和央行反应来看,美国继续大幅度加息的概率在降低,我们依旧维持原有判断:12月通胀数据会因为圣诞节假期等因素反弹,并可能迎来最后的高强度加息。1月之后,由于大宗商品价格持续回落,以及中国春节停工,欧洲地区逐渐度过冬天,对能源需求相对减弱,通胀会逐步回落。而明年美国加息预计会到5.25%,也就是央行基准利率。澳洲央行基准利率根据RBA的数据显示,大概率在4.2%-4.6%之间。因此,大家的澳洲房贷明年应该会在5.5%-6.5%之间浮动。对于非美货币对来说,此前美国加息预期持续走强,导致澳元跌落0.63附近。而目前来看,主要国家货币不太可能持续走弱。因为发达国家购买力比较接近,同时资本又可以自由流通。如果澳洲汇率过低,则其他国家可以更低的价格购买澳洲优质资产,造成澳洲资产流失。这是国家不希望看到的。所以,如果CPI通胀走弱,美国加息减缓,对于非美货币来说,将重新回到此前的公允价值区间,澳币也会重新站在0.68上方。

对于股市来说,澳洲股市相对比较平稳。此前大部分股票经过大幅度下挫之后,股价被低估。现阶段大量机构资金进入,寻找被错杀的上市公司。同样,对于香港恒生和中国CHINA50指数来说,我们也是看涨的。未来政治相对稳定的情况下,经济重心就会变为国家战略。所以,未来各国股市方面都会有不错的表现。总之,经济是否会进入危机,从根源上看科技生产力是否能再次带来新的科技革命。从宏观调控的角度看,美国是否降低或减缓加息力度。从表象来看,股市是否会企稳并再次进入上涨周期。这些都会决定我们未来1-3年的经济走势。至少目前来看,澳洲的经济不会进入衰退期。明年经济复苏的可能性更大。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain reported total revenue of $152.8 billion for the quarter (up by 8.7% year-over-year) vs. $147.668 billion expected. Earnings per share reported at $1.50 per share (up by 3.4% year-over-year) vs. $1.321 per share estimate. ''We had a good quarter with strong top-line growth globally led by Walmart and Sam’s Club U.S., along with Flipkart and Walmex.

Walmart U.S. continued to gain market share in grocery, helped by unit growth in our food business. We significantly improved our inventory position in Q3, and we’ll continue to make progress as we end the year. From The Big Billion Days in India, through our Deals for Days events in the U.S. and a Thanksgiving meal that will cost the same as last year, we’re here to help make this an affordable and special time for families around the world.

We have an amazing group of associates that make all this happen, and I want to say thank you,'' President and CEO of Walmart, Doug McMillon said in a press release. Walmart raised its full-year outlook after its strong Q3 results and announced a $20 billion share buyback program. Shares of Walmart were up by 6.54% on Tuesday at $147.14 a share.

Stock performance 1 month: +10.69% 3 month: +54% Year-to-date: +62% 1 year: +71% Walmart price targets Jefferies: $165 Keybanc: $155 Morgan Stanley: $150 DA Davidson: $163 Cowen & Co.: $165 Stifel: $149 Oppenheimer: $155 Credit Suisse: $145 Deutsche Bank: $162 Citigroup: $162 Walmart is the 14 th largest company in the world with a market cap of $402.87 billion. You can trade Walmart Inc. (NYSE: WMT) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Walmart Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap