Estrategias de trading para respaldar tu toma de decisiones

Explora técnicas prácticas para ayudarte a planificar, analizar y mejorar tus operaciones.

La volatilidad tiene una forma de aparecer sin invitación.

Un día el ASX está a la deriva silenciosamente... y al siguiente, los requisitos de margen aumentan, las paradas no llenan donde se esperaba, y las carteras se abren con incómodas brechas de la noche a la mañana.

Si has estado buscando respuestas, no estás solo. Algunas de las preguntas más buscadas sobre la volatilidad entre los comerciantes australianos se relacionan con llamadas de margen, deslizamiento, brechas nocturnas, fondos cotizados en bolsa apalancados (ETF) y herramientas como promedio true range (ATR).

Esto es lo que está pasando.

Por qué esto es importante ahora

Los mercados mundiales se han vuelto más sensibles a las tasas de interés, los datos de inflación, la geopolítica y los flujos impulsados por la tecnología. Cuando la liquidez se hace más baja y la incertidumbre sube, las oscilaciones de precios se ensanchan. Eso es volatilidad.

Y la volatilidad no solo afecta la dirección de los precios, sino que cambia la forma en que se ejecutan las operaciones, cuánto capital se requiere y cómo se comporta el riesgo debajo de la superficie.

Traducción: La volatilidad no se trata solo de movimientos más grandes, más bien, se trata de movimientos más rápidos y liquidez más delgada, ahí es cuando más importa la mecánica del trading.

¿Quieres un estudio de caso de volatilidad del mundo real?

¿Por qué mi broker aumentó los requerimientos de margen?

Una de las preguntas más buscadas sobre la volatilidad es por qué los requerimientos de margen aumentan sin previo aviso.

Cuando los mercados se vuelven inestables, los corredores pueden aumentar los requerimientos de margen en los contratos por diferencia (CFDs) y otros productos apalancados. Las oscilaciones de precios mayores pueden aumentar el riesgo de que las cuentas pasen a acciones negativas, por lo que aumentar los requerimientos de margen reduce el apalancamiento disponible y puede ayudar a administrar la exposición durante condiciones extremas.

Lo que esto puede significar en la práctica

-Una llamada de margen puede ocurrir incluso si el precio no se ha movido significativamente.

-El apalancamiento efectivo puede caer rápidamente.

-Es posible que sea necesario reducir las posiciones con poca antelación.

Los ajustes de margen suelen ser una respuesta al riesgo cambiante del mercado, no una decisión aleatoria. En mercados altamente volátiles, es prudente asumir que los ajustes de margen pueden cambiar rápidamente, por lo tanto, muchos operadores optan por revisar los tamaños de posición y los buffers disponibles a la luz de ese riesgo.

¿Qué es el deslizamiento y por qué mi stop no llenó a mi precio?

Otro tema que se busca con frecuencia es el deslizamiento.

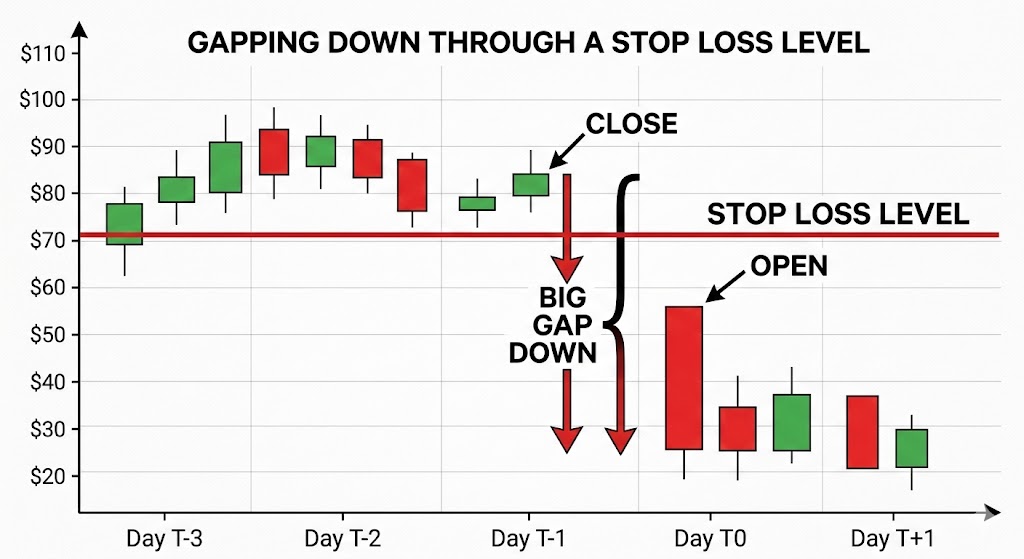

El deslizamiento puede ocurrir cuando una orden de stop se activa y se ejecuta al siguiente precio disponible, el resultado puede depender del tipo de orden, liquidez del mercado y brechas. En los mercados tranquilos, la diferencia puede ser pequeña mientras que en los mercados rápidos, los precios pueden dispararse más allá del nivel de parada.

Los controladores comunes incluyen

-Principales liberaciones económicas o de ganancias.

-Liquidez delgada.

-Niveles de parada abarrotados.

-Sesiones nocturnas.

Las órdenes stop-loss generalmente priorizan la ejecución en lugar de la certeza del precio y durante los períodos de alta volatilidad, esta distinción se vuelve importante. Ajustar el tamaño de la posición y colocar topes con referencia al movimiento típico del precio puede ser más efectivo que simplemente apretar los topes en condiciones inestables.

¿Cómo administro la división nocturna en el ASX?

Australia comercia mientras Estados Unidos duerme, y viceversa. Esta diferencia de zona horaria es, lamentablemente, una de las razones por las que los comerciantes australianos buscan con frecuencia el riesgo de brecha nocturna. Si los mercados estadounidenses caen bruscamente, el ASX podría abrir a la baja a la mañana siguiente, sin oportunidad de salir entre el cierre y el abierto.

Los ejemplos de enfoques de gestión de riesgos que los comerciantes del mercado pueden utilizar incluyen

-Cobertura de índices mediante futuros ASX 200 o CFD*.

-Cobertura parcial durante eventos de alto riesgo.

-Reducir la exposición antes de los principales anuncios de macro.

La cobertura puede compensar parte de un movimiento, pero introduce un riesgo de base, ya que las acciones individuales pueden no moverse en línea con el índice más amplio.

No existe una protección perfecta, solo compensaciones entre costo, complejidad y reducción de riesgos.

*Los CFDs son instrumentos complejos y conllevan un alto riesgo de perder dinero debido al apalancamiento.

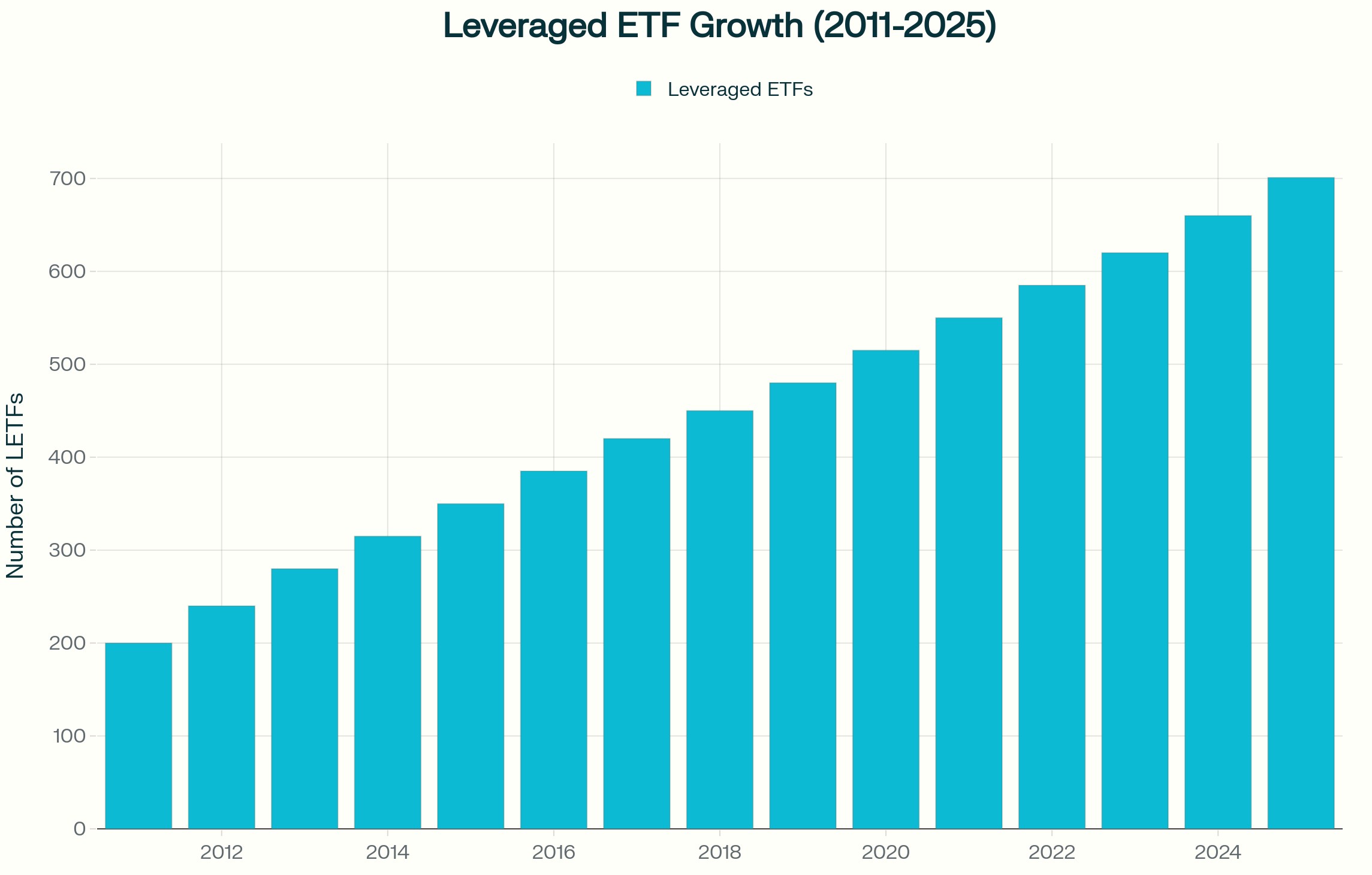

¿Cuáles son los riesgos clave de los ETF apalancados o inversos en mercados volátiles?

Los ETF apalancados e inversos a menudo se buscan durante períodos de mayor volatilidad.

Si bien estos productos generalmente se restablecen diariamente, su objetivo es ofrecer un múltiplo del rendimiento diario del índice, no su retorno a largo plazo. En un mercado volátil, lateral, la composición diaria puede erosionar el valor aunque el índice termine cerca de su nivel inicial.

Esto ocurre porque las ganancias y pérdidas se combinan asimétricamente. Una caída del 10 por ciento requiere una ganancia de más del 10 por ciento para recuperarse. Cuando ese efecto se multiplica diariamente, los resultados pueden divergir materialmente del índice subyacente a lo largo del tiempo.

Dichos instrumentos pueden ser utilizados tácticamente por algunos participantes en el mercado. Por lo general, no están diseñados como herramientas de cobertura a largo plazo y comprender su estructura es esencial antes de utilizarlos en una estrategia.

¿Cómo se puede utilizar ATR para informar la colocación de paradas??

El rango verdadero promedio (ATR) es un indicador comúnmente utilizado para medir la volatilidad.

ATR estima cuánto se mueve típicamente un activo durante un período determinado, incluidas las brechas. En lugar de establecer una parada en un porcentaje arbitrario, algunos comerciantes hacen referencia a ATR y colocan paradas en un múltiplo, como dos o tres veces ATR, para reflejar las condiciones prevalecientes.

Cuando la volatilidad aumenta, el ATR se expande y eso puede implicar paradas más amplias o tamaños de posición más pequeños si el riesgo general va a permanecer constante. El cambio es de preguntar: “¿Hasta dónde estoy dispuesto a perder?” a preguntar: “¿Qué es una mudanza normal en las condiciones actuales?”

Consideraciones prácticas en mercados volátiles

Durante los períodos de elevada volatilidad, los comerciantes pueden considerar

- Permitiendo la posibilidad de cambios de margen

- Dimensionamiento de posiciones de manera conservadora si aumenta la volatilidad

- Reconocer que las órdenes de stop-loss no garantizan un precio de salida específico

- Revisar la exposición antes de los principales eventos económicos

- Comprender la mecánica de reinicio diario de los ETF apalancados

- Uso de medidas de volatilidad como ATR para informar la colocación de paradas

- Mantenimiento de los búferes de efectivo adecuados

La volatilidad no recompensa por sí sola la predicción. La preparación y el conocimiento del riesgo pueden ayudar a los comerciantes a comprender los riesgos potenciales, pero los resultados siguen siendo impredecibles.

Lea: Volatilidad global y cómo operar con CFD

Lo que esto significa para los comerciantes australianos

Los mercados australianos enfrentan consideraciones estructurales específicas en comparación con los mercados asiáticos y estadounidenses. El riesgo de brecha durante la noche está influenciado por las horas de negociación de Estados Unidos y los índices con gran cantidad de recursos como el ASX pueden responder rápidamente a los movimientos de los precios de las materias primas y los datos de China. La exposición a la moneda, incluidos los movimientos del AUD y el dólar estadounidense (USD), puede agregar otra capa de variabilidad.

La volatilidad no es uniforme en todas las regiones. Se comporta de manera diferente dependiendo de la estructura del mercado y la profundidad de liquidez.

Preguntas frecuentes sobre volatilidad

¿Qué causa picos repentinos en la volatilidad del mercado?

Las decisiones sobre tasas de interés, los datos de inflación, la evolución geopolítica, las sorpresas de ganancias y las limitaciones de liquidez son desencadenantes comunes.

¿Por qué los brokers aumentan el margen durante los mercados volátiles?

Para reducir la exposición del apalancamiento y administrar el riesgo cuando las oscilaciones de precios se amplíen.

¿Pueden fallar las órdenes stop-loss durante la volatilidad?

Pueden experimentar deslizamiento si los mercados se disparan más allá del nivel stop, lo que significa que la ejecución puede ocurrir a un precio peor de lo esperado. En mercados rápidos o ilíquidos, esta diferencia puede ser significativa.

¿Los ETF apalancados son adecuados para la cobertura a largo plazo?

Por lo general, están estructurados para la exposición a corto plazo debido a los reajustes diarios. Si son adecuados depende de tus objetivos, situación financiera y tolerancia al riesgo.

¿Cómo se puede medir la volatilidad antes de realizar una operación?

Herramientas como ATR, indicadores de volatilidad implícita y análisis de rango histórico pueden ayudar a cuantificar las condiciones prevalecientes.

Advertencia de riesgo: Los períodos de mayor volatilidad pueden conducir a rápidos movimientos de precios, cambios de margen y ejecución a precios diferentes a los esperados. Las herramientas de gestión del riesgo, como las órdenes de stop-loss y los indicadores de volatilidad, pueden ayudar a evaluar las condiciones del mercado, pero no pueden eliminar el riesgo de pérdida, especialmente cuando se utilizan productos apalancados.

If you are willing to look at your Forex experience a bit like an apprentice completes an apprenticeship you are likely going to achieve a higher level of success. Why should opening a live account and making money in the financial markets be any different to any other career? You don’t get to build a house without the appropriate qualifications nor do you get to fly a plane without taking hours of flying lessons and passing some final tests.

A professional sports person spends hours building their body, mind and talent to compete at the highest level but being a Forex trader for some reason is often considered differently. Why? Because as human beings we want instant gratification and because online forex trading involves the opportunity to make money we as humans are greedy and are usually not prepared to take a logical and sensible approach to learning, practice, discipline and patience.

We want it all now so the gambling approach can take over. When you trade forex you are effectively competing and the online trading competitors who you are playing against (banks, institutions) are some of the most experienced, knowledgeable and at times ruthless currency trading competitors on the planet. They want to win and your best chance of winning in my experience is to learn to ride their coat tails and trade similar strategies and systems, which also includes extremely tight risk management.

For example most successful forex banking traders have honed their skills for years often working their way up from a retail banking position, through the research departments, through the company courses and finally over time into a forex trading position on the trading desk. They’ve done an apprenticeship. With such strong competition does this ultimately put you in an uncompetitive position?

No, provided you are willing to spend the time to learn about the fundamentals and technical charts that give you an edge and apply professional risk management you can succeed in the currency markets. There is no question you will fail along the way just as every apprentice failed at times through their apprenticeship but if you do things steadily and slowly you will likely fail gracefully as you learn and stay in the currency trading game long term. Success in the currency markets requires one very important ingredient.

Time! You are going to need time and you need to be able to give yourself the time to fail, time to win, time to learn and time to grow as a currency trader. Think of trading forex like an apprenticeship and you are likely going to achieve a higher level of success.

Join me live online every Wednesday evening at 7pm AEST for a Free Professional Forex training lesson. I will do my best to share with you the important fundamental and technical information to make your currency apprenticeship as enjoyable as possible. To log into the session simply use the following link.

Please make sure you are logged in at 6.45pm AEST as the room is often full. http://gomarkets.webinato.com/room1 Andrew Barnett | Director / Senior Currency Analyst Andrew Barnett is a regular Sky News Money Channel Guest and one Australia’s most awarded and respected financial experts, and is regularly contacted by the Australian Media for the latest on what is happening with the Australian Dollar. Connect with Andrew: Email

Candlestick charts are one of the most popular and commonly used tools by traders in analysing the markets. In this article, we will briefly look at its history then move on to some basics on how to interpret these charts. We will also look at some of the major candlestick chart patterns to give you an understanding of how you can use them for your trading analysis.

A brief history of candlestick charts Candlestick charts originated in Japan in the 18 th century and is one of the earliest known forms of technical analysis. Today, it is the most popular chart used by FX traders as it provides a quick and easy picture of price action in a particular trading session. Analysing and understanding a candlestick A candle is made up of a rectangular ‘body’ and single lines at both ends called ‘wicks’.

Candlesticks provide a more visual representation of price action than you get from simple Bar or Line charts. For the purpose of this article, the bear (down) candle will be red, and a bull (up) candle will be blue. One candle will represent one whole trading day.

However, it is important to note that with the MT4 platform you can also set up the candlestick chart to reflect 1 min, 5 min, 15 min, 30 min, 1 hour, 4 hour, daily, weekly and monthly time frames. Candlestick body represents strength of price action As per the diagram below, the formation of a candlestick represents the open, high, low and close price for the day. The length of the body shows the strength of the price action.

The longer the body of a candlestick, the stronger or more aggressive the price action is. In the example below shows two similar size candles, however, the second one is a stronger bullish candle as the body is longer. Wicks represent buyer and seller activities The thin lines above and below the body are called ‘wicks’ and represent the high and low range of the price for the day.

The wick on top of the body represents sellers and selling activity. The bottom wick indicates the presence of buyers and buying activity. The length of the wick gives a good indication of the strength of the type of activity i.e. a longer wick is more definitive than a shorter one.

A long upper wick and short lower wick indicates that there were buyers earlier in the day pushing prices higher. However, strong sellers later on in the session forced the prices down from their highs, creating a long upper wick. A long lower wick and short higher wick indicates that sellers dominated earlier in the day, however, stronger buyers entered later in the session pushing the prices higher from their lows and creating a long lower wick.

Common Candlestick chart formations Here are some of the most common candlestick chart formations that FX traders use for their trading analysis. Spinning Tops A Spinning Top is a Candlestick with a short body and a long upper and lower wick. It indicates uncertainty in the market and puts a question over which way prices may be heading.

The long wicks indicate strong buying and selling activities at some stage during the trading session, but with no clear winner at the end. If a Spinning Top occurs towards the end of a trend it may indicate that the trend is coming to an end. If it occurs while the market is moving sideways, it may indicate a start of a trend.

A Spinning Top is usually a Neutral signal. Doji A Doji candlestick is formed when the opening price is the same or very close to the closing price. It signals a balance between buyers and sellers.

A Doji with a long upper wick indicates the initial presence of buyers. The price has initially moved higher and eventually attracted sellers. In this case, the sellers are seen as the stronger group, as they closed out the day.

A Doji with long lower wick indicates the initial presence of sellers. The lower prices attracted buyers, who ended up being the stronger group as they closed out the trading session. Looking at a Doji on its own may not give a clear buy or sell signal.

But looking at it and taking into consideration preceding candles, it can provide some valuable information. For example, if a Doji occurs at the end of a trend or even one trading session, it may be a sign that a potential change in direction may happen. It might also occur at the end of a congestion phase.

It might follow an up candle or a down candle. The strength of the previous candle, as measured by the length of the real body, will give traders an idea on how to interpret the Doji signal. In the diagram below, a Doji appears after a relatively bullish session.

This can either indicate a start of a new phase of the uptrend (if a trend exists), or a potential change into a new (bearish) direction. Gravestone Doji It is a reversal pattern that could mean a bullish rally is about to end. This is formed when the open, low and close are equal and the high creates a long upper wick.

The resulting candlestick looks like an inverted “T”. A Gravestone Doji indicates that buyers dominated trading and drove prices higher during the early part of the session. However, by the end of the trading day, sellers started to appear and pushed prices back to the opening level and the session low.

A Gravestone Doji is usually a bearish signal. Dragonfly Doji This Doji formation is another signal of indecision between buyers and sellers. A Dragonfly Doji is formed when the open, high and close are equal and the low creates a long lower shadow.

The resulting candlestick looks like a “T”. A Dragonfly Doji indicates that sellers dominated early trading and drove prices lower during the session. But by the end of the session, buyers appeared and drove prices back to the opening level and the session high.

A Dragonfly Doji is usually a bullish signal. Harami A Harami is a reversal pattern and consists of two candlesticks. A Harami formation can be bullish or bearish depending on the direction of the price action.

The most important thing to consider when looking for a Harami is the gap up and gap down in price. A bearish Harami is formed when a large bullish candle (Day 1) is followed by a small bearish or bullish candle (Day 2) which showed a gap down in price. A bullish Harami occurs when a large bearish candle (Day1) is followed by a small bearish or bullish candle that showed a gap up in price.

The important thing to consider is the size of the body of both candles as it is indicative of the strength of the signal. The first candle should have a rather large body. The smaller the body in the second candle the stronger the signal.

Example of a Bearish Harami: Hammer A Hammer is a bullish reversal pattern usually formed at the end of a declining price trend. It is identified by its small body at the higher side of the range. The bottom wick should be at least twice the size of the real body and the upper wick should only be small, if it exists at all.

In chart analysis, it is the length of the wick (of a Hammer formation) relative to the body that creates the signal. The wick could be viewed as a sign of rejection of lower prices and therefore a possible reversal of the trend. Hanging Man A Hanging Man is a bearish reversal pattern.

Its formation is similar to the hammer formation, except that it occurs at the end of a bullish trend. Once again the body is at the top of the range with the lower wick at least twice as long as the body. The upper wick should be short if it can be found at all.

It is best to seek confirmation of a bearish reversal with a follow-up signal the next day. These are just some of the basic candlestick patterns. There are numerous books and online resources available about Candlestick charting.

If you you’re new to FX trading, it would be highly recommended to read up on Candlestick charts to find out how you can use it for your trading. For information on other trading tools, see our Autochartist, Genesis for MetaTrader, VPS for MetaTrader and a-Quant information pages. Rom Revita | Sales Manager Rom is the Sales Manager at Go Markets Pty Ltd and manages the day-to-day running of the Sales, Support and Marketing teams.

He has been with the company since 2013 and is also one of our two appointed Responsible Managers, helping to ensure that the company follows all AFSL regulatory requirements. Rom has extensive financial markets experience and originally comes from an equities & derivatives trading background. He has served on the Trading & Sales Desk with several large broking houses, and now specialises in Margin FX and CFDs.

Connect with Rom: [email protected]

One of the worlds most profitable Hedge Fund Managers Paul Tudor Jones called it in Tony Robbins Money Master Book " my #1 Trading indicator " and some of my colleagues in institutions and banks have referred to it as a key barometer for where substantial money flow often occurs. I am referring to the 200-Day Moving Average on a Daily chart and as the charts will demonstrate below the 200 MA (moving average) not only has the potential to reverse a currency market but can also be a general guide to where the overall trend is. So how can you use the 200 MA to potentially improve your strike rate in the currency markets?

It is generally viewed by most professional traders that if price is above the 200 MA they will not attempt to short a currency and will generally only look to use their trading system to buy into the market they are trading. The opposite when price is below the 200 MA, they will generally look to only short the currency pair they are trading. Trading systems that appear to have an edge on a higher time frame such as a 4-hour or daily chart can potentially be enhanced by applying this rule of thumb.

Following are 4 charts showing the 200 MA on a Daily Chart. If you’d like to apply a 200 MA to your MT4 platform simply go to the Menu at the top of the page, click on Insert, then click on indicators and then trend. You will see Moving Average listed there for you to click on and load.

Make sure you input 200 into the Period box under Parameters. Andrew Barnett | Director / Senior Currency Analyst Andrew Barnett is a regular Sky News Money Channel Guest and one Australia’s most awarded and respected financial experts, and is regularly contacted by the Australian Media for the latest on what is happening with the Australian Dollar. Connect with Andrew: Email

As a trader, you’ve probably found that having the right trading plan plays a significant role in your trading success. A basic trading plan should tell you what, when and how much to trade. It should also have specific instructions on when to close out your trades.

As traders, we all need a well thought out trading plan to navigate our way through the turbulent waters of financial markets, with the added benefit of having something to hang on to when we’re in the middle of a trade. Devising a trading plan needs detailed analysis and careful consideration. Unfortunately, we are not able to go through how to develop a complete trading plan in a short article such as this.

However, we are going to discuss some fundamental points to assist anyone who already has a trading plan or is in the process of developing one, helping to make sure it includes these minimum standards. 1. A trading plan that suits your character In any trading plan lies a trading philosophy that determines the overarching framework. The trading philosophy represents your beliefs about the markets.

For example, it shows whether you believe in short-term technical trades, or if you think success can be achieved by making long-term fundamental trades. It shows if you are a trend trader looking to move with the flow of the market, or if you are contrarian in nature and are looking for opportunities to go against the others. Regardless of the trading philosophy you choose, our suggestion is to make sure that it A) is proven and valid, and B) suits your personality.

If the trading philosophy does not suit your character and the way you look at the markets, you will inevitably deviate from your plan and potentially put yourself in a difficult situation, both financially and psychologically. Once you are confident that your trading philosophy is appropriately reflected in your trading plan, your plan should be capable of delivering and managing desired trading opportunities in the context of your trading philosophy. To achieve this, you need to make sure all the below requirements are met as a bare minimum. 2.

Your trading plan should be bias-free Biases occur because we have pre-set ideas in our minds that stop us from making objective decisions. This problem lies within human nature and is the result of our emotional and cognitive limitations. Within the long list of biases that exist, there are two which are the most harmful to many traders: confirmation bias and hindsight bias.

Confirmation bias is when we systematically look for what confirms our prior beliefs and ignore most evidence that challenges our set preconceptions. An excellent example of this bias is when we are trying to ascertain a simple breakout strategy by looking at a chart, a strategy used by many traders to trade the news. If the market keeps going in the direction of the breakout, we gladly count it as a success (after the fact), but if it fails — that is, it reverses its course after the breakout — we call it a Bull/Bear Trap and forget about the failure which has just happened.

By renaming the model, we have shifted our attention from a failed breakout strategy to a now successful Bull/Bear Trap! Under the influence of the confirmation bias, we are likely to pursue trading patterns which otherwise would have had little to no merit. This bias makes us derive conclusions that we’d like to see, instead of seeing what’s actually happened in reality.

The second most crucial bias traders face is the hindsight bias. Hindsight bias is when we look at a chart and find ourselves counting easy trades that would have worked well in the past. It is the moment that you go “it was an obvious head and shoulder” after seeing what had happened afterwards.

This bias comes from our tendency to distort our judgment towards the successful event. If you are given a set of questions about uncertain events (i.e. is the market going to consolidate, trend, reverse etc…) and the correct answer at the same time, it is very likely that you would distort your analysis to conclude in line with the correct answer, as if it really was obvious. Hindsight bias makes trading look easy, and can trick you into believing in trading rules and your ability to forecast – either of which may not be accurate.

If your trading plan has seemingly worked well on historical data but is failing to deliver desired results in real time, then it may be suffering from the above biases. Biases must be removed from your trading plan in order for it to be objective and testable. 3. Your trading plan should be objective An objective trading plan can enable traders of different market views to arrive at the same trading decision.

It has enough details and instructions that it takes any confusion out of trades and leaves no room for personal judgment. For example, a good trading plan does not allow traders to draw any trend lines they see fit, but instead, it dictates the trend line which is appropriate to be drawn. It has as many detailed guidelines as possible to stop traders from improvising. 4.

Your trading plan should be testable The best way to make sure your trading plan is objective and bias-free is to convert it into a set of clear trading rules and let a computer test the trading plan for you. This is called backtesting. By using a computer to do the testing, you are essentially removing human emotions and biases from the equation.

Often during the backtest, you will get a much better understanding of the strengths and weaknesses of your trading plan. The downside to backtesting is that it is not easy (it requires coding), and validating a backtested result requires some maths and statistical skills to avoid being trapped by the backtest itself. However, this is still one of the better and cleaner ways to ascertain the validity of your trading system. 5.

Information about the market you are trading The trading plan must hold enough historical information about the performance of the patterns and behaviours of markets you are looking to trade. Whilst the type of the information required depends on the trading strategy, below are a few suggestions that we think should be present in any trading plan that is based on intraday charts: Average size and duration of price swings per trading session Average range per trading session Times of major turning points per trading session Correlations between various trading sessions Historical reactions of the currency to news announcements Important pivots and trends Technical indicators that have worked best over recent history Historical reaction to the session opening and closing times Volatilities per trading session (this can be used to set dynamic stop losses) Intraday correlation with other markets The above should be modified based on your trading strategy. Note that the more you can do to add to the list above, the more confidence you can have in your trading plan. 6.

A solid risk management plan Many of us believe that “stop losses” are the same as risk management. The truth is, stop losses are an essential part of a risk management plan, but are only an element of appropriate risk management. A good risk management plan should have three parts: Tradable instruments: Sometimes you may need to leave a specific currencies/indices out of your tradeable universe just because they can’t justify the risks you will have to take to trade them.

On the other hand, you may at times need to add a few instruments to your universe in order to reduce your risk and maximise your return. You should be able to refer to your risk management plan for these types of questions. Trading size: Your risk management plan should be able to tell how much to trade each time.

It must have a mechanism in place to make sure one or two bad trades do not impact the integrity of your account. Stop losses: Your risk management plan should make sure that your stop losses suit the trading strategy you’re pursuing. For example, a trend trading system may require having close stop losses, whereas this might not be the case for a mean-reverting strategy.

Stop losses should be adaptable to market changes and should be backtested and validated during the testing process. Conclusion: Trading plans are vital for trading success. They have many parts which should be carefully designed and tested.

We appreciate that contemplating all the above points can be challenging and time consuming, however you will become more confident in your trading as you will have in place a structured and improved trading plan.

Annihilation of the Yen It was the year 2013. Some interesting events took place that caused some reverberations in global markets. The once one booming city of Detroit (known for its car manufacturing) filed for bankruptcy and the US government shutdown for almost two weeks.

But the most significant story was the fall of the Japanese currency against all its major counterparts. A dangerous climb In 2013 the value of the Yen fell 21% against the US dollar, making it the most sizeable yearly gain against the Asian currency since 1979. Whenever a currency pair rises or falls this quickly, traders have a tendency to become complacent and think it will continue regardless.

If we’re looking for an analogy, we can view the rise of the US dollar and other currencies to lofty heights against the Yen as something similar to an inexperienced or over-zealous climber attempting to reach the top, but failing to plan for future events and construct a safe passage back down. Resurrection of the Yen Despite the Japanese government’s best efforts – adopting negative interest rates and championing an aggressive stance to help weaken their currency – the Yen has gained both in strength and popularity in 2016. And this is creating some significant moves in the FX world.

Before we discuss the technical side of the charts, it is worth noting that all the Japanese pairs mentioned are currently following a bearish resistance line (BR) or downtrend according to the latest point and figure analysis. Finding 300+ pip moves In the previous newsletter introducing point and figure, we discussed why this method is an excellent tool for locating key areas of support and resistance. The recurring Yen pattern we’ve identified here was discovered using point and figure.

It suggests some long-term moves that could be over 300+ pips in total. The freefall pattern The pattern itself if is quite simple. It appears as if the sharpest JPY declines of 2013 are now becoming the largest JPY rallies of 2016.

Consider the climbing analogy, the latest price swings and resulting patterns are the climbing equivalent of forgetting to place anchors in the cliff face in preparation for the abseil back down. When we study the charts, there are simply no immediate signs of support or footholds that the pairs can target leaving them vulnerable to a potential freefall. As the same pattern is discussed over multiple pairs, we can analyse this into three sections: » Completed » In-progress » Emerging.

Completed Pattern - CADJPY Click to enlarge In a previous CADJPY article, we discussed the importance of the triple bottom located at the 90.00 level and the distinct lack of support below. This is the first example of the pattern of what might happen to some of these JPY pairs once key support levels are breached. No doubt the pressure of global oil prices on the Canadian dollar helped accelerate this move.

As we can see from the chart above, the CADJPY fell to our longer-term target of 80.50 before finding adequate support. The pattern almost resembles a window where price drops significantly to the previous level of demand. This pair may be consolidating now, especially looking at the most recent price action.

While the key level of 80.50 may continue to act as a strong support, resistance to the upside appears to be located at 84.00 and 86.50. In-progress pattern – USDJPY, GBPJPY USDJPY Click to enlarge We also discussed the latest USDJPY move in a recent article and currently we have a longer-term target price of 109.50. Clearly the break of the spread triple bottom at 116.50 was when this pattern activated and the price dropped from 116.50 down to 112.50 creating a 400 pip move.

The pair has since recovered but the main point to take note of is the recent change from an uptrend following a bullish support line (BS) to a downtrend following a bearish resistance line (BR). The level of 114.50 has established as short-term resistance and above here 116.50 may attempt to cap any bullish plays. GBPJPY Click to enlarge Similar to the USDJPY pair, we can see the pattern is in progress here with a downside target of 159.00 where a previous triple top is found.

The trigger point for this move was when the price broke through the spread double bottom at 165.00. Certainly one of the weakest currencies at the time of writing, the Pound has been one of the worst affected by the sudden surge in strength of the Yen. With the looming threat of a ‘Brexit’ (Britain exiting the Euro zone) towards the end of June this year, things may end up going from bad to worse for the GBPJPY pair.

Emerging pattern– EURJPY, NZDJPY, AUDJPY EURJPY Click to enlarge The last group, which we believe has the potential to move in similar fashion to the completed CADJPY pair, is sitting around key support levels which are beginning to look slightly exposed to the downside. The EURJPY has recently produced a sell signal after breaching the 125.50 level. If we look at the chart, there appears to be a glimmer of support around 124.00, but a longer-term target of 120.00 would be the more obvious choice.

The pair has had a rocky road on the way down so far perhaps this would be one of the most stable shifts down if the pattern continued. NZDJPY Click to enlarge The potential NZDJPY setup looks to be one of the cleanest examples of this freefall window pattern. During the past couple of weeks, price action has danced around the key support level 75.00 which is also a spread double bottom.

If this area fails to hold, the next longer-term support and initial target would be 69.00 at this stage. AUDJPY Click to enlarge Although closely related to the NZDJPY pair, the Australian counterpart AUDJPY doesn’t seem to belong to this group. Of course, the potential is still clearly visible on the chart between the levels of 80.00 and 75.00, but the Australian dollar may be more resilient based on recent events and previous price action.

In summary, the pattern itself is not unique. If you follow point and figure, you will notice similar setups on various trading products from time to time. What makes it interesting is that it appears to be happening on nearly all the Yen pairs simultaneously.

The completed pattern on the CADJPY went directly to the nearest support which was almost a thousand pips away. But do not be fooled by the process. Remember these are generally long-term set-ups and without any obvious signs of support, the market may gravitate towards round numbers with psychological importance or become less reliable in general.

There is also an alternate scenario whereby the Yen finds a bottom at current market levels and some of these key areas of support hold, perhaps providing a springboard for price action in the coming months. This also could present an opportunity to find some reasonable risk/reward trades. If you would like to keep up-to-date follow on Twitter or through the GO Markets technical analysis section.

The opinions and information conveyed in the GO Markets newsletter are the views of the author and are not designed to constitute advice. Trading Forex and CFD's is high risk. Adam Taylor | Senior Analyst Adam Taylor joined the GO Markets' team in early 2013 and has gone on to become a valued analyst on our Research and Trading team.

Adam's key strength lies in his technical analysis skills, perhaps honed over his time as a Champion Chess player for his native Scotland. While Adam's primary role is concentrated towards risk management for GO Markets, he's a regular contributor to our News and Analysis team, using the highly regarded but rarely used, point and figure method. Connect with Adam: Twitter | Email | Adam's posts

People often ask me how they can get an edge over other traders in the currency market. My simple answer is this. Study financial market history and it will greatly enhance your profit opportunity because Forex markets will highly likely react the same way each time based on how they reacted last time.

Human beings are what drive all financial markets and as a whole the big money is reasonably predictable in what it will do. It will likely do the same is it did last time when a similar event occurred. Take for example the Yen, which has risen some 17% in 2016 as the BOJ has tried to lower its value by printing more money and putting interest rates into the negative.

Each time the BOJ announces more of the same (money printing & bond and stock buying) the forex market buys more Yen. This is one of the reasons why you have to be in this business for the long haul because the longer you are in the business the more you learn about the history of how the forex market behaves. The average trader often doesn’t want to do the time and they want the profits quickly without doing the forex trading apprenticeship that is required.

This does not mean sitting in front of a computer for hours a day it simply means reading for 15 or 20 minutes a day about why price is moving. The chart is NOT making the price move, the news is making the price move and the chart is simply a reflection of how traders have interpreted the news and bought up or sold off a currency. Join with me and become a detective of forex trading and you will highly likely enhance your profit making potential.

You can join me every Wednesday evening at 7pm AEST for a free one-hour live currency coaching session. Simply click on this link to join the session. http://gomarkets.webinato.com/room1 Andrew Barnett | Director / Senior Currency Analyst Andrew Barnett is a regular Sky News Money Channel Guest and one Australia’s most awarded and respected financial experts, and is regularly contacted by the Australian Media for the latest on what is happening with the Australian Dollar. Connect with Andrew: Email