市场资讯及洞察

Expected earnings date: Thursday, 4 February 2026 (US, after market close) / ~8:00 am, Friday, 5 February 2026 (AEDT)

Alphabet’s earnings provide insight into global digital advertising demand, enterprise cloud spending, and broader technology-sector investment trends.

As Google Search and YouTube are widely used by both consumers and businesses, results are often used as one input when assessing online activity and corporate marketing budgets, alongside other indicators.

Key areas in focus

Search

Search advertising remains Alphabet’s largest revenue driver. Markets are likely to focus on ad growth rates, pricing metrics such as cost-per-click, and overall advertiser demand across sectors such as retail, travel, and small-to-medium businesses.

YouTube

YouTube contributes to both advertising and subscription revenue. Markets commonly monitor advertising momentum, engagement trends, and monetisation developments as indicators of digital media conditions and brand spending.

Google Cloud

Sustained Cloud profitability is often discussed as a factor that may influence longer-term earnings expectations, though outcomes remain uncertain. Markets are expected to focus on revenue growth, enterprise adoption trends, and operating margins.

Other bets

Initiatives such as autonomous driving and life sciences, while typically smaller contributors to revenue, markets may still watch spending levels and progress updates as indicators of capital allocation and cost discipline.

Cost and margin framework

Management has previously flagged elevated capex tied to AI infrastructure, including data centres, specialised chips, and computing capacity. Traffic acquisition costs, staffing levels, and infrastructure expansion are also key variables influencing profitability.

What happened last quarter

Alphabet’s most recent quarterly update highlighted advertising trends, Cloud profitability, and continued increases in capex to support AI initiatives.

Management commentary has indicated that infrastructure spending is intended to support long-term competitiveness, while the market continues to assess the near-term margin trade-offs.

Last earnings key highlights

For reported figures and segment detail from the most recent quarter, refer to Alphabet’s latest earnings release materials, including revenue, earnings per share (EPS), Services mix, Cloud operating income, and capex commentary.

- Revenue: US$102.35 billion

- EPS: US$2.87

- Operating income: US$31.23 billion

- Services revenue: US$87.05 billion

- Cloud revenue: US$15.16 billion

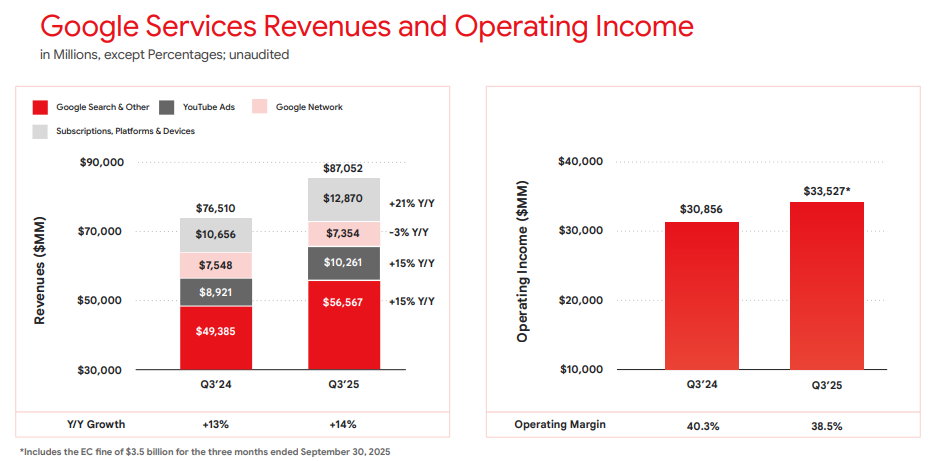

Google Services revenues and operating income Q3 2025 | Alphabet earnings release

What’s expected this quarter

Bloomberg consensus estimates moderate year-on-year (YoY) revenue growth and higher EPS versus the prior-year quarter, with ongoing focus on operating margins given AI-related investment.

Bloomberg consensus reference points:

- EPS: low-to-mid US$2 range

- Revenue: high US$80 billion to low US$90 billion range

- Capex: expected to remain elevated

*All above points observed as of 31 January 2026.

Market-implied expectations

Listed options implied an indicative expected move of around ±4% to ±6% over the relevant near-dated expiry window. Movements derived from option prices observed at 11:00 am AEDT, 2 February 2026.

These are market-implied estimates and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian market participants

Alphabet’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Expert Advisors are programs which are configured to execute trades or read market price movements. When a parameter is met or triggered, it commands the EA to open or close trades on your behalf whilst you are otherwise engaged or sleeping. EAs are compatible to be used on the Metatrader 4 and 5 systems.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders.

It is widely used by investment banks, pension funds, mutual funds, hedge funds that may need to spread out the execution of a larger order or perform trades too fast for human traders to react to. It is now also widely available to retail clients. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans.

What are the advantages of using EA’s? Timesaving – The Forex market is open 24 hours. As a trader you are always looking for an opening in the market for you to execute an order, however, as a human you need to be able to sleep to operate normally, especially if you want to live a healthy life.

With an EA in place, you can time the market, set alerts, watch various markets simultaneously, set open and close trades yourself or allow it to open and close trades on your behalf. For a lot of forex traders who’d like to profit from market movements during a particular trading session but are stuck in a different time zone, using an expert advisor means that they don’t need to worry about trading sleep for pips. Emotionless Trading – The market is wholly affected by emotion, whether the emotion makes you want to buy or sell an asset is down to how you understand the information or how you perceive the charts.

With emotion you can either be gripped in a circle of greed or a loss of confidence which can cloud your thinking and deviate from a trusted strategy. An EA does not suffer from these as it just needs to meet various mathematical parameters to work. Expert advisors are wired to stick to system commands and take valid trade signals, without feeling pain from losses or joy from wins.

Backtesting - Another advantage of having an expert advisor is the ease of conducting backtests, particularly on an MT4 platform. In fact, Babypips have a short tutorial on how to backtest and EA on MT4 and you’d be surprised to know that it just takes a few clicks to see how a system fared over several years. This is mainly used, to make sure that the EA you have acquired, works in the way you want it to work before letting it loose on your live account with real money at stake.

Quick and Flexible – EAs can open and close trades in a blink of an eye; whilst humans tend to second guess these actions by taking price movements and reading indicators, an EA is built to take these decisions with mathematical precision. Depending on the EA you are also able to check multiple markets and have various EAs on one system at the same time. Some of these features are also extremely useful for short term traders who trade on smaller movements of 1 – minute to 5 – minutes charts.

Human Error and Accessibility – Human error have cost many a trader in years past, opening the wrong direction on trades, making the size of the position too big or too small, or opening a trade whilst misreading the technical can all have a negative effect on your trading experience. Having an EA can limit these errors as EAs are programmed to your specifications and they would never deviate from that, unless they are not set properly to begin with, but this is the reason why you would always backtest! EAs are available with a decent variety and with great accessibility to these programs, it is no hard to see why they are becoming the automated popular choice for traders.

In my follow up article on this subject, I will talk about the use of a VPS and popular EAs. If you like to incorporate your MT4/5 systems with EAs, you can talk to one of our Account Managers who will be happy to talk you through the process, feel free to contact us on +61 3 8566 7680 or email me directly on [email protected] Sources: Tradersunion.com, IG, Wikipedia, Babypips.

The USA and other Western nations have intimated that they are planning to block Russia's access to its international stockpile of gold. Russia has so far been able to use gold to support the Rubel as a tool to reduce the impact of sanctions. Russia has been able to trade gold assets for more liquid foreign exchange that have not been subject to current sanctions.

Tech stocks continued their momentum overnight as the Nasdaq closed at its highest level since February 9, up 1.93%. Intel was a top performer overnight as it rose 6.94% on reports that it may assist NVIDIA corporation in chip manufacturing. Uber also had a stellar night increasing by 4.96% after it reached an agreement to list NYC taxis on its app.

The Dow Jones closed 1.02% higher as material stocks performed well. The S&P 500 reflected the positive momentum as it closed the day up 1.43%. In Europe, the FTSE had a relatively flat day.

The material sector performed strongly, supporting the index as it closed up 0.09%. The DAX also had a relatively flat day finishing down 0.069%. Commodities Brent Crude oil failed to carry on its rise as it dropped back 2.69% to $118.14.

Although the price is still holding above the $115 level. The gold price saw a mini spike out of its consolidation as it jumped by 0.69% to USD 1957.41. The move can be somewhat attributed to the potential for new sanctions on Russia.

Natural Gas had another bumper day as it rose by 5.81%. The price extended break out as it closed at its three-month highs of $5.464. The USA may be forced to increase its exports to Europe to offset any disruption in supply from Russia.

Cryptocurrency Bitcoin performed solidly overnight. It is currently testing the highs of its recent range and as the BTC/USD approaches the $46,000 resistance level. The pair closed at $44,091, a 2.56% increase, at 22.36 GMT.

Ethereum has kept its strong week going with another 2.59% rise holding the $3118 at 22.42 GMT. The ETH/USD has seen a recent period of consolidation before overnight breaking above the trend line. The JPY continues to be smashed against most other currencies.

The USD/JPY rose by 0.97% to 122.324. The GBP/JPY also saw a huge move moving 0.88% to close at 161.330. The AUD/USD had a mixed day.

Initially, the currency pair sold down, however it recovered later to close at 0.7512. The EUR/USD has seen a settling of its price as Ukraine and Russian conflict has settled. The pair finished trading at 1.0998 USD.

Global indices were choppy overnight, mainly finishing lower on the back of failed peace talks and Russia continued advances in Ukraine. According to reports from the French government, the Russian president Vladimir Putin intends to take the country by any means and that “the worst is to come”. The reports sent the FTSE 100 down 2.57%.

The decline was further aided by the removal of Russian equities from the index. In addition, the DAX followed dropping 2.16%. In the USA the NASDAQ closed down 1.56% as the tech sector saw more selling.

The FANG stocks were all down continuing from what has been a volatile week. The Dow Jones and the SP500 performed a little better but were still up and down during the trading session. Overall, the S&P500 finished down 0.53% and the Dow Jones 0.29% respectively.

Money continues to flow into commodities as pressure is growing for Western countries to ban Russian oil and gas imports. Gold continues to provide strength in the volatile market holding $1936 USD per ounce. Oil touched $119 USD a barrel before tapering to $110.

Nickel was also a strong mover jumping 6% to $27,815 its highest level since April 2011. Wheat continued its rise another 5.46%. Palladium, another commodity in which Russia is a large producer, is also up 3.2% to $2,753.68 by 12.43 GMT.

Palladium is a crucial metal needed by Automakers for catalytic converters to curb emissions. Iron Ore showed some strength increasing by 5.5% to $153USD per tonne. In currencies, the BTC/USD pair lost momentum at $42,541 USD down 3% at 10.45 pm GMT.

Ethereum is also down 4.48% over the last 24 hours. The EUR/USD fell to fresh levels of 1.1032 its lowest level since May 2020. The markets remain volatile and very reactive to news coming out of Europe as the weekend approaches.

US indices had a bumper day of trading as the Federal Reserve increased interest rates by 25 basis points. The Reserve is also expected to raise rates to between 1.75% and 2.00% by the end of the year, with 7 increases expected till the end of 2022. The Federal Reserve made it clear that they are doing their utmost to fight inflation.

Jerome Powell also indicated that the economy shouldn't need to enter into a recession. Whilst the Federal Reserve lowered economic projections for 2022 and increased inflation most of this had already been priced in. The Nasdaq finished the very strong session up 3.77% as tech stocks rebounded after initially selling down on the Federal Reserve’s announcement.

It was supported by the Dow Jones and the S&P500 which were up 1.55% and 2.24% respectively. In Europe, the FTSE had a solid day rising 1.62% and the DAX performed very well increasing by 3.76%. The Chinese stock market both in Hong Kong and on the mainland was also roaring yesterday on the back of a commitment from China’s State Council to sure up and introduce policies to boost its economy.

The CSI 300 index gained 4.3% and the Hang Seng index jumped 9.1%, its largest jump since 2008. This may provide some confidence for the region. Commodities Commodity prices continue their retreat from their highs a few weeks ago.

Brent Crude Oil continues to hover below 100 USD finishing the day at 97.96 USD a drop of 0.74%. Gold was able to hold its support level at 1917 USD per ounce and bounced after initially dropping below 1,900 USD due to the interest rate announcement. Natural gas continues to tighten its price range and increased by 2.80% Cryptocurrency Bitcoin had a high volume buying day as buyers stepped up and the price of BTC/USD increased by 4.83% to 41,202 USD.

Bitcoin remains rangebound however the volume increase indicates attention may be returning. Similar results occurred for Ethereum with the ETH/USD increasing by 5.60% to 2,766 USD. FOREX The USD was weak against most other currencies following the Federal Reserve's announcement.

The AUD had a strong day backed by its commodities moving up 1.29% against the USD. The EUR/USD and GBP/USD both reacted positively to Federal Reserve’s announcement, with them moving up 0.71% and 0.81% respectively. Against the CHF the USD was able to hold up relatively well at the 0.9400 level.

The market will likely continue to react to the news from the Federal Reserve as the week draws to an end.

The US technology sector rose again last night and worked back the losses from the previous day of trading as the market came to grips with the Federal Reserve’s announcement surrounding interest. Tesla was a standout performer and has seen a huge rise in the last week rising more than 20% and rising 7.91% overnight. The Nasdaq moved up 1.95%.

The Dow Jones was slightly weaker as commodities had mixed results, although the index was still up by 0.74% and the S&P 500 finished the session up 1.13%. In Europe, banks and financial stocks helped power the FTSE to a solid day up 0.5% and the DAX ended up 1% with similar strength shown in the financial sector as they look to benefit from rising interest rates. Commodities Commodities saw relatively mixed results across the board.

Gold was down 0.75% to 1920.80 as it continues to consolidate after pulling back from the highs a fortnight ago. Brent Crude Oil fell back 1.59% to USD 114.48. The commodity took a breath after rising 17.89% in the preceding three days.

Natural gas has seen a breakout of its consolidation as it broke above $5.00. The spot price finished up 4.35% at $5.185. Natural Gas daily chart Cryptocurrency Bitcoin had another solid session with the BTC/USD pair at $42,650 at 10.31 pm GMT.

Bitcoin has continued its rally from the previous week which is up a combined total of 12.56%. Ethereum has performed even better with a 4.92 rise overnight and an 18.63% increase over the last two weeks. The price of ETH/USD is currently sitting just above $3000 at $3002.71 at 10.36 pm GMT.

FOREX The AUD/USD has continued its move up. The price has broken out of its channel and is approaching $0.75. The EUR/USD, after selling down early in the day, the price was able to recover and then finish the day up 0.12% at $1.1029 as it continues its rally from the lows of two weeks ago.

The USD/JPY is rocketing along as it approaches its long-term resistance at 125 JPY. Overnight the price broke through 120.00 JPY and closing at 120.092JPY, a 1.08% increase.

Andrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and beef producer and is recognised as the oldest continuously operating company in Australia. In recent week’s key investment figure, Twiggy Forrest through his investment company Tattering, has doubled its holding from 8.97% to 17.4% at a cost of approximately $122 million making it a substantial holder.

The old investing and trading adage is that you should always follow the big money, and, in this case, the big money could not be much bigger then Twiggy. Company Overview AAC operations consist of properties, feedlots, and farms on around 6.4 million hectares of land in QLD and the Northern Territory representing almost 1% of all land mass in Australia. The company then exports the beef to key markets globally.

The company currently has a market capitalisation of $1.28 Billion and a share price of $2.11 as of 3pm EST 5 July 2022. Recent Performance The company has seen very strong earnings in recent years as they have improved their margins and reduced their costs. In the 2022 year their sales and production volumes dropped off.

At the same time Asian and Australian volume were down 21% and 24% respectively which do lead to some concern. With over half of its product being sold in Asia, the Asia pacific region specifically is a pause for concern. However, with the price of Wagyu beef sales increasing by 20%, the company has been able to offset the volume drop off and see revenue remain steady.

Opportunities The company has been expanding globally and this has seen a high demand for its products internationally. With a 56% increase year on year and a 21% volume increase in sales the USA represents a market that is hungry for AAC and its beef. The leadership of AAC has shown an impressive ability to minimise costs in times of low profitability and ensure the company does not operate with negative cashflow.

According to DataM Intelligence Analysis (2021) The price of Wagu Beef is expected to compound 7% annual for the rest of the decade. These figures bode well for AAC. Management has shown itself to be particularly impressive in reducing costs and improving margins particularly during difficult years during Covid 19.

It was able to improve its operating margin by 43% from the prior year showing just how effective it can be. Weaknesses With growing inflationary pressures and a global theatre that has seen many disruptions to the supply chain, the potential increase or blowout of costs related to the logistical movement of good may be cause for concern. Particularly with much of its market overseas, the potential for supply chain pressures is great for AAC.

In addition, any further border closures, or economic sanctions may prove to be problematic for the company. Technical Analysis The company’s share price has seen a significant rise in recent weeks in its price and pure volume of buying. The chart shows a significant coiling of the price as the buying volume was building and the sellers were drying up.

The price has also broken through the multi decade high of $2.13 on significant volume. The $2.13 level had added importance as it was also the midpoint of the 20-year range. In recent days the market has retested the $2.10 level but a short/medium term technical target of $3.38 is not out of the question.

In the Long term a price target based on the fundamentals of the company, the increase in price of Beef, management’s history of effective financial management and the growth pathways in the USA and Asia may see the share price rise towards $4.50.