Estrategias de trading para respaldar tu toma de decisiones

Explora técnicas prácticas para ayudarte a planificar, analizar y mejorar tus operaciones.

La volatilidad tiene una forma de aparecer sin invitación.

Un día el ASX está a la deriva silenciosamente... y al siguiente, los requisitos de margen aumentan, las paradas no llenan donde se esperaba, y las carteras se abren con incómodas brechas de la noche a la mañana.

Si has estado buscando respuestas, no estás solo. Algunas de las preguntas más buscadas sobre la volatilidad entre los comerciantes australianos se relacionan con llamadas de margen, deslizamiento, brechas nocturnas, fondos cotizados en bolsa apalancados (ETF) y herramientas como promedio true range (ATR).

Esto es lo que está pasando.

Por qué esto es importante ahora

Los mercados mundiales se han vuelto más sensibles a las tasas de interés, los datos de inflación, la geopolítica y los flujos impulsados por la tecnología. Cuando la liquidez se hace más baja y la incertidumbre sube, las oscilaciones de precios se ensanchan. Eso es volatilidad.

Y la volatilidad no solo afecta la dirección de los precios, sino que cambia la forma en que se ejecutan las operaciones, cuánto capital se requiere y cómo se comporta el riesgo debajo de la superficie.

Traducción: La volatilidad no se trata solo de movimientos más grandes, más bien, se trata de movimientos más rápidos y liquidez más delgada, ahí es cuando más importa la mecánica del trading.

¿Quieres un estudio de caso de volatilidad del mundo real?

¿Por qué mi broker aumentó los requerimientos de margen?

Una de las preguntas más buscadas sobre la volatilidad es por qué los requerimientos de margen aumentan sin previo aviso.

Cuando los mercados se vuelven inestables, los corredores pueden aumentar los requerimientos de margen en los contratos por diferencia (CFDs) y otros productos apalancados. Las oscilaciones de precios mayores pueden aumentar el riesgo de que las cuentas pasen a acciones negativas, por lo que aumentar los requerimientos de margen reduce el apalancamiento disponible y puede ayudar a administrar la exposición durante condiciones extremas.

Lo que esto puede significar en la práctica

-Una llamada de margen puede ocurrir incluso si el precio no se ha movido significativamente.

-El apalancamiento efectivo puede caer rápidamente.

-Es posible que sea necesario reducir las posiciones con poca antelación.

Los ajustes de margen suelen ser una respuesta al riesgo cambiante del mercado, no una decisión aleatoria. En mercados altamente volátiles, es prudente asumir que los ajustes de margen pueden cambiar rápidamente, por lo tanto, muchos operadores optan por revisar los tamaños de posición y los buffers disponibles a la luz de ese riesgo.

¿Qué es el deslizamiento y por qué mi stop no llenó a mi precio?

Otro tema que se busca con frecuencia es el deslizamiento.

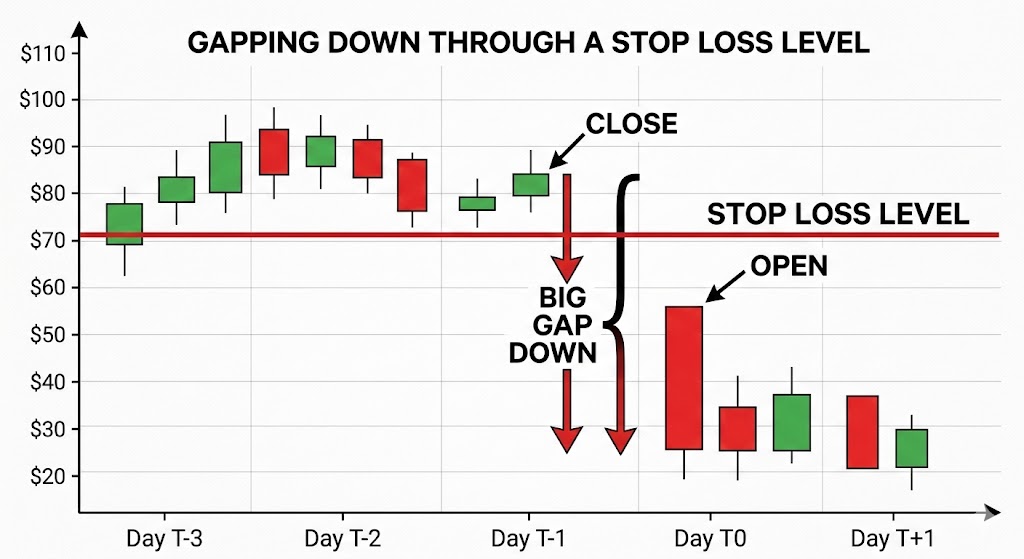

El deslizamiento puede ocurrir cuando una orden de stop se activa y se ejecuta al siguiente precio disponible, el resultado puede depender del tipo de orden, liquidez del mercado y brechas. En los mercados tranquilos, la diferencia puede ser pequeña mientras que en los mercados rápidos, los precios pueden dispararse más allá del nivel de parada.

Los controladores comunes incluyen

-Principales liberaciones económicas o de ganancias.

-Liquidez delgada.

-Niveles de parada abarrotados.

-Sesiones nocturnas.

Las órdenes stop-loss generalmente priorizan la ejecución en lugar de la certeza del precio y durante los períodos de alta volatilidad, esta distinción se vuelve importante. Ajustar el tamaño de la posición y colocar topes con referencia al movimiento típico del precio puede ser más efectivo que simplemente apretar los topes en condiciones inestables.

¿Cómo administro la división nocturna en el ASX?

Australia comercia mientras Estados Unidos duerme, y viceversa. Esta diferencia de zona horaria es, lamentablemente, una de las razones por las que los comerciantes australianos buscan con frecuencia el riesgo de brecha nocturna. Si los mercados estadounidenses caen bruscamente, el ASX podría abrir a la baja a la mañana siguiente, sin oportunidad de salir entre el cierre y el abierto.

Los ejemplos de enfoques de gestión de riesgos que los comerciantes del mercado pueden utilizar incluyen

-Cobertura de índices mediante futuros ASX 200 o CFD*.

-Cobertura parcial durante eventos de alto riesgo.

-Reducir la exposición antes de los principales anuncios de macro.

La cobertura puede compensar parte de un movimiento, pero introduce un riesgo de base, ya que las acciones individuales pueden no moverse en línea con el índice más amplio.

No existe una protección perfecta, solo compensaciones entre costo, complejidad y reducción de riesgos.

*Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero debido al apalancamiento.

¿Cuáles son los riesgos clave de los ETF apalancados o inversos en mercados volátiles?

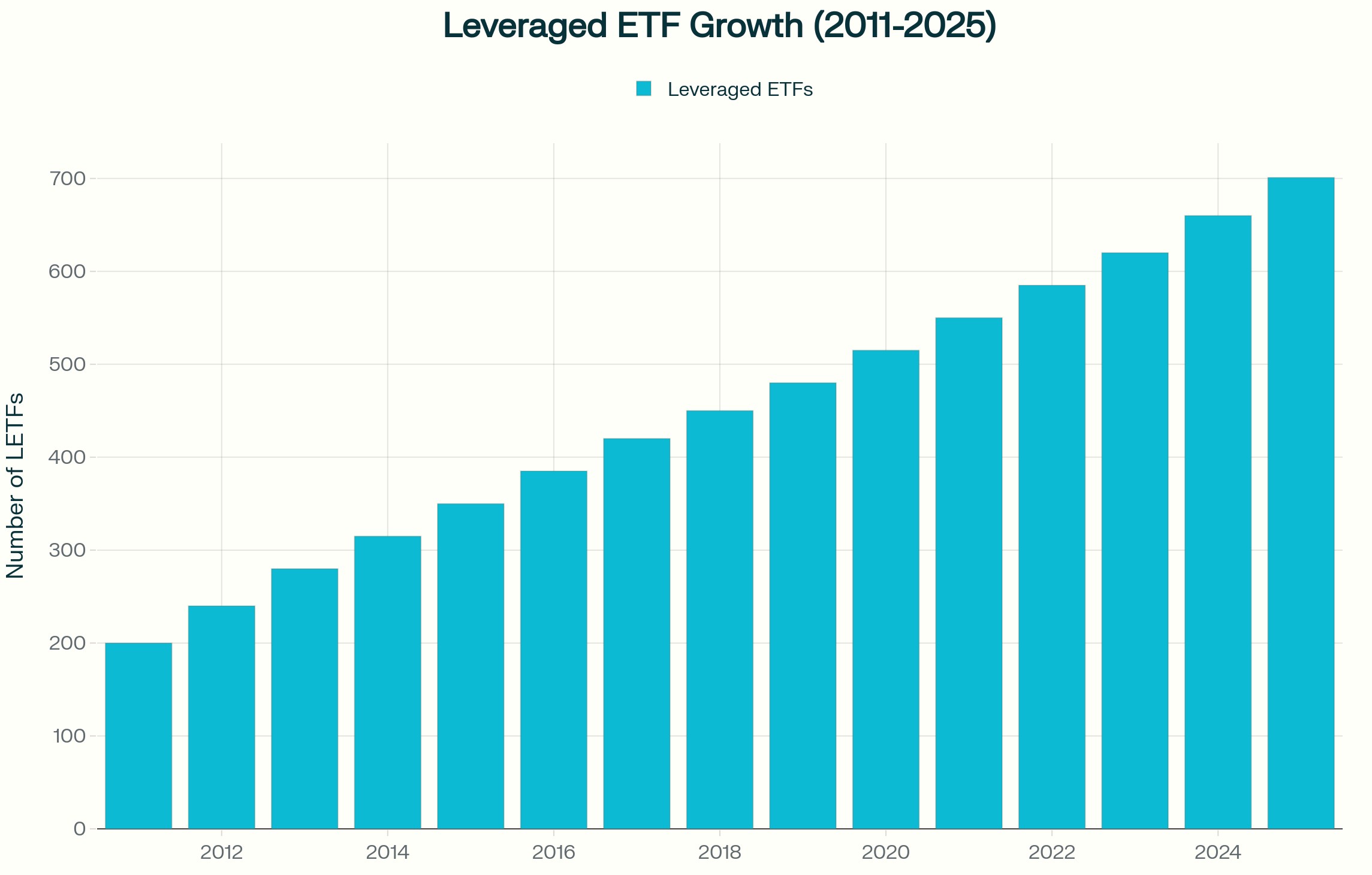

Los ETF apalancados e inversos a menudo se buscan durante períodos de mayor volatilidad.

Si bien estos productos generalmente se restablecen diariamente, su objetivo es ofrecer un múltiplo del rendimiento diario del índice, no su retorno a largo plazo. En un mercado volátil, lateral, la composición diaria puede erosionar el valor aunque el índice termine cerca de su nivel inicial.

Esto ocurre porque las ganancias y pérdidas se combinan asimétricamente. Una caída del 10 por ciento requiere una ganancia de más del 10 por ciento para recuperarse. Cuando ese efecto se multiplica diariamente, los resultados pueden divergir materialmente del índice subyacente a lo largo del tiempo.

Dichos instrumentos pueden ser utilizados tácticamente por algunos participantes en el mercado. Por lo general, no están diseñados como herramientas de cobertura a largo plazo y comprender su estructura es esencial antes de utilizarlos en una estrategia.

¿Cómo se puede utilizar ATR para informar la colocación de paradas??

El rango verdadero promedio (ATR) es un indicador comúnmente utilizado para medir la volatilidad.

ATR estima cuánto se mueve típicamente un activo durante un período determinado, incluidas las brechas. En lugar de establecer una parada en un porcentaje arbitrario, algunos comerciantes hacen referencia a ATR y colocan paradas en un múltiplo, como dos o tres veces ATR, para reflejar las condiciones prevalecientes.

Cuando la volatilidad aumenta, el ATR se expande y eso puede implicar paradas más amplias o tamaños de posición más pequeños si el riesgo general va a permanecer constante. El cambio es de preguntar: “¿Hasta dónde estoy dispuesto a perder?” a preguntar: “¿Qué es una mudanza normal en las condiciones actuales?”

Consideraciones prácticas en mercados volátiles

Durante los períodos de elevada volatilidad, los comerciantes pueden considerar

- Permitiendo la posibilidad de cambios de margen

- Dimensionamiento de posiciones de manera conservadora si aumenta la volatilidad

- Reconocer que las órdenes de stop-loss no garantizan un precio de salida específico

- Revisar la exposición antes de los principales eventos económicos

- Comprender la mecánica de reinicio diario de los ETF apalancados

- Uso de medidas de volatilidad como ATR para informar la colocación de paradas

- Mantenimiento de los búferes de efectivo adecuados

La volatilidad no recompensa por sí sola la predicción. La preparación y el conocimiento del riesgo pueden ayudar a los comerciantes a comprender los riesgos potenciales, pero los resultados siguen siendo impredecibles.

Lea: Volatilidad global y cómo operar con CFD

Lo que esto significa para los comerciantes australianos

Los mercados australianos enfrentan consideraciones estructurales específicas en comparación con los mercados asiáticos y estadounidenses. El riesgo de brecha durante la noche está influenciado por las horas de negociación de Estados Unidos y los índices con gran cantidad de recursos como el ASX pueden responder rápidamente a los movimientos de los precios de las materias primas y los datos de China. La exposición a la moneda, incluidos los movimientos del AUD y el dólar estadounidense (USD), puede agregar otra capa de variabilidad.

La volatilidad no es uniforme en todas las regiones. Se comporta de manera diferente dependiendo de la estructura del mercado y la profundidad de liquidez.

Preguntas frecuentes sobre volatilidad

¿Qué causa picos repentinos en la volatilidad del mercado?

Las decisiones sobre tasas de interés, los datos de inflación, la evolución geopolítica, las sorpresas de ganancias y las limitaciones de liquidez son desencadenantes comunes.

¿Por qué los brokers aumentan el margen durante los mercados volátiles?

Para reducir la exposición del apalancamiento y administrar el riesgo cuando las oscilaciones de precios se amplíen.

¿Pueden fallar las órdenes stop-loss durante la volatilidad?

Pueden experimentar deslizamiento si los mercados se disparan más allá del nivel stop, lo que significa que la ejecución puede ocurrir a un precio peor de lo esperado. En mercados rápidos o ilíquidos, esta diferencia puede ser significativa.

¿Los ETF apalancados son adecuados para la cobertura a largo plazo?

Por lo general, están estructurados para la exposición a corto plazo debido a los reajustes diarios. Si son adecuados depende de tus objetivos, situación financiera y tolerancia al riesgo.

¿Cómo se puede medir la volatilidad antes de realizar una operación?

Herramientas como ATR, indicadores de volatilidad implícita y análisis de rango histórico pueden ayudar a cuantificar las condiciones prevalecientes.

Advertencia de riesgo: Los períodos de mayor volatilidad pueden conducir a rápidos movimientos de precios, cambios de margen y ejecución a precios diferentes a los esperados. Las herramientas de gestión del riesgo, como las órdenes de stop-loss y los indicadores de volatilidad, pueden ayudar a evaluar las condiciones del mercado, pero no pueden eliminar el riesgo de pérdida, especialmente cuando se utilizan productos apalancados.

The following EAs are examples of Expert Advisors rated on Trustpilot. They have been rated by traders in general, however, please understand that past performances are not indication of future success. Below is a list of EAs, which you can purchase online, however there are several free ones you can find on the market, these are labelled (f), please do your own research when choosing the right EA for your own trading style, objectives, and risk settings. 1000pip Climber – This EA has the highest rated metric on Trustpilot.

Apart from the added support that is on offer by the developers, this EA is specifically impressive given its high yield in both trending and range bound markets. Flex – Has been voted best EA on the market for an incredible 8 consecutive years! Flex requires a deposit of $3000 and works well in trending markets.

FXCharger – With a great yield of 77.3% and a high rating on Trustpilot, this EA opens trades every day and closes them at the right time, such that the trader earns a profit. FXCharger requires a deposit of $1000. Fortnite – Another customisable EA that allows the user to change the settings according to the trading style they want.

Is yield ranks around the 135%, it requires a deposit of $500. Alfa Scalper – Using a scalping method to get trading opportunities this EA yields sits at 49.36% and has a rating of 8.57. Its one of the easiest EAs to use and requires a deposit of $100.

Forex Gump – It’s probably one of the most rated EAs by traders on the market, it has a rating of 8.52 and a yield of 2200%. It utilizes daily trading and scalping to make trading decisions. This one requires a small deposit of $40.

Trade Manager – With a 65.39% yield, you can create your own strategies and set your own parameters for the best results. A deposit of $100 is required. Forex Diamond – Has a yield of 63.39%.

This EA uses trend and countertrend strategies to make trading decisions, is fast, safe, and precise. Requires a deposit of $1000. Below is a list of free experts’ advisors which you can look up with the power of the internet: Trader New (f).

Daydream01 (f). Calypso (f). Day Profit SE (f).

Breakout11 (f). Euro FX2 (f) Channels (f). As a trader it is important to know what type of trading you would like to do, this means what types of strategy, which markets and if you would benefit from the use of an EA or if you would prefer to trade manually.

If you are thinking that having access to an EA might benefit your trading activity, then there are many available on the MQL5 commuminty. If you are interested in automating your own strategy, then there are companies like TradeView that help traders to automate and create their own Expert Advisor without coding experience. GO Markets also provides access to their TradeView X platform via the client portal with a monthly subscription at a reduced cost other than directly with them.

By having an account with GO Markets you will also have access to our Metatrader 4 and 5 trading platform and a VPS (needed for EA traders). Please visit us here to get started or call us directly and speak to one of our account managers on 03 8566 7680. Sources: tradersunion.com.

Trading FOREX, equities, commodities, and any other asset can be an emotional rollercoaster. With so many different emotions and external factors difficulties impacting a trade, it is crucial that before any trade is executed a trading plan is produced to minimise the impact of the ‘noise’. Generating the Idea The first step to any plan is to generate a trading idea.

Trade ideas, come from one of three sources. A fundamental source, a technical source, or a mix of both. What does this mean exactly?

Well, when generating ideas from a fundamental perspective, a trader can generate idea based on economic events, monetary policy from a Central bank or company relevant information just to name a few. From a technical perspective, a trader may find that an asset is trading near a potential support or resistance level or developing into a breakout pattern. Alternatively, the price may have touched an important moving average which indicates it may be ready to trade.

Traders can also put these ideas together to come up with even more robust trading ideas. Background economic factors and sector analysis Before entering a trade, a good trader should have at the very least a rudimentary understanding of the relevant sector or economic factors that may influence the trade. For example, a trader decides to trade the AUDUSD currency pair.

The trader has seen that the price is approaching a short-term support point and decides to buy the pair expecting the price to bounce of the level. However, the trader is not aware that the Federal Reserve has just increased interest rates which has increased the value of the USD. Consequently, the price goes against the trader.

Technical breakdown Prior to entering any trade, the trader should analyse the price chart and set up relevant support and resistance levels. This allows the trader to have a clear idea of key supply and demand zones for the asset before the emotions of the actual trade become prevalent. To effectively go about this step, support and resistance levels can be analysed on multiple time frames to gain an even greater edge. [caption id="attachment_272243" align="alignnone" width="2560"] Business Team Investment Entrepreneur Trading discussing and analysis graph stock market trading,stock chart concept[/caption] Entry condition Having a trade idea is one aspect however having a clear entry criterion will help reduce the impact of emotion when watching the trade unfold.

Some examples of potential entries conditions can be related to a break and retest of a certain level for an entry or waiting for a specific candlestick pattern. Furthermore, an entry may also be defined by a disproportionate increase in volume supporting a breakout. Exit Conditions Like determining entry conditions having pre planned exit points can improve the management of emotions during also trade whilst also enhancing risk management.

Setting take profit targets/stop loss areas will help ensure that a trade is well structured even before initiating the trade. Having pre-determined exit points can also help determine if a trade is worth entering in the first place as it allows for a determination of the potential risk reward before execution. Risk management No matter whether the trade is a scalp, swing trade or longer-term investment, each should have clear risk management guidelines.

Good risk management involves the use of stop losses and correct sizing of a trade. One method that can be effective is to have a maximum amount of the total account that you are willing to lose per trade. This could be a percentage figure or a fixed amount.

For example, if the total account size is $10,000 and you decide that the maximum loss per trade is 1%. This means that the maximum loss per trade would be $100. The next step is to then set stop loss.

The stop loss in many cases should be independent of the actual maximum risk amount. The stop loss level should be calculated before the sizing. Once the stop loss is set the size of the trade can be determined.

Risk management is perhaps the most crucial element of the trading plan because minimising losses is crucial to any long-term success in trading. Whilst having a clear trading plan will not guarantee success it will help remove many behavioral biases that can impact on a trade.

Is it time to Capitalise on Short Squeezes ? Short Squeezes are one of the interesting price action patterns that can occur in the market. They can provide It can provide explosive momentum trading opportunities that can go on for days.

They can provide trading opportunities for scalpers, intraday, and swing traders. What actually is a short squeeze and why do they occur? To understand a short squeeze it is important to go back to the basics of trading and understand what an actual short is and why market participants go short on a product.

What is a short? A short is a position that a market participant takes when they expect the price of a market product to go down. This can include but is not excluded too, Securities, Commodities and Forex.

A trader may take a short position because they believe a company is overvalued, a currency will go down in value due to economic factors, to hedge or for a number of other reasons. Short positions can be taken in a range of ways, however, the most common method for shorting a CFD is quite simple. It involves borrowing units to sell with the short holder having to buy-back the units at a lower price and pocketing the difference.

Example A trader believes that company ABC is overvalued at $1.00 and decides to borrow 100 CFD units of ABC to short at $1.00 per CFD with a total value of $100. The price then falls to $0.50. The trader closes their position and buys back the CFDs at $50.

They are then able to pocket the difference of $50.00. The mechanics of a short squeeze. Due to the nature of a short position which requires a buying back of the stock to both close the position and lock in profit a trader will inevitably have to buy-back or close their position at some point.

This subsequently drives up the price. Most of the time in a trending market this process works without any issues. However, if the price stops falling and consolidates or to a stage where the market starts to see value in the price again, large short holders may decide to close out their position.

If big positions or institutions close all at once it can create an avalanche effect. Indicators of a short squeeze A stock, currency, or commodity that is highly shorted or is overextended to the sell side is often ripe for a squeeze. In addition, if the underlying asset is getting closer to an area of support or resistance it may show that the selling has dried up.

Shorters may then need to close their positions soon otherwise they risk holding losing positions If a stock is bottoming or basing it may indicate that buyers are beginning to take control of the price again. This shows that the asset has reached a point where it really can’t fall any further in price because buyers see too much value. A shift in the relative volume can indicate that either a big position is closing or buyers have found an area of value and that the price might be ready to reverse.

The large volume can also indicate that an institution is playing an active role in the price. It is usually good practice to follow where the big money is when trading. Squeezing in the current market A short squeeze can represent a great opportunity to profit for traders.

They can often be explosive moves and last for days. This means that whether you are a swing trader, day trader, or a scalper anyone can capitalise on a squeeze. In addition, with the current state of the market having one of its worst first half of the years in history, with bearish sentiment being very high.

The Nasdaq in particular and growth stocks in particular have seen their value smashed. As big short positions have been taken at some stage they will have to be closed and if the market can rally, then this phenomenon may become more regular. For instance the company ZIP a strong player in the Buy Now Player Sector had seen its share priced reduced to a fraction of its peak prior to just a few weeks ago.

However as seen in the chart below, a shift in volume was the first signal that the stock was about squeeze and shift strongly to the upside. In this instance, ZIP on the weekly chart saw a massive jump in volume, followed by an even larger jump in volume the following week. Importantly ZIP, according to (Shortman.com.au) had a short % of 7.34 on July 1 2022, prior to the breakout.

Looking at the daily chart underneath, the sheer volume of buying continued to get larger and larger which is indictive of a short squeeze as large positions began to close. The subsequent price action provided great consistent buying opportunities for traders.

Market response to any specific economic data release is far from standard even if actual numbers differ greatly from consensus expectations. Rather the market response is based on context of the current economic situation. This week’s non-farm payrolls, being one of the major data points in the month, is a great case in point.

There are many factors and of course the key one for you as an individual trader is your chosen vehicle you are trading (and of course direction i.e. long or short for open positions). The context of today’s impending non-farm payrolls from a market perspective is interest rate expectations going forward. This week the Fed gave the market the expected.25% cut that was already priced into currency, bond and equity market pricing.

The market response however, as this was already priced in, was as a result of the accompanying statement which was not as dovish as perhaps anticipated and a reduction in expectations of a further imminent cut. From an equity market point of view the result, despite the interest rate cut, was to sell off, whereas from the USD perspective this lessening expectation of further rate cuts was bullish. Perhaps this could be viewed as contrary to what the textbooks would suggest is a standard response.

So, onto todays non-farm payrolls (NFP) figure… Logic would suggest that a strong number is good news for the economy, and so should be positive for equities and perhaps bearish for USD. However, as this may be a critical number in the Feds decision making re. interest rate decisions, a strong NFP is likely to have the opposite effect. A weaker number is likely to be perceived as potentially contributory to thinking that another rate cut may be prudent sooner and so despite on the surface being “bad news”, it would not be surprising to see equities stronger and USD weaker.

It remains to be seen of course what the number is and the actual response but is perhaps a lesson in seeing new market information within the potential context of the current economic circumstances and of course incorporate this in your risk assessment and trading decision making.

Many traders utilise shares or options amongst their investment strategies either for income or capital growth. One key factor that such traders may consider in their choice of specific markets to trade is liquidity, with a higher trading volume impacting positively on the ability to get in and out of trades at a fair price. Others may find the choice to trade specific companies or sectors not as well represented in their local market.

For many therefore, the breadth of choice and liquidity may make this market the preferred market to trade. Like any type of trading, sustainable results require a depth of knowledge and commitment to trading an individual tried and tested system. This system should include in depth reference to risk management throughout.

However, due to the choice of market, a trader can make regular profit and yet lose this (and potentially more) through the currency risks associated with trading in US dollars rather than, for example, their base currency of Australian dollars or GB pounds. Holding a significant position in US shares or options means that many traders have exposure to positions in tens of thousands in USD. So what is the currency risk?

The reality is that profits can be ‘used up’, or losses can be compounded, by adverse currency movements. The reason for this is simple. Let’s assume that your currency is AUD and it is transferred into USD for trading purposes.

The exchange value when converted back to the original currency at some time in the future will be dependent not only on trading results but on the movement of AUD versus USD. While your money is in your account in USD, weakness in AUD will mean a greater worth in AUD when converted back, whereas a lesser conversion worth will result if there is AUD strength while your money is sitting is USD. Let’s give an example...

See below a daily chart of AUD/USD for the last 3 years. Note the price from the end of January 2018 at a level of 0.8134. The price at Nov 2019 was at 0.6776 so a difference of 0.1358 So, an investment to fund a trading account of AUD$30,000 would have equalled an original USD value of $24,402.

With the movement in the currency alone over this period (assuming no movement in share price) the value of the account when transferred back into AUD would have risen to $36,007.59 or in other words a 20.03% increase. So, in this case the underlying currency movement was of benefit. However, if this positive currency outcome is the case when there is USD strength (when your trading capital is in USD), with the same AUDUSD currency movement in the other direction, the loss could be 20.03%.

This would mean that you would have had to profit by this 20.03% in your trades simply to breakeven. This WAS the case if you look at a chart from the beginning of Jan 2016 to Aug 2017. More than this of course, if you have lost $6007.59 on a similar price move in the other direction, broke even on your trades during that period, so your equivalent AUD value is $23,992.41, your trading return would have to be now 25% profit to recover the original capital level simple because of currency movement.

Bear in mind, of course we have chosen only a $30,000 example, some of you may have considerably more than this in the market (and so considerably more currency risk) than the example we have given. Risk management of your hedge Although you are entering a low margin requirement Forex position due to the leverage associated with Forex, we cannot understate the importance of a full understanding of the implications of this. Should the AUD move lower still (as we explained above in looking at what has happened since January 2018), the value of your hedge may move significantly.

If we look at using the analogy of an insurance policy in trying to explain the concept, the maximum risk is the initial “premium” paid in this case. However, with any Forex position there is obviously the risk of losing more than your original investment. Additionally, you are trading your shares/options in a different account and hence there must be the ability to money manage between the two accounts.

Our team can guide you further on these important issues. One last thing… Although we cannot advise when it is right for you, if at all, to put in a currency hedge, it is worthwhile raising the question about what the current AUDUSD chart is telling you now technically. Additionally, with the potential for further US rate cuts, and if you believe there will be some resolution to trade tariff wars between the US and China, both events have the potential to strengthen AUD (and so weaken your USD capital).

If invested in USD based trading for some time you have benefitted, logically, it is not unreasonable to consider whether it is worth ‘locking’ some of this in. So, what can you do? Your choices are twofold. 1.

Allow your invested trading capital to be subjected to the risks associated with underlying currency movements or, 2. Hedge the currency risks with a non-expiring Forex position. If option “2” looks attractive, the reality is you can: • Mitigate the risk through consideration of a Forex hedge. • Attempt to optimise your hedge by timing its placement and exit i.e. use technical landmarks, to decide when to get in and out of a hedge. (Please note: a hedge is for insurance purpose and so although there may be merit in timing entry and exit, we are not suggesting you trade in and out of a hedge on a regular basis).

Learn how to reduce the risk We are happy not only to show you how but guide you step by step in how to set this up. There are a couple of practical issues you would need to have in place to manage this well but again we can go through these to enable you to make the right decision for you. If you think this might be for you, then simply connect with us at [email protected] and we will arrange for one of our account team to discuss a currency hedge that may be a fit for you.

Irrespective of what vehicle you are choosing to trade (Forex, CFDs, share CFDs ), position sizing is a crucial part of your trading risk management. It is position sizing, along with effective exit strategies, that have an undoubted major impact on your trading results both now and going forward. At a basic level, the following are part of a position sizing system: a.

Identify a tolerable risk level per trade based on your account size (often 1-3%) meaning you aim to keep any loss sustained within this tolerable limit. b. Using any stop level for specific trades and your tolerable limit to work out how many lots/contacts you can enter to achieve this goal. c. Ensuring you are not inadvertently over-positioning in one market idea (e.g. broad-based USD strength or weakness, by entering multiple trades across currency pairs/ commodity CFDs that will multiply the impact of USD movement).

But what then? How do we explore refining our position sizing to potential optimise results? Here are two initial ideas for potential testing… Idea 1 – Position sizing according to volatility When exploring using volatility for any trading decision it is not just the level but potentially, more importantly, the direction of the volatility i.e. increasing/decreasing.

Volatility is often seen as a reflection of market certainty but perhaps consider volatility as a measure of the likelihood that an asset e.g. Fx pair, is more likely to move away from its current position (and that can be either positively or negatively of course). Logically, therefore, increasing volatility in either direction could represent an increase in risk (and of course visa versa).

Consequently, it is not unreasonable to consider altering your tolerable risk level according to this. So, for example, if your standard is 2% of account capital on any one trade, if you were to implement this as an idea, increasing volatility could mean a decrease in risk level to 1% and decrease to 3%. The challenge, of course, is to determine a method through which you can determine this change.

The ATR is a volatility measure commonly used and would be a potential tool that can assist. Of course, the other aspect is to choose the timeframe to measure this variable. Logically, the shortest timeframe should be the timeframe you are trading but there may be wisdom in looking at longer-term timeframes also.

Idea 2 – Ensure that trail stops account for your tolerable risk level. Arguably a common mistake made by many traders is to view trades on their P/L and make decisions on the fact they are “up” on the deal and as long as the trade is closed before getting back to breakeven then they have a win. An alternative and logically an advanced approach is your net worth in the market is where it is right NOW and hence any pullback in any position is a “loss” from your current place.

This is the rationale behind trailing a stop in an attempt to still have access to the further upside (“letting your profits run”) whilst capping any pullback to a new an improved level to that of your initial stop. There are many ways of trailing a stop e.g. retracement, price/MA cross but again would it not make sense to use your tolerable risk level as part of your trail stop equation. So lets see, for example, use an account size of $10,000 and you are trading a 2% maximum risk level to set your initial stop.

This means that your contract/lot size is based on your technical stop and $200. You have a position that is now up to $350 if you were to adopt this approach when you trail your stop you should ensure that it is placed at a level that would mean that the worst scenario would be that you would close the position at $150 profit. There are of course other advanced position sizing techniques you could test which will be the topic of an upcoming Inner Circle session.

Make sure that you are part of this through registering for these sessions so you can jump on board with this advanced trading education group to access the topics applicable to your trading development. In the meantime, we would be delighted, as always, to hear from you, so if you are using an advanced position sizing technique it would be great to hear from you at [email protected]