市场资讯及洞察

.jpg)

特朗普的伊朗战争,最终大概率不会以“大获全胜”作为结束标志,而真正决定这场冲突何时收场的,是特朗普还能承受多大的政治、经济与舆论压力。问题在于,伊朗显然比他更能忍痛。也正因如此,特朗普即便选择撤出,也一定会把这一切包装成一场胜利;而伊朗必然会确保外界不会轻易相信这种说法。这正是特朗普如今最深的困境:他可以宣布结束,却未必有能力定义结束。

如果特朗普在动手之前更认真评估过后果,他本可以为今天的局面做更多准备。首先,他原本应该提前补充美国战略石油储备。俄乌战争之后,美国战略石油储备已明显下降,却始终没有得到有效回补。一旦中东战火扩大,油气供应受到冲击,能源价格飙升几乎是必然结果。相比在危机爆发后被动补救,事先做好准备的成本显然低得多。

其次是提前争取海湾阿拉伯国家的支持,至少让这些关键地区盟友在政治和能源层面与美国保持协调。然而问题在于,特朗普自己始终没有清晰、稳定、可执行的战争目标。没有人愿意为一场目标模糊、边界不清、结果难料的战争站台。结果就是,他不仅没有换来坚定支持,反而面对一个日益焦躁、愤怒、充满不安的海湾地区。

第三,他也没有为美国公众做好心理准备。任何一场针对伊朗的冲突,都不可能只是一次轻描淡写的军事打击。它天然带有升级风险,可能拖长,可能外溢,也可能反噬全球能源市场和美国自身经济。可特朗普并没有为美国社会讲清楚这些代价,更没有为一场可能持续更久的对抗建立政治耐受度。于是,当战争真正进入消耗阶段时,他将发现自己并没有足够的国内空间去承受它。

而这恰恰是当前局势最危险的地方。即便伊朗遭受重创,也不意味着它失去了继续施压的能力。它仍然可以威胁海湾航运,恐吓油轮远离关键海域,也依然有能力扰乱地区能源生产。只要霍尔木兹海峡的通行安全无法被彻底保证,全球能源市场就始终处在阴影之下。除非美国愿意付出占领伊朗的代价,否则特朗普根本无法真正消除这种风险。更何况,伊朗的无人机与非对称作战体系本就高度分散,不可能靠几轮空袭就被连根拔起。

同样,特朗普也没有能力决定伊朗未来由谁统治。政权更迭从来不是外部军事打击就能轻易塑造的结果。阿富汗和伊拉克早已证明,美国可以摧毁一套政权机器,却很难按自己的意志重建一个稳定、听话、亲美的新秩序。即便哈梅内伊体系被削弱,继任者也未必更温和,反而很可能更强硬、更封闭、更敌视美国。在这种背景下,特朗普想逼出停火、迫使伊朗让步,甚至幻想所谓“无条件投降”,都显得愈发不现实。

于是,他手里其实只剩下两个高风险选项。

一个是通过突击行动夺取伊朗剩余的高浓缩铀库存。若行动成功,特朗普也许能获得一个勉强体面的退场台阶,并借此宣称自己“摧毁了伊朗核威胁”。对于一个极度在意自己形象、又急于摆脱“临阵退缩”标签的总统来说,这种闪电式战果的诱惑无疑巨大。但问题在于,这种行动的失败成本也极其高昂。历史上,吉米·卡特营救伊朗人质失败,几乎直接埋葬了他的总统生涯。特朗普已经反复高调宣称自己“摧毁了伊朗核计划”,一旦现实打脸,他恐怕承受不起这样的政治后果。

另一个选项是占领或切断伊朗关键石油出口节点,例如哈尔克岛,从源头上打击伊朗财政命脉。这听上去像是一种更具压迫力的战略手段,但实际风险甚至更大。因为这不再是一次短促、有限、可控的打击,而意味着更深程度的军事卷入、更长时间的兵力部署,以及更高概率的地面消耗。这不仅会进一步推高石油危机,也可能把美国直接拖入一场它原本并不想真正承受的长期冲突。从回报来看,这几乎是一次极其鲁莽的豪赌。

现实是,美国国内对这种战争的耐受度,远没有特朗普想象得那么高。今天的美国社会,对海外战争的容忍度早已不复昔日。公众不愿接受长期消耗,更无法容忍不断上升的油价、市场动荡,人员伤亡。也就是说,特朗普最可能的结局,不是彻底取胜,而是在代价迅速上升之后选择退场。

抛开这些问题,伊朗在这次冲突中向世界证明了一件事:真正能够保障自身安全的,不是克制,而是核武器。过去几年,伊朗已经多次遭受以色列与美国主导的军事打击。对于这个政权而言,如果不想在未来几个月或几年内再次陷入同样境地,那么最有说服力的自保逻辑,就是尽快提升核威慑能力。即使外部情报与打击能力再强,也未必能彻底摧毁伊朗的核潜力;相反,这场战争反而会把“拥核求生”的逻辑推得更加牢固。更危险的是,其他国家也会从中得出类似结论:在一个越来越不稳定的世界里,真正能防止外部打击的,也许不是国际规则,而是足够强的威慑能力。

而特朗普最难修复的损失,并不只是油价、战损或地区局势,而是美国信誉的进一步流失。世界会记住的,不只是这场战争本身,更是美国政府在尚有其他选项时,依然主动选择动武的方式。战争本应是穷尽外交、威慑、谈判与制裁之后的最后手段,但特朗普给外界留下的印象,却更像是沉迷于展示“杀伤力”和强硬姿态。这样的选择,也许能制造一时的震慑,却会长期侵蚀美国作为理性领导者的可信度。

所以,特朗普真正面对的,不是一场能否赢下的战争,而是一场他很可能无法体面收场的战争。他可以宣布胜利,却无法保证世界买账;他可以选择撤出,却无法阻止伊朗在未来继续抬高原油价格;他可以暂时压低战火,却无法消除这场冲突在核扩散、能源安全与全球信任层面留下的长期阴影。从这个意义上说,特朗普不是在掌控战争或是向世界证明我依旧是那个老大哥,而是变成了世界动荡开始的催化剂。

热门话题

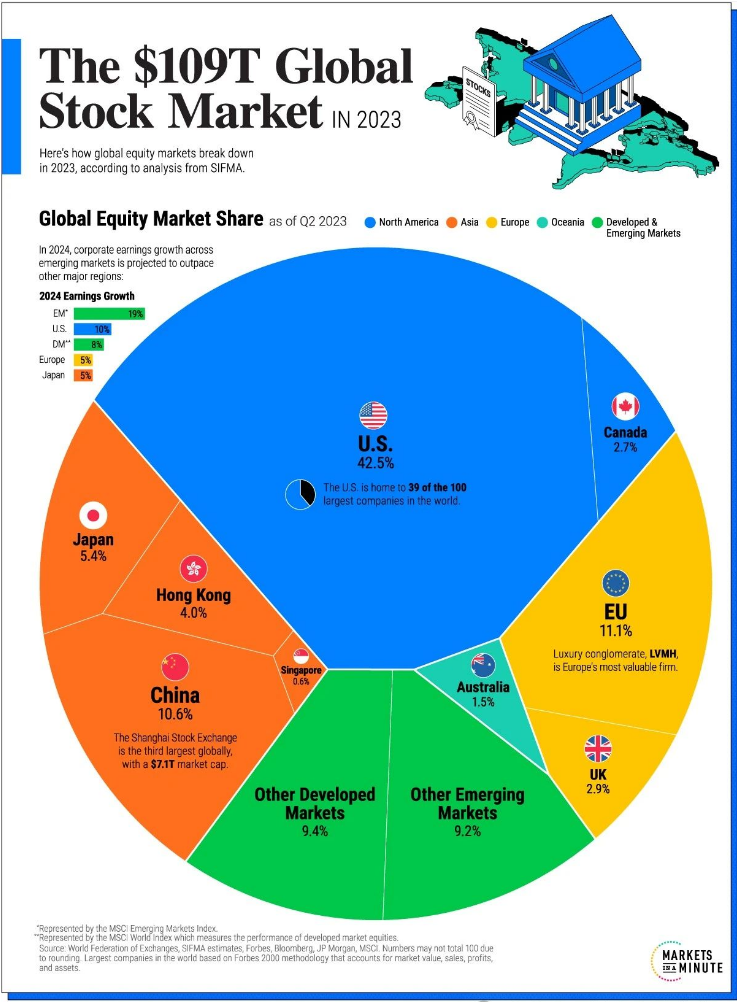

根据日经2024的最新统计: 美国企业的合计总市值正在接近全球整体的5成,创出了约20年来的最高水平。在全球整体总市值中的占比达到48.1%中国企业占全球总市值的份额目前降至10%左右,2015年6月曾一度上升至近2成,不断下跌的A股和港股,给看好中国的投资人带来了深深的伤害。

24年初的A股和港股一路暴跌,市场充斥着失望,绝望的哀嚎。面对已经连续三年大跌的中国A股,连续四年大跌的港股,这几年有多难,想必只有局中人才知道,即使对经济再有信心的人,也无法承受无底线的下跌,今年一月,市场下杀突然加速了,中国中小盘股票平均跌幅在30%,港股中小股也是纷纷再创低点,反观全球其他各国屡创新高,可以说,中国已经陷入了GUZAI和流动性危机,目前恒生指数市盈率略高于7倍,创下40年来最低水平,也远低于全球股市。可以说,港股某种程度上已经陷入了市场下跌、流动性萎缩和估值下降的恶性循环,恒生AH股溢价指数高达151%,创下十年新高,从而对A股市场估值产生了直接的向下带动,以至于跌到没有信心,越出利好越跌,跌到不再相信股市跌出系统性风险出现的时候,市场的预期就会自我实现,现在的救市,也是迫在眉睫了,那救市会有用吗?历史上有哪些救市案例: 2015-2016年期间,中国股市经历了严重的动荡。这一时期的特点是散户投资者参与激增所驱动的快速牛市,仅在2015年前五个月就新开设了3000多万个账户。经验不足的投资者、投机交易和杠杆收购的结合导致了高度波动的市场环境。2015年6月12日到7月3日早盘,仅仅13个交易日,沪指暴跌近30%。2015年7月3日,证监会召集21家证券公司(以上市券商为主)召开紧急会议,决定各券商以2015年6月底净资产15%出资,合计不低于1200亿元,用于投资蓝筹股ETF。这1200亿在7月6日11点前到位,开盘由证金公司垫资入市,市场才开始止跌企稳,当然后来还又创下新低。当时来说,救市是成功的,给了市场流动性避免了更严重的踩踏。

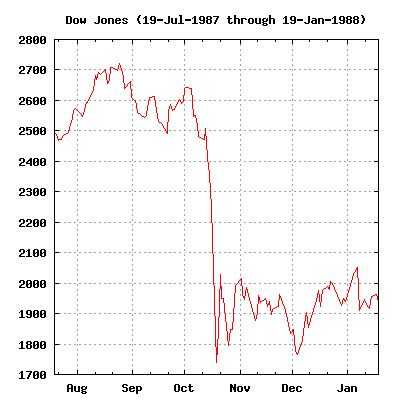

1987年10月19日(黑色星期一),美国道琼斯指数重挫508.32点,跌幅达22.6%。“股价下跌—抛售—流动性出问题—加速卖出—股价暴跌”这样的恶性循环,同样在1987年的美股市场上演。从历史上来看,美国的这次救市,被认为是比较成功的。10月20日开盘前,美联储发表紧急声明,美联储准备就绪为支撑经济和金融体系提供流动性,支持商业银行为券商发放贷款,为上市公司提供回购股票资金。同时,美联储通过大量购买政府债券的方式压低利率,提供充足流动性。10月20日,芝加哥商品交易所、期货交易所暂停交易,阻止股指期货、商品期货给市场带来的恶性循环。美国政府、美联储、美国证监会、银行业的组合拳,使得市场恐慌情绪迅速得以缓解,市场逐步恢复,成为一个救流动性的典范。政府及时大力救市、提供流动性、降息、保证续贷、公司回购、熔断机制。恐慌情绪缓解、未从股灾演变成金融和经济危机、美股再创出新高。

中国大力救市能成功吗? 信心没有了,才是真的没有了,史诗级的买盘的救市,要能起到维稳市场,扭转信心。Austin认为:短期来看,打破暴跌恶性循环,会有效果;长期来看,救市要做的是改革,否则难以持续。举个例子,中国股市被诟病的是融资市场,不是真投资市场,易会满就任1760天, IPO数量1860家,平均每天1.08家;IPO募资22000亿,平均每天募资12.6亿。他是任期内新股发行最快、数量最多、募资数额最大的一届。学美股搞IPO注册制,搞成注水制,融资全球第一投资回报倒数第一,将限售股出借转融通,大小非变相减持,放任券商搞衍生雪球产品,不严厉打击上市公司造假,这些才是毁掉股市生态和投资人信心的点。所以长期来说,还是要看改革,单纯地更换了新的证监会主席,只是解一时之急。至于一直都知道的几个中国股市的其他下跌影响因素,如美元加息,外资逃离,地方债的大窟窿,房地产硬着陆,新经济产能过剩,这些在跌了好几年的市场里面,该预期的也都计价了。真的要考虑的是实实在在的做点改革,给中国的老百姓留个活路,给点阳光,A股市未来才有希望今天是除夕,我们GO Markets全体祝您在龙年财源滚滚,龙行龘龘,前程朤朤。

Markets enter the new week with risk-on firmly the narrative with all three major US indexes hitting all-time highs last week. In FX markets, the positive market sentiment has seen the march higher in the US Dollar hit resistance and cyclical currencies AUD, NZD and GBP bounce. Ahead this week, traders have a slew of risk events to navigate with Central Bank meetings in Canada, Japan and Europe set to headline, also some big US data in Q4 GDP and the PCE inflation reading set to move FX markets.

Charts to Watch USDCAD – Bank of Canada set to hold after hot CPI A hotter than expected December inflation reading out of Canada presumably will make any meaningful dovish shift from the BoC very unlikely in this week’s policy meeting with markets fully pricing in a hold from the central bank. The 2024 rally in USDCAD hit resistance at the 50% fib level last week and pulled back sharply to test the lower trend line support late in the week. Key levels to watch will be the 50% fib level to the upside (1.3541) if the Bank does confound analysts and take a dovish turn.

If the bank strikes a hawkish tone then the trendline support followed by the big figure at 1.34 to the downside. EURUSD – to pushback or not pushback In December’s policy meeting the ECB basically announced the end of the current rate hiking cycle. Since then markets have priced in an aggressive trajectory of ECB rate cuts this year against the backdrop of a slowing EZ economy.

Are the markets being too dovish in their predictions? This weeks ECB meeting may settle it if we see a hawkish pushback, or no pushback at all. EURUSD set new 2024 lows last week, breaking the key 1.09 support level, which has now turned into resistance.

This will be a key level to watch this week to see if it can re-establish itself as support, or continue as a cap to the upside. USDJPY - BoJ to maintain YCC No surprises are expected from the BoJ on Thursday, with the bank look set to maintain its YCC policy and negative short-term rate policy. It’s more likely any policy shift will come after the March annual wage negotiations, though the BoJ have been known to surprise before.

USDJPY has risen sharply in 2024, at these levels it does look a little overbought as it has streaked ahead of the US10Y-JP10Y yield differential which has been the main driver of this pair in recent past. We are also approaching the 150 level, where chatter of intervention may start up. The weeks full calendar at the link below: https://www.gomarkets.com/au/economic-calendar/

TSLA comes into Wednesdays Q4 earnings report having taken a beating so far is 2024, with the stock price down almost 16% in the first 4 weeks of the new year. Q4 was a quarter that saw the company’s deliveries trend higher, driven by stronger sales of its entry-level vehicles following price cuts, an upside surprise may be on the cards lending relief to stockholders after a big miss in Q3 earnings. Earnings reports for Tesla have been volatile to say the least as mixed results are apparent in the past four quarterly earnings reports, where we have seen two beats and two misses.

For this earnings report, the company is expected to report the same earnings per share (EPS) as Q3, where they missed by 17%, seeing TSLA stock drop around $20 as a result. Looking at the chart TSLA has been trading in a descending channel since August 2023 with a support zone possible between the October ’23 lows of 194.62 and the bottom of the channel around 180.71 if TSLA has another miss. To the upside on a beat the support/resistance level at 232.20 would be the level to watch.

Downside could also be limited by the extreme oversold reading we already see on the daily RSI indicator. Another positive sign for the bulls is skew in the options market currently, with equidistant options from the stock price to the downside (puts) and upside (calls) showing a higher price for calls, while this doesn’t mean the stock price is going higher, it does indicate that options traders are in the belief that a big move to the upside is slightly more likely. TSLA is due to release Q4 earnings after the US market close on Wednesday 24 th of January where they are expected to report earnings-per-share (EPS) of $0.73 on $25.76 billion in revenue.

World’s second largest semiconductor company, Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), reported the latest results for Q4 of 2023 before the opening bell in Wall Street on Thursday. TSMC achieved revenue of $19.785 billion in Q4 2023 vs. $19.675 billion expected.

Revenue rose by 14.4% from Q3. Earnings per share was reported at $1.456 per share, which exceeded estimate of $1.385 per share. Company overview Founded: 1987 Headquarters: Hsinchu Science Park, Taiwan Number of employees: 73,090 (2022) Industry: Semiconductor Key people: Mark Liu (Chairman), C.C.

Wei (CEO and vice-chairman), Wendell Huang (VP and CFO) CEO commentary "Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology. Moving into first quarter 2024, we expect our business to be impacted by smartphone seasonality, partially offset by continued HPC-related demand," Wendell Huang, CFO of the company said in statement to investors. Stock reaction The stock rose by over 7% during Thursday’s session after the company posted the latest results, trading at $110.32 a share.

Stock performance 5 day: +9.03% 1 month: +7.62% 3 months: +18.78% Year-to-date: +6.12% 1 year: +24.84% Taiwan Semiconductor Manufacturing stock price targets TD Cowen: $95 Barclays: $105 Needham & Company LLC: $115 Susquehanna: $130 Taiwan Semiconductor Manufacturing Co. Ltd. is the 11th largest company in the world with a market cap of $570.66 billion. You can trade Taiwan Semiconductor Manufacturing Co.

Ltd. (NYSE: TSM) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Taiwan Semiconductor Manufacturing Co.

Ltd., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Prologis Inc. (NYSE: PLD) announced reported its latest financial results before the market open in the US on Wednesday. The largest real estate company in the US reported revenue of $1.756 billion for Q4 of 2023. Revenue missed analyst estimate of $1.85 billion.

Earnings per share (EPS) reported at $0.68 per share, above $0.588 per share expected. Company overview Founded: 1983 Headquarters: San Francisco, California, United States Number of employees: 2,466 (2022) Industry: Real estate Key people: Hamid Moghadam (Chairman and CEO), Dan Letter (President), Gary Anderson (COO), Tim Arndt (CFO) CEO commentary "We closed 2023 adding another year of exceptional performance. I couldn't be more proud of our team," CEO of the company, Hamid Moghadam said in a press release to investors.

Moghadam also highlighted challenges for the company for the year ahead: "While uncertainties remain in the economic and geopolitical environment, we are positive about the outlook for 2024. We remain focused on executing the strategy outlined at our recent Investor Forum to drive significant value from our global scale and continue to be a best-in-class partner to our customers." Stock reaction The stock was down by over 2% on Wednesday, trading at $126.86 a share – the lowest level since 12/12/2023. Stock performance 5 day: -5.01% 1 month: -2.77% 3 months: +21.54% Year-to-date: -4.83% 1 year: +3.43% Prologis stock price targets Mizuho: $130 JP Morgan: $148 Scotiabank: $143 Truist Financial: $120 Stifel Nicolaus: $130 Raymond James: $130 Barclays: $153 Evercore ISI: $125 BNP Paribas: $141 Morgan Stanley: $128 UBS Group: $144 Goldmans Sachs: $170 BMO Capital Markets: $145 Prologis Inc. is the 118th largest company in the world with a market cap of $117.21 billion.

You can trade Prologis Inc. (NYSE: PLD) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Prologis Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

World’s largest consumer goods company, Procter & Gamble Company (NYSE: PG), announced second quarter of fiscal year 2024 results on Tuesday. The company achieved revenue of $21.441 billion for the quarter (up by 3% year-over-year), slightly short of Wall Street estimate of $21.476 billion. Earnings per share reached $1.84 per share (up by 16% year-over-year), which was above analyst estimate of $1.697 per share.

Company overview Founded: October 31, 1837 Headquarters: Cincinnati, Ohio, United States Number of employees: 27,560 (2023) Industry: Consumer goods Key people: David S. Taylor (Executive Chairman), Jon R. Moeller (President and CEO) CEO commentary ''We delivered strong results in the second quarter, enabling us to raise our core EPS growth guidance and maintain our top-line outlook for the fiscal year,'' CEO of the company, Jon Moeller, said in a press release to investors. ''We remain committed to our integrated strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organization.

The P&G team’s execution of this strategy has enabled us to build and sustain strong momentum. We have confidence this remains the right strategy to deliver balanced growth and value creation,'' Moeller added. Stock reaction The latest results had a positive impact on the stock in Tuesday’s session.

Shares were up by 4.39% at $154.35 a share – the highest since 14/9/2023. Stock performance 5 day: +2.99% 1 month: +5.71% 3 months: +2.92% Year-to-date: +5.28% 1 year: +8.78% Procter & Gamble price targets JP Morgan Chase & Co.: $162 Barclays: $160 Jefferies Financial Group: $177 DZ Bank: $155 Wells Fargo & Company: $162 Stifel Nicolaus: $151 Sanford C. Bernstein: $153 HSBC: $179 Bank of America: $175 Morgan Stanley: $174 Deutsche Bank: $173 Royal Bank of Canada: $167 Truist Financial Procter & Gamble Company is the 22nd largest company in the world with a market cap of $363.71 billion, according to CompaniesMarketCap.

You can trade Procter & Gamble Company (NYSE: PG) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to "Trading" then select "Share CFDs". GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours? Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Procter & Gamble Company, TradingView, MarketWatch, MarketBeat, CompaniesMarketCap