市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

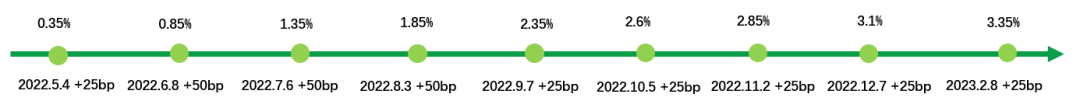

热门话题事件:2023年2月7日当地时间下午2:30,澳大利亚储备银行将将官方利率上调至3.35%,达到2012 年以来的最高水平,并表示未来几个月可能会进一步加息,以继续应对持续的通胀压力。

原因:2022年第四季度以来虽然大多数发达经济体的通胀已经放缓,但澳大利亚的通胀却逆势而上。2022年最后三个月,澳大利亚整体通胀率加速升至32年来最高水平达到7.8%,高于市场普遍预期。澳大利亚统计局表示,第四季度CPI增长的最主要贡献来自于国内假期旅行和住宿、电力以及新住宅购买等方面。澳大利亚央行行长Philip Lowe 在一份声明中表示,鉴于通胀趋势远高于央行2% 至 3% 的目标利率,未来仍需要进一步加息。历史:澳联储自2022年开始加息,三季度幅度较大,四季度起每次保持在25bp。

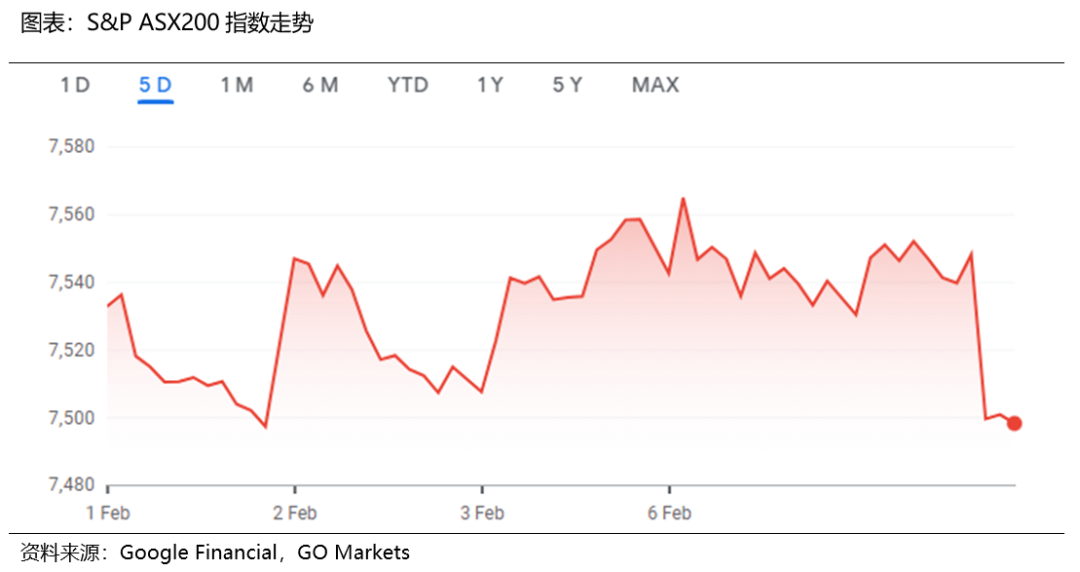

股市:S&P/ASX 200 指数(ASX: XJO) 在澳大利亚储备银行(RBA) 宣布再次加息后的几分钟内出现下跌0.54%。我们可以发现,澳联储自2022年十月开始就一直保持每次加息25bp的温和节奏,本次也不例外。然而,对比美国,我们可以看到美联储加息的幅度比较大,造成抑制通胀的效果也相对较强,2022年12月美国通胀已经有下降的趋势。而澳洲在此前7.8%的32年来最高通胀水平下加息仍然保持温和的步伐,这也说明了澳联储想要长期维持稳步的通胀抑制政策,小幅加息也不会对股市带来较大的冲击,甚至在短期内市场普遍认知高通胀加息的情况下会稍微利好股市,当然澳联储也表示未来将会继续加息,未来股市何去何从还要继续观测加息地幅度。

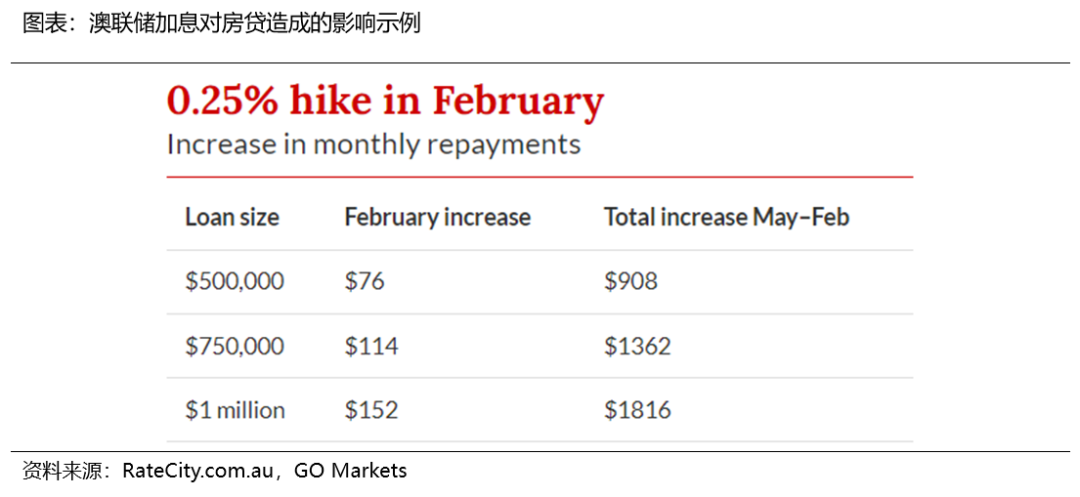

房地产:利率上升也将继续给家庭财富带来压力,根据PropTrack的数据预测,2023年房地产价格将再下跌7% 至 10%。PropTrack 经济研究主管Cameron Kusher 表示:“随着借贷成本持续上升以及随之而来的借贷能力下降,2023年房地产价格可能会继续下跌并加速下跌,价格较高的城市可能会出现最大的价格跌幅。例如对于750,000 的抵押贷款,如果商业银行全额转嫁,增加的金额将使每月还款额增加116 。自储备银行开始加息以来,750,000抵押贷款的每月还款额将攀升近1400 。

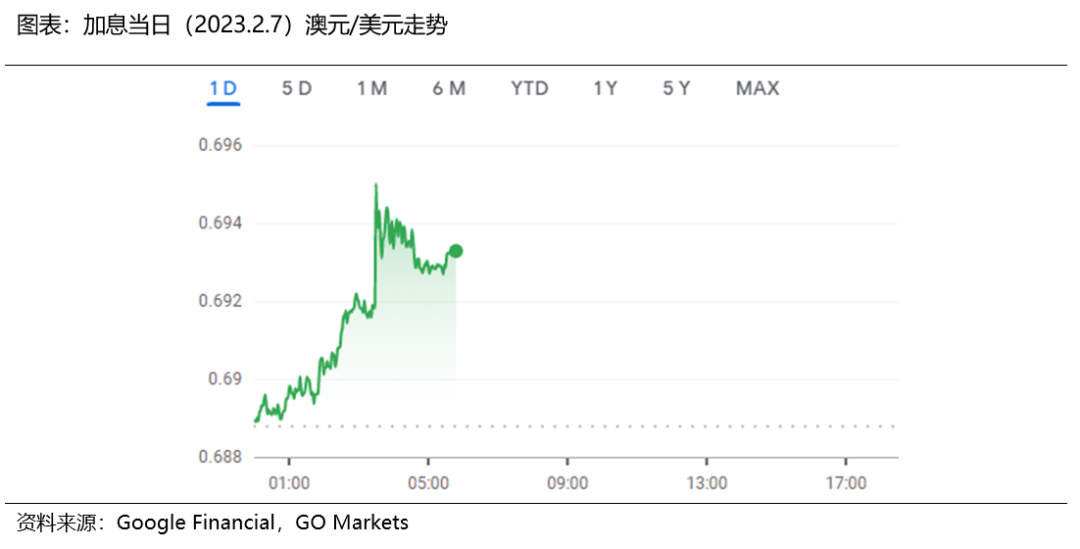

外汇:在宣布决定之前,澳元一整天都在上涨,但这主要是美元走软,纽元、英镑、日元和加元均走高,欧元上涨但落后于其他货币。在加息声明发布后,澳元/美元跳升至0.6950 至盘中高点然后稳定在0.6940 左右。澳元对美元的汇率取决于市场对澳联储的加息预期与实际加息幅度之差,在加息之前,普遍市场预期加息25bp,也有一部分声音预计加息50bp以应对32年以来的高通胀,但实际上却保持了温和的步伐25bp。因此,澳元汇率在加息之前就将25-50bp的预期反映在了价格之中,而加息却只有25bp,所以对于澳元来讲,未来短期或有小幅下降。然而,我们也要继续观测澳联储方面的消息,如果未来加息态度走向偏鹰派的话澳元将会再次上涨。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Yiduo Wang | GO Markets 助理分析师

热门话题我们知道随着澳洲央行未来还将继续的加息进程,澳洲各银行和机构专家们给出的判断在地产价格上都一致的看跌,但是对于澳洲经济在2023年的走势而言,各家的意见就不再统一了。有的人觉得澳洲可能会进入衰退,但是依然有些人觉得澳洲不会进入衰退,他们各自背后的观点是什么,今天我给大家简单转述一下,顺便最后再加上我的想法,希望能帮助到各位。

我们先来看看唱衰的一方。比如澳洲国民银行。澳洲国民银行(NAB)首席经济学家奥斯特(Alan Oster)在上周说到,澳洲经济正在陷入困境。他说:“我们预测2023年日历年的经济增长率为0.7%,2024年也是0.7%。失业率会上升一些,但不会过度。房地产价格在2022年下降了6%,今年将再下降11%。” 澳洲其他三家主要银行的经济学家们也做出了相似的预测,大家普遍认为,澳洲的房价在今年还将继续下跌8-12%。而澳洲央行过去8次的加息,已经让所有贷款申请人可以申请的贷款数额下降了至少25%。换句话说,银行发行的住房贷款总量,也将会因为申请人还款能力的减弱而出现下跌,从而影响银行的盈利能力。澳洲当地的一个调查机构在今年1月随机调查了29名专家学者,他们的平均预测是2023年央行把现金利率从3.1%加到3.6%。其中有个人预测利息将一直加,加到5%。还好只有一个人是这么预测的,要不然基础利息真到了5%,那自住房的贷款利息就会到7.5%了。那可不是闹着玩的,毕竟在悉尼墨尔本这样的大城市,手里有百万以上贷款的人有很多,现在已经叫苦连天了,真到了7.5%那将会对消费和地产市场产生非常负面的影响。但是即便大多数人都认为今年还有3-4次的加息,但是超过一半的受访者也认为,澳洲的经济不太可能进入衰退。根据29人的调查结果,平均来看,这些经济学家们认为未来两年经济衰退的可能性为26%,虽然高于2022年中估计的20%。但是距离通常50%的分界点,依然还有很多空间。其中一个专业人士,前外交部首席经济师Jenny Gordon说如果欧洲在2023-24年冬季进入衰退而中国的恢复又比较缓慢的话,那么澳洲就更有可能衰退。

而相比这29人得出的26%的衰退可能,在同一个调查里,他们预计美国未来2年有42%的概率会进入衰退,欧盟57%,英国更是达到了73%。那为啥澳洲作为发达国家,2008年金融危机,2012年欧债危机,包括这次疫情之后的危机,都能表现好于其他欧美国家呢?其实原因我之前的文章说过很多次,总结来说就是两点:1.澳洲目前保持开放的移民政策,以及 2.澳洲丰富的矿产资源。其中第一点尤为重要。

因为通常来说一个人口较为固定的国家,面临目前的利息不断上涨的情况,大部分居民都会减少消费。从而造成这个社会消费力的下降。但是澳洲的绝招就是:开放移民,每年可以有计划的控制新增人口。经济差了,就多进一点,经济过热了,就少近一点。这些新移民,以及很多例如留学生,打工签证甚至探亲签证的人士,在澳洲,都需要消费。这些新增移民所带来的消费就可以弥补原本因为利息提高而减少的本地人群消费,从而实现澳洲整体消费可以在利息增加的情况下依然实现总体增长从而维护经济。而第二个原因,基本也是命:就是咱澳洲地下又矿。而且不仅仅是过去20年一直需要的铁矿石和铜矿。同时也有未来20年新能源时代所需要的锂矿,镍矿和锌矿。什么叫躺赢?澳洲就是躺赢。这么说吧。光靠这澳洲移民水龙头和地下的矿。就算是最差的情况来了,澳洲也一定过的比欧美好。第二个问题来了,那在不断加息情况下,按理说股市应该随着消费一起下跌啊。但是澳洲的股市我们看到却在过去3个月出现强劲反弹。这不刚才还有很多专家们还在说澳洲可能会衰退,那为什么股市却还能保持强劲走势呢?如果是技术派,肯定是这个线,那个支撑,一顿操作猛如虎。但是我一般是透视派,啥叫透视派?就是一针见血看问题,打破沙锅看到底。澳洲股市,基本自己没有主心骨。不是看中国,就是看美国。其中主要看美国。中国放弃清零了,最坏情况过去了,澳洲就涨,为啥?之前说过,因为投资者觉得中国要刺激经济了,肯定要资源矿产啊。那另一边,世界大哥美国,12月出的通胀数据有所好转,似乎物价开始被控制住了?那是不是意味着美国加息要缓缓了?加息慢点,那股市就快点上了。所以,澳洲作为依靠中美两个国家两头吃的专家,两边都有好消息,自然自己的股市也跟着上。但是真正2023年是否能持续,接着上,就得看中国那边刺激的政策到底有多狠,以及美国经济会不会真的衰退,还是最终躲过一劫了。从最近上涨最多的板块来看,不外乎矿业,旅游交通,以及消费类板块,其实都是吃的大量新增移民和短期人口的新闻红利。说白了,要是没有每年可以随意调节的人口阀门,澳洲也没这么轻松。但是还是那句话,大家记住了。只要澳洲还有移民这个大部分国家没有的绝招,加上地下的矿,咱们在绝大部分的时候,都不会比欧美差。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

The stronger-than-expected US non-farm employment change data release last week saw the DXY climb strongly higher, beyond the 103 price level. With markets now anticipating that the US Federal Reserve could reinforce its hawkish stance, further upside is expected for the DXY. On the other hand, uncertainty rises over the Bank of Japan’s (BoJ) monetary policy stance following the surfacing of rumors that Masayoshi Amamiya was approached to succeed the current BoJ Governor, Haruhiko Kuroda.

The appointment of Amamiya as governor could likely see the BoJ continue with its ultra-easy monetary policy, ultimately leading to further weakness for the Japanese Yen. Technical Overview The recent change in sentiment of the DXY has led the USDJPY to pause on the previous downtrend, finding support at the 127.00 price area. The current retracement of price to the upside has seen the USDJPY break above the bearish trendline formed in November last year.

If this upward momentum continues and the USDJPY breaks above the 133.50 price level, which coincides with the 23.60 Fibonacci retracement level, this could signal confirmation for a bullish correction. The USDJPY could continue to trade higher, with the bullish momentum supported by the divergence in the Moving Average Convergence & Divergence (MACD), toward the target price level of 142.50 price level, formed by the 61.80% Fibonacci retracement level and previous swing high from November 2022.

热门话题每当一个概念变得炙手可热,资本市场总是会剧烈波动,掀起疯狂的炒作盛宴。随着OpenAI旗下聊天机器人ChatGPT爆红,美股投资者迅速开始狂热炒作,在该赛道有所布局的企业无一例外受到了热捧。百度美股一度大涨逾10%,“美版头条”BuzzFeed两天暴涨300%,C3.ai股价翻了一番多......这股热潮不禁让人回想起了20世纪90年代末的大麻热潮和加密热潮,甚至是网络泡沫。投资者们纷纷涌入股市,随后提出问题。那么经典的争论来了,这波ChatGPT炒作热潮是投机泡沫还是追求长期价值?

ChatGPT是 OpenAI 于 11 月 30 日推出的一款聊天机器人,可以免费测试,能根据用户的提示,模仿类似人类的对话。它是GPT-3模型的变体,GPT-3经过训练,可以在对话中生成类似人类的文本响应。ChatGPT 旨在用作聊天机器人,我们可以对其进行微调,以完成各种任务。ChatGPT不仅会聊天,写得了代码,修复得了bug,还能帮你写工作周报、写小说、进行考试答题,绘画,看病,甚至你还可以诱骗它规划如何毁灭人类,许多人认为,ChatGPT不仅仅是一个聊天机器人,而可能是现有搜索引擎的颠覆者。细分来说,ChatGPT的亮点如下:1)新增代码理解和生成能力,对输入的理解能力和包容度高,能在绝大部分知识领域给出专业回答。2)加入道德原则。即ChatGPT能够识别恶意信息,识别后拒绝给出有效回答。3)支持连续对话。ChatGPT具有记忆能力,提高了模型的交互体验。ChatGPT背后的算法基于Transformer架构,这是一种使用自注意力机制处理输入数据的深度神经网络。Transformer架构广泛应用于语言翻译、文本摘要、问答等自然语言处理任务。以ChatGPT为例,该模型在大量文本对话数据集上进行训练,并使用自我注意机制来学习类人对话的模式和结构。这使它能够生成与它所接收的输入相适应且相关的响应。从投资者角度看,大家更为关注的是ChatGPT的商业化道路是怎样的。从GPT进化到GPT 3,参数量从1.17亿增加到1750亿,预训练数据量从5GB增加到45TB,其中GPT 3训练一次的费用是460万美元,总训练成本达1200万美元。高额投入使得B端变现更具可行性。而如今很多C端应用均为免费版,在C端付费形式刺激度较低的情况下,未来B端或将成为AI绘画软件的核心客户。由于ChatGPT不限于普通聊天,还可解决具体难题,部分用户在社交媒体上表达了对ChatGPT的付费意愿。在商业化道路上,版权问题是生成式AI绕不开的一道坎,绝大多数原创作品的版权拥有者会介意AI提取自身作品的部分元素,但毫无疑问,人工智能将继续发展,并带来各领域一些根本性的变化。就目前而言,相关股票价值真的如当前股价所体现的吗?部分分析师认为这项技术还不成熟,其落地应用仍然不稳定,投资仍然具有高度投机性。

让我们看看近期AI概念股的走势,有美版头条之称的数字媒体公司BuzzFeed,在过去一年股价大跌,但有消息称该公司计划采用人工智能程序 ChatGPT 协助内容创作,股价近期连续大涨,曾在两天内暴涨300%。人工智能软件提供商C3.AI Inc也备受关注,自两年多前上市以来,C3.ai的股价大幅下跌,然而自1月底C3.ai宣布将ChatGPT集成到其产品中,该股股价大幅飙升,自1月5日以来翻了一番多。纵然是其芯片供应商英伟达,在刚刚过去的1月大涨33%,这也是其近6年来涨幅最高的一个月。然而,投机泡沫的迹象似乎也正显现,BuzzFeed的股价已从上周的盘中高点抹去40%,有分析师认为BuzzFeed在短视频内容货币化方面存在不确定性,以及在消费者支出环境疲软的情况下,其易受数字广告支出减少的影响。那么AI概念是否有长期价值呢?基于GPT-3.5的ChatGPT具备更出色的表现和更高的关注度,能够进一步帮助企业、个人节省时间和资源,其背后的的应用空间更为广阔。根据瑞银预计,ChatGPT的月活跃用户已在今年1月份突破1亿,且瑞银称整个生成式人工智能应用程序的市场规模或高达1万亿美元,潜在的发展空间正吸引投资者涌入。Meta CEO扎克伯格最近表示,其主要目标之一是成为生成式人工智能领域的领导者。Alphabet CEO皮查伊在本周的电话财报会议上表示,人工智能之旅才刚刚开始,Snap首席执行官埃文·斯皮格则认为,生成式人工智能是一个“巨大的机会”,并已经投入大量资金。我想这也是近期热炒AI主题股的主要原因。其实我们在筛选投资板块的时候,所谓的追求长期价值需要自己定义一个时间期限,是现在开始的一年?三年?五年?还是十年或许更久?在我看来,AI概念股当下是炒作气势,但缺乏上涨稳定性,不宜追高,至少在3至5年的周期内,AI题材并非首要的热门板块,而这恰恰是大部分散户投资者投资股票的一个临界期,极少数人愿意为3至5年后有可能爆发的股票做等待,很多投资者连一年都持有不了,更不用说AI的时间线或许在十年以上了。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 专业分析师

Market response to any specific economic data release is far from standard even if actual numbers differ greatly from consensus expectations. Rather the market response is based on context of the current economic situation. This week’s non-farm payrolls, being one of the major data points in the month, is a great case in point.

There are many factors and of course the key one for you as an individual trader is your chosen vehicle you are trading (and of course direction i.e. long or short for open positions). The context of today’s impending non-farm payrolls from a market perspective is interest rate expectations going forward. This week the Fed gave the market the expected.25% cut that was already priced into currency, bond and equity market pricing.

The market response however, as this was already priced in, was as a result of the accompanying statement which was not as dovish as perhaps anticipated and a reduction in expectations of a further imminent cut. From an equity market point of view the result, despite the interest rate cut, was to sell off, whereas from the USD perspective this lessening expectation of further rate cuts was bullish. Perhaps this could be viewed as contrary to what the textbooks would suggest is a standard response.

So, onto today's non-farm payrolls (NFP) figure… Logic would suggest that a strong number is good news for the economy, and so should be positive for equities and perhaps bearish for USD. However, as this may be a critical number in the Feds decision making re. interest rate decisions, a strong NFP is likely to have the opposite effect. A weaker number is likely to be perceived as potentially contributory to thinking that another rate cut may be prudent sooner and so despite on the surface being “bad news”, it would not be surprising to see equities stronger and USD weaker.

It remains to be seen of course what the number is and the actual response but is perhaps a lesson in seeing new market information within the potential context of the current economic circumstances and of course incorporate this in your risk assessment and trading decision making. Mike Smith Educator Go Markets [email protected] Disclaimer The articles are from GO Markets analysts based on their independent analysis. Views expressed are of the their own and of a ‘general’ nature.

Advice (if any) are not based on the readers personal objectives, financial situation or needs. Readers should therefore consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice.

We frequently refer both in the articles we publish and the weekly “Inner Circle” sessions we present, to the benefits of a trading journal. However, the reality is that many traders make the choice not to measure trading despite the logical benefits of doing so. Whether you do or don’t currently, the bottom-line decision you are making is not only whether you do or don’t but how that positions yourself with your trading development.

We would suggest that this overall choice can be broken down into the following three sub-choices. You can make the decisions that are right for you subsequently. Sub-choice 1 – Measuring your system You are either making the choice to: Have certainty on not only whether your trading plan as a whole can create positive outcomes but have evidence to know which component parts of your plan are e.g. indicators you use for entry and exit, comparing strategies you trade, timeframes that work best for you, (and which are not) contributing to such outcomes.

Additionally, it allows you to compare what would happen if you change some of the perimeters on your potential results. OR You have no evidence as to whether your system as a whole and its components parts are working well to serve you in getting the results you desire. Nor do you can test and gather evidence as to what the impact of nay changes you may make to that system, Ask yourself… If I am serious about trading results which choice should I make?

Sub-choice 2 – Measuring you as a trader You are either making the choice to: Know the degree to which you are following your plan or otherwise so you can ultimately make a judgement on: a. Whether your system is working for you (all the points in sub-choice 1 above CANNOT be made unless you are following your plan religiously). b. What you need to work on in terms of tightening your behaviour e.g. on exits or entry c.

Whether there are certain market conditions which you find difficult or are ill-prepared for (so you can fill any knowledge gaps or avoid in the future). OR You can continue to trade as you do, avoiding any self-assessment and growth, and the refinement of your behaviour that may contribute to more positive trading outcomes. Ask yourself… If I am serious about trading results which choice should I make?

Sub-choice 3 – Improving your trading (closing the circle) (let’s assume you are keeping a journal for this one) You are either making the choice to: Measure with purpose that has clear follow through into further development and refinement of your trading plan and subsequently your actions. This facilitates the development of you as a trader based on your individual character and trading style. In practical terms, you ‘close the circle’ with a defined review and develop an action plan based on your review to test and change parts of your plan.

This is evidence-based trading! OR You can measure for measurements sake to on the surface appear to be “doing a right thing” but in reality, failing to unleash the real power of journaling, that is to make an on-going and continuous positive difference to your trading outcomes. Ask yourself… If I am serious about trading results which choice should I make?

In summary, if you have made the choice to read this article to its end you are left with one ultimate choice…to journal or not to journal including the three sub-choices that dependent on which you are making can impact on your trading. So, for one last time, Ask yourself… If I am serious about trading results what should my actions be with what I have read in this article? Our next steps and Share CFD education programme both have indicative trading journal templates to help get you started, and we would be delighted if you could join us.

Mike Smith Educator GO Markets Disclaimer The articles are from GO Markets analysts based on their independent analysis. Views expressed are of their own and of a ‘general’ nature. Advice (if any) are not based on the reader’s personal objectives, financial situation or needs.

Readers should, therefore, consider how appropriate the advice (if any) is to their objectives, financial situation and needs, before acting on the advice. Find additional Forex trading education resources here. Next: 5-point checklist for using chart patterns within your tradin