市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

热门话题

特斯拉(Tesla,以下称“特斯拉”)位于美国帕洛阿托(Palo Alto),设计、开发、制造、销售和租赁高性能全电动汽车和能源发电及储存系统,并提供与销售产品有关的服务。汽车业务包括电动汽车的设计、开发、制造、销售和租赁等。能源与储能部门主要负责太阳能发电和能源存储产品的设计、制造、安装、销售和租赁以及相关服务。

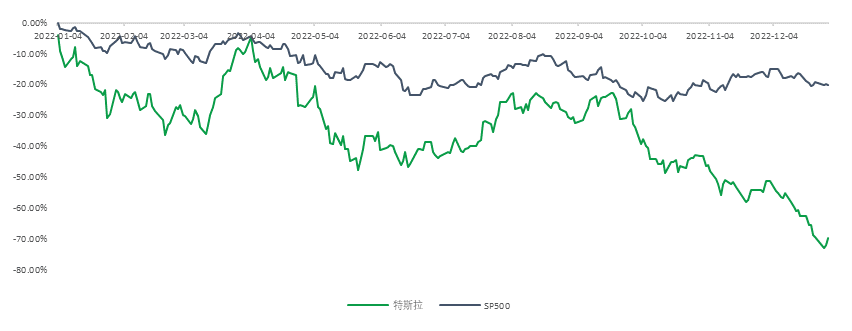

股价表现回顾:迄今为止,特斯拉今年股价下跌近75%,其市值从高峰期缩水了约8000亿美元(约合人民币5.57万亿元),几乎高于传统汽车制造商的总估值。在2020年7月,特斯拉市值达到了2100亿美元(约合人民币14633亿元),成为彼时全球市值最高的汽车公司,相当于5.5个通用汽车和8.3个福特汽车市值之和。此后,特斯拉便在海外积极扩建业务,不断扩大生产,然而自2022年以来多重因素的影响导致了特斯拉表现每况日下。最近一个季度以来,特斯拉股价加速下跌,明显被美国市场主要指数超越,最近三个月、一个月分别下跌约 50%、23%。

全球市场:新能源汽车市场蓬勃发展,高销量增长趋势或将持续。根据国际能源署(IEA)发表的《2022年全球电动汽车展望》,当前大约有40个国家(地区)制定了全面的电动化时间计划表或发布了燃油车禁令。政策因素持续驱动全球新能源汽车销量空间膨胀。特斯拉最大主营业务为新能源汽车,因此新能源车的全球销量将成为主导其业绩的一个重要因素。近年来,全球范围内各种新车型的密集发布刺激了消费需求。根据历史数据以及普遍的市场预期,我们认为2025年全球新能源汽车渗透率将达到30%左右。从全球及各地区、国家的渗透率来看,目前新能源汽车行业整体处于增长的前中期阶段,仍有较大的市场空间。

完整证券研究报告请联系GO Markets小助手获取

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。

联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Yiduo Wang | GO Markets 助理分析师

热门话题

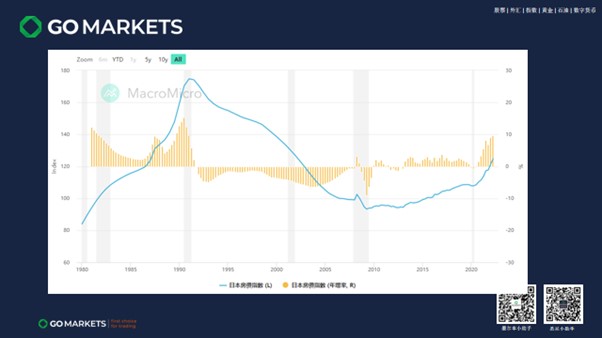

《吕氏春秋·博志》:“全则必缺,极则必反。”上回说到,日本昭和幻梦的辉煌,在上个世纪80年代,卖掉日本,买下美国的梦想。 我们先来回顾一下,日本经济如何从战败国迅速腾飞的。 二战战后,美国占领管制,经济开始重组,但是内需不足。却因为朝鲜战争,外需开始急速扩大。低廉的物价和劳动力,使得日本成为世界工厂。

第一第二次石油危机,日本车迅速走向全世界。而此时的美国因为,黄金脱钩,石油危机,高通胀,滞涨等问题,开始大刀阔斧的加息,然后签订了广场协议,逼迫日本抛售美元,以达到转移自身矛盾的目的。 广场协议之后,日元快速升值,日本出口受创,开始了衰退期。于是在经济低迷,日元高位,稳定通胀情况下,日本央行开始降息。降息刺激了经济,消费,日元贬值,也刺激了出口。但是低利率太久后,导致借钱变得容易,钱跑去了房市股市。加上大量的房屋抵押贷款,钱兜兜转转,再次回到了房市股市。因此房价,股价一路攀升,造成了全球最大的资产泡沫,今天的故事就从这里开始。

开始之前,先要说一说日本独有的一个经济体系,就是财阀(财团体系),我们一听首先想到的就是韩国财阀。那么韩国财阀是家族化的企业管理模式,就是围绕着龙头企业进行调配,就像三星集团,企业经营权一直掌握在李氏家族的手中。而当时日本财团体系不一样,是一个权利不集中的模式,是诸多企业围绕着银行和保险公司来运作的一个模式。大家背靠银行,保险公司抱团取暖,进行互帮互助,形成了独有的产业链,从上游到中游再至下游,都在一个财团进行循环,也就是类似于俄罗斯的裙带资本主义。其中有好处,也一定有坏处。那么这里先说好处。在蓬勃发展时期,大家共同推进,共同发展,可以更有效率,发展速度更快。那么在上世纪80年代,金融市场的开放,大多数公司选择发债融资,造成的后果就是银行贷款压力巨大。那么银行方面,每年的贷款是有指标的,当指标完不成之后,就开始寻找信用等级较差的个人和公司进行放贷。当时贷款基本上都是抵押贷款,那个年代,谁没套房子呀,管你还的上还不上,只要抵押,就放贷。这就造成了信用膨胀。是不是有点像08年美国次贷危机的感觉?

而信用膨胀,成为了昭和幻梦,崩塌最为关键的一环。在1990年,日本央行开始意识的持续低利率问题的严重性了,开始瞬间加息,直接从2.5%的低利率给干到了6%。顺应而下的就是股市和楼市的大跌。全球最大的资产泡沫开始被刺破。这次加息造成的就是很多人的失业。当然这个问题还不是很严重,毕竟只是钱开始变得是钱了,那么继续正常运转,也不会出现什么大问题。但是接下来发生的事却是又给了日本经济一记重拳。在加息开始之后,信用膨胀的问题就开始凸显,房子开始越来越不值钱了,抵押贷款的危机来临,银行和各个公司间的坏账成为了一颗逐渐进入倒计时的定时炸弹。

在92左右,通过维持正常运转,似乎已经看到一些回复的希望,无论是GDP还是其他各种数据。然而,财团效应就带来了巨大的蝴蝶效应后果。这就说到了财团两面性的坏处,在大环境不好的时候,大家被一起拉下水。在90年代,日本政府给银行注入了大量资金,希望银行这个定海神针不会倒下。但是呢,银行方面,因为财团间的“互帮互助”,用很多资金救活了大量本应该倒闭,或者淘汰的公司。直接造成了垃圾公司数量上升,好公司数量下降,逐渐的大家就开始了一起摆烂。这时候,实体经济开始出现巨大问题。1997年4月,以日本寿险资产规模排名第16位的日产生命保险公司(Nissan Mutual Life)宣布破产为伊始,拉开了1997-2001年四年间连续7家寿险公司接连倒闭的序幕。在1997年11月26日,是日本经济“最危险的一天”,当天大量民众去银行排队进行取款,风控团队就警告说,银行可能会出现大规模挤兑事件。还好在当天那些排队取款民众及时得到安抚,日本媒体也没有声张,才使得这次危机的没有发生。

虽然没有崩坏,但是日子也不好过,大量的失业率,自杀率,使得日本国民一度是去信心,这也是造成了之后经济停滞的30年的开端。那么再下期,将和大家聊聊,近30年,日本经济为何还在停滞不前,是天灾?还是人祸?或者有着其他更重要的因素?免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 助理分析师

热门话题

眼看它起高楼,眼看它宴宾客,眼看它楼塌了。就像新闻铺天盖地报道的那样,随着特斯拉股价2022年70%的暴跌,在刚刚过去的圣诞月欧洲大亨、LVMH董事长阿尔诺(Bernard Arnault)以1706亿美元的身价取代马斯克成为新世界首富。

为什么皮包商也可以成为世界首富?要知道不单单是造火箭才能成功啊!其实阿尔诺长期接近世界首富的位置,但其财富却没有像美国科技公司富豪的财富那样在狂飙突进的年代里呈现指数级增长,而是正如其人一样沉稳低调。但当在科技公司受到加息打击之际,阿尔诺的商业帝国却经受住了考验。LVMH全称叫酩悦·轩尼诗-路易·威登集团,旗下汇集七十多个世界知名品牌,业务遍及5大商业领域,包括有路易威登(LV)、迪奥、纪梵希、芬迪、轩尼诗以及蒂芙尼。其中赫赫有名的路易威登(LV)经营产品包括手提包,旅行用品,小型皮具,配饰,高级珠宝及个性化订制服务等。LV有着百年的发展历史,最初只生产箱包,上世纪八十年代中后期,品牌与Moet Hennessy合并,组成全球最大规模及最成功的奢侈品集团。合并后的路易威登转身成为全面性的时装品牌,男女成衣及鞋履、配饰及珠宝部门相继成立。

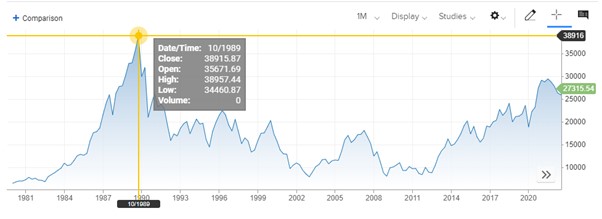

LVMH作为目前全球最大和最有价值的奢侈品牌集团,相比其他奢侈品集团,LVMH集团的市值3520亿欧元是其最大竞争对手开云集团的5倍多,开云集团拥有古驰、麦昆、圣罗兰等品牌。现在可以回答前面的问题了,皮包商也可以成为首富,答案是阿尔诺的大部分财富也是来自其占有48%股份的LVMH集团。现在我们来看下LVMH的股价周线图。

LVMH目前股价在702欧元,已经远远超出2020年3月低迷时期的280欧元。刚刚过去一年的最低回撤也未超过530欧元,形态上有呈圆弧底走势,当前多头运行稳健,很快在逼近历史前高757的节奏。即使短线行情有变,只要价格不下破枢轴点657左右,笔者的偏见是继续保持看多。长期看,LVMH在2023年是会像过去一年一样横盘整理,还是会再创前高帮助首富更上一层楼?除了技术面看法,我们可以看下基本面在新的一年有没有相关利好!从历史上看,中国游客一直是奢侈品人均消费最高的国家。中国买家通常在欧洲购买大部分奢侈品,在那里他们可以使用欧洲的退税来免税购物。在LVMH里,由中国驱动的亚洲市场一直增长强劲,营收增长率均超过其他国家份额,是集团增速最为迅猛的市场。根据贝恩咨询公司(Bain & Company)预计,到2030年,中国将成为全球最大的奢侈品市场,约占全球总销售额的40%。

无独有偶,中国在新的一年开始重启境外旅游。消费力在压抑了漫长的三年后,旅游需求已经达到了史诗般的比例。根据中国最大的在线旅行社Trip.com的数据,在宣布取消隔离要求的第二天,出境航班预订量飙升了令人难以置信的254%。这不仅是中国游客和航空公司的好消息,也是海外零售商的好消息,尤其是奢侈品零售商。中国人历来是世界上出国旅游的最大消费国,2018年的支出超过2770亿美元。到2021年,这一总额下降到1050亿美元,所以我相信2023年零售商们将铺红地毯庆祝,奢侈品零售商将再次高兴地看到中国游客的回归。反向来看,根据下图一组数据,在与中国业务往来最多的25家欧洲上市公司中,有9家可以被归为奢侈品制造商。总部位于瑞士的历峰集团(CFRUY)拥有卡地亚、皮亚杰等奢侈品牌,在中国市场的敞口最大,27.6%的收入来自中国。而酩悦·轩尼诗·路易·威登(LVMH)其风险敞口相对较低,仅占收入的6.8%。即使将来因为其他原因导致这一块收入的不确定,也不会特别影响集团的长期稳健发展。

免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jack Lin | GO Markets 新锐分析师

热门话题

新年假期刚刚结束,大家是否有去电影院一睹今年最受瞩目的电影之一阿凡达2:水之道。目前阿凡达的票房已经超过了14亿,但是导演卡梅隆表示阿凡达2的票房需要达到历史第三或者第四才能实现盈利。这也就意味着其票房需要达到至少20亿才有可能盈利,迪士尼距离回本还有一段距离。这部让观众等待了13年的阿凡达2可能无法重现第一部的辉煌,这似乎也隐隐暗示了迪士尼的命运。

迪士尼在2022年年底也经历了一个重大的变革,迪士尼董事会辞退了CEO Bob Chapek,召回了曾执掌迪士尼15年的前CEO Robert Iger。可以说如今的迪士尼是Robert Iger一手打造的,在其任职期间,迪士尼在2006年收购了皮克斯,在2009年又收购了漫威,开启了新的超级英雄宇宙。后又在2012年收购了卢卡斯影业,将星球大战和夺宝奇兵等IP拿下;随后在2018年以710亿美元的价格收购了21世纪福克斯,又给迪士尼的IP库纳入了死侍,阿凡达和辛普森一家等。在2019年,Iger任期的最后一年,迪士尼开启了Disney+进军流媒体,在短短一年多的时间里就实现了超1亿订阅,这是Netflix用了10年时间才达到的。Iger在任期间,迪士尼的股价增长了近485%。反观前CEO Chapek的管理期间,仅从2020年到2022年,迪士尼的股价就下跌了约28%,去年更是下跌了近50%。当然,Bob在任期间面对的是突如其来的疫情和紧随其后的通胀加息,但是股价的大幅下跌和盈利水平极具恶化让股东们无法接受,低于市场预期的2022年Q4财报最终送走了Chapek。Robert的回归给市场了一剂强心针,但是短暂的上涨后迪士尼的股价又继续下跌。那么,Iger是否能如董事会所期待的一样带领迪士尼绝地反击呢?

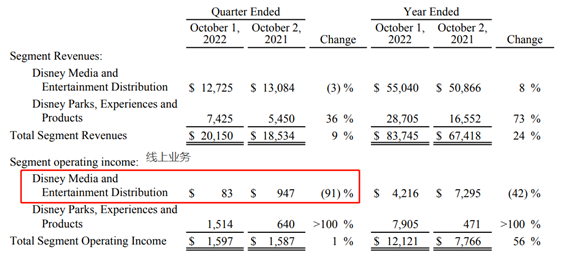

迪士尼目前的情况与之前已经截然不同。首先,迪士尼面临的最迫切的问题是盈利。迪士尼的业务主要分为两个板块,一个是线下的乐园和产品周边,随着疫情的恢复,从最新的财报可以看到,该板块的盈利大幅增长;但是线上板块的盈利较去年同期下降了91%,特别是其中的流媒体板块盈利同比下降超100%,拖累了整体利润。Iger的首要任务就是探索出如何让用户愿意持续付费的流媒体服务。Iger也表示重新审视迪士尼的成本结构将是他工作的重点。在整体经济向好的时候,投资者关注订阅人数,有耐心等待流媒体的发展。而如今的经济环境下,投资者的眼光转向了利润表上的数字,是否创造了利润才是关键。

另外,Iger面临的第二大难题是修复迪士尼的形象。一方面,在Chapek任职期间,迪士尼面临了几次公关危机。其中,最受关注的无疑是由于黑寡妇在院线和流媒体同步上映,主演斯嘉丽将迪士尼告上法庭。还有,迪士尼在疫情解除后马上提高了乐园票价,都给迪士尼的老少皆宜的亲民形象蒙尘。另外,Chapek对于内容创作的忽视也破坏了迪士尼的内部文化。Iger上任后马上重组了媒体和发型部门,给予了内容创作部门独立性,稳定了民心。迪士尼的强大IP库以及其独特的线下和线上结合的业务结构都给予了其强大的支撑。Iger作为本世纪最伟大的企业家之一应该有能力解决这些问题,但他本次的任期目前仅有两年,在两年中制定策略并且找到继任者时间紧迫。

迪士尼的股价目前仍在下跌趋势中,如果在80价格获得支撑,即疫情初期的低点,有小幅反弹的可能,但涨幅有限。长期来看迪士尼迟迟没有恢复派息,同时由于收购福克斯所产生的48亿债务还躺在其负债表上,加息后所增加的利息支出是否会继续蚕食其现金流量表而使迪士尼继续推迟派息还是个问题。另外, Iger结束两年任期后管理层的不确定性,让我对迪士尼能否恢复其股价辉煌抱有怀疑。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jaden Wang | GO Markets 助理分析师

热门话题

特斯拉,目前全世界可能是最热门的公司,其创始人马斯克不但身兼数职,同时管理SpaceX, 无聊公司,特斯拉,和推特等多个跨行业和板块的龙头企业,不得不说,马斯克是一个比其他所有CEO更加能吸引公众眼球的超级网红。而他不仅仅在全世界拥有着比美国总统还要多的粉丝,更重要的是,他至今为止的成功,绝大部分是靠着其超越常人的努力和对未来事务的判断。我们说,人可以靠运气成功一次,但是不可能连续靠运气成功多次。早在20年前,2002年,EBay就以15亿美元收购PayPal。马斯克作为拥有11.7%股份的第一大股东获得了1亿多美元,成功的达到了其人生的第一个小目标。但是真正让他成为全球首富的,则是其几次就差一点要破产倒闭的电动车企业特斯拉。特斯拉真正股价起飞,其实就是在其上海超级工厂建成投产之后。而这个巨大的超级工厂从一片空地到建成一期投产,只用了仅仅10个月的时间。而且马斯克几乎没有花一分钱。当然,一分不花是明显夸张了,但是当时上海,合肥,北京和深圳同时都在抢特斯拉这个项目,各自开出的条件都简直是疯了:免费土地平整,免费土地租赁费用,当地政府负责当地人员招聘,并且大幅减免,有的甚至几年不收企业的税费,但是最终上海依靠着上汽集团以及成熟的汽车配套零件基地拿下了订单。同时中国的国有银行联合多家银行给这个项目支持,低息贷款,最终在10个月里投产。应该说,这个速度在其他任何一个国家都不可能。美国不可能,印度更不可能。之后的特斯拉德国工厂甚至还要造到一半停下来打官司,判了以后再继续造。

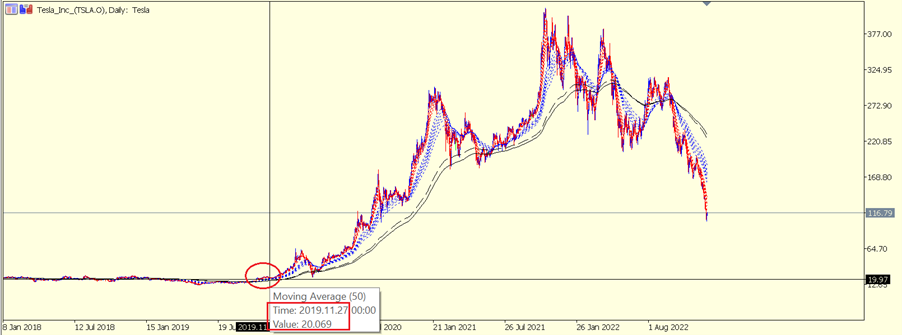

从上面的走势图我们可以清楚的看到,特斯拉股价的起飞,就是在2019年底上海工厂完成之后。(图形显示价格是多次拆分后现在折算价格,按照当时价格在200美元以上)在上海超级工厂投产之前,特斯拉每个季度的财报都在亏损,而马斯克几乎每天都睡在美国工厂里,用帐篷搭额外生产线依然无法达到预计产能。每个月都在亏钱,要不断融资,那时很多分析师都预测特斯拉熬不过12个月就要破产。正是上海超级工厂的投产,让特斯拉在2020年上半年的财报中一局扭亏为盈,股价因此一飞冲天。之后马斯克更是依靠SpaceX的猎鹰火箭,把一辆特斯拉3送入太空而名噪一时。从此成为神话级人物,超越了苹果创始人乔布斯,成为全世界科技领域拥有最多粉丝的企业家。好了,介绍完特斯拉发家史之后,我来回到现实中。过去半年,我身边越来越多的朋友和同事都纷纷购买了特斯拉的3或者Y系列电动车,并且普遍给与正面评价。但是因为我一直没有亲自试驾过,所以耳听为虚,我不能没有对比就发言。作为爱车人士,我2001年来到澳洲之后前后一共自己买过10辆车,覆盖了日本美国德国从基础代步,到运动手动跑车的大部分车系,但是我从没有开过电动车,刚好明年我有换车打算,就在本周四下午去Chadstone 商场的特斯拉预约了3系和Y系列的试驾。为了彻底真实还原,我还特地叫上了家人和孩子,带上了儿童座椅,在停车场里换,差点没把我累死。其实在没有试驾之前的静态体验,已经让我对特斯拉最基础款的3系列刮目相看。作为拥有过雷克萨斯,奥迪和宝马等多款以内饰豪华或者科技著称的车,特斯拉进去之后的感觉仿佛就不是一个时代的汽车。在之后的实际驾驶体验中,更让我觉得很惊讶。不论是形式质感,底盘操控,加速推背,还是电脑科技,安全防护,作为一款7万澳元的车,特斯拉给与驾驶者的体验感在其他7万澳元的车型中我感觉是无法超越的。也许宝马奔驰也有自己的电动车,但是价格早已超过10万,甚至14万澳元,如果要这么比,就需要把特斯拉S系列拿出来溜溜了。所以作为爱车人士的我,不难想象为什么现在大街上越来越多的人选择了特斯拉。虽然其价格依然会比更加热门的丰田佳美混动系列高1.5-2万澳元,依然有很多人会为了不同的价值体验和科技感而支付额外的差价。我没有试驾过宝马奔驰的电动车,但是毫无疑问,不论是特斯拉3还是Y,都让我非常感慨,用7万澳元这个价格以内的电动车,目前为止,特斯拉3应该没有对手了。那既然特斯拉3给我的体验这么好,为什么特斯拉的股价在过去12个月跌的却如此之惨?按照拆股后折算价格,特斯拉在2021年底曾经达到400美元一股的价格。而在本周最低的时候却只有104美元,这都不是对折了,是跌了75%了。

那为什么特斯拉卖的越来越多,股价却跌这么多?要回答这个问题,我们首先就需要了解,特斯拉之前为什么上涨这么快?是特斯拉3好?对,但是不完全是。那是上海超级工厂帮忙?对,但不是最主要的。那什么因素是让特斯拉股价暴涨的?不是车,不是工厂,而是马斯克这个人。特斯拉的车和股价受欢迎很大程度上源于人们对马斯克“是一个很酷的人”的印象。在马斯克收购推特之前,绝大部分的股民和投资者都把马斯克之前的成功无限放大,并且用各种包装,成功的把自己和自己能影响到的所有人都迷晕了。大家都愿意为其个人魅力和个人成功的故事来买单。简单来说,就是主角光环。但是中国有句古话,叫做成也萧何,败也萧何。既然投资者可以因为马斯克的个人原因而不断追高特斯拉的股价,也同样可以因为马斯克的一系列昏招,让其失去主角光环而“粉转黑”。我非常同意马斯克希望控制舆论来继续为他其他企业增光添彩的战略布局。毕竟大部分民众都很容易被舆论引导。但是他在收购推特这件事,以及收购之后的一系列操作,光从市场和股价来看,就很容易得出一个结论:投资者不认可,股东不认可。我们普通人无法知道马斯克这样的快刀斩乱麻能不能让推特在短时间重新恢复盈利能力(之前每天亏40万美金)但是这步棋,不论最后结果如何,都让马斯克和特斯拉的股东付出了极为惨痛的代价。当然了,马斯克手里还有世界最强的航空企业SpaceX公司,以及覆盖地球的4万颗星链互联网。这两个项目如果成功上市,分分钟就能让马斯克重新变成世界首富。但是特斯拉未来将会迎来更多车企进军电动车领域之后所推出的更多车型。而那些日本韩国车企包括比亚迪所推出的电动车将会给特斯拉带来巨大压力。特斯拉前期所积累的用户无法像苹果,谷歌或微信一样实现商业闭环。使得这些用户未来转移去其他车企电动车的成本太小。大家想想,你用惯了苹果手机,换一个有多难受,你现在可以离开微信,可以离开谷歌产品吗?几乎不可能。但是你可以离开特斯拉,换一个品牌。这就是差别。特斯拉如果可以留住客户,才能真正实现长期的垄断式盈利。说了这么多,我来总结几点:

- 特斯拉的车很不错,值得一试。和传统燃油车截然不同。竞争力超过宝马奔驰奥迪等传统豪华车品牌的电动车。

- 特斯拉的成功和暴跌都源自于对于马斯克的个人崇拜,和之后的失望。

- 特斯拉目前缺乏像苹果,谷歌或微信一样的客户粘性。

- 马斯克意识到了危机,已经在改,其手里还有“诗和远方”(SpaceX和星链)所以未来依然将会是全世界的焦点。

特斯拉股价已经跌了75%,未来可以抄底,还是再等等?我们将会在近期推出特斯拉股价报告,尽请关注。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Mike Huang | GO Markets 销售总监

热门话题

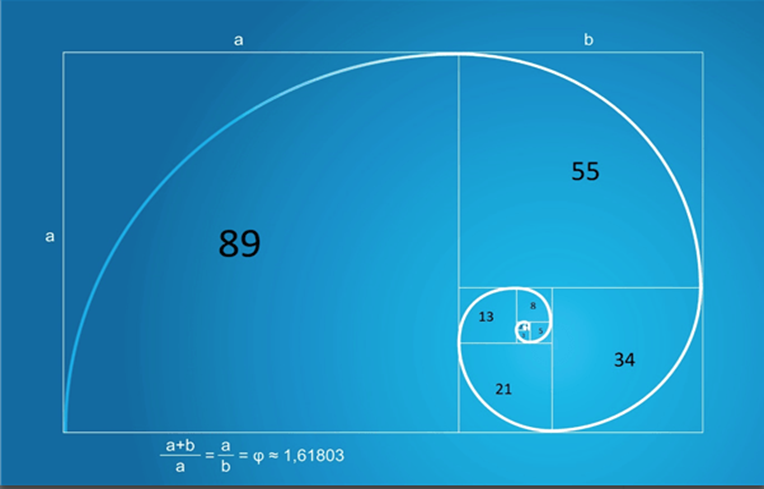

前一篇我们介绍了波浪理论的基本模型,其中的子浪(3浪、5浪、C浪)目标位测算结合了斐波那契扩展的用法,一般3浪为1浪的1、1.272、1.618倍等,5浪为1浪的1.618、2、2.618倍等,C浪为A浪的0.618、1、1.618倍等。本文将用特斯拉和澳美货币对的2个实例来验证下理论的有效性,并搭配MACD指标背离的信号,一起构建五浪模型的经典战法。

首先,我们还是解释下背离指标问题,一般常用的背离指标有MACD和RSI。MACD是趋势指标,RSI是震荡指标,前者对长期形成的趋势定位和转向比较有效,后者对行情在震荡走势中的超买超卖后反转寻找比较准确,通常灵敏度要稍高于MACD。但因为五浪模型显然是任何周期里的主趋势,所以我们就用MACD发出的背离信号来结合使用。所谓背离,可以分为顶背离和底背离。在股票市场里,当股价的高点比前一次的高点更高,而MACD指标的高点却比前一次高点要低,这叫顶背离现象。顶背离一般是股价在高位即将反转转势的信号,表明股价短期内即将下跌,是卖出的信号。底背离一般出现在股价的低位区,当K线图上的股价还在下跌,而MACD指标图形上的由绿柱构成的图形的走势是一底比一底高,这叫底背离现象。底背离现象一般是预示股价在低位可能反转向上的信号,表明股价短期内可能反弹向上,是短期买入的信号。但需要注意的是,不是指标一发出背离信号价格就会转向,有时需要多次背离的出现,行情才会真正反转。

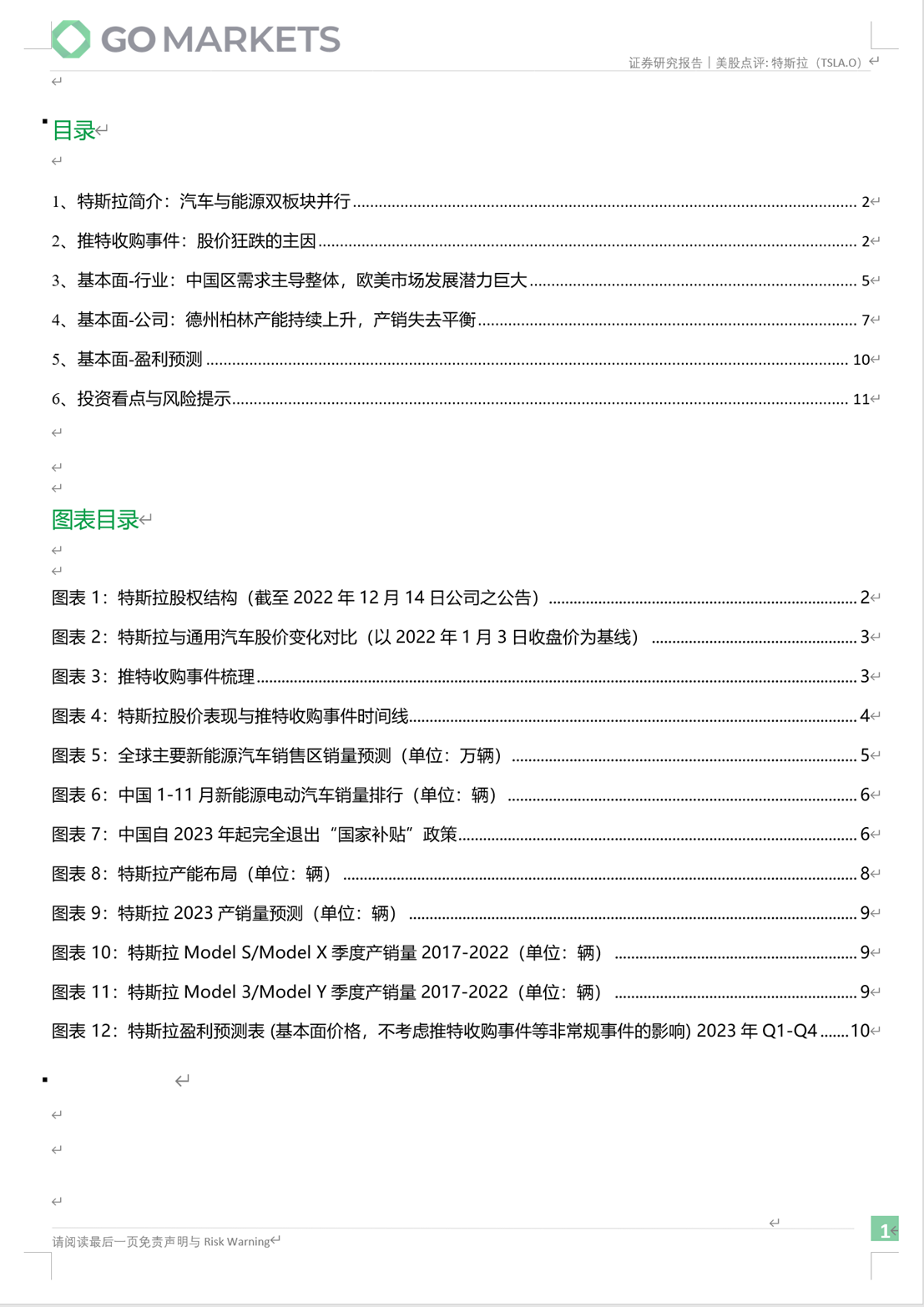

下面我们来看下特斯拉的五浪走势和背离信号。周线图可见,特斯拉从2019年6月的12美元左右股价开启五浪上涨,1浪结束位置还在65美元左右,到第3浪则是巨长浪,直接把价格从2浪回撤的23.7美元拉升到了300美元,这个幅度不得不说是资金疯狂炒作的结果,是一般产品所未有的。因此交易者需要灵活多变,打破浪幅的固有思维,要考虑多种可能性,切忌心存执念。接下去看,4浪则是标准的前浪回撤三分之一左右,幅度较浅。相较之下,5浪是主推浪里长度较短的,尽管股价从回撤后的190美元还是拉升到最高点413美元左右,但是这个时候MACD指标已经发出明显的向下背离信号,既然五浪也已走完,这个信号也就预示后市价格很有可能转而下跌。果不其然,在此后股价高位震荡一个月,MACD也出现死叉,进一步确认了转空。如上所述,一般背离用法要结合在4浪和5浪阶段,如果走势较弱情况下,有时5浪甚至不会超过3浪高点,形态也呈楔形。

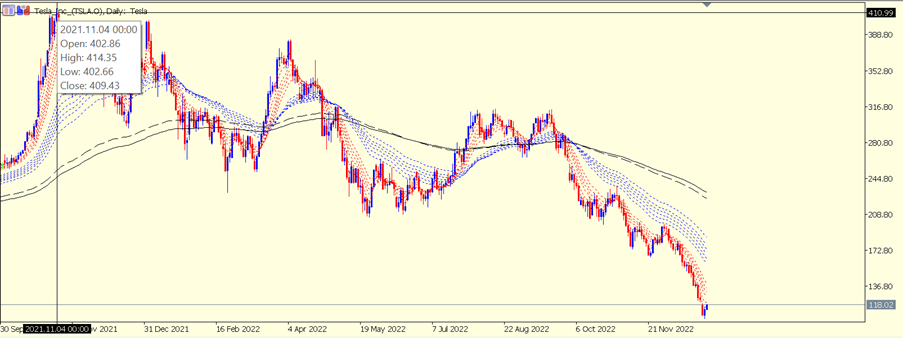

当年的大牛股特斯拉近期抛售严重,空头交易量也一直上升,现在价格直逼100美元大关。上图看浪型处于调整浪的C浪,依据模型,如果C浪和A浪是等长情况下,则目标位就是当前的109美元。如果109-100区间大概率依然无法止跌,下方目标位就是1.272比例的53美元左右。笔者的偏见是,作为普通交易者,任何抄底目前都是不切实际的,直到出现右侧信号和卖压较少。另外一个例子就是澳美的月线大级别走势,也是非常标准的五浪模型,目前价位可能处于调整C浪的起点左右。下图可见,该货币对在2011年7月达到峰值1.1后三角盘整开启下跌1浪,此模型中1浪较长,3浪和1浪几乎等长,5浪稍短终点为1浪的1.618倍,触底在0.55。MACD指标在该极限位置显示有背离,同时历经筑底3个月后出现金叉信号,确认为A浪调整。如果依据模型的C浪和A浪一般等长情况,本轮上涨的目标位可以看到0.86左右。

波浪理论是一种蕴含了斐波那契数列原理的定义趋势阶段和目标的技术分析方法,是投资者在这个市场里博取利润减少损失不可不知的一门课,但素有千人千浪的诟病,所以如何正确数浪以无招胜有招,则是长期的修行。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jack Lin | GO Markets 新锐分析师