Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

20 Years Strong

Celebrating 20 years of trading excellence.

Built for traders since 2006.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for high-volume traders and sophisticated investors.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Latin America recorded $730 billion in crypto volume in 2025. Across the region, 57.7 million people now own some form of digital currency rankingslatam, a base that is growing faster than anywhere else in the world

As institutional capital arrives and regulation matures, these are the publicly traded names investors are watching closest.

Why LATAM is a crypto powerhouse right now

Top LATAM crypto stocks to watch

1. Nu Holdings (NYSE: NU)

Digital banking · 127M users across Brazil, Mexico and Colombia

Nubank could be one of the most direct listed proxies for LATAM's fintech and crypto boom. The company integrated cryptocurrency trading directly into its Nu app and partnered with Lightspark to embed the Bitcoin Lightning Network for faster and more cost-effective Bitcoin transactions.

In Q3 2025, revenue jumped 42% year-on-year to $4.17 billion, customer deposits rose 37% to $38.8 billion, and gross profit was up 35% to $1.81 billion.

The stock has returned roughly 36% over the past year and tripled the S&P 500's returns over the last three years. The company dominates Brazil, with over 60% of the adult population using Nubank.

Nu Holdings also recently secured conditional approval to launch Nubank N.A., a US national digital bank. However, the announcement triggered a pullback, with investors cautious about capital deployment timelines and expansion costs.

UBS has lowered its price target to $17.20, citing some market caution despite positive operational shifts.

What to watch

- Credit quality trends in Brazil and Mexico.

- Pace of USDC adoption via Nubank rewards.

- US bank charter timeline and early cost disclosures.

2. MercadoLibre (NASDAQ: MELI)

E-Commerce/Fintech · 18 countries across Latin America

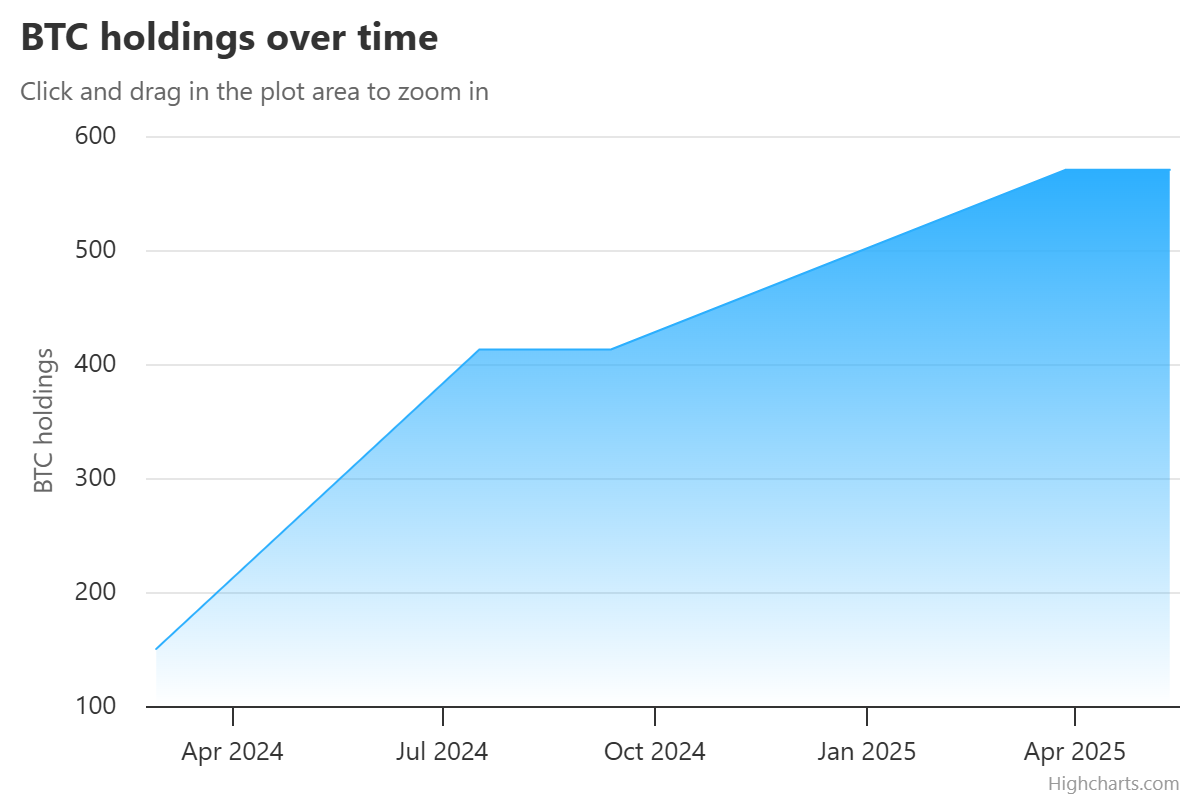

MercadoLibre is not a pure crypto play, but Mercado Pago (its fintech arm) has become one of the most important financial rails in LATAM. The company holds around 570 BTC on its balance sheet as a hedge against regional inflation, and has issued its own US dollar-pegged stablecoin, Meli Dólar.

Full year 2025 net revenue from Mercado Pago reached $12.6 billion, up 46% year-on-year, while total payment volume hit $278 billion, up 41%. Fintech monthly active users have grown close to 30% for ten consecutive quarters, and the credit portfolio nearly doubled to $12.5 billion year-on-year.

The catch for MercadoLibre is profitability. Overall margin compression of 5–6% is attributed to persistent investments in free shipping, credit card expansion, first-party commerce, and cross-border trade.

The stock has declined around 14.5% over the past six months, with the market repricing the stock around what management has framed as a deliberate investment phase heading into 2026.

The longer-term case remains compelling. Mercado Pago has introduced crypto-asset management and insurance products across its core markets, positioning it less as an e-commerce company and more as a full-scale digital bank with crypto infrastructure built in.

What to watch

- Mercado Pago loan loss trends and credit portfolio quality.

- Stablecoin integration and crypto volume through its payment network.

- Whether the Argentina credit card launch can reach profitability.

3. Méliuz (B3: CASH3.SA)

Fintech/Bitcoin treasury · Brazil's first listed Bitcoin treasury company

Méliuz is the most direct equity expression of the corporate Bitcoin treasury trend in LATAM. In early 2025, Méliuz became the first publicly traded company in Latin America to formally adopt a Bitcoin treasury strategy, receiving shareholder approval to allocate cash reserves toward Bitcoin accumulation.

Rather than issuing cheap dollar-denominated debt to buy BTC, Méliuz uses share issuance and operational cash flow. The company also sells cash-secured put options on Bitcoin to generate yield, a playbook borrowed from Japanese Bitcoin treasury firm Metaplanet, keeping 80% of BTC holdings in cold storage

CASH3 essentially acts as a leveraged vehicle for BTC exposure, capturing upside intensely in bull cycles, but generating greater volatility on the way down, especially where debt is involved.

The stock surged approximately 170% in May 2025 following the announcement of the Bitcoin strategy. However, it has since pulled back to its April 2025 levels, broadly tracking Bitcoin's price action and highlighting the stock's volatility.

What to watch

- Bitcoin price direction.

- BTC per share metric.

- Expansion of yield-generation strategies

- Any moves to list shares internationally.

4. OranjeBTC (B3: OBTC3.SA)

Pure-play Bitcoin treasury · LATAM's largest corporate Bitcoin holder

Where Méliuz is a fintech business that also holds Bitcoin, OranjeBTC is the opposite: a company whose entire purpose is Bitcoin accumulation.

The company listed on B3 in October 2025 through a reverse merger with education firm Intergraus, marking Brazil's first public debut of a firm whose business model centres entirely on Bitcoin accumulation.

OranjeBTC currently holds over 3,650 BTC and raised nearly $385 million in Bitcoin, with backing from notable investors including the Winklevoss brothers, Adam Back, FalconX, and Ricardo Salinas.

Its $210 million financing round was led by Itaú BBA, the investment arm of Brazil's largest bank, in a significant vote of institutional confidence.

In 2026, OBTC3 has fallen around 32% year-to-date, making it the hardest-hit of the two Brazilian Bitcoin treasury stocks. The stock hit an all-time high of 29.00 BRL on its listing day (October 7, 2025) and an all-time low of 6.06 BRL in February 2026.

It currently trades around 7.06 BRL, a steep discount to its debut, but one that closely mirrors Bitcoin's own pullback from peak levels.

OranjeBTC is the most volatile name on this list and should be treated as a high-beta Bitcoin vehicle. Liquidity is thinner than established names.

What to watch

- Bitcoin per share trajectory.

- Any capital raises or new BTC purchases.

- Potential international listing ambitions.

- How the market-value net asset value (mNAV) discount/premium evolves relative to Bitcoin's price.

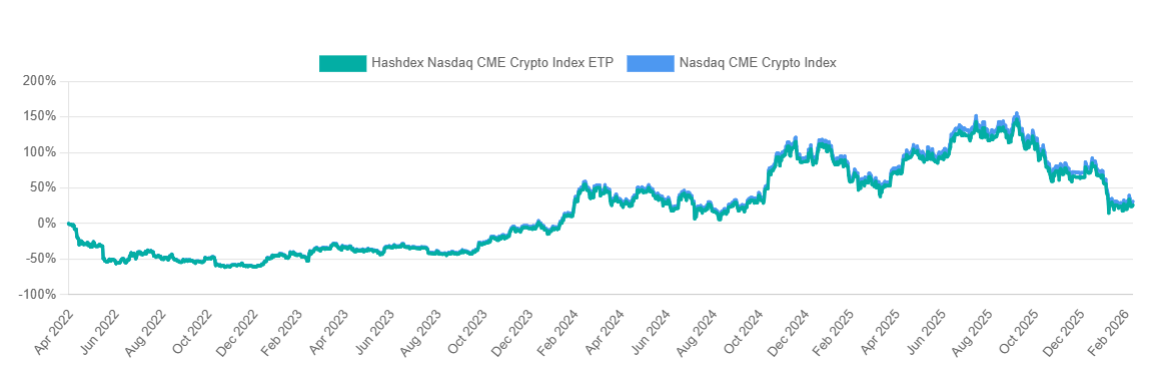

5. Hashdex — HASH11 (B3: HASH11)

Crypto Asset Management · Brazil's leading crypto ETF issuer

Hashdex offers a different kind of exposure to crypto. Rather than a single company's balance sheet or business strategy, HASH11 is a diversified basket of crypto assets wrapped in the familiarity of a regulated Brazilian ETF structure.

Brazil hosts 22 ETFs offering full or partial exposure to crypto assets, with Hashdex funds attracting 180,000 investors and daily transaction volumes averaging R$50 million.

Hashdex launched the world's first spot XRP ETF (XRPH11) on Brazil's B3 in April 2025, tracking the Nasdaq XRP Reference Price Index and allocating at least 95% of net assets to XRP.

The company also operates single-asset ETFs for Bitcoin (BITH11), Ethereum (ETHE11) and Solana (SOLH11), alongside its flagship HASH11 multi-asset index fund.

In mid-2025, Hashdex launched a hybrid Bitcoin/Gold ETF (GBTC11) that dynamically adjusts allocations between the two assets.

For investors who want diversified crypto market exposure rather than single-asset risk, HASH11 is the most accessible on-ramp through Brazil's regulated equity infrastructure.

However, as a multi-asset crypto index, HASH11 is still subject to the broad performance of digital asset markets. And unlike the equity names on this list, there is no operating business creating independent value.

What to watch

- Crypto market sentiment broadly.

- Potential expansion of Hashdex products into the US market.

- AUM growth as institutional adoption accelerates in Brazil.

- Relative performance of HASH11 vs single-asset alternatives.

What to watch next

Institutional infrastructure is still in early innings — Deutsche Börse's Crypto Finance Group entered LATAM in early 2026, and local exchanges have opened over 200 BRL-denominated trading pairs since 2024. The pace of that buildout will set the tone for all five names.

Regulatory progress in Brazil, Mexico, and Chile is the key enabler for the next wave of capital. Any setbacks would hit the higher-beta names like OBTC3 and CASH3 hardest.

Stablecoin volume is the region's most reliable real-time signal. Despite a global slowdown in early 2025, LATAM still recorded $16.2 billion in trading volume between January and May, up 42% year-on-year. Watch whether that momentum holds — a reacceleration lifts all five; a reversal pressures them equally.

From AI infrastructure to pet care, semiconductors, and gold exploration, here are the five top candidates most likely to list on the ASX in 2026.

What is an Initial public offering (IPO)?

1. Firmus Technologies

Firmus Technologies is building AI-powered data centre infrastructure in Tasmania, and it may be one of the most strategically positioned tech companies in Australia right now.

Firmus is an Nvidia Cloud Partner and has joined the GPU maker's Lepton marketplace. The company has designed its modular, liquid-everywhere AI Factory platform to evolve with Nvidia's latest architectures, including Nvidia Spectrum-X Ethernet networking.

A September 2025 raise of A$330m closed at a post-money valuation of A$1.85 billion for the company. By November 2025, after a further A$500m raise, that valuation had trebled to approximately A$6 billion.

A subsequent A$100m investment from Maas Group in early 2026 confirmed the November valuation. Firmus is reported to be contemplating an ASX IPO within the next 12 months and, given the A$6 billion private valuation, any public raise is expected to be well above A$1 billion.

With Australia's growing demand for sovereign AI compute capacity and Tasmania's cool climate and renewable energy advantage for large-scale data centre operations, Firmus stands as one of the largest-scale ASX IPO candidates in 2026.

However, although market interest in Firmus appears to be growing, timing is everything when it comes to IPOs. Watch for confirmation of exact IPO timing, AI data centres sentiment, and whether Nvidia signals deepening its involvement as a strategic anchor investor post-listing.

2. Rokt

Sydney-founded Rokt has quietly become one of Australia's most valuable private tech companies. The e-commerce adtech platform aimed at helping brands monetise the “transaction moment” is now valued at ~US$7.9 billion.

A term sheet prepared by MA Financial projected an exit share price of US$72 under base-case scenarios, when shares are freed from escrow in November 2027.

Rokt is expected to potentially dual-list in the US and on the ASX in 2026, possibly as soon as the first half of the year. IG The most widely discussed structure is a primary Nasdaq listing with an ASX CDI (CHESS Depositary Interest) structure for Australian investors, rather than a full dual listing.

Rokt’s revenue for the year ending August 2025 is projected at US$743m (up 48% year-over-year), with EBITDA forecast at US$100m and a gross profit margin of approximately 43%. It is currently projected to cross the $US1 billion annual revenue milestone by August 2026.

Amazon, Live Nation, and Uber are all reported to be Rokt customers, and the company has expanded rapidly across North America and Europe.

Whether Rokt opts for a primary Nasdaq listing with an ASX CDI structure, or a full dual listing, could significantly affect liquidity and local investor access.

3. Greencross

Greencross, the business behind Petbarn, City Farmers, and Greencross Vets, is preparing to relist on the ASX after being taken private by US private equity firm TPG in 2019.

TPG currently owns 55% of Greencross, while AustralianSuper and the Healthcare of Ontario Pension Plan (HOOPP) hold the remaining 45%.

The company reported revenue of A$2 billion for the 2025 financial year, a modest increase from A$1.95 billion in 2024. TPG paid A$675 million in equity value for the business in 2019; it sold a 45% stake in 2022 at a valuation of more than A$3.5 billion. The proposed IPO implies a valuation of more than A$4 billion.

TPG is targeting an initial public offering of at least A$700 million. The IPO will mark Greencross's return to the ASX after an eight-year absence. TPG's relatively small raise size suggests the firm is banking on strong aftermarket performance before fully exiting.

TPG's exit timeline announcement is still a watch for whether a 2026 IPO is on the cards. And whether the company pursues a traditional IPO or a trade sale, which remains an alternative path.

4. Morse Micro

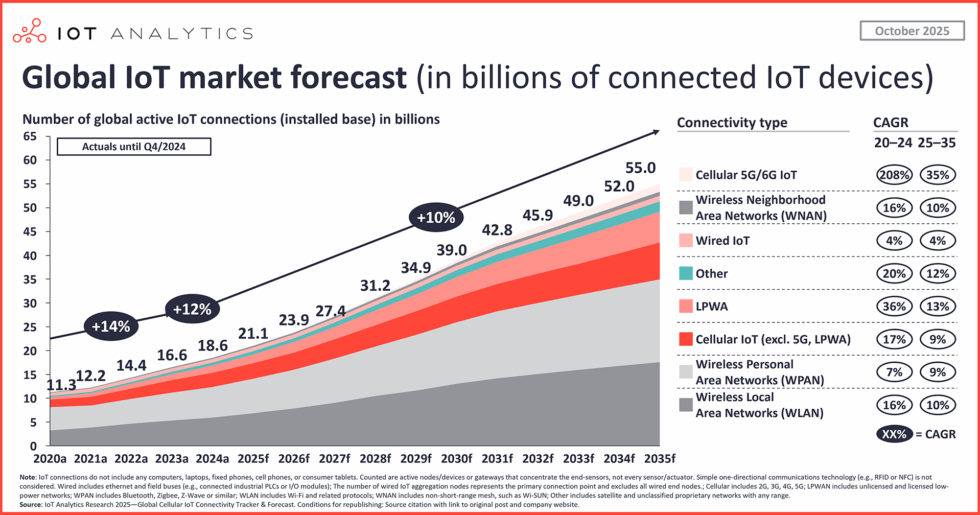

Morse Micro is a Sydney-based semiconductor company developing Wi-Fi HaLow chips designed for IoT applications across agriculture, logistics, smart cities, and industrial monitoring.

Morse Micro held a Series C round in September 2025, raising US$88 million, followed in November 2025 by a US$32 million pre-IPO raise, taking total funding to over A$300 million.

It is targeting an ASX listing in the next 12–18 months. The Series C was led by Japanese chip giant MegaChips and the National Reconstruction Fund Corporation.

Global IoT device connections forecast to exceed 30 billion by 2030, and Morse Micro would be a rare ASX-listed pure-play semiconductor company, which could attract significant interest from tech-focused fund managers.

Morse Micro’s Revenue traction with tier-one hardware partners ahead of listing is a watch, and whether the company seeks a concurrent US listing given the depth of US semiconductor investor appetite.

5. Bison Resources

Bison Resources is a newly incorporated US-focused gold and precious metals explorer currently in the middle of its ASX IPO.

The offer closes on 20 March 2026, with an ASX listing targeted for mid-April 2026. At an indicative market capitalisation of A$13.25 million on full subscription, Bison is the most speculative name on this list by a significant margin.

The company holds four exploration projects in north-east Nevada, within the Carlin Trend (one of the world's most prolific gold-producing belts), responsible for approximately 75% of US gold output.

The IPO seeks to raise A$4.5 to A$5.5 million (22.5 to 27.5 million shares at A$0.20 per share). The team has prior experience at Sun Silver (ASX: SS1) and Black Bear Minerals, giving it a track record in ASX junior mining listings out of Nevada.

Global IPOs: What are the biggest IPOs happening globally in 2026?

Bottom line

Australia's 2026 IPO calendar spans the full risk spectrum. A Nvidia-backed AI infrastructure play, a billion-dollar e-commerce platform, and a junior gold explorer with its IPO already underway.

Each candidate reflects a different stage of maturity and a different investor profile. Together, they suggest the ASX could see a meaningful injection of new listings across sectors that have been largely absent from the local market in recent years.

Oil prices tend to rise when demand is strong, supply is constrained or geopolitical events disrupt normal trade flows. In this case, the US and Israel appeared to act pre-emptively in what they saw as a defensive move. The broader market impact has been felt more widely.

When oil prices move, they rarely move in isolation. Higher crude prices can affect inflation, central bank expectations, shipping costs and corporate margins across the global economy.

What is happening

There are three broad ways companies can benefit from higher oil prices:

1. Producing oil and gas, by selling the commodity at a higher price

2. Providing services and equipment to producers

3. Transporting oil around the world

Each of the stocks below represents one of those exposure types, with a different risk profile when crude climbs.

1. Exxon Mobil (NYSE: XOM)

Exxon Mobil is one of the world’s largest integrated oil companies, involved in everything from exploring for and producing oil to refining it into fuel and producing chemicals. When oil prices rise, its upstream business may benefit from wider margins, while its size and diversification can help cushion weaker spots in the cycle.

Exxon has major positions in growth regions such as the US Permian Basin and large offshore projects, which are designed to deliver relatively low-cost barrels over many years. When prices are high, low-cost production may support free cash flow and the company’s capacity for dividends, buybacks or further investment.

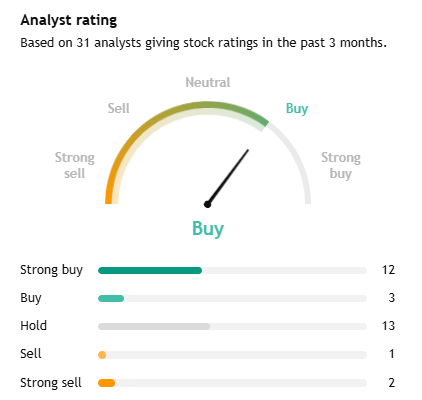

Exxon Mobil (XOM) vs. Brent Crude 6-month performance

Consensus: Buy

According to TradingView, analyst sentiment towards Exxon is broadly positive, with a consensus Buy rating. Of the 31 analysts tracked, 15 rate the stock as Strong Buy or Buy, while 13 rate it Hold.

The positive view is linked to Exxon’s balance sheet strength and higher-margin production, with the most optimistic analysts projecting a 1-year price target as high as US$183.00. However, a small minority of 3 analysts has issued a Sell or Strong Sell rating, contributing to an average price target of US$145.00, which sits about 3.6% below the current trading price.

2. Chevron (NYSE: CVX)

Chevron is another global integrated major that has benefited from the recent move higher in crude, with its shares trading near 52-week highs. Like Exxon, Chevron operates across the value chain, including upstream production, refining and marketing. Chevron’s completed acquisition of Hess adds Guyana and other upstream assets, which some analysts see as supportive over time, although the earnings impact remains subject to integration, project execution and commodity-price risks.

In an environment where oil and gas prices can be volatile, that diversification may help smooth earnings while still providing leverage to stronger energy prices.

Exxon Mobil vs Chevron performance, 6-month chart

Consensus: Buy

Chevron is viewed similarly to Exxon, with broker sentiment remaining broadly constructive. Recent TradingView aggregates show 30 analysts covering the stock over the past three months, with 17 rating it Strong Buy or Buy, 11 at Hold, 1 at Sell and 1 at Strong Sell. Analysts have highlighted its diversified portfolio and the potential contribution from Hess, although commodity-price volatility and execution risks may keep some more cautious.

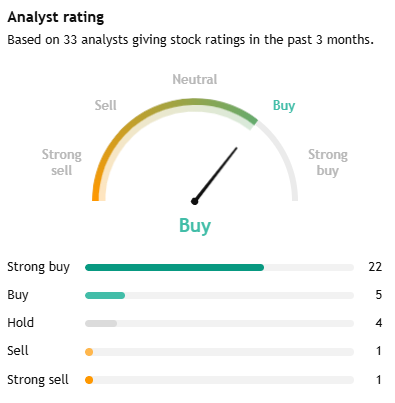

3. SLB (NYSE: SLB)

Higher oil prices do not only affect producers. In this case, SLB (formerly Schlumberger) is one of the world’s largest oilfield services companies, providing technology, equipment and services that help producers find and extract hydrocarbons more efficiently. When crude trends higher, producers may increase drilling and completion activity, which can lift demand for SLB’s services and software. Recent commentary has also pointed to the company’s growing digital business and global exposure, which may support earnings growth if the upcycle continues.

Consensus: Buy

According to TradingView, analyst consensus on SLB is Buy, indicating broadly positive sentiment. Of the 33 analysts tracked, 27 rate the stock Strong Buy or Buy, while 4 rate it Hold and 2 rate it Sell or Strong Sell.

Analyst sentiment appears to reflect expectations around SLB’s position as a broader technology partner. The average price target of US$55.71 implies 15.8% upside from current levels, while the highest target stands at US$74.00. These forecasts appear to be linked to expectations of increased international drilling activity and a recovery in offshore deepwater markets.

4. Baker Hughes (NYSE: BKR)

Baker Hughes is another major oilfield services and equipment provider, with additional exposure to industrial segments such as LNG and power infrastructure. Even when oil prices are not at extreme highs, advances in drilling technology and lower break-even costs have helped keep many shale plays profitable, supporting demand for its services.

The company has been described as well positioned because of its balance sheet and its exposure to ongoing exploration and production activity. In a period of higher, or even stable-to-firm, oil prices, that mix of services and energy technology may create several revenue drivers.

Consensus: Strong Buy

Broker sentiment towards Baker Hughes is broadly positive, similar to SLB. More than 75% of covering analysts rate the stock as a Buy or Strong Buy, with the remainder generally at Hold. Analysts have pointed to its exposure to both traditional oilfield services and energy and industrial technology, including LNG infrastructure.

[CHART]

Transport and shipping exposure

5. Global oil tanker operators

Oil tanker companies can benefit when higher prices, OPEC+ policy shifts and geopolitical tensions increase long-distance shipments and disrupt usual routes.

Recent reports have pointed to stronger freight rates and high volumes of oil in transit, as increased production from the Middle East and supply growth from the US, Brazil, Guyana and Canada flow towards Asian markets. That ‘tonne-mile’ demand may support tanker day rates and profitability even when the broader energy market is volatile.

Consensus: N/A

This is a broader industry category rather than a single publicly traded stock, so there is no single broker consensus for it. Analyst views would need to be assessed at the company level, such as Frontline plc (FRO), Euronav (EURN) or Scorpio Tankers (STNG). More broadly, the sector is often viewed as cyclical, although current conditions may support freight rates when geopolitical disruptions lengthen shipping routes.

6. Woodside Energy (ASX: WDS)

Woodside adds an Australia-based name with global LNG and oil exposure. Its 2024 full-year results showed underlying profit down 13%, primarily because of lower realised oil and gas prices, according to the company’s full-year results announcement. That highlights how sensitive earnings can be to commodity price realisation.

If crude and related energy prices strengthen, Woodside’s earnings outlook may improve, although the extent of that change will still depend on company-specific factors and realised pricing.

Consensus: Hold

In contrast to the larger US majors, broker sentiment towards this Australian-based producer is more cautious, with consensus generally at Hold. Most analysts favour maintaining existing positions rather than increasing exposure. That more measured view is often linked to its LNG pricing exposure, softer realised commodity prices and longer-term regulatory and decarbonisation pressures.

[CHART]

Risks and constraints

Higher oil prices are not a free ride for these stocks.

- If prices spike too far, too fast, they may trigger demand destruction and policy responses that weigh on future profits.

- Political decisions from OPEC+ or major producers mau reverse a rally by increasing supply.

- Services and tanker companies are highly cyclical. When the cycle turns, pricing power can fade quickly.

In other words, these names may benefit from higher oil prices, but they also carry sector-specific, geopolitical and company-level risks that deserve close attention.

Key market observations

- Higher oil prices often support integrated majors such as Exxon and Chevron through stronger upstream margins and diversified cash flows.

- Oilfield services stocks such as SLB and Baker Hughes may see stronger demand when producers increase drilling and completion activity.

- Tanker operators may benefit from higher freight rates when geopolitics and supply shifts increase long-haul shipments.

- These stocks can be volatile, so diversification and time horizon remain important during commodity upcycles.

References in this article to Exxon Mobil, Chevron, SLB, Baker Hughes, Woodside, tanker operators, analyst consensus ratings and price targets are included for general market commentary only and do not constitute a recommendation or offer in relation to any financial product or security. Third-party data, including consensus ratings and target prices, may change without notice and should not be relied on in isolation. Energy and shipping exposures are cyclical and can be materially affected by commodity price volatility, realised pricing, production changes, project execution, geopolitical disruptions, freight market conditions, regulatory developments and shifts in investor sentiment. Any views about potential beneficiaries of higher oil prices are subject to significant uncertainty.