市场资讯及洞察

.jpg)

全球石油市场的稳定,很大程度上悬于几条关键的海上通道。这其中,霍尔木兹海峡无疑是重中之重。“全球约20%的石油都得从这儿过”,这个说法流传很广。它并非夸张,而是揭示了全球能源供应链的一个结构性现实。要理解这个现象,我们需要从它的地理位置、贸易格局和经济影响说起。

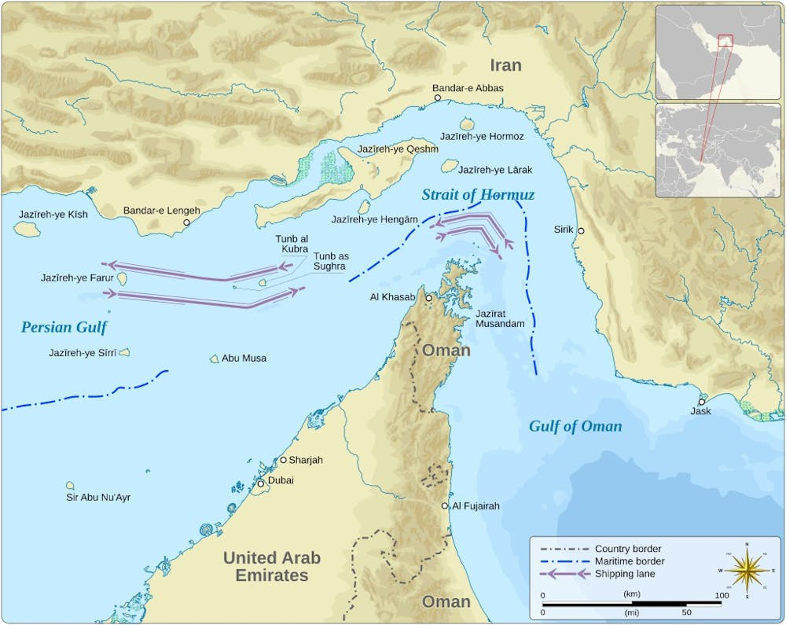

1. 地理瓶颈:无法绕行的“世界油阀”霍尔木兹海峡位于阿曼与伊朗之间,是连接波斯湾与阿拉伯海的唯一水道。对沙特、伊拉克、阿联酋这些波斯湾沿岸的产油大户来说,这里是他们把石油运往全球市场的几乎唯一海上出口。根据美国能源信息署(EIA)的数据,2024年,每天约有 2,000万桶 石油及成品油穿过海峡。这个数字,相当于:

- 全球石油液体日消费量的 20%。

- 全球海运石油贸易总量的 25% 以上。

之所以如此依赖这条水道,并非偶然。独特的地理位置、产油国集中的港口布局、以及替代方案的极度稀缺,三者共同造就了它今天的地位。

近年来的运输量数据,也印证了这一点。下图显示,通过海峡的石油运输量长期维持在极高水平。

2. 贸易格局:谁在出口?谁在进口?

谁在出口,谁又在进口?海峡的贸易流向,就像一面镜子,照出了全球石油的供需格局。

主要出口国:海峡的石油主要来自波斯湾内的产油国。2023年的数据显示,供给侧高度集中:

主要进口方:相比之下,需求侧更加集中,主要在亚洲。EIA估算,2024年从霍尔木兹海峡运出的原油与凝析油中,约 84% 都流向了亚洲市场。其中,中国、印度、日本和韩国 是四个最主要的买家。这就意味着,一旦海峡发生航运中断或地缘政治风险,第一波冲击将直接传导至亚洲的炼厂和能源市场,并迅速通过布伦特原油这样的全球基准,影响世界经济。

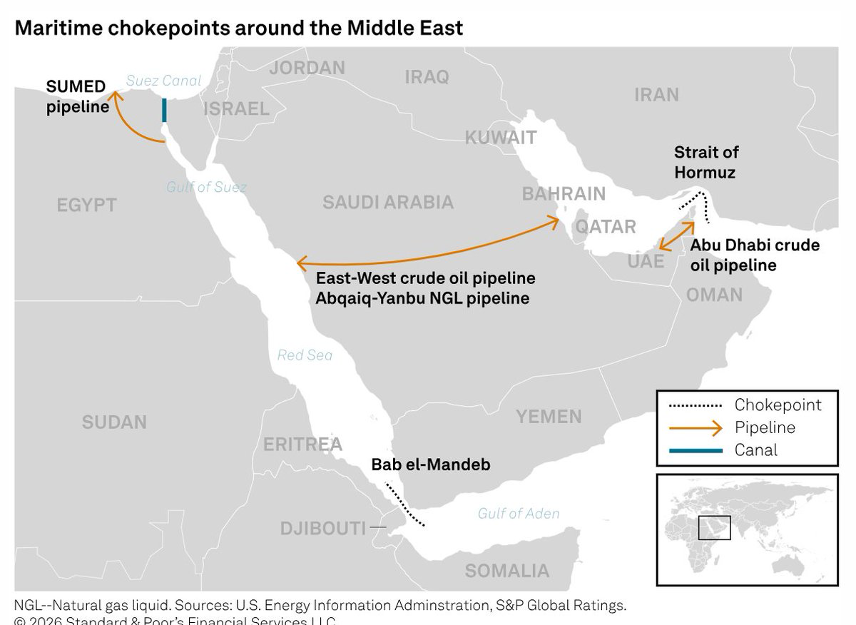

3. 替代方案:管道与运力的“远水”与“近渴”

既然霍尔木兹海峡如此关键,难道没有备用方案来分散风险吗?答案是:有,但能力非常有限。

主要的陆上替代方案,是沙特和阿联酋运营的两条输油管道。

下表对比了海峡的日常流量与几个关键替代方案的运力。

至于油轮,船队通常都在高负荷运转,闲置的本就不多。一旦需要绕行非洲好望角这样的长航线,不仅运输时间和成本会暴增,全球的有效运力也会被大量占用,加剧市场本就紧张的神经。

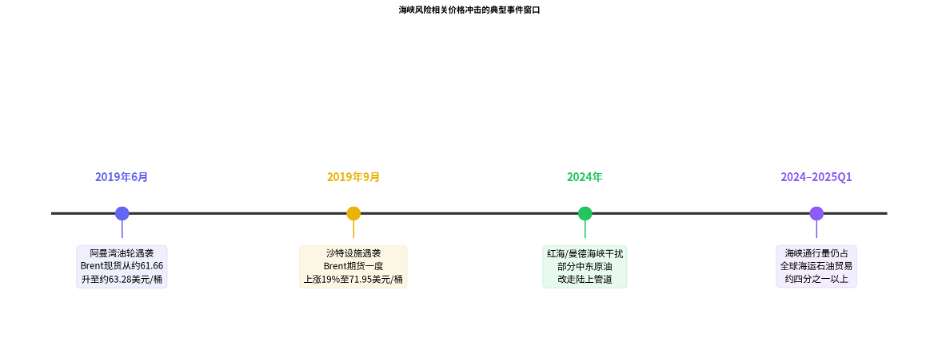

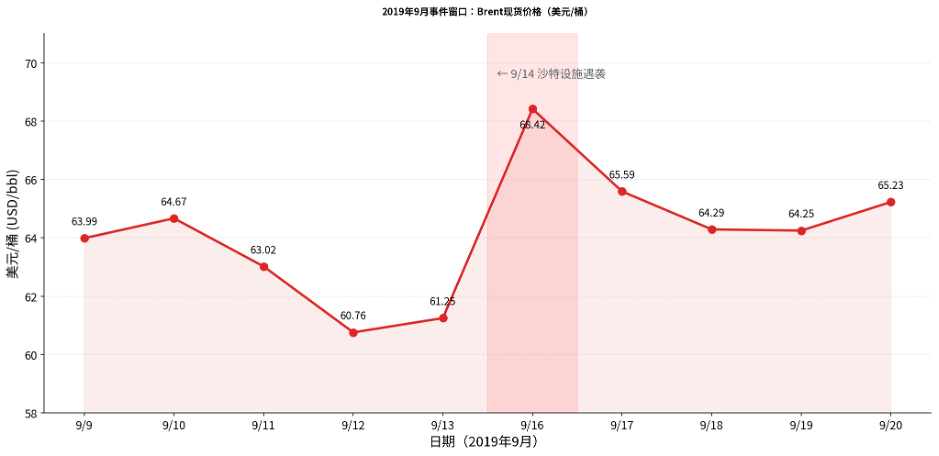

4. 风险传导:从地缘政治到市场价格为什么霍尔木兹海峡的风险,总能迅速搅动全球油价?关键在于,短期内,无论是石油的生产还是消费,都缺乏弹性,很难快速调整。历史上,任何对海峡通航的威胁,都会立刻反映在价格上。下面的时间线和图表,就回顾了近年的几次典型风险事件。

2019年9月沙特石油设施遇袭后,布伦特原油价格的急剧跳升,就让市场感受到了供给中断的寒意。

市场如何消化这种风险呢?通常有几种方式:

- 即期价格跳升:交易员出于避险,会立即将最坏情景计入价格。

- 期货期限结构变化:对未来供给短缺的担忧,会推高近期合约的价格,形成“现货溢价”。

- 风险溢价:金融机构通过期权等工具,把地缘政治风险量化为每桶数美元不等的溢价,叠加在基础油价之上。

由单一通道风险引发的价格冲击,会沿着下面的链条,最终传导到整个宏观经济层面。

结语

霍尔木兹海峡的核心地位,根植于地理的唯一性、产油国港口的集中布局,以及替代方案的严重不足。全球五分之一的石油供给被锁定在这条狭窄水道上,而现有的管道和运力冗余远不足以对冲一次大规模中断。

这不只是一个运输瓶颈的问题。它意味着,任何围绕海峡的地缘政治摩擦,都有可能在短时间内转化为油价的剧烈波动,并沿着通胀和货币政策的链条向全球经济传导。对于关注能源市场和宏观风险的投资者而言,霍尔木兹海峡始终是一个不可忽视的变量。

参考文献与数据来源

- 1EIA (2025-06-16), Amid regional conflict, the Strait of Hormuz remains critical oil chokepointhttps://www.eia.gov/todayinenergy/detail.php?id=65504

- 2EIA (2024-06), World Oil Transit Chokepoints (PDF; Table 3 含 2018–2023 海峡通行量与全球海运石油贸易/消费口径) https://www.eia.gov/international/content/analysis/special_topics/world_oil_transit_chokepoints/wotc.pdf

- 3EIA (2017-08-04), Three important oil trade chokepoints are located around the Arabian Peninsulahttps://www.eia.gov/todayinenergy/detail.php?id=32352

- 4EIA, Europe Brent Spot Price FOB (Daily history table) https://www.eia.gov/dnav/pet/hist/rbrted.htm

- 5IEA (2019-10), Oil Market Report October 2019 (PDF; 2019年9月事件、库存与期货结构) https://iea.blob.core.windows.net/assets/953b7442-bc56-467d-94ef-7cded75d0843/October_2019_OMR.pdf

- 6Morgan Stanley (2026-02-26), Thoughts on the Market — Oil Rallies on Fresh Uncertainty (transcript; 风险溢价示例与期限结构识别) https://www.morganstanley.com/insights/podcasts/thoughts-on-the-market/oil-market-rally-geopolitical-risks-martijn-rats

- 7IMF Working Paper (2022), Second-Round Effects of Oil Price Shockshttps://www.imf.org/-/media/files/publications/wp/2022/english/wpiea2022173-print-pdf.pdf

- 8BIS Working Paper (2010), Oil shocks and optimal monetary policyhttps://www.bis.org/publ/work307.pdf

- 9FRBSF Working Paper (2023), How Oil Shocks Propagate: Evidence on the Monetary Policy Responsehttps://www.frbsf.org/wp-content/uploads/wp2024-07.pdf

- 10UNCTAD (2024), Review of Maritime Transport 2024 — Chapter 2 (全球船队与油轮占比)https://unctad.org/system/files/official-document/rmt2024ch2_en.pdf

- 11Reuters (2025-12-15), Oil tanker rates to stay strong into 2026…(VLCC 利用率/闲置口径) https://www.reuters.com/business/energy/oil-tanker-rates-stay-strong-into-2026-sanctions-remove-ships-hire-2025-12-15/

- 12Reuters (2025-06-18), Goldman estimates geopolitical risk premium…(风险溢价区间示例) https://www.reuters.com/business/energy/goldman-estimates-geopolitical-risk-premium-around-10-per-barrel-brent-after-2025-06-18/

The negative dollar reaction to a modest tick-up in US jobless claims yesterday (231k versus consensus 212k) where the US Dollar Index (DXY) dropped from session highs at 105.74 to close at session lows of 105.20 seems to be telling FX traders that tells us that: a) markets are probably lacking some sense of direction in the period between payrolls and US CPI. b) the generally overbought dollar remains quite vulnerable to even slightly softer US data releases. c) markets may be buying in more convincingly on the softening US jobs market narrative. Beyond very short-term price movements, it’s looking like the key for the USD to trend materially lower remains inflation. Consensus is looking at 0.3% month-on-month core CPI print on Wednesday, which is still too high for the Fed to start cutting rates this summer.

Today’s US calendar includes only the University of Michigan surveys. Markets will be watching closely whether the medium and long-term inflation expectations have moved at all from April’s 3.0/3.2% levels. From the Fed the most interesting speaker will be Neel Kashkari, who recently argued for a higher neutral rate, which would suggest current monetary policy is not as restrictive as perceived.

USD was notably lower after what was seen as a dovish FOMC meeting on Wednesday. The Fed 2024 median dot was left unchanged with 3 cuts for 2024 still the Fed forecast but the dovish part came at the presser where Fed Chair Powell downplayed the hot January and February CPI numbers. This dovish tilt saw risk assets surge and the USD dump.

USDJPY bucked the weak Dollar trend pushing up to 152 before the result from the FOMC saw it pare some of those gains. A hawkish BoJ source reporting in Nikkei that suggested another hike could come in July or October also supporting the Yen somewhat. There is also speculation if the Yen weakness were to continue the BoJ/MoF could step in to intervene, with ING noting that local accounts felt that 155 would be red line.

Gold ripped to all time highs, with XAUUSD hitting a high of 2222 USD an ounce on the back of USD weakness and falling yields post FOMC, before falling back just above the old high at 2195 heading into the APAC session. Today ahead, more Central Bank action out of the BoE and SNB for FX traders to look forward to.

USD was slightly lower on Monday with DXY hitting a low of 104.140, holding above the 104 support level. News was light with only New Home Sales of any note, which missed modestly to the downside (662k vs the expected 675k). There was some Fed speak, the highlight being Fed hawk Bostic where he reiterated his desire of just one rate cut in 2024, this failed to make much impact on the Dollar though.

AUD and NZD saw gains to differing degrees against the USD with AUD outperforming, continuing the steep rally in AUDNZD to see the pair touching on 1.09 and firmly in overbought territory. Both AUD and NZD supported by the surprise Yuan fix by the PBoC that was much firmer than forecast. AUDUSD initially tested Friday's low at 0.6510, before the fix and improving risk sentiment saw it reverse course to hit a high of 0.6546.

USDJPY was ultimately flat in a tight ranged session. Some more jawboning from top currency diplomat Kanda saying that the BoJ has been closely watching “FX moves with a high sense of urgency and will take appropriate steps to respond” saw the talk of intervention arise with Bank of America noting that intervention is seen as a 'realistic option' to support the Yen, especially if the USDJPY cross rises to the 152-155 zone.

JPY was the currency everyone was watching coming into the pivotal BoJ meeting on Tuesday. The BoJ, as widely telegraphed, ended 17 years of negative interest rates, ETF purchases and their yield curve control policy. While a big move from the central bank there was no real surprise, with USDJPY surging to touch on 151, well into the “intervention zone” above 150.

The US Dollar Index was bid on JPY weakness, seeing DXY briefly rise above 104.00 to a peak of 104.06 in the UK session before paring some gains head of today’s closely watched FOMC meeting. AUDUSD dropped to 1 week lows after the RBA rate decision which left rates on hold as expected, but pulled back slightly on the tightening bias namely a language change from “further increase in interest rates cannot be ruled out “ to “not ruling anything in or out on interest rates”. NZD saw weakness in sympathy of the Aussie although AUDNZD saw marginal gains but failed to breach 1.08 with a high of 1.0793.

USD saw marginal weakness on Wednesday in a quiet news day. The US Dollar Index (DXY) pushing to lows after a strong 30yr Treasury saw yields drop and DXY briefly breaking beneath Tuesdays low of 102.72. A turn around later in the session saw DXY retake the 50% Fib support level at 102.80 ahead of today’s Retail Sales, Jobless Claims, and PPI data.

EUR saw decent gains vs the Dollar, with EURUSD setting a weekly high of 1.0948. ECB member Villeroy spoke, saying the ECB is winning the inflation battle, but cuts are more likely appropriate in June rather than April. EURUSD holding the key 1.09 support so far this week, with 1.10 the next major resistance level to the upside.

USDJPY was ultimately flat in a whipsawing session that saw USDJPY testing 148.00 to the upside. Before pairing gains as the Yen strengthened on a report from Reuters suggesting that early signs suggest a strong outcome in the annual wage talks that have heightened the chances that the BoJ will end NIRP next week. Gold popped on Wednesday, bouncing off the 2151 support level and recouping most of Tuesday’s losses to head into the APAC session at 2175 USD an ounce, with the next upside resistance the all-time high at 2195.

As April draws to a close, the global economy stands at a pivotal juncture, grappling with the resurgence of inflationary pressures that refuse to retreat. In fact, it feels as though the inflation genie has re-emerged, asking, "Oh, you want more?" This resurgence prompts a crucial question: have we truly witnessed the peak of inflation, and consequently, the peak in interest rates, or are we merely witnessing a temporary lull before central banks are compelled to escalate interest rates further? The market has become entangled in this debate over the past few weeks, and it's far from reaching a resolution.

At the heart of the matter lies 'sticky' inflation. Economies such as Australia, the United States, and New Zealand are grappling with persistent price increases in essential fixed goods and services, including insurance, rent, housing costs, and utilities. The resilience of inflation in these sectors underscores the enduring impact of global economic forces on household budgets.

Remarkably, despite facing a post-COVID landscape fraught with challenges, households in these nations have displayed remarkable resilience. They have weathered the storm of rising interest rates while managing to maintain or marginally adjust their spending habits. Such resilience would typically be viewed as a positive narrative in a conventional economic cycle, signaling prudent financial management and adaptability.

However, the current economic landscape is anything but conventional. Against the backdrop of a global interest rate cycle reaching decade-high levels, the resilience of households and the absence of significant spending contractions raise concerns. Will tentative central banks be forced to raise rates again, rather than enact the forecasted rate cuts that were almost certain just eight weeks ago?

The chart depicting the change in the 30-day interbank cash rate implied yield curve from the start of March to the end of April vividly illustrates this shift. The difference is staggering. The resurgence of inflationary pressures threatens to upend optimistic projections.

It challenges the notion that the peak of the current economic cycle has already been reached. Instead, it suggests that the trajectory of interest rates may continue to trend upward, defying earlier forecasts and unsettling financial markets. From and FX perspective this is creating and interesting situation in the policy divergences of other central banks.

The US is facing a similar issue to that of the RBA - market pricing for the Federal Funds rate has gone from a fully pricing in 3 rate cuts with the real possibility of a 4 th in 2024 too just 1 rate cut in 2024 and only 2 cuts in 2025. Both are facing much higher rate situations in 2024. Compare that to the likes of European Central Bank (ECB), Swiss National Bank (SNB), Bank of Canada (BoC), and the Riksbank.

All are signalling potential rate cuts in upcoming meetings. In the case of the ECB it looks like being as early as June. This policy divergence creates significant implications for FX markets.

Bullish bets in the AUD have been coming thick and fast as interest rate differentials has seen crosses moving firmly in the AUD’s favour. EURAUD, AUDCAD, AUDJPY and the likes In the case of the AUDUSD this pair is hard to read as both have similar dynamics. The rule of thumb in a scenario like this is ‘all roads lead to the USD’ and explains why the AUD is lagging in this pair but not elsewhere.

On the USD – the clearest example of the pressure it is putting on the rest of its peers is USDJPY. For the first time since 1990 USDJPY passed Y160. It would appear this is a market test for the Bank of Japan.

Does it defend its falling currency? Does it lose its authority due to it losing control of its control mechanism? The economic fundamentals make this a very interesting question indeed.