市场资讯及洞察

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

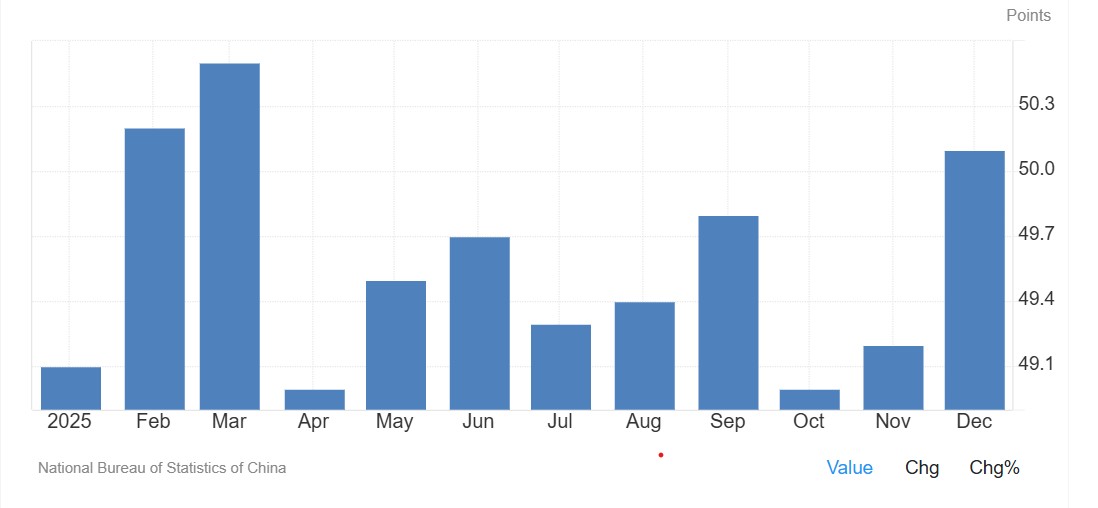

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

US technology giant Microsoft Corporation (NASDAQ: MSFT) released the latest financial results for the quarter ended March 31, 2023, after the market closed in the US on Tuesday. Company overview Founded: April 4, 1975 Headquarters: Washington, United States Number of employees: 221,000 (2022) Industry: Information technology Key people: Satya Nadella (executive chairman and CEO), Brad Smith (vice chairman and president), Bill Gates (technical adviser) The results Microsoft reported revenue that beat analyst estimates at $52.857 billion (up by 7% year-over-year) vs. $51.019 billion. Earnings per share also topped expectations at $2.45 per share (up by 10% year-over-year) vs. $2.239 per share estimate.

Company commentary Satya Nadella, chairman and CEO of Microsoft commented on the rise of AI and highlighted company’s focus on the software: ''The world's most advanced AI models are coming together with the world's most universal user interface - natural language - to create a new era of computing.'' ''Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.'' Amy Hood, executive vice president and CFO highlighted Microsoft Cloud’s revenue for the quarter which increased year-over-year: ''Focused execution by our sales teams and partners in this dynamic environment resulted in Microsoft Cloud revenue of $28.5 billion, up 22% (up 25% in constant currency) year-over-year.'' Share of Microsoft were down by -2.25% on Tuesday at $275.33 before the results were announced. The stock rose by around +4% in the after-hours trading as results beat estimates. Stock performance 1 month: +0.07% 3 months: +13.79% Year-to-date: +14.84% 1 year: +1.92% Microsoft price targets Bank of America: $320 Citigroup: $332 Jefferies: $325 Goldman Sachs: $325 Cowen & Co.: $300 Microsoft Corporation is the 3 rd largest company in the world with a market cap of $2.050 trillion, according to CompaniesMarketCap.

You can trade Microsoft Corporation (NASDAQ: MSFT) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Microsoft Corporation, TradingView, MarketWatch, MetaTrader 5, TipRanks, CompaniesMarketCap, Wikipedia

US food giant The Kraft Heinz Company (NASDAQ: KHC) reported Q1 financial results before the market open on Wall Street on Wednesday. The company topped both revenue and earnings per share (EPS) estimates for the quarter. Company overview • Founded: July 2, 2015 • Headquarters: Chicago, Illinois and Pittsburgh, Pennsylvania, United States • Number of employees: 37,000 (2022) • Industry: Food • Key people: Alex Behring (Chairman), John Cahill (Vice chairman), Miguel Patricio (CEO), Paulo Basilio (CFO) The results Kraft Heinz reported revenue of $6.489 billion vs. $6.394 billion expected.

Revenues were up by 7.3% year-over-year. EPS reported at $0.68 per share (up by 7.9% year-over-year) vs. estimate of $0.597 per share. The company also announced a quarterly dividend of $0.40 per share.

CEO commentary "We delivered strong results in the first quarter of 2023, with net sales growth across both our North America and International zones that continues to be fueled by Foodservice, Emerging Markets, and U.S. Retail GROW platforms," Kraft Heinz CEO, Miguel Patricio said in a press release. "I am very proud of the entire Kraft Heinz team as we continue to deliver on what we can control by unlocking efficiencies and reinvesting in our brands and capabilities. Our team's continued focus on executing against the strategy is coming to fruition, but it's not time to declare victory just yet.

We remain committed to advancing our business transformation, and we are confident we have the right strategy in place to win with customers and consumers, and to deliver profitable growth and create value for our stockholders," Patricio concluded. The latest results had a positive impact on the stock. Shares were up by over +4% at $40.95 per share.

Stock performance 1 month: +5.28% 3 months: +1.33% Year-to-date: +0.91% 1 year: -5.17% Kraft Heinz price targets JP Morgan: $44 Mizuho Securities: $50 Berenberg Bank: $39 BNP Paribas: $39 Goldman Sachs: $43 The Kraft Heinz Company is the 318 th largest company in the world with a market cap of $50.46 billion, according to CompaniesMarketCap. You can trade The Kraft Heinz Company (NASDAQ: KHC) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: The Kraft Heinz Company, TradingView, MarketWatch, MetaTrader 5, TipRanks, CompaniesMarketCap, Wikipedia, Macrotrends

The Australian Consumer Price Index (CPI) y/y was released at 6.3%, lower than the market forecast of 6.5% and from the previous data of 6.8%. With inflation growth on a clear downtrend following its peak of 8.4% in January 2023, this is likely to reduce the need for further rate increases from the Reserve Bank of Australia (RBA). The Australian cash rate is currently at 3.60% with the RBA anticipated to keep with the previous decision of holding rates steady next Tuesday (2nd May).

While the RBA has previously indicated that some further tightening may be needed to ensure that inflation returns to target, the decision to keep interest rates at 3.60% or comments regarding a pivot in future decisions could lead to further weakening in the AUDUSD. Following the release of the CPI y/y data, the AUDUSD traded lower, breaking out of the channel, and signaling a possible continuation of the downtrend since February 2023. Additionally, with the Ichimoku cloud acting as a resistance and indicating further downside potential, the AUDUSD could trade down to retest the support level of 0.6565.

Beyond the immediate support level, the next key support level is the previous swing low at the 0.64 price area. This move lower could be driven by a further recovery in strength on the DXY and if the RBA decides to hold interest rates at 3.60%.

Gold has always been one of the most popular and highly traded markets for CFD traders, especially recently as its price has risen to test its all-time highs. It’s easy to see why, Gold has been a store of value throughout history, and with CFDs it’s possible to take a position in this exciting market, whether you think the price will head up or down. In this CFD gold trading Article we will look at the following: How to use CFDs to trade gold Fundamental forces that drive the price of gold Technical strategies for trading gold CFDs How to use CFDs to trade gold CFDs or Contracts For Difference allow you to speculate on the price of gold, without owning the underlying asset (No gold vaults needed!) A spot gold CFD tracks the price of the spot market being the cleanest and most efficient way to speculate on the price of gold.

They also allow you to take a position in both directions, you would enter a buy (Long) positions if you believed the price will rise, or a sell (Short) position if you believe the price will fall. With Long positions you are looking to buy and sell at a higher price at a later time to profit on the trade. With a Short position you are selling with the view to buy back at a later time to profit on the trade.

At GO Markets we offer our clients the worlds most popular gold trading platform in Metatrader 4 and 5, another advantage to these CFD trading platforms is the ability to automate gold trading strategies. Other advantages to trading gold CFDs with GO Markets: Trade 23 hours a day, unlike an ETF or gold miner listed on a stock exchange that is only open while that stock exchange is open. Leverage – the margin required to open the trade will be a fraction of the face value of the position depending on what leverage your account is set to.

Flexibility in position sizing starting from 1 ounce ($1USD per point movement in gold) unlike gold futures which have rigid contract sizes. Rolling contract, no expiries such as in options or futures to worry about. To Enter a position in Metatrader, you would bring up a deal ticket by clicking “New Order” then select your position size, any Stop Loss or Take Profit levels you want the position to automatically close at and hit Buy or Sell.

As with any instrument, make sure you are familiar with the lot sizing. 1 standard lot in gold (XAUUSD) is 100 ounces, or $100 USD a point so make sure you set the volume to a level commensurate to your account size and risk appetite. Now, the next question is how you decide on a buy or sell, lets look at the fundamentals of what drives gold and some technical analysis you can use to answer this question. Fundamental forces that drive the price of gold While no one reason can be fully attributed to movements in the price of gold, there are an important few fundamental drivers that will influence the price of gold and whose relationship has been time tested.

None of these on their own should be used as a sole reason to enter a position, but having the fundamentals on your side will certainly give you an advantage. The main fundamental drivers in my experience are (not an exhaustive list by any means!) The gold price relationship to US bond yields Safe haven flows Central Bank buying Real Yields and Gold The inverse relationship between bond yields and the price of gold is well established, especially the real yield on the US 10 year bond. The reason for this mainly is because the real yield (the real yield is calculated by subtracting inflation expectations from the actual yield of the US 10 year government bond) is seen as the “risk free” rate on an investment, the higher the “risk free” rate is, the less attractive a non-yield paying asset like gold is.

As both gold and bonds are seen as safe havens, they are competing for the same investors. See the screenshot below to illustrate this point. The gold line is the price of gold, the black line is the inverted real yield of 10 year treasuries.

This chart stretches back 16 years, but the close relationship has gone back much longer than that. This chart is showing that historically, gold is expensive at the moment as compared to real yields as can be seen by the growing gap between the two recently, this interesting decoupling has been mainly caused by our second fundamental driver – Safe haven flows. Safe Haven Flows Geopolitical strife with war in Ukraine and doubts over the health of the global economy got things started with the surge we have seen in gold prices in the last 5 months, but things went into overdrive in March 2023 when Signature bank and Credit Suisse collapsed, bring into question the integrity of the banking system and massive safe haven flows into gold which has pushed the price to within touching distance of hitting all-time highs.

With the banking crisis seemingly under control (for now maybe?) gold has lost some momentum, but the fact it is holding around these elevated prices indicates some investors may not think the crisis is over just yet. Central Bank Buying Central banks are some of the biggest buyers of gold on the open market, and 2022 saw the most central bank buying of gold on record. Whatever the reasons for this, such massive amounts of buying would be seen as a bullish sign for the gold price (if it continues) Technical strategies for trading gold CFDs While having a good understanding of the fundamentals (in my opinion) is important to help you choose the best trades most traders will use a combination of technical analysis and fundamentals with the aim for higher probability outcomes in their trades.

Some traders will use technical analysis exclusively without any interest in the fundamental drivers using things such as RSI oscillators, support and resistance areas and trend lines solely to decide on their trade direction. Which option is best is solely up to the trader, their time frames for the trades and risk appetite, all can work, and all can fail neither option can be seen as “better” than the other, it all depends on the individual trader. Technical analysis is an art in itself and there is a lot to learn on this subject, I encourage anyone interested to research the many weird and wonderful technical analysis strategies that are documented online.

But let’s take a look at a couple of popular technical indicators that gold traders use to make their trades. Support and Resistance Support and resistance are one of the most widely used and accurate (when used correctly) technical indicators that can be used by traders. Support and Resistance areas are points in the market where the price is held from going lower (Support) or going higher (Resistance), these are areas where buyers or sellers are entering the market as they see value in the asset at that price.

These levels can last a long time, or be temporary and can be used to predict turn arounds in the market, or a break of these levels could indicate a further push in that direction. Lets take a look at the recent Gold chart for examples below: From the above you can see that there are areas that Gold will find its price supported. or upside resisted as buyers and sellers battle it out. These areas are very important to keep in mind when deciding on trade direction.

Trend Channels Another simple, but effective and popular Technical Analysis tool is trend channels. These channels are a common sight on the gold chart and can give the trader some confidence in levels that will provide support or resistance, or a break of these channels can indicate a trend change. Example of trend channels on gold below: While technical analysis is useful for gold, it can be difficult to spend the time analysing all the patterns that may form, in that regard GO Markets clients have access to Trading Central which automatically detect technical set ups for our traders to add to their decision making.

Trading Central can be accessed by account holders through their Client Portal. Trading Central Pattern example below: Hopefully this article has given you an interest to learn more about trading gold with CFDs. Fell free to contact the GO Markets team if you have any questions on trading gold CFDs and opening an account with us.

Gold has been one of the most popular and highly traded markets recently as price action in the precious metal has really come alive, rate hikes, the war in Ukraine and Bank Crises have all played a part in the fundamental reasons for gold price movements in the last 12 months. Let’s take a look at the chart to see these fundamental effects and how the technical are shaping up. Firstly, the macro picture of what fundamentals have done to the price of Gold are where it’s turning points have been.

The chart below shows the decline in the Gold Price during most of 2022 as the USD rallied strongly on the back of an aggressive Federal Reserve hiking cycle, this put downward pressure on gold where we can see it bottomed and found support around the 1617 level. Next was the talk of a Fed pivot, the market starting to price in the end of the Fed hiking cycle and a subsequent bear market in the USD which lifted Gold prices. After this mov retraced in Feb/Mar we then had the collapses of Signature bank and Credit Suisse, this saw the dynamics of Gold change from following interest rates and USD strength to being a bona fide safe haven and an explosive move up to where we are now, looking to test the all-time highs set back in 2020.

Zooming in on the technical, I believe Gold is still in a strong uptrend and will continue to benefit from safe haven flows while the left-over worries of the banking crisis still remain (is it really over?) but saying that it will find tough going above 2040 USD an ounce, as we can see from the forceful rejection at that price last week, without a further catalyst to push it though, such as another leg to the bank crisis or escalation in geopolitics events. The other Key level is 1805, the last swing low which can be seen as major support. If you believe the Gold bull story the way to play the long side is to avoid getting long above 2020 until a confirmed break of this major resistance level is confirmed and legging into longs everywhere above 1805, a break of that major support level would see the bears certainly in charge.

If you’re a Gold bear, Use the major resistance at 2020-2040 to your advantage, getting short and using that area as an exit if a confirmed break to the upside occurs.

The Bank of England (BoE) is due to release its interest rate decision today, with markets expecting a 12th consecutive hike to take interest rates to 4.50%. There has been increasing speculation that the BoE is reaching its terminal rates and could follow the lead of the US FOMC and the ECB in signaling a slowdown or pause on further rate hikes following the decision today. However, inflation in the UK is yet to signal a sustained slowdown, with the recent March Consumer Price Index (CPI) still above 10%.

The UK economy has been performing better than expected this year, which has seen the GBPUSD rise steadily to trade just below the key resistance area of 1.27, which was last tested in May 2022. Any indication that the BoE could potentially pause on monetary tightening or dissent in the voting (expected 7-0-2) on the rate hike could see the GBPUSD come under renewed downward pressure. A bearish divergence (prices rallying to new highs while the oscillator retraces from a peak) has formed at the resistance level and could signal the potential for a reversal to the downside.

This reversal could be confirmed if the GBPUSD continues to trade lower past the 1.2550 price level, which coincides with the 38.2% Fibonacci retracement level from the short term. The downside on the GBPUSD could be significant, with the next key support level at 1.2350 which aligns with the 38.2% Fibonacci retracement level from the longer term.