市场资讯及洞察

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

The Tesla earnings release can act as a barometer for both global EV demand and capital-intensive innovation across automation and energy systems.

Vehicle deliveries and margins are likely to be the primary near-term drivers of sentiment. Investors will also be watching updates across adjacent initiatives that may influence longer-term growth expectations.

Autonomy and software (FSD)

Tesla’s “Full Self-Driving” (FSD) is a branded advanced driver-assistance feature sold in some markets and requires active driver supervision; availability and capabilities vary by jurisdiction.

Further rollout and any expansion of autonomy-linked services remain subject to regulatory approvals and continued evolution of the underlying technology.

Energy generation and storage

Solar, Powerwall and Megapack remain a key focus, particularly given the segment’s recent growth contribution.

Robotics (Optimus)

Optimus remains early stage, with no disclosed revenue contribution to date. It may become more relevant to Tesla’s longer-term AI and automation aspirations.

Expectations remain delicately balanced between near-term margin pressure, the impact of demand and interest rate movements, and longer-term product and platform developments.

What happened last quarter?

In Q3 2025 (September quarter), Tesla reported mixed results versus consensus expectations. Revenue and deliveries reached record levels, while earnings and margins remained under pressure amid pricing and cost dynamics.

Tesla said it was navigating a challenging pricing environment while continuing to invest for long-term growth (as referenced in the shareholder communications cited below).

Last earnings key highlights

- Revenue: ~US$28.1 billion

- Earnings per share (EPS): ~US$0.50 (non-GAAP, diluted)

- Total GAAP gross margin: ~18.0%;

- Operating margin: ~5.8%

- Free cash flow (FCF): ~US$4.0 billion

- Vehicle deliveries: ~497,099 units, up ~7% year on year (YoY)

How did the market react last time?

Tesla shares were volatile in after-hours trading, with attention focused on margins relative to revenue.

What’s expected this quarter?

As of mid-January 2026, third-party consensus estimates (Bloomberg) indicated continued focus on revenue growth alongside profitability and margin resilience. These are third-party estimates, not company guidance, and can change.

Key consensus reference points include:

- Revenue: market expectations ~US$27 billion to US$28 billion

- EPS: consensus clustered near US$0.55 to US$0.60 (adjusted)

- Deliveries: market estimates ~510,000 to 520,000 vehicles

- Margins: focus on whether automotive gross margin stabilises near recent levels or trends lower

- Capital expenditure (capex): focus on spending discipline and efficiency rather than acceleration

*All above points observed as of 16 January 2026.

Key areas markets often focus on include:

- Profit margin trajectory, and whether cost efficiencies are offsetting pricing pressure

- Delivery volumes relative to consensus expectations

- Pricing strategy and evidence of demand elasticity across regions

- Capex and implications for future FCF

- Progress in energy storage and non-automotive revenue streams

- Commentary on AI, autonomy and longer-term investment priorities

Expectations

Market sentiment could be described as cautiously optimistic, with investors weighing revenue momentum against margin concerns.

Price has pulled back into a range following a brief test of recent highs in December. Given the recent range-bound price action, deviations from consensus across key earnings metrics may prompt a larger move in either direction.

Listed options were pricing an indicative move of around ±5.5% based on near-dated options expiring after 28 January and an at-the-money (ATM) options-implied expected move estimate.

Implied volatility (IV) was about 47.7% annualised into the event, as observed on Barchart at 11:30 am AEDT on 16 January 2026 (local time of observation).

These are market-implied estimates and may change. Actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Tesla’s earnings may influence near-term sentiment across US growth and technology indices, with potential flow-through to broader risk appetite.

For Australian markets, any read-through is often framed through supply chain sensitivity. Market participants may look to related sectors such as lithium and rare earth producers linked to EV inputs are one potential channel, alongside broader sentiment impacts from Tesla’s innovation commentary.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

热门话题周二(10月31日)交易时段,日央行公布利率决议,维持负利率政策:基准利率在-0.10%不变,仅小幅调整了收益率曲线控制政策(YCC)。

日央行提高了收益率曲线控制政策(YCC)的灵活性,即允许10年期日债收益率升至1%以上。但这一措施不及市场此前预期,使得日元迅速走低。美元/日元上涨势头明显,消息当日上涨1.75%至151.66,一度接近去年10月的最高点151.94。

不久前,市场一直在猜测日本央行是否会对其YCC政策进行调整。一些机构,包括瑞银,曾预测日本央行可能采取更激进的措施来缩小日本与美国之间的利率差距,甚至取消对收益率曲线的控制。今年以来,日元是表现最差的主要货币之一,兑美元汇率下跌了超过13%。尽管如此,疲软的日元和高于目标水平的通胀并没有足以让日本央行下定决心放弃其极度宽松的货币政策。困局:保持货币政策独立性or维稳汇率去年以来,日本一直陷入所谓的“不可能三角”政策困境。这意味着,日本央行必须在低利率下刺激经济和工资型通胀,同时努力维持汇率稳定,以防止输入型通货膨胀侵蚀国内购买力和减缓国内复苏。因此,日本央行面临了两难选择:是保持货币政策独立性还是维稳汇率?显然,日本央行选择保持货币政策独立性。尽管这导致汇率大幅贬值,日本央行坚守其量化宽松政策,坚决捍卫10年期国债收益率上限目标。如果国债收益率大幅上升,政府和私人部门的融资成本都将大幅上升,这可能使过去10年来日本央行采取的量化宽松政策的努力付之东流。日本每年依靠发行大规模国债来刺激经济,而国债总额已占日本国内生产总值的超过250%。如果10年期国债收益率大幅上升,政府融资成本将增加,日本央行资产贬值。此外,国债收益率的失守可能会带来“股债双杀”的风险。尽管今年以来日元汇率大幅贬值,但日本金融市场一直保持相对稳定,日经225股指表现强劲今年以来涨幅实现超20%,而对比澳洲ASX200下跌1.66%。这在很大程度上要归功于宽松的流动性支持。

未来:充分存在调整货币政策的可能性未来,存在调整货币政策的可能性。美银曾指出,在美国利率波动减弱之前,日本政策制定者可能需要采取外汇干预和额外的债券购买等措施来缓解日元和日本国债的疲软。然而,仅仅依靠外汇干预无法持续支撑日元的下跌,日元的走势将主要受美联储货币政策的变化影响,因为这将影响美元汇率,从而影响日元。目前,不断下跌的日元汇率已经给日本央行带来了潜在风险,因为日元的疲软推高了进口商品的成本,这可能导致通胀进一步恶化,不利于日本央行实现其2%的通胀目标。

因此,投资者普遍认为,鉴于经济依然强劲,通胀持续高于目标,日本央行最终将不可避免地采取政策正常化措施。摩根大通预计,日本央行今后可能会采取更积极的态度,最早在明年春季可能会考虑负利率政策的调整。而一旦调整YCC,日元将引来上涨,日本股市也将获得利好。美元/日元在决议公布后迅速走高,目前汇价来到了去年10月高点151附近,多头需关注日线美元/日元能否站稳在150.00关键位置上方。反之,如果美元/日元收于50日均线下方,短期内空头可能会阻碍消息面的利多效应。不过,美元/日元变动将仍主要取决于日本央行会议对货币政策调整程度。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Cecilia Chen | GO Markets 分析师

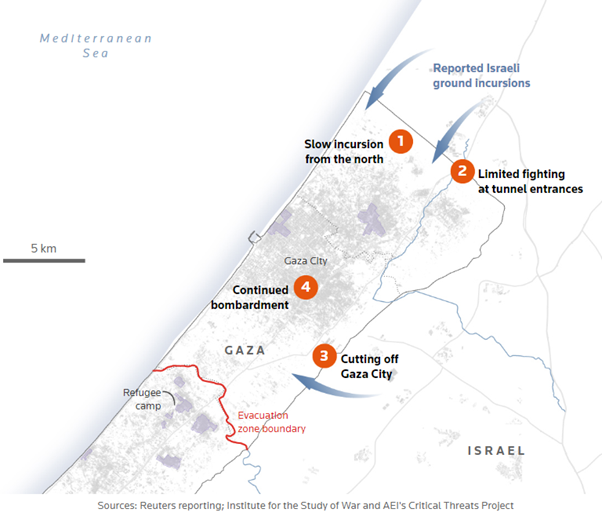

热门话题超过3500名儿童阵亡,我们表示遗憾与愤怒。自10月7日战争爆发以来,死亡人数可能已经超过万人。100多万人流离失所,无家可归。经过三周多的猛烈空袭,以色列地面部队已进入加沙。图中1和2的少量部队,数十辆坦克和装甲运兵车在直升机和无人机的配合下,已开进加沙城北部的半农村地区。同时,图中3的部队,以色列坦克军团停在加沙城以南的道路上,切开加沙地区,将加沙分为南北两部分。

10月19日,胡塞武装向以色列发射了一连串巡航导弹和无人机,五角大楼称这些导弹和无人机在红海被一艘美国驱逐舰拦截,随后也门与沙特边境爆发了冲突。这个组织趁乱介入,可能导致沙特的国家政策发生变化。2019年的时候,胡塞武装使得沙特石油减产超过30%。2015年美国干预也门战争后,胡塞武装开始定期袭击沙特阿拉伯。胡塞武装表示支持巴勒斯坦人并会加入对以色列的袭击。他们声称拥有一种名为“Toufan”的液体推进剂导弹,射程可达 1,350-1,950 公里。随着以色列与哈马斯的战争升级,冲突将蔓延到整个地区,吸引更多敌视以色列的势力加入。有混战加剧的可能性。22日以来,以色列袭击了黎巴嫩和叙利亚。叙利亚与以色列接壤,许多伊朗支持的民兵在该区域活动。而伊朗和美国也有矛盾。10月27日,美国袭击了伊朗伊斯兰革命卫队和伊朗支持的组织在叙利亚使用的两个设施,并空袭了叙利亚。10月30日和31日,火箭弹和两架武装无人机袭击了伊拉克西部的艾因阿萨德空军基地,即美军基地。所以,参与的国家变成了沙特,也门,黎巴嫩,叙利亚,以色列,巴勒斯坦。在对待以色列问题上,美国还是坚定的支持者。不过美国内部也出现分歧,由议长迈克·约翰逊(Mike Johnson)领导的众议院共和党周一公布了一项价值 143 亿美元的以色列援助计划,该计划在如何处理冲突援助问题上与拜登政府分歧。但是不管怎样,美国大概率会通过对以色列的支持法案,只是金额问题。RTX股票走势如下:

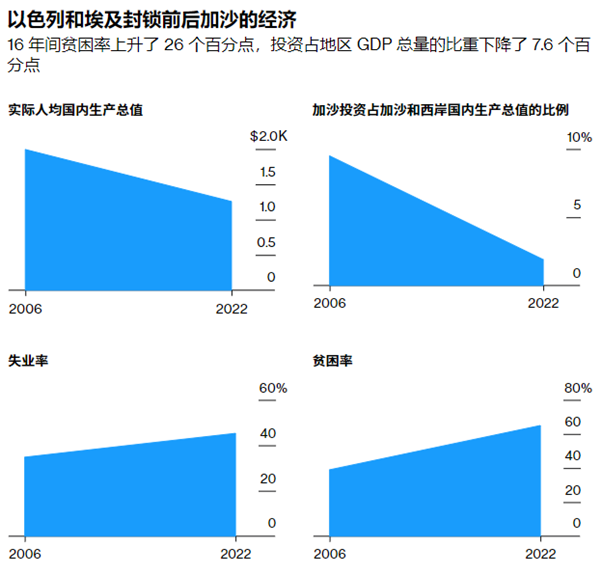

加沙的无奈,相信大家通过抖音、TIktok、YouTube、Facebook、小红书等渠道都能看到。从数据上我们也能明显感觉到,压迫下的人民反抗只是时间问题。没有一个国家,能够允许自己的民众在监狱里生活,贫困率逐年递增,全员陷入没有水没有食物的日子。

不在沉默中爆发,就在沉默中灭亡。对于巴勒斯坦,这个形容很贴切。没有这次冲突,世界也不会聚焦在全球最大的监狱这里,联合国也不会支持加沙人民,进行人道主义救援。但是,生命的代价确实残酷。谨希望未来战事能够在联合国的支持下,逐渐缩小规模,不要扩散。此次事件我们也能够看出来,国家的强大,真的是前辈们靠着血与泪打拼出来的。珍惜当下的和平。

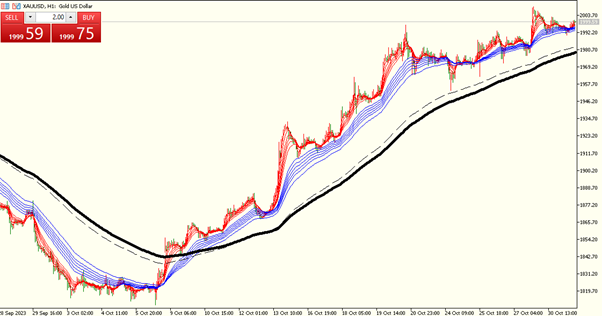

各国利益错综复杂,尤其是还有美国这类背后有其他想法的大国。所以,战事短时间内难以平息,黄金就不能做空。对于投资者们来说,我们可以用买黄金赚到的钱,捐赠给联合国,这届联合国,虽然依旧没什么实权,但是我们看到的立场,是客观公正的。我们没办法阻止什么,但是我们可以支持公平的和平的一方。联合国捐赠链接:https://crisisrelief.un.org/澳洲的朋友,捐赠的金额是可以抵扣税务的,大家可以咨询自己的会计师。从战争中,我们可以利用资本市场,劫富济贫。我们黄金赚到的钱,还是要捐一些出去的,捐的时候,喊出那句孩时的心声,为了我们的和平,为了世界的和平。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

CPI is a globally recognised economic indicator used by many countries to measure inflation and assess changes in the cost of living for their citizens. It evaluates the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, such as food, clothing, rent, healthcare, entertainment, and transportation. Compiled by national statistical agencies or organisations in various countries, the CPI reflects the purchasing power of a country's currency.

By monitoring CPI trends, policymakers and economists gain insights into the overall economic health, make informed decisions about monetary policy, and understand how price changes impact the general population's standard of living. In an international context, different countries might have their own versions of CPI tailored to their specific economic circumstances and consumer behaviours. However, the fundamental concept remains consistent: CPI measures the average change in prices paid by consumers, making it a crucial tool for understanding inflationary pressures and making economic comparisons across nations.

Key takeaways CPI functions as a universal tool used by countries around the world to measure inflation and evaluate changes in the cost of living. Here are the key points in this global perspective: Global Measurement of Consumer Prices: The CPI serves as a global standard for measuring changes in the prices of goods and services consumed by households. Each country typically has its own CPI, tailored to its specific consumption patterns, demographics, and economic structure.

Universal Indicator of Inflation: Internationally, the CPI is universally recognised as a crucial indicator of inflation. Central banks, policymakers, economists, and businesses in various countries closely monitor CPI trends. It helps them understand the impact of price changes on their economies and make informed decisions about monetary policies and economic strategies.

Diverse Basket of Goods and Services: The CPI in different countries includes a diverse basket of goods and services that are essential to the local population. This basket is regularly updated to reflect contemporary consumption habits, ensuring that the CPI accurately represents the changing cost of living for people. Data Collection and Analysis: Countries globally conduct extensive data collection efforts to calculate their CPI.

This involves collecting price data from various sources, including retail outlets, service providers, and housing markets. The data collected provides valuable insights into the purchasing power of the local currency and helps assess the economic well-being of citizens. Policy Implications: CPI data influences policy decisions not only at the national level but also in international trade and finance.

It affects decisions related to interest rates, social welfare programs, and economic reforms. Moreover, it plays a significant role in international economic comparisons, enabling policymakers to assess their country's economic performance relative to others. Understanding the CPI For example, the US has the Bureau of Labor Statistics (BLS) conduct extensive data collection efforts to create the CPI data, gathering approximately 80,000 price points every month from 23,000 retail and service outlets.

Despite both CPI variants having the term "urban" in their names, the more comprehensive and widely referenced version covers 93% of the U.S. population. Within the CPI, the housing category, which constitutes a significant one-third of the index, is determined through a survey of rental prices for 50,000 housing units. This data is then utilised to calculate the increase in rental prices as well as the equivalent costs for homeowners.

In particular, the owners' equivalent category factors in the rent equivalent for owner-occupied housing, ensuring an accurate representation of housing expenses in consumer spending. It includes user fees and sales or excise taxes but excludes income taxes and the prices of investments like stocks, bonds, or life insurance policies from CPI calculations. The calculation of CPI indexes incorporates several important considerations.

Firstly, it accounts for substitution effects, recognising that consumers tend to redirect their spending when certain products or categories become relatively more expensive. Additionally, the calculation adjusts price data to accommodate changes in product quality and features, ensuring a more accurate representation of actual consumer spending. Moreover, the weighting of product and service categories in the CPI indexes is based on recent consumer spending patterns, derived from a separate survey.

This weighting reflects the significance of different items in the average consumer's budget, providing a realistic portrayal of how expenditure is distributed across various goods and services. By integrating these factors, CPI indexes offer a nuanced and precise measurement of changes in the cost of living for consumers. CPI Categories The monthly CPI released by the BLS provides a comprehensive overview of economic changes.

This report highlights alterations from the previous month for the overall CPI-U and its significant subcategories, including the unadjusted year-over-year changes. The BLS detailed tables further break down price shifts for a wide array of goods and services grouped under eight overarching spending categories. These detailed tables allow for precise analysis, estimating price variations for items ranging from everyday groceries like tomatoes and salad dressing to services such as auto repairs and sporting event tickets.

For each subcategory, both seasonally adjusted and unadjusted price changes are provided, offering a nuanced understanding of consumer spending patterns. Beyond the national CPI indexes, the BLS also publishes CPI data for US regions, sub-regions, and major metropolitan areas. Notably, metropolitan data can exhibit more significant fluctuations, primarily serving the purpose of identifying localised price changes based on unique regional conditions.

What Makes CPI Significant for Currency Traders? The CPI indicator, often termed "headline inflation" in markets, holds immense significance in the realm of currency trading. This is primarily because inflation has a profound impact on the decisions taken by central banks concerning their monetary policies.

Central banks, like the Federal Reserve and the Bank of Japan, typically have a mandate to maintain inflation at a specific level, often around 2.0% annually (source: the Fed, BOJ). To achieve these targets, policymakers adjust interest rates, employing them as a mechanism to attain the desired inflation levels. Additionally, they might implement other strategies such as bond-purchasing agreements or expanding the money supply.

When inflation levels deviate from these targets, it serves as an important signal for central banks to consider altering interest rates. If inflation exceeds the 2.0% target, central banks like the Federal Reserve might increase interest rates to curb excessive spending. This, in turn, strengthens the dollar against other currencies since a higher interest rate makes the U.S. currency more attractive.

Furthermore, CPI serves as a forward-looking indicator of an economy's performance. In instances where inflation rises sharply, as witnessed in countries like Brazil and Venezuela in recent years, consumers tend to save less as their purchasing power diminishes. This dynamic reflects the broader economic landscape and significantly influences market behaviours and currency values.

When a central bank raises interest rates to counter inflation, it usually leads to a reduction in borrowing. Both individuals, seeking loans for purchases, and businesses, aiming to expand their operations, tend to cut back on borrowing due to the higher cost. This decrease in borrowing activity can have significant implications for a nation's overall Gross Domestic Product (GDP).

How CPI Data Affects the Dollar on the Forex Market? The Federal Reserve operates under a dual mandate: to achieve full employment and maintain a stable, healthy rate of inflation during economic expansion. Consequently, forex traders closely watch both unemployment and inflation data, as these figures influence the central bank's decisions on adjusting interest rates—decisions that significantly affect currency strength or weakness.

Forex traders regard the CPI and Core CPI figures as pivotal indicators for gauging an economy's performance. Among these, Core CPI provides a more insightful perspective by excluding volatile energy and food prices. In the United States, the Labor Department releases these figures, excluding energy and food costs from the measurement.

If the Core CPI surpasses market expectations, the dollar typically strengthens against other currencies. Conversely, if these readings fall short of consensus forecasts, the currency weakens relative to other pairs. Importantly, the impact extends beyond the monthly report.

Like all government data, CPI figures are subject to revisions by economists. Such revisions can spark significant volatility in a currency's value on the global market. This continuous assessment of economic indicators shapes traders' strategies, highlighting the vital role of CPI data in the forex market.

Conclusion CPI is a pivotal measure reflecting pricing dynamics within an economy and serves as a reliable indicator of inflation. Forex traders keenly observe the CPI because it often prompts adjustments in monetary policies by central banks. These policy changes can either bolster or diminish a currency's value relative to its counterparts in the markets.

Additionally, the strength or weakness of a currency profoundly influences the earnings of companies operating in diverse global markets, making CPI a key metric watched closely by both traders and businesses.

Retail sales play a fundamental role in shaping the economic landscape of any country. These sales represent the culmination of consumer demand for finished products, serving as a barometer for economic health and a predictor of market trends. In the United States, this vital metric is meticulously tracked and reported monthly by the U.S.

Census Bureau, making it a cornerstone of economic analysis. Diverse Scope of Retail Sales Data Retail sales data encompasses a wide array of transactions, including both durable and non-durable goods, within a specific timeframe. These transactions emanate from 13 distinct types of retailers, ranging from food services to retail stores.

This broad spectrum of goods and services reflects the intricate tapestry of consumer spending habits, providing invaluable insights into market behaviour. Unravelling the Significance Retail sales offer more than just a glimpse into consumer preferences; they provide a macroeconomic perspective on consumer demand for finished products. By compiling data on durable and non-durable goods, the retail sales report becomes a powerful tool for analysts and investors.

These figures serve as a pulse check for the economy, guiding decisions by shedding light on economic health and identifying potential inflationary pressures. The U.S. Census Bureau's meticulous gathering of data from various establishments ensures the accuracy of retail sales metrics.

This accuracy is imperative due to the pivotal role consumer spending plays in the U.S. economy. Consumer spending, also known as Personal Consumption Expenditure (PCE), constitutes a staggering two-thirds of the country's gross domestic product (GDP). Therefore, understanding retail sales is not just a matter of economic analysis; it is essential for gauging the overall economic well-being of the nation.

Decoding Retail Sales: Insight into Economic Vitality Retail sales do not exist in isolation; they are intertwined with broader economic trends, offering a window into the vitality of the economy. These figures, reported by food service and retail stores, are meticulously compiled by the U.S. Census Bureau.

Utilising sophisticated data sampling techniques, these measurements are extrapolated to model nationwide patterns, providing a comprehensive view of consumer behaviour. The categories of retail sales are diverse, spanning in-store, catalogue, and out-of-store sales of both durable and non-durable goods. This diversity highlights the multifaceted nature of consumer preferences and purchasing behaviours.

From clothing and pharmaceuticals to electronics and furniture, retail sales encompass a myriad of products, each reflecting distinct market dynamics. Influence of Inflation: Navigating Economic Challenges Inflation, a ubiquitous economic phenomenon, significantly impacts retail sales. As prices of goods and services rise, consumers are compelled to recalibrate their spending habits.

Higher inflation often leads to a reduction in overall expenditures, with consumers prioritising necessities and purchases resistant to inflationary pressures. This adjustment underscores the intricate dance between economic forces and consumer behaviour, shaping the trajectory of retail sales figures. Special Considerations in Interpreting Retail Sales Data Interpreting retail sales data requires a nuanced understanding of various factors.

The U.S. Census Bureau's Monthly Retail Trade Survey, released mid-month, provides detailed insights into total sales, accompanied by percentage changes from previous reports. To account for seasonal fluctuations, the report includes year-over-year changes, offering a comprehensive view of consumer-based retail trends.

Economists and analysts face the challenge of interpreting retail sales figures accurately. One such challenge lies in the inclusion of auto and gas sales, both of which are volatile categories. Many experts prefer analysing retail sales data excluding these segments, considering their propensity to fluctuate unpredictably.

Gas station sales, influenced by oil and gas price volatility, are particularly prone to sharp shifts, making them a less reliable indicator of consumer behaviour. Seasonality and Retail Sales: The Impact of Festive Seasons Seasonality significantly shapes retail sales patterns, with the holiday season, notably Christmas, witnessing a surge in consumer spending. This festive period accounts for a substantial portion of annual sales, especially for retailers specialising in hobbies, toys, games, and department stores.

Recognizing these seasonal fluctuations is essential for a nuanced interpretation of retail sales data. It underscores the cyclical nature of consumer behaviour and its intersection with cultural and economic factors. Calculating Retail Sales Data: Precision in Reporting The U.S.

Department of Commerce's Census Bureau plays a pivotal role in compiling and disseminating retail sales figures. Through its Monthly Retail Trade Survey, the Bureau meticulously collects data, summarising the previous month's sales activity. This precision in data collection ensures the accuracy and reliability of retail sales metrics, providing a foundation for informed economic analysis.

The Bottom Line: Retail Sales as Economic Barometer In essence, retail sales represent far more than mere transactions; they encapsulate the collective choices and behaviours of consumers, offering a nuanced portrayal of economic health. As a leading macroeconomic indicator, retail sales serve as a compass, guiding investors, policymakers, and analysts through the complex terrain of economic trends. The surge or decline in retail sales figures echoes the heartbeat of the economy.

Increasing retail sales signify a robust and expanding economy, eliciting positive movements in equity markets. Shareholders of retail companies welcome these high sales figures, indicating enhanced earnings and market stability. However, the story is not devoid of complexities.

Bondholders, sensitive to economic nuances, exhibit mixed sentiments. While a flourishing economy benefits all, lower retail sales and economic contraction can lead to reduced inflation. This prompts investors to turn to bonds, potentially increasing bond prices as they seek stability in the face of economic uncertainty.

In conclusion, understanding retail sales is akin to deciphering an intricate economic code. It requires a keen eye for detail, an understanding of market dynamics, and an awareness of the broader economic landscape. Retail sales are not just numbers on a report; they encapsulate the aspirations, choices, and challenges of a nation's consumers.

By delving into the nuances of retail sales data, analysts and investors gain invaluable insights, enabling them to navigate the ever-changing currents of the global economy. As a barometer of economic health, retail sales continue to be a beacon, guiding stakeholders toward informed decisions and a deeper understanding of the intricate web of economic interactions.

热门话题在说了很多上市公司以及宏观环境之后,今天我们又回到了单个产品上。还是说说咱们都关心的澳元走势。大家都知道,澳元在过去4,5个月的时间里,其走势就如同是王小二过年,那是一年不如一年。为啥曾经一度价值甚至超越美元的澳元,如今却沦落到如此这般田地呢?是人性的扭曲,还是道德的沦丧?让我们一起走进今天的文章,给您来详细的马后炮一把。作为南半球最发达国家的澳洲,一直以来都以矿业丰富,人口稀少而著称。也正是因为澳洲地下蕴含着巨大的矿业资源,因此仅仅依靠着铁矿石和铜,澳洲在过去20年里就成为了发达国家里经济发展平均增速最快,持续发展而没有衰退时间最长的国家。从2000年悉尼的奥运会到现在2023年,澳洲已经成为人均GDP超越英法德日加,接近美国的水平。放眼全世界,也只有例如瑞士芬兰卢森堡这样的小国在人均GDP上超越澳洲,以正常大国范围来看,澳洲几乎已经达到了非常高的水平。

但是澳洲过去20年的成功,很大程度上是依靠着成为中国基建的供货商来实现的。在中国加入世贸后的20年,其城镇化建设高速发展,因此对于钢铁煤炭和其他主要工业原料的需求大增,而澳洲,连同智利,巴西一起,成为了中国工业化道路上的主要供货商。而其中澳洲又因为矿石品质最好,人口最少,因此获利最多。但是也由于主要出口给中国,使得澳洲的矿业出口过度集中,为之后因为中国订单锐减而大幅亏损埋下了隐患。大家回忆一下,澳元和美元汇率最高的时候是什么时候?就是在2011年金融危机之后的那几年。之后随着美国经济的恢复,澳元的价值也一路下跌。一直到2020年疫情开始时澳元和美元最低只有0.55。以及2022年10月中国疫情清零政策放弃,全国感染率激增的时候,澳元的汇率也下跌到了0.61. 从这两次可以看得出,澳元每次下跌,都是在市场对于中国经济担忧加剧的时候。换而言之,如果国际投资者觉得中国未来的情况可能会更加不乐观,那澳元的下跌走势就不会停止。我从2015年到现在一直重复我对澳元走势的看法:我个人认为,影响澳元最大的三个因素从影响大到小的排列是:1. 铁矿石价格,2. 中国经济好坏,和3.美元政策(加息还是降息)以下就是铁矿石的走势图

从2021年高点到现在价格已经跌了50%。虽然几乎和2019年差别不大。但是大家需要记住,过去3年每年的通货膨胀可是在7%左右,也就是说,物价3年里上涨了21%。因此如果现在的价格和疫情之前一样,就意味着实际价格已经下跌了20%。至于第二个中国经济的情况,相信不用多说,我们也应该都能感觉到经济下行的压力很大。作为过去一直支撑GDP的房地产行业,随着恒大和许家印最终的下台,也迎来了一个巨大的回调期。而作为各地主要财政来源,土地拍卖在今年也进展不顺。当然,从大方向来看,随着和去年相比疫情限制政策的完全打开,以及以马云回归为代表的一系列支持民企重新发展的动作出台,中国未来几年至少在民营经济层面,将会出现一个过去5年难得的宽松期。希望各行各业可以在政策有利时期,可以抓住时机,为经济多创造就业,为千万普通百姓家庭创造一个可以生活的机会。其实从2007年工作到现在,见证了世界金融危机,见证了欧债危机,见证了澳元的疯狂,也见证了2020年后3年的痛苦。过去1年,咱们澳洲华人金融企业也是频频出事,搞得大家人心惶惶,似乎再也不敢碰华人的企业了。虽然GO Markets是澳洲本地公司,而且70%是澳洲英文客户,但是我们的中文部一样也会受到这类事件的影响。客户会担心,会怀疑所有只要是华人的金融企业。我知道短期内这无法改变。但是我希望未来会有更多华人企业,愿意做稳,做长久,不要追求短期的爆炸式发展,也不要追求短时间的利润翻翻。信任这东西,需要几年,甚至更长时间来建立,但是要毁掉它,真的是分分钟,甚至一句话,一件事就行。扯远了。说回到澳元。澳元目前三大因素里,铁矿石疲软,中国经济疲软,而美元则因为战争,加息等多重因素在过去6个月继续走强。这样反过来也给澳元不断施加了压力。当然了,澳元对于美元贬值其实是好事,因为这可以帮助澳洲出口的产品在交割美元后可以换回来更多的利润。但是和美元加息完全根据自己国家情况有所不同的是。澳洲现在面临一个非常矛盾的情况:一方面澳洲当地的通胀还是很高,有5%左右,远高于目标的2%。理论上这是肯定要继续加息。然而在另一方面,由于中国经济下调,导致对于澳洲主要出口商品需求量下降,加上澳洲本地居民因为不断加息而消费减少。所以如果和美国保持加息幅度一样,澳洲会受到双倍伤害:来自自己居民消费降低的伤害,和来自于中国订单减少的伤害。所以澳洲在过去3个月才始终不太愿意加息。能不加就不加。但是最终结论还是那句话:在目前影响澳元最大的三个因素里,全部都不利于澳元。所以澳元的回调依然没有结束。只有当这三个因素出现一个,甚至两个变化后,澳元的回调才会改变。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

热门话题在过去的一年中,微软的2023财年创下了记录,实现了2110亿美元的收入和超过880亿美元的营业利润。2014年2月4日,萨提亚·纳德拉接管微软。当时,微软在市值上被苹果、亚马逊、谷歌、Facebook等公司超越,市值跌至2000亿美元。他重新定义了微软的使命:赋能全球每一个人、每一个组织,实现卓越。这一使命将四分五裂的团队凝聚在一起,开启了新的方向,为微软注入了新的活力和远大愿景,包括人工智能、混合现实和量子计算。到2019年9月,微软重新夺回市场第一的位置,市值已达到2.45万亿美元。

今天,我们将了解微软现任首席执行官纳德拉在最新的公开信中强调的几个要点。全人类正经历一个充满挑战和机遇的历史时刻。全球面临着持续的经济、社会和地缘政治不确定性。与此同时,我们迎来了新的人工智能时代,这项技术将从根本上改变全球每个人、每个组织和每个行业的生产力,帮助人类应对最紧迫的挑战。下一代人工智能将重塑每一个软件领域和每个企业,包括我们自己。拥有48年历史的微软仍然是一家具有深远影响力的公司,微软将继续专注于三个核心领域:首先,微软将继续在商业云领域保持领先地位,并在消费领域如游戏和职业社交网络等方面进行创新。其次,在平台转型的过程中,微软将强化在人工智能领域的领先地位,将这一技术融入技术的各个层面。最后,微软将持续提升经营效率,确保成本结构与收入增长相匹配。纳德拉认为人工智能的新时代由两个关键突破定义。首先是最通用的界面:自然语言。多年来,计算技术的持续发展一直受到对越来越直观的人机界面(如键盘、鼠标、触摸屏)的追求的影响。如今,我们相信我们已经跨越了下一个阶段,进入了自然语言的领域,即看、听、理解和解释我们的意图以及我们周围的世界。第二个突破是强大的新推理引擎的涌现。多年来,我们已经数字化了日常生活、地点和物品,并将它们整合到数据库中。这一代人工智能以更强大的方式与数据互动,从处理或总结文本到检测异常和识别图像,帮助我们更快地识别模式和提供见解。这两个关键突破将共同开启巨大的新机遇。微软将重新思考其客户解决方案和技术栈的每一层,以适应人工智能时代。这包括基础设施、数据和人工智能、数字和应用创新、业务应用、现代化办公、网络安全、搜索、广告和新闻,以及LinkedIn、游戏、设备和创意。这些领域将共同促进微软实现其长远目标。

在追求机遇的同时,微软也在努力确保技术成为解决问题的工具,而不是问题的根源。为实现这一目标,微软坚守四项长期承诺,这些承诺是微软使命的核心,尤其重要在这个新时代。对微软而言,这些承诺不仅仅是口头上的奉献。无论是在产品设计和开发、业务流程和政策制定,还是在帮助客户成功和建立合作伙伴关系等方面,它们都应该是微软决策的指南。微软会时刻审视自己的行为,确保符合这些承诺。在竞争激烈的经济环境中,过去的卓越成就已经不能满足今天的期望,微软的每一位员工都需要接受成长型思维,勇敢地突破传统思维。重新定义创新、商业模式和销售模式需要勇气。作为一家高绩效组织,微软致力于帮助员工最大化发展机会,同时帮助他们在专业上学习和成长,并将个人的激情和目标融入日常工作和公司使命。为了实现成功,微软必须根据客户和世界的需求行动。微软需要在创新和合作方面团结一致,以实现“一个微软”的愿景。微软需要积极寻求多样性和包容性,以更好地为客户服务,创造一种让每个人都能发挥最佳水平的文化。为了赋能世界,微软需要持续挖掘多样性的代表,并加强包容性文化。尽管在今年微软经历了各种挑战,但全球多样性程度创下了历史新高。作为一家公司,现在是微软展现实力的时刻。微软要负责任地打造解决方案,促进经济发展,造福每个社区、国家、行业和个人。只要微软做得好,整个世界就会更美好,微软也会取得更大成功。纳德拉对此充满信心。在未来的日子里,微软全体员工将携手努力,兑现这一承诺。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师