市场资讯及洞察

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

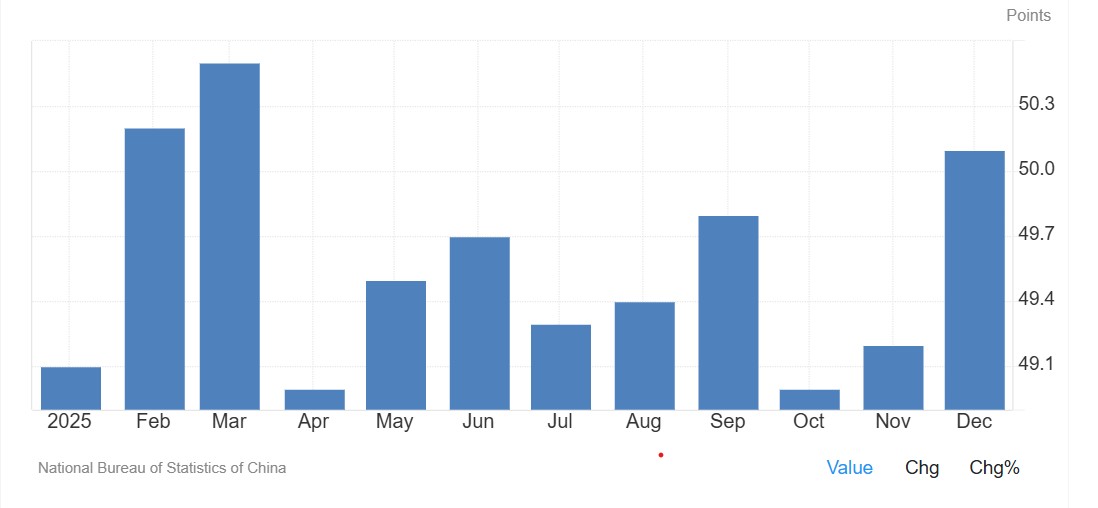

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

World’s largest automaker, Tesla Inc. (NASDAQ: TSLA), reported Q1 financial results after market close in the US on Wednesday. Elon Musk’s company posted mixed results for the quarter. Let’s take a closer look at how it performed.

Company overview Founded: July 1, 2003 Headquarters: Austin, Texas, United States Number of branches: 764 retail stores/galleries and service centers (2022) Number of employees: 127,855 (2022) Industry: Automotive, renewable energy, artificial intelligence Key people: Elon Musk (CEO), Robyn Denholm (chair) The results Tesla reported revenue that missed analyst estimate at $23.329 billion vs. $23.596 billion expected. Revenues were up by 24% compared to Q1 2022. Earnings per share reported at $0.85 per share (down by -21% year-over-year) vs. $0.846 per share estimate.

The automaker produced 440,808 and delivered 422,875 cars in Q1, up by 44% and 36% year-over-year, respectively. Company commentary ''In the current macroeconomic environment, we see this year as a unique opportunity for Tesla. As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader.

We are focused on rapidly growing production, investments in autonomy and vehicle software, and remaining on track with our growth investment,'' Tesla said in a letter to shareholders. The company also commented on its pricing strategy: ''Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors.'' ''Although we implemented price reductions on many vehicle models across regions in the first quarter, our operating margins reduced at a manageable rate.

We expect ongoing cost reduction of our vehicles, including improved production efficiency at our newest factories and lower logistics costs, and remain focused on operating leverage as we scale. ''We are rapidly growing energy storage production capacity at our Megafactory in Lathrop and we recently announced a new Megafactory in Shanghai. We are also continuing to execute on our product roadmap, including Cybertruck, our next generation vehicle platform, autonomy and other AI enabled products.'' ''Our balance sheet and net income enable us to continue to make these capital expenditures in line with our future growth. In this environment, we believe it makes sense to push forward to ensure we lay a proper foundation for the best possible future,'' the statement concluded.

The stock was down by -2.02% on Wednesday at $180.48 a share before the results were announced. Share price dropped by around -3% in the after-hours as investors digested the earnings report. Stock performance 1 month: -5.38% 3 months: +40.44% Year-to-date: +46.83% 1 year: -44.48% Tesla price targets RBC Capital: $217 Barclays: $230 Wedbush: $225 TD Cowen: $170 Deutsche Bank: $250 Goldman Sachs: $225 Citigroup: $192 Tesla is the 8 th largest company in the world with a market cap of $576.43 billion, according to CompaniesMarketCap.

You can trade Tesla Inc. (NASDAQ: TSLA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Tesla Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap, Wikipedia

Target Corporation (NYSE: TGT) announced Q1 financial results before the market open in the US today. The company posted solid results beating revenue and earnings per share (EPS) estimates. Company overview Founded: June 24, 1902 Headquarters: Target Plaza Minneapolis, Minnesota, United States Number of employees: 440,000 (2023) Industry: Retail Key people: Brian Cornell (Chairman & CEO) The results Revenue reported at $25.322 billion vs. $25.262 billion expected.

EPS reported at $2.05 per share (down by 4.8% year-over-year) vs. $1.766 per share estimate. CEO commentary "We came into the year clear-eyed about the challenges consumers are facing, and we were determined to build on the trust we've established with our guests. It's required agility and the ability to flex across our multi-category portfolio as we lean into value and the product categories our guests need most right now.

Thanks to the team's dedication, we saw an increase in guest traffic in Q1, with total sales increasing and profitability ahead of expectations," CEO of Target, Brian Cornell said in a statement. "As we look ahead, we now expect shrink will reduce this year's profitability by more than $500 million compared with last year. While there are many potential sources of inventory shrink, theft and organized retail crime are increasingly important drivers of the issue. We are making significant investments in strategies to prevent this from happening in our stores and protect our guests and our team.

We're also focused on managing the financial impact on our business so we can continue to keep our stores open, knowing they create local jobs and offer convenient access to essentials." "For the full year, we are maintaining our full-year financial guidance, based on the expected benefit from efficiency and cost-savings efforts and our team's continued focus on agility, flexibility and retail fundamentals in the face of continued challenges including inventory shrink. At the same time, we will continue making long-term investments in our stores, supply chain and our team, positioning Target for profitable growth and market-share gains in the years ahead," Cornell concluded. The stock was up by around 2% on Wednesday at $160.17 per share.

Stock performance 1 month: -0.76% 3 months: -8.37% Year-to-date: +8.21% 1 year: -0.20% Target price targets Telsey Advisory Group: $185 Raymond James: $190 JP Morgan: $175 Morgan Stanley: $170 Credit Suisse: $170 Baird: $195 Cowen & Co.: $200 Piper Sandler: $220 Barclays: $163 Oppenheimer: $190 Wells Fargo: $142 Target is the 193 rd largest company in the world with a market cap of $74.95 billion, according to CompaniesMarketCap. You can trade Target Corporation (NYSE: TGT) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Target Corporation, TradingView, MarketWatch, MetaTrader 5, CompaniesMarketCap, Wikipedia

American electric vehicle Rivian Automotive Inc. (NASDAQ: RIVN) reported the latest financial results for Q1 after the market close in the US on Tuesday. Company overview Founded: June 2009 Headquarters: Irvine, California, United States Number of employees: 14,122 (December 2022) Industry: automotive, energy storage Key people: R. J.

Scaringe (CEO) The results The company reported revenue that fell slightly short of analyst estimates at $661 million (up from $95 million from Q1 2022) vs. $664.396 million expected. Loss per share reported at -$1.25 per share, which was less than -$1.622 loss per share expected. Rivian reiterated that it is on track to produce 50,000 vehicles in 2023, which would represent a 100% increase from last year.

Company commentary "In the first quarter of 2023, we produced 9,395 and delivered 7,946 vehicles. This progress was despite our commercial van production line being down for a significant portion of the quarter as we introduced our Enduro motor and LFP technology into the commercial van production process," company said in a letter to shareholders. "We expect to continue to see a variance between production and delivery volumes as we ramp our production facility." "Operating and financial results during the first quarter of 2023 were in-line with our expectations and as a result, we are reaffirming our previously disclosed 2023 guidance of 50,000 total units of production, $(4,300) million in Adjusted EBITDA, and $2,000 million in capital expenditures." "We want to thank our employees, customers, suppliers, partners, communities, and shareholders for their continued support of our vision." The latest results and comments from the company had a positive impact on the share price. The stock was up by around +4% on Wednesday at $14.44 a share.

Stock performance 1 month: +1.94% 3 months: -27.96% Year-to-date: -21.51% 1 year: -29.78% Rivian price targets Evercore ISI: $25 Cantor Fitzgerald: $27 Canaccord Genuity: $40 JP Morgan: $23 A. Davidson: $16 Rivian is the 1181 st largest company in the world with a market cap of $13.53 billion, according to CompaniesMarketCap. You can trade Rivian Automotive Inc. (NASDAQ: RIVN) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Rivian Automotive Inc., TradingView, MarketWatch, MetaTrader 5, TipRanks, CompaniesMarketCap, Wikipedia

The Reserve Bank of Australia rate meeting today was supposed to be a done deal of another hold in rates, with futures markets pricing in an over 90% chance of that being the outcome. The RBA however, showing their determination to get an inflation rate still well outside their target band instead delivered a 25bp hike after last months pause, surprising the market and seeing a dramatic reaction in the Aussie dollar (pump) and equity markets. (dump) AUDUSD and ASX200 reaction: Adding to this was what was see as a hawkish statement accompanying the decision, helping to cement the original moves which look now to have some legs, likely seeing the AUDUSD break the 0.67 level this session. *RBA RAISES CASH RATE TARGET 25 BASIS POINTS TO 3.85% *RBA: SOME FURTHER TIGHTENING OF MONETARY POLICY MAY BE REQUIRED *RBA SAYS RATE RISE TO HELP ANCHOR INFLATION EXPECTATIONS

Procter & Gamble Company (NYSE: PG) announced third quarter fiscal 2023 before the opening bell in the US on Friday. World’s largest consumer goods company beat both revenue and earnings per share estimates for the quarter, sending the stock higher. Company overview Founded: October 31, 1837 Headquarters: Cincinnati, Ohio, United States Number of employees: 101,000 (2021) Industry: Consumer goods Key people: David S.

Taylor (Executive Chairman), Jon R. Moeller (President and CEO) The results The company reported revenue of $20.1 billion vs. $19.28 billion expected. EPS reported at $1.37 per share vs. analyst estimate of $1.323 per share.

CEO commentary ''We delivered strong results in the third quarter of fiscal year 2023 in what continues to be a very difficult cost and operating environment,'' Jon Moeller, CEO of Procter & Gamble said about the latest results in a press release. ''Our team’s strong execution of our strategies and our progress through three quarters enable us to raise our fiscal year outlook for sales growth and cash return to shareowners and maintain our guidance range for EPS growth despite continued cost and foreign exchange headwinds. We remain committed to our integrated strategies of a focused product portfolio of daily use categories where performance drives brand choice, superiority, productivity, constructive disruption and an agile and accountable organization structure. These strategies have enabled us to build and sustain strong momentum, and we’re confident they remain the right strategies to deliver balanced growth and value creation going forward,'' he concluded.

The latest results had a positive impact on the stock on Friday. Share price was up by around 3%, trading at around $156.44 a share. Stock performance 1 month: +6.58% 3 months: +9.38% Year-to-date: +3.18% 1 year: -3.02% Procter & Gamble price targets Stifel Nicolaus: $147 Berenberg Bank: $141 Evercore ISI: $160 Wells Fargo: $162 CFRA: $152 Procter & Gamble Company is the 20 th largest company in the world with a market cap of $369.12 billion, according to CompaniesMarketCap.

You can trade Procter & Gamble Company (NYSE: PG) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Procter & Gamble Company, TradingView, MarketWatch, MetaTrader 5, TipRanks, CompaniesMarketCap, Wikipedia

Natural Gas price action has had an amazing two years, with the usually pretty boring commodity showing extreme volatility pushing it to all time highs before a dramatic collapse seeing it back where it started in 2020. Like all the energy complex, Oil being a good example, the start of the Covid panic saw wild price fluctuations as traders came to terms with lockdowns and the related slowdowns, followed by unprecedented Central Bank stimulus. But the real push higher in Natural Gas came at the start of the war in Ukraine and the loss of Russian Gas for European suppliers, with fears of a cold winter with a much constrained supply of gas seeing the price spike to all-time highs.

But instead of a long cold gas starved winter the northern hemisphere experienced higher-than-average temperatures which meant the gas supply crunch wasn’t as dire as feared which sent liquefied natural gas prices tumbling to pre covid levels from a record all-time high. With Natural gas back to historical support levels there is a technical and fundamental case for a move higher in the near future. From a technical perspective, on a daily chart we can see that Natural Gas has found strong support since February around the 2.09 level, an historic level it found support at before the pandemic as well, we can also wee a rounding bottom pattern forming on a daily chart, this is considered one of the most reliable chart patterns in technical analysis.

According to a recent interview with Bloomberg by Yukio Kani, the chairman and CEO of Jera Co which is the worlds largest buyer of LNG, he is expecting a price spike again in natural gas this year due to Chinese re-opening demand, unusually war Northern Hemisphere weather increasing energy demand for cooling purposes and increased import capacity in Europe and China. Certainly, a market worth watching going forward!