市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

Shares of Pfizer rise as Q3 earnings beat estimates Pfizer Inc. (NYSE:PFE) reported its latest financial results for the third quarter before the opening bell on Tuesday in the US. The US pharmaceutical company reported revenue of $22.638 billion (down 6% year-over-year) vs. $21.072 billion expected. Earnings per share reported at $1.78 per share vs. $1.387 per share estimate.

David Denton, CFO of Pfizer commented on the results: ''Third-quarter results demonstrated commercial strength across many areas of our business but was somewhat obscured by the incredibly strong performance in the prior year. We saw strong operational performance this quarter from key brands such as Paxlovid and Eliquis, particularly in the U.S., as well as the continued impressive launch of Prevnar 20 for adults in the U.S. In addition, we continue to make progress toward our goal of adding at least $25 billion in risk adjusted 2030 revenues to Pfizer’s portfolio through business development.

Since we last reported earnings, we completed the acquisitions of Biohaven and Global Blood Therapeutics, each of which bring significant scientific breakthroughs to Pfizer and which present opportunities where we believe we can add great value.'' ''I look forward to continuing to execute on Pfizer’s strategies to deliver breakthroughs to patients and value to shareholders,'' Denton concluded. The stock was up by around 3% on Tuesday, trading at $47.94 a share. Stock performance 1 month: +7.85% 3 months: -3.50% Year-to-date: -18.80% 1 year: +5.50% Pfizer price targets Morgan Stanley: $50 Barclays: $44 SVB Leerink: $48 Wells Fargo: $55 Citigroup: $57 B of A Securities: $70 Pfizer is the 27 th largest company in the world with a market cap of $269.29 billion.

You can trade Pfizer Inc. (NYSE:PFE) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: Pfizer Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

NIO Inc. (NYSE:NIO) reported its latest delivery numbers for October on Tuesday. The Chinese electric vehicle company delivered 10,059 cars last month – up by 174.3% year-over-year. The deliveries in October consisted of: 5,979 premium smart electric SUV’s 4,080 premium smart electric sedans Production and deliveries were impacted by supply chain issues and other constraints caused by COVID-19 outbreaks in certain parts of China, according to the company.

NIO has delivered a total of 259,563 electric vehicles as of October 31, 2022. The stock made some gains on Tuesday, up by around 2% at $9.93 a share. Shares of NIO have plummeted by over 75% in the past year.

Stock performance 1 month: -40.68% 3 month: -50.82% Year-to-date: -68.67% 1 year: -75.97% NIO price targets Morgan Stanley: $31 HSBC: $28 Goldman Sachs: $56 Barclays: $34 Mizuho: $42 Citigroup: $31.3 B of A Securities: $26 UBS: $32 Barclays: $19 NIO is the 22 nd largest automaker in the world with a market cap of $16.56 billion. You can trade NIO Inc. (NYSE:NIO) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: NIO Inc., TardingView, Benzinga, CompaniesMarketCap

The Boeing Company (NYSE:BA) announced Q3 earnings results before the market open in the US on Wednesday. The world’s largest aerospace company reported revenue that missed analyst expectations at $15.956 billion (up by 4% year-over-year) vs. $17.911 billion estimate. The company reported a loss per share of -$6.18 per share vs. $0.132 earnings per share expected. "We continue to make important strides in our turnaround and remain focused on our performance," Dave Calhoun, Boeing President, and CEO said in a press release following the announcement. "We generated strong cash in the quarter and are on a solid path to achieving positive free cash flow for 2022.

At the same time, revenue and earnings were significantly impacted by losses on our fixed-price defense development programs. We're squarely focused on maturing these programs, mitigating risks and delivering for our customers and their important missions. We remain in a challenging environment and have more work ahead to drive stability, improve our performance and ensure we're consistently delivering on our commitments.

Despite the challenges, I'm proud of our team and the progress we've made to strengthen our company," Calhoun concluded. Shares of Boeing took a hit on after the announcement of the latest results. The stock was down by around 3% at $140.85 a share.

Stock performance 1 month: +6.50% 3 months: -8.95% Year-to-date: -29.41% 1 year: -31.21% Boeing price targets Credit Suisse: $98 Morgan Stanley: $233 Wells Fargo: $210 Benchmark: $200 RBC Capital: $200 JP Morgan: $188 Citigroup: $209 Boeing is the 147 th largest company in the world with a market cap of $83.94 billion. You can trade The Boeing Company (NYSE:BA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD. Sources: The Boeing Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

热门话题

上周道指大涨5.72%,纳指上涨2.24%,标普则涨了3.59%,随着美国中期选举的临近,加上周五核心PCE助推,三大股指已经回到前期牛熊分界位。由于澳洲CPI报表,直接从6.1%跃升至7.3%,上周ASX200仅上涨1.63%。整体上看澳股还是跟随美盘而走。纳指上周的几天下落原因是高科技巨头财报不佳导致的,过了财报这一关,本周纳指将动力十足。

本周的一系列重要经济数据有,周一欧元区三季度GDP和10月CPI,美国继续财报潮,但极大高科技巨头已经公布了财报。周二澳联储将再次加息,上次加息幅度骤降至25个基点是否能继续在11月延续成为一大看点,澳联储可以说是压力山大。周三小非农预期略低于前值,也是周五非农的一个重要前瞻。周四美联储利率决议,预计本次加息75个基点概率最大,利空其实已经被市场消化。周五重磅非农数据以及美国10月失业率,都是直接影响股市走势的消息。非农预测数据20万,远低于前值26.3万,也是一大不确定因素。从本周经济数据推测股市走向,其实不确定性还是很大的,特别是澳联储加息力度和非农数据对美股的影响。但是整体上看11月行情,真正加息利空以及被市场消化,无论是小非农还是非农,预期值都比前值要低,加上上周核心PCE的好于预期,市场在数据出炉前还是向好的。从最差情况考虑,如果澳联储加息力度增加,非农数据高于预期,市场的下跌还是短暂的,毕竟政治层面的影响摆在那里,美国中期选举前为了选票股市很难崩。历史上每次中期选举时期甚至选举之后,股市涨幅都是非中期选举年的两倍增幅,极大助推股市上行。

既然11月大方向对美股是看涨的,澳股自然也不会太差。具体到板块方面,新能源电动车相关行业还是布局重点。继美国能源部投入28亿扶持电动车产业链并努力促成供应链回流本土的举措后,相关澳股代码以及有了跳跃性的涨幅,加上欧盟刚刚确立了2035年后禁止燃油车上路的共识,相应板块的利好将会是持续性的。因此诸如锂矿,石墨,电池测试,电池组装,电池回收等澳股代码会持续受益。强力拉升后的回调反而是他们入场的好机会。

从锂矿看,全世界大国抢夺锂矿资源还会持续一年以上,当前有产出的锂矿股无疑还有行情可以抓。美股的几大锂矿巨头大部分把持着南美卤水资源,而澳洲的锂矿以矿石为主,澳股几大有产出的上市锂矿多少可以见到巨无霸企业作为大股东的加持。澳股锂矿目前上市的有产出的企业屈指可数,加上半年内将有产出的锂矿上市公司也就几个手指可以数过来,这批代码11月会继续保持强势。从电池电极生产企业看,澳股可选择上市企业也不多,临近投产的或者受大力资助的更是寥寥无几,稍加搜索就可以筛选出来,参考美国能源部拨款对象列表就可以发现收益的澳股,也是11月可以继续看涨的代码。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 专业分析师

Stop loss hunting is frustrating, annoying and can be detrimental to any retail trader. The premise of stop hunting is that large systemised institutional trading strategies know where the average retail trader or most traders will set stop losses and therefore profit off triggering these ‘stops. Their own algorithm will then deliberately, trigger the stop losses.

For traders there are few things as frustrating as have a well-positioned trade, being stopped out and then watching the price reverse in their original direction of the trade. What is a stop loss? Understanding stop loss hunting requires a simple understanding of what a stop loss is.

A stop loss is a trigger on traders’ position to close the position at a certain price. Generally, once triggered the position will attempt to be closed at the specified price. Stop losses provide an important role in risk management for many traders.

Generally, traders use stops losses to avoid emotional mismanagement and better manage overall risk by having clear exit points for the trade in worst case scenarios. The second element that is important to understand is where traders put their stop losses and why. Retail traders often place their stop losses near important market structures also known as support and resistance levels.

These areas represent strong zones of supply and demand. When support and resistance zones become more and more consistent and more obvious, it can create a clump of stop losses. These stop losses can be thought of as orders that must get filled if the price reaches those points.

This creates an attractive opportunity for large institutions with powerful algorithms that can push the price down and generate profits by ‘stopping out’ traders by triggering these stop losses. Once this process has occurred, the price will often move back in the direction the original trades were positioned for. Why would a system want to trigger stop losses Firstly, when stop losses are triggered, a price tends to see an increase in relative volatility.

Therefore, it may indicate the beginning of a reversal which sophisticated traders profiting. It also allows these large institutions to maximise their own existing trades as it may allow for better entries. Common areas for where stop hunters will look Stop Loss hunting tends to be most active around significant and clear areas of support and resistance.

This is especially true with regards to commonly traded assets. However, stop loss hunting can occur in all assets with various sizes. A stop hunt can be seen often with a small candlestick and a large wick.

In addition, they often occur on very short time frames. Common Area for Stop Loss Hunting At key moving average levels Clear Support and Resistance Levels Historical Support and Resistance Levels ie, Multiyear levels How to deal with Stop Loss Hunting? The obvious tactic to deal with stop hunting is to lower the stop loss below the obvious support and resistance level by a factor of maybe 10%.

This may require smaller trade size, but overall will allow the trade to hopefully avoid these potential stop losses. Treat support and resistance as areas instead of specific price points. Support and resistance do not exist at one price and rather a range of prices that are supply and demand zones.

Therefore, placing stop losses below these 'zones' may put the trade out of arm length of stop hunters. Simply being aware of stop loss hunting may provide some reassurance when a sharp spike in price occurs, to remain in the trade and not exit immediately. Ultimately, Stop Loss Hunting is just another challenge that traders must deal with in the pursuit of profit.

However, with some knowledge traders can adequately accommodate these tricky occurrences.

热门话题

Liontown Resources 是一家电池材料勘探和开发公司,专注于在澳大利亚开发伟晶岩锂矿床,旗下核心资产为Kathleen Valley锂钽项目和Buldania锂项目。LTR目前市值近40亿,52周股价区间从最低的$0.875至最高$2.19,自股市入熊后并没有出现趴在低位的情况,属于跑赢了大盘的一类股票。

在进入10月后,随着公司消息面的不断利好,股价已经稳步上行,回到了年初的高位平台。从LTR手上的合同可以看出,公司将在2024年二季度投产,除了与特斯拉的限制性合同,公司还有LG的五年承购协议,以及跟福特的限制性承购协议和融资方案,公司最近还跟Zenith签署了电力供应合作合同。

项目

Kathleen Valley锂钽项目是一项LTR全资拥有的一级电池金属资产,包括4个已授予的采矿许可证和1个采矿许可证申请。项目位于珀斯东北部约680公里处,Kalgoorlie北部约400公里处,是西澳最好的矿区之一。项目所处地交通便利,可通过高速公路达到,并且公路还连接Geraldton和Esperance的矿产出口港口和周围良好的基础设施。当地的其他基础设施包括高压线、天然气管道和中型飞机的跑道。

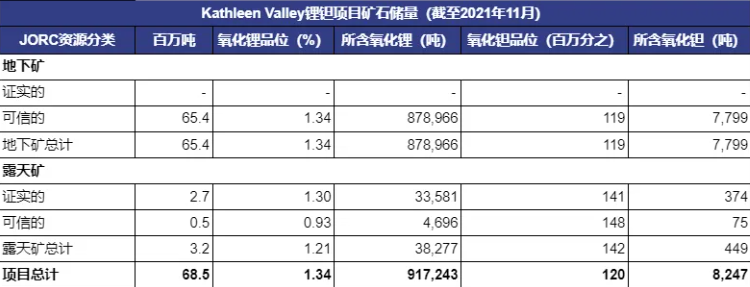

LTR通过钻探已经确定了多个高品位区域,其中包括个别品位超出5%的氧化锂,21米厚品位3.8%的氧化锂以及7米厚品位3.4%的氧化锂。资源方面,该项目最新的矿产资源量估算为1.56亿吨,氧化锂品位1.4%,以及品位130ppm的氧化钽。最新的矿石储量为6850万吨, 氧化锂品位为1.34%,氧化钽品位为120ppm。

Kathleen Valley项目的初始产能为250万吨/年,可生产锂辉石精矿50万吨/年。项目还计划在第六年扩建至400万吨/年,届时锂辉石精矿产量可达70万吨/年。项目采矿活动将主要在地下进行,这有助于直接从高品位矿化中进行开采,同时最大限度地减少项目的浪费和环境足迹。该项目开采出的矿石将通过一个全套矿石浮选回路进行处理,预计在整个矿山服务年限内的回收率为78%,钽精矿的现场回收率为42%。

财务

公司季末手握现金45m,足够支撑较长时间。2021年十月公司以实物配售的方式完成了Minerals 260 Limited的合并,它本就是LTR的全资子公司,因此改合并项目并没有产生税务方面的问题,最主要的是剥离了Moora,Koojan JV,Dingo Rocks和Yalwest这一批非锂矿勘探项目,可谓更加专业和精细化。Mineral 260 Limited的拆分再并购公允价值为9096万,因此在财报中显示LTR本财年在没有锂矿产出的情况下有了超过40m的净利润。2022年6月,公司正式和福特签署了具有约束力的完整融资机制协议,完成了3亿澳元的债务融资。连同LTR于 2021 年 12 月筹集的 4.63 亿澳元,意味着它现在已经获得了项目所需资金的承诺,以支持项目全面发展直到实质性产出。

更详细的股评报告,请联系小助手获取。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 专业分析师