市场资讯及洞察

Expected earnings date: Thursday, 4 February 2026 (US, after market close) / ~8:00 am, Friday, 5 February 2026 (AEDT)

Alphabet’s earnings provide insight into global digital advertising demand, enterprise cloud spending, and broader technology-sector investment trends.

As Google Search and YouTube are widely used by both consumers and businesses, results are often used as one input when assessing online activity and corporate marketing budgets, alongside other indicators.

Key areas in focus

Search

Search advertising remains Alphabet’s largest revenue driver. Markets are likely to focus on ad growth rates, pricing metrics such as cost-per-click, and overall advertiser demand across sectors such as retail, travel, and small-to-medium businesses.

YouTube

YouTube contributes to both advertising and subscription revenue. Markets commonly monitor advertising momentum, engagement trends, and monetisation developments as indicators of digital media conditions and brand spending.

Google Cloud

Sustained Cloud profitability is often discussed as a factor that may influence longer-term earnings expectations, though outcomes remain uncertain. Markets are expected to focus on revenue growth, enterprise adoption trends, and operating margins.

Other bets

Initiatives such as autonomous driving and life sciences, while typically smaller contributors to revenue, markets may still watch spending levels and progress updates as indicators of capital allocation and cost discipline.

Cost and margin framework

Management has previously flagged elevated capex tied to AI infrastructure, including data centres, specialised chips, and computing capacity. Traffic acquisition costs, staffing levels, and infrastructure expansion are also key variables influencing profitability.

What happened last quarter

Alphabet’s most recent quarterly update highlighted advertising trends, Cloud profitability, and continued increases in capex to support AI initiatives.

Management commentary has indicated that infrastructure spending is intended to support long-term competitiveness, while the market continues to assess the near-term margin trade-offs.

Last earnings key highlights

For reported figures and segment detail from the most recent quarter, refer to Alphabet’s latest earnings release materials, including revenue, earnings per share (EPS), Services mix, Cloud operating income, and capex commentary.

- Revenue: US$102.35 billion

- EPS: US$2.87

- Operating income: US$31.23 billion

- Services revenue: US$87.05 billion

- Cloud revenue: US$15.16 billion

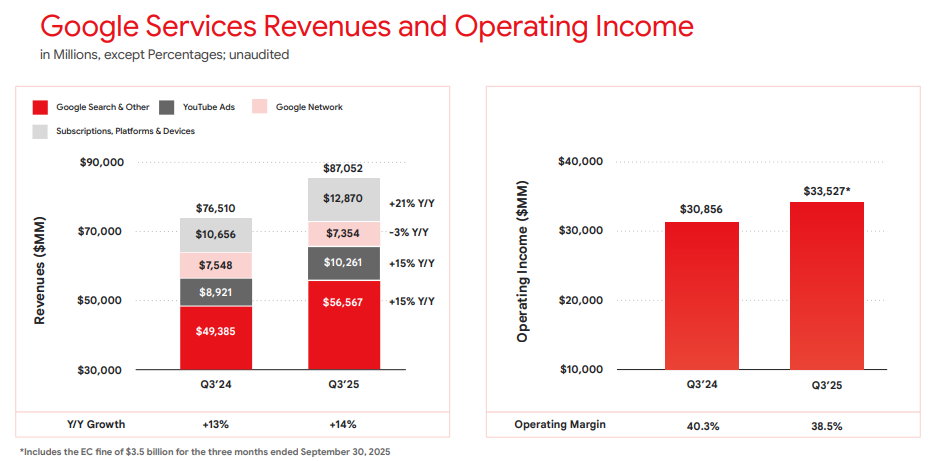

Google Services revenues and operating income Q3 2025 | Alphabet earnings release

What’s expected this quarter

Bloomberg consensus estimates moderate year-on-year (YoY) revenue growth and higher EPS versus the prior-year quarter, with ongoing focus on operating margins given AI-related investment.

Bloomberg consensus reference points:

- EPS: low-to-mid US$2 range

- Revenue: high US$80 billion to low US$90 billion range

- Capex: expected to remain elevated

*All above points observed as of 31 January 2026.

Market-implied expectations

Listed options implied an indicative expected move of around ±4% to ±6% over the relevant near-dated expiry window. Movements derived from option prices observed at 11:00 am AEDT, 2 February 2026.

These are market-implied estimates and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian market participants

Alphabet’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

US markets continued their gains overnight as the market continued to rally on the back of the prior day’s Federal Reserve news. The Nasdaq finished up 1.33%. The Dow Jones Index closed 1.23% higher and the S&P 500 ended the session 1.23% higher as well.

In Europe, the FTSE performed well finishing up and 1.28%, and the DAX closed at 0.36% lower than the prior day although it did bounce off the lows of the day to finish mostly flat. Commodities Brent and WTI oil both made significant gains, up 10% on the back of the market losing hope that Russia and Ukraine will end the conflict from the most recent talks. Consequently, sanctions will continue driving up the demand for commodities rose again.

Gold saw a smaller move to the upside rising by 0.78% to 1938 USD. The gold price has continued its bounce off the support level at 1893 USD per ounce. Natural gas also had a strong night as it continues to coil and rise to move 3.68% higher.

Cryptocurrencies had a genera lly flat day. BTC/USD dipped 0.53% but continues to hold in a tight range. Ethereum was up 1.35% as it also continues to consolidate.

FOREX The Bank of England raised their interest rates in line with the Federal reserve 25 basis points to a current rate of 0.75% and saw a volatile day of trading. The GBP/USD initially sold down likely because just one member of the panel had voted for a 50-point hike. The pair ended up closing flat for the day after recovering from the initial sell down.

The AUD has continued to perform well against the USD. The AUD/USD was able to confirm the breakout of its channel, rising 1.21%.

Australian lithium company, Liontown Resources, has secured another offtake agreement for its Kathleen Lithium project. The agreement with global car manufacturer Ford, means that it will now be the third offtake partner as part of the foundational financing for the development of the Project. Lithium is key for the batteries in electric vehicles in order to allow the vehicles to store electrical energy.

The agreement specifies that LTR will supply Ford with up to 150,000 dry metric tonnes, (DMT) per annum of spodumene concentrate. For the first year, they will provide 75,000 DMT, 125,000 DMT in year 2, and then 150,000 DMT for the remaining 3 years of the initial term of the agreement. Lisa Drake, Ford Vice President of EV industrialisation stated, “Ford continues working to source more deeply into the battery supply chain to meet our goals of delivering more than 2 million EV’s annually for our customers by 2026.” This makes up a third of the foundational offtakes for the Kathleen Project with Tesla and LG also committing to offtake agreements with the company.

The current Kathleen project will be able to produce approximately 500,000 tonnes of spodumene concentrate per annum before expanding to approximately 700,000 tonnes once production starts. The financing of the development will be supported by an agreement in which, Ford will supply $300,000,000 AUD. This combined with $463,000,000 AUD raised by LTR last year should cover the development of the project until production.

The LTR share price was up by 5.4% to $1.12 as of 11.41 EST 29 June 2022 as the market reacted to the news.

Two junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years. The Backstory Lithium stocks companies had seen a momentous rise in the past 3 years largely on the back of the push towards renewable energy and electric vehicles which require lithium for their batteries. Core Lithium (CXO) and Lake Resources, (LKE) have been two companies who have benefited a great deal from the rise in interest and price of lithium.

Both companies became so large that on the 20 th June 2022 they were both added to the ASX200 Index or XJO. This was a key milestone as it meant that large funds and ETF’s were required to buy shares of the companies. This created an almost artificial surge in demand as pools of money were flowing into these companies.

Leading up to the sell off Prior to the addition into the XJO, many lithium stocks had suffered through a bloodbath type of sell off. The selloff was caused by rising inflation and interest rate levels disproportionately affecting growth companies which many lithium companies are and also an over extended bull market that was in need of a pullback. As the price of many of these companies began to see their share prices drop such as Tesla and Allkem, LKE and CXO remained relatively strong.

Once again much of this strength was due to institutions and funds holding the price up due to the rebalancing. The sell off Once the rebalancing occurred on 20 June 2022 the buying pressure subsided and the selling took over in a fairly violent manner. LKE in particular saw a massive drop.

Furthermore, the selloff was exacerbated by CEO, Stephen Promnitz, quitting on the same day for no apparent reason. The relative selling volumes of LKE shares were drastically higher than prior periods of trading. The price is now holding just above its support at $0.70 after falling almost 75% from its peak in April 2022.

With the market capitalisation now under 1 billion dollars, what happens next for the company will be intriguing. After such a large capitulation can the share price have a strong bounce, or does it have further to go? The CXO share price has seen a less aggressive dump.

Whilst it was not struck with the same bad news as LKE was with regards to its lead, it still saw a massive sell off although with the volume of selling not at the same level as LKE. The price is just holding above its 200 day moving average and has pulled back just over 51.33% from its peak in April 2022. The next week or so of price action may provide a great deal of insight into where the share price will go next.

With inflationary pressure set to continue and growth companies baring the brunt of the sell off the short term future of both these companies is murky at best.

The operator of KFC and Taco Bell restaurants across Australia, Europe and South East Asia Collins Foods Limited, (CKF) saw its share price shoot up by above 11% on Tuesday after releasing its annual report. The company saw its revenue increase to 1,184,521,000 and increased its profit by an impressive 47%. The company also saw a decrease in its net debt and net leverage ratio, as improved cashflow saw the business become more solvent.

CKF saw particularly good growth in its European sector where it saw revenue increase from $134.9 million to $190.4 million year on year. With inflation being a key concern for most businesses in the short/medium term future, CKF outlined how it will deal with rising costs. The company will focus on providing better value than competitors.

It has also already locked in prices for chickens until the end of 2022 and 95% of its inputs are sourced locally, minimising supply chain pressures and costs. CKF managing Director, Drew O’Malley stated that, “KFC Australia managed to deliver positive same store sales growth for the full year, despite cycling unprecedented growth in the prior year. The KFC brand has never been stronger in Australia, and metrics around quality, value and purchase intent are at record level, particularly important in times like these.

Looking forward the company has already seen positive results since the report was finalised. O’Malley outlined that the proven track record of the brands and their customer appeal ensures that CKF is well positioned to manage the challenging economic conditions. From a technical perspective on the day the annual report came out, the share price gapped up above the 50 day moving average on a high level of volume.

The price has so far been unable to make a large move higher as it consolidates through a relatively strong resistance zone. If the price can break out of the resistance zone a target or $11.04 or a secondary target of $12.84 may be practical targets to aim for.

Global indices ended the week on a high as the US indices all recovered some of their recent sell offs. The Nasdaq was the strongest performer rising 2.05% to close the week. For the week, the index was able to recover some of its recent selling, finishing up 8.18%.

It was also the Technology sector's best week since November 2020. However, it is still down 14.34% from its all-time high. The S&P 500 was up 1.17% and the Dow Jones 0.80% as Wall Street consolidated its gains.

In Europe, the markets were a little weaker, with the DAX finishing flat up 0.17% and the FTSE slightly better up 0.26%. Commodity prices continued to taper as the economic ramifications of the Russian and Ukraine conflict remain steady. Gold has settled at near support at 1900 USD per ounce and the price closed the week at 1920 USD as it holds that level.

Natural Gas continues to hold near its highs finishing the week down 0.54% as it remains in a tight range. Brent Crude Oil followed a similar pattern ending the week just below $108 at 107.96 after bouncing off the low at $97. The price spiked on the back of an escalation of hostilities in Yemen, as Houthi Rebels unleashed an assault on Saudi Arabia’s critical energy facilities.

Previously, a sophisticated strike in 2019 on Aramarco (The world’s largest oil company) facilities took out half of Saudi Arabia’s oil production. The UAE and Saudi Arabia have also so far resisted calls to increase oil production to offset the deficit from the embargo on Russia. FOREX The JPY was pummelled against other currencies as it hit its lowest levels in 4 years against the AUD dropping 3.26% for the week.

Against the USD, the JPY saw its lowest value in 6 years dropping 1.62%. The AUD has continued to be a great performer, with the AUD/USD rising 0.51% as it holds 0.7408 cents. The market will be looking forward to Reserve Bank of Australia Governor Phillip Lowe’s speech on Tuesday for an indication of the likely monetary policy for April.

The AUD has performed well during recent volatility relative to other global currencies due to high commodity prices which have supported the AUD. The EUR/USD and GBP/USD both have been following a steady pattern as Ukraine and Russian conflict has settled. Both pairs remain below their recent resistance.

Coal and Gas prices have surged and joined gold and oil as demand surges due to the supply shortages stemming from the Russia and Ukraine conflict. The global indices were up overall as the market still remains unsure of how to react to the unfolding crisis. In Europe, the FTSE provided strength with a 1.36% gain and the DAX provided a small bounce rising 0.69%.

In America the Dow Jones and the NASDAQ both saw decent rises, moving 1.79% and 1.62% respectively. The US markets responded positively after Jerome Powell testified that the Federal Reserve still intends to increase interest rates later this month by 25 basis points. Mr.

Powell did, however, allow for some flexibility in the face of the increased conflict. The biggest mover was coal which shot up almost 33% to $400 on the back of the energy crisis. It has led to many countries attempting to scavenge for coal reserves.

Germany is poised to create coal power reserves and Italy announced it may reopen some of its previously shut coal plants. The Aussie dollar has benefited from this and other rises in commodity prices with AUDUSD touching on 0.73c overnight. Oil prices reached as high as $114.00 and touched the 8 year high before settling in at $111.

This is after OPEC decided overnight to hold production level at the current level leaving the potential shortfall in demand unaccounted for, claiming that that demand for oil is being driven by geopolitics and not fundamentals. The price of wheat and aluminium also hit 14-year highs overnight and Gold continues to remain steady at $1,927 per ounce. Bitcoin saw a slight slump and is down 1.47% although is still very much moving upward due to the momentum from Russian investors.

The Ruble saw some strength as it saw upward of 5% gains against many other currency pairs. The US dollar continues to be strong on the back of the Federal reserve and from the risk aversion seen in the market at the moment.