Noticias del mercado & perspectivas

Anticípate a los mercados con perspectivas de expertos, noticias y análisis técnico para guiar tus decisiones de trading.

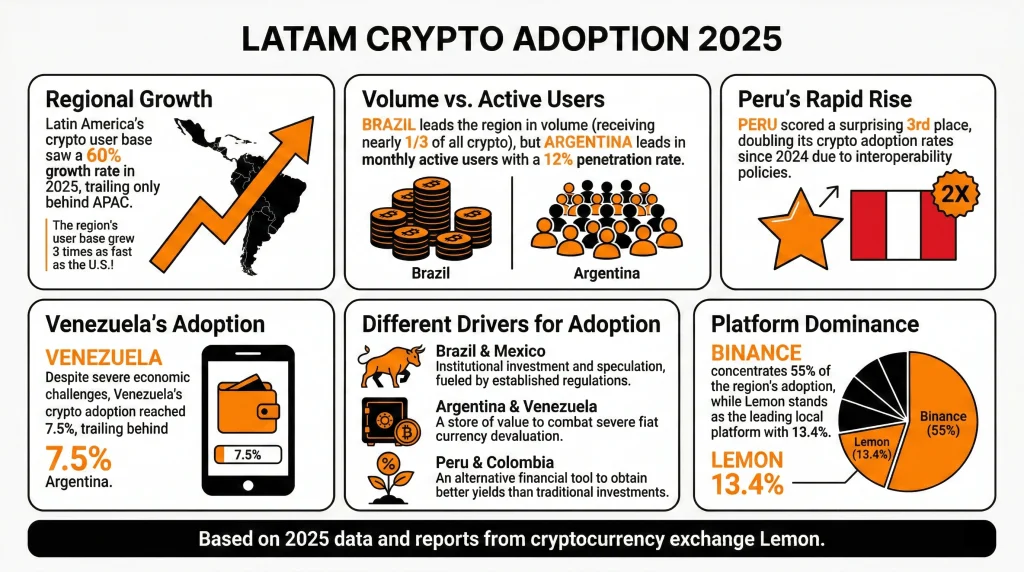

América Latina (LATAM) registró más de 730 mil millones de dólares en volumen de criptomonedas en 2025, un aumento interanual del 60% que hizo a la región responsable de aproximadamente el 10% de la actividad criptográfica mundial.

En 2026, los actores institucionales están empezando a tomar en serio a la región, la regulación se está cristalizando y los impulsores estructurales a partir de 2025 no muestran signos de desvanecimiento. Pero la región no es una sola historia, y 2026 pondrá a prueba si el impulso actual se basa en fundamentos sólidos o en optimismo especulativo.

Datos rápidos

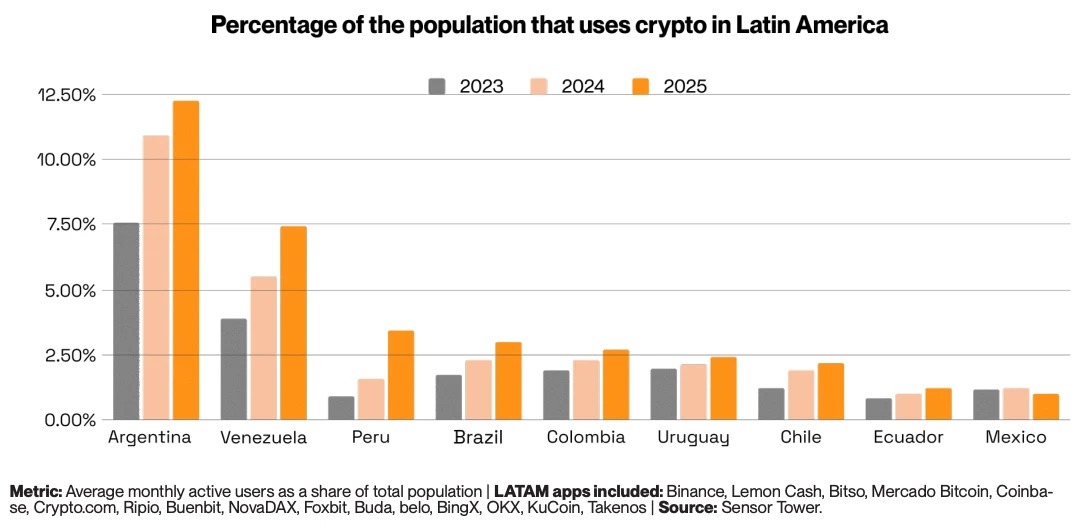

- Los usuarios activos mensuales de criptomonedas de LATAM crecieron 18% interanual (YoY), tres veces más rápido que Estados Unidos.

- Argentina alcanzó 12% mensual de penetración de usuarios activos, lo que representa más de una cuarta parte de la actividad criptográfica de la región.

- Más del 90% de los flujos criptográfico brasileños están ahora relacionados con la moneda estable.

- Tres países de LATAM se encuentran en el top 20 mundial: Brasil (5º), Venezuela (18º), Argentina (20º).

- Las descargas de aplicaciones criptográfico de Perú crecieron 50% en 2025, con 2.9 millones de descargas.

De la herramienta de supervivencia a la infraestructura financiera

América Latina no abrazó la criptomoneda debido a la especulación. Lo abrazó porque los sistemas financieros tradicionales fallaron repetidamente a la gente común. En los últimos 15 años, la inflación promedio anual en las cinco economías más grandes de la región se ubicó en 13%, en comparación con solo 2.3% en Estados Unidos durante el mismo período.

En Venezuela, alcanzó el 65,000% en un solo año. En Argentina, superó el 220% en 2024. Para millones de personas, mantener los ahorros en moneda local fue un lento acto de autodestrucción. Las monedas stablecoins se convirtieron en la respuesta natural. Los activos digitales conectados al dólar estadounidense ofrecían un depósito confiable de valor, transferibilidad sin fronteras y acceso sin una cuenta bancaria.

A diferencia de Occidente, donde el cripto se ve más como un instrumento especulativo, en LATAM se ha convertido en una herramienta financiera necesaria. Sin embargo, los impulsores de adopción no son del todo uniformes en toda la región. Brasil y México son historias institucionales, impulsadas por la participación regulada en el mercado y los actores financieros establecidos.

Argentina y Venezuela siguen siendo jugadas de almacenamiento de valor, con cripto sirviendo como cobertura directa contra el colapso fiduciario. Y Perú y Colombia son mercados más de búsqueda de rendimiento, donde las criptomonedas ofrecen rendimientos que las cuentas de ahorro tradicionales no pueden igualar.

¿Qué tan rápido está adoptando LATAM las criptomonedas?

El volumen criptográfico en cadena de LATAM aumentó 60% interanual en 2025. La región ha registrado casi 1.5 billones de dólares en volumen acumulado desde mediados de 2022, llegando a un máximo récord de 87.700 millones de dólares en un solo mes en diciembre de 2024.

Los usuarios criptoactivos mensuales en LATAM también crecieron 18% en 2025, tres veces más rápido que en Estados Unidos.

Las monedas stablecoins son el vehículo principal que impulsa esta adopción. De los 730 mil millones de dólares recibidos en 2025, 324 mil millones de dólares se movieron a través de transacciones de stablecoin, un aumento interanual del 89%. En Brasil, más del 90% de todos los flujos de criptomonedas están relacionados con stablecoin, y en Argentina, las stablecoins representan más del 60% de la actividad.

De cara al futuro, se pronostica que el mercado latinoamericano de criptomonedas alcance los 442.6 mil millones de dólares para 2033, creciendo a una tasa anual compuesta de 10.93% a partir de 2025, según IMARC Group.

Para los comerciantes, la velocidad de adopción importa menos como titular que lo que lo está impulsando: una región de 650 millones de personas construyendo infraestructura financiera paralela en tiempo real, con stablecoins como base.

El giro institucional

Durante la mayor parte de la historia criptográfica de LATAM, la adopción fue de abajo hacia arriba. Los usuarios minoristas no bancarizados o subbancarizados impulsaron los volúmenes a través de los intercambios locales. Ese panorama ahora está cambiando en el extremo superior del mercado.

En febrero de 2026, Crypto Finance Group, parte del principal operador de intercambio global Deutsche Börse Group, anunció su expansión en América Latina, dirigida a bancos, administradores de activos e intermediarios financieros que buscan custodia de grado institucional e infraestructura comercial.

Los bancos tradicionales y las fintechs están siguiendo su ejemplo. Nubank ahora recompensa a los clientes por tener USDC. La bolsa B3 de Brasil aprobó los primeros ETF spot XRP y SOL del mundo, por delante de Estados Unidos, en 2025. Los intercambios centralizados, incluidos Mercado Bitcoin, NovaDax y Binance, han listado colectivamente más de 200 nuevos pares comerciales denominados en BRL desde principios de 2024.

En marzo de 2025, la fintech brasileña Meliuz se convirtió en la primera empresa que cotiza en bolsa en el país en lanzar una estrategia de acumulación de Bitcoin, ahora con 320 BTC.

“La adopción de criptomonedas en América Latina ya es a escala global. Lo que el mercado necesita ahora es una gobernanza de nivel institucional, y esa es exactamente la razón por la que estamos aquí”, dijo Stijn Vander Straeten, CEO de Crypto Finance Group

Caso de uso de remesas criptográfico

América Latina recibe cientos de miles de millones de dólares anualmente de trabajadores en el extranjero, haciendo de las remesas uno de los casos de uso criptográfico más concretos y medibles de la región. Los servicios de transferencia tradicionales cobran un promedio de 6.2% por transacción. En una transferencia de US$300, eso equivale a aproximadamente US$20 en honorarios.

La infraestructura basada en blockchain en términos más generales ofrece reducciones dramáticas de tarifas. Bitcoin eleva los costos a alrededor de US$3.12 por cada US$100 transferidos. Mientras que las alternativas más baratas como XRP o la infraestructura de capa 2 de Ethereum pueden reducir eso a menos de US$0.01.

Para un trabajador migrante que envía US$1,500 a su casa a Perú, cambiar de un banco heredado ahorra más que el salario semanal promedio peruano solo en honorarios.

Entorno regulatorio criptográfico de LATAM

La variable que más determinará si LATAM está a la altura de su potencial 2026 es la regulación criptográfica. Y aquí, el panorama es genuinamente mezclado.

Brasil lidera la región con su Ley de Activos Virtuales, que cubre la segregación de activos, licencias VASP, requisitos AML/KYC y estándares de capital. También implementó la Regla de Viajes para las transferencias nacionales de VASP, que entró en vigor en febrero de 2026. Sin embargo, algunas propuestas más controvertidas, incluido un límite de 100.000 dólares estadounidenses en las transacciones transfronterizas de monedas stablecoin y la prohibición de las transferencias de billetera de autocustodia, siguen bajo consulta activa.

La Ley Fintech 2018 de México sigue siendo uno de los primeros reconocimientos formales del mundo de activos virtuales. La Ley Fintech de Chile de 2023 estableció licencias para intercambios, billeteras y emisores de stablecoin, reconociendo formalmente los activos digitales como 'dinero digital'.

Bolivia revirtió una prohibición criptográfica de una década en junio de 2024 al autorizar transacciones reguladas de activos digitales. Argentina introdujo el registro obligatorio de intercambio en 2025. Y El Salvador continúa expandiendo las iniciativas económicas tokenizadas a pesar de eliminar el estatus de moneda de curso legal de Bitcoin.

Diez países de la región ahora tienen marcos criptoactivos formales de algún tipo. Pero para los comerciantes, la divergencia regulatoria sigue siendo un riesgo real, y dado que Brasil recibe casi un tercio de todo el volumen criptográfico de LATAM, cualquier reversión significativa de la política allí podría tener consecuencias descomunales.

Lo que los comerciantes deben ver

El impulso institucional de Brasil es la tendencia estructural más significativa. Con 318.8 mil millones de dólares en volumen en cadena en 2025, Brasil es efectivamente el mercado LATAM.

El resultado de la consulta de la stablecoin brasileña podría tener una gran influencia. Una restricción a las monedas stablecoins extranjeras en los pagos nacionales afectaría directamente a la clase de activo más negociada en el mercado dominante de la región.

Argentina es la jugada de volatilidad. La penetración mensual de usuarios activos del 12% y 5.4 millones de descargas de aplicaciones criptográfico en 2025 señalan una participación profunda y creciente del retail.

Colombia es un mercado de alerta temprana a vigilar. La depreciación del 5.3% del peso en 2025 y la profundización de la crisis fiscal están impulsando las entradas de stablecoin en un patrón que refleja la trayectoria de Argentina en años anteriores. Si la situación macro de Colombia se deteriora aún más, la adopción de criptomonedas podría acelerarse.

También hay un riesgo de concentración cambiaria en juego. Binance Crypto Exchange es el principal intercambio para más del 50% de los usuarios de criptomonedas de LATAM. Si el intercambio enfrenta alguna acción regulatoria, interrupción operacional o choque competitivo, podría tener un impacto desmedido en el mercado.

Conclusión

El mercado criptográfico de América Latina ha entrado en una nueva fase. Los impulsores estructurales que causaron la cripto-demanda inicial en la región no han desaparecido: la inflación, las remesas, la exclusión financiera y la inestabilidad monetaria siguen en juego.

Lo que ha cambiado es la capa que se construye encima de ellos. Infraestructura institucional, marcos regulatorios, adopción de tesorería corporativa y capital cambiario global que fluía hacia una región que, hasta hace poco, era en gran medida autónoma.

El crecimiento del volumen cercano al -250% de Brasil en 2025 y su posición recibiendo casi un tercio de todas las criptomonedas de LATAM son los desarrollos definitorios del mercado. Su trayectoria regulatoria, las decisiones de política de stablecoin y la cartera de ETF marcarán efectivamente la pauta para la región en 2026.

Para los comerciantes, las cifras generales de crecimiento son reales, pero también lo son los riesgos de concentración, las incertidumbres regulatorias y las divergencias a nivel de país que se encuentran debajo de ellos.

Acceda a 39 de los principales CFD sobre criptomonedas en GO Markets

Last week I highlighted Governor Chris Waller’s speech – however the more I look into his talk the more it needs greater emphasis as it contained both hawkish and dovish elements. The Hawk Waller indicated that he would need at least three more months of "good" inflation data before considering a rate cut. He was suggesting this might happen late this year or early next year.

The Dove However, while he supports delaying the first cut, he emphasised that he does not expect to hike rates further. More importantly he highlighted that once the initial cut is made it should be followed by a series of cuts at no slower than a quarterly pace. That is a pretty aggressive stance it gives traders a clear understanding that once the Fed starts lower yields will be coupled with lower USD values – it’s just a question of when does it start?

The catch will be EUR, GBP, SEK etc are also facing dovish central bankers so these pair will have some push on them. Just remember ‘don’t fight the Fed’. Toeing the line Waller also reiterated the now-standard Fed caveat about rate cuts: a significant weakening of the labour market would prompt Fed officials to cut rates earlier or more aggressively.

Reviewed the plethora of labour market indicators out of the US and it is pretty clear further softening is likely. Looking at the non-farm payrolls in April only 175k jobs where added, and the forward-looking May hiring surveys show further slowdowns. Risks are skewed to the downside, and a sub-100k or even negative reading in the next few months wouldn't be surprising.

Hiring rates according to JOLTS and hiring intentions according to NFIB have dropped rapidly, and the employment subcomponents of services PMI and ISM are below 50 in most states. Now, the unemployment rate, currently sits at 3.9%, the Fed’s year-end forecast is 4.0% that could be reached this month – so next week’s NFP is going to huge for US indices and USD bulls that are staking everything on a ‘soft-landing’ and rate cuts in 2024. Looking to the next major indicator - Retail sales, which have been weak in the first four months of 2024.

It’s clear rate rises are biting, and consumers are depleting their excess savings acquired during the COVID years. Retail discounts are starting to ramp up have just to maintain sales volumes. This leads us to real GDP growth because it has a mixed set of data.

Real GDP slowed to an annualised 1.6%, but inside that figure was final private domestic demand. Which was buoyed strong consumer spending and contributions from business and residential fixed investment seeing it come in at 3.1%. A contradiction to the retail sales numbers.

However, investment looks to be weakening, with durables orders and shipments remaining soft in the second quarter of the year. Couple is with high mortgage rates and house prices have also resulted in softer housing data. This suggests that private demand in Q2 will eventually fall back in line with other components of the GDP reading.

All this again backs the consensus trade views that US indices are riding the soft-landing wave and are in the main driving USD inflow. Great example is AUD/USD – the AUD has been a huge performer in 2024 as the RBA looks to be pushing out expectations of rate cuts, couple this with booming commodity markets and a China looking to bounce out of malaise, yet the pair is stuck in a range of $0.64-$0.67. Against EUR, GBP JPY the AUD is going one way – not in the pair though and shows how attractive the US is for investment and flow.

Let me come back to Waller’s ‘good’ quote on inflation. In his remarks he suggested this week’s PCE expected to come in around 0.24-0.26% MoM April a "C+" grade. That would suggest sub-0.22% is "good” and would need several months of that kind of figure to move.

This is a figure traders need to have in the back of their minds each month especially on the lead up to and just after the data hits the wires. One final part of the PCE - Fed minutes indicate that a further slowdown in shelter prices will be crucial for Fed officials to be confident that inflation is easing. This is yet to materialise in the data.

Considering how big a component housing is it needs to slow in this week’s reading or rate cut expectations will drift out even further. Speaking of the PCE what is expected? The Trade week Monday saw the US observe the Memorial Day holiday and trade leading into it was limited.

Al three major indices finished last Friday in the green with is a positive sign as holding long positions over a long weekend is rare. In short – indices will be a bit directionless until Wednesday as only then will global markets get their first trading day of the US week. Thus, we need to turn our attention to end of the week and position for the most important release of May PCE inflation on Friday.

This is a core metric of the Fed and if there is any chance of several rate cuts in 2024 this piece of the puzzle must show structural signs of decline. Based on CPI and PPI elements, the consensus estimates are for core PCE to rise by 0.24% MoM, rounding to 0.2% for the first time since December. Shelter inflation should slow gradually, and core services ex-shelter inflation should also slow relative to March.

The consensus range for core PCE is 0.20-0.26% MoM, we will await if this boosts Fed officials' confidence that inflation is moving towards 2%. The biggest take out of the consensus data is all expect April to show a slowdown in spending. Weaker goods spending which correlated from the weak retail sales last week should override a modest 0.4% MoM increase in services spending.

Overall real spending should remain flat. This will create debate in the market as indices bears point to the recent increase in Services PMI, as a sign of accelerating services activity and thus inflation is a long way off ‘returning to sustained level of inflation’ The second release of Q1 GDP will be out on Thursday, providing more comprehensive data on components like net exports, investment, and consumption. With March retail sales revised lower, there is a risk that consumption growth could also be revised down.

Case Shiller index due Thursday is expected to increase by another solid 0.63% MoM in March but anticipate softer home price increases in the coming months due to signs of weakening housing demand and improving supply of existing homes. Final part of the puzzle for trader is always Fed speak and there is a big one this week with NY Fed President Williams on Thursday. Recently, he indicated that he does not expect to gain "greater confidence" on inflation in the near term – and he is a voting member of the Board.

Turning to home: Oz data to watch Inflation April's CPI data is due Wednesday. Consensus is headline CPI to slow to 3.4% YoY from 3.5% in March (range is 3.2%-3.5%), following three months of flat or rising prints. As this is the first print of the second quarter, the sample will likely skew towards goods prices, resulting in softer monthly growth, consistent with the prior two quarters.

Either way a further softening in the monthly data will elevate fears the RBA’s narrow path is evaporating. Retail sales came out on Tuesday at 0.1% MoM a 0.5% jump on the March read. However, this blurs the biggest take out the annual growth is at historically low levels outside of the COVID period (1.2% YoY).

Consumers are finally slowing their spending habits. Australia 200 The A200 ended a five-week winning streak, on Friday down 1.1% for the trading week. For the month A200 is up 1.36%, any good news that can be taken from the CPI data on Wednesday should see the index lock in a positive May over all.

Let’s make things very clear – Australia’s inflation rate is plateauing in fact I would argue it’s starting to reaccelerate in areas Australia can least afford. From a trading and momentum perspective this needs explaining. Stronger Than Expected Print April's CPI data exceeded expectations and was at the very top of the surveyed range.

Headline CPI increased by 3.6% YoY, well ahead of the consensus of 3.3% YoY. Seasonally adjusted, the increase was even higher at 3.8% YoY. Both the headline and core CPI rose for the third consecutive month.

This is a major concern. Now, the monthly increase slowed sequentially to 0.2% MoM, annual headline inflation has risen every month in 2024. Then the RBA’s core: trimmed mean inflation rose from 4.0% to 4.1%, and the ex-volatiles measure increased from 4.1% to 4.2%, with a three-month annualized rate of 5%, there is clear daylight between the RBA’s target band of 2%-3% and the core measure of inflation Here is the chart of the three main figures.

Monthly CPI Indicator annual moment (%) All this makes the RBA’s ‘narrow path’ almost unattainable. A point not lost on the AUD and the ASX as seen by each one’s initial reactions. ASX 200 v AUD/USD Source: Refinitiv Broadening Persistence However, with the passage of time the data is throwing up bigger concerns – and that is the persistence of price pressures in areas that make up large parts of the CPI basket.

The expectation for a weaker April CPI print was based partly on the skew towards goods in the sampling for the first month of the quarter which have been in structural decline. However, both goods and services contributed to the rise. Notable increases were seen in categories such as: Fruit and vegetables: from -1.2% YoY to 3.5% YoY Apparel: from 0.3% YoY to 2.4% YoY, with a 4% MoM increase Healthcare: from 4.1% YoY to 6.1% YoY The upside surprise was mainly due to significant increases in volatile expenditure items, including: Fruit: +7.3% MoM Oils and fats: +4.6% Women's garments: +4.5% Children's garments: +6.8% Accessories: +3.6% Furniture: +3.3% International holiday travel and accommodation: +11% These items constitute 7.5% of the CPI basket and largely explain the forecast miss.

Then you have clothing, which was expected to fall by 0.4%, rose by 4.1%. Furnishings, household equipment, and services, expected to be flat, all increased by around 0.6%. Recreation and culture, predicted to rise by 0.8%, actually went up by 2.3% in April.

This point was not lost on the Bond market with both the 3-year and 10-year Australian bonds surge on the data seen here: Australian 3-yr and 10yr Bond reactions Source: Refinitiv (Blue 3-year, White 10-year) Goods Prices Acceleration You can certainly explain away the volatile items as being affected by the early Easter period and a correction in the March data that had these items under pressure. But that ignores the seasonal and 3- and 6-month averages which are still high. You can also ignore the volatile international travel and accommodation sector, which accounted for much of the forecast miss, but again you can’t ignore the acceleration in goods prices where deflation was expected.

Categories such as clothing & footwear, furniture, and other major household and electronic appliances, typically measured once per quarter, suggest that goods inflation will likely remain strong. The monthly measurement of goods inflation rose by 0.9% in April, adding 0.2 percentage points to the headline monthly CPI, marking the largest increase since April last year. Services Inflation – the ‘sticking’ point One of the floors with the April CPI print is that is was heavy on goods prices but light on services.

This will be reversed in May - services prices are expected to remain fairly sticky. These are the areas the media like to quote like dentists and hairdressers. But somewhat cheapens the services that do move the dial, rents, telecommunications, financial service and insurances etc. these are big components of the CPI basket.

Considering the upside miss in April and the anticipated persistence of services inflation in May and June, the consensus now for Q2 headline CPI has been upwardly revised to 0.9% QoQ (range of 0.6% to 1.2%), that implys an annual reading of 3.7%. For core inflation (trimmed-mean), it has been adjusted to 0.8% QoQ, implying an annual reading of 3.8% - which is in line with the RBA’s new forecast. Implications for the RBA The implications from this CPI print will challenge the Reserve Bank of Australia (RBA).

It does pressure its assumption that the re-acceleration in inflation in Q1 would quickly revert. The unexpected strength in goods in particular coupled with sticky services suggests more persistent inflationary pressure than initially anticipated. It also shows that ‘inflation psychology’ is real – there is an argument to be made that spending has maintained on the ‘idea’ cuts would come because inflation is falling.

Which has left enough demand in the economy to hold inflation up. So, does this imply the RBA is about to raise rates? Here is the market’s pricing on that idea.

Interestingly enough despite the hawkish risks, the likelihood of the RBA hiking rates is still tempered in the market and explains why the AUD in the hours since the CPI has moderated. Why? Emerging signs of activity weakness.

Retail sales have been weak, corroborated by several companies reporting soft trading updates. Then there was Q1 construction work done which was released at the same time as the CPI data - significantly missed expectations (-2.9% QoQ versus the expected 0.5%) that is a huge miss. Things the RBA will be watching over the coming week is the Fair Work Commission's Minimum Wage decision on Monday and the Q1 GDP release next Wednesday.

These events will be crucial in assessing the broader economic outlook and potential RBA policy responses. Anything that has an upside surprise should be seen as a AUD positive and an index negative. The RBA will likely need to jawbone this result to further slow household demand for non-essential items, which is way we highlight the ‘inflation psychology’ term and the effect ‘anticipation’ is having.

However, as the market and economist point out it is unlikely that the RBA will increase interest rates again, as this would disproportionately impact households already struggling under tight financial conditions. Thus – we are stuck in this weird holding pattern and as other central banks around the world begin to cut rates it will attract flows to the AUD and its higher yields. There is a silver lining here too – as countries cut due to their respective disinflation moves and thus cheaper imports, this will benefit Australia’s inflation problem but that is a way off and the AUD will remain attractive for a while to come.

The USD saw decent strength in Wednesdays session, with The US Dollar Index (DXY) rising from an open of 104.67, pushing through the resistance at 105 to hit a high of 105.14 on the back of firmer US Treasury yields. Despite this rally DXY is heading into the end of the month looking to have its first monthly decline since December 2023. Ahead today we have US GDP as well as several Fed speakers, including Williams at the Economic Club of NY.

JPY declines against a resurgent USD with rising US yields pushing the US10Y-JP10y rate differential higher. USDJPY remained above 157.00 and pushing to a high of 157.74 and back in the April intervention zone. Remarks from BoJ Board Member Adachi, who stated that if excessive Yen falls are prolonged and expected to affect the achievement of the BoJ's price target, responding with monetary policy becomes an option, failing to help the Yen significantly.

AUD, and to some extent NZD, saw some short lived strength after a hotter than expected Aussie CPI reading in the APAC session. This strength did fade in the UK and US session with both the AUD and NZD currencies resuming their weakness, tracking risk appetite. AUDUSD just holing above the psychological 0.66 level heading into Thursdays APAC session.

We know that this is slightly contrary to the consensus views but we think it needs to be said. The communication from the RBA (Reserve Bank of Australia) is unusually unclear, confusing and conflicted. The view conveyed in statement, press conference and minutes currently we would argue counter each other.

And the reason for this we believe is because the RBA is a reluctant hawk and is frightened to act. Let us now present why we think this and what it will mean for FX and yields in particular. The RBA has just completed a mass review of its operations and one of the key changes was to improve transparency.

This included press conferences, extended meetings, and more public discussions from members. The catch with this has been the mixed communications. Take for example the statement which was extremely ambiguous.

It was filled with terms like uncertainty, mixed signals, and complexity. It explains why the statement has this line: ‘the path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.’ That’s fair – things are complex and we understand why the board is waiting for more data. That was countered with this: ‘ The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.’ Historically, whenever the Board has included such a resolute statement in its communications, they followed up with a cut or a hike in the preceding meetings – the frightened hawk is there and strongly suggests that a rate hike is likely.

The initial AUD reaction to the statement we think shows why the communication is mixed. Then take the press conference – Governor Bullock’s were much stronger than the statement, indicating a significant stance, not really clear in the statement. As mentioned, the Board stated they are not ruling anything in or out, but in reality, they have dismissed the possibility of rate cuts.

That was confirmed when Bullock was asked on this exact point and confirmed that rate hikes were the only things discussed. There was no ongoing discussion about cuts in the near or medium term as they do not expect inflation to reach their target by mid-2026. The Board’s concern is that inflation is notably higher than expected, employment is solid and that overall demand is still generating inflation.

The reaction to all this was clear here: The next notable reaction was the interbank market. All though it doesn’t appear like much in this chart. Please understand this change is actually from a ‘cut’ to ‘hike’ so yes there is a 10% chance of a hike, that is from a 10% chance of a cut.

July will be crucial with substantial data releases, including the second quarter CPI (July 31), GDP figures, and the wage price index. Current forecasts suggest that inflation and employment are performing better than expected, raising concerns about the need for a potential harder landing in the economy to return inflation back to target. The focus is now shifting towards slowing down the economy further despite the per capita recession because in the RBA’s view the impact on the household’s price power in the future from high inflation is still too high.

Future Rate Decisions All things being equal – with the RBA turning itself in knots and trying so hard to stay the course the RBA's commentary suggests it still has preference to hold rates if possible. The big issue as it acknowledges is the possible need for near term tightening due to a lack of progress towards inflation targets. Here is the market’s forecast for rates post the meeting on Tuesday Which probably explains the AUD/USD reactions in the following 24 hours It flatlined – thus the market is telling us that it needs a catalyst, and those catalysts are clearly coming in July.

So to finish what’s the key? A significant upside surprise in the RBA's core inflation measure could lead to a rate hike, despite slowing demand and labour market conditions. We get the monthly inflation data next week, this will be the first strike then the July 31 quarterly read.

This will be huge and will be the biggest AUD mover outside of an RBA meeting. We will be providing as much information on this release the closer we get to the release. However as shown the RBA is a terrified hawk and without this inflation beat, the risk of further tightening diminishes, with expectations for the RBA to remain on hold until potentially the first rate cut in February 2025.

The next RBA meeting on August 6 it’s going to be an interesting 6 weeks for AUD traders ahead of what is a likely live event.

Entries for longer-term stock investment approaches can be based on either long-term technical trends or more commonly, fundamental data related to a company’s current and projected performance. Despite the plethora of such suggestions, there is often a lack of clear guidance, or even a complete absence, of instructions on determining the timing of an exit from a long-term position. Logically, whether it’s a short-term technical entry or long-term fundamental entry, many of the “rules of the game” are similar, including the need for clear and unambiguous exit strategies seems paramount for consistently positive investment outcomes.

The approach originally used to make an entry decision can serve as a good starting point but there are other considerations that can potentially benefit outcomes. This article aims to briefly describe six potential exit approaches you could consider, providing some detail and examples as to how to action your chosen approach. Target Price Exit Strategy Setting Targets: Determine a fair value (and thus exit price target) by conducting in-depth fundamental analysis, utilizing metrics like Price-to-Earnings ratio (P/E), Cash flow, debt levels, book value, or longer-term technical levels.

On-going monitoring: Regularly track the price against this target. For example, if you calculate a fair value for a stock at $50, and it’s currently trading at $45, you might decide to sell once it reaches or exceeds $50. Other Considerations: Regularly review and adjust the target price, taking into account changes in fundamental factors impacting the relevant sector or market as a whole.

Ongoing Fundamental Awareness Ongoing Analysis: Continuously evaluate underlying fundamentals, such as earnings, balance sheets, cash flow, and management quality. Be vigilant not only when next company reporting dates are due but also for the often-unpredictable release of operational updates or changes in guidance. Trigger Points: Identify specific company indicators or information that would prompt an exit.

An example of this may be a sustained decline in revenue or mounting debt levels, particularly when beyond what was originally expected. Other Considerations: Implementing this strategy requires consistent research and a nuanced understanding of the particular business and industry factors influencing the investment. Having the optimum resources in place to be able to do this is vital and identifying these should be a primary goal of any fundamental investor.

Economic & Sector Changes On-going Analysis: Regularly review broader economic indicators like GDP growth, inflation, interest rates, or industry trends. Understand how such changes in these key data points may correlate with the asset price and establish exit criteria accordingly.For example, you may reconsider a position in a technology stock if there’s a widespread shift away from tech spending or growth concerns or regulatory changes that detrimentally affect the sector. Other Considerations: This strategy necessitates a broad understanding of economic cycles, industry dynamics, and how these elements interact with your particular investment holdings.

Additionally, it’s worth noting that appropriate resources should be in place to ascertain this as proactively as possible, or at worst in a timely manner. This may assist in preventing excess depreciation in asset price to the point where action is delayed and major capital damage has occurred. Dividend Targeted Approaches On-going Analysis: If part of your entry criteria and anticipated return from fundamental analysis-oriented trades is based on dividend yield to some degree, it is worthwhile to not only look at what is current but also perform ongoing evaluation of the reliability and/or growth of dividends.

Exit Criteria: Having established an expected return, it logically makes sense to have criteria in place to help decision making. For example a decrease in dividend yield below a certain threshold or a cut in dividends could be part of your potential exit plan for a specific investment. Other Considerations: As well as vigilance for the timing of company announcements where dividend changes are often announced, awareness of the yield of your current investment compared to others, and industry trends is required, as they could influence the sector and the market as a whole.

Time-Based Exits On-going Analysis: Often with time-based exits, there is alignment with a particular impending event. Examples of this type of event include a shift to EVs from petrol-fuelled cars or the impact on assets in the lead-up to an election. Either way, your investment time horizon needs to be reviewed should there be a change in circumstances and the rationale behind your initial thinking on entry.

Other Considerations: There is a discipline involved in exiting from a stock position that remains strong even after an event, or the impact of such, has passed. With a systematic approach to fundamental entries in place, it is legitimate to review whether other fundamental approach criteria are met and perhaps consider continuing to hold. Without this in place, or if no match with other approaches exists, logic would dictate that a planned exit is an exit, and you should action it as such, no matter how well this specific position has served you to date.

Portfolio Rebalancing On-going Analysis: Although not based on a specific entry approach, periodically evaluate your overall portfolio asset allocation is prudent. Reviewing whether the current holdings are still a fit with long-term investment aims and risk tolerance in current and ongoing market circumstances are appropriate rebalancing considerations. Rebalancing Exit Approach: Criteria for rebalancing should be pre-planned and clearly defined.

These may require consideration of multiple factors, such as an asset becoming an excessive portion of the portfolio on good performance, or changes in market or economic circumstances that threaten specific portions of the portfolio. Other Considerations: Continuous monitoring of the portfolio is required, and checking continuing congruence with desired asset allocation and your risk profile is vital. Rather than based on a specific entry approach, just to reinforce that the concept of rebalancing is one that is important across all of the approaches described above.

Summary Although they receive little “airplay” in comparison to technical approaches and exits, the exit strategies within a portfolio based on fundamental analysis entries are multifaceted, frequently interconnected, and equally important to master. Crafting a proficient exit system demands a comprehensive knowledge of each specific investment holding, and wider market and economic dynamics, in the context of your personal investment objectives, and risk tolerance. The need for a set of written system criteria for all actions, regular monitoring, thorough analysis, and disciplined adherence to predetermined exit criteria are essential.

The European Central Bank (ECB) is set to announce its interest rate policy this Thursday. Market participants are widely expecting the rate to remain on hold, but most importantly, the “language” and the “tone” of the statement will be closely watched. It is unlikely that there will be any surprises from the ECB policy meeting and they are expected to maintain the current guidance about ending bond purchases and keeping rates on hold.

Despite being mostly uneventful, it should stay on the Euro traders radar as policymakers have been slightly more hawkish on the underlying inflation pressures recently and some have even highlighted the possibility of bringing forward the timing of the first rate hike. The growing uncertainty around the Italian budget and fiscal position will be the main significant issue that investors will be keen to watch. This week, the European Commission officially rejected Italy’s budget proposal.

The proposal of the deficit is definitely below the 3% EU deficit ceiling, but the EU was hoping that Italy will curb its massive debt given that they are the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are concerned on the country’s ability to repay its debt. European leaders have ramped up pressure on Italy over its public spending plans and gave unprecedented warnings.

Source: National Institute of Statistics All eyes will, therefore, be on the President Draghi’s comments on Italy’s budget woes to gauge the thoughts on the developments in Italy and the possible effects it may have on the Eurozone economy. Investors will also closely watch how the ECB is balancing the “external” risks that have become more prominent over the coming months: Threat of protectionism Vulnerabilities in the emerging markets Financial Market Volatility