市场资讯及洞察

.jpg)

2026年3月3日,澳大利亚储备银行(RBA)行长米歇尔·布洛克(Michele Bullock)在悉尼举行的AFR商业峰会上发表重要演讲,阐述了当前货币政策立场及经济形势判断。

关于劳动力市场

布洛克明确指出,澳大利亚劳动力市场"总体上有些紧张"。这种紧张状态与更广泛经济领域的产能压力共同作用,成为近期通胀上升的重要推动因素。劳动力供需失衡反映出经济运行接近或超过其潜在产能。

关于通胀压力来源

布洛克强调,当前部分通胀压力源于需求超过了经济的供给能力。值得注意的是,这一供需缺口在六个月前被显著低估。自2025年中期以来,通胀的意外增长很大程度上归因于特定行业的需求和价格压力,尽管这些压力预计将逐步缓解。

关于利率政策前景

布洛克发出明确警告:维持利率不变可能导致通胀长期高于目标水平。基于这一判断,她表示在未来两周的下一次货币政策会议上,加息"有可能"成为现实,这一表态为市场传递了强烈的紧缩信号。(据RBA官网信息,下一次Cash rate target将于 2.30 pm, 17 March 2026更新)

关于地缘政治风险

在评估外部风险时,布洛克特别提到了地缘政治不确定性的双重影响。伊朗冲突导致的油价冲击可能会加剧本地通胀压力,但同时也可能对全球经济活动产生负面影响,从而带来通胀下行压力。面对这些复杂交织的因素,RBA将花时间审慎评估当前地缘政治事件对澳大利亚经济的实际影响。

Artificial intelligence stocks have begun to waver slightly, experiencing a selloff period in the first week of this month. The Nasdaq has fallen approximately 2%, wiping out around $500 billion in market value from top technology companies.

Palantir Technologies dropped nearly 8% despite beating Wall Street estimates and issuing strong guidance, highlighting growing investor concerns about stretched valuations in the AI sector.

Nvidia shares also fell roughly 4%, while the broader selloff extended to Asian markets, which experienced some of their sharpest declines since April.

Wall Street executives, including Morgan Stanley CEO Ted Pick and Goldman Sachs CEO David Solomon, warned of potential 10-20% drawdowns in equity markets over the coming year.

And Michael Burry, famous for predicting the 2008 housing crisis, recently revealed his $1.1 billion bet against both Nvidia and Palantir, further pushing the narrative that the AI rally may be overextended.

As we near 2026, the sentiment around AI is seemingly starting to shift, with investors beginning to seek evidence of tangible returns on the massive investments flowing into AI, rather than simply betting on future potential.

However, despite the recent turbulence, many are simply characterising this pullback as "healthy" profit-taking rather than a fundamental reassessment of AI's value.

Supreme Court Raises Doubts About Trump’s Tariffs

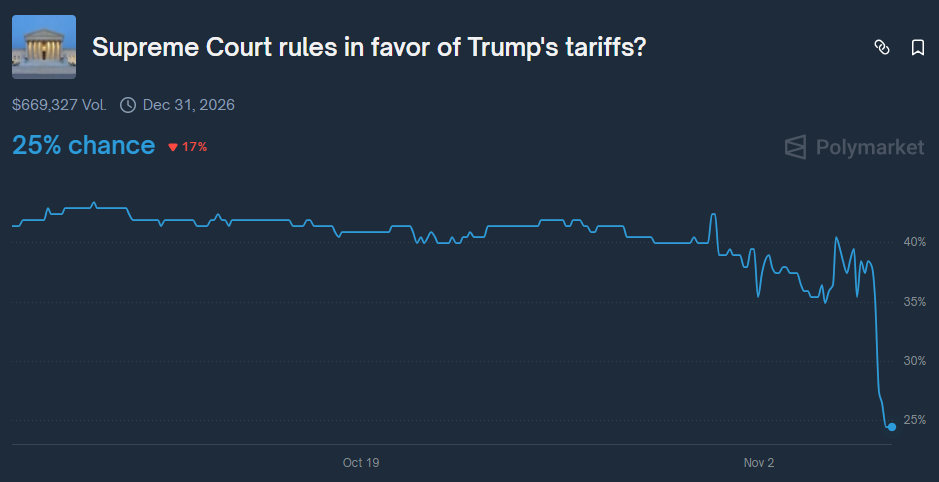

The US Supreme Court heard arguments overnight on the legality of President Donald Trump's "liberation day" tariffs, with judges from both sides of the political spectrum expressing scepticism about the presidential authority being claimed.

Trump has relied on a 1970s-era emergency law, the International Emergency Economic Powers Act (IEEPA), to impose sweeping tariffs on goods imported into the US.

At the centre of the case are two core questions: whether the IEEPA authorises these sweeping tariffs, and if so, whether Trump’s implementation is constitutional.

Chief Justice John Roberts and Justice Amy Coney Barrett indicated they may be inclined to strike down or curb the majority of the tariffs, while Justice Brett Kavanaugh questioned why no president before Trump had used this authority.

Prediction markets saw the probability of the court upholding the tariffs drop from 40% to 25% after the hearing.

The US government has collected $151 billion from customs duties in the second half of 2025 alone, a nearly 300% increase over the same period in 2024.

Should the court rule against the tariffs, potential refunds could reach approximately $100 billion.

The court has not indicated a date on which it will issue its final ruling, though the Trump administration has requested an expedited decision.

Shutdown Becomes Longest in US History

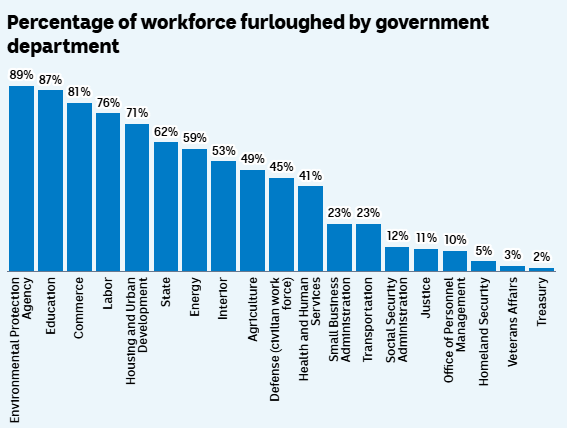

The US government shutdown entered its 36th day today, officially becoming the longest in history. It surpasses the previous 35-day record set during Trump's first term from December 2018 to January 2019.

The Senate has failed 14 times to advance spending legislation, falling short of the 60-vote supermajority by five votes in the most recent vote.

So far, approximately 670,000 federal employees have been furloughed, and 730,000 are currently working without pay. Over 1.3 million active-duty military personnel and 750,000 National Guard and reserve personnel are also working unpaid.

SNAP food stamp benefits ran out of funding on November 1 — something 42 million Americans rely on weekly. However, the Trump administration has committed to partial payments to subsidise the benefits, though delivery could take several weeks.

Flight disruptions have affected 3.2 million passengers, with staffing shortages hitting more than half of the nation's 30 major airports. Nearly 80% of New York's air traffic controllers are absent.

From a market perspective, each week of shutdown reduces GDP by approximately 0.1%. The Congressional Budget Office estimates the total cost of the shutdown will be between $7 billion and $14 billion, with the higher figure assuming an eight-week duration.

Consumer spending could drop by $30 billion if the eight-week duration is reached, according to White House economists, with potential GDP impacts of up to 2 percentage points total.

You've been using a 30-pip trailing stop for as long as you can remember. It feels professional, manageable and relatively safe.

But during volatile sessions, you see your winners get stopped out prematurely, while low-volatility winners drift back and hit stops that are relatively too tight.

Same 30 pips, different market contexts, but inconsistent in the protection of profit and overall results.

The Fixed-Pip Fallacy?

Traders gravitate toward fixed pip trailing stops because they feel concrete and calculable. The approach is easy to execute, readily automated through platforms like MetaTrader, and aligns with how most people naturally think about profit and loss.

But this simplicity masks a fundamental problem.

A twenty-five pip move in EURUSD during the London open represents an entirely different market event than the same move during the Asian session. The context matters, yet the fixed-pip approach treats them identically.

This becomes even more problematic when you consider different currency pairs. GBPJPY might have an average true range of thirty pips on an hourly chart, while EURGBP shows only ten. The same trailing stop applied to both instruments ignores the reality that volatility varies dramatically across pairs.

Timeframe introduces yet another layer of complexity. Take AUDUSD as an example: a ten-pip move on a four-hour chart barely registers as meaningful price action, but on a five-minute chart it represents a significant swing. The fixed-pip method treats these scenarios as equivalent.

The natural response might be to use something more sophisticated, like an ATR multiple. This accounts for your chosen timeframe, the instrument's normal volatility, and even session differences. But it brings its own complications.

When do you measure the ATR? Do you use the value at entry, knowing it might be distorted by sessional effects? Or do you make it dynamic, which becomes far more complex to implement in practice?

Perhaps there's another way forward that doesn't rely on abstract measures of volatility but instead responds directly to the movement of price in relation to the trade you're actually in—accounting for your lot size and the profit you've already captured.

Maximum Give Back: The Percentage Approach

Instead of asking "how do I protect profit after fifty pips," ask "how do I protect profit after giving back a certain percentage of open gains."

Consider a maximum give-back threshold of 40%. When your trade is up one hundred pips, the trailing stop activates if price retraces forty pips from peak, locking in a minimum of sixty pips.

But when that same trade reaches two hundred fifty pips of profit, the stop adjusts, and now it activates at a one-hundred-pip pullback, securing at least one hundred fifty pips. The stop distance scales naturally with the magnitude of the win you're sitting on.

This creates a logical asymmetry that fixed pip approaches miss entirely. Small winners receive tighter protection. Big winners get room to breathe.

The approach adapts automatically to what the market is actually giving you in real time, without requiring you to predict anything in advance.

You don't need to maintain a reference table where EURUSD gets thirty pips and GBPJPY gets sixty. You don't need different standards for different instruments at all.

The same 40% logic works whether the average true range is high or low, whether volatility is expanding or contracting. It is designed to be more adaptive to regime changes than fixed-pip stops, potentially requiring less manual recalibration as it's responding to the trade itself rather than to abstract measures of what the instrument normally does.

The market tells you how much it's willing to move in your direction, and you protect that information proportionally. Nothing more complicated than that.

Key Parameters to Specify in Your System:

- Maximum Give Back Percent: 30-50% is typical, but is dependent on how much profit retracement you can tolerate.

- Minimum Profit to Activate: In dollar amount or an ATR multiple form entry. This prevents premature exits on tiny winners, e.g., if it has moved 5 pips at 40% that would mean you are only locking in a 3-pip profit.

- Update Frequency: Potentially every bar. More frequent, but there may be issues if there is a limited ability to look at the market (if using some sort of automation, this could be programmed).

Is Maximum Giveback Always the Optimum Trail?

As with many approaches, results can be highly dependent on underlying market conditions. It is important to be balanced.

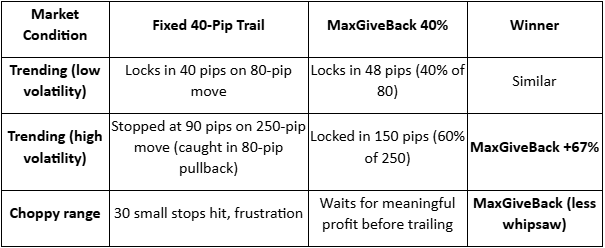

The table below summarises some observations when maximum giveback has been used as part of automated exits.

The major difference isn’t likely to be an increased win rate. It is about keeping more of your runners during high-volatility price moves rather than donating them back to the market.

It may not always be the best approach, as different strategies often merit different exit approaches.

There are two obvious scenarios where fixed pips may still be worth consideration.

- Very short-term scalping (sub-20 pip targets)

- News trading, where you want instant hard stops

Integrating Maximum Giveback With Your System

You may have other complementary exit filters in place that you already use. Remember, the ideal is often a combination of exits, with whichever is triggered first.

There is no reason why this approach will not work well with approaches such as set stops, take profits and partial closes (where you simply use maximum Giveback in the remainder as well as time-based exits.

Final Thoughts

To use fixed-pip trailing stops irrespective of instrument pricing, volatility, timeframe, and sessional considerations is the trading equivalent of wearing the same jacket in summer and winter.

Maximum Give Back trailing adjusts to the ‘market weather’. It won't make bad trades good, but it could help stop you from cutting your best trades short just because your stop was designed for average conditions.

The market doesn't trade in averages but has specific likely moves dependent on context. Your exits should not be average either.

.jpg)

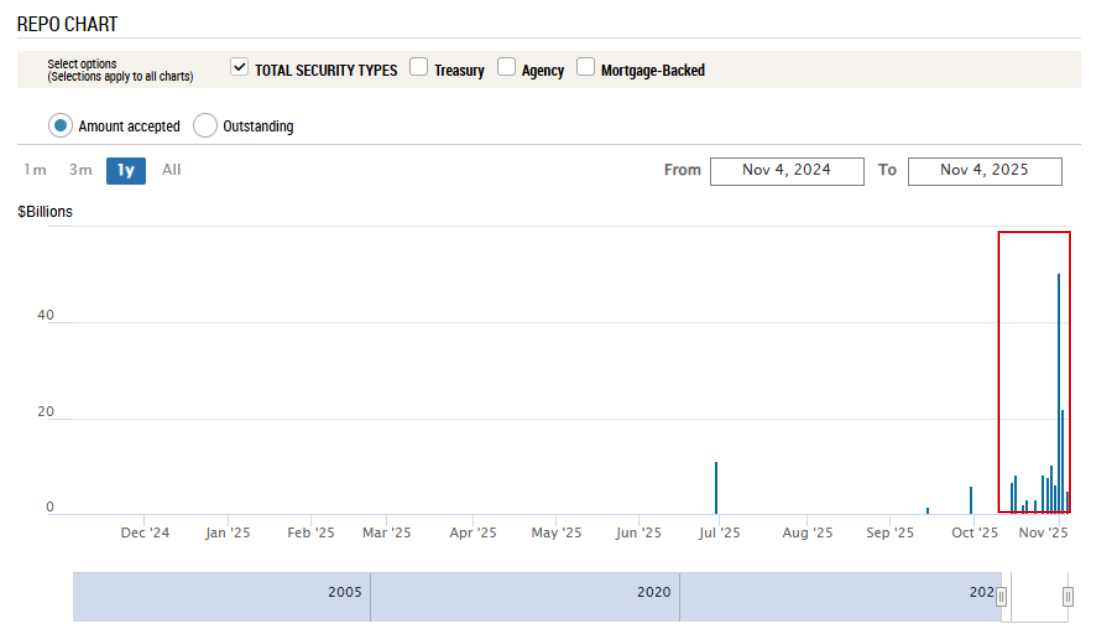

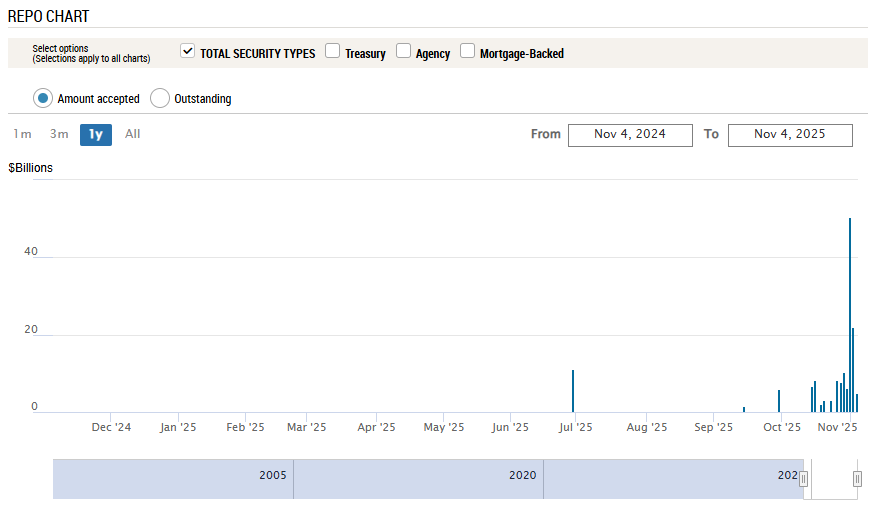

近期,全球投资者越来越明显地感受到一个信号——美元的钱,开始“紧”了。这似乎有些不对劲,美联储10月底刚刚降息,理论上市场流动性应该更宽松,资金成本更低,但现实却是美元资金反而愈发紧张,资产价格开始同步下挫。这究竟是怎么回事?先看一个最直接的指标:纽约联储的正回购操作(Repo)和逆回购操作(Reverse Repo)。一个基本的原理是:Repo 上升、Reverse Repo 下降 = 市场资金紧张;Repo 下降、Reverse Repo 上升 = 市场资金充裕。10月末,联储的正回购操作量一度达到 500亿美元,这一数值在以往往往出现在极端流动性紧张的时刻。更关键的是,这种“抽水”并非短暂的月末现象——进入11月初后,正回购仍在持续,这意味着美元市场的“钱紧”已经趋于常态化。

(纽联储官网)

资金紧张的根源在于:原先支撑流动性的“美元蓄水池”——ONRRP(超额逆回购工具)几乎被抽干了。

在过去两年,美联储在执行量化紧缩(QT)和财政部大量发债的同时,市场的流动性压力能通过ONRRP缓冲。但如今,这个高峰时期曾超过 2万亿美元 的“蓄水池”已经见底。

这意味着,财政部每多发一笔债、每回笼一笔资金,都将直接以消耗银行准备金为代价。

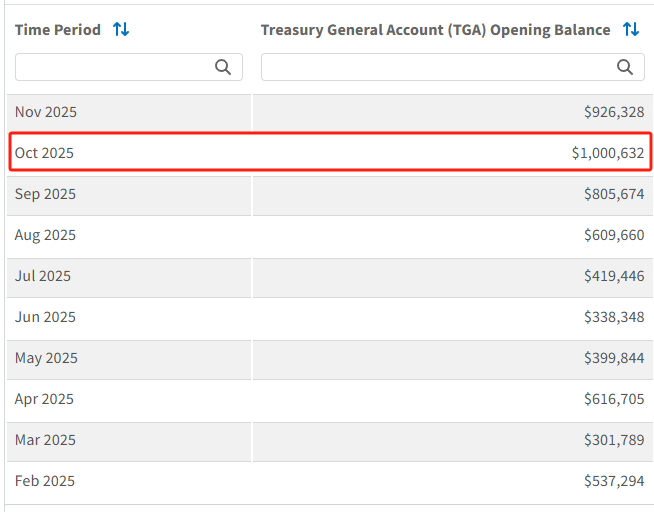

更雪上加霜的是,美国政府的“关门”也在加剧这一紧张。当前,美国政府停摆已进入第36天,创历史纪录,市场普遍预测将会持续更久。虽然财政部仍在继续发行美债,但政府支出却被迫收缩——这造成了所谓的“只收钱不花钱”的状态。结果是财政部的 TGA账户余额 从关门前的 8000亿美元 飙升至 1万亿美元。

这相当于财政部把市场的钱吸走,暂时“锁进保险柜”,导致金融系统内的资金流动性被进一步抽走。

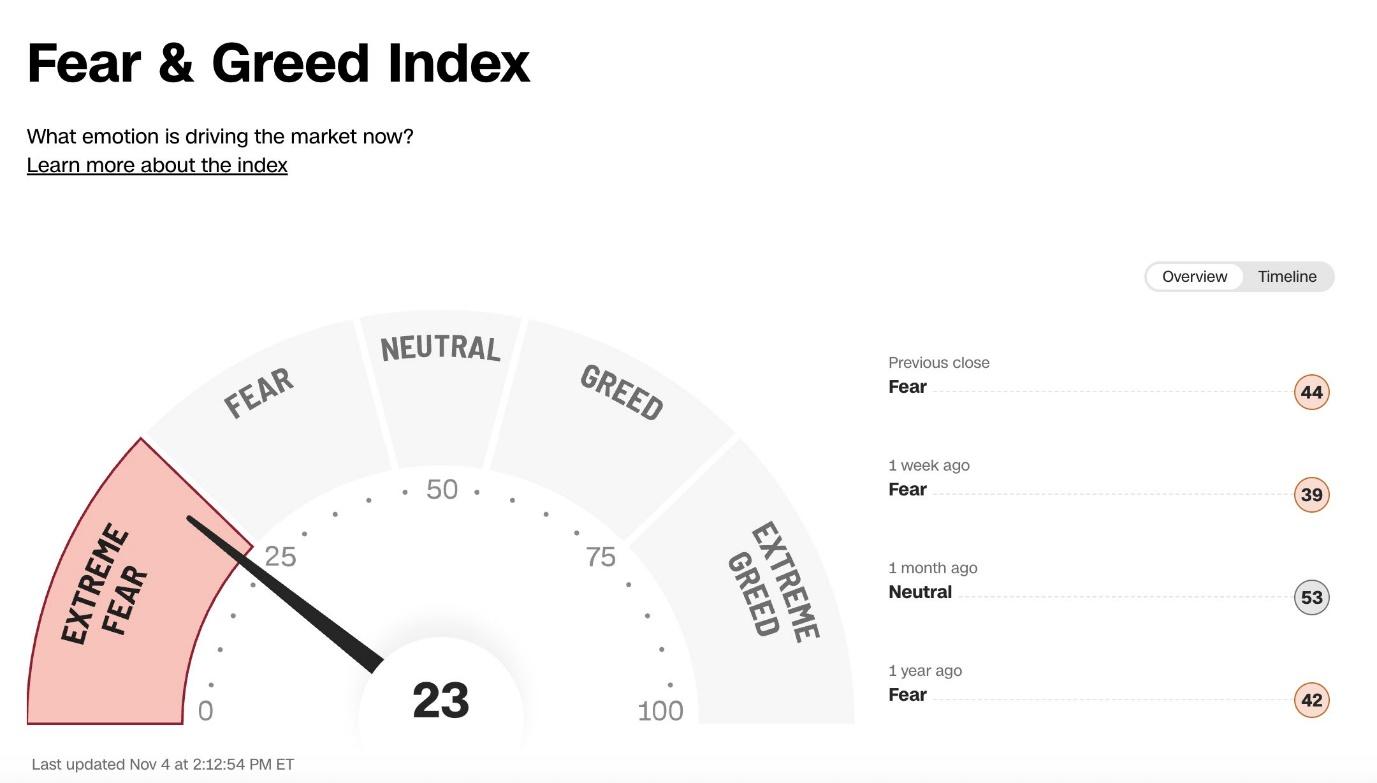

(美国财政部官网)因此,美联储降息≠流动性宽松。流动性收紧最先体现在资产价格上。鲍威尔释放“鹰派降息”信号,美元走强压制非生息资产(美股、黄金、数字货币),BT币已跌破10万关键技术与心理支撑位。股票方面,尽管AMD、英伟达等AI概念股业绩亮眼,但估值已高企;一旦预期无法持续超越,抛压立即显现。美股在强劲的企业盈利支撑下,仍然出现广度恶化、板块分化严重的迹象——少数科技巨头拉动指数,而多数板块早已疲弱。近期,美股盘中波动明显加大。大盘科技股盘前集体走低,Palantir、AMD 等年内翻倍的热门股出现回吐,而小盘股指数罗素2000则因流动性担忧大幅下跌。多家华尔街机构已开始提示短期调整风险:摩根士丹利与高盛均警告未来12–24个月内市场或回调超10%;美国银行称当前AI板块和消费板块估值“已被透支”;Piper Sandler认为,六个月的牛市之后,市场正在寻找一次“健康的修正”。总结来说,盈利没问题,但资金太紧。过去一周,比特币跌破10万美元关键支撑位,创下年内第二大单日跌幅;以太坊也同步重挫超过10%。黄金从高点跌落到4000美金/盎司,苦苦挣扎在整数位上。市场的“贪婪指数”迅速转为“极度恐惧”。

钱荒之下,现金为王。数字货币和黄金都是“无息资产”,当美元利率仍高、而流动性又紧时,这类资产当然最先被抛售。短期看,美元的“钱紧”确实是一个政策性扰动。一旦美国政府重新开门,财政支出回流,TGA账户下行,流动性将得到缓解。市场也在等待未来两周的经济数据,以重新定价12月的降息预期。另外,本周三还需关注美最高法院关于特朗普政府依据《国际紧急经济权利法》发起全球关税是否合法的审理——如果判定不合法,这将是对总统权限边界的重新划定,美债、美股反而可能双双下跌。在这样的阶段,建议分层思考:

- 长期投资者:若已具备股、债、黄金等多元化配置,无需恐慌。市场的短期波动反而创造了优质资产的加仓窗口。

- 短线交易者:在美国政府重新开门前,适当对冲股票头寸(如配置防御性板块、买入波动率或保护性期权),以应对政策真空期与流动性扰动。

- 资产配置层面:流动性紧缩往往是“转折期信号”。美联储一旦释放宽松信号,资产价格将快速反弹。保持现金、等待机会,或许比急于抄底更重要。

当财政扩张与货币紧张的矛盾同时存在,美国金融市场正经历一个微妙的临界点。短期的钱确实“紧”了,但正如历史无数次验证的那样:每一次“钱荒”,最终都以更猛烈的放水收场。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

Christine Li | GO Markets 墨尔本中文部

%20(1).jpg)

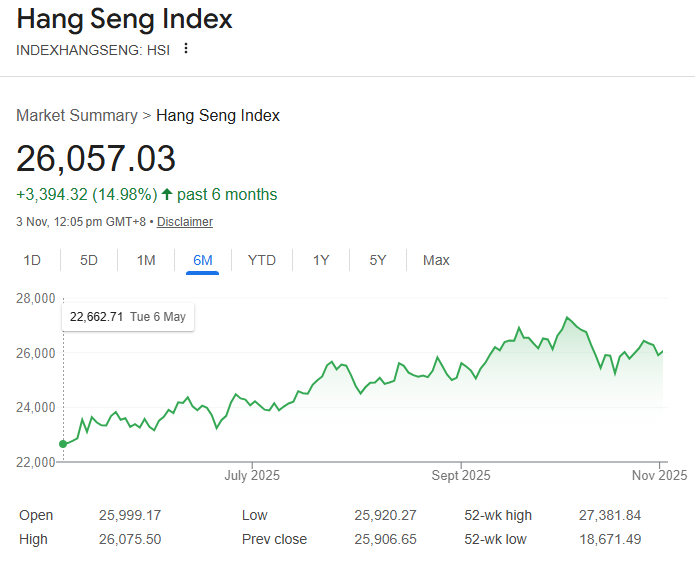

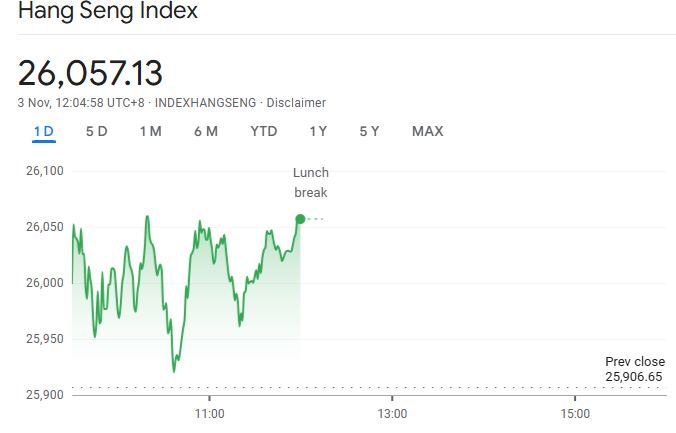

震荡中的信号,港股能否迎来真正的底部?

10月,恒生指数延续回调格局,全月累计下跌948点,月初触及27,381点高位后快速回落至25,145点,跌幅达到61.8%的黄金比率水平,随后虽反弹至26,588点,但未能持续突破,显示短期受均线压制,向上动力有限。内地9月制造业PMI创半年低位且低于预期,加上全球宏观因素如美元走强、通胀压力持续,使恒指多次受挫,市场情绪谨慎。

进入11月,恒指夜期先行反弹69点,显示短期市场情绪略有回暖。此前美联储降息预期和中美贸易谈判利好消息已陆续落地,提供有限支撑,但短期缺乏新利好刺激,恒指重返高位可能性有限。若A股走势改善或科技股业绩超预期,恒指未来两个月仍有机会向今年高位27300点挑战。

本周一盘中,恒指回到26,000点附近震荡,显示市场仍在观望。技术面上,强势股指数微升,弱势股指数下降,优质板块仍具一定抗跌能力。整体来看,港股短期延续震荡整固格局,预计仍在25,300至26,300点区间震荡整理。

市场个股表现

从板块来看,科技股受业绩不及预期及全球芯片需求疲软影响出现回调;高股息蓝筹如银行、公用事业等抗跌板块成为资金避险首选;部分资源类个股受金属价格反弹支撑出现阶段性上涨;房地产板块风险仍存,部分开发商财务困境对市场情绪形成压制。总体而言,港股呈现“震荡筑底”态势,反映出市场在基本面、政策面及宏观因素间的博弈。

主要影响因素

- 美联储政策预期主导资金流向

多位美联储官员暗示降息窗口可能在明年上半年开启,短期推高风险资产包括港股和A股的资金流入。然而,美国通胀仍保持黏性,政策宽松节奏不确定,使市场短线资金频繁进出,缺乏持续上涨动力。对于港股而言,这意味着短期资金流入可能只是“阶段性反弹”,而非趋势性上涨。 - 内地经济复苏分化,港股估值修复受限

中国10月制造业PMI略低于荣枯线,显示复苏力度仍不足。尽管政策持续宽松,如专项债加速发行、房地产融资边际放松,但企业盈利恢复仍需时间。港股估值虽处历史低位,但市场仍在等待更强的基本面催化。投资者可关注政策落地力度及企业盈利改善的信号,这将决定港股后续的估值修复空间。 - 地缘局势与全球风险偏好

中东紧张局势持续,提升全球避险情绪,推动黄金、原油价格上行,部分风险资产承压。港股短期可能面临外资重新配置至美元或避险产品的压力,削弱流入力度。同时,人民币汇率波动也让南向资金趋于保守,进一步增加市场的不确定性。 - 宏观经济数据与市场情绪

美国通胀压力仍存,市场对降息预期降温,加息预期增强可能导致资金流出香港,从而对港股形成下行压力。中国经济数据虽显示复苏,但房地产市场调整拖累整体增长,使市场短期内难以形成强劲上涨动力。 - 行业特定新闻

中国科技行业监管政策仍是市场关注焦点。虽然监管有所缓和,但未来可能出台的新规仍对科技股产生压力,导致板块短期承压。投资者应关注科技股业绩发布及政策变化,以判断其中长期投资价值。 - 地缘政治因素

中美关系紧张、贸易摩擦及技术竞争仍在,对市场情绪形成影响。国际贸易环境的变化可能影响港企盈利前景,从而影响港股表现,尤其是出口导向型及高科技板块。

结构性机会与市场影响

尽管港股整体震荡,但结构性机会逐渐显现:高股息、现金流稳定的金融与公用事业板块受机构青睐;科技股短期承压,但AI、半导体及互联网龙头中长期前景仍被看好;新能源与资源板块受能源转型及金属价格上涨支撑;内地消费和旅游板块若政策落地,有望迎来补涨。

如果政策与市场流动性同步改善,恒指有望逐步筑底并展开估值修复;反之,若全球通胀回升或地缘风险加剧,市场可能继续维持震荡格局。短期来看,恒指预计将在25,300至26,300点区间震荡整固,投资者应关注内地经济数据、科技股业绩及全球宏观因素对市场的影响。

总体而言,港股正处筑底期,中长期投资价值逐步显现。投资者应保持审慎,密切关注市场动态,并结合板块机会进行合理配置,以应对潜在不确定性。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

Alena Wang | GO Markets 墨尔本中文部

.jpg)

上周我们看到美联储在十月的利率决议一如市场预期的进行了25个基点的降息操作,在决议公布后全球的金融市场波动较为平淡;但是重点集中在鲍威尔和记者在一些尖锐问题上的看法和一些话外音当中。利率决议重要信息总结:预期管理方面:

- 全面否认12月必定降息的预期,美联储官员内部存在分歧

- 利率已经接近中性利率,在这个观点上相较于九月来说有所提升

- 在风险平衡方面表示通胀问题暂时比就业问题影响要大

就业数据方面:

- 就是市场放缓,但是病危显著恶化

- 将主要因素归功于劳动力供给下降

通胀

- 9月CPI表现温和,剔除关税核心PCE 2.3-2.4%

- 服务通胀(除住房)“横盘”,将逐步回落

资产负债表

- 将在12月1日起停止缩表,已达“充裕储备”

- 未来再投资短期美债,缩短久期

- 准备金将随现金增长自然下降,但“不会太久”

其他方面答记者问:

- AI投资对利率不敏感,对AI泡沫化表示不是工作重点

- 车贷和商业地产的次级贷违约局部、可控,未系统性蔓延

- 银行资本十分充足,整体金融体系稳健,压力测试并无风险

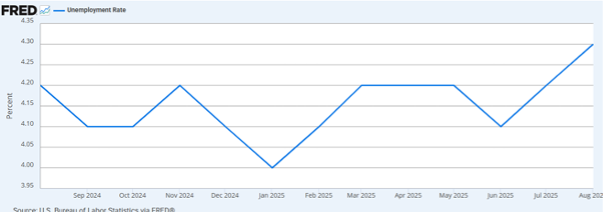

对鲍威尔讲话的数据交叉验证尽管从鲍威尔本次的利率决议中我们发现市场并没有过度敏感,甚至在鲍威尔口中一切欣欣向荣,数据空窗期只给美联储的决策带来了小部分影响,但是并不会对整体经济走势带来大的逆转,所以全球市场并未表现出任何的过度恐慌和逆向交易,在短暂波动中便产生了震荡的收敛,但是事实也许并无那么乐观。就业方面:根据已知数据,美国现阶段就业“稳固”:失业4.3%(BLS数据),随后陷入了数据真空期,而我们也可以从图表中看到,失业率数据在2025年整体上呈现上升态势,也许现在的真空隐藏了数据中最会促使市场衰退恐慌的一面,而鲍威尔通过一句整体稳健维持市场对美联储决策方向的信心;恰巧利用了该真空期对市场进行议论新的预期管理。

通胀方面:如果对美国通胀进行长期的观测会看到实际上美国通胀水平已从疫情期间回归常态,而逐渐在现水平出现下行放缓的迹象,尽管鲍威尔提及了关税可能带来的影响,但是随后中美会谈对关税带来的通胀影响实际上是多方利好,从通胀角度看,美联储的压力将会逐步缩减,但是也从长期中可以关注为何鲍威尔会重点强调中性利率的攀升,而这也会对市场对长期的利率预期产生一定程度的影响。

美国现在的次级贷问题:近期市场十分关注的二手车暴雷事件在两周前引起了一波小范围的恐慌,本次利率决议记者也就该问题对鲍威尔进行了相关问答,美联储主席在该话题上表现得非常含糊粉饰太平,基本上话语中处处透露本次事件影响范围较小,不会带来较大范围的扩散和金融市场的整体压力,但是实际数据并非如此支持。

从真实数据上看多重数据显示房地产由于受到了08年的教训影响,整体违约率水平处于低位看起来并不存在大范围暴雷的潜在危机,但是二手车和商业地产确实实打实的在数据上已经亮起了黄灯。如果接下来出现中等银行的挤兑和暴雷那将是对金融系统带来真正意义上的考验。结论来看:从近期中美更新合作协议,降低关税来看,美国的通胀压力或将不会过度挤压美联储后续的政策空间,但是美国的失业率真空也许会在公布后给美国带来一定程度的惊吓,而鲍威尔尽管言辞已经极其谨慎仍然在次级贷近期的问题上表态过于乐观,各类型数据并不支持该市场不存在隐患的定论,对于风险偏好类的投资,也许赛道的拥挤或将拱火危机进行进一步发酵,所以在投资偏好和风险均摊上投资者应进行更进一步的风险管理。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。

联系方式:

墨尔本 03 8658 0603

悉尼 02 9188 0418

中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903

作者:

William Zhao | GO Markets 墨尔本中文部

Multi-Timeframe (MTF) analysis is not just about checking the trend on the daily before trading on the hourly; ideally, it involves examining and aligning context, structure, and timing so that every trade is placed with purpose.

When done correctly, MTF analysis can filter market noise, may help with timing of entry, and assist you in trading with the trending “tide,” not against it.

Why Multi-Timeframe Analysis Matters

Every setup exists within a larger market story, and that story may often define the probability of a successful trade outcome.

Single-timeframe trading leads to the trading equivalent of tunnel vision, where the series of candles in front of you dominate your thinking, even though the broader trend might be shifting.

The most common reason traders may struggle is a false confidence based on a belief they are applying MTF analysis, but in truth, it’s often an ad-hoc, glance, not a structured process.

When signals conflict, doubt creeps in, and traders hesitate, entering too late or exiting too early.

A systematic MTF process restores clarity, allowing you to execute with more conviction and consistency, potentially offering improved trading outcomes and providing some objective evidence as to how well your system is working.

Building Your Timeframe Hierarchy

Like many effective trading approaches, the foundation of a good MTF framework lies in simplicity. The more complex an approach, the less likely it is to be followed fully and the more likely it may impede a potential opportunity.

Three timeframes are usually enough to capture the full picture without cluttering up your chart’s technical picture with enough information to avoid potential contradiction in action.

Each timeframe tells a different part of the story — you want the whole book, not just a single chapter.

Scalpers might work on H1-M15-M5, while longer-term traders might prefer H4-H1-H15.

The key is consistency in approach to build a critical mass of trades that can provide evidence for evaluation.

When all three timeframes align, the probability of at least an initial move in your desired direction may increase.

An MTF breakout will attract traders whose preference for primary timeframe may be M15 AND hourly, AND 4-hourly, so increasing potential momentum in the move simply because more traders are looking at the same breakout than if it occurred on a single timeframe only.

Applying MTF Analysis

A robust system is built on clear, unambiguous statements within your trading plan.

Ideally, you should define what each timeframe contributes to your decision-making process:

- Trend confirmed

- Structure validated

- Entry trigger aligned

- Risk parameters clear

When you enter on a lower timeframe, you are gaining some conviction from the higher one. Use the lower timeframe for fine-tuning and risk control, but if the higher timeframe flips direction, your bias must flip too.

Your original trading idea can be questioned and a decision made accordingly as to whether it is a good decision to stay in the trade or, as a minimum action, trail a stop loss to lock in any gains made to date.

Putting MTF into Action

So, if the goal is to embed MTF logic into your trade decisions, some step-by-step guidance may be useful on how to make this happen

1. Define Your Timeframe Stack

Decide which three timeframes form your trading style-aligned approach.

The key here is that as a starting point, you must “plant your flag” in one set, stick to it and measure to see how well or otherwise it works.

Through doing this, you can refine based on evidence in the future.

One tip I have heard some traders suggest is that the middle timeframe should be at least two times your primary timeframe, and the slowest timeframe at least four times.

2. Build and Use a Checklist

Codify your MTF logic into a repeatable routine of questions to ask, particularly in the early stages of implementing this as you develop your new habit.

Your checklist might include:

- Is the higher-timeframe trend aligned?

- Is the structure supportive?

- Do I have a valid trigger?

- Is risk clearly defined?

This turns MTF from a concept into a practical set of steps that are clear and easy to action.

3. Consider Integrating MTF Into Open Trade Management

MTF isn’t just for entries; it can also be used as part of your exit decision-making.

If your higher timeframe begins showing early signs of reversal, that’s a prompt to exit altogether, scale out through a partial close or tighten stops.

By managing trades through the same multi-timeframe approach that you used to enter, you maintain logical consistency across the entire lifecycle of the trade.

Final Action

Start small. Choose one instrument, one timeframe set, and one strategy to apply it to.

Observe the clarity it adds to your decisions and outcomes. Once you see a positive impact, you have evidence that it may be worth rolling out across other trading strategies you use in your portfolio.

Final Thought

Multi-Timeframe Analysis is not a trading strategy on its own. It is a worthwhile consideration in ALL strategies.

It offers a wider lens through which you see the market’s true structure and potential strength of conviction.

Through aligning context, structure, and execution, you move from chasing an individual group of candles to trading with a more robust support for a decision.