GO Markets,让交易更进一步

智慧交易,从选择值得信赖的全球券商开始。低点差、快速成交、零入金手续费、功能强大的交易平台,以及屡获殊荣的客户支持,让您的交易更进一步

二十年稳健实力,成就值得信赖。

二十年专注打造极致交易体验。

自2006年起,致力缔造卓越的交易环境。

全球交易者共同的选择

自 2006 年起,GO Markets 已帮助全球数十万交易者实现他们的投资目标。凭借严格监管、以客户为本的服务,以及屡获殊荣的教育资源,我们始终是交易者值得信赖的合作伙伴。

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

GO Markets

让交易更进一步

探索上千种交易机会,享受专业机构水准的交易工具、流畅稳定的交易体验,以及屡获殊荣的客户支持。开户流程简单快捷,让您轻松开启交易之旅。

从人工智能基础设施到宠物护理、半导体和黄金勘探,以下是最有可能上榜的五大候选人 ASX 在 2026 年。

1。Firmus 科技

Firmus Technologies正在塔斯马尼亚州建设人工智能驱动的数据中心基础设施,它可能是澳大利亚目前最具战略地位的科技公司之一。

Firmus是英伟达的云合作伙伴,并已加入这家GPU制造商的Lepton市场。该公司设计了模块化、无处不在的液体AI Factory平台,以适应Nvidia的最新架构,包括Nvidia Spectrum-X以太网网络。

2025年9月,该公司完成了3.3亿澳元的融资,盘后估值为18.5亿澳元。到2025年11月,在又筹集了5亿澳元之后,该估值已增长三倍至大约 60 亿澳元。

马斯集团随后在2026年初进行的1亿澳元投资证实了11月份的估值。据报道,Firmus正在考虑在未来12个月内在澳大利亚证券交易所进行首次公开募股,鉴于60亿澳元的私募估值,任何公开募集的资金预计都将远高于 10亿澳元。

随着澳大利亚对主权人工智能计算能力的需求不断增长,以及塔斯马尼亚州在大型数据中心运营方面的凉爽气候和可再生能源优势,Firmus成为2026年澳大利亚证券交易所规模最大的IPO候选人之一。

但是,尽管市场对Firmus的兴趣似乎在增长,但就首次公开募股而言,时机决定一切。留意确切的首次公开募股时机、人工智能数据中心情绪的确认,以及英伟达在上市后是否表示将深化其作为战略主要投资者的参与。

2。Rokt

悉尼创立的Rokt已悄然成为澳大利亚最有价值的私营科技公司之一。旨在帮助品牌在 “交易时刻” 获利的电子商务广告技术平台现在的估值为 ~79 亿美元。

MA Financial编写的条款表预计退出 股价为72美元 在基本情景下,股票将于 2027 年 11 月从托管中解除。

预计Rokt可能会在2026年在美国和澳大利亚证券交易所双重上市,最快可能在上半年。IG 最广泛讨论的结构是纳斯达克的主要上市,澳大利亚投资者采用澳大利亚证券交易所CDI(CHESS存托权益)结构,而不是全面的双重上市。

截至2025年8月的财年,Rokt的收入预计为7.43亿美元(同比增长48%),息税折旧摊销前利润预计为1亿美元,毛利率约为43%。目前预计到2026年8月,其年收入将突破10亿美元的里程碑。

据报道,亚马逊、Live Nation和Uber都是Rokt的客户,该公司已在北美和欧洲迅速扩张。

无论Rokt选择以澳大利亚证券交易所CDI结构在纳斯达克进行主要上市,还是选择全面双重上市,都可能严重影响流动性和本地投资者准入。

3.格林克罗斯

Petbarn、City Farmers和Greencross Vets背后的企业Greencross在2019年被美国私募股权公司TPG私有化后,正准备在澳大利亚证券交易所重新上市。

TPG目前拥有Greencross55%的股份,而AustralianSuper和安大略省医疗保健养老金计划(HOOPP)持有其余45%的股份。

该公司报告称,2025财年的收入为20亿澳元,较2024年的19.5亿澳元略有增长。TPG在2019年为该业务支付了6.75亿澳元的股权;它在2022年出售了45%的股份,估值超过35亿澳元。拟议的首次公开募股意味着估值超过 4 亿澳元。

TPG的目标是进行至少7亿澳元的首次公开募股。首次公开募股将标志着格林克罗斯在缺席八年后重返澳大利亚证券交易所。TPG的加薪规模相对较小,这表明该公司在完全退出之前寄希望于强劲的售后市场表现。

TPG的退出时间表公告仍在关注2026年的首次公开募股是否即将到来。而且,无论公司是追求传统的首次公开募股还是贸易出售,这仍然是另一种途径。

4。摩尔斯微电子

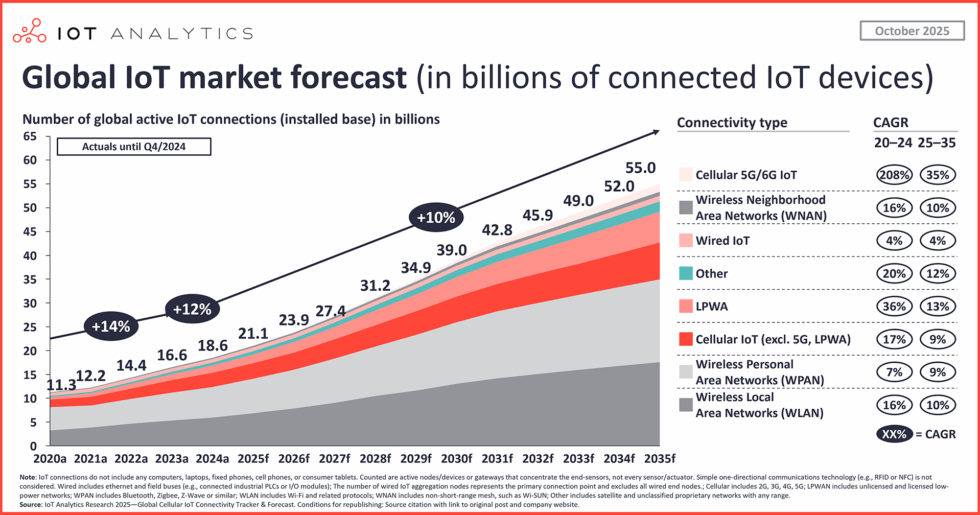

Morse Micro是一家总部位于悉尼的半导体公司,开发Wi-Fi HaLow芯片,专为农业、物流、智慧城市和工业监控领域的物联网应用而设计。

摩尔斯微于2025年9月举行了C轮融资,筹集了8,800万美元,随后在2025年11月进行了3,200万美元的首次公开募股前融资,使融资总额超过3,200万美元 3 亿澳元。

它的目标是在未来12-18个月内在澳大利亚证券交易所上市。C轮融资由日本芯片巨头MegaChips和国家重建基金公司牵头。

预计到2030年,全球物联网设备连接将超过300亿,摩尔斯微将成为一家罕见的在澳大利亚证券交易所上市的纯半导体公司,这可能会吸引专注于科技的基金经理的浓厚兴趣。

摩尔斯微在上市前与一级硬件合作伙伴的收入吸引力值得关注,鉴于美国半导体投资者的胃口深厚,该公司是否寻求同时在美国上市。

5。野牛资源

Bison Resources是一家新成立的专注于美国的黄金和贵金属勘探公司,目前正在澳大利亚证券交易所进行首次公开募股。

该要约将于2026年3月20日结束,目标是在2026年4月中旬在澳大利亚证券交易所上市。按指示性市值计算 1325 万澳元 在全面订阅后,Bison是这份清单上最具投机性的名字。

该公司在内华达州东北部的卡林趋势(世界上最多产的黄金产地带之一)内拥有四个勘探项目,约占美国黄金产量的75%。

首次公开募股旨在筹集450万澳元至550万澳元(2,250万至2750万股,每股0.20澳元)。该团队之前曾在Sun Silver(澳大利亚证券交易所股票代码:SS1)和黑熊矿业公司任职,这使其在内华达州的澳大利亚证券交易所初级矿业上市中创下了良好的记录。

底线

澳大利亚2026年的首次公开募股日历涵盖了全部风险范围。一家由NVIDIA支持的人工智能基础设施公司,一个价值十亿美元的电子商务平台,以及一家正在进行首次公开募股的初级黄金勘探者。

每位候选人反映不同的成熟阶段和不同的投资者概况。他们共同表明,澳大利亚证券交易所可能会有意义地注入近年来当地市场基本上没有上市的行业的新上市。

石油的最新走势使能源公司重新成为人们关注的焦点。在过去的六个月中,埃克森美孚和贝克休斯在正常化的基础上表现优于布伦特原油,雪佛龙保持了广泛的建设性,SLB落后于该大宗商品,伍德赛德的经纪商共识更加谨慎。

当原油走势时,其影响很少局限于大宗商品本身。油价上涨会影响全球经济的通货膨胀预期、运输成本和企业利润率。

最新举动显示了什么

公司可以通过三种主要方式从油价上涨中受益:

- 通过以更高的价格出售大宗商品来生产石油和天然气

- 向生产者提供服务和设备

- 在世界各地运输石油

以下每个名称都代表其中一种风险敞口类型,当原油上涨时,风险状况会有所不同。

1。埃克森美孚(纽约证券交易所代码:XOM)

在过去的六个月中,埃克森美孚的表现超过了布伦特原油,其股价上涨了近35%,而布伦特原油的股价上涨了约30%。截至2026年3月11日,两者的交易价格均比历史新高略低3%以上,而埃克森美孚仍接近52周高点。

埃克森美孚是全球最大的综合石油公司之一,其投资范围涵盖勘探、生产、炼油和化工。当油价上涨时,其上游业务可能会受益于更大的利润,而其规模和多元化可以帮助缓冲周期的疲软部分。

埃克森美孚(XOM)对比布伦特原油6个月表现

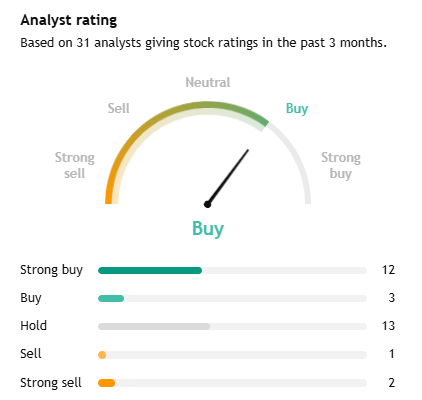

分析师共识:买入

根据TradingView的数据,分析师对埃克森美孚的情绪普遍乐观。在追踪的31位分析师中,有15位将股票评为强势买入或买入,13位将其评为持有,1位将股票评为卖出,2位将股票评为强势卖出。

这种积极的观点与埃克森美孚的资产负债表实力和更高的利润率产量有关。最乐观的分析师预计,1年期目标股价将高达183.00美元。平均目标价为145.00美元,比当前交易价格低约3.6%。

2。雪佛龙(纽约证券交易所代码:CVX)

雪佛龙是另一家受益于最近原油价格上涨的全球综合性巨头,其股价交易价格接近52周高点。像埃克森一样,雪佛龙在整个价值链中运营,包括上游生产、炼油和营销。

雪佛龙完成对赫斯的收购增加了圭亚那和其他上游资产,一些分析师认为,随着时间的推移,这会起到支撑作用。尽管如此,收益影响仍受整合、项目执行和大宗商品价格风险的影响。

埃克森美孚与雪佛龙的表现,6个月走势图

分析师共识:买入

雪佛龙的看法与埃克森美孚类似,经纪商的情绪仍然具有广泛的建设性。TradingView最近的汇总数据显示,有30位分析师在过去三个月中报道了该股,其中17位分析师评为强势买入或买入,11位评为持有,1位为卖出,1位为强势卖出。

分析师强调了雪佛龙的多元化投资组合以及赫斯的潜在贡献,尽管大宗商品价格的波动和执行风险可能会使一些人更加谨慎。

3.SLB(纽约证券交易所代码:SLB)

SLB,前身为斯伦贝谢,是世界上最大的油田服务和技术提供商之一。它提供工具、设备和软件,帮助生产商更有效地查找、钻探和完井。

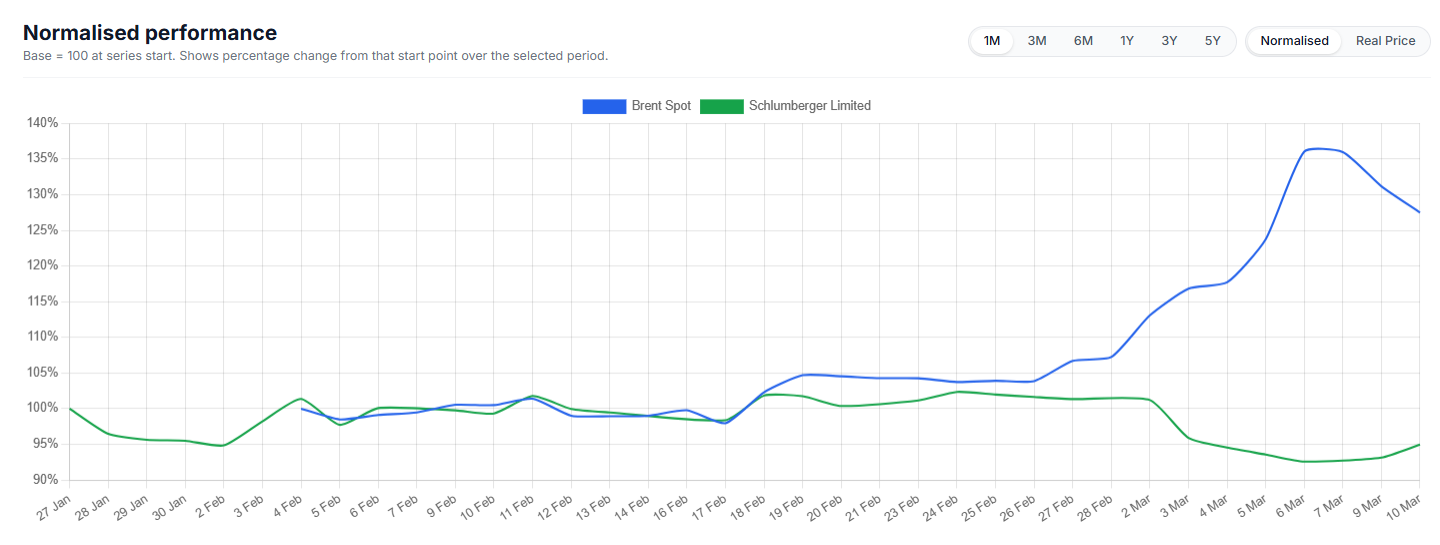

在过去的六个月中,SLB一直落后于布伦特原油,股价处于波动区间内,仍低于最近的峰值。这表明强劲的石油背景并未完全反映在股价中。

这种模式对于油田服务公司来说并不罕见,在这些公司中,客户的支出决策通常遵循标的商品的走势,而不是与标的商品同步变化。未来的任何重新评级都将取决于生产者资本支出、合同时机、服务定价、离岸活动和更广泛的市场状况等因素。不应假设更坚挺的油价会自动转化为更坚固的SLB股价。

SLB兑布伦特原油,6个月正常化表现

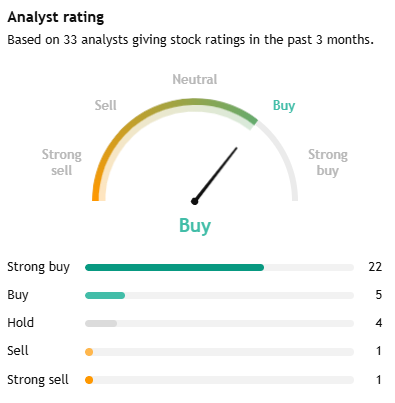

共识: 购买

根据TradingView的数据,第三方分析师对SLB的共识是买入。在报道该股的33位分析师中,有27位将其评为强势买入或买入,4位将其评为持有,2位将其评为卖出或强势卖出。

这表明了经纪商的建设性情绪,尽管油价与SLB最近股价表现之间的差距表明,在股票充分反映强劲的大宗商品背景之前,投资者可能仍希望有更明确的证据证明服务需求和定价的改善。

4。贝克休斯(纳斯达克股票代码:BKR)

贝克休斯是另一家主要的油田服务和设备提供商,在液化天然气和电力基础设施等工业领域拥有额外的投资机会。即使油价没有处于极高水平,钻探技术的进步和较低的盈亏平衡成本也帮助许多页岩油田保持盈利,支持了对其服务的需求。

由于其资产负债表以及对持续勘探和生产活动的敞口,该公司也被描述为处于有利地位。在油价上涨甚至稳定的时期,服务和能源技术的组合可能会创造多种收入驱动因素。

在过去的六个月中,贝克休斯在正常化的基础上表现明显优于布伦特原油。布伦特原油在大部分时间内交易区间要窄得多,然后才走高,而BKR的攀升更加稳定,累计涨幅明显增强。这表明BKR的股价不仅受益于石油背景,还受益于公司特定的乐观情绪以及对油田服务和能源科技公司的更广泛支持。

BKR兑布伦特原油,6个月正常化表现

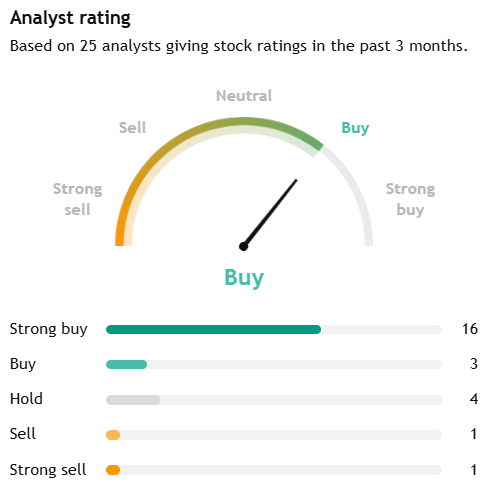

分析师共识:买入

根据TradingView的数据,贝克休斯被归类为强势买入。根据在过去三个月中提供评级的25位分析师,16位对该股进行了强势买入,3位评级为买入,4位评级为持有,1位评级为卖出,1位评级为强势卖出。

总体而言,经纪商对贝克休斯的情绪普遍乐观,超过四分之三的报道分析师将该股评为强势买入或买入,其余大部分处于持仓状态。分析师的这种支持性观点似乎反映了BKR对传统油田服务以及包括液化天然气基础设施在内的更广泛的能源和工业技术市场的敞口。

5。伍德赛德能源 (ASX: WDS)

伍德赛德能源向该名单提供了一家总部位于澳大利亚的生产商,该生产商在液化天然气和石油市场拥有大量敞口。其收益与已实现的大宗商品价格密切相关,这使得该股对原油和天然气价格的变化以及更广泛的全球能源需求敏感。

与一些较大的美国能源公司相比,经纪商对伍德赛德的情绪似乎更加谨慎。投资者正在平衡公司的全球液化天然气敞口和能源价格上涨的杠杆作用与近期疲软的已实现价格、项目和执行风险以及长期监管和脱碳压力。

分析师共识:持有

根据TradingView的数据,伍德赛德被评为中性/持有。在15位分析师中,有2位将其评为强势买入,4位将其评为买入,7位将其评为持有,1位将其评为卖出,1位将其评为强势卖出。

12个月的平均目标股价为29.20澳元,而目前的价格约为30.28澳元,这意味着下跌幅度约为3.6%。与该清单中较大的美国能源公司相比,这表明经纪商的观点更加谨慎。

6。全球油轮运营商

当油价走强、欧佩克+政策转变和地缘政治紧张局势增加长途运输并扰乱通常的贸易路线时,油轮公司可以从中受益。当石油产量进一步增长时,即使整个能源市场波动不定,“吨英里” 需求也可以支撑油轮的日利率和盈利能力。

分析师共识:N/A

这是一个更广泛的行业类别,而不是单一的公开交易股票,因此没有单一经纪商的共识可供引用。分析师的观点需要在公司层面进行评估,例如Frontline plc(FRO)、Euronav(EURN)或Scorpio Tankers(STNG)。

更广泛地说,该行业是周期性的。如果航线正常化、运费下降或供应增加,则航运市场紧缩带来的任何好处都可能逆转。

风险和制约因素

油价上涨并不能消除这些名称的风险。

- 如果价格上涨太大、过快,需求破坏和政策应对可能会压制未来的收益。

- 欧佩克+或其他主要生产国的政治决策可以通过增加供应来逆转涨势。

- 服务业和油轮公司具有很强的周期性。当周期转折时,定价能力会迅速减弱。

- 公司的具体问题,包括项目执行、已实现定价和资本支出,仍然很重要。

总而言之,这些公司可能会受益于油价的走强,但它们也带来了特定行业、地缘政治和公司层面的风险,值得密切关注。

主要市场观察

- 伍德赛德提供了液化天然气和石油敞口,尽管目前经纪商的情绪比美国大型公司的情绪更为中立。

- 当货运市场收紧时,油轮运营商可能会受益,尽管这种贸易仍然高度周期性且依赖航线。

- 如果油价走强转化为更多的钻探和完井活动,SLB和贝克休斯可能会受益,但股价反应喜忧参半。

- 在多元化业务的支持下,埃克森美孚和雪佛龙直接投资更高的上游利润率。

本文提及的埃克森美孚、雪佛龙、SLB、贝克休斯、伍德赛德、油轮运营商、分析师共识评级和目标价格仅供一般市场评论之用,不构成与任何金融产品或证券相关的建议或报价。第三方数据,包括共识评级和目标价格,可能会更改,恕不另行通知,因此不应孤立地依赖。能源和航运风险敞口是周期性的,可能受到大宗商品价格波动、已实现定价、生产变化、项目执行、地缘政治干扰、货运市场状况、监管发展和投资者情绪变化的重大影响。对油价上涨的潜在受益者的任何看法都存在很大的不确定性。

.jpg)

全球石油市场的稳定,很大程度上悬于几条关键的海上通道。这其中,霍尔木兹海峡无疑是重中之重。“全球约20%的石油都得从这儿过”,这个说法流传很广。它并非夸张,而是揭示了全球能源供应链的一个结构性现实。要理解这个现象,我们需要从它的地理位置、贸易格局和经济影响说起。

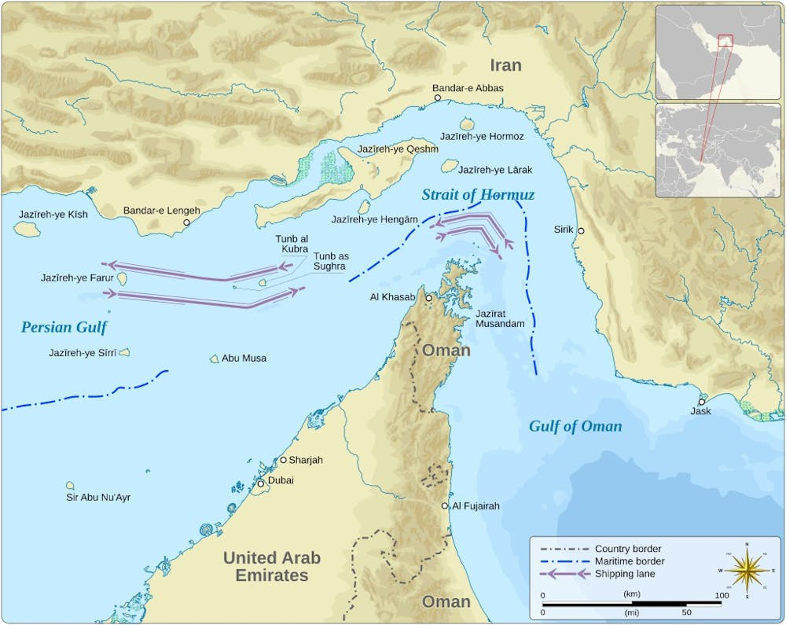

1. 地理瓶颈:无法绕行的“世界油阀”霍尔木兹海峡位于阿曼与伊朗之间,是连接波斯湾与阿拉伯海的唯一水道。对沙特、伊拉克、阿联酋这些波斯湾沿岸的产油大户来说,这里是他们把石油运往全球市场的几乎唯一海上出口。根据美国能源信息署(EIA)的数据,2024年,每天约有 2,000万桶 石油及成品油穿过海峡。这个数字,相当于:

- 全球石油液体日消费量的 20%。

- 全球海运石油贸易总量的 25% 以上。

之所以如此依赖这条水道,并非偶然。独特的地理位置、产油国集中的港口布局、以及替代方案的极度稀缺,三者共同造就了它今天的地位。

近年来的运输量数据,也印证了这一点。下图显示,通过海峡的石油运输量长期维持在极高水平。

2. 贸易格局:谁在出口?谁在进口?

谁在出口,谁又在进口?海峡的贸易流向,就像一面镜子,照出了全球石油的供需格局。

主要出口国:海峡的石油主要来自波斯湾内的产油国。2023年的数据显示,供给侧高度集中:

主要进口方:相比之下,需求侧更加集中,主要在亚洲。EIA估算,2024年从霍尔木兹海峡运出的原油与凝析油中,约 84% 都流向了亚洲市场。其中,中国、印度、日本和韩国 是四个最主要的买家。这就意味着,一旦海峡发生航运中断或地缘政治风险,第一波冲击将直接传导至亚洲的炼厂和能源市场,并迅速通过布伦特原油这样的全球基准,影响世界经济。

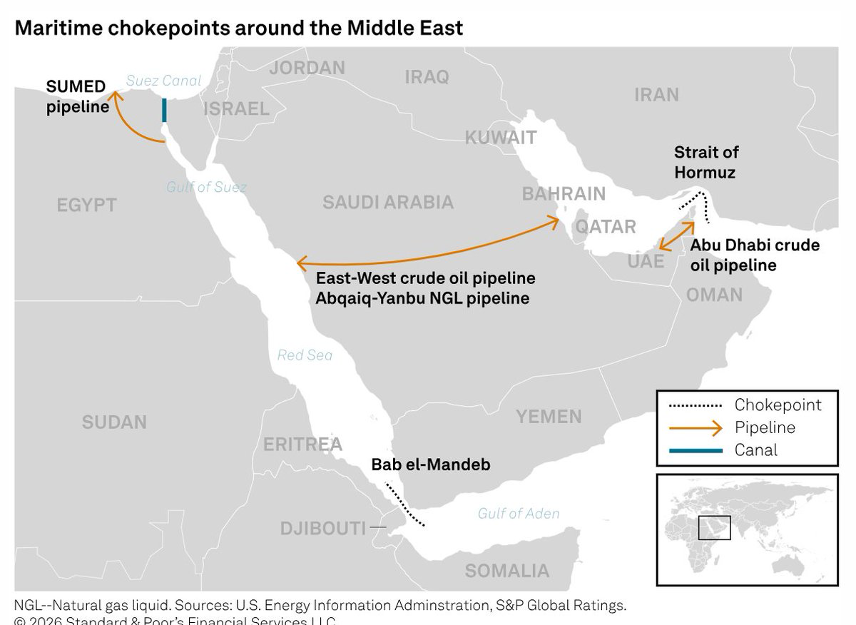

3. 替代方案:管道与运力的“远水”与“近渴”

既然霍尔木兹海峡如此关键,难道没有备用方案来分散风险吗?答案是:有,但能力非常有限。

主要的陆上替代方案,是沙特和阿联酋运营的两条输油管道。

下表对比了海峡的日常流量与几个关键替代方案的运力。

至于油轮,船队通常都在高负荷运转,闲置的本就不多。一旦需要绕行非洲好望角这样的长航线,不仅运输时间和成本会暴增,全球的有效运力也会被大量占用,加剧市场本就紧张的神经。

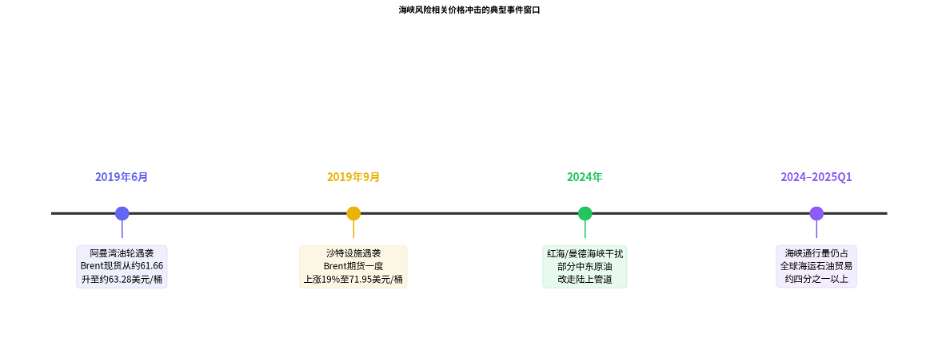

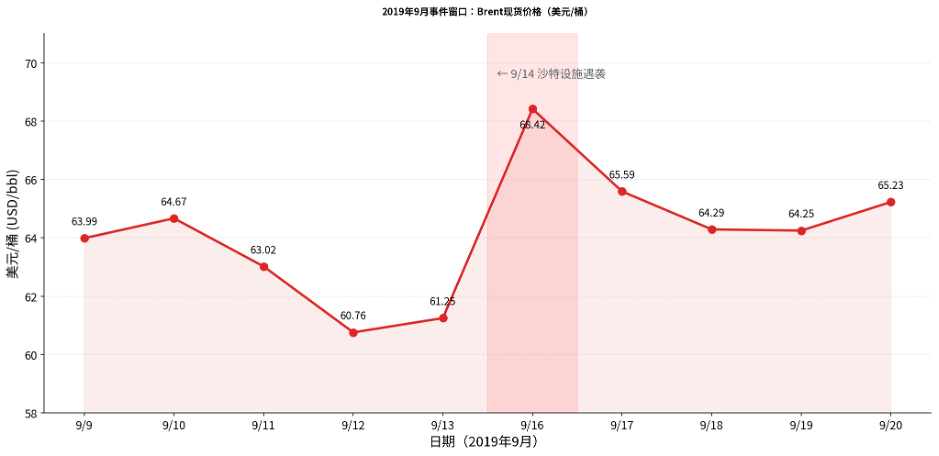

4. 风险传导:从地缘政治到市场价格为什么霍尔木兹海峡的风险,总能迅速搅动全球油价?关键在于,短期内,无论是石油的生产还是消费,都缺乏弹性,很难快速调整。历史上,任何对海峡通航的威胁,都会立刻反映在价格上。下面的时间线和图表,就回顾了近年的几次典型风险事件。

2019年9月沙特石油设施遇袭后,布伦特原油价格的急剧跳升,就让市场感受到了供给中断的寒意。

市场如何消化这种风险呢?通常有几种方式:

- 即期价格跳升:交易员出于避险,会立即将最坏情景计入价格。

- 期货期限结构变化:对未来供给短缺的担忧,会推高近期合约的价格,形成“现货溢价”。

- 风险溢价:金融机构通过期权等工具,把地缘政治风险量化为每桶数美元不等的溢价,叠加在基础油价之上。

由单一通道风险引发的价格冲击,会沿着下面的链条,最终传导到整个宏观经济层面。

结语

霍尔木兹海峡的核心地位,根植于地理的唯一性、产油国港口的集中布局,以及替代方案的严重不足。全球五分之一的石油供给被锁定在这条狭窄水道上,而现有的管道和运力冗余远不足以对冲一次大规模中断。

这不只是一个运输瓶颈的问题。它意味着,任何围绕海峡的地缘政治摩擦,都有可能在短时间内转化为油价的剧烈波动,并沿着通胀和货币政策的链条向全球经济传导。对于关注能源市场和宏观风险的投资者而言,霍尔木兹海峡始终是一个不可忽视的变量。

参考文献与数据来源

- 1EIA (2025-06-16), Amid regional conflict, the Strait of Hormuz remains critical oil chokepointhttps://www.eia.gov/todayinenergy/detail.php?id=65504

- 2EIA (2024-06), World Oil Transit Chokepoints (PDF; Table 3 含 2018–2023 海峡通行量与全球海运石油贸易/消费口径) https://www.eia.gov/international/content/analysis/special_topics/world_oil_transit_chokepoints/wotc.pdf

- 3EIA (2017-08-04), Three important oil trade chokepoints are located around the Arabian Peninsulahttps://www.eia.gov/todayinenergy/detail.php?id=32352

- 4EIA, Europe Brent Spot Price FOB (Daily history table) https://www.eia.gov/dnav/pet/hist/rbrted.htm

- 5IEA (2019-10), Oil Market Report October 2019 (PDF; 2019年9月事件、库存与期货结构) https://iea.blob.core.windows.net/assets/953b7442-bc56-467d-94ef-7cded75d0843/October_2019_OMR.pdf

- 6Morgan Stanley (2026-02-26), Thoughts on the Market — Oil Rallies on Fresh Uncertainty (transcript; 风险溢价示例与期限结构识别) https://www.morganstanley.com/insights/podcasts/thoughts-on-the-market/oil-market-rally-geopolitical-risks-martijn-rats

- 7IMF Working Paper (2022), Second-Round Effects of Oil Price Shockshttps://www.imf.org/-/media/files/publications/wp/2022/english/wpiea2022173-print-pdf.pdf

- 8BIS Working Paper (2010), Oil shocks and optimal monetary policyhttps://www.bis.org/publ/work307.pdf

- 9FRBSF Working Paper (2023), How Oil Shocks Propagate: Evidence on the Monetary Policy Responsehttps://www.frbsf.org/wp-content/uploads/wp2024-07.pdf

- 10UNCTAD (2024), Review of Maritime Transport 2024 — Chapter 2 (全球船队与油轮占比)https://unctad.org/system/files/official-document/rmt2024ch2_en.pdf

- 11Reuters (2025-12-15), Oil tanker rates to stay strong into 2026…(VLCC 利用率/闲置口径) https://www.reuters.com/business/energy/oil-tanker-rates-stay-strong-into-2026-sanctions-remove-ships-hire-2025-12-15/

- 12Reuters (2025-06-18), Goldman estimates geopolitical risk premium…(风险溢价区间示例) https://www.reuters.com/business/energy/goldman-estimates-geopolitical-risk-premium-around-10-per-barrel-brent-after-2025-06-18/