Noticias del mercado & perspectivas

Anticípate a los mercados con perspectivas de expertos, noticias y análisis técnico para guiar tus decisiones de trading.

Desde infraestructura de IA hasta cuidado de mascotas, semiconductores y exploración de oro, aquí están los cinco principales candidatos con más probabilidades de figurar en el ASX en 2026.

¿Qué es una oferta pública inicial (OPI)?

1. Firmus Technologies

Firmus Technologies está construyendo una infraestructura de centro de datos impulsada por IA en Tasmania, y puede ser una de las empresas tecnológicas más estratégicamente posicionadas en Australia en este momento.

Firmus es un socio de Nvidia Cloud y se ha unido al mercado Lepton del fabricante de GPU. La compañía ha diseñado su plataforma AI Factory modular y líquida en todas partes para evolucionar con las últimas arquitecturas de Nvidia, incluida la red Ethernet Nvidia Spectrum-X.

Un aumento de 330 millones de dólares australianos en septiembre de 2025 cerró en una valuación posterior al dinero de mil 850 millones de dólares australianos para la compañía. Para noviembre de 2025, después de un aumento adicional de 500 millones de dólares australianos, esa valoración se había triplicado a aproximadamente A$6 mil millones.

Una posterior inversión de 100 millones de dólares australianos de Maas Group a principios de 2026 confirmó la valoración de noviembre. Se informa que Firmus está contemplando una OPI de ASX dentro de los próximos 12 meses y, dada la valuación privada de A$6 mil millones, se espera que cualquier aumento público esté muy por encima A mil millones de dólares.

Con la creciente demanda de Australia de capacidad informática soberana de IA y el clima frío y la ventaja de energía renovable de Tasmania para las operaciones de centros de datos a gran escala, Firmus se erige como uno de los candidatos a OPI de ASX a mayor escala en 2026.

No obstante, aunque el interés del mercado en Firmus parece estar creciendo, el momento lo es todo cuando se trata de OPI. Esté atento a la confirmación del momento exacto de la OPI, el sentimiento de los centros de datos de IA y si Nvidia señala una profundización de su participación como inversor ancla estratégico después de la cotización.

2. Rokt

Rokt, fundada en Sídney, se ha convertido silenciosamente en una de las empresas tecnológicas privadas más valiosas de Australia. La plataforma de comercio electrónico adtech dirigida a ayudar a las marcas a monetizar el “momento de transacción” ahora se valora en ~7,9 mil millones de dólares.

Una hoja de términos preparada por MA Financial proyectó una salida precio de las acciones de 72 US$ en escenarios de caso base, cuando las acciones se liberan del escrow en noviembre de 2027.

Se espera que Rokt tenga una lista potencialmente dual en Estados Unidos y en el ASX en 2026, posiblemente tan pronto como el primer semestre del año. IG La estructura más discutida es una cotización primaria del Nasdaq con una estructura ASX CDI (CHESS Depositary Interest) para inversores australianos, en lugar de una doble cotización completa.

Los ingresos de Rokt para el año que termina en agosto de 2025 se proyectan en US$743 millones (un alza de 48% interanual), con un EBITDA pronosticado en US$100 millones y un margen de utilidad bruta de aproximadamente 43%. Actualmente se proyecta cruzar el hito de ingresos anuales de mil millones de dólares para agosto de 2026.

Se informa que Amazon, Live Nation y Uber son clientes de Rokt, y la compañía se ha expandido rápidamente en América del Norte y Europa.

Si Rokt opta por una cotización primaria en Nasdaq con una estructura ASX CDI, o una cotización dual completa, podría afectar significativamente la liquidez y el acceso de los inversores locales.

3. Cruz verde

Greencross, el negocio detrás de Petbarn, City Farmers y Greencross Vets, se prepara para volver a listar en el ASX luego de ser privado por la firma estadounidense de capital privado TPG en 2019.

TPG posee actualmente 55% de Greencross, mientras que AustralianSuper y Healthcare of Ontario Pension Plan (HOOPP) mantienen el 45% restante.

La compañía reportó ingresos por 2.000 millones de dólares australianos para el ejercicio 2025, un modesto aumento desde los mil 950 millones de dólares australianos de 2024. TPG pagó 675 millones de dólares australianos en valor patrimonial por el negocio en 2019; vendió una participación del 45% en 2022 con una valuación de más de 3.5 mil millones de dólares australianos. La OPI propuesta implica una valoración de más de 4 mil millones de dólares australianos.

TPG apunta a una oferta pública inicial de al menos 700 millones de dólares estadounidenses. La OPI marcará el regreso de Greencross a la ASX después de una ausencia de ocho años. El tamaño relativamente pequeño del aumento de TPG sugiere que la empresa está basando en un sólido desempeño del mercado de posventa antes de salir por completo.

El anuncio de la línea de tiempo de salida de TPG sigue siendo un reloj para saber si una OPI 2026 está en juego. Y si la empresa persigue una OPI tradicional o una venta comercial, que sigue siendo un camino alternativo.

4. Morse Micro

Morse Micro es una compañía de semiconductores con sede en Sydney que desarrolla chips Wi-Fi HaLow diseñados para aplicaciones IoT en agricultura, logística, ciudades inteligentes y monitoreo industrial.

Morse Micro celebró una ronda Serie C en septiembre de 2025, recaudando 88 millones de dólares, seguida en noviembre de 2025 por un aumento previo a la OPI de 32 millones de dólares, llevando la financiación total a más 300 millones de dólares.

Está dirigido a una lista ASX en los próximos 12 a 18 meses. El Serie C fue dirigido por el gigante japonés de chips MegaChips y la Corporación del Fondo Nacional de Reconstrucción.

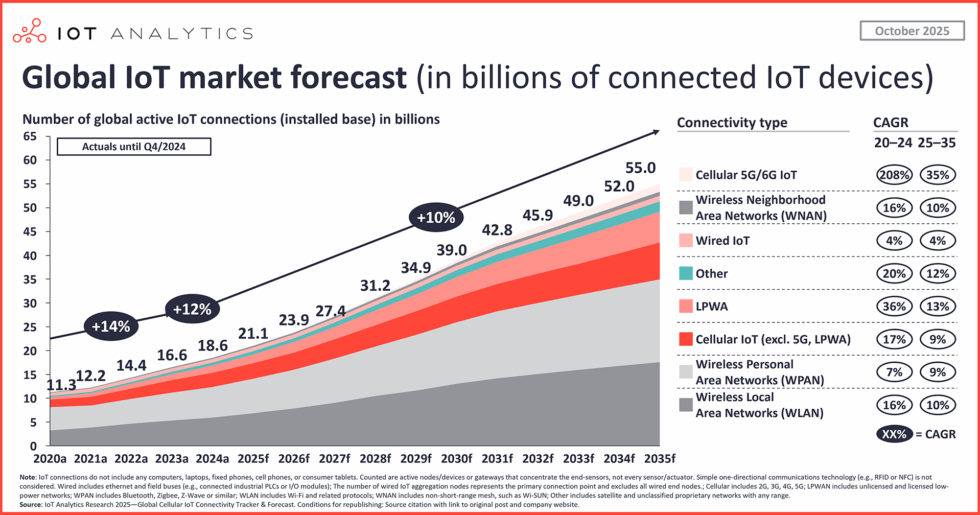

Se pronostica que las conexiones globales de dispositivos IoT superarán los 30 mil millones para 2030, y Morse Micro sería una rara compañía de semiconductores pure-play que cotiza en ASX, lo que podría atraer un interés significativo de los administradores de fondos centrados en la tecnología.

La tracción de ingresos de Morse Micro con socios de hardware de primer nivel antes de la cotización es un reloj, y si la compañía busca una cotización concurrente en Estados Unidos dada la profundidad del apetito de los inversores estadounidenses en semiconductores.

5. Recursos de bisontes

Bison Resources es un explorador de oro y metales preciosos recientemente incorporado centrado en Estados Unidos que actualmente se encuentra en medio de su OPI ASX.

La oferta se cierra el 20 de marzo de 2026, con una cotización ASX dirigida a mediados de abril de 2026. En una capitalización de mercado indicativa de 13,25 millones de dólares en suscripción completa, Bison es el nombre más especulativo de esta lista por un margen significativo.

La compañía tiene cuatro proyectos de exploración en el noreste de Nevada, dentro de Carlin Trend (uno de los cinturones productores de oro más prolíficos del mundo), responsable de aproximadamente el 75% de la producción de oro de Estados Unidos.

La OPI busca recaudar A$4.5 a A$5.5 millones (22.5 a 27.5 millones de acciones a A$0.20 por acción). El equipo cuenta con experiencia previa en Sun Silver (ASX: SS1) y Black Bear Minerals, lo que le otorga una trayectoria en los listados mineros ASX junior fuera de Nevada.

OPI globales: ¿Cuáles son las OPI más grandes que se están produciendo a nivel mundial en 2026?

Conclusión

El calendario de OPI 2026 de Australia abarca todo el espectro de riesgo. Un juego de infraestructura de IA respaldado por NVIDIA, una plataforma de comercio electrónico multimillonaria y un explorador de oro junior con su OPI ya en marcha.

Cada candidato refleja una etapa diferente de madurez y un perfil de inversionista diferente. Juntos, sugieren que el ASX podría ver una inyección significativa de nuevos listados en todos los sectores que han estado ausentes en gran medida del mercado local en los últimos años.

Going into the month’s last day of trading, Global markets have performed well despite a sell off this week. Continued hopes that we’re on a path to economic recovery, with COVID vaccines rolling out and the subsequent drop in cases, have supported markets and drawn in investors. Global Equities Major US Indices all saw record highs, with the Dow and S&P500 finishing the month strongly.

The tech heavy NASDAQ also hit all-time highs before selling off as investors rotated into traditional cyclical stocks. Tech stocks such as Amazon, Peloton and DocuSign, which all performed well during COVID lockdown measures, dragged down the index as lockdowns started to ease all over the world. European, UK, Asian and Australian equity markets also performed strongly.

Source: Bloomberg US Markets February saw record highs earlier in the month as COVID vaccinations rolled out out and the Federal Reserve re-iterated its commitment to accommodative conditions until employment and inflation targets are met. Despite these assurances from the Fed there's been a spike in bond yields which has caused concern for investors in the last days of the month, resulting in a significant sell off in US markets overnight. Investors will be watching this coming into March as any continuation of rising yields will be a negative for equities.

Asian Markets Asian markets performed strongly in February with the Nikkei being the strongest performer, breaking above 30000 - a level not seen since the bubble era of the 80s/90s. Source: Bloomberg Hong Kong’s Hang Seng also continued its impressive run. HKEX has seen record volumes on Chinese firms finding a new home there over concerns they'd be booted from US exchanges.

HKEX is now the world's biggest bourse by market value, easily beating rival bourses in London and the US. Australia The ASX 200 has rallied over 3% to date in February. Persistently high commodity prices, an extension in the RBA’s QE bond buying program, and a recovering labour market all supported Aussie equities.

COVID vaccinations starting also gave investors optimism for a continuing economic recovery. Source: tradingeconomic.com FX market February saw a mostly weaker US dollar, with the greenback only outperforming safe haven currencies the Swiss Franc and Japanese yen. With equity markets rallying and record commodity prices, risk and commodity backed currencies outperformed, with the AUDUSD breaking decisively through its 2021 resistance level of 78c US.

Source: Bloomberg British Pound Despite being neither a risk on nor commodity currency the British pound strongly rallied this month on impressive COVID vaccination progress. The pound hit its highest level against the US dollar in nearly three years, amid rising optimism about an end to lockdown in the UK. Australian Dollar The Australian Dollar was the top performing major currency in February.

This despite a dip at the start of the month, when the RBA somewhat surprised the market with an announcement of the extension of the 100 billion bond buying program. Strong signs of recovery in the local labour market, Chinese demand for commodities which are near record highs, and the status of AUD being a 'risk on' currency all helped AUDUSD break through the 78c US level. Analysts at ANZ and CBA expect the Australian dollar to trade as high as 82 US cents by the end of the year.

Source: GO MT4 Bitcoin Bitcoin again proved how volatile it can be with wild swings during the month. The cryptocurrency gyrated wildly from 32k USD at the start of the month, hitting an all-time high above 57K before selling off to be around 47k at the time of writing. Increased optimism in the institutionalising of Bitcoin as big players such as Morgan Stanley, Bridgewater capital, BNY Mellon and Tesla announced Bitcoin investments drove the price higher as momentum traders jumped on board.

The party was somewhat spoilt by comments from Treasury secretary Janet Yellen who labelled Bitcoin “an “inefficient” digital currency and one that is often used for illegal transactions” Government regulation and banning of Bitcoin is the biggest fear of traders in this market. Source: GO MT4 Gold Spot Gold prices dropped around 5% in February to date as the precious metal came under serious selling pressure. This drop is despite US dollar weakness; as the economic recovery progresses globally, gold's appeal is waning.

With inflation reportedly low in developed economies gold's other function as an inflation hedge has also waned. XAUUSD is now testing critical support levels that were set late in 2020. Source: GO MT4 Monday, 22 February 2021 Indicative Index Dividends Dividends are in Points ASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 10.832 8.224 0.097 0.029 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 0.718

XAUUSD Analysis 3 – 7 April 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the closing of the Doji bar and last week's sell pressure bar indicate market hesitation. Although the previous week, gold has had strong buying momentum and has continued since the beginning of March.

But even so, the gold price has not yet clearly shown strong selling momentum. In addition, last week's closing of the Doji bar and selling pressure bar was a close of the candlestick above the 1960 support, the latest high of gold prices on the Weekly timeframe level, so it can be expected that the price of gold will still hold. Opportunity to rise to test resistance 2070, which is an important resistance in the weekly timeframe level or the price that gold has ever done the most in history.

And in the event that gold prices cannot continue to rise A retracement to support at the time frame level of 1880 is the next target to watch. But regardless of whether the price will rise or fall Short-term forecasts on the time frame day can be seen as the possibility of a sideways or consolidation between the 1960 support and the 2000 resistance until the price direction is clear. AUDUSD Analysis 3 – 7 April 2023 The AUDUSD price sideways and swings within the 0.67750 resistance and 0.6560 support levels as seen from the H4 timeframe and Daytime timeframe.

Also, last week's close on the Weekly timeframe level has wicked as much as half of the candle even when it closed with a buying bar. The buying momentum of the price is not yet clearly seen compared to the selling momentum. forecasting that price May have a more negative direction. As the price of AUDUSD continues to be in a downtrend in both the short and medium term.

Therefore, the correction to further down is very eye-catching, especially the 0.6560 time frame support is expected to be the next target for the AUDUSD price. EURUSD Analysis 3 – 7 April 2023 The EURUSD has started to lose buying momentum noticeably as the weekly and previous weekly timeframes have dipped as much as half of the candlestick. (Significantly) as last week's closing price was lower than last week's high. After rising to test the timeframe resistance 1.08800.

Then it broke up to the price level of 1.09300, which was the price that could move up the most last week. Before there was a continuous sell down like this for two weeks in a row. forecasting that price May have both upward direction (but probably not much) and a downtrend in the medium term like time frame day. Due to the loss of buying momentum over the past week and the previous week, the trend of the price has become less pronounced.

The important price line to watch in the day frame is support 1.05250 (latest low) and resistance 1.08800 (latest high).

XAUUSD Analysis 27 – 31 March 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the close of last week's Doji bar indicates hesitation in the market. Although the previous three weeks, gold has had strong and consistent buying momentum since the beginning of March.

But even so, the gold price has not yet clearly shown strong selling momentum. Also, last week's close of the Doji bar was a candle close above the 1960 support, the latest high of gold prices on the Weekly timeframe. The bull rose to test the resistance 2070, which is an important resistance at the weekly timeframe level or the price line that gold has ever done the most in history. and in the event that gold prices cannot continue to rise A retracement to support at the time frame level of 1880 is the next target to watch.

But regardless of whether the price will rise or fall Short-term forecasts on the time frame day can be seen as the possibility of a sideways or consolidation between the 1960 support and the 2000 resistance until the price direction is clear. GBPUSD Analysis 27 – 31 March 2023 The GBPUSD outlook is bullish in the short and medium term, as the pair is currently moving sideways on the daily time frame and H4 (support 1.19140 and resistance 1.21460) rises above them. 1.21460 plus continued buying momentum based on the weekly nighttime buy candlestick, although last week's closing price has retraced. Still, the price has yet to show a strong sell candle on the Weekly timeframe, indicating a clear uptrend in both the short and medium term. forecasting that price There is a tendency for the price to rise to test the resistance of 1.24470, which is a key resistance at the time frame, which in the past the price has previously tested and formed a Double Top pattern, with the key support being 1.21460, a key support at the Tai level.

Timeframe predicts that the price may be shortened or sideways. Corrected to rebound to test the resistance of 1.24470, which is the price target of GBPUSD. EURUSD Analysis 27 – 31 March 2023 The EURUSD started to lose its buying momentum significantly as the weekly timeframe was bullish as much as half of the candlestick. (Significantly) as last week's closing price was lower than last week's high.

After rallying to test the 1.08800 time frame resistance and then breaking up to the 1.09300 level, which was the strongest upside of the week. Before there is a continuous sell down forecasting that price There may be both upward and downward directions in the medium term, such as the time frame day. Due to the loss of buying momentum last week, the trend or trend of the price becomes less clear.

The important price line to watch in the day frame is support 1.05250 (latest low) and resistance 1.08800 (latest high).

Leading online broker GO Markets has hired ex-Pepperstone Head of Market Risk, Peter Spanos. Peter has joined GO Markets as Head of Risk & Product Development, flagging a new era of growth for the Australian-founded broker. Spanos said of his new position, “It’s exciting to work at a company with a supportive culture.

GO Markets has big plans for the future, with some notable key hires recently. I look forward to helping the company on that journey. It’s a great place to be, surrounded by lots of very talented people.” Spanos started out at IG 15 years ago, as Senior Quoting Dealer / Market Maker.

He then moved to CMC Markets as Volatility Risk Manager, and most recently Head of Market Risk at Pepperstone, a role he’d held since 2018. GO Markets Director, Khim Khor said, “It’s great to have Peter on board. He has a wealth of experience and fits well into the culture at GO Markets.

We are very optimistic about what the future holds.” Several key personnel from Pepperstone have moved to GO Markets in the last 3 years, including GO Markets’ current Chief Marketing Officer, Head of Design, and their recently hired Senior Premium Client Manager.

Australia’s biggest lender has suffered a dropped in price the last few days. Shares in the bank fell as much as 5.7% in early trading in Sydney while the broader market (.AXJO) fell 1.0%, amid concerns of a weaker mortgage business in the high interest rate environment and the bank's lending margins peaking. Key points Brokers think that CBA’s margins can benefit from higher interest rates, however bad debts could rise CBA shares are down approximately 5%, which is a similar fall to the ASX 200 Morgans thinks that there’s more declines to come for CBA shares, though the dividend is expected to rise However, is not all doom and gloom when you peel back the layers as long-term shareholders would testify that while CBA shares have dropped 15% over the past week, it only registers an 8.5% drop in the last 6 months.

They are also sitting at the same price it was before the COVID-19 crash of 2020. Morgans is expecting a growing dividend from the big bank in the future. The estimated grossed-up dividend yield is 5.7% in FY22 and 6.25% in FY23.

After 8 rate hikes in 2022 and a further quarter-basis point raise last week, the central bank has indicated more tightening ahead to stamp out inflation. Soaring rates have cooled off the housing market and added to rising cost of living. "We expect business credit growth to moderate and global economic growth to slow during 2023," said Chief Executive Officer Matt Comyn. "However, we remain optimistic that a soft landing for the Australian economy can be achieved." "We are conscious that many of our customers are feeling significant strain from rising interest rates, alongside the rising costs of electricity, groceries and other household items,” Comyn said in an analyst and investor briefing. Comyn said some customers have drawn down savings and reduced spending, but they have not fallen behind on repayments yet.

To conclude the RBA interest rate hike was always going to affect the markets and cost of living, this much was advised at the Jackson Hole meeting last year. Many analysts and bankers hope that Australia has enough about them to have a soft landing and avoid a recession coming into 2023. GO Markets provides access to a range of Securities in the ASX, NASDAQ, NYSE and LSE and other additional major markets, by providing our clients with access to a platform, where you can either build a diverse portfolio of ASX Shares, or alternatively you can trade these markets as a CFD, visit us here for more information www.gomarkets.com/au or call us on 03 8566 7680 to speak to one of our Account Managers.

Sources: https://www.fool.com.au/, https://www.reuters.com/

US telecommunications giant Cisco Systems Inc. (NASDAQ:CSCO) announced the latest earnings results for the fiscal Q2 ending January 28, 2023, after market close in the US on Wednesday. Cisco beat revenue and earnings per share estimates for the quarter, sending the stock higher. The company reported revenue of $13.592 billion (up by 7% year-over-year) vs. the $13.419 billion estimate.

EPS reported at $0.88 per share (up by 5% year-over-year) vs. $0.855 EPS expected. Cisco also announced a quarterly dividend of $0.39 a share. CEO commentary ''With Cisco's strong Q2 performance, our fiscal 2023 is shaping up to be a great year," Chuck Robbins, CEO of the company said in a press release. "The modern, highly secure networks we are building serve as the backbone of our customers' technology strategy.

This, combined with the success of our ongoing business transformation and operational discipline gives me confidence in our future," Robbins added. Stock reaction The latest results had a positive impact on the share price. The stock was up by 5.24% at market close on Thursday in the US, trading at $50.96 a share.

Stock performance 1 month: +10.99% 3 months: +10.68% Year-to-date: +8.24% 1 year: -7.54% Cisco stock price targets Loop Capital: $66 Piper Sandler: $53 UBS: $51 Cowen & Co.: $64 JP Morgan: $55 Credit Suisse: $69 Rosenblatt: $53 Wells Fargo: $57 Raymond James: $63 Morgan Stanley: $55 Cisco is the 46 th largest company in the world with a market cap of $211.81 billion. You can trade Cisco Systems Inc. (NASDAQ:CSCO) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Cisco Systems Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap