市场资讯及洞察

%20(1).jpg)

在过去两周里,白银市场经历了极端剧烈的震荡与高位博弈:价格一度快速攀升至历史极高水平,随后出现剧烈回落,反映出市场在避险情绪、基本面需求与投机力量之间的动态平衡。这一阶段白银的表现不仅成为贵金属市场的焦点,也凸显出当前全球经济风险偏好和宏观预期的复杂变化。

一、价格表现:高峰与震荡并存

自年初以来,白银价格持续上涨,并在近期迎来非常显著的高点突破。本周一,白银价格在近段时间内冲高至历史高位——一度触及每盎司约 117.75 美元 的峰值水平,盘中涨幅一度接近 14%,创下自2008年以来的最大单日涨幅。上涨之后的价格快速回落,最终在震荡中收复1%涨幅收盘。反映出,在连续多日由动量推动、追涨情绪主导的行情之后,这轮上涨已经变得相对脆弱。

同一时间段内,黄金虽也创新高,但白银的价格波动要更加剧烈,表现出更高的弹性和交易热度。国内市场对应的沪银主连合约也在本轮行情中刷新了历史高点,盘中涨幅显著。

二、推动白银上涨的核心因素

白银价格在这两周内的大幅波动并非偶然,它是多重基本面与市场情绪因素共同作用的结果:

1. 全球供需高度紧张

从供给端看,全球白银市场已连续多年处于供给短缺状态。截至最近数据(约 2025 年末),白银产量约 3.18 万吨,而实际需求达到了约 3.55 万吨,现实中每年存在接近 8 亿盎司的累计缺口。供应端无法快速响应需求增长,因为全球大部分白银是伴生矿产品,其生产扩张依赖于铜、铅锌矿的开发节奏,且新矿开发周期长达 5–10 年。供给结构的僵化,成为白银价格持续上行的重要基本面支撑。

此外,即使在高价区间,工业消费仍保持强劲,特别是在新能源、光伏、电子设备等领域对白银的需求持续增长,这进一步加剧了供应紧张的局面。

2. 避险需求与宏观不确定性

宏观经济的多重不确定性是近期贵金属走强的重要逻辑背景之一。通胀预期、货币政策路径的不确定性、全球地缘风险等因素,使白银不仅具备避险功能,还因其对市场情绪敏感而呈现高波动性。今日,美国对韩国商品提高关税至25%,以及市场对美联储政策和主席人选的猜测,加剧了投资者的不确定性。此外,财政支出和货币政策压力也促使部分资金从债券和货币资产转向贵金属,形成所谓的贬值交易。

3. 美元与利率预期影响

美元走势与美国货币政策预期对贵金属价格影响显著。随着市场对美联储未来可能降息的预期升温,以及美元在多重政策不确定性下有所承压,白银作为非收益资产吸引了更多资产配置需求。这种“美元弱、避险升”组合在贵金属市场整体放大了资金对价格上行的共振。

三、短期震荡与风险提示

此次白银行情的一个明显特征是急涨之后伴随急跌与回撤,反映出市场对“过热状态”的风险意识正在增强。

分析人士认为,这种极端振幅表明白银部分上涨动力已接近短期极限,且高企价格开始对工业使用产生“挤压”效应,迫使光伏等行业加速寻求替代材料,从而削弱部分实需支撑。这种供需博弈下的潜在阻力,是当前白银短期回落不可忽视的风险因素。

虽然工业需求是白银的基本面支撑之一,但高价会对需求端形成反压。例如光伏等行业可能加快替代材料布局,减少对白银的边际需求,这在极端高价位很可能削弱部分基本面支撑,从而影响中长期供需平衡。

四、未来走势展望

从长期供需基本面来看,白银的结构性紧张、工业需求增长与避险功能并存,为其价格中枢提供了较强支撑。只要这些基本因素未发生根本性逆转,白银在未来阶段仍有潜力维持高位波动。

不过,从技术面和市场情绪出发,高位的急速上涨属于典型的“爆发型行情”,短线极易出现回调或震荡加剧,特别是在遇到宏观数据或全球金融风险事件时,价格波动可能进一步放大。

因此,在关注白银中长期上涨逻辑的同时,需要警惕短期波动风险,避免在高位盲目追涨,并重点关注供需基本面数据、美元走势和全球避险情绪的变化。

总结

基本面供需紧张、工业需求增长和宏观不确定性构成了白银中长期支撑,价格快速透支上涨动能,叠加高位获利了结与需求端压力,短期波动风险显著,需要投资者保持谨慎。

热门话题最近马斯克成立了X.AI公司,宣称要解释宇宙真相。X. AI的成立确实为马斯克提供了一个与人工智能科技巨头公司抗衡的新筹码。马斯克希望通过X.AI与特斯拉,Twitter以及他的脑机接口公司Neuralink等公司实现协同合作,这将为X.AI提供丰富的资源和技术支持。

X.AI的创始成员团队特别强大,其中包括了来自DeepMind的明星工程师Igor Babuschkin以及多名华裔数据研究员,他们大多具有在DeepMind、OpenAI、谷歌研究院、微软研究院、Twitter和特斯拉等公司的工作经验。他们参与过DeepMind的AlphaCode项目以及OpenAI的GPT-3.5和GPT-4聊天机器人等重要项目。团队拥有丰富的人工智能研究和开发经验,为X. AI的发展提供了坚实的基础。通过与这些重要公司和优秀人才的协同合作,X.AI有望在人工智能领域取得重大突破,并成为马斯克在人工智能领域的重要战略布局之一。这也进一步展示了马斯克对于人工智能的重视和投入。上周五马斯克直播了一场X.AI团队面向大众的公开会议,期间马斯克透露了X.AI的一些重要细节和他的想法。马斯克表示X.AI的使命是构建一个拥有极致好奇心且寻求真理的AI。他认为理解宇宙的本质是构建最安全的人工智能的关键。通过研究宇宙,X.AI将能够获得更深入的洞察和智慧,为人类创造更有价值的解决方案。X.AI拥有一个精锐的研发团队,每个人都能获得大量的计算资源。这种模式在SpaceX和特斯拉中已经得到验证,X. AI将充分利用这些资源来推进研究和开发。X.AI计划与特斯拉进行硬件合作,利用特斯拉在高效训练和推理方面的积累。这种合作将使X.AI能够将更多精力集中在软件开发和模型优化方面,以加快AI的发展和进步。X.AI计划尽快发布产品,并从公众那里获取反馈。马斯克希望X.AI对人们来说是有用的,通过与用户的互动和反馈,X. AI将不断改进和完善。X.AI承诺对任何政府保持公开透明,并反对任何违反公众利益的行为。马斯克强调他不希望X.AI对人类构成威胁或不利影响,而是希望X.AI能够为人类福祉和社会发展做出积极贡献。

在这场公开直播中,除了马斯克的发言外,X.AI团队的成员也进行了介绍并表达了他们的观点。X.AI将与特斯拉和推特进行合作,涵盖资源、技术和数据等方面。在芯片方面,X.AI计划与特斯拉合作,利用特斯拉自研的Dojo D1芯片和Dojo超算。此外,推特作为一个丰富的数据源,X.AI计划使用推特上的公开数据进行训练,而不访问私人数据。X.AI的重点不仅仅是硬件,也将专注于软件开发和模型优化。马斯克表示特斯拉的AI团队非常强大,暗示在软件方面也可能会有合作。他提到希望X.AI能够像谷歌的Alpha Zero一样拥有决策类算法,展示出更高级的智能。X.AI的大模型将从数学角度入手,以开辟新的方式思考基础物理和其他问题。马斯克解释了选择数学的原因,即通过数学角度理解神经网络可能会引发一系列有趣的理论、问题和观点。X.AI团队中有专注于AI数学领域问题的研究人员,如数学家Greg Yang。马斯克明确表示X.AI的目标是在2029年之前实现人工通用智能(AGI)。他透露正在抢购NVIDIA的GPU,并表示给X.AI团队中的顶级研究人员提供高额薪酬和股票期权。当然目前马斯克组建X.AI初创公司面临算力瓶颈。他曾试图从NVIDIA购买4万张GPU用于训练AI,但最终只承诺在1年内提供2万张。马斯克在演讲中提到特斯拉的Dojo不是GPU,虽然常常被人们与GPU等同看待。这场公开直播透露了一些X.AI团队的战略合作,技术方向以及马斯克对于AI发展的观点,但是对于X.AI如何反超谷歌和OpenAI的细节马斯克没有多加说明,但这次公开演讲为X.AI的未来发展奠定了一定的基础,并引起了广泛的关注。总的来说,马斯克在这场演讲中展示了其认为的X.AI的使命,团队,合作伙伴以及他对AI发展的愿景和承诺,他强调X.AI将致力于深入理解宇宙的本质,并通过利用资源,合作伙伴和公众的反馈来不断改进和推动AI的发展,同时坚持公开透明和确保人类利益的原则。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师

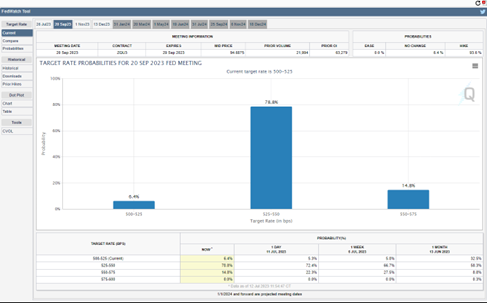

热门话题7月12日美国发布了6月的CPI数据,同比上涨3.0%,略低于预期的3.1%,前值4%;而核心CPI(不含食品和能源)与预期差距更大,同比4.8%,而预期为5.0%,前值5.3%。当日,美元指数暴跌1.08%至100.55,相反欧元黄金等非美资产大涨。一个数据可能不足以说明问题,但是结合上周的非农数字,有一些初步的迹象表明美国经济可能正在放缓,这一发展可能会让美联储最终结束我们在过去16个月里看到的激进的加息周期。虽然本月美联储仍然大概率会再加息,但是根据芝加哥商品交易所(CME)的FedWatch工具显示,9月停止加息的概率已经上升至78.8%。

美元跌落神坛,机会首先看向欧洲,英镑与欧元将会受到资本的追逐。大道至简,原因有二,欧洲通胀还很高,劳动力市场异常火热。所以,彼处加息不能停,涨声一片。英国的通货膨胀率是七国集团中最高的根据5月份的数据,通胀率同比达到8.7%,核心CPI同比达到7.1%。因此,英格兰银行当局别无选择,只能考虑大幅提高利率,可能利率终值将高达6.5%,而目前基准利率为5%。需要强调的是,自3月份以来,英国的核心CPI持续呈现上升趋势,这一点尤其令人担忧。虽然通胀峰值(11.1%)似乎已经过去。

此外,还有本周二公布的工资增长率问题。这一价格再次出人意料地上涨,并保持在相对较高的水平,使遏制价格过快上涨的斗争进一步复杂化。这些情况对于抗通胀和维持经济稳定构成了重大挑战。

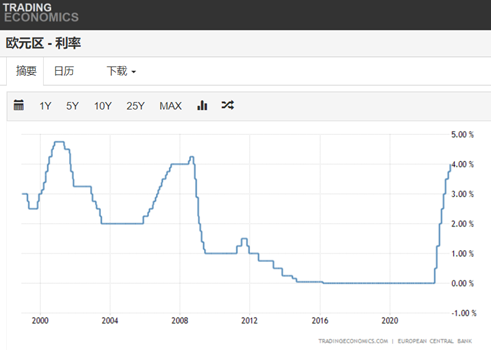

在下周的周三,我们将看到英国6月CPI的关键数据,这将极大地影响英国央行在即将召开的会议上的决定。目前的前景表明,货币紧缩的趋势将继续下去。欧洲央行将继续维持高利率欧元区的情况似乎稍好一些,CPI同比为5.5%。然而,欧洲央行行长克里斯蒂娜•拉加德(Christine Lagarde)和委员会的其他成员强调,要将通胀降至目标水平,仍有大量工作要做。根据Allianz Trade的最新预测,预计通胀要到2025年才会达到预期范围。最近在葡萄牙辛特拉举行的欧洲央行(ECB)论坛对货币政策没有留下任何怀疑的余地。各国央行行长开会讨论高通胀带来的挑战,与会代表的普遍共识是,有必要坚持加息,预计加息将持续到2024年底。拉加德(Christine Lagarde)强调了强劲的劳动力市场,劳动力市场继续支撑着经济,避免了衰退的威胁,这为进一步加息提供了余地。因此,在即将于7月27日召开的议息会议上,欧洲央行预计将再次加息25个基点,使利率达到2008年以来的最高水平。

技术分析:随着美元的回落,英镑对美元的交易似乎越来越有吸引力。周线图看,该货币对已将达到1.30整数位,正在靠近1.3170-1.3200区间的短期压力位。如果再次突破,将有机会冲向1.3680-1.3700区间。反之,如果价格回调,1.2600前后位置料将形成有力支撑。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jack Lin | GO Markets 新锐分析师

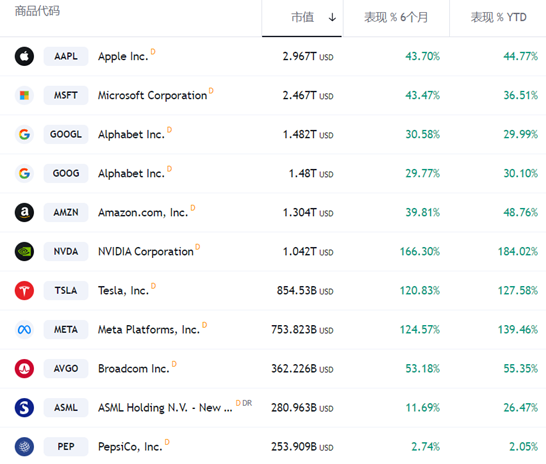

热门话题今年以来,科技股展现出令人瞩目的强势上涨态势。美股市场新兴科技代表指数的纳斯达克100指数今年已经上涨了38%,这是近40年以来,纳指100上半年实现的最大涨幅。纳斯达克100指数,简称纳指100,因其优异的交易量和波动性表现而广为人知,也是GO Markets平台最为受欢迎的交易产品之一。纳斯达克指数只代表科技股吗?纳斯达克100指数(NASDAQ 100),选取纳斯达克交易所交易排行榜上前100的非金融服务公司作为指数样本。指数组成公司除科技股外,其实还包括一些零售业、工业、生物科技和健康行业的公司。让我们具体看下纳指100的前十大市值成分股的组成,目前市值最大的是苹果、其次是微软、谷歌、亚马逊、英伟达、特斯拉、Meta这些大家耳熟能详且的与科技息息相关的热门大市值股票。目前这七家市值最高公司已经占据纳指55%,超过一半的权重,因此这也是为何我们往往将纳指100视作美国科技股的风向标。纳斯达克前十大成分股

来源:Trading view,2023/7/10纳斯达克的表现以及今年上涨的主要原因具体到表现来看,纳指100上半年实现累计涨幅36.3%,今年的反弹主要由苹果和微软等超高市值的科技股贡献。这主要是由于对人工智能可能性的兴奋促使投资者涌入少数大型科技公司。

上半年的最后一个交易日,苹果上涨2.3%,成为史上首家市值突破3万亿美元的公司,创下新高。2023年席卷市场的AI主题投资热中,受益于AI技术最多的是AI芯片霸主英伟达,其股价在今年上半年飙升超180%,也成为第一家市值达到1万亿美元的芯片制造商,市值增加超过5000亿美元。特斯拉与Facebook母公司Meta都实现超过100%的涨幅。

泡沫还是机会 纳指与科技股还能追吗?美国加息环境下,今年以来已经大涨的美股科技股面临短期不确定性。科技龙头股大涨也引发了对估值的担忧,这也是投资者们最为担心的追高买在山顶,因此多数对纳指100保持短期观望的态度。纳斯达克100指数的远期市盈率目前已接近26倍,高于10年均值。苹果、微软和英伟达三者估值尽管仍低于疫情期峰值,但还是明显高于历史平均水平。此外,就是美联储连续激进的加息下,投资者担忧高利息环境下的经济衰退对美股企业的影响,并进一步担心恐慌情绪蔓延至科技股。目前多数投资者相信美联储会在未来数月降息,这将带动美股走强,然而一旦美联储决定继续加息,货币环境再次紧缩,风险偏好将不利于美股后续走势。而乐观的投资者们则认为,AI代表着巨大的新市场,有望多年保持高速增长。同时,投资者将持续被大型科技公司所具备的特质所吸引,包括稳健的资产负债表、持久的收入来源和强大的竞争力。整体来说,我们认为泡沫这一词来描述今年科技股的上涨是有失偏颇的。今年引领纳指上涨的苹果、微软、特斯拉、谷歌、META、亚马逊、英伟达,有一个共同的特性,那就是他们是各自领域的领先公司,未来的科技变革也大概率也绕不开这些公司。当前正处于世界科技变革的关口,随着一轮以人工智能、新能源、智能驾驶、云计算、5G通信、物联网为代表的科技革命的到来,世界迎来新一轮科技周期,消费电子、汽车、通信终端等可能面临新一轮更新周期,相关产业可能面临一场新的变革和机遇。而如果在这些领域中去寻找投资机会,纳指100所代表的这些公司大概率会是最终的行业赢家。从纳指100成立的近40年的历史来看,尽管中间经历过几次波折,但是总体看美股是一个长牛市场,纳指100在近40年的时间里涨了超过100倍。美国作为全球最大的经济体,未来依然会为美股提供强大的动力,优质的行业和公司,从而继续走强。目前美联储临近加息周期尾声,各项经济数据显示经济仍具备韧性,较为乐观的软着陆是可能实现的。

纳指技术面纳指100整体依然维持强劲的上涨趋势,6月冲刺15300后回落,15300转而作为阻力位,若冲破该位置纳指有望继续创新高。短期支撑位14800,如果纳指转头向下跌破14800,则严防趋势反转下跌的可能。整体来说,目前纳指技术面依然看涨。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Cecilia Chen | GO Markets 分析师

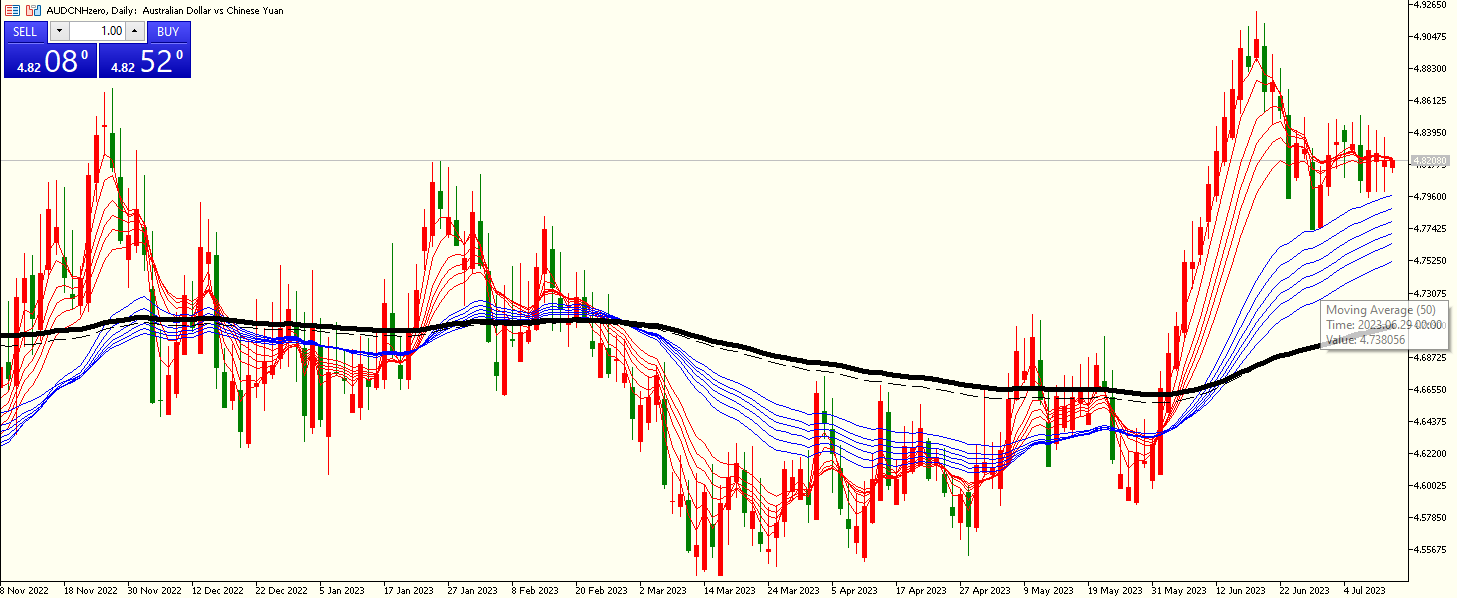

热门话题澳币兑人民币近日大幅上涨,价格攀升至4.82,最高时一度到达4.9上方。美元兑人民币也上涨到7.3附近,年内贬值超过7%。也就意味着,出国留学或者置业投资的华人,人民币的购买力下降了7%,需要支付的金额多了7%。假设对于一个留学生学费是4-5万澳币或者美金,他的学费在7月会比6月之前多缴纳2万多人民币。当然,对于回国的华人朋友是利好,外币的购买力提升了。对中国的外贸企业在收入上是利好,因为回款的价值更高。

这次贬值对于我们华人有没有影响?很明显影响不小。部分投资者或者移民华侨对于人民币的贬值产生了担忧,顾虑这次贬值会成为持续的行为。一个国家的汇率价值,是综合国力的体现,包含了货币政策、财政政策、经济状况、实际购买力等各类因素。本次大家担忧的点在于,中国经济的衰退,是否能够被有效逆转。从2023年第二季度之后,中国宏观经济显著走弱。5月,中国出口金额同比下降7.5%,等同于人民币贬值幅度。房地产开发投资连续13个月下降,房地产价格出现明显回落。高盛将中国全年GDP增速预期从6%下调至5.4%,野村中国从预期5.5%下调至5.1%。中国失业率也在大幅度攀升,而可提供的就业岗位和新毕业的大学生、研究生人数呈现明显反差。另外一点,很多国内的华人,将人民币换成美元,购买美元产品或者固定收益,获取更高的5%左右的美元存款利息,而放弃人民币2%左右收益的产品。利差交易的大面积市场行为,也是导致人民币汇率快速贬值的原因。美元国债收益率明显超过中国的固定收益。6月30日,中国央行再次讲话,要坚定防止汇率大起大落,开始启动逆周期因子。也就是通过讲话等方式,给市场干预汇率的预期,低成本的阻止贬值加剧。同时,中国各大国有银行开始响应政策,将美元存款产品利率从5%下调至2.8%,通过行政干预的方式,阻止套息情况加剧。

但是人民币能否因此坚挺呢?我认为任重而道远。首先,美元升值加息,这是世界范围的事情,美元的流动,中国央行可以通过行政手段,降低国内银行美元产品存款利息,却没办法改变其他国家美元产品的收益率。因此,境内的汇率转换政策改变可以延缓人民币贬值,而一旦国内的居民有了投资海外银行理财产品的渠道,这类资金还是会卖出人民币买入美金。资本逐利的市场行为很难被完全限制。另外,大量美元回流美国,导致了境内美元数量急剧减少。境内美元呈现净流出的状态,一度达到500亿美元,再继续持续几个月,问题还会加剧。境外机构连续减持中国主权债券,目前已经超过100亿人民币,还是老问题,美元和人民币的无风险收益已经产生了超过3%的收益差,机构更愿意进行无风险套息。中国央行数据显示,5月末,外币存款余额8518亿美元,同比下降13.5%。5月外币存款减少301亿美元,同比多减171亿美元。5月末,外币贷款余额7215亿美元,同比下降20.7%。5月外币贷款减少160亿美元,同比多减44亿美元。拉动经济增长的“三驾马车”——出口、投资、消费从疫情封锁之后,都没有完全恢复,甚至部分行业出现明显衰退。

美联储年内还有至少1次加息,中国还可能降息,人民币依旧有很强的贬值预期。中国国家统计局数据显示,6月制造业PMI(采购经理指数)为49%,连续第三个月位于经济收缩区间50%以下。这一次对于中国人民币来说,劣势较大,因为贬值会影响购买力。但是,2022年人民币交易量占比由2019年的4%提升至7%,成为仅次于美元、欧元、日元和英镑的全球第五大交易货币。如果贬值的力度可以控制,从经济和出口的角度来说,是较为有利的。西方国家包括澳洲、日本,在经济不景气的时候,对于汇率都是希望贬值,有利于出口。但是,对于中国经济目前面临的挑战和困难,暂时看不到很好的解决方案。因此,人民币贬值和中概股下跌,包括传递到China50和HK50产品上,都是可能在下半年继续发生的事情。一旦中国陷入通缩,未来会很难,尤其是在人口老龄化的关口,失业率却飙升。青年失业率高达20%。工业产出同比增长5.6%,低于预期的10%。对于澳洲来说,澳洲华人依赖于中国新移民和留学生的生意,未来6-24个月收益可能会有所下滑。SGR,Star公司的股价,以及铁矿石和各类依赖中国消费者的上市公司股价,可能也会受到压力。而大家持有澳股、港股、中国股票的朋友,可以在GO Markets适当做空对冲。也可以在人民币汇率产品上直接交易,能够提前保护自己的投资组合,减弱人民币进一步贬值或中国经济下行带来的风险。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

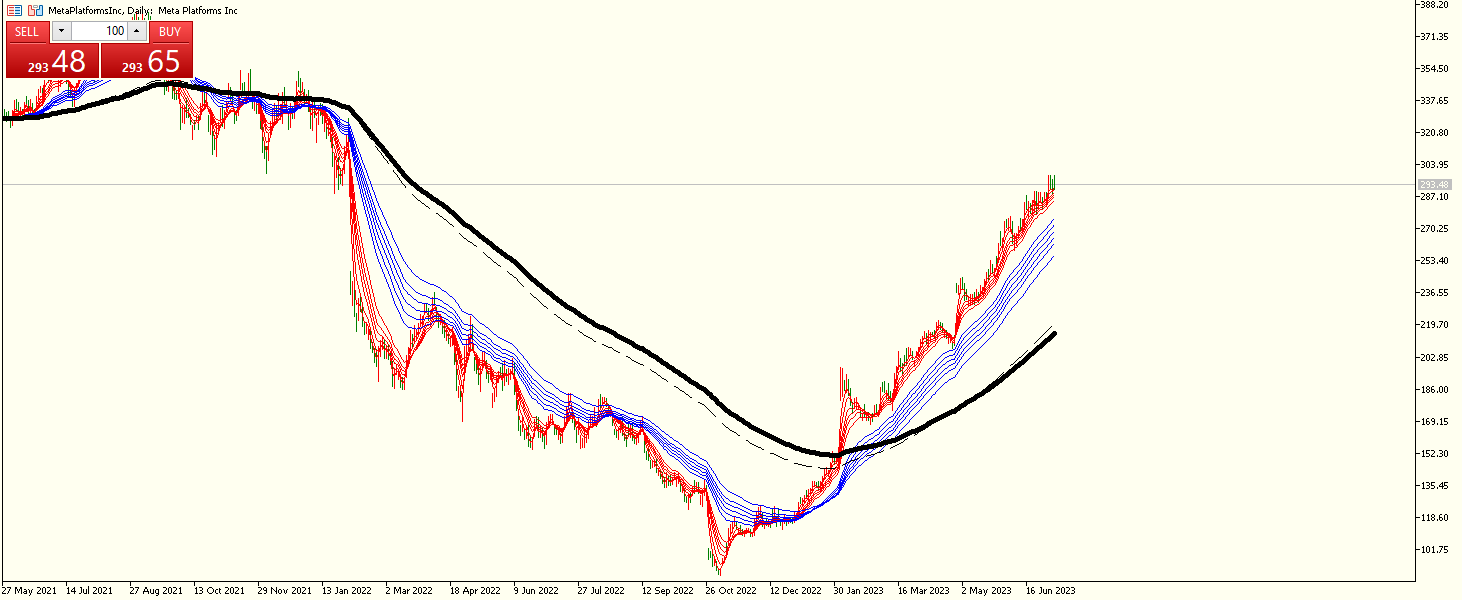

热门话题2022年底GO Markets的活动上,我记得我再次重点推荐了Meta,这个由Facebook改名后的公司。原因很简单,不管是VR还是AR,还是Instagram,扎克伯格的定位很明确,就是围绕社交,聚集人气。科技的发展,就是打破了人们的地理边界,使得友谊,爱好,认同,等等这类情绪,可以穿越万里,传递千万人。所以,Meta的股价从2022年11月不足100美金,暴涨到今天的290美金左右,出乎意料,又意料之中。

今天,扎克伯格最新推出的Threads,仅用了4天,注册用户突破了1亿。这是什么概念?超越了所有商业行为,占领全球可能只需要1个月。而俄罗斯用一年也没有办法占领乌克兰。现代战争,是文化之争,传承之争,经济之争。现代商业的背后,是用户的争夺,用户时间和注意力的争夺。Threads上线1天注册超过3000万用户,发布超过9500万条内容。成为当之无愧的商业王者。前不久,推特还因为马斯克的各种个人主义操作,陷入了运营危机,通过各种拆借和人员调整,包括解雇大量员工的形式,勉强度过了内部生存危机。但是当下面临来势汹汹的Threads,推特未来堪忧。Meta甚至在推特裁员后,雇佣了几十位推特前员工,马斯克非常愤怒,在推特上面喊话扎克伯格。从我的角度来看,扎克伯格很像马化腾,都是做社交类产品的,思维模式出奇一致:模仿或收购。但不管怎样,扎克伯格目前快速领先马斯克,至少在twitter和新兴的Threads竞争中,Threads 4天的表现完虐twitter。在商业行为上,免费和付费是两兄弟。我们愿意为可以持续拥有的东西付费,比如特斯拉。但我们不愿意为可有可无的推文付费。因为当下获取免费信息的渠道太多了,以华人为例,我们有微信公众号,视频号,抖音,Tiktok,小红书等。如果小红书每天只能免费浏览10篇文章,我相信大部分人会选择去浏览抖音或者公众号,而不是付费继续浏览小红书。所以,在Threads上线的前一个周末,马斯克突然宣布,推特所有用于浏览文章的数量都有上限。瞬间,大部分用户跑去了同类产品注册新的账户。竞争对手的用户数量增加数倍,包括Mastodon,Bluesky这类需要邀请码的去中心化社区。我们再看扎克伯格的Threads是如何操作的:Threads以Instagram为驱动器,整个产品基于Instagram的引流,二者不需要重新注册账户。且Instagram上面的好友和动态可以迁移到Threads上面。这就打破了新社交媒体需要重新打造好友圈的困境。除此之外,Meta在Threads的页面中提到了更远见的设计,就是加入了去中心化互动的社交属性,包括接入Mastodon这种开源合作。胸怀更广阔。相当于告诉其他社交平台,欢迎你来加入我,我们是一个阵营。

从Instagram在2012年创立以来,Facebook就开始体现了它在社交属性的特有优势,同年Facebook拥有超过7亿用户。但是,当时的Facebook正在向手机端转移,却很不顺利。这有点像2021年12月1日,Facebook改名Meta一样,扎克伯格希望进军社交元宇宙,但在2022年全年,公司没有得到投资者的认可。这有一点像是腾讯集团的发展,从QQ到微信,深耕领域更容易出现完美的新的产品。而阿里巴巴集团虽然添加了很多社交功能,但整体总是缺少一些社交属性,无法在社交领域与QQ、微信抗衡。而腾讯在微信产生之前,也面临着投资者的质疑。从投资者的角度来讲,长期稳定的来看,我更喜欢腾讯和Meta这样的上市公司。通过既有优势,以威逼利诱的方法,收购和模仿,并保证仅推流和资金支持收购的公司独立运营,保持特有风格。Meta旗下的Instagram和whatsapp加上Facebook本身,全球月活跃用户达到36亿,日活跃29亿,是当之无愧的社交帝国。Threads暂时仅在几个国家测试上线,未来依旧有很大的增长空间。但是,任何的新社交产品推出,总是会面临各类的可能潜在的隐私安全,言论自由和非法言论等,也要考虑新的用户体验和技术更新带来的便利和法律风险。

所以,从商业竞争的角度来看,Meta和推特的斗争还未结束。但是,用户是有限的,用户的注意力是有限的。我们期待马斯克拿出更有吸引力的产品或模式,推动社交媒体行业继续良性发展,使得更多用户受益。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题上周末最令市场关注的事件无疑是美国财政部长耶伦访华。作为拜登内阁成员中继国务卿布林肯后第二位访问北京的成员,这是耶伦首次以财长身份访问中国。耶伦在今年年初就多次表示期待访问中国,此后美国媒体频繁报道她的访华计划,如今终于成行。美国有线电视新闻网(CNN)此前分析称,耶伦一直以来都表达了拜登政府想加强与中国沟通,降低两国紧张关系的意愿。今年4月,耶伦再次强调了与中国保持关系的重要性,并表示"脱钩"将是一个巨大错误。上周,耶伦接受美国媒体采访时再次表示,美中关系对全球至关重要,"良性竞争"可以使两国的劳工和企业受益。她还希望通过此次访华重新建立联系,消除误解。对此,中国外交部杨涛表示,中美应该从人类福祉出发,共同引领全球合作,应对全球风险。

为期4天的访华行程转瞬即逝,耶伦在离开前在北京召开发布会总结了此次访问。耶伦表示,尽管美中之间仍存在分歧,但最近几天的会晤进一步推动了双边关系重返稳定轨道。她再次强调,美国并不寻求与中国经济“脱钩”。耶伦在发布会上表示,她与中方官员进行了累计约10个小时的双边会谈,从双边到全球,关税,投资,半导体,全球债务,应对气候变化,乌克兰危机,议题包罗万象。这些对话直接而充满实质性且富有成效,是美方为推动“美中关系建立更坚实基础”而迈出的一步。耶伦表示,此次访华的目的是与中国新一届经济团队建立和深化关系,减少误解风险,并为两国未来在气候变化及债务危机等领域的合作铺平道路。她认为已经取得了一些进展,但同时指出没有一次访问能在一夜之间解决一切面临的挑战。耶伦承认美中两国仍存在重大分歧,但她强调华盛顿并不寻求与中国经济“脱钩”,因为这对两国都将是灾难性的,也会破坏世界的稳定。耶伦相信两国可以建立对彼此和世界都有益的经济关系。

让我们来分析下耶伦此次访华将给中美两国以及世界带来哪些影响:首先能够促进中美双边关系:耶伦作为美国财政部长,此次访华将加强中美双方在经济和财政领域的对话和合作。她的到访有助于推动双方就贸易、投资、关税等问题进行沟通和协商,寻求共识和解决方案,为双边关系的稳定发展创造条件。其次是能够推动全球议题合作:除了双边议题,耶伦的访问还提供了机会,让中美就全球性议题展开讨论和合作。这些议题包括全球债务问题、应对气候变化等。通过加强双方的合作,可以为解决这些全球性挑战提供更多机会和推动力。另外,能够传递合作信号:耶伦的访问可以传递出双方都愿意加强合作的信号。尽管中美之间存在分歧,但通过高级别官员之间的对话和合作,可以展示双方愿意通过协商解决分歧,并在合作领域取得共赢的结果。这有助于缓解双方的紧张氛围,为未来的合作奠定基础。最后,能够促进全球经济稳定:中美是全球两大经济体,两国之间的经济关系对全球经济稳定至关重要。耶伦作为美国财政部长的访问,可以为全球经济提供一种信心和稳定的信号。通过加强中美之间的经济合作,可以减少不确定性,并为全球市场提供更稳定的环境。总之,耶伦的访问将为中美关系和全球议题的合作提供新的机遇和动力,通过对话和合作解决分歧,推动共同发展和全球稳定。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师