市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

热门话题众所周知,澳洲上周公布的通胀数据依然高的吓人。2022年全年物价上涨了7.8%,而2022年第四季度的通胀更是超过了10%,相比于美国已经降低的第四季度物价,澳洲的数据显得非常突兀。而澳洲央行给出的合理通胀水平应该是在2-3%之间。毫无疑问,7.8%已经不仅仅是高与目标,而是失控了。

失控了怎么办?你说呢?当然是继续上药啊!在圣诞节之前,市场普遍猜测2023年还要加息2到3次,我保守点说就是2次。这第四季度通胀数据一出之后,得了,别保守了,市场普遍预计今年还要加息3-4次,而且4次的可能更大。按照目前3.1%的澳元利率,3次就会到3.85%,而4次就要去4.1%。如果澳元到了4.1%,那我们自住房贷款就是6.6%,投资房贷款就是7.1%,而银行计算贷款能力还要加上3%的额外利率来测试还款能力,也就是,自住房银行按照9.6%,投资房按照10.1%来计算申请人能不呢还款。120万的房子,首付20万,申请贷款100万,那银行就会用9.6%的利息来测试你的还款能力。换句话,就是你必须可以还得起一年96000澳元,一个月8000澳元的利息,还能生活过得去。而且这个收入还必须是经过核实和审查的。8000利息,加上各种开支,一个月差不多在房子上就是接近一万澳元的开支,等同于税前一个20万收入人士的税后收入。澳洲20万收入的人士肯定不少,但是占总人口数绝对小于5%。换句话来说,当澳元再加息3次之后,可以申请到100万澳元以上贷款的人将会大幅减少。准确的说,是所有申请人的可申请贷款总数将会严重缩水。再不作假的情况下,原本你可以借100万,现在估计就只剩70万了,如果原本是70,现在可能只有30了。因为低收入贷款申请人,受到加息影响所减少的贷款金额会比高收入的申请人更多。但是澳洲央行已经多次表态,会不惜一切代价控制通货膨胀。类似的发言也来自于美国,欧洲和日本央行。各国其实都知道,这恶性通胀就如同是顽疾,一定要彻底治好,要不然药吃了一半就停,很容易死灰复燃,得不偿失。而相比澳洲通胀还在节节攀升,美国已经开始出现了下滑。因此明显的,美元在过去2个月的走势出现了明显的下跌。因为大家觉得,美国加息会放慢,而通胀高的国家比如英国,澳洲,加息不但不会停,还有可能会加码。就这样了,在本周澳洲居然还有某些专家说:澳洲央行可能是西方国家里第一个降息的。给出的理由也是非常搞笑,是因为高利息会压得家庭债务透不过气,最终会影响到经济,因此澳洲央行会为了经济而率先降息。首先,我要说,这个所谓的专家(澳洲本地某第三方股票报告机构)为了出名真是什么话都敢说。反正到时候如果说错没加息,估计也没人记得。如果真的第一个降了,他就可以因此中奖高调宣传。这种投机倒把的言论,其实就是为了博眼球。但是毫无疑问,不论是央行的态度,还是澳洲目前的实际情况来看,在失控的通胀还没有控制住之前说降息,太早了。买房的朋友可能还可以再等等。毕竟3-4次的加息之后,你的可贷款金额估计会比房价跌的更多。7%一年的利息,100万的房,2年利息可就是14万啊,还不算其他税费。聪明的读者,你一定可以自己算出来。再来说个鼓气的。来吧兄弟们,请客请起来,特斯拉飞起来了。在圣诞节之前我写的一篇特斯拉到104美元的文章里,明确说到特斯拉股价从400跌到104的最大原因就是马斯克本人的分心。我们知道买奔驰宝马的,牌子至少让你多支付20%的价格。而买特斯拉不买其他电动车的,也因为马斯克这个巨大的网红魅力。2022年一整年,马斯克几乎都把重心放在了他的媒体事业上,他为了收购推特,以及整合推特,前后花了几百亿美金,为了融资,卖了无数特斯拉的股票,还抵押了无数股,这样一来,直接把中小投资者给整怕了:你创始人CEO自己都扔,我们怎么办?大股东也不乐意了,几乎要联合发起投票推他下台。终于,马斯克也意识到自己轻重搞错了,那个最赚钱的不管,去顾及这个天天亏40万美元的破公司,差点把自己搞破产了。玩归玩,闹归闹,马斯克毕竟时马斯克。在重新回到特斯拉之后,连续出招:降价,再降价。全球降价。直接把其他车企搞无语了。我们知道宝马奔驰每年上涨三五千,就连丰田起亚这几年也是每年涨价。但是特斯拉居然在中美两个最大的市场每年降价。得罪了千万现有车主,但是带来了更多的新订单。光是在中国,特斯拉宣布降价之后3天,多了整整3万辆的订单。要知道很多电动车企业一年也卖不出1万辆。美国也是一样,直接说,12月底之前提车,最多可以便宜5000美金。直接把订车系统搞奔溃了。1月初公布了12月和第四季度业绩报告毫无悬念的超过了预期。然后马斯克还多说一句,手里的订单是目前生产能力的2倍。啥意思,就是我不再接收新订单了,也可以够吃2年的。这样一来,特斯拉的股价也直接起飞。马斯克以每天100个小目标的速度迅速朝着全球首富的位子进发。

现在特斯拉大约是175左右,对比104的最低价以及上涨接近70%了。才1个月时间。按照这样的情况,到200的机率是很大的,虽然不敢说一定能回到400.但是如果能在2023年推出3系列的新车型的话,那我本人预计回到250也是个大概率事件。说了这么多。不要忘记感谢我。写了这么多字,多累啊。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

热门话题

历史上美债从未实际上发生过违约行为,但12年前,当时的奥巴马政府与掌控众议院的共和党人在债务上限谈判中陷入僵局,对峙到了财政部资金枯竭前的最后一刻。当时的债务上限违约危机是美国迄今为止离违约最近的一次,直接导致权威评级机构标普历史上首次下调美国主权信用评级,从AAA降至AA+,而后引发了金融市场剧烈震荡,股市、债市激烈动荡,黄金飙升近13%,标普500在一个月内暴跌17%,道指下跌15%,10年期收益率下行82bps。

12年后,华尔街投行近期纷纷发出警告,表示美国目前正滑向2011年8月以来最危险的债务上限困局,这一次市场可能大大低估了这次美国债务上限危机的风险。摩根大通在周五的报告中称,围绕债务上限的斗争可能是2023年美国经济面临的最重要问题。随着共和党入主众议院,拜登政府如果想继续提高债务上限,必须争取共和党的配合。但众多共和党人已决定以债务上限作为筹码,迫使民主党在其他议题上让步,如大幅削减公共开支。让我们回顾历史,近些年美国国会隔段时间就会围绕债务上限问题爆发一系列斗争和博弈,但最终都有惊无险,在到期日前两党总能达成一致。不过这次的情况比之前更复杂一些,由于目前美国一党一院的控制情况,国会的分化使得重要提案的表决都会剑拔弩张,要阻止美国这个全球最大经济体债务违约的协议可能比以往更难达成。那么如果出现债务违约会有什么影响呢?具体数字很难预测,但显而易见的是债务违约肯定会导致美国经济衰退更为严重。但目前共和党人显然不以为然,既然今年初众议院议长、共和党人凯文·麦卡锡经过15轮投票后才当选,就已经很尴尬了,共和党人狠起来自己都咬,最终为了获得党内强硬派的支持,麦卡锡承诺大幅削减开支,才艰难坐稳位置。但这更意味着未来需要两党表决的债务上限问题势必上演恶战,极难达成一致。对立党很可能利用本次机会要挟以实现自己的一些政治诉求,迫使对方让步妥协,这就是2011年债务上限危机中曾出现的“边缘政策”(Brinkmanship)。所谓的边缘政策,是在冷战时期形成的一种极其冒险的战略,一方故意推升局势,试图在相对高压的环境下,利用对手对局势稳定的需求而被迫妥协,从而达成自身政策目标的一种策略。这跟擦枪走火很相似,有些刀口嗜血的意味。

美国国债市场是全球金融体系的基石,也是全球各国央行和投资者的避风港。一旦美债出现违约,对市场来说不亚于一场金融海啸。这一次美国债务更多,利率更高。因为在实施多年货币刺激后,美联储正以极快的速度从市场抽走资金。美国银行早前也提到,此次美国债务违约可能性高于往年,由于共和党方面似乎认为进入违约窗口的“成本”很低,对整体经济的影响有限,却能使民主党付出很高的代价,因此谈判很可能会被拖延到“最后一刻”,那将意味着美国政府可能会陷入几天或几周的违约区,这还是乐观估计,一旦失控没有及时达成一致,美国政府的信用评级很可能被再度下调,甚至真正出现违约情况。然而从一月股市和债市的走势看,市场目前并未将此风险计入价格,因受到美国通胀放缓以及美联储考虑放慢加息步伐的提振,美国主权债和公司债今年开年表现强劲,一月股市大幅反弹,俨然一片欣欣向荣的景象,似乎认为避免衰退和经济软着陆可能性很大。过去几年两党都是在悬崖边勒住了缰绳,所以这一次市场也愿意相信,国会在最后时刻再次采取行动的可能性非常高,但这明显是很危险的赌博式押注。债务上限目前还没有对市场造成影响,但今年下半年影响可能会逐渐显现。在1月19日美国触及31.4万亿美元债务上限后,美国财政部开始采用特别措施避免政府违约,这些特别措施包括,美国财政部将停发新债,使用两个政府运营的退休基金作为财政资源,以便在不提高债务水平的条件下维持政府运转。但财政部警告说,特别措施只能允许政府支付账单到6月初,到那时美国可能面临无法偿付政府债券的风险。靠特别措施续命只是权宜之计,要解决债务上限危机,必须取得国会授权,增加美国政府债务上限。但随着两党政治斗争加剧,今年美国债务违约风险已然急剧上升。综合历史实际情况看,美债危机一直都是造势为主,最终两党会妥协,只不过本次过程会特别坎坷,延续历史的“名危实不危”还是主流预期。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 专业分析师

热门话题

一鼓作气,再而衰,三而竭。--《曹刿论战》在开始之前,还是按照惯例回顾下前期内容,在90年代最大的资产泡沫之后,在1991年日本央行开始降息操作,花了两年多把利率从6%降至了1.75%。但是恰逢美国也在降息周期,所以本次降息的效果并没有太好。在1995年,第一剂强心针被注入,货币政策和财政政策同时进行作用,央行降息到了0.5%,政府也开始做各种基建项目,刺激需求,拉动内需,经济开始有好转。可惜其中信用膨胀,坏账等根本问题没有解决。1997年开始了银行保险公司破产潮,到了1998年民间贷款的数量极具下降,大家的钱开始变少了,流入市场的钱也变少了。从1998年开始,通货紧缩的漩涡开始,-->需求下降-->不得不降价出售-->物价开始下降-->营业额利润下降-->大家的收入下降-->需求继续下降。在1999年,日本首创了0利率,加上政府开始大量发债,第二剂强心针开始注入。2001年日本开始实行量化宽松,直到2006年,一切开始好转。利率恢复,QE停止。可是2008年全球金融危机加上2011年福岛核电站泄露,使得日本再次陷入到巨大的危机当中。于是在2012年,安倍晋三和黑田东彦联手给日本注入了第三剂的强心针,也是最猛烈的一剂。

安倍晋三在2012年底开始担任总理,并且提出了闻名于世的安倍经济学。那么作为非经济学家的安倍,是如何“创造”出安倍经济学的呢。安倍认为之前的两剂强心针效果不好是因为没有多项政策一起发力。于是就提出了安倍的三支箭。其实这个三支箭源自于一个我们从小就听过的类似的故事。总结来说就是,一个国王有三个儿子,然而三个儿子之间并不和睦,于是国王想了个办法,想让大家知道团结的重要性。于是在某天他把三个儿子叫过来,每个人发了一支箭,让他们掰断,于是三个人很轻松的就掰断了,于是国王发了三支箭,让三个儿子尝试掰断,但是这次就都没有成功。最后三个儿子体会到了团结的力量,于是共同努力,王国蓬勃发展。安倍政府的目标是“摆脱通货紧缩”和“扩大财富”。那么安倍的三支箭的具体内容我们来看看。第一之箭:大胆的货币政策—— 进行实质化的量化宽松。日本央行原行长被撤换成黑田东彦,开始实行QQE(质化、量化货币宽松政策),用于驱散在企业和家庭中根深蒂固的通缩心态。不仅仅货币端开始大量放水,考虑到经济和价格发展,日本央行提出了2% 的物价稳定目标。第二支箭:灵活的财政政策---- 增加政府的支出,创造有效的需求。安倍寻求了大规模的公共投资,专注于有助于可持续增长和桥接增长战略的领域。2013年1月11日,日本通过了总额高达2267.6亿美元的政府投资。但是,通过提升消费税率来弥补政府收入,安倍政府于2014年在5%的基础上提高至8%。并于2019年将消费税上调至10%。第三支箭:变革增长的经济政策——提振民间投资。先是专注于生物医药研究,然后通过投资提高生产率,让就业和补偿的成果在人们的生活中广泛传播。再将将退休老人、适龄失业人口、年轻人和家庭主妇纳入补充劳动力不足的体系中。最后振兴高科技和实质性产业,可持续化的让人们产生需求并使经济走上强劲的增长轨道。乍一看这三支箭可谓是奇兵布阵,来势汹汹,我们就先拆开来看这三支箭。第一支箭的大搞QQE,黑田觉得之前的QE量化宽松,量还是太小了,这一次要来真的了。一是“收益率曲线控制”,银行通过市场操作控制短期和长期利率,主要就是买低国债,刺激个人和公司的长期借贷;二是“通胀超调承诺”,即央行承诺扩大基础货币,直至观察到的消费者价格指数同比涨幅超过2%的物价稳定目标,并保持在目标水平之上。我们可以从日本央行资产负债表图看出来,从13年开始,呈现了指数般暴增。

(日本央行资产负债-Source:tradingeconomics)QQE加上负利率的刺激,这支箭穿心箭,期待着千军万马来相见。第二支箭,其实主要核心就是盘活消费,虽然有着这样投资,基建刺激。但是,却犯了一个致命错误,也是大家所诟病的消费税上调。2014年在5%的基础上提高至8%。并于2019年将消费税上调至10%,在两次上调期间,日本的消费出现了断崖式的下跌。这支箭不仅仅射偏了,还起到了反向作用。

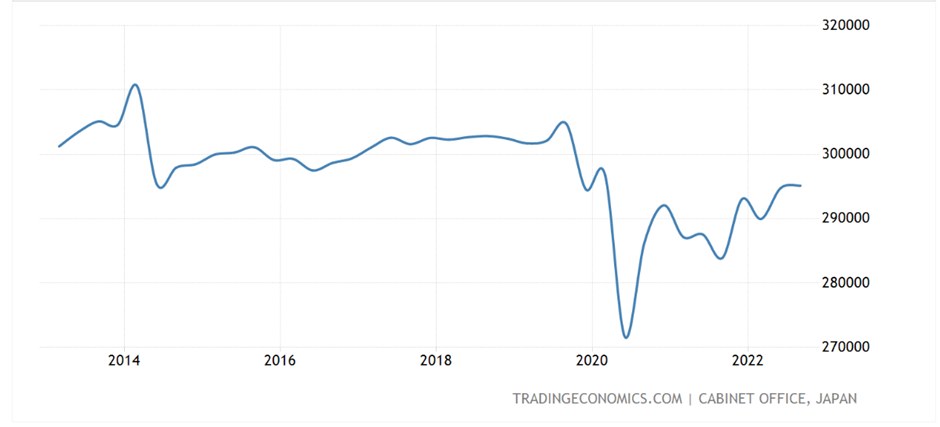

(日本消费支出-Source:tradingeconomics)第三支箭,提供更多的工作,放宽监管,贸易更加自由,振兴高科技和实质性产业,这些政策不错,但是无法立竿见影。因此,合起来看三支箭的效果。GPD在这个期间是有一定上涨,但是幅度远远低于预期,通胀也没有太大起色,虽然走出来通货紧缩,可是效果嘛,一般般。最终发现,涨的最好的却是资本市场,股市债市一路高歌猛进。

(日本GDP-Source:tradingeconomics)

(日本通货膨胀率-Source:tradingeconomics)所以,为什么,安倍经济学没有达到预期呢?在我看来有两个原因,一个是人口老龄化,另一个是恐慌心理。首先就是老龄化问题。日本目前是一个长寿国,老年人喜欢存钱,不喜欢消费,需求相比年轻人大大减少。钱都去哪了呢?大多数都是去存银行,购置房产和股票。大量的钱流入资本市场。而且,每年老年人福利对于日本政府也是一笔巨大开支。第二就是恐慌情绪,经历过80-90年代醉生梦死和幻想崩塌的这代人都在差不多40-60岁,首先自己就是处于一个不敢花钱,或者是不想花钱的情绪中。害怕再来一次辉煌和崩塌。对于下一代的教育中也会言传身教的进行“节省”,钱拿在手中才是自己的,这也是为什么日本人欲望那么低的原因。

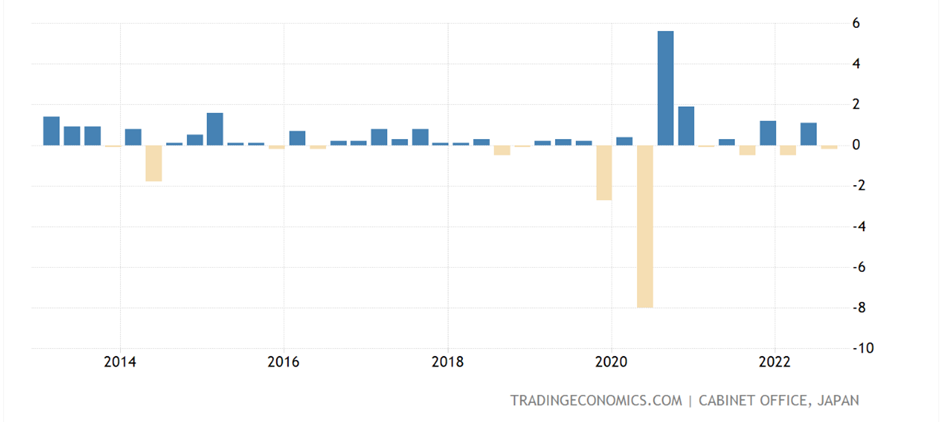

(日本人口结构 Source:nippon.com)那么这些政策没有成功还有一些特定因素。就是在紧缩漩涡中的重点组成部分。比如物价水平低,日本人民薪资上不去。那么这时候大家就会有个疑问,为什么日本的物价水平那么低。除了之前的紧缩漩涡影响以外还有就是陷入了锚定效应。一般又叫沉锚效应,是一种重要的心理现象。就是指当人们需要对某个事件做定量估测时,会将某些特定数值作为起始值,起始值像锚一样制约着估测值。价格预期出现锚定效应也变相导致了物价上不去。最离谱的就是,在日本涨价的话商家还会出来道歉,除非大家一起涨价,要不然民众都不买账。第二就是薪资水平,和30年前相比,日本的薪资变化并不是很大。而且和西方国家不同,西方国家人们喜欢用跳槽来不断提高自己的薪资水平,而日本却大多是终生雇佣制,没有跳的欲望,就算跳槽了,薪资可能没多少变化,因此也变相造就了薪资水平的禁锢。到了2020年,新冠疫情的爆发,GDP,需求,出口世界范围内的骤降,得嘞,日本政府想着,又白搞了。于是再再再次刺激(有史以来最大,嗯?好像说过了,没有最大,只有更大),通过发债(债务GPD比飙升),印钞(资产负债表继续飙升)并发放了将近1万亿美金。加上全球供应链出问题,世界工厂再起开启发动机---出口上升,失业率开始下降。再加上和前两次石油危机一样,2022年代俄乌战争导致的能源危机,油价飙涨,对日本造成了输入型的通货膨胀,通货膨胀率也来到了4%。

(日本GDP增长率-Source:tradingeconomics)日本政府和央行也看到了久违的曙光,然后这样的增长会持续下去吗?日本能不能摆脱这个紧缩漩涡,人口问题存在能否解决。这一切,都正在发生中,我们也在持续的见证历史。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 助理分析师

Tesla Inc. (NASDAQ: TSLA) reported Q4 2022 financial results after the market close in the US on Wednesday. World’s largest automaker reported revenue that fell short of Wall Street expectations at $24.32 billion (up by 37% vs. Q4 2021) vs. $24.669 billion expected.

The company beat earnings per share (EPS) estimates for Q4. EPS at $1.19 per share vs. $1.127 per share estimate. Company commentary ''Q4-2022 was another record-breaking quarter and 2022 was another record- breaking year.

In the last quarter, we achieved the highest-ever quarterly revenue, operating income and net income in our history. In 2022, total revenue grew 51% YoY to $81.5B and net income (GAP) more than doubled YoY to $12.6B.'' ''As we progress into 2023, we know that there are questions about the near- term impact of an uncertain macroeconomic environment, and in particular, with rising interest rates. The Tesla team is used to challenges, given the culture required to get the company to where it is today.

In the near term we are accelerating our cost reduction roadmap and driving towards higher production rates, while staying focused on executing against the next phase of our roadmap.'' Stock reaction The share price of Tesla was up by 0.38% at $144.34 a share at market close on Wednesday. The stock rose by around 1% in the after-hours trading after the results. Stock performance 1 month: +28.14% 3 months: -35.71% Year-to-date: +17.25% 1 year: -53.78% Tesla stock price targets High: $436 Median$194 Low: $85 Average: $208.55 Tesla is the 13 th largest company in the world with a market cap of $455.91 billion.

Tesla’s total market cap has decreased by 52% in the past year. You can trade Tesla Inc. (NASDAQ: TSLA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Tesla Inc., TradingView, MarketWatch, MetaTrader 5, WSJ, CompaniesMarketCap

Mastercard Inc. (NYSE: MA) announced the latest financial results for the previous quarter before the market open on Thursday. World’s third largest financial services company beat both revenue and earnings per share (EPS) estimates for Q4 2022. The company reported revenue of $5.817 billion vs. $5.793 billion estimate.

EPS at $2.65 per share in Q4 vs. $2.575 per share expected. CEO commentary ''We closed out the year with strong financial results and notable wins which will help us capitalize on the tremendous secular shift to digital payments,'' Michael Miebach, CEO of the company said in a press release. ''As we look at the broader economy, we see the continued recovery of cross-border travel, with volumes up 59% versus a year ago and we’re encouraged by Asia opening up further. While macroeconomic and geopolitical uncertainty persists, consumer spending has been remarkably resilient.

We are well prepared to adjust our investment profile quickly if needed,'' Miebach concluded. Stock reaction Share price of Mastercard dipped by around 2% on Thursday, trading at around $374 a share. Stock performance 1 month: +7.91% 3 months: +17.65% Year-to-date: +8.06% 1 year: +7.19% Mastercard stock price targets Baird: $410 Barclays: $427 Truist Securities: $450 Jefferies: $430 Keybanc: $425 UBS: $441 Wells Fargo: $405 Mizuho: $380 Morgan Stanley: $437 Mastercard is the 19 th largest company in the world with a market cap of $363.31 billion.

You can trade Mastercard Inc. (NYSE: MA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Mastercard Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

热门话题

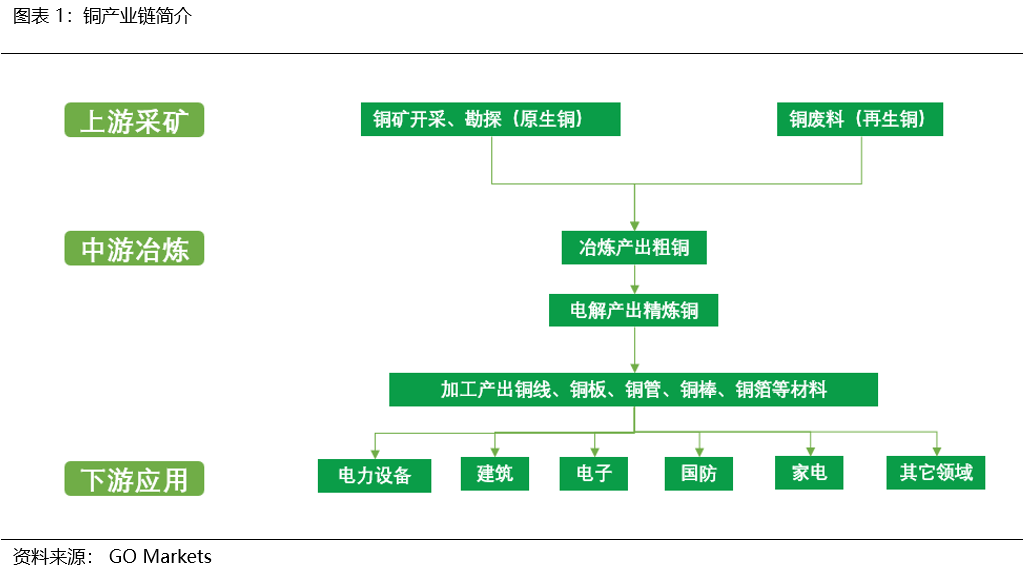

1. 铜产业链简介铜,作为继铁、铝之外的世界第三大金属,被广泛应用在计算机、电子通信、能源发电、汽车、国防以及建筑等各大领域。铜具有良好的导电性质、耐腐蚀以及良好的延展性等优点。同时,铜作为工业原材料,被市场赋予了双重属性,即自身的工业商品属性和与黄金类似的金融属性。铜价被誉为“铜博士”,是反映宏观经济运行状况的锚,当铜价上涨时,经济活动往往会随之而来;当铜价下跌时,经济活动往往会逐渐停滞。

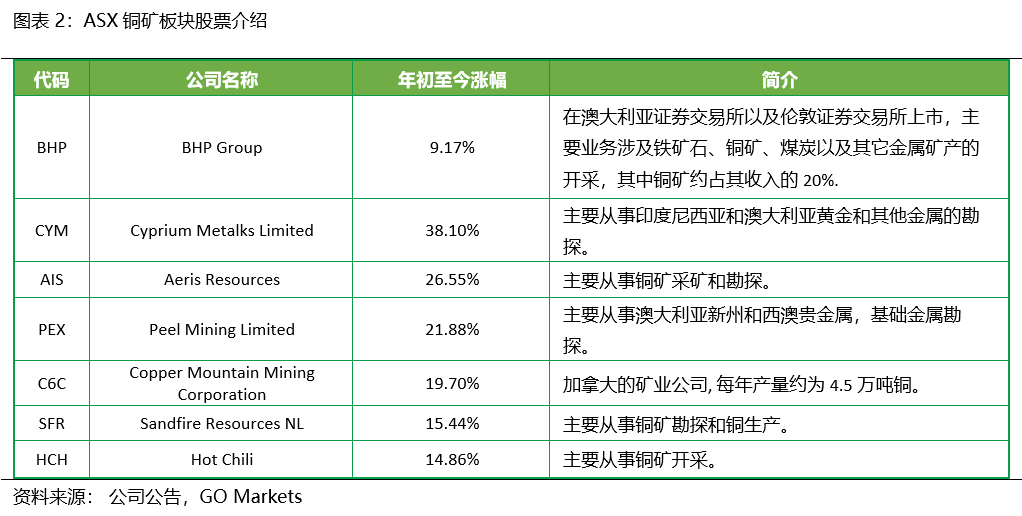

纵观整个铜产业链,从上游采矿、勘探到中游的冶炼加工以及到下游的应用。上游主要针对铜矿的开采和勘探从而获得冶炼铜的原材料,同时作为生产再生铜的铜废料也可以看作上游的一部分,铜矿分布在世界各地,ASX中有一些公司便属于铜上游板块。中游主要负责对铜矿的冶炼和粗铜的加工,通过不同的加工工艺将精炼铜加工成铜棒、铜管、铜箔等不同形状的产品,下游即进入消费端,涵盖电力、建筑、电子、国防等行业。2. 铜价:乘新能源趋势东风,受益美联储政策回暖供给端:ICSG统计数据显示2022年全球铜矿产能为2604万吨,精炼铜产能3014万吨,主要分布在智利(24.7%)、秘鲁(10.4%)等地区,全球产能之首的铜矿Escondida拥有1510千吨/年的产能,由BHP Billiton控制57.5%的权益。2022年前三季度全球铜矿产量1614.3 万吨,同比增长3.5%;全球精炼铜产量1900.1 万吨,同比增长2.3%,其中原生精炼铜产量1590.6 万吨,再生精炼铜产量309.5 万吨。全球一些龙头矿企产量受维修、罢工以及干旱等影响同比大幅下滑,短期来看,供给难以快速恢复;长期来看, 铜矿从勘探、开采、建设到生产周期太长,供给端很难有增幅。需求端:铜被广泛应用到各个领域,其中新能源板块值得关注。新能源汽车在电池、电机等部件需要大量用铜,燃油车单车含铜量23kg,而新能源汽车PHEV单车含铜量约为60kg, BEV 单车含铜量约为83kg;光伏中铜用于逆变器、电缆以及电线等, 1MW 光伏需要 5.5吨铜;此外风电产业也需要用铜,海上风电每MW需要约 15 吨铜,陆上风电每MW需要约 5 吨铜。整体来看,三大新能源板块的迅速发展将强势拉动用铜需求。结合供需两个角度来看,未来铜价或将上行。金融属性:2022年美联储一次次的加息导致了铜价承压,出现了整体下滑的趋势,而2022年12月的CPI数据回暖也导致了市场对美联储2023年停止加息甚至降息的预期。对于铜价来说,降息也会对其价格形成上行的驱动力。3. ASX-铜矿板块股票

上图所示为澳交所中铜矿板块股票,从年初至今,有七家公司涨幅比较明显,其中涨幅最高的为CYM(38.10%),其次像AIS,PEX,C6C等涨势也比较明显,他们主要都是从事铜矿的勘探与开采,位于铜产业链上游。与上文分析一致,未来铜价由于需求增加以及美联储的政策放松将有上行趋势,进而带动上游铜矿的业绩,建议投资者关注ASX中铜板块的股票所带来的交易机会,也敬请关注我们将在后期推出铜矿个股的研究报告。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Yiduo Wang | GO Markets 助理分析师