ข่าวสารตลาด & มุมมองเชิงลึก

ก้าวนำตลาดด้วยมุมมองเชิงลึกจากผู้เชี่ยวชาญ ข่าวสาร และการวิเคราะห์ทางเทคนิค เพื่อเป็นแนวทางในการตัดสินใจซื้อขายของคุณ.

ละตินอเมริกาบันทึกปริมาณคริปโต 730 พันล้านดอลลาร์ในปี 2025ทั่วภูมิภาคมีประชากร 57.7 ล้านคนเป็นเจ้าของการจัดอันดับสกุลเงินดิจิทัลบางรูปแบบ ซึ่งเป็นฐานที่เติบโตเร็วกว่าที่อื่นในโลก

เมื่อเงินทุนสถาบันมาถึงและข้อบังคับครบกำหนดนี่คือชื่อที่ซื้อขายสาธารณะที่นักลงทุนกำลังเฝ้าระวังอย่างใกล้ชิด

ทำไม LATAM ถึงเป็นโรงไฟฟ้า crypto ในขณะนี้

หุ้นคริปโต LATAM อันดับแรกที่ควรดู

1.นู โฮลดิ้งส์ (NYSE: NU)

ธนาคารดิจิทัล · ผู้ใช้ 127 ล้านคนทั่วบราซิล เม็กซิโก และโคลอมเบีย

Nubank อาจเป็นหนึ่งในพร็อกซีที่จดทะเบียนโดยตรงที่สุดสำหรับการบูมฟินเท็กและคริปโตของ LATAMบริษัท รวมการซื้อขายสกุลเงินดิจิทัลเข้ากับแอป Nu โดยตรงและร่วมมือกับ Lightspark เพื่อฝังตัว บิตคอยน์ Lightning Network สำหรับการทำธุรกรรม Bitcoin ที่รวดเร็วและคุ้มค่ามากขึ้น

ในไตรมาสที่ 3 2025 รายได้เพิ่มขึ้น 42% เมื่อเทียบเป็นปีเป็น 4.17 พันล้านดอลลาร์ เงินฝากของลูกค้าเพิ่มขึ้น 37% เป็น 38.8 พันล้านดอลลาร์ และกำไรขั้นต้นเพิ่มขึ้น 35% เป็น 1.81 พันล้านดอลลาร์

หุ้นได้กลับมาประมาณ 36% ในช่วงปีที่ผ่านมา และเพิ่มผลตอบแทนของ S&P 500 เป็นสามเท่าในช่วงสามปีที่ผ่านมาบริษัท ครองบราซิลโดยมีประชากรผู้ใหญ่กว่า 60% ใช้ Nubank

เมื่อเร็ว ๆ นี้Nu Holdings ยังได้รับอนุมัติตามเงื่อนไขในการเปิดตัว Nubank N.A. ซึ่งเป็นธนาคารดิจิทัลแห่งชาติของสหรัฐอเมริกา อย่างไรก็ตาม การประกาศดังกล่าวทำให้เกิดการถดถอยหลัง โดยนักลงทุนระมัดระวังเกี่ยวกับระยะเวลาการปรับใช้เงินทุนและต้นทุนการขยายตัว

UBS ได้ลดเป้าหมายราคาลงเหลือ 17.20 เหรียญ โดยอ้างถึงความระมัดระวังของตลาดแม้จะมีการเปลี่ยนแปลงการดำเนินงานในเชิงบวก

สิ่งที่ต้องดู

- แนวโน้มคุณภาพเครดิตในบราซิลและเม็กซิโก

- อัตราการยอมรับ USDC ผ่านรางวัล Nubank

- ไทม์ไลน์กฎบัตรธนาคารสหรัฐและการเปิดเผยต้นทุนก่อนกำหนด

2.MercadoLibre (NASDAQ: MELI)

อีคอมเมิร์ซ/ฟินเทค · 18 ประเทศทั่วละตินอเมริกา

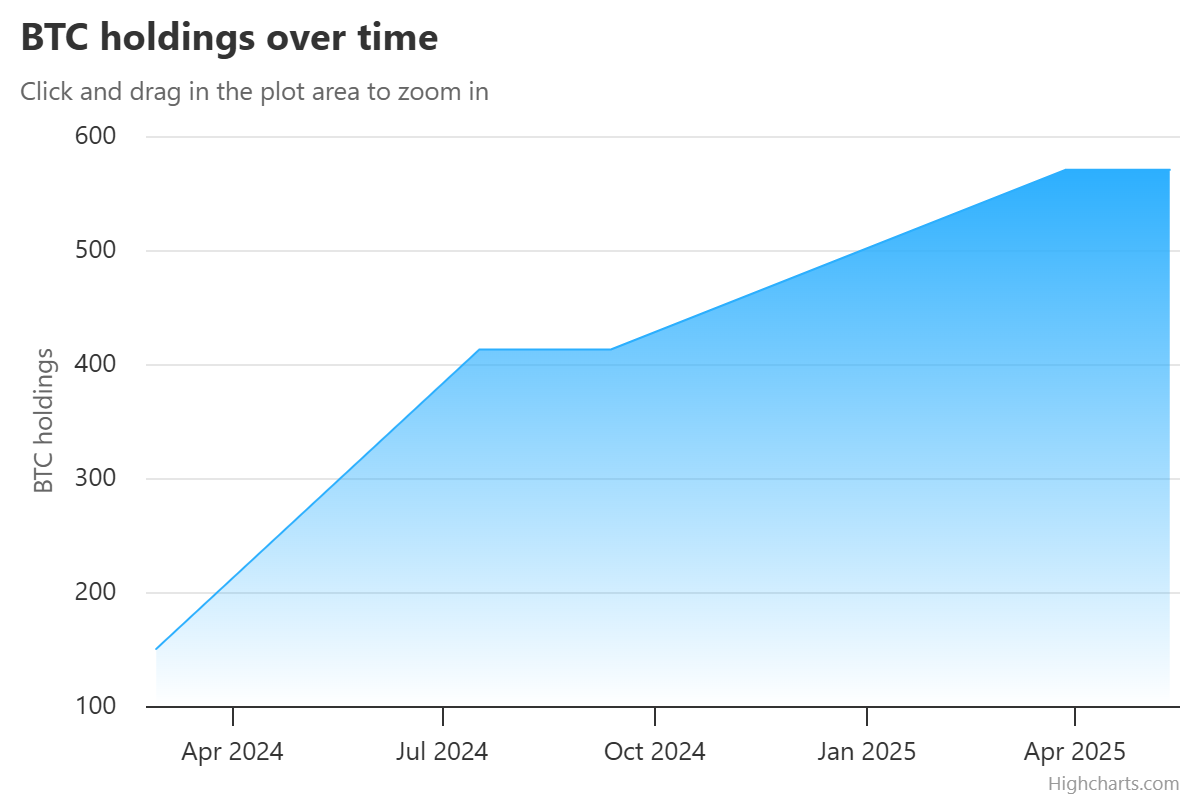

MercadoLibre ไม่ใช่การเล่นคริปโตที่แท้จริง แต่ Mercado Pago (แขน fintech) กลายเป็นหนึ่งในรางทางการเงินที่สำคัญที่สุดใน LATAMบริษัท ถือหุ้นประมาณ 570 BTC ในงบดุลเพื่อป้องกันเงินเฟ้อในระดับภูมิภาค และได้ออก Meli Dólar Stablecoin ที่เชื่อมโยงกับดอลลาร์สหรัฐของตัวเอง

รายได้สุทธิเต็มปี 2025 จาก Mercado Pago สูงถึง 12.6 พันล้านดอลลาร์เพิ่มขึ้น 46% เมื่อเทียบเป็นรายปี ในขณะที่ปริมาณการชำระเงินทั้งหมดสูงถึง 278 พันล้านดอลลาร์เพิ่มขึ้น 41%ผู้ใช้รายเดือนของ Fintech เติบโตใกล้เคียง 30% เป็นเวลาสิบไตรมาสติดต่อกัน และพอร์ตโฟลิโอเครดิตเกือบสองเท่าเป็น 12.5 พันล้านดอลลาร์เมื่อเทียบเป็นรายปี

จุดเด่นของ MercadoLibre คือการทำกำไรการบีบอัดมาร์จิ้นโดยรวม 5— 6% เกิดจากการลงทุนอย่างต่อเนื่องในการจัดส่งฟรี การขยายบัตรเครดิต การค้าของบุคคลที่หนึ่ง และการค้าข้ามพรมแดน

หุ้นลดลงประมาณ 14.5% ในช่วงหกเดือนที่ผ่านมา โดยตลาดปรับราคาหุ้นตามสิ่งที่ฝ่ายบริหารจัดตั้งไว้ว่าเป็นขั้นตอนการลงทุนโดยเจตนามุ่งสู่ปี 2026

คดีระยะยาวยังคงน่าสนใจอยู่Mercado Pago ได้เปิดตัวผลิตภัณฑ์การจัดการสินทรัพย์และประกันภัยคริปโตในตลาดหลัก ทำให้เป็นบริษัทอีคอมเมิร์ซน้อยลงและเป็นธนาคารดิจิทัลเต็มรูปแบบที่มีโครงสร้างพื้นฐานคริปโตในตัว

สิ่งที่ต้องดู

- แนวโน้มการขาดทุนสินเชื่อ Mercado Pago และคุณภาพพอร์ตโฟลิโอเครดิต

- การรวม Stablecoin และปริมาณ crypto ผ่านเครือข่ายการชำระเงิน

- การเปิดตัวบัตรเครดิตอาร์เจนตินาสามารถทำกำไรได้หรือไม่

3.เมลิอุซ (B3: CASH3.SA)

Fintech/คลังบิทคอยน์ · บริษัท คลัง Bitcoin จดทะเบียนแรกของบราซิล

Méliuz เป็นการแสดงออกของหุ้นโดยตรงมากที่สุดของแนวโน้มคลัง Bitcoin ขององค์กรใน LATAMในช่วงต้นปี 2025 Méliuz กลายเป็น บริษัท ที่ซื้อขายต่อสาธารณะแห่งแรกในละตินอเมริกาที่ใช้กลยุทธ์คลังของ Bitcoin อย่างเป็นทางการ โดยได้รับการอนุมัติจากผู้ถือหุ้นในการจัดสรรเงินสำรองเงินสดเพื่อการสะสม Bitcoin

แทนที่จะออกหนี้ในสกุลเงินดอลลาร์ราคาถูกเพื่อซื้อ BTC Méliuz ใช้การออกหุ้นและกระแสเงินสดจากการดำเนินงานบริษัท ยังขายออปชั่นการขายที่มีการรักษาความปลอดภัยด้วยเงินสดบน Bitcoin เพื่อสร้างผลตอบแทน ซึ่งเป็นหนังสือเลย์บุ๊คที่ยืมจาก บริษัท คลังบิทคอยน์ของญี่ปุ่น Metaplanet ซึ่งเก็บไว้ 80% ของ BTC ไว้ในห้องเย็น

โดยพื้นฐานแล้ว CASH3 ทำหน้าที่เป็นพาหนะที่มีเลเวอเรจสำหรับการเปิดเผย BTC โดยยึดตัวสูงขึ้นอย่างรุนแรงในวัฏจักรขาลง แต่สร้างความผันผวนมากขึ้นในทางขาลง โดยเฉพาะอย่างยิ่งเมื่อมีหนี้เกี่ยวข้อง

หุ้นเพิ่มขึ้นประมาณ 170% ในเดือนพฤษภาคม 2025 หลังจากประกาศกลยุทธ์ Bitcoin อย่างไรก็ตามตั้งแต่นั้นมา มันได้ย้อนกลับสู่ระดับเมษายน 2025 โดยติดตามการเคลื่อนไหวของราคาของ Bitcoin อย่างกว้างขวางและเน้นความผันผวนของหุ้น

สิ่งที่ต้องดู

- ทิศทางราคา Bitcoin

- เมตริก BTC ต่อหุ้น

- การขยายกลยุทธ์การสร้างผลผลิต

- การย้ายใดๆ เพื่อจดทะเบียนหุ้นในระดับสากล

4.ส้ม BTC (B3: OBTC3.SA)

คลังบิทคอยน์ Pure-play · ผู้ถือบิทคอยน์องค์กรรายใหญ่ที่สุดของ LATAM

ที่ Méliuz เป็นธุรกิจ Fintech ที่ถือครองบิทคอยน์ด้วย OranjeBTC ก็ตรงกันข้าม: บริษัท ที่มีวัตถุประสงค์ทั้งหมดคือการสะสม Bitcoin

บริษัท จดทะเบียนใน B3 ในเดือนตุลาคม 2025 ผ่านการควบรวมกิจการย้อนกลับกับ บริษัท การศึกษา Intergraus ซึ่งเป็นการเปิดตัวครั้งแรกในสาธารณะของบราซิลของ บริษัท ที่มีรูปแบบธุรกิจมุ่งเน้นไปที่การสะสม Bitcoin ทั้งหมด

ปัจจุบัน OranjeBTC ถือหุ้นกว่า 3,650 BTC และระดมทุนเกือบ 385 ล้านดอลลาร์ใน Bitcoin โดยได้รับการสนับสนุนจากนักลงทุนที่มีชื่อเสียง รวมถึงพี่น้อง Winklevoss Adam Back FalconX และ Ricardo Salinas

รอบการจัดหาเงินทุน 210 ล้านดอลลาร์นำโดย Itaú BBA ซึ่งเป็นกองทุนการลงทุนของธนาคารที่ใหญ่ที่สุดของบราซิลในการลงคะแนนความเชื่อมั่นของสถาบันอย่างมีนัยสำคัญ

ในปี 2026 OBTC3 ลดลงประมาณ 32% เมื่อเทียบกับปัจจุบันทำให้เป็นหุ้นคลังบิทคอยน์ของบราซิลที่ได้รับผลกระทบมากที่สุดสองหุ้น หุ้นแตะระดับสูงสุดตลอดกาลที่ 29.00 BRL ในวันจดทะเบียน (7 ตุลาคม 2025) และระดับต่ำสุดตลอดกาลที่ 6.06 BRL ในเดือนกุมภาพันธ์ 2026

ปัจจุบันมีการซื้อขายประมาณ 7.06 BRL ซึ่งเป็นส่วนลดสูงจนถึงการเปิดตัว แต่เป็นส่วนลดที่สะท้อนกลับของ Bitcoin จากระดับสูงสุดอย่างใกล้ชิด

oranjeBTC เป็นชื่อที่ผันผวนมากที่สุดในรายการนี้และควรได้รับการพิจารณาว่าเป็นพาหนะ Bitcoin รุ่นเบต้าสูงสภาพคล่องนั้นบางกว่าชื่อที่กำหนดไว้

สิ่งที่ต้องดู

- วิถีบิทคอยน์ต่อหุ้น

- การระดมทุนหรือการซื้อ BTC ใหม่

- ความทะเยอทะยานในการลงทะเบียนระดับนานาชาติ

- ส่วนลด/พรีเมียมมูลค่าสินทรัพย์สุทธิมูลค่าตลาด (mNav) มีวิวัฒนาการอย่างไรเมื่อเทียบกับราคาของ Bitcoin

5.แฮชเด็กซ์ - แฮช11 (บ3: แฮช11)

การจัดการสินทรัพย์ Crypto · ผู้ออก ETF crypto ชั้นนำของบราซิล

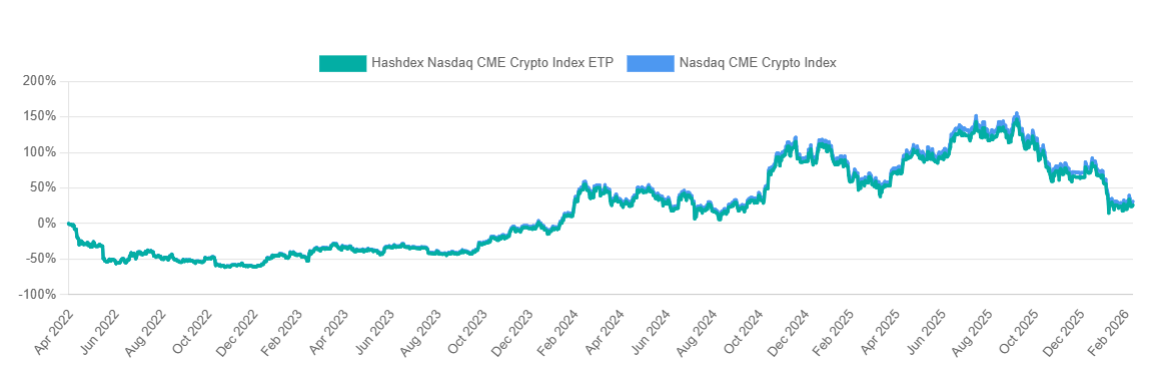

Hashdex เสนอการเปิดเผยต่อคริปโตประเภทที่แตกต่างกันแทนที่จะเป็นงบดุลหรือกลยุทธ์ทางธุรกิจของ บริษัท เดียว HASH11 เป็นตะกร้าสินทรัพย์ crypto ที่หลากหลายซึ่งห่อด้วยความคุ้นเคยของโครงสร้าง ETF ของบราซิลที่มีการควบคุม

บราซิลเป็นเจ้าภาพ ETF 22 รายการที่เสนอการเปิดเผยสินทรัพย์คริปโตเต็มหรือบางส่วน โดยกองทุน Hashdex ดึงดูดนักลงทุน 180,000 รายและมีปริมาณธุรกรรมรายวันโดยเฉลี่ย 50 ล้านเหรียญ

Hashdex เปิดตัว Spot XRP ETF (XRPH11) แรกของโลกบน B3 ของบราซิลในเดือนเมษายน 2025 ติดตามดัชนีราคาอ้างอิง Nasdaq XRP และจัดสรรสินทรัพย์สุทธิอย่างน้อย 95% ให้กับXRP

บริษัท ยังดำเนินการ ETF สินทรัพย์เดียวสำหรับ Bitcoin (BITH11), Ethereum (ETHE11) และ Solana (SOLH11) พร้อมกับกองทุนดัชนีหลายสินทรัพย์หลัก HASH11

ในช่วงกลางปี 2025 Hashdex ได้เปิดตัว ETF Bitcoin/Gold แบบไฮบริด (GBTC11) ที่ปรับการจัดสรรระหว่างสินทรัพย์ทั้งสองแบบไดนามิก

สำหรับนักลงทุนที่ต้องการการเปิดเผยตลาดคริปโตที่หลากหลายมากกว่าความเสี่ยงของสินทรัพย์เดียว HASH11 เป็นระบบที่เข้าถึงได้มากที่สุดผ่านโครงสร้างพื้นฐานหุ้นที่มีการควบคุมของบราซิล

อย่างไรก็ตาม ในฐานะดัชนีคริปโตหลายสินทรัพย์ HASH11 ยังคงอยู่ภายใต้ประสิทธิภาพที่กว้างขวางของตลาดสินทรัพย์ดิจิทัลและแตกต่างจากชื่อหุ้นในรายการนี้ไม่มีธุรกิจการดำเนินงานที่สร้างมูลค่าอิสระ

สิ่งที่ต้องดู

- ความเชื่อมั่นของตลาด Crypto ในวงกว้าง

- ศักยภาพในการขยายผลิตภัณฑ์ Hashdex เข้าสู่ตลาดสหรัฐอเมริกา

- การเติบโต AUM เมื่อการยอมรับจากสถาบันเร่งตัวขึ้นในบราซิล

- ประสิทธิภาพสัมพัทธ์ของ HASH11 เทียบกับทางเลือกสินทรัพย์เดียว

สิ่งที่ต้องดูต่อไป

โครงสร้างพื้นฐานของสถาบันยังอยู่ในช่วงเริ่มต้น — Crypto Finance Group ของ Deutsche Börse เข้าสู่ LATAM ในช่วงต้นปี 2026 และการแลกเปลี่ยนในท้องถิ่นได้เปิดคู่การซื้อขายที่มีสกุลเงิน BRL มากกว่า 200 คู่ตั้งแต่ปี 2024ความเร็วของการสร้างนั้นจะกำหนดโทนเสียงสำหรับทั้งห้าชื่อ

ความคืบหน้าด้านกฎระเบียบในบราซิลเม็กซิโกและชิลีเป็นตัวกระตุ้นหลักสำหรับคลื่นทุนครั้งต่อไปความพ่ายแพ้ใด ๆ จะส่งผลกระทบต่อชื่อรุ่นเบต้าสูงกว่า เช่น OBTC3 และ CASH3 ได้ยากที่สุด

ปริมาณ Stablecoin เป็นสัญญาณแบบเรียลไทม์ที่น่าเชื่อถือที่สุดในภูมิภาคแม้จะมีการชะลอตัวของโลกในช่วงต้นปี 2025 แต่ LATAM ยังคงบันทึกปริมาณการซื้อขาย 16.2 พันล้านดอลลาร์ระหว่างเดือนมกราคมถึงพฤษภาคม เพิ่มขึ้น 42% เมื่อเทียบเป็นรายปีดูว่าโมเมนตัมนั้นคงอยู่หรือไม่ — การเร่งความเร็วสูงทั้งห้าตัว การกลับกดดันพวกมันอย่างเท่าเทียมกัน

For new traders, it can be difficult to know which indicators to use, the saturation of various moving averages, RSI’s, MACD’s and more can be overwhelming and counterproductive. However, utilising relative volume, as an indicator is one of the most important sources of information for technical traders. What is Volume?

Volume is quite simply, the volume of the asset traded over a specified time. This volume is usually shown by bars, generally located at the bottom of a price chart. Each bar represents one unit of the corresponding time period’s volume traded.

It also shows whether the period ended in the green or red. Volume tends to be reflective of the interest in the asset and is therefore a valuable tool. Why Relative volume?

Now that there is a clear definition of what volume is, understanding relative volume is straight forward. It has been established that volume is indicative of the amount of the asset traded for that time. Essentially, most assets will have a consistent or average volume that gets traded over a specified time, whether it be an hour, day, or a week.

Generally, the longer the time frame, the more weight a trader should give to that average. A large spike in the volume relative to the average is what a trader should be looking for. The volume bars are the best indicators of this.

Larger volumes can indicate larger positions being taken and increasing interest. Therefore, increases in relative buying volume can be a leading indicator for a move to the upside. On the contrary, a large red volume bar can be a leading indicator that price drop is about to occur as a large position is exiting.

A rule that many retail traders like to use is to follow the “big money” or institutions. Big institutions cannot just enter or exit their positions quickly like retail traders. Therefore, these institutions leave a trail of their entries and exits, that experienced traders can capitalise on and follow.

Understanding how shifts in volume can indicate, potential break outs, break downs and reversals takes time and practice but is a valuable tool that any trader should utilise to improve their entries and exits. A few examples of volume indicating changes in price action. Apple's sharp increase in selling volume indicated the ‘top’ and has not reached those high since.

Similarly, the chart for Brent Oil showed a similar pattern whereby it could not breakthrough a long-term resistance level and combined with a large volume of selling signaled that the price had peaked. The price for Stanmore Resources saw a big push after the influx of new volume and has its price increase since the first candle. This may indicate that institutions have added the company to its holdings or that significant buying interest has returned.

Further way to optimise using relative volume Anticipating Relative volume shifts by understanding that they tend to follow on from big news events, such as unexpected results or broader macro factors. Combining big volume shifts with a break of a key support or resistance level Combining with other technical indicators. Use a collection of volume bars vs just one to see the shift in relative volume

What is a deflationary Cryptocurrency? A Deflationary Cryptocurrency is one that burns, (mints) its supply. This process lessens the number of coins or tokens on the market over a specific period (generally a year), which reduces supply and increases the price.

In general terms, ensuring that there isn’t an oversupply of a currency can be an important monetary tool to reducing inflation. Evidence of quantitative easing and what can happen when there is an oversupply can be seen by the record high inflation seen around the world. The two largest cryptocurrencies, Bitcoin and Ethereum, are both tipped to become deflationary in the future but for varying reasons Is Bitcoin deflationary?

Bitcoin has a fixed, maximum supply of 21,000,000 BTC that will be fully mined in the year 2140. The current supply of BTC is 19,008,012.00 and 20% of this supply has been lost due to forgotten passwords and forgotten keys. It’s projected that Bitcoin may officially become deflationary once its full supply has been created, as the circulating supply will continue to reduce due to holders’ unintentional losses.

Is Ethereum deflationary? Unlike, Bitcoin, Ethereum does not have a maximum supply. Rather, it has an annual supply cap at 18 million ETH.

For Ethereum to become deflationary, 2 ETH would need to be burned per block; this is because this amount is minted for each block that is mined. As per the historical data, the ETH net issuance will dive lower creating a rally in the ETH price as the circulating supply will be less. A common way to achieve deflation is by burning tokens.

Ethereum does this by minting tokens that are staked or when NFTs are minted. A point worth noting is that cryptocurrencies with a finite supply are deflationary by default. When investors buy and hold the coin, the supply reduces.

Ethereum has temporarily turned deflationary in the last few days. An unknown project by the name of XEN has assisted in the burning of ETH. What is XEN?

XEN is a project created by the “Fair Crypto Foundation,” backed by Jack Levin, one of the first employees at Google working on cloud infrastructure. The ethos aims to empower the individual with a token that starts with a zero supply and has no pre-mint, CEX listings, admin keys, or immutable contracts. XEN, which launched on Oct. 8, can be claimed, minted, or staked and is based on the first principles of cryptocurrency: self-custody, transparency, trust through consensus, and permissionless value exchange without counterparty risk.

XEN can only be traded on Uniswap, where there is very little liquidity. Time will tell if the latest hot cake in crypto turns into just another swindle. Key Takeaways ETH has turned deflationary over the past 24 hours.

High gas consumption to mint tokens for the new project XEN Crypto is the primary cause of the ETH supply drop. ETH's supply has dropped on several occasions since Ethereum completed "the Merge" in September. Are you keen to venture into trading Cryptocurrency pairs, FX, stocks or commodities?

If so, you can do so by opening an MetaTrader trading CFD account with GO Markets here or call our Melbourne based office on 03 8566 7680 to discuss your trading goals with our account managers to get started. Sources: https://au.finance.yahoo.com/, https://xcoins.com/, https://coingape.com/, https://cryptopotato.com/, https://cryptoslate.com/

Long and Short trading and investing strategies are often seen as advanced strategies only used for large hedge funds and large banks. However, retail traders can learn valuable lessons and ideas from this type of trading strategy that is usually reserved for institutional players. What is a long-short strategy?

A long-short strategy as described by its name involves holding a basket of both long and short positions of assets all a part of a portfolio or a singular trading strategy. These assets tend to be equities securities or derivatives but can also be other asset classes such as commodities and FOREX. The idea behind the strategy is that due to the negative correlation between the shorts and long positions they cancel out much of the market volatility whilst at the same time profiting up movements in price in either direction.

Steps to develop a Long Short strategy Establish which assets classes you wish to trade This step involves generating ideas for which asset classes you whish to trade. This may include FOREX, Commodities, Indices, or equities. For many traders, a combination of assets may produce an effective strategy.

For example, someone may choose to allocate 60% of the portfolio to equities, 20% to FOREX and 20% to commodities or 100% to equities. Determine how many assets to hold with in strategy. The aim of this section is to ensure that there are enough assets to be, diversified enough that a significant move in one direction will not blow the strategy out and to ensure.

The strategy requires that enough assets are held to minimise the volatility. If too few assets are used, then the returns may not be consistent enough and prone to large gains and losses. A standard range may include 20 assets with the breakdown of long and short varying from strategy to strategy.

Apportion the % of assets that will be held long and those that will be held short? This step involves an element of discretion and is where the individual trader can utilise their own experiences and edge to enhance the strategy. For instance, some traders may choose to create a 50/50 split strategy.

This means that exactly half the assets will be long, and half will be short. More specifically this split may occur via value weighting, number of assets or by price per share. Alternatively other strategies may involve having a lower proportion of short assets held, such as 20% Short and 80% long.

These types of strategies may work better when in a trending market because the strategy can still make money on assets that are falling in value whilst also taking advantage of the strong overall market trend. Choosing the individual assets to be held This is perhaps the most important step of the process. Choosing assets to hold can be a difficult task and may require both technical and fundamental analysis to find top performing assets to hold long and poor performing stocks to hold short.

The craft of the long, short strategy is performed at this stage as a trader needs to find high performing or low performing assets. An example of a 50/50 Long Short Portfolio construction is shown below. (NOTE this is a fictional Long Short portfolio and is not a real strategy or portfolio) Positives of a Long Short Strategy A long-short strategy may be able to avoid volatile returns and the effect of a choppy market because the short positions can reduce negative returns if the market is falling, and long positions can take advantage of the market is lifting. if a trader can effectively allocate their Longs and shorts, profit can be effectively achieved in most market conditions. Allows a trader to utilise their ‘edge’ for a wider array of assets.

Disadvantages This approach requires active portfolio management. As positions are constantly changing and weightings for different assets change, adjustments may need to be made to ensure that the strategy continues to balance. A Long Short strategy also generally requires a longer time frame then other scalping strategies or intraday strategies.

Having short positions means that the holder of the short is at risk of short squeezes. A short squeeze is something that anyone wishing to short should be aware of. It occurs when to many short positions attempt to close their positions at once.

This can cause a spike in the price and may force bigger positions to close, further driving up the price. Ultimately, a Long Short strategy for trading and investing can be a way to achieve more stability in volatile market conditions and provide a way to capitalise on market movements in both directions. Even just understanding how a Long-Short strategy works can provide traders and investors with enhanced understanding of how market forces impact on trading and potentially provide new strategies.

Gold has finally seen some respite in its price after it fell to 12-month lows. With slowing growth forecasts being a key reason as to the drop in price. Recessionary fears can sometimes be good for the price as volatility draws money to gold as it is seen as a haven.

However, with the USD being so strong and investors pulling their money away from Gold, the commodity has struggled to protect its value. The price has shown some interesting action in recent days. The weekly price was able to break through its long terms support at about $1690.

However, as this level was so significant, the price is now retesting zone. In addition, the price has bounced off the 200-week moving average. The 200-week moving average is often seen as an extremely strong support level and rarely gets broken without significant resistance and then combined with the support zone has proven difficult to break down through.

However, the price is no sure thing to continue to bounce. As seen on the chart, the price is also in a consistent downward channel and has so far failed to break through the top of the channel. The daily chart confirms the bounce and shows why the price may have found resistance.

This is because it is currently resting below the 50-day moving average which is acting as long-term resistance and has acted as resistance since May 2022. The question remains, will the price remain at its current level, push up or push down. As more economic data comes out and Central banks either double down on inflation or pivot towards easing interest rates which will hopefully provide some more clarity on which way the price may go.

At this stage it would be best to wait for a confirmation either to the downside or upside of the channel.

The EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair move with some momentum in recent days and weeks. The RBA came out in its most recent meeting and raised rates by an unexpectedly low 25 bps vs 50 bps. This helped equities and housing stability but pushed the AUD to very lows levels.

The Euro on the other hand has suffered with geopolitical conflicts and recessionary pressures that have hit major players in the Union. With Germany in particular suffering quite large inflationary issues putting severe pressure on the EUR. After to dipping to as low as 1.42 AUD in both April and August this year, the pair has been able to move back into the major range that the price has been holding since 2013, excluding the commencement of the pandemic.

Technical Analysis The weekly chart as discussed above highlight that this pair does not usually trend and if it does trend it tends not hold the trend for very long. Rather the price tends to hold a range with breaks of range usually the outcome of extreme economic events such as the GFC or the pandemic before retreating into the range. The weekly chart also indicates that the price may be ready to reverse back up as seen by the double bottom pattern that has formed.

The neckline needs to be broken by the price at 1.54 for the pattern to be confirmed. The question is whilst this price is showing signs of a reversal, the price is sitting just on a significant resistance area. The daily chart shows an interesting case for either a breakout or a breakdown.

Firstly, the price has so far not broken out completely and is still consolidating at the neckline. In addition, the price is overbought to a high level and on previous occasions when it was this overbought, it has fallen back down. However, it is possible that the RSI is also just consolidating and getting ready to breakout.

This chart needs a little bit more time to be sure of a direction, however a potential long target if it breaks out to the long side could be 1.60 and to the short side if it fails could be 1.42. With economic still to flow for both Australia and Europe the EURAUD is definitely one to keep an eye on.

Brexit 23rd June 2016 – the day the people of United Kingdom voted to leave the European Union, it’s a day which will go down in the history and will always be remembered. The margin by which people voted to leave was not big (51.9% voted to leave, 48.1% voted to stay) but it will undoubtedly continue to have a big impact on the United Kingdom, European Union and the global financial markets. What does it mean to the UK economy?

Many leading economists before the referendum had been predicting an instant and significant impact on the UK economy and consumer confidence should the country leave the European Union, but so far, these predictions have not been accurate. Latest figures show that UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.7% between Quarter 3 (July to Sept) 2016 and Quarter 4 (Oct to Dec) 2016, revised up 0.1 percentage points from the preliminary estimate of GDP published on 26 January 2017. Upward revisions (due to later data received) within the manufacturing industries is the main reason (these revisions were first published as part of the Index of Production for December 2016 released on 10 February 2017).

UK GDP growth in Quarter 4 2016 saw a continuation of strong consumer spending which is in line with the Retail Sales Index for Quarter 4, which grew by 1.2% (published on 20 January 2017) and strong growth in the output of the services sector with a notable contribution in consumer-focused industries. In Quarter 4 2016, there has been a slowdown within business investment which fell by 1.0%, driven by subdued growth within the “ICT equipment and other machinery and equipment” assets. Quarterly growth and levels of GDP for the UK source: www.ons.gov.uk Currency The pound fell to a to a 31-year low and was on course for its biggest one-day loss in history on the day the people of Britain voted to leave the European Union in June and has been steadily falling against the dollar since the vote.

When Theresa May announced that the UK would begin formal Brexit negations by the end of March, it did not do much to alleviate the concerns of investors about a ‘hard’ Brexit, negatively impacting Sterling once more. But what is keeping the Pound low? It’s uncertainty, uncertainty of how Brexit will turn out.

A notable portion of participants in the Forex market is made up of speculators and the consensus outlook they hold for a currency sometimes has a significant impact on its overall value, regardless of the impact from companies and individuals looking to move money for practical purposes. GBP/USD since the Brexit vote source: www.tradingview.com It is hard to predict to how, when or if, pound sterling will recover but there are some key things to keep an eye out for. > There could be a strong positive movement for pound sterling if the United Kingdom get a favourable exit deal with the European Union. > The Bank of England is not likely going to cut interest rates any further in the near term or put more money in the economy and that will be viewed as signs of confidence in the UK and will most likely make the pound more attractive. > UK Economic data will continue to have a significant impact on Sterling. If enough data suggests that the United Kingdom is in a strong position going into Brexit, for example if companies are continuing to hire and invest in the British economy and not planning to relocate to other EU countries, we should see renewed optimism in Sterling.

Meanwhile, stock markets have been strong since the Brexit vote. The FTSE100 closed at a record high at the end of 2016, up 14.4% during the year. FTSE100 since the Brexit vote Source: www.tradingview.com Key dates this month worth noting in the diary: Tuesday March 7 Deadline to pass the Brexit Bill - The May government wants the Lords to approve the Brexit bill by Tuesday March 7.

It will then need royal assent to become law. Thursday March 9 and Friday March 10 EU Summit: Should the bill pass in time, British Prime Minister May could decide to trigger Article 50 in Brussels. Friday March 31 The Prime Minister has publicly said that she plans to trigger Article 50 by the end of March 2017.

Triggering Article 50 will be followed by the arduous two-year process of the UK's break up with the EU.