市场资讯及洞察

Expected earnings date: Thursday, 4 February 2026 (US, after market close) / ~8:00 am, Friday, 5 February 2026 (AEDT)

Alphabet’s earnings provide insight into global digital advertising demand, enterprise cloud spending, and broader technology-sector investment trends.

As Google Search and YouTube are widely used by both consumers and businesses, results are often used as one input when assessing online activity and corporate marketing budgets, alongside other indicators.

Key areas in focus

Search

Search advertising remains Alphabet’s largest revenue driver. Markets are likely to focus on ad growth rates, pricing metrics such as cost-per-click, and overall advertiser demand across sectors such as retail, travel, and small-to-medium businesses.

YouTube

YouTube contributes to both advertising and subscription revenue. Markets commonly monitor advertising momentum, engagement trends, and monetisation developments as indicators of digital media conditions and brand spending.

Google Cloud

Sustained Cloud profitability is often discussed as a factor that may influence longer-term earnings expectations, though outcomes remain uncertain. Markets are expected to focus on revenue growth, enterprise adoption trends, and operating margins.

Other bets

Initiatives such as autonomous driving and life sciences, while typically smaller contributors to revenue, markets may still watch spending levels and progress updates as indicators of capital allocation and cost discipline.

Cost and margin framework

Management has previously flagged elevated capex tied to AI infrastructure, including data centres, specialised chips, and computing capacity. Traffic acquisition costs, staffing levels, and infrastructure expansion are also key variables influencing profitability.

What happened last quarter

Alphabet’s most recent quarterly update highlighted advertising trends, Cloud profitability, and continued increases in capex to support AI initiatives.

Management commentary has indicated that infrastructure spending is intended to support long-term competitiveness, while the market continues to assess the near-term margin trade-offs.

Last earnings key highlights

For reported figures and segment detail from the most recent quarter, refer to Alphabet’s latest earnings release materials, including revenue, earnings per share (EPS), Services mix, Cloud operating income, and capex commentary.

- Revenue: US$102.35 billion

- EPS: US$2.87

- Operating income: US$31.23 billion

- Services revenue: US$87.05 billion

- Cloud revenue: US$15.16 billion

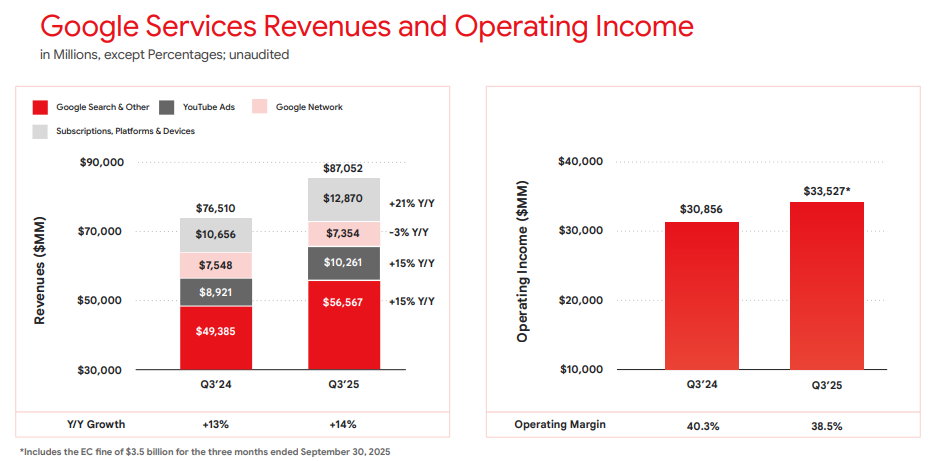

Google Services revenues and operating income Q3 2025 | Alphabet earnings release

What’s expected this quarter

Bloomberg consensus estimates moderate year-on-year (YoY) revenue growth and higher EPS versus the prior-year quarter, with ongoing focus on operating margins given AI-related investment.

Bloomberg consensus reference points:

- EPS: low-to-mid US$2 range

- Revenue: high US$80 billion to low US$90 billion range

- Capex: expected to remain elevated

*All above points observed as of 31 January 2026.

Market-implied expectations

Listed options implied an indicative expected move of around ±4% to ±6% over the relevant near-dated expiry window. Movements derived from option prices observed at 11:00 am AEDT, 2 February 2026.

These are market-implied estimates and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian market participants

Alphabet’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

After weeks of relentless selling the market provided a decent rally to end the week. The S&P 500 saw a nice jump rising 3.44% during Friday’s trading session. This may provide investors and traders some positive momentum for the beginning of the week.

Whilst the market is still holding a down trend, it was able to bounce of the bottom of the downward channel. Similar moves were seen on the NASDAQ and the Dow Jones as well as other global indices. In Australia, the ASX 200 was not quite as productive as the American indices in its Friday session.

The Aussie market may catch some of the gains from the Friday US session in the early part of the week. Inflationary pressures have eased somewhat with hard commodities such as Oil and Natural Gas have pulled back from their recent highs. This has also supported leading to money flowing back into growth markets.

Small Cap companies had an important day as the market rallied, lifting 3.31%. This marks the strongest day since July 2020 and some much-needed relief after a brutal sell off. As the end of the financial year approaches, tax selling should be expected on the market.

Furthermore, it is a time where funds and fixed weight portfolios rebalance their assets. Stocks in the spotlight Anteris Technologies, (AVR) The Bio/Medi Tech company saw great growth in its share price during the last week as it climbed more than 33%. The company announced a 6-month update of its first cohort of 5 patients using its DurAVR 3D Single piece aortic valve.

The results showed an 86% improvement in Haemodynamic/normal blood flows since the product was implanted into patients. The company’s share price rose to $28.30 its highest level since 2019 om the back of these results. With a relatively small float the share price can be quite volatile and have a high daily range.

BlueScope Steel (BSL) Blue Scope Steele has seen a large drop in its share price sitting just above its long-term support. The large Steele manufacturer has seen as the market reacts to an increase in costs for the manufacturing and construction sectors. The share price has been trending downward after peaking in August 2021.

Woolworths (WOW) Consumer staple Woolworth’s had a strong rally as its share price rose 7.26% to $35.46 after slipping to as low as $32.60 in the middle of June. The company’s share price has held up relatively well during the recent volatility as inflation and geopolitical pressure have seen much of the market slip.

The USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions imposed on Russia’s top oligarchs and government officials along with its central bank in a bid to push against Russia’s war on Ukraine. The market responded to the news with a volatile trading session.

In the USA the NASDAQ finished the day down 0.28% after it had made a 2.6% during the middle of the day. The Dow Jones finished the day in a similar way finishing down 0.56% and the S&P 500 down 0.72%. The European markets were flat with the FTSE down 0.067% and the DAX down 0.024%.

The VIX index also reached 37 and is at its highest level since the start of the pandemic. Commodities On the back of the oil imports ban from Russia, Brent Crude jumped 7.7% at $132.75 before settling to $123.21. As a reference in 2021, the USA imported 8% of if its total oil imports from Russia.

Other commodities such as Nickel and Palladium continued their runs as bearish investors closed their positions causing a short squeeze. Gold was able to push through the $2000 resistance and touched its all-time high of $2075. Gold will be one to watch as the US Federal Reserve is poised to release its CPI figures on Friday.

With record levels of volume being transacted through gold, it is worth keeping watch on. 4-hour gold chart below: Bitcoin had another relatively flat day rising by.64% in the BTC/USD pair. Ethereum performed better with ETH/USD rising 3.28% although it could not finish above the previous day’s highs. The USD/AUD pair continues its grind up moving 0.63% as it moves to test resistance.

The USD/EUR looks to be consolidating although it did finish the day down 0.39%. The USD/JPY climbed for the second straight day climbing 0.32% as it continues tightening its range.

The Swiss National Bank, (SNB) has surprised the market and raised interest rates by 0.5% to combat inflation. The SNB was one of the last central banks holding firm in its dovish stance, however with growing inflation felt now was the time to intervene and raised rates from -0.75% interest to -0.25%. It was the first interest rate rise since 2007 and followed rate increases from the US Federal Reserve earlier this week.

Pressure had been building on the Swiss after recent data showed a near 14-year high rate of inflation. Similarly, the European Central Bank signalled it will kick off rate hiked in July. SNB Governor, Thomas Jordan flagged the potential for more interest rate hikes outlining that the currency was not as strong as it once was.

This leaves The Bank of Japan as the only developed central bank who not adjusted interest rates. In response to the announcement the USD tumbled 3.1% against the CHF as it saw it largest drop in almost 7 years. The EUR also dropped 1.8% against the CHF which saw it largest since January 2015.

The yields on Swiss 10 year bonds rose 18 basis points and Swiss stocks dropped by 3%. The USDCHF The EURUSD

The Dow Jones closed flat after another volatile day. The Nasdaq and the S&P 500 finished 2.04% and 0.74% lower respectively, as tech continued its sell-off and the Nasdaq confirmed its Bear market. The European markets performed a little better as optimism that the worst of Ukraine and Russian conflict may have passed.

The FTSE moved up 0.53% and the DAX 2.21%. As the conflict settles, renewed sentiment may return. Brent crude oil dipped again by 5.5% to USD 106.53 as it continues its pullback from its recent highs.

Iron Ore was also 6.2% lower to $144.90 a tonne from the pressure from China and could impact the Australian market. Gold has continued its pullback from its recent highs falling to $1949. Natural gas prices fell across the world with the prospect of another round of talks between Russia and Ukraine, along with wilder weather conditions.

Cryptocurrency looks set to operate under increased regulations. A last-minute attempt by European lawmakers to potentially create a soft ban on Bitcoin failed overnight. The key amendment that would have banned Proof-of-Work distributed ledger technology that is responsible for a considerable amount of carbon emissions.

The parliamentary committee will now seek a compromise solution that will address the sustainability of crypto asset mining without discriminating against specific technologies by proposing to include them in the EU Taxonomy for Sustainable Finance. This rule book seeks to classify what kind of investments can be deemed to match Environmental, Social, and Governance (ESG) criteria. Bitcoin has continued to hold its support level around $37,500 – 38,000 and the BTC/USD is up 2.40% at 9.50 pm GMT.

Ethereum continues to consolidate into a tight range with the ETH/USD going 1.75% lower. FOREX The AUD/USD struggled to hold above $0.73 and fell 1.40% to 0.7204%. The USD/EUR continues to consolidate as it reacts to the Ukraine and Russian conflict.

All eyes are still on the Federal Reserve which is expected to raise rates by 25 basis points later this week. The commentary associated with the rates will hopefully give some indication about how hawkish they are and their plans going forward.

US and European equity markets remained volatile as fighting between Russian and Ukraine forces continued and negotiation talks failed to result in any progress. Both parties however have committed to another round of discussions. The VIX, Wall Street’s volatility measure surged 12% to 30 indicating the increased fear investors are feeling from the ongoing situation.

The Dow Jones and the S&P 500 both closed down 0.5% and 0.25% respectively, the Nasdaq finished up 0.4% as tech and growth stocks outperformed. In Europe, the FTSE finished down 0.4% and the DAX 0.7%. Not surprisingly, with SWIFT bans and other banking sanctions levied against Russia, the financial sector was the poorest performer overnight in the USA.

Brent Crude oil has ticked back over to $101.10USD as a consequence of the conflict and is still expected to rise further. An OPEC meeting is scheduled for tomorrow however there is no expectation of a significant change. Gold hasn’t seen much change and is still hovering around $1,908USD.

The price has remained stable after bouncing from its recent highs. The RBA is meeting today at 2.30 pm to discuss interest rates and their outlook of the Australian economy, however, no change is expected as they deal with the current sentiment relating to the Russia and Ukraine crisis. Inflation is still the key concern, though a mild Wage Price Index figure last week has given the RBA some room to continue the mostly dovish tone seen at recent meetings.

Above expected retail figures came out yesterday increasing 1.8% and beating most expectations. The USA federal reserve is also indicating that it may be more cautious in tackling inflation through interest rates although they are still expected to increase rates in March with a 25 bp rate rise fully priced in by the market. On the back of the retail figures and improving risk sentiment, the AUD/USD was up 1.46% from the session lows and could be one to watch for the day.

The EUR/JPY was down 1.3% indicating a move out of the Euro to safe haven currencies on the back of the continuing conflict. In cryptos, Bitcoin was a standout pushing up 11.18% to be trading at 41,933.30USD as of 9.00 pm GMT. This jump in price and increase in volume is likely due to many users in Russia moving to attentive payment as the Ruble continues to dive.

Global indices finished relatively flat compared to recent day's price action on the back of failed peace talks between Russia and Ukraine and the ECB decision to speed up the ceasing of stimulus support. All eyes were on the USA and their CPI figures which came in as expected with a rise of 0.8% for February and the 12-month figure increased by 7.9%. The Federal Reserve is still expected to increase interest rates by 25 basis points next week in a bid to stifle inflation.

The Nasdaq dropped 0.95% and Dow Jones performed a little better only falling 0.34%. The S&P 500 performed similarly registering a 0.43% drop. The European markets were a little weaker with the FTSE finishing the day down 1.27% and the DAX coming off worse with a 2.93% drop.

The European Central Bank met on Thursday to discuss the early easing of its economic stimulus effort to combat inflation. The bank announced its plans to make an early exit from its asset purchasing which surprised some analysts who expected no change. The bank indicated that it is currently more concerned with the rise in inflation than the potential fallout from the conflict.

They did, however, leave room for policy changes should things change. Oil again fell with Brent Crude oil fell to $109.49 a 1.5% drop. Gold found some support near $2000 as it continues attracting investors and traders alike.

Major commodities continue to be trading at elevated levels even with some tapering overnight. Bitcoin had a big fall overnight dropping back below USD 40,000 to $39,285 a 6.37% drop at 10.20 pm GMT. On Wednesday BTC had spiked on the back of an executive order from Joe Biden that would potentially expand the adoption of cryptocurrency assets.

However, the general sentiment between more risk on assets and inflationary fears has sparked the drop back below $40,000. The AUD/USD performed well and has continued its recent rise, moving 0.49%. The move has been on the back of Australia’s healthy commodity industry and its geographical distance from the conflict.

The NZD also rose against the USD holding its recent highs at 68 cents to $1.00. The AUD/EUR had another strong night rising 1.27%. The EUR showed weakness after the ECB’s policy shift and the lack of progression from the Russian and Ukraine peace talks and dropped 0.82% against the USD.