市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

Bitcoin has dropped dramatically over the last 24 hours to its lowest level for the year after fears were sparked that major player FTX faced a liquidity crisis. In the last two years cryptocurrency has become available to large institutions and funds which has increased the overall size of the market. However, at the same time it has made it vulnerable to large liquidity events such as the one that is occurring now.

The reason for the large drop-off was the news that exchange FTX was facing serious liquidity issues after a large drop in the price of Bitcoin and other cryptocurrencies this year. Subsequently almost as an act of mercy, Binance the world’s largest cryptocurrency exchange has proposed that it will buy out FTX and its subsidiaries to stabilise the market. In addition, fears over customers’ ability to withdraw their funds from accounts were abounds on Tuesday.

This is not the first-time withdrawal issues have hurt the sector with frozen accounts being an issue when Celsius was facing difficulties. This run has seen the price of Bitcoin fall sharply to its lowest levels since November 2020. The price dumped about USD 2000 as the news hit the market.

The price then bounced of the USD 17,000 level to where it now rests near in the mid USD 18,000’s. The volume sold was the highest level since June 2022. Importantly, the price continues to hold its longer term range indicating some level of strength at the USD 18,000 level.

There is still a fair bit to play out regarding this potential merger. A failed deal or an accelerated acquisition could either help or hinder the price of Bitcoin and other cryptocurrencies.

In recent days and weeks there have been rumours that China is beginning to consider an easing of its Covid restrictions. As virtually the last country with extreme Covid restrictions, a shift in policy from China would be a major catalyst for the global markets and economy. Whilst the CCP has not yet announced any actual easing, there are hopes that they will soon begin to ease off on some of their measures.

Health officials have stated that local governments should not “double down” on restrictions and allow people’s livelihoods and economic activity to remain normal even in the face of increasing covid cases. General activity has shown an increase in flights and covid vaccine uptake across the country which may signal a move towards ending restrictions. Impact on the markets The country is set to have one of its worst years of growth in the last 20 years as it deals with the prolonged restrictions.

The Shanghai Stock Exchange has fallen by more than 17% and the Yuan has depreciated almost 17% against the USD. This is in the wake of global inflation and recessionary pressures. A strong China is a very good thing for the global economy, especially with regards to growth economies.

Once restrictions do ease, it is expected that Chinese stocks will rally heavily. However, it is not just Chinese stocks that will receive a boost. Australian mining companies and the AUD will likely benefit as China is a large importer of Australian resources.

It may also weaken the USD as money flows back into riskier assets and away from the greenback as the general economy begins to accelerate again. Ultimately, regardless of when exactly, China decides to ease its restrictions it would be prudent to be aware of the potential ramifications as it may provide a strong boost to the equities market and on some aspects of the foreign exchange market as well.

热门话题

推特的收购大戏终于落下了帷幕。从推特使用毒丸计划试图阻止收购,到马斯克狂喷推特水军太多,意图退出收购,再到推特将马斯克告上法庭,这出大戏终于迎来了大结局。看着马斯克手捧洗手池入主推特总部,人们不禁要问这只重获自由的蓝鸟将飞向何处?

马斯克以440亿,每股54.2美元的价格收购推特,特别是在今年,并不是个划算的买卖。如果没有这出收购大戏的来来回回和起起落落,推特的股价很有可能会像Snap一样,从年初的46.59每股一路跌超70%,到如今的每股不到10美元。推特本身就面临很多问题。一方面,因为推特拥有政客,记者等用户而具有很大的影响力,特别是在公共事件上。但是,推特做不到的最重要的事情就是赚钱。推特2022年二季度的财报,也是其作为上市公司的最后一份财报显示其二季度亏损2. 7亿美元。另一方面,推特的日活用户为2.378亿,而同样的老牌社交媒体Facebook的日活用户是20亿,后起之秀Tick Tok的日活用户也已经达到10亿。因此,推特需要创新,需要新的业务模式和盈利模式。当然,这也不只是推特的问题,由于宏观经济状况对广告业务的影响,Meta和Google的三季度财报都不尽如人意。特别是Meta,扎克伯格的元宇宙还在烧钱,导致其净利润同比下降52%,盘后股价跌超20%。这也让人对于营收重度依赖广告的业务模式是否可持续产生了怀疑,社交媒体是否到了变革的节点?推特被私有化后,至少肯定会比现在更给人以希望。推特说不定可以成为先行者,进行一些新的尝试,给社交媒体提供一些新的思路和方向。

从入主推特到现在不到两周,马斯克作为一个实干家已经开始行动。第一件事就是把和他不对付的推特高管通通开除,扫除他改革路上的绊脚石。接下来,马斯克就掀起了黑色星期五,大刀一挥裁掉了50%的员工。对此,马斯克坦荡表示,公司每天亏损超过400万美元,没钱养这么多人。Facebook在2012年上市初年的营收与2021年推特的营收相当,但是Facebook当时的员工数量为3500人左右,而推特在马斯克大举裁员前的员工数量高达7500人,所以对推特来说的确需要控制成本。第二,虽然马斯克为了稳住广告商,在推特上言辞恳切地发表了一封“告广告商书”,声明推特的审查制度没有变化,试图挽留。但是,通用汽车,辉瑞,通用磨坊以及奥迪仍然都暂停了广告。因此,为了降低对于广告商的依赖,也为了支付因收购借款产生的每年10亿的巨额利息,马斯克启用了蓝V认证收费模式,具体效果如何,让我们拭目以待。第三,马斯克重新启用Vine。Vine是一款短视频平台,在2012年被推特收购,这个项目没有被好好经营并于2016年被关闭。同年,抖音首次上线,随后开启了短视频时代。

马斯克的推特时时刻刻都在更新,新点子也一个接一个,实在难以看出姓“马”的推特到底会长成什么样。但是,或许我们可以从被作为举证材料的马斯克的短信群聊中一窥究竟。从短信中可以看出,马斯克想要的核心是言论自由,这也是收购的导火索。推特的前CEO提醒马斯克不要发表不利于推特的言论惹怒了马斯克,小马在短信中当即表示我不会加入董事会,这一切都是在浪费时间,我要直接收购推特。1分钟后,他就在和弟弟的聊天中表示我们需要一个基于区块链并且包括支付的新媒体。可以看出,马斯克希望推特朝着去中心化,开源协议,支持加密货币和数字资产的方向前行。

当然,前路会面临很多的挑战,譬如如何建立新的可持续的盈利模式,譬如马斯克想要放宽推特的审查制度,但是欧盟内部市场专员表示,在欧洲,这只鸟要按我们的规矩飞。其实,社交媒体的困境并不仅在技术方面,更多的是在政治、文化方面,马斯克作为一个理科尖子生是否能解好这道文科题。但是,我们还是很期待接下来推特是否会带给我们惊喜,互联网人追求的 “要协议,不要平台” 是否会在世界首富的助力下实现。虽然,推特的股票我们现在是买不到了,但是推特的发展必然会对其他社交媒体公司产生影响。马斯克之前也表示,最快三年内推特会重新上市,推特是否会华丽返场让我们拭目以待。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jaden Wang | GO Markets 助理分析师

热门话题

大家都知道,自从美国开始加息以来,全世界的股市以及地产市场基本都和利息走势相反。从3月开始跌了半年,直到10月。但是关心股市的朋友们应该发现,过去3,4周,不仅仅是美国的股市出现了反弹,就连澳洲也出现了明显的变化。澳洲200指数从6400点的低位一路上涨到了现在的6950点,反弹幅度接近8%。当然,美国的加息没有结束,澳洲的加息也没有结束,更为关键的通货膨胀还没有回落。因此我们很难说股市之后一定会持续反弹。从大环境来说,只有当加息周期达到顶峰,开始准备考虑降息的时候,才会对股市产生持续有效的利好。但是在众多人还在等待中,有一家机构率先发表了他们的犀利观点。这家机构就是美国知名投行摩根大通。

这家大投资银行和券商预计,到2023年6月,澳洲市场基准的标普/澳证200指数( S&P/ASX 200 Index)将上涨约8.2%,达到7400点,它还预计澳洲储备银行预计将在同一时期再提高现金利率0.25个百分点,使之达到3.1%。毫无疑问的是,这家银行非常敢说,对于其在澳股上的预测,我们投资者是很开心的。但是它对于澳元利率的预测,基本可以说是将会100%被打脸。因为现在傻子都知道,澳元目前已经是2.85%,从现在到明年6月之间,注定不会只有1次加息。摩根大通还说,他们尤其看好澳洲银行板块,它们认为澳洲银行股可以在未来两年内累计增长10%至15%,这在一个加息通道中是非常难得的。摩根认为,澳洲家庭比大多数其他国家的家庭在储蓄和财务管理上处于更有利的地位,而且看起来工资价格螺旋式上升的可能性很小。所以,摩根大通对澳洲的股市持乐观态度。

以上是它们对于澳股上涨预测的观点。但是我读了三遍,也没有看懂它们到底要表达什么。似乎只有结论,没有推理过程。澳元半年加息到3.1%肯定是错误的,我们不用看了。但是对于澳股上涨的观点,在我看来还是有很大机会的。但是摩根磨磨唧唧想说又不敢说。我觉得,摩根之所以敢于预测澳股会上涨的最大原因,就是它们押宝认为,中国的防疫政策会在半年内发生很大的改变。现在有越来越多的声音都在传闻。中国将会在明年春节后逐步开始放宽目前的规定。虽然目前没有任何官方消息证实。但是从各地方的卫健委和防疫中心的部分发言来看。舆论风向已经开始有所改变,如果说之前是0%和100%的关系,那现在已经变成了5%和95%的关系。如果地方上的官方或半官方的不同声音和风向越来越多,那就从侧面让最终的政策改变的几率会不断增加。这么说吧。一旦官宣了,中国股市和香港股市必定大涨,而同时和中国经济联系密切的澳洲,其矿业,消费行业,以及航空旅游板块也将会迎来大涨。

但是,目前大家都是充满希望的去猜测,谁也不敢保证。摩根大通说的很含蓄,但是同样是美国投行的高盛则明确预测,政策改变将会在2023年第二季度。而高盛还说,一旦全面放开后,中国股市将可以上涨20%。在高盛11月6号的报告中明确说到,目前放宽限制,已经成为了金融市场里最清晰可见,大家期待最久,也是最强大的全球股市反弹和上涨的催化针。而澳洲因为和中国紧密的经济联系,受到的正面影响将会比欧美国家更多。我们都希望这一天快点来临,我们也知道,目前为止,大家都是在猜测。我们希望猜测最终能成为现实。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

热门话题

11月4日上午,中国国家主席习近平在人民大会堂会见到华正式访问的德国总理朔尔茨。这是新冠疫情爆发以来,欧洲国家领导人首次访华,也是朔尔茨就任德国总理以来首访中国。朔尔茨在《法兰克福汇报》发文表达了自己的看法:即使世界形势变化,德国仍将中国视为重要的经贸伙伴,德国不会与中国“脱钩”。他认为德中两国应找出“符合双方利益的领域并寻求合作”。

中国与德国经贸合作互补性强,利益融合度高。中德双方都致力于推动经济全球化和贸易自由化,也致力于推动经贸各领域务实合作并创造有利环境。这就为双边经贸发展奠定了坚实的基础。德国是欧盟对华直接投资最多的国家。截至2020年7月底,中国累计批准德国企业在华投资项目11079个,德方实际投入357.3亿美元,经中国商务部核准的中国累计在德全行业投资存量为166.6亿美元。德国本次访华,是在欧盟摇摇欲坠,俄乌争端依旧未解,美国货币紧缩收割全世界情况下,为德国经济寻求出路的一种体现,从侧面反映出欧盟内部拒绝经济上坐以待毙的态度。

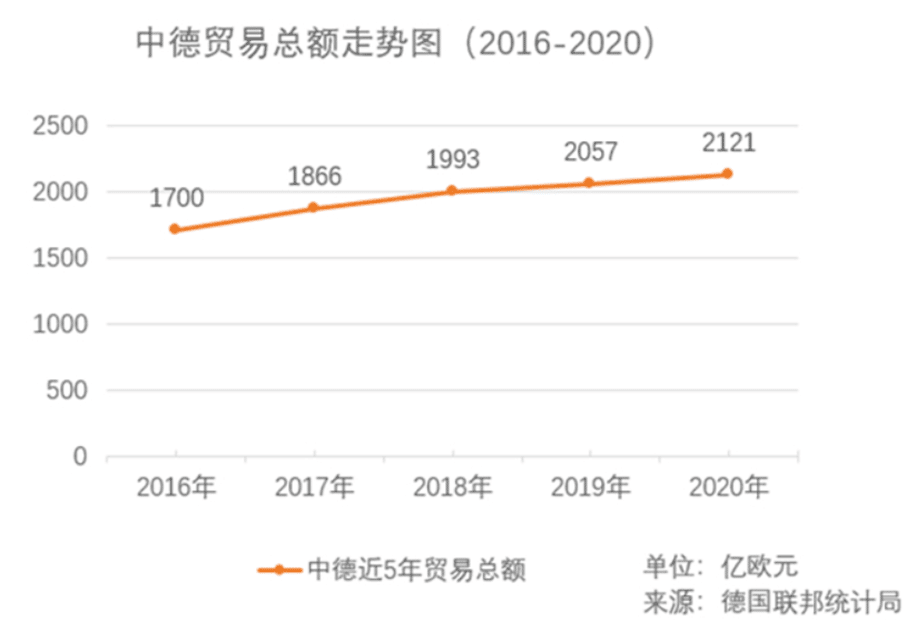

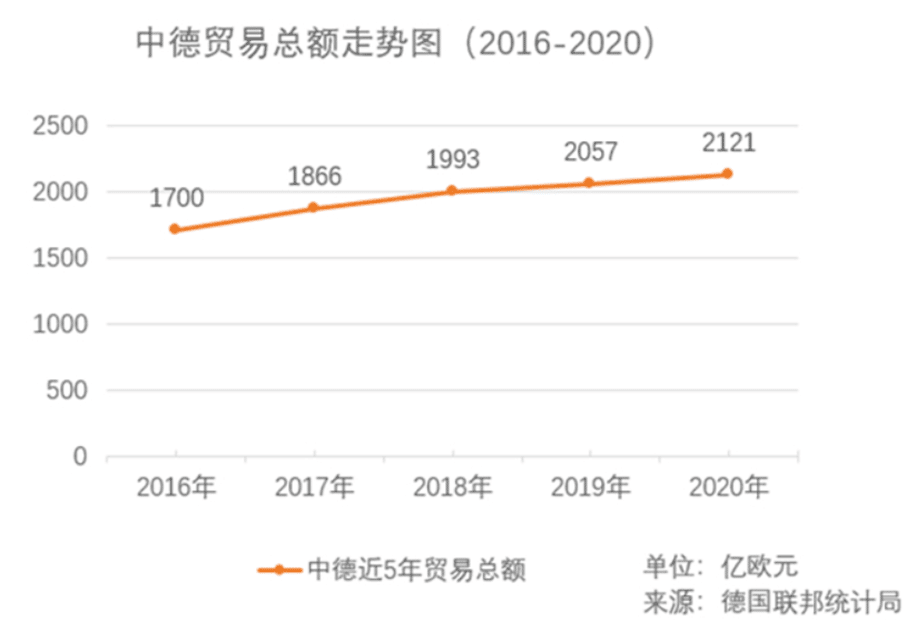

德国联邦统计局在报告中指出,中国在德国进口贸易中的重要性不断提升。回顾历史,1980年中国仅排在德国进口来源国第35位,到2015年起,中国就已经连续成为德国最大的进口来源国。近年来两国在数字化、新能源汽车、人工智能、自动驾驶等新兴领域加强互利合作,已成为中德合作的新引擎。虽然新冠肺炎疫情肆虐全球,世界经济受到严重影响,但中德两国的交往与合作并没有因此停下脚步,去年中德两国开启了人员往来的“快捷通道”,帮助数千名德国企业人士顺利返回中国。各地也纷纷出台措施为在华德国企业的复工复产提供便利。中德合作为维护产业链和供应链的稳定也做出了贡献。

[caption id="attachment_274790" align="alignnone" width="916"]

本次朔尔茨的访华阵容豪华,原本有约100家德国企业和个人申请随行,最终定格在12名头部企业代表,也体现出本次朔尔茨率商界代表团访华是以经济和贸易为重要主题,是迫于德国经济发展需求的。[/caption]

中国是德国企业界最重要的销售市场之一,最重要的原材料供应商之一,也是最重要的创新市场之一。德国工商总会主席万斯勒本近日对德媒表示,当前乌克兰局势导致的能源危机正在损害德国的竞争力,经济形势不容乐观,因此与中国继续经济交往是很有必要的,也“不会导致我们国家失去繁荣”。

朔尔茨访华的重点不止有经贸议题。在气候问题、地区稳定、世界经济增长、能源问题等方面,中国和德国都是全球治理的重要参与方,朔尔茨也要寻求德中两国在全球治理方面的共识。此次中德双方有可能就气候变化问题达成一些共识,还可能在乌克兰问题上共同寻求恢复和平稳定的办法。

2022年正值中德建交50周年,两国贸易额从1972年不到3亿美元增长到2021年的2453亿欧元,中国也连续6年成为德国的全球最大贸易伙伴,超5000家德国企业在华发展,汽车、机械、化工等德国经济支柱行业,早已将中国作为最主要销售市场之一。 “脱钩”是一种极端的说法,但是不“脱钩”并不代表着德国对华政策不会有变化。推动产业链、价值链更加多样化,是现在欧洲多国的共识之一,朔尔茨访华更多目的是为德国经济稳定发展寻求出路,和政治立场并无太多联系。

从2021年12月至今,朔尔茨执政还未满一年。后默克尔时代,德国对华政策路线图很大可能会延续默克尔时代的老路。朔尔茨是默克尔政府中的老将,熟谙前任施政风格。2007年至2009年,在默克尔第一届大联合政府当中,他担任劳工 部长;2018年,他出任德国副总理兼财政部长。2011年开始,朔尔茨曾连续7年担任德国汉堡市第一市长。主政汉堡期间,朔尔茨支持中国“一带一路”倡议,将汉堡打造成中欧间的贸易货运枢纽,增强了经贸往来。此次访华前,朔尔茨还提及德国政府批准中远海运入股汉堡港集装箱码头一事,称该交易不仅体现了德国,也体现了欧盟促进贸易多样化、实现互惠的理念。

默克尔政府时期也和朔尔茨政府一样,在价值观和经济利益之间找平衡。需要指出的是,与默克尔政府不同,朔尔茨政府是由社民党、绿党和自民党三党联合执政的。组成“红绿灯政府”的三党间,对不少问题的看法存在分歧。从朔尔茨政府组建到现在,对华关系处理出现不少干扰和杂音,其在对华关系的处理上更强调价值观。朔尔茨此次访华,可能就是想传递这种信号。

德国是欧盟第一大经济体,它的一举一动包括与中国的关系,都会对欧洲整体上产生影响。西方政界一直在讲一些对中欧关系不利的说法,但经济界、贸易界并没有跟着这样的节奏走。2022年,中德、中欧贸易和相互投资处于稳固增加的势头。英国《金融时报》援引德国经济研究所数据称,仅2022年上半年,德企在华投资,就创下100亿欧元纪录。对于以出口为导向的德国经济来说,与中国深入开展经贸交流,至关重要。

近段时间以来,欧洲内部对华看法和政策方面理智、务实的声音多了起来。这也可以看出在整个中德、中欧关系当中,经济关系所展现的韧性。整体来看,德国总理率队访问中国,是欧洲为经济一筹莫展寻找出路的表现,也体现出德国为主的欧盟国家寻求恢复疫情前经贸繁荣的深切期望。俄乌战争,供应链危机,能源危机,每一种都肆虐着欧洲经济。而拜登政府在这些危机上的做法明显没有特朗普时代优秀,尽管德国在政治上的价值观与美国在一条战线,但经济发展上的需求迫使其做出改变去接受多样化,毕竟当下真正挥着镰刀割韭菜的是美国人,德国也不想成为待宰的羔羊。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537

中国地区(英文) +248 4 671 903

作者:

Xavier Zhang | GO Markets 专业分析师

BioNTech SE (NASDAQ:BNTX) reported its third quarter financial results on Monday. The German pharmaceutical company beat both revenue and earnings per share (EPS) estimates for the quarter, sending the stock price higher. The company reported revenue of $3.392 billion vs. $2.024 billion expected.

EPS reported at $6.841 per share vs. $3.352 per share estimate. ''Thanks to our strong execution in the third quarter of 2022, we updated our COVID-19 vaccine revenue guidance for the year 2022 to the upper end of the original range. We started shipments of our Omicron-adapted bivalent vaccines early in September and we expect to carry on with our deliveries throughout the fourth quarter of 2022,'' Jens Holstein, CFO of BioNTech commented on the latest results. ''We believe in the potential of our COVID-19 franchise and plan to build on our leading position with ongoing innovations in this field. The power of our scientific innovation combined with our strong financial position allows us to accelerate and expand our diversified clinical pipeline and to create future growth in the interest of all stakeholders,'' Holstein concluded.

The stock was up by around 2% during the session on Monday following the latest results, trading at $155.52 a share. Stock performance 1 month: +16.38% 3 months: -7.00% Year-to-date: -38.93% 1 year: -35.10% BioNTech price targets JPMorgan: $132 Deutsche Bank: $250 HC Wainwright & Co.: $272 SVB Leerink: $224 Morgan Stanley: $194 Goldman Sachs: $206 BioNTech SE is the 411 th largest company in the world with a market cap of $38.46 billion. You can trade BioNTech SE (NASDAQ:BNTX) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: BioNTech SE, TradingView, Benzinga, CompaniesMarketCap