市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

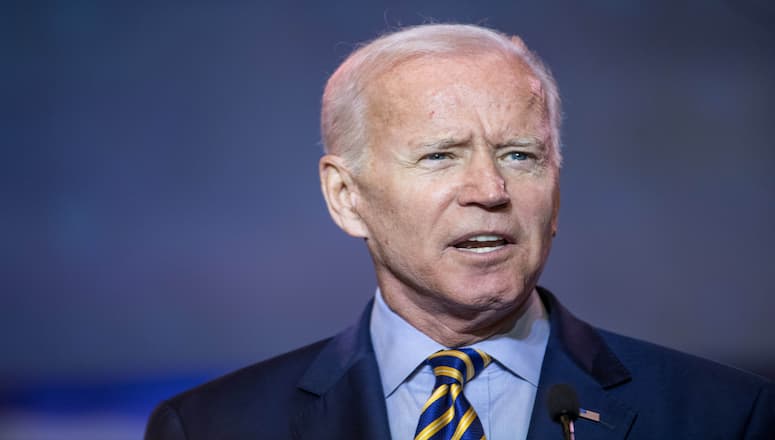

The US midterm elections are coming up next week on 8 November and have the potential to have a big say on the direction and volatility of the US and global markets. All the 435 seats in the House of representatives will be decided upon. Currently, the makeup of the house includes 220 Democrats, 212 republicans and 3 vacant seats.

The senate is just as intriguing with the senate essentially split 50 – 50, with the Democrats having the support of 2 independents. This means that Vice President, Kamala Harris has the deciding opinion on bills that get put forward. It also means that the Republicans only need one more seat to take control of the senate.

This is crucial because it means if the Republicans take control, then bills put forward by Democrats will face a much tougher road to turn into law. It is also possible that the Republicans could take both the senate and the house of representatives which would make it almost impossible for the Democrats and Joe Biden to pass any legislation. Impact on the Markets When US elections occur, there tends to be a decrease in performance before the election and increase in volatility around the US markets.

After the election there is usually a period of growth for equities. The issue at the forefront of all American’s minds is still inflation and the new government will deal with it. A major impact on the economy may be the government’s ability to deal with issues surrounding the economy such as inflation, a recession, or other fiscal matters.

For instance, a gridlocked congress will restrict the President’s ability come up with policies that the Republicans will ok. The president may have to resort to using Executive orders which are more limited in scope and done without support of congress. More responsibility might be taken by the Federal Reserve to loosen monetary policy to fight a potential recession without fiscal support.

This bodes well for the equities market and dampen some of the strength of the US dollar. From a more ideological perspective, Biden’s push for environmental and sustainability reform. Biden and the democrats have pushed forward policies that have supported these developments.

Therefore, money flow away from these sectors if that support gets pushed away. Ultimately, the midterm elections will likely have some effect on both the direction and volatility of the market. A swing towards the Republicans may see a shift in volatility and sentiment across the economy.

热门话题相信不少朋友们都有看过电影头号玩家,在电影里,描述了一个五彩斑斓的虚拟世界-绿洲,无论现实中是怎么样的情况,只要带上VR眼镜,就可以随时随地进入到其中。在这个世界中,你可以自定义角色形象,能力等等。还可以在其中购置资产,装备物品。因为游戏玩家众多的原因,其中的道具就变得弥足珍贵。很多人也为了游戏中的物品而花费大量的时间,金钱。即便如此,在电影的世界观下,仍然有很多人对其中的世界产生无比的向往,其中最重要的一个原因就是,逃避现实,或者说是以另一种方式去改变现实,遥远的梦想也许就能在游戏中实现。电影也表达了了虚拟和现实之间的关系的看法:人们不应该太重视结局,而是应该更加关注过程本身,享受过程。应该多花点时间感受现实世界最真实的感受,毕竟现实更加重要一些。

而如今,我们的VR技术发展的如何呢?VR技术又有着怎么样的现实意义?

曾经在几年前的我也尝试过VR头显设备,那个时候还是用的连接电脑端的VR设备。在当时我尝试时就感觉很惊艳,不俗的视觉感受,有趣的交互体验,声临其境的游戏战斗,都让我不可自拔。但是就当时来说,技术条件没有那么成熟,颗粒感的严重,真实性的欠缺,最后还有一个致命缺点,就是大部分人在玩VR一段时间后,就会感到头晕恶心,甚至出现呕吐现象,虽然我没有出现类似的现象,但是在脱下VR之后还是有一种奇怪的感觉,我称它为“现实失重”。所以当头号玩家电影上映之后,以当时的角度来看,想要成功创造这样一个世界,可能短期是不太可能的事情,无论从真实感,交互体验来说,都是很难达到的事情。然而当我还在觉得这一切都还仅仅是幻想的时候,一款VR 大作改变了我的看法,那就是2020年上线的半条命Alyx。那时间正值疫情严重时期,很多人都居家抗击疫情,我也不例外,对于现实世界出行的渴望还有对新代作品的好奇,我也在当时,选择了这个游戏。首先说一点,当时进入游戏之前,我其实觉得可能就和之前玩过的设计VR游戏一样,可以清楚的明白,这只是一个游戏。然而,当我进入这个世界后,我发现,我错了,极具真实的交互体验,震撼的场景,还有引人入胜的剧情,让我感到了无比的真实,虽然没有触觉,嗅觉的模拟,但是在一些场景下,我仍然可以脑补出外星生物的气味,受伤的疼痛感,即便我知道它是假的,我也愿意相信它是真实的。随之也出现了,每当我脱下眼镜的时候,总有种怅然若失之感。

回到如今,看了看最近的VR设备和应用,发现有一些新的软件,对于我们现实中也有不小的意义。其中有几个有意思的,第一个就是钓鱼,对于我这样怕冷而又喜欢钓鱼的人来说,VR钓鱼可真是太开心了。还有一个就是练车软件,可以模拟去练车,开车。虽然类似的软件也并不是那么成熟,但是让我看到了希望。未来这些软件的发达后可以让很多在现实中没有条件做这些事的人们,可以去体验不一样的人生。特别是此次疫情之后,让我感受到,其实世界上可能很多地方我们无法去到,很多事情无法亲身体验。那么随着VR的发展,也许未来有一天我们也可以在VR里面掌握技能,在VR中授课,五湖四海的朋友可以在VR中面对面交流,可以去到世界上很多地方旅游。当然这也会出现一个问题,那就是现实中这类产业将会受到巨大冲击。传统旅游业受到的冲击将有可能会演变为一种变革,甚至会被慢慢淘汰。就个人观点而言,VR的未来可期,虽然让我们未来可能在VR的虚拟世界中感受不一样的人生,但是也要警惕可能会对现实中的实体产业,甚至经济逻辑造成重大影响。科技的进步会带来好的一面,也可能带来负面影响,我们都需要做好准备。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 助理分析师

热门话题

11月1号,澳洲加息25个基点,目前基准利率到达2.85%。加息力度较小,因此澳币当天出现下跌,股市上涨。11月4号,澳联储将发表货币政策声明。至此,澳洲房贷利率突破5.5%。

11月3日,美联储加息75个基点,连续4次加息75个基点给市场造成了极大影响。美联储自1994年以来从未在一次政策会议上加息75个基点,而昨晚再次给市场巨大冲击,美国股市快速回落,科技股普遍下跌5%左右。美联储讲话中继续强调通胀问题:坚决致力于降低通货膨胀。美国经济较去年大幅放缓。劳动力市场极度紧张。通胀仍远高于我们的目标。近期通胀数据再次高于预期。其实此次讲话内容,与我们预期基本一致。我们始终认为,最高的通胀应该在12月至明年3月。原因很简单,来自于供给端的产能始终在降低,来自需求端的需求逐渐复苏。比如中国因为疫情影响了产能输出,而制造业有生产周期,此前原材料价格上涨给到制成品产出大约就是6个月之后。而目前相对减少产出也会在3-6个月后出现供给端产量不足。也就是在明年中国春节前后。传递到澳洲或其他海外国家,超市的货柜物品可能依旧紧缺。

最终物价下降,我们看一下Coles和Woolworths的蔬菜价格和纸制品价格就可以知道了。另外,黑五打折力度较高,但是我们要看出货总量是否会有明显提升。打折力度大,很明显是经济不景气造成的资金回笼。就好比Qantas和Virgin在疫情期间亏损,但是在现在,我们订悉尼和墨尔本之间的机票,价格已经平均在500澳币以上往返,而疫情前,这个价格在200澳币附近徘徊。美联储同时强调,利率水平存在重大不确定性。在某个时候,放慢加息速度将是合适的。终端利率水平将高于此前预期。这一点无疑给市场继续造成冲击。也就是此前我们认为美联储利率水平会在2.65%-2.95%之间,取决于美债还款利息和美国政府收入的偿还能力。如果利率太高,美国可能存在还款压力。但是,目前美国的重点并不会考虑还债能力,重点将放在通胀水平的降低。而12月至3月,美联储可能依旧会快速加息,因此,非美货币的反弹和黄金白银的反弹,可能要延后至12月或1月,在下一次加息结束之后,有可能度过加息峰值。

此外,美联储讲到,加息速度现在变得不那么重要了。主要关注点是保持利率的限制性水平。并再次强调,我们没有过度加息。不觉得我们的加息速度太快了。短期通胀预期上升“非常令人担忧”。现在考虑暂停加息还为时过早。房地产市场活动正在下降。房地产市场没有明显的金融稳定风险。还没有看到劳动力市场真正疲软的迹象。没有看到工资-物价螺旋上升。没有迹象表明通货膨胀正在下降。美联储对利率的预期一直在不断上升。基于以上内容,我们能够比较清楚的确定,美联储的加息速度会依旧保持目前的节奏,直至明年1月。未来两个月资产价格依旧会比较动荡。如果未来美联储将现金利率提高到5%附近,对澳洲市场将会有更大冲击。房贷利率会突破7.5%,这个是没有办法的事情。因为银行吸储端和固收端的利率必须同步上涨,不然资金全部流向美国。所以,对澳洲房地产价格的冲击目前远未结束,大家需要及时做好预防措施。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

Bitcoin, the currency of tomorrow, a new age currency, has seen some severe ups and downs over the last few years. From reaching highs of nearly 70,000 dollars to dropping to lows of 17,000 the volatility and action around the cryptocurrency has been startling. Even compared to other traditional currencies the range and volatility of the price has been far more aggressive.

In fact, when compared to other more volatile tradable assets such as indices and equities, Bitcoin still stacks up with how volatile it is. For traders this is an important aspect to consider when deciding what to trade. Recent Chronology Early on, there was a thought that Bitcoin would become a hedge against inflation, or an alternative to Gold or Oil.

With the recent wave of record high inflation that has swept up much of the world the leading cryptocurrency failed this test, and this proved to be wishful thinking. In fact, Bitcoin showed itself to be quite the oppositive of a hedge and was rather much more aligned with growth assets such as the Nasdaq and the technology sector. Prior to May 2022, the Nasdaq and Bitcoin has a correlation of 0.82 out of 1.

In addition, with still so much unknown about how governments and Central Banks will come to treat the cryptocurrency and what regulations may be implemented there is a lot of uncertainty about how market regulation will affect the supply and demand. The chart indicates just how correlated the Nasdaq and Bitcoin were, sharing similar peaks in mid-November 2021 and following very similar price action until July 2022. However, after July there has been a shift in the correlation.

Today, Bitcoin is neither correlated strongly with either Gold or the NASDAQ and has carved out a niche for itself. Whilst the Nasdaq has continued to fall, Bitcoin has seemingly found its bottom. The price of Bitcoin has reclaimed its 50-day moving average which is its short-term support, and the price looks like it may continue to move up.

The range of Bitcoin has also become much tighter indicates, that the overall volatility has reduced and that the price has reached some level of equilibrium showing that neither the buy nor sell side has been able to gain any ascendancy. Due to how vicious the selling has been this may very well indicate the last of the selling. Importantly, even with the increased liquidity that has flowed into the asset from institutions and ETF’s, the price has still been able to find support and not fall int a liquidity vacuum.

Where it fits in? The recent price action brings up a more existential question which is where does Bitcoin fit in on the spectrum of safe to risky assets? Based on the information presented above there is no way that Bitcoin should at this stage be considered as a haven asset.

The price is still too volatile to be considered a safe asset. In addition, there is still so much unknown with how the price might react in the future, specifically regarding future regulations. On the other hand, Bitcoin has exhibited some characteristics of a safer asset, mainly, in recent times, its increasing resistance to high volatility and wild price fluctuations.

This may indicate that it is maturing as an asset. Therefore, at this stage of its life it may be best to classify Bitcoin in its own quasi- growth basket. When analysing Bitcoin for potential trading or investing opportunities it is important keep in mind that it does not act like a traditional asset.

Another day, another hike. On Wednesday, the US Federal Reserve announced its latest policy decision to raise its interest rates from 3.25% to 4%, to its highest level since January 2008. On Thursday, it was the Bank of England's turn to announce its decision.

As expected, the central bank raised its interest rates by 0.75% to 4%. It was the highest single increase since 1989. Inflation Bank of England highlighted that its biggest job is to bring inflation back to its 2% target.

The bank expects inflation to rise in Q4 but start falling from early next year. ''Inflation is too high. It is well above our 2% target. High energy, food and other bills are hitting people hard,'' the bank said in a statement. ''It’s our job to make sure that inflation returns to our 2% target.

This month we have raised our interest rate to 3%. In total, since December 2021, we have increased our interest rate from 0.1% to 3%.'' ''What will happen to interest rates will depend on what happens in the economy. At the moment, we expect inflation to fall sharply from the middle of next year.'' Economic outlook As for the economy, the central bank did not have the most positive outlook for the near future.

It now expects the recession to last for a prolonged period. ''There has been a material tightening in financial conditions, including the elevated path of market interest rates. In addition, high energy prices continue to weigh on spending, despite an assumption of some fiscal support for household energy bills over the next two years. As a result, the UK economy is expected to remain in recession throughout 2023 and 2024 H1, and GDP is expected to recover only gradually thereafter.'' Market reaction The Pound was weaker against all major currencies on Thursday, falling the most vs. the US Dollar.

Cable was down by around 1.93%, trading at 1.11771 level. The next Bank of England rate decision will be on 15th December.

Airbnb Inc. (NAS:ABNB) reported its latest financial results after the closing bell in the US on Tuesday. World’s second largest online travel company beat both revenue and earnings per share (EPS) estimates for the quarter. Revenue reported at $2.884 billion (up by 29% year-over-year) vs. $2.852 billion expected.

EPS at $1.79 per share (up by 46% year-over-year) vs. $1.485 per share estimate. ''Q3 was our biggest and most profitable quarter ever despite geopolitical and macroeconomic headwinds,'' Airbnb wrote in a letter to shareholders. ''In Q3 2022, we had nearly 100 million Nights and Experiences Booked, up 25 percent year-over-year, and $15.6 billion in Gross Booking Value, up 31 percent year-over-year (or 40% ex-FX). Revenue grew 29 percent year-over-year (or 36% ex-FX) to $2.9 billion—our highest quarter ever.'' ''We also had our most profitable quarter with net income of $1.2 billion, up 46 percent year-over-year, representing a 42 percent net income margin. Free cash flow of $960 million increased more than 80 percent from a year ago.

And, over the last twelve months, we generated $3.3 billion in FCF, representing a FCF margin of more than 40 percent. ''Our Q3 results demonstrate that Airbnb continues to drive growth and profitability at scale. And regardless of continued macro uncertainties, we believe we’re well positioned for the road ahead.'' The company expects revenue of between $1.80 billion to $1.88 billion in Q4, which represent growth of between 17% and 23% year-over-year. Shares of Airbnb were trading lower on Wednesday, despite beating Q3 estimates due to future outlook.

The stock was down by around 10% at $97.80 a share. Stock performance 1 month: -12.18% 3 months: -14.67% Year-to-date: -41.05% 1 year: -43.23% Airbnb price targets Morgan Stanley: $110 Mizuho: $125 Baird: $120 UBS: $112 Credit Suisse: $154 Goldman Sachs: $98 Piper Sandler: $110 Keybanc: $142 Jefferies: $138 Airbnb Inc. is the 208 th largest company in the world with a market cap of $63.27 billion. You can trade Airbnb Inc. (NAS:ABNB) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Airbnb Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap