市场资讯及洞察

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

The Tesla earnings release can act as a barometer for both global EV demand and capital-intensive innovation across automation and energy systems.

Vehicle deliveries and margins are likely to be the primary near-term drivers of sentiment. Investors will also be watching updates across adjacent initiatives that may influence longer-term growth expectations.

Autonomy and software (FSD)

Tesla’s “Full Self-Driving” (FSD) is a branded advanced driver-assistance feature sold in some markets and requires active driver supervision; availability and capabilities vary by jurisdiction.

Further rollout and any expansion of autonomy-linked services remain subject to regulatory approvals and continued evolution of the underlying technology.

Energy generation and storage

Solar, Powerwall and Megapack remain a key focus, particularly given the segment’s recent growth contribution.

Robotics (Optimus)

Optimus remains early stage, with no disclosed revenue contribution to date. It may become more relevant to Tesla’s longer-term AI and automation aspirations.

Expectations remain delicately balanced between near-term margin pressure, the impact of demand and interest rate movements, and longer-term product and platform developments.

What happened last quarter?

In Q3 2025 (September quarter), Tesla reported mixed results versus consensus expectations. Revenue and deliveries reached record levels, while earnings and margins remained under pressure amid pricing and cost dynamics.

Tesla said it was navigating a challenging pricing environment while continuing to invest for long-term growth (as referenced in the shareholder communications cited below).

Last earnings key highlights

- Revenue: ~US$28.1 billion

- Earnings per share (EPS): ~US$0.50 (non-GAAP, diluted)

- Total GAAP gross margin: ~18.0%;

- Operating margin: ~5.8%

- Free cash flow (FCF): ~US$4.0 billion

- Vehicle deliveries: ~497,099 units, up ~7% year on year (YoY)

How did the market react last time?

Tesla shares were volatile in after-hours trading, with attention focused on margins relative to revenue.

What’s expected this quarter?

As of mid-January 2026, third-party consensus estimates (Bloomberg) indicated continued focus on revenue growth alongside profitability and margin resilience. These are third-party estimates, not company guidance, and can change.

Key consensus reference points include:

- Revenue: market expectations ~US$27 billion to US$28 billion

- EPS: consensus clustered near US$0.55 to US$0.60 (adjusted)

- Deliveries: market estimates ~510,000 to 520,000 vehicles

- Margins: focus on whether automotive gross margin stabilises near recent levels or trends lower

- Capital expenditure (capex): focus on spending discipline and efficiency rather than acceleration

*All above points observed as of 16 January 2026.

Key areas markets often focus on include:

- Profit margin trajectory, and whether cost efficiencies are offsetting pricing pressure

- Delivery volumes relative to consensus expectations

- Pricing strategy and evidence of demand elasticity across regions

- Capex and implications for future FCF

- Progress in energy storage and non-automotive revenue streams

- Commentary on AI, autonomy and longer-term investment priorities

Expectations

Market sentiment could be described as cautiously optimistic, with investors weighing revenue momentum against margin concerns.

Price has pulled back into a range following a brief test of recent highs in December. Given the recent range-bound price action, deviations from consensus across key earnings metrics may prompt a larger move in either direction.

Listed options were pricing an indicative move of around ±5.5% based on near-dated options expiring after 28 January and an at-the-money (ATM) options-implied expected move estimate.

Implied volatility (IV) was about 47.7% annualised into the event, as observed on Barchart at 11:30 am AEDT on 16 January 2026 (local time of observation).

These are market-implied estimates and may change. Actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Tesla’s earnings may influence near-term sentiment across US growth and technology indices, with potential flow-through to broader risk appetite.

For Australian markets, any read-through is often framed through supply chain sensitivity. Market participants may look to related sectors such as lithium and rare earth producers linked to EV inputs are one potential channel, alongside broader sentiment impacts from Tesla’s innovation commentary.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

热门话题WeWork 破产,投资WeWork的故事为什么不靠谱?WeWork Inc. 从未弄清楚如何赚钱。但创始人Adam Neumann仍是亿万富翁,哪怕如今已经破产,身价仍然为 17 亿美元。WeWork拥有190亿美元的负债和150亿美元的资产。包括软银集团公司和愿景基金在内的长期投资者将进一步增加在该合资企业中承受的巨额损失。WeWork Inc.周三首次出现在破产法庭,启动了长达数月的程序,且该公司无力偿还超过40亿美元的借款。

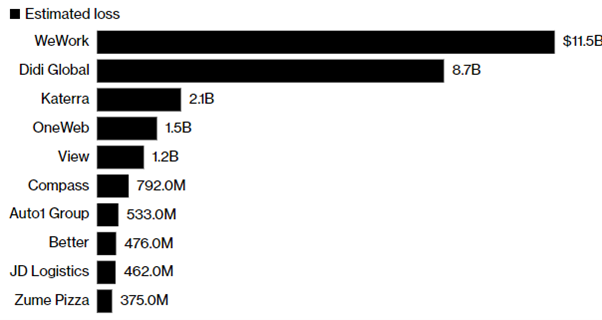

2019年,公司估值达到470亿美元,成为当时美国估值最高的创业公司。但是,他提供的服务却并没有很强的稀缺性。商业物业办公租赁。并且,该模式需要大量现金流,一旦现金流为负,很容易倒闭。2021年,WeWork营收25.7亿美元,净亏损约为44.4亿美元,2022年营收约32. 5亿美元,净亏约22.9亿美元。此前WeWork通过与一家收购公司合并上市时,诺伊曼拥有23 亿美元的财富,其中近三分之一持有 WeWork 股票。但之后,它们的跌幅已超过 99%。咱也不知道,为什么机构这么看好这家公司,还是说只是一个击鼓传花的游戏。大鱼吃小鱼,软银为了营造一个繁荣的IPO项目。在经济不景气的这几年,WeWork有很多大笔支出,其中包括 1.85 亿美元的竞业禁止协议、1.06 亿美元的和解付款以及诺伊曼旗下 We Holdings 向软银出售股票所获得的 5.78 亿美元。同时,孙正义为WeWork提供了高额贷款和担保。WeWork 的破产给亿万富翁孙正义创立并领导的软银造成了约 115 亿美元的股权损失,另外还有 22 亿美元的债务悬而未决。一笔生意亏了上百亿美金。孙正义在WeWork身上亏掉了106亿美元,他还在滴滴身上也亏掉了110亿美元。连续的大额亏损也让他的投资能力受到质疑。孙正义旗下基金亏损情况:

而对于创始人Adam来说,从2022年8月开始,重点就放在新的项目Flow上面,将经营多户住宅物业,旨在培养主人翁感和社区感。从商业地产回归到住宅地产。并成功获得10亿美金风投。作为一家上市公司,WeWork从未实现盈利,净亏损总计 30 亿美元。他的出发点是承诺提供一个与同事共度时光的有趣空间,提供桶装啤酒、乒乓球桌和大量舒适的休闲空间,供人们喝酒吹牛。但很明显,对于社交属性来说,为WeWork买单的公司并不多。在澳洲,也有几家WeWork的地点,但并没有招满公司。而WeWork的竞争对手也很多,其中不少先后破产或跑路。原因在于疫情之后,商业物业的青睐程度下降。很多人和企业开始Work from home,居家办公。同时远程办公开始流行。这件事情很难靠谱的原因就在于,成功只有一种情况,而每一个因素的变化,都会导致公司快速亏损:经济衰退、居家办公、利率上涨、竞争出现。而这四个因素在疫情后快速出现。作为“二房东”的WeWork,首当其冲承受了所有,但是不见得他的客户们,也有充足的租金继续在WeWork办公。因为WeWork的群体并不是中大型公司,这些中大型公司都有自己独立的办公室。比如GO Markets,在墨尔本有两层办公室,在悉尼也是独立海景办公室。因为中大型公司是不会share分享办公场地的,需要有一定的保密性和正规性。什么样的人会在WeWork办公呢?sole trader或者IT服务类的会在WeWork办公,也就是本来就是可以work from home的人会选择WeWork。但是疫情后,澳洲居家办公可以抵扣税务,同时上涨的房租或者利率,让大家不愿意拿闲钱再去租一个工位或者小办公室,很多时候谈事情,在咖啡店就可以了。所以,WeWork的倒闭是时间问题,除非一直有资金输血。我们在做股票投资的时候,优先要投资未来有成长正现金流的生意,孙正义失败也在于他过于依赖于估值游戏,忽略了投资本身的核心:公司是要赚钱的。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

The USD has remained bid today heading into today’s pivotal US CPI where both the headline M/M and Y/Y figures are expected to show an increase over Julys readings. This is the last major inflation figure before next weeks FOMC meeting where the Fed is widely expected to hold rates (Fed Funds futures pricing in only a 7% chance of a 25bp hike). A beat on CPI today is unlikely to sway the rate hike odds much but it will cast doubt on any narrative that the Feds work on inflation is done.

A CPI coming inline with expectation or higher will likely see a reasonably hawkish FOMC statement and presser, where despite unchanged rates, the Fed may give a dot plot projection indicating one more hike this year. DXY has rallied in today’s session after yesterday’s whipsawing price action, with the upward trendline holding as support. US 10-year yields have also rallied to move towards the August highs as traders brace for a higher CPI and more hawkish Fed as a result, higher yields also a tailwind for the USD.

Headwinds for the DXY will be the 105+ resistance zone which has capped further gains in DXY for the last 12 months, also 10-year yields in the recent past finding a lot of resistance when over the 4% level.

Li Auto Inc. (NASDAQ: LI) released Q3 results before the market open in the US on Thursday. Let’s take a look at how the Chinese company performed. Company overview Founded: 2015 Headquarters: Beijing, China Number of employees: 19,396 (2022) Industry: Automotive Key people: Li Xiang (Chairman and CEO), Yanan Shen (President), Tie Li (CFO) The results World’s 12th largest automaker reported revenue of $4.749 billion for Q3 (up by 271.2% year-over-year), above analyst estimate of $4.581 billion.

EPS reported at $0.449 per share vs. $0.368 per share expected. The electric vehicle company delivered 105,108 cars in the previous quarter – up by 296.3% from the same period in 2022. Li Auto has delivered 284,647 vehicles so far this year.

CEO commentary "In response to the evolving market demand in the third quarter, we continued to strengthen synergies across production, supply, and sales, while enhancing our production capability. With these efforts, we achieved a number of breakthroughs across our delivery performance during the quarter, becoming China’s first emerging new energy automaker to reach the milestone of 500,000 cumulative deliveries. Each of our three Li L series models recorded over 10,000 monthly deliveries for three consecutive months since August, maintaining our position as the sales champion among SUVs and NEVs priced over RMB300,000 in China.

As we further expand our business scale, we will continue to maintain our profitability at a healthy level, while investing in research and development to propel the long-term growth of our business," Chairman and CEO of Li Auto, Li Xiang said in a press release to investors. The stock was down by around 2% on Thursday despite posting better-than-expected results. Shares of Li Auto are up by 118.68% in the past year at $38.28 a share.

Stock performance 1 month: +10.41% 3 months: -11.16% Year-to-date: +86.62% 1 year: +118.67% Li Auto price targets B of A Securities: $60 Barclays: $48 Citigroup: $54.3 HSBC: $36 Jefferies: $20.66 Li Auto Inc. is the 453rd largest company in the world with a market cap of $38.17 billion, according to CompaniesMarketCap. You can trade Li Auto Inc. (NASDAQ: LI) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time. Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: Li Auto Inc., TradingView, MarketWatch, CompaniesMarketCap, Wikipedia, Benzinga, Macrotrends

The recent surge in gold prices, following recent events in the Middle East and the declining US Dollar (DXY), raises the question: Is this the end of the bull run for Gold (XAU/USD)? Gold started rising earlier this month after rejecting the price level of 1815.00. Since then, it has steadily climbed back to its previous peak of 1984.00, a resistance point that was notably challenging to breach in July.

This recent surge in gold prices, due in part to recent events in the Middle East, is attracting more bullish activity in the gold market. Simultaneously, the declining value of the US Dollar (DXY) has contributed to the upward movement of gold prices. Where can we see gold go in the near future?

In the market, assets tend to move in one of three directions: up, down, or sideways, often referred to as consolidation. Given that gold has reached its previous peak, it may seek potential support, which appears to be around 1930-1931. Concurrently, the US Dollar is experiencing a decline in value.

If gold manages to surpass the resistance at 1984.00, the next hurdle could be at 2060.00. This level is evident on the daily timeframe, where the price has approached 2060 on multiple occasions, only to be rejected. What about the DXY and XAU/USD?

The relationship between DXY (Dollar Index) and gold (XAU/USD) is intricate. Sometimes, when the dollar index is declining, the price of gold tends to move sideways or increase. However, examining larger time frames like the 4-hourly or daily charts reveals an inverse pattern of rejection and price rise between these two markets.

It's important to note that gold's movements are not solely dependent on the USD; other significant factors, including news, social and geo-political events can also play a substantial role in influencing its price fluctuations. Why is gold so important? Apart from its physical shine and the enduring symbolic connection with wealth seen throughout human history, gold holds significance as a historically reliable store of value and a means of exchange.

Unlike many other commodities, gold does not diminish or get depleted, giving it a timeless sense of worth. It can act as a safeguard against the erosion of currency value caused by inflation, prompting numerous investors to view gold as an alternative asset and a method of preserving their wealth. How can I trade gold?

At GO Markets, we provide Metal CFDs for trading, offering not only gold but also silver and copper futures. Our goal is to deliver an exceptional trading experience to our clients. We take pride in offering one of the best online trading platforms for gold, silver, and copper futures, in addition to providing access to FX, Soft Commodities, Shares, and Indexes, enabling our clients to diversify their investments across various financial markets.

The Walt Disney Company (NYSE: DIS) reported its fourth quarter and full fiscal year 2023 results ending September 30, 2023, after the market close in the US on Wednesday. Company overview Founded: October 16, 1923 Headquarters: Team Disney Building, Walt Disney Studios, Burbank, California, United States Number of employees: 220,000 (2022) Industry: media, entertainment Key people: Mark Parker (chairman), Bob A. Iger (CEO) The results World’s third largest entertainment company reported revenue of $21.241 billion for the quarter (up by 5% year-over-year), narrowly missing analyst estimate of $21.369 billion.

Revenue for the full year reached $88.898 billion, an increase of 7% from the previous year. Earnings per share reported at $0.82 per share, above analyst estimate of $0.71 per share. EPS for the full year reached $3.76 per share.

Disney+ added 7 million core subscribers during the previous quarter. CEO commentary "Our results this quarter reflect the significant progress we’ve made over the past year," Robert A. Iger, CEO of Disney commented on the latest results. "While we still have work to do, these efforts have allowed us to move beyond this period of fixing and begin building our businesses again.

We have a solid foundation of creative excellence and innovation built over the past century, which has only been reinforced by the important restructuring and cost efficiency work we’ve done this year, and we’re on track to achieve roughly $7.5 billion in cost reductions. Combined with our portfolio of valuable businesses, brands and assets – and the way we manage them together – Disney has a strong hand that differentiates us from others in our industry." "As we look forward, there are four key building opportunities that will be central to our success: achieving significant and sustained profitability in our streaming business, building ESPN into the preeminent digital sports platform, improving the output and economics of our film studios, and turbocharging growth in our parks and experiences business. We have already made considerable advancements in these four areas and will continue to move forward with a sense of purpose and urgency, and I’m bullish about the opportunities we have before us to create lasting growth and increase shareholder value," Iger concluded.

The latest results had a positive impact on the stock in the after-hours trading. Shares were up by around 3%.The stock is down by 2.59% in the past year at $84.50 per share. 1 month: -0.41% 3 months: -3.42% Year-to-date: -2.74% 1 year: -2.59% Walt Disney price targets JP Morgan: $120 Seaport Global: $93 Bernstein: $103 Rosenblatt: $103 B of A Securities: $110 Truist Securities: $105 Raymond James: $97 Wells Fargo: $110 Goldman Sachs: $136 Deutsche Bank: $135 Walt Disney is the 68th largest company in the world with a market cap of $154.61 billion, according to CompaniesMarketCap. You can trade The Walt Disney Company (NYSE: DIS) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs. Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time. Why trade during extended hours?

Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours Reduce your risk and hedge your existing positions ahead of a new trading day Extended trading hours on popular US stocks means extended opportunities Sources: The Walt Disney Company, TradingView, MarketWatch, CompaniesMarketCap, Wikipedia, Benzinga

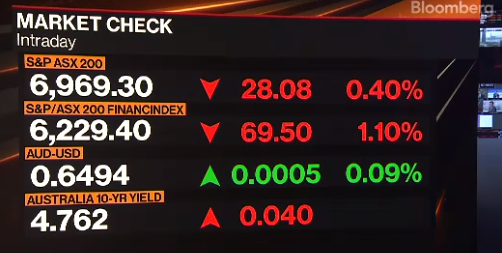

热门话题最近澳洲的消息有点多:第一件事,是澳大利亚总理Albanese 在北京会见中国国家主席。标志着中澳关系出现缓和,未来中国澳洲的华人们福利多多,贸易旅游往来也会逐渐恢复。Albanese成为7年来首次访问中国的国家领导人。中澳总理年度会晤联合成果声明:双方欢迎恢复中澳高级别对话。第二件事,就是澳洲加息了。澳洲加息这件事情,在三四个月之前,我就一直在强调,澳洲至少还有一次加息。大家可以通过Youtube搜索GO Markets找到Jacky过去的视频,就可以看到。为什么加息呢?逻辑很简单,圣诞节之前,得来这么一次。如果痛是一定要发生的,就让痛来得快一点,而不是一直悬在脑袋上。Michele在上任的第一个月,还没有时间加息,而12月是圣诞节,更不可能了。12月加息就会影响大部分有房产朋友的心情,好不容易躺在沙滩上度假,结果打开手机发现,过节的时候,澳洲加息了,瞬间假期不香了,加息导致旅游经费超出预算了。所以,11月是最好的选择。加息后,澳洲股市下跌,最多下跌超1%,收盘时下跌0.3%左右。

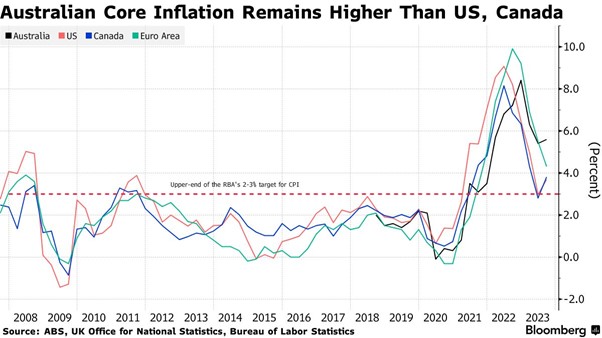

好消息是什么呢?大部分人认为这是澳洲最后一次加息,主要目的还是在高消费旺季的圣诞节到来之前,把通胀压一压,防止通胀反弹。自2022 年 5 月以来,澳洲联储已加息13 次。那么为什么之后加息的概率很低呢?主要还是跟政治有关。工党政府在中期民调中民调下滑,正在努力控制加息对房主的影响,同时承认需要抑制通货膨胀。这本身就很矛盾。所以,就像我们做交易,你入场了,亏了,是继续加仓,还是多等一段时间?目前澳洲央行就是,正在通过加息做空通胀,稍微加加仓,加个0.25%,让子弹飞一会,静待通胀下跌。澳洲联储正在努力确保通胀在 2025 年底前回落至 2-3% 的目标范围内。

在一系列强于预期的通胀和零售销售报告迫使澳大利亚央行采取行动后,周二央行将现金利率提高了四分之一个百分点至4.35%,这是五个月来的首次政策举措。这是行长米歇尔·布洛克 (Michele Bullock) 领导下的首次加息,现金利率升至 2011 年以来的最高水平。同时暗示进一步收紧政策的障碍更大,从而推低了澳元。甚至部分彭博经济学家预测,未来澳联储的行动是降息。而澳洲房地产市场已反弹至接近历史高位,零售额增幅超出预期,商业信心依然强劲。人口激增也对经济有帮助,这增加了对住房、交通和外出就餐等各方面的需求。所以,未来的加息可能性还是存在的。我们再来看美国美联储的态度,昨晚美联储理事鲍曼:我仍然预计我们需要进一步提高联邦基金利率。尽管如此,他也承认通胀有望回到3%以下,同时就业和经济开始疲软。所以本质上来说,美国保留了加息的可能性,但是不再坚定的加息。而是给通胀反弹留了一个后手。意思就是,通胀反弹到没办法控制,我还是加息。但是,目前来看,还不错。所以,相比于美国,澳洲未来继续加息的概率低于美国,对于金融市场买预期卖事实来说,澳币冲高回落也在合理范围内。在过去几周里,加息预期不断升温,使澳元在 G10货币中大幅上涨。市场的定价不仅是今天加息,还包括在本轮周期内再次加息。然而,澳洲联储的声明未能证实这种鹰派立场,而是采用了依赖数据的方法来评估进一步紧缩的需求。

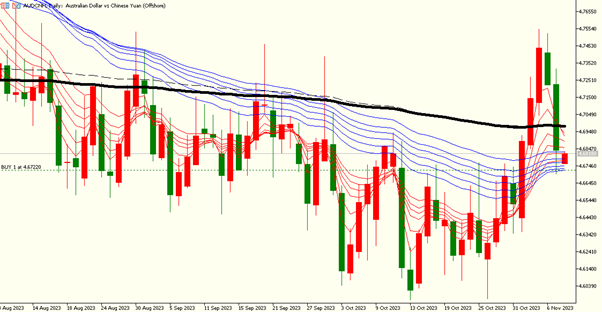

AUDCNH价格回落到4.7下方,再次迎来底部建仓机会免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管