ข่าวสารตลาด & มุมมองเชิงลึก

ก้าวนำตลาดด้วยมุมมองเชิงลึกจากผู้เชี่ยวชาญ ข่าวสาร และการวิเคราะห์ทางเทคนิค เพื่อเป็นแนวทางในการตัดสินใจซื้อขายของคุณ.

ละตินอเมริกาบันทึกปริมาณคริปโต 730 พันล้านดอลลาร์ในปี 2025ทั่วภูมิภาคมีประชากร 57.7 ล้านคนเป็นเจ้าของการจัดอันดับสกุลเงินดิจิทัลบางรูปแบบ ซึ่งเป็นฐานที่เติบโตเร็วกว่าที่อื่นในโลก

เมื่อเงินทุนสถาบันมาถึงและข้อบังคับครบกำหนดนี่คือชื่อที่ซื้อขายสาธารณะที่นักลงทุนกำลังเฝ้าระวังอย่างใกล้ชิด

ทำไม LATAM ถึงเป็นโรงไฟฟ้า crypto ในขณะนี้

หุ้นคริปโต LATAM อันดับแรกที่ควรดู

1.นู โฮลดิ้งส์ (NYSE: NU)

ธนาคารดิจิทัล · ผู้ใช้ 127 ล้านคนทั่วบราซิล เม็กซิโก และโคลอมเบีย

Nubank อาจเป็นหนึ่งในพร็อกซีที่จดทะเบียนโดยตรงที่สุดสำหรับการบูมฟินเท็กและคริปโตของ LATAMบริษัท รวมการซื้อขายสกุลเงินดิจิทัลเข้ากับแอป Nu โดยตรงและร่วมมือกับ Lightspark เพื่อฝังตัว บิตคอยน์ Lightning Network สำหรับการทำธุรกรรม Bitcoin ที่รวดเร็วและคุ้มค่ามากขึ้น

ในไตรมาสที่ 3 2025 รายได้เพิ่มขึ้น 42% เมื่อเทียบเป็นปีเป็น 4.17 พันล้านดอลลาร์ เงินฝากของลูกค้าเพิ่มขึ้น 37% เป็น 38.8 พันล้านดอลลาร์ และกำไรขั้นต้นเพิ่มขึ้น 35% เป็น 1.81 พันล้านดอลลาร์

หุ้นได้กลับมาประมาณ 36% ในช่วงปีที่ผ่านมา และเพิ่มผลตอบแทนของ S&P 500 เป็นสามเท่าในช่วงสามปีที่ผ่านมาบริษัท ครองบราซิลโดยมีประชากรผู้ใหญ่กว่า 60% ใช้ Nubank

เมื่อเร็ว ๆ นี้Nu Holdings ยังได้รับอนุมัติตามเงื่อนไขในการเปิดตัว Nubank N.A. ซึ่งเป็นธนาคารดิจิทัลแห่งชาติของสหรัฐอเมริกา อย่างไรก็ตาม การประกาศดังกล่าวทำให้เกิดการถดถอยหลัง โดยนักลงทุนระมัดระวังเกี่ยวกับระยะเวลาการปรับใช้เงินทุนและต้นทุนการขยายตัว

UBS ได้ลดเป้าหมายราคาลงเหลือ 17.20 เหรียญ โดยอ้างถึงความระมัดระวังของตลาดแม้จะมีการเปลี่ยนแปลงการดำเนินงานในเชิงบวก

สิ่งที่ต้องดู

- แนวโน้มคุณภาพเครดิตในบราซิลและเม็กซิโก

- อัตราการยอมรับ USDC ผ่านรางวัล Nubank

- ไทม์ไลน์กฎบัตรธนาคารสหรัฐและการเปิดเผยต้นทุนก่อนกำหนด

2.MercadoLibre (NASDAQ: MELI)

อีคอมเมิร์ซ/ฟินเทค · 18 ประเทศทั่วละตินอเมริกา

MercadoLibre ไม่ใช่การเล่นคริปโตที่แท้จริง แต่ Mercado Pago (แขน fintech) กลายเป็นหนึ่งในรางทางการเงินที่สำคัญที่สุดใน LATAMบริษัท ถือหุ้นประมาณ 570 BTC ในงบดุลเพื่อป้องกันเงินเฟ้อในระดับภูมิภาค และได้ออก Meli Dólar Stablecoin ที่เชื่อมโยงกับดอลลาร์สหรัฐของตัวเอง

รายได้สุทธิเต็มปี 2025 จาก Mercado Pago สูงถึง 12.6 พันล้านดอลลาร์เพิ่มขึ้น 46% เมื่อเทียบเป็นรายปี ในขณะที่ปริมาณการชำระเงินทั้งหมดสูงถึง 278 พันล้านดอลลาร์เพิ่มขึ้น 41%ผู้ใช้รายเดือนของ Fintech เติบโตใกล้เคียง 30% เป็นเวลาสิบไตรมาสติดต่อกัน และพอร์ตโฟลิโอเครดิตเกือบสองเท่าเป็น 12.5 พันล้านดอลลาร์เมื่อเทียบเป็นรายปี

จุดเด่นของ MercadoLibre คือการทำกำไรการบีบอัดมาร์จิ้นโดยรวม 5— 6% เกิดจากการลงทุนอย่างต่อเนื่องในการจัดส่งฟรี การขยายบัตรเครดิต การค้าของบุคคลที่หนึ่ง และการค้าข้ามพรมแดน

หุ้นลดลงประมาณ 14.5% ในช่วงหกเดือนที่ผ่านมา โดยตลาดปรับราคาหุ้นตามสิ่งที่ฝ่ายบริหารจัดตั้งไว้ว่าเป็นขั้นตอนการลงทุนโดยเจตนามุ่งสู่ปี 2026

คดีระยะยาวยังคงน่าสนใจอยู่Mercado Pago ได้เปิดตัวผลิตภัณฑ์การจัดการสินทรัพย์และประกันภัยคริปโตในตลาดหลัก ทำให้เป็นบริษัทอีคอมเมิร์ซน้อยลงและเป็นธนาคารดิจิทัลเต็มรูปแบบที่มีโครงสร้างพื้นฐานคริปโตในตัว

สิ่งที่ต้องดู

- แนวโน้มการขาดทุนสินเชื่อ Mercado Pago และคุณภาพพอร์ตโฟลิโอเครดิต

- การรวม Stablecoin และปริมาณ crypto ผ่านเครือข่ายการชำระเงิน

- การเปิดตัวบัตรเครดิตอาร์เจนตินาสามารถทำกำไรได้หรือไม่

3.เมลิอุซ (B3: CASH3.SA)

Fintech/คลังบิทคอยน์ · บริษัท คลัง Bitcoin จดทะเบียนแรกของบราซิล

Méliuz เป็นการแสดงออกของหุ้นโดยตรงมากที่สุดของแนวโน้มคลัง Bitcoin ขององค์กรใน LATAMในช่วงต้นปี 2025 Méliuz กลายเป็น บริษัท ที่ซื้อขายต่อสาธารณะแห่งแรกในละตินอเมริกาที่ใช้กลยุทธ์คลังของ Bitcoin อย่างเป็นทางการ โดยได้รับการอนุมัติจากผู้ถือหุ้นในการจัดสรรเงินสำรองเงินสดเพื่อการสะสม Bitcoin

แทนที่จะออกหนี้ในสกุลเงินดอลลาร์ราคาถูกเพื่อซื้อ BTC Méliuz ใช้การออกหุ้นและกระแสเงินสดจากการดำเนินงานบริษัท ยังขายออปชั่นการขายที่มีการรักษาความปลอดภัยด้วยเงินสดบน Bitcoin เพื่อสร้างผลตอบแทน ซึ่งเป็นหนังสือเลย์บุ๊คที่ยืมจาก บริษัท คลังบิทคอยน์ของญี่ปุ่น Metaplanet ซึ่งเก็บไว้ 80% ของ BTC ไว้ในห้องเย็น

โดยพื้นฐานแล้ว CASH3 ทำหน้าที่เป็นพาหนะที่มีเลเวอเรจสำหรับการเปิดเผย BTC โดยยึดตัวสูงขึ้นอย่างรุนแรงในวัฏจักรขาลง แต่สร้างความผันผวนมากขึ้นในทางขาลง โดยเฉพาะอย่างยิ่งเมื่อมีหนี้เกี่ยวข้อง

หุ้นเพิ่มขึ้นประมาณ 170% ในเดือนพฤษภาคม 2025 หลังจากประกาศกลยุทธ์ Bitcoin อย่างไรก็ตามตั้งแต่นั้นมา มันได้ย้อนกลับสู่ระดับเมษายน 2025 โดยติดตามการเคลื่อนไหวของราคาของ Bitcoin อย่างกว้างขวางและเน้นความผันผวนของหุ้น

สิ่งที่ต้องดู

- ทิศทางราคา Bitcoin

- เมตริก BTC ต่อหุ้น

- การขยายกลยุทธ์การสร้างผลผลิต

- การย้ายใดๆ เพื่อจดทะเบียนหุ้นในระดับสากล

4.ส้ม BTC (B3: OBTC3.SA)

คลังบิทคอยน์ Pure-play · ผู้ถือบิทคอยน์องค์กรรายใหญ่ที่สุดของ LATAM

ที่ Méliuz เป็นธุรกิจ Fintech ที่ถือครองบิทคอยน์ด้วย OranjeBTC ก็ตรงกันข้าม: บริษัท ที่มีวัตถุประสงค์ทั้งหมดคือการสะสม Bitcoin

บริษัท จดทะเบียนใน B3 ในเดือนตุลาคม 2025 ผ่านการควบรวมกิจการย้อนกลับกับ บริษัท การศึกษา Intergraus ซึ่งเป็นการเปิดตัวครั้งแรกในสาธารณะของบราซิลของ บริษัท ที่มีรูปแบบธุรกิจมุ่งเน้นไปที่การสะสม Bitcoin ทั้งหมด

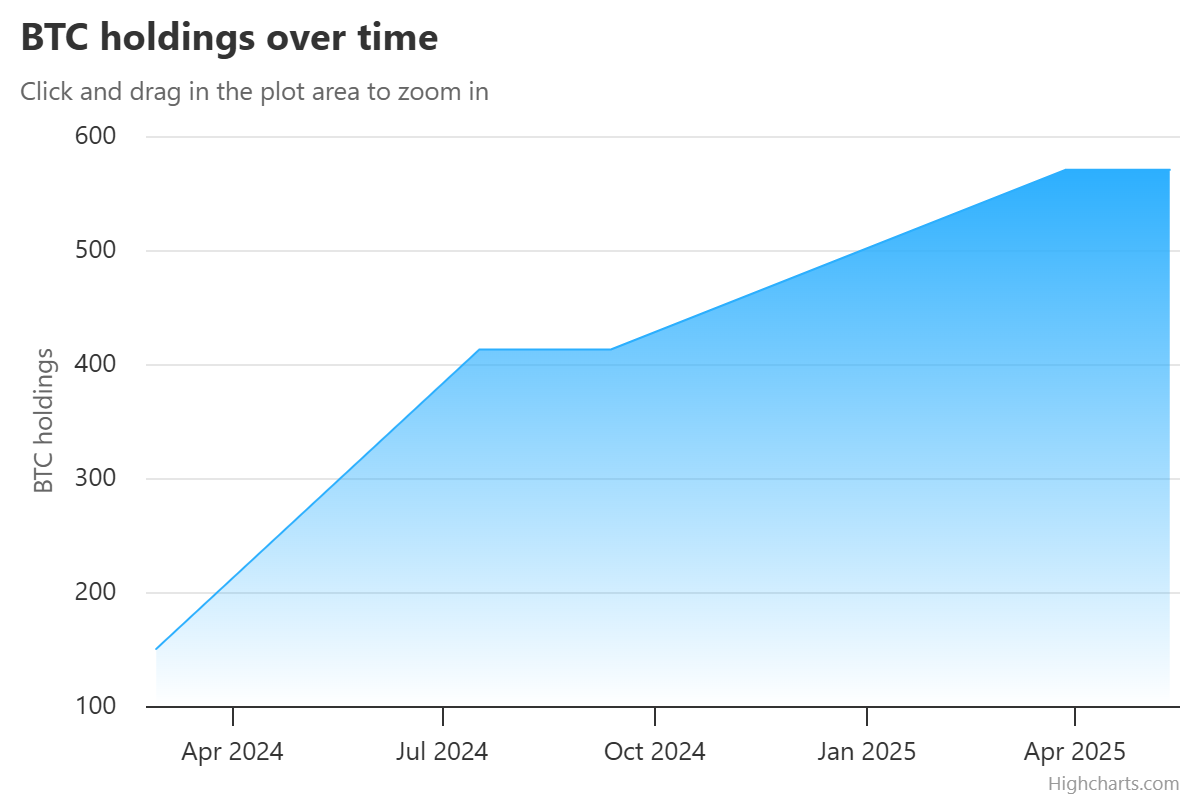

ปัจจุบัน OranjeBTC ถือหุ้นกว่า 3,650 BTC และระดมทุนเกือบ 385 ล้านดอลลาร์ใน Bitcoin โดยได้รับการสนับสนุนจากนักลงทุนที่มีชื่อเสียง รวมถึงพี่น้อง Winklevoss Adam Back FalconX และ Ricardo Salinas

รอบการจัดหาเงินทุน 210 ล้านดอลลาร์นำโดย Itaú BBA ซึ่งเป็นกองทุนการลงทุนของธนาคารที่ใหญ่ที่สุดของบราซิลในการลงคะแนนความเชื่อมั่นของสถาบันอย่างมีนัยสำคัญ

ในปี 2026 OBTC3 ลดลงประมาณ 32% เมื่อเทียบกับปัจจุบันทำให้เป็นหุ้นคลังบิทคอยน์ของบราซิลที่ได้รับผลกระทบมากที่สุดสองหุ้น หุ้นแตะระดับสูงสุดตลอดกาลที่ 29.00 BRL ในวันจดทะเบียน (7 ตุลาคม 2025) และระดับต่ำสุดตลอดกาลที่ 6.06 BRL ในเดือนกุมภาพันธ์ 2026

ปัจจุบันมีการซื้อขายประมาณ 7.06 BRL ซึ่งเป็นส่วนลดสูงจนถึงการเปิดตัว แต่เป็นส่วนลดที่สะท้อนกลับของ Bitcoin จากระดับสูงสุดอย่างใกล้ชิด

oranjeBTC เป็นชื่อที่ผันผวนมากที่สุดในรายการนี้และควรได้รับการพิจารณาว่าเป็นพาหนะ Bitcoin รุ่นเบต้าสูงสภาพคล่องนั้นบางกว่าชื่อที่กำหนดไว้

สิ่งที่ต้องดู

- วิถีบิทคอยน์ต่อหุ้น

- การระดมทุนหรือการซื้อ BTC ใหม่

- ความทะเยอทะยานในการลงทะเบียนระดับนานาชาติ

- ส่วนลด/พรีเมียมมูลค่าสินทรัพย์สุทธิมูลค่าตลาด (mNav) มีวิวัฒนาการอย่างไรเมื่อเทียบกับราคาของ Bitcoin

5.แฮชเด็กซ์ - แฮช11 (บ3: แฮช11)

การจัดการสินทรัพย์ Crypto · ผู้ออก ETF crypto ชั้นนำของบราซิล

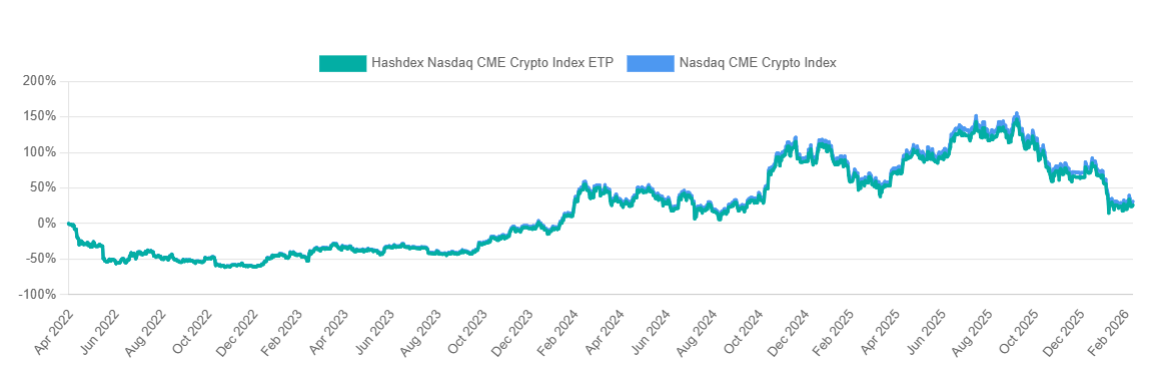

Hashdex เสนอการเปิดเผยต่อคริปโตประเภทที่แตกต่างกันแทนที่จะเป็นงบดุลหรือกลยุทธ์ทางธุรกิจของ บริษัท เดียว HASH11 เป็นตะกร้าสินทรัพย์ crypto ที่หลากหลายซึ่งห่อด้วยความคุ้นเคยของโครงสร้าง ETF ของบราซิลที่มีการควบคุม

บราซิลเป็นเจ้าภาพ ETF 22 รายการที่เสนอการเปิดเผยสินทรัพย์คริปโตเต็มหรือบางส่วน โดยกองทุน Hashdex ดึงดูดนักลงทุน 180,000 รายและมีปริมาณธุรกรรมรายวันโดยเฉลี่ย 50 ล้านเหรียญ

Hashdex เปิดตัว Spot XRP ETF (XRPH11) แรกของโลกบน B3 ของบราซิลในเดือนเมษายน 2025 ติดตามดัชนีราคาอ้างอิง Nasdaq XRP และจัดสรรสินทรัพย์สุทธิอย่างน้อย 95% ให้กับXRP

บริษัท ยังดำเนินการ ETF สินทรัพย์เดียวสำหรับ Bitcoin (BITH11), Ethereum (ETHE11) และ Solana (SOLH11) พร้อมกับกองทุนดัชนีหลายสินทรัพย์หลัก HASH11

ในช่วงกลางปี 2025 Hashdex ได้เปิดตัว ETF Bitcoin/Gold แบบไฮบริด (GBTC11) ที่ปรับการจัดสรรระหว่างสินทรัพย์ทั้งสองแบบไดนามิก

สำหรับนักลงทุนที่ต้องการการเปิดเผยตลาดคริปโตที่หลากหลายมากกว่าความเสี่ยงของสินทรัพย์เดียว HASH11 เป็นระบบที่เข้าถึงได้มากที่สุดผ่านโครงสร้างพื้นฐานหุ้นที่มีการควบคุมของบราซิล

อย่างไรก็ตาม ในฐานะดัชนีคริปโตหลายสินทรัพย์ HASH11 ยังคงอยู่ภายใต้ประสิทธิภาพที่กว้างขวางของตลาดสินทรัพย์ดิจิทัลและแตกต่างจากชื่อหุ้นในรายการนี้ไม่มีธุรกิจการดำเนินงานที่สร้างมูลค่าอิสระ

สิ่งที่ต้องดู

- ความเชื่อมั่นของตลาด Crypto ในวงกว้าง

- ศักยภาพในการขยายผลิตภัณฑ์ Hashdex เข้าสู่ตลาดสหรัฐอเมริกา

- การเติบโต AUM เมื่อการยอมรับจากสถาบันเร่งตัวขึ้นในบราซิล

- ประสิทธิภาพสัมพัทธ์ของ HASH11 เทียบกับทางเลือกสินทรัพย์เดียว

สิ่งที่ต้องดูต่อไป

โครงสร้างพื้นฐานของสถาบันยังอยู่ในช่วงเริ่มต้น — Crypto Finance Group ของ Deutsche Börse เข้าสู่ LATAM ในช่วงต้นปี 2026 และการแลกเปลี่ยนในท้องถิ่นได้เปิดคู่การซื้อขายที่มีสกุลเงิน BRL มากกว่า 200 คู่ตั้งแต่ปี 2024ความเร็วของการสร้างนั้นจะกำหนดโทนเสียงสำหรับทั้งห้าชื่อ

ความคืบหน้าด้านกฎระเบียบในบราซิลเม็กซิโกและชิลีเป็นตัวกระตุ้นหลักสำหรับคลื่นทุนครั้งต่อไปความพ่ายแพ้ใด ๆ จะส่งผลกระทบต่อชื่อรุ่นเบต้าสูงกว่า เช่น OBTC3 และ CASH3 ได้ยากที่สุด

ปริมาณ Stablecoin เป็นสัญญาณแบบเรียลไทม์ที่น่าเชื่อถือที่สุดในภูมิภาคแม้จะมีการชะลอตัวของโลกในช่วงต้นปี 2025 แต่ LATAM ยังคงบันทึกปริมาณการซื้อขาย 16.2 พันล้านดอลลาร์ระหว่างเดือนมกราคมถึงพฤษภาคม เพิ่มขึ้น 42% เมื่อเทียบเป็นรายปีดูว่าโมเมนตัมนั้นคงอยู่หรือไม่ — การเร่งความเร็วสูงทั้งห้าตัว การกลับกดดันพวกมันอย่างเท่าเทียมกัน

Two junior lithium companies, Core Lithium, (CXO) and Lake Resources, (LKE) have seen aggressive sell offs after motoric rises in the last few years. The Backstory Lithium stocks companies had seen a momentous rise in the past 3 years largely on the back of the push towards renewable energy and electric vehicles which require lithium for their batteries. Core Lithium (CXO) and Lake Resources, (LKE) have been two companies who have benefited a great deal from the rise in interest and price of lithium.

Both companies became so large that on the 20 th June 2022 they were both added to the ASX200 Index or XJO. This was a key milestone as it meant that large funds and ETF’s were required to buy shares of the companies. This created an almost artificial surge in demand as pools of money were flowing into these companies.

Leading up to the sell off Prior to the addition into the XJO, many lithium stocks had suffered through a bloodbath type of sell off. The selloff was caused by rising inflation and interest rate levels disproportionately affecting growth companies which many lithium companies are and also an over extended bull market that was in need of a pullback. As the price of many of these companies began to see their share prices drop such as Tesla and Allkem, LKE and CXO remained relatively strong.

Once again much of this strength was due to institutions and funds holding the price up due to the rebalancing. The sell off Once the rebalancing occurred on 20 June 2022 the buying pressure subsided and the selling took over in a fairly violent manner. LKE in particular saw a massive drop.

Furthermore, the selloff was exacerbated by CEO, Stephen Promnitz, quitting on the same day for no apparent reason. The relative selling volumes of LKE shares were drastically higher than prior periods of trading. The price is now holding just above its support at $0.70 after falling almost 75% from its peak in April 2022.

With the market capitalisation now under 1 billion dollars, what happens next for the company will be intriguing. After such a large capitulation can the share price have a strong bounce, or does it have further to go? The CXO share price has seen a less aggressive dump.

Whilst it was not struck with the same bad news as LKE was with regards to its lead, it still saw a massive sell off although with the volume of selling not at the same level as LKE. The price is just holding above its 200 day moving average and has pulled back just over 51.33% from its peak in April 2022. The next week or so of price action may provide a great deal of insight into where the share price will go next.

With inflationary pressure set to continue and growth companies baring the brunt of the sell off the short term future of both these companies is murky at best.

The operator of KFC and Taco Bell restaurants across Australia, Europe and South East Asia Collins Foods Limited, (CKF) saw its share price shoot up by above 11% on Tuesday after releasing its annual report. The company saw its revenue increase to 1,184,521,000 and increased its profit by an impressive 47%. The company also saw a decrease in its net debt and net leverage ratio, as improved cashflow saw the business become more solvent.

CKF saw particularly good growth in its European sector where it saw revenue increase from $134.9 million to $190.4 million year on year. With inflation being a key concern for most businesses in the short/medium term future, CKF outlined how it will deal with rising costs. The company will focus on providing better value than competitors.

It has also already locked in prices for chickens until the end of 2022 and 95% of its inputs are sourced locally, minimising supply chain pressures and costs. CKF managing Director, Drew O’Malley stated that, “KFC Australia managed to deliver positive same store sales growth for the full year, despite cycling unprecedented growth in the prior year. The KFC brand has never been stronger in Australia, and metrics around quality, value and purchase intent are at record level, particularly important in times like these.

Looking forward the company has already seen positive results since the report was finalised. O’Malley outlined that the proven track record of the brands and their customer appeal ensures that CKF is well positioned to manage the challenging economic conditions. From a technical perspective on the day the annual report came out, the share price gapped up above the 50 day moving average on a high level of volume.

The price has so far been unable to make a large move higher as it consolidates through a relatively strong resistance zone. If the price can break out of the resistance zone a target or $11.04 or a secondary target of $12.84 may be practical targets to aim for.

Global indices ended the week on a high as the US indices all recovered some of their recent sell offs. The Nasdaq was the strongest performer rising 2.05% to close the week. For the week, the index was able to recover some of its recent selling, finishing up 8.18%.

It was also the Technology sector's best week since November 2020. However, it is still down 14.34% from its all-time high. The S&P 500 was up 1.17% and the Dow Jones 0.80% as Wall Street consolidated its gains.

In Europe, the markets were a little weaker, with the DAX finishing flat up 0.17% and the FTSE slightly better up 0.26%. Commodity prices continued to taper as the economic ramifications of the Russian and Ukraine conflict remain steady. Gold has settled at near support at 1900 USD per ounce and the price closed the week at 1920 USD as it holds that level.

Natural Gas continues to hold near its highs finishing the week down 0.54% as it remains in a tight range. Brent Crude Oil followed a similar pattern ending the week just below $108 at 107.96 after bouncing off the low at $97. The price spiked on the back of an escalation of hostilities in Yemen, as Houthi Rebels unleashed an assault on Saudi Arabia’s critical energy facilities.

Previously, a sophisticated strike in 2019 on Aramarco (The world’s largest oil company) facilities took out half of Saudi Arabia’s oil production. The UAE and Saudi Arabia have also so far resisted calls to increase oil production to offset the deficit from the embargo on Russia. FOREX The JPY was pummelled against other currencies as it hit its lowest levels in 4 years against the AUD dropping 3.26% for the week.

Against the USD, the JPY saw its lowest value in 6 years dropping 1.62%. The AUD has continued to be a great performer, with the AUD/USD rising 0.51% as it holds 0.7408 cents. The market will be looking forward to Reserve Bank of Australia Governor Phillip Lowe’s speech on Tuesday for an indication of the likely monetary policy for April.

The AUD has performed well during recent volatility relative to other global currencies due to high commodity prices which have supported the AUD. The EUR/USD and GBP/USD both have been following a steady pattern as Ukraine and Russian conflict has settled. Both pairs remain below their recent resistance.

Coal and Gas prices have surged and joined gold and oil as demand surges due to the supply shortages stemming from the Russia and Ukraine conflict. The global indices were up overall as the market still remains unsure of how to react to the unfolding crisis. In Europe, the FTSE provided strength with a 1.36% gain and the DAX provided a small bounce rising 0.69%.

In America the Dow Jones and the NASDAQ both saw decent rises, moving 1.79% and 1.62% respectively. The US markets responded positively after Jerome Powell testified that the Federal Reserve still intends to increase interest rates later this month by 25 basis points. Mr.

Powell did, however, allow for some flexibility in the face of the increased conflict. The biggest mover was coal which shot up almost 33% to $400 on the back of the energy crisis. It has led to many countries attempting to scavenge for coal reserves.

Germany is poised to create coal power reserves and Italy announced it may reopen some of its previously shut coal plants. The Aussie dollar has benefited from this and other rises in commodity prices with AUDUSD touching on 0.73c overnight. Oil prices reached as high as $114.00 and touched the 8 year high before settling in at $111.

This is after OPEC decided overnight to hold production level at the current level leaving the potential shortfall in demand unaccounted for, claiming that that demand for oil is being driven by geopolitics and not fundamentals. The price of wheat and aluminium also hit 14-year highs overnight and Gold continues to remain steady at $1,927 per ounce. Bitcoin saw a slight slump and is down 1.47% although is still very much moving upward due to the momentum from Russian investors.

The Ruble saw some strength as it saw upward of 5% gains against many other currency pairs. The US dollar continues to be strong on the back of the Federal reserve and from the risk aversion seen in the market at the moment.

Equity markets US stocks jumped overnight to reach record levels as stronger than expected print on retail sales and a sharp improvement in the number of new jobless claims cheered the investors. Source: Yahoo Finance US reporting season kicked off this week with impressive results so far from Finance heavyweights JP Morgan, Goldman, BOA and Citi, all handily beating estimates. The week's economic figures, strong corporate earnings and comments from Fed Chairman Powell regarding the commitment of the central bank's easy money policies have seen US markets make all time highs on an almost daily basis.

European stocks also hit record highs this week with the EUROSTOXX 50 breaking 4000 and having rallied nearly 80% from the pandemic lows in March 2020. Analysts are confident there is further upside in Europe as prices remain low compared to the U.S and vaccination rates climb to catch up to the U.S. “European equities are set to benefit from a sharp acceleration in euro area GDP (gross domestic product) growth over the coming months, but that is due to the boost from reopening and the support from a powerful U.S. recovery, rather than a function of the dispersal of NGEU funds,” two analysts at Bank of America said in a note to clients. World equity indices are mostly up for the week with only Asian indices lagging.

Traders will be watching today's upcoming Chinese figures, including the all-important GDP figure, which is expected to be the highest quarterly economic growth since it began releasing such figures 30 years ago. Source: Bloomberg Forex markets The US dollar weakened dramatically during the week, under performing all major currencies bar the Canadian dollar. Despite a strong week in Oil, current COVID lock down measures in Canada are causing a headwind for the Loonie.

Source: Bloomberg The recent run up in the US dollar index in tandem with rising 10 year bond yields has reversed in April as yields stabilise and are starting to decline. Overnight 10 year Treasury yields dropped to 1.57%, its lowest level in a month. Source: Bloomberg Source: GO MT4 Commodities Gold Spot gold (XAUUSD) rallied this week on the back of a weaker US dollar.

US CPI figures also came in higher than expected this week, giving gold an extra boost as it is seen as a traditional inflation hedge. Source: GO MT4 Oil US crude prices rallied strongly this week on continued expectation of a global economic recovery. Agreed production cuts have also given Oil a boost as OPEC is holding back just over 7 million barrels per day, with Saudi Arabia voluntarily cutting an additional 1 million barrels per day.

From next month OPEC+ will start gradually curbing production cuts. In May OPEC+ will allow an additional 350,000 barrels per day to join the markets. Source: GO MT4 Bitcoin The highly anticipated Coin base (COIN) IPO launched this week, with investors piling into the new stock.

This mainstreaming of cryptocurrencies in general and Bitcoin in particular saw strong buying in Bitcoin pushing it through the 60k resistance level and hitting all time highs just short of $65k USD. Source: GO MT4 Monday, 19 April 2021 Indicative Index Dividends Dividends are in Points ASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 0 0 0 0.005 0 2.808 1.234 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 79.017 0 0 0 0 0

The market closed the week down overall as volatility continues due to the Russia and Ukraine conflict. The Dow Jones dipped 0.5%, the S&P500 fell 0.8%, and the NASDAQ performed the worst, declining 1.7%, despite generally positive sentiment from the USA concerning the employment figures released on Friday. Employers added 678,000 jobs to the workforce in February, and unemployment was lowered to 3.8% beating most analysts' expectations.

CPI figures will be on the agenda next week as inflation continues to garner attention. European stocks were hit the hardest, with the DAX losing more than 10% over the week and 4.41% on Friday, as it continues to be hit hard by the conflict. The FTSE also had a tough week and closed Friday down 3.48%.

Commodities had a belter week and got close to their largest rise in prices since 1960. European natural gas more than doubled in price, wheat soared 40%, and oil increased 20%. These increases may have an impact on the energy and commodity sector in the Australian market going forward.

The surge in energy prices has occurred despite economic sanctions that have not targeted Russia’s energy exports. Gold finished the week exceptionally strong, closing at the upper end of the weekly range towards $1,970. The price continues to provide a haven for investors as the volatility remains.

Oil followed its strong closing towards the high of the week at $117.96. Cryptocurrency Bitcoin had shown strength earlier in the week, but it could not hold its highs around $45,000 BTC/USD. It closed the week below $40,000.

Ethereum followed a similar pattern falling to $2,593. FOREX The EUR/USD had a massive drop falling -1.23%. The Euro struggled against all of the currency pairs, recording big drops for the week.

The GBP also was a weak performer for the week. Due to their geographical exposure, the EUR and GBP have been the most sensitive to news from the conflict. The AUD and NZD performed well for the week and have seen a nice move into recent resistance.