市场资讯及洞察

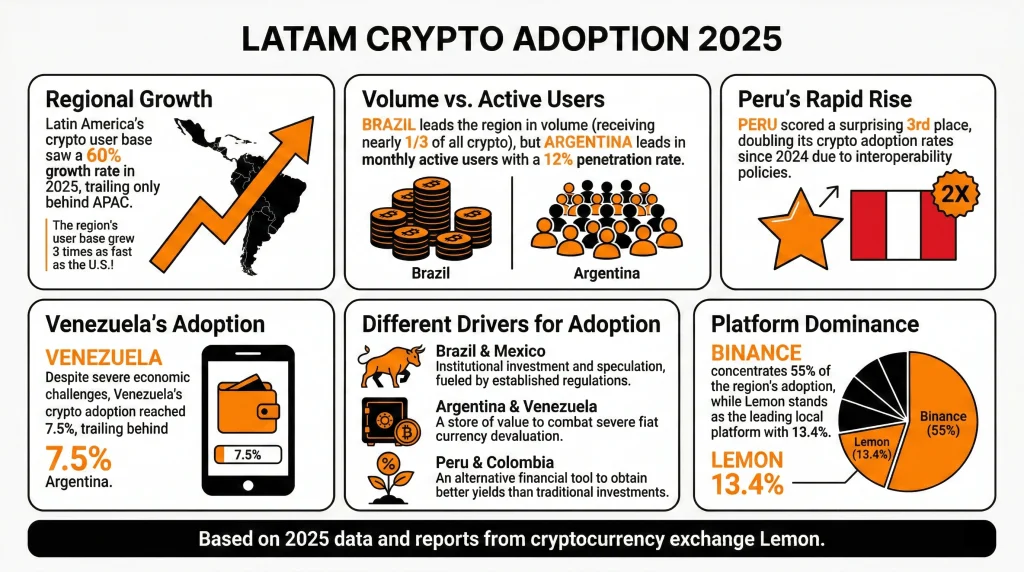

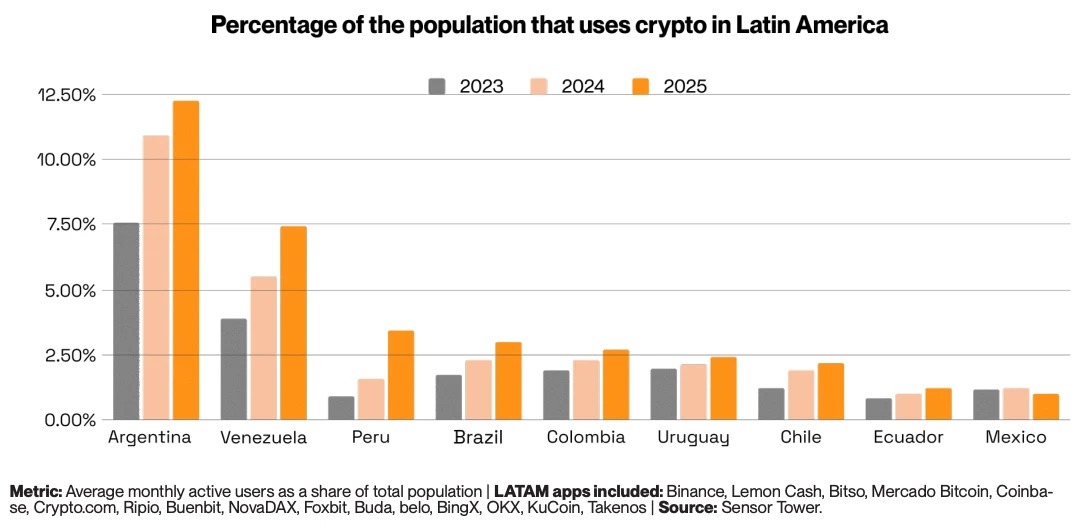

2025年,拉丁美洲(LATAM)的加密货币交易量超过7300亿美元,同比增长60%,这使该地区约占全球加密活动的10%。

2026年,机构参与者开始认真对待该地区,监管正在具体化,2025年以来的结构性驱动因素没有减弱的迹象。但是该地区不是一个单一的故事,2026年将考验当前的势头是建立在坚实的基本面还是投机乐观情绪之上。

事实速览

- 拉丁美洲每月活跃的加密用户同比增长18%,是美国的三倍。

- 阿根廷的月活跃用户渗透率达到12%,占该地区加密活动的四分之一以上。

- 现在,超过90%的巴西加密货币流量与稳定币有关。

- 三个拉美国家进入全球前20名:巴西(第5位)、委内瑞拉(第18位)、阿根廷(第20位)。

- 秘鲁的加密应用程序下载量在2025年增长了50%,下载量为290万次。

从生存工具到金融基础设施

由于投机,拉丁美洲没有接受加密货币。它之所以接受它,是因为传统的金融体系一再让普通百姓失望。在过去的15年中,该地区五个最大经济体的平均年通货膨胀率为13%,而同期美国的平均年通货膨胀率仅为2.3%。

在委内瑞拉,这一比例在一年内达到了65,000%。在阿根廷,这一比例在2024年超过了220%。对于数百万人来说,以当地货币持有储蓄是一种缓慢的自我毁灭行为。稳定币成为了自然的反应。与美元挂钩的数字资产提供了可靠的价值储存、无国界的转移性以及无需银行账户即可访问。

与西方不同,在西方,加密货币更多地被视为一种投机工具,而在拉丁美洲,它已成为一种必要的金融工具。但是,该地区的采用驱动因素并不完全统一。巴西和墨西哥是机构故事,受监管的市场参与和成熟的金融参与者的推动。

阿根廷和委内瑞拉仍然是保值游戏,加密货币是抵御法币崩盘的直接对冲工具。秘鲁和哥伦比亚是更追求收益的市场,加密货币提供的回报是传统储蓄账户无法比拟的。

拉美采用加密货币的速度有多快?

2025年,拉美的链上加密货币交易量同比增长了60%。自2022年年中以来,该地区的累计交易量已达到近1.5万亿美元,在2024年12月达到创纪录的单月877亿美元的峰值。

2025年,拉丁美洲的月活跃加密用户也增长了18%,是美国的三倍。

稳定币是推动这种采用的主要工具。在2025年收到的7,300亿美元中,有3,240亿美元是通过稳定币交易转移的,同比增长89%。在巴西,超过90%的加密货币流量与稳定币相关,而在阿根廷,稳定币占活动的60%以上。

展望未来,根据IMARC集团的数据,到2033年,拉丁美洲的加密货币市场预计将达到4426亿美元,从2025年起将以10.93%的复合年增长率增长。

对于交易者而言,采用速度与其说是头条新闻,不如说是推动采用速度的原因:该地区有6.5亿人以稳定币为基础,实时建设平行金融基础设施。

机构转向

在拉美的大部分加密历史中,采用率是自下而上的。没有银行账户或银行账户不足的零售用户通过本地交易所推动了交易量。现在,高端市场的这种情况正在发生变化。

2026年2月,全球领先交易所运营商德意志交易所集团旗下的Crypto Finance集团宣布向拉丁美洲扩张,目标是寻求机构级托管和交易基础设施的银行、资产管理公司和金融中介机构。

传统银行和金融科技公司纷纷效仿。Nubank现在奖励持有USDC的客户。巴西的B3交易所于2025年批准了世界上第一只现货XRP和SOL ETF,领先于美国。自2024年初以来,包括梅尔卡多比特币、NovaDAX和币安在内的中心化交易所共上市了200多个新的以巴西雷亚尔计价的交易对。

2025年3月,巴西金融科技公司Meliuz成为该国第一家推出比特币增持策略的上市公司,目前持有320比特币。

“拉丁美洲已经在全球范围内采用加密货币。市场现在需要的是机构级治理,这正是我们来到这里的原因,” ——加密金融集团首席执行官Stijn Vander Straeten

加密汇款用例

拉丁美洲每年从海外工人那里获得数千亿美元,这使汇款成为该地区最具体、最可衡量的加密用例之一。传统的转账服务平均每笔交易收取6.2%的费用。对于300美元的转账,大约相当于20美元的费用。

基于区块链的基础设施可以更广泛地降低费用。比特币使每转账100美元的成本约为3.12美元。而像XRP或以太坊第二层基础设施这样更便宜的替代方案可以将其降低到0.01美元以下。

对于向秘鲁汇款1,500美元的移民工人来说,仅从传统银行转账就能节省的费用超过秘鲁每周平均工资。

LATAM 的加密监管环境

最能决定LATAM是否发挥其2026年潜力的变量是加密监管。在这里,情况确实好坏参半。

巴西的《虚拟资产法》在该地区处于领先地位,该法涵盖资产隔离、VASP 许可、AML/KYC 要求和资本标准。它还实施了国内 VASP 转账旅行规则,该规则于 2026 年 2 月生效。但是,一些更具争议的提案,包括对跨境稳定币交易设定10万美元的上限以及禁止自托管钱包转账,仍在积极磋商中。

墨西哥的2018年金融科技法仍然是世界上最早正式承认虚拟资产的法规之一。智利的2023年金融科技法为交易所、钱包和稳定币发行人设立了许可证,正式承认数字资产为 “数字货币”。

玻利维亚于2024年6月批准了受监管的数字资产交易,撤销了长达十年的加密禁令。阿根廷于2025年引入了强制性交易所登记。尽管取消了比特币的法定货币地位,但萨尔瓦多仍在继续扩大代币化经济举措。

该地区的十个国家现在拥有某种正式的加密框架。但是对于交易者来说,监管分歧仍然是一种现实风险,鉴于巴西获得的拉美加密货币交易量占拉美所有加密货币交易量的近三分之一,任何重大的政策逆转都可能产生巨大的后果。

交易者应该注意什么

巴西的制度势头是最重要的结构性趋势。到2025年,巴西的链上交易量为3188亿美元,实际上是拉丁美洲市场。

巴西稳定币磋商的结果可能会产生很大的影响。限制在国内支付中使用外国稳定币将直接影响该地区主导市场中交易量最大的资产类别。

阿根廷是波动率的玩家。2025年,月活跃用户渗透率为12%,加密应用程序下载量为540万次,这表明零售参与度不断提高。

哥伦比亚是一个值得关注的预警市场。2025年比索贬值5.3%,财政危机的加深正在推动稳定币流入,其模式反映了阿根廷早年的发展轨迹。如果哥伦比亚的宏观形势进一步恶化,加密货币的采用可能会加速。

交易所集中风险也在起作用。币安加密货币交易所是超过50%的拉丁美洲加密用户的主要交易所。如果交易所面临任何监管行动、运营中断或竞争冲击,可能会对市场产生巨大的影响。

底线

拉丁美洲的加密市场进入了一个新阶段。导致该地区最初出现加密需求的结构性驱动因素尚未消失:通货膨胀、汇款、金融排斥和货币不稳定都仍在起作用。

所发生的变化是建立在它们之上的图层。机构基础设施、监管框架、企业资金的采用以及流入直到最近还基本自给自足的地区的全球交易所资本。

巴西在2025年将近-250%的交易量增长及其占拉美所有加密货币的近三分之一的地位是决定性的市场发展。其监管轨迹、稳定币政策决策和ETF渠道将有效地为该地区在2026年定下基调。

对于交易者而言,总体增长数据是真实的,但其背后的集中风险、监管不确定性以及国家层面的分歧也是真实的。

There is an apparent enthusiasm among traders nowadays to add indicators to charts that resemble modern art more than market analysis. RSI, MACD, moving averages, stochastic oscillators, Bollinger Bands, volume profiles, and so many more. While these tools do have their place in some strategies, many traders forget the fundamental truth: price is the source, everything else is a reaction.Learning to read price as a narrative, showing a sequence of events that reveals the intentions and psychology of both buyers and sellers, can offer the trader a level of understanding that no single or even multiple indicators can give.

Indicators Are the Supporting Act — Not the Main Show

Don’t take from the opening that I think for one moment that Indicators are inherently bad. They can be helpful when used correctly as a way to offer some confluence to what the current price may be suggesting.But by design, most indicators are lagging. They take price and/or volume data and apply mathematical formulas to summarise or smooth the past.Moving Averages tell you where the price has been over the period of the MA setting. RSI shows whether the recent move has been relatively strong, even if it doesn’t tell you why. MACD illustrates the relationship between two moving averages and whether it's changing, but not necessarily market intent.Indicators are descriptive, not predictive. They are great at confirming bias but may not produce desired outcomes when used as your primary decision-making tool.

Price Action is a Language

Every candlestick is a snapshot of a battle occurring between buyers and sellers over a fixed point in current time. The shape and size of each bar contain a message.A large bullish candle (close near the high) indicates strong buyer control during that bar.A long wick above the body shows attempted movement upward but failure to hold — in other words, a rejection at higher prices.A doji (small body, long wicks) suggests indecision — neither side in control.And of course, the reverse is the case for a bearish candle.These are not random. They reflect the psychology of where market participants are now and can imply a degree of confidence, hesitation, exhaustion, or even reversal pressure.

Key takeaway:

There could be merit in starting each trading session by scanning the last 5–10 candles on your timeframe and asking: Who was in control? Are they still in control? And is there evidence that this may continue or be changing on THIS candle?”These simple questions can dramatically shift your perspective from reaction to anticipation.

What is Market Structure?

While individual candles can show immediate intent, structure reveals progression.A trend is never a continued straight line; market structure is the pattern of swing highs and swing lows that form the underlying skeleton of a trend.An uptrend forms higher highs (HH) and higher lows (HL).A downtrend forms lower highs (LH) and lower lows (LL).A range is where highs and lows are roughly equal, showing balance between buyers and sellers.Structure tells you where traders are likely to place orders and whether a trend may continue.There may be stops placed below swing lows, creating potential support. There may be profit targets at prior highs, creating potential resistance.Breakout or breakdown movement may be triggered if there is a break of these structural key levels, e.g., a break of a previous swing high may suggest continuation.

Key takeaway:

Try to map out the most recent swing highs/lows on your chart. Ask the question: Are we building a structure to continue, or is there a potential pause point where the market may decide to shift direction? And how should this impact my decision to enter a trade or stay in an open trade?This framing, based on current market structure, helps you align with momentum rather than chase it.

Volume: The Emotion in the Story

While price tells you what is happening, volume gives a sense of how much conviction is behind it. Volume adds depth and credibility to the story of price. Although there are those who would be reluctant to use tick volume with Forex and CFD trading, there is still potential legitimacy in testing this in your trading. As it is leading, not lagging, volume with price (arguably) acts as an important market gauge. High volume on a breakout = genuine interest with evidence of market convictionLow volume breakout = potential trap. Lack of participation means the move may fail.Effort vs. Result = if price moves very little despite high volume, it suggests absorption — large opposing orders are sitting there.

Volume as a Visual Lie Detector?

Sometimes price action looks bullish, but volume says otherwise. For example, A bullish engulfing candle that forms with lower-than-average volume is often a false signal. A reversal candle that forms with a volume spike often suggests a strong shift in sentiment.To use this practically, consider a volume average line to highlight when it may be time to act (or time not to).

How to Practice Your Trading Story Creation

Through the key fundamental principles covered above, you can start training how to create a market story.

Daily Market Story Exercise:

- Strip off all indicators apart from volume!

- Look at the last 10–20 candles.

- Say out loud or write the story you see in front of you — e.g., “Price was rising but slowed near resistance. After a rejection candle, sellers stepped in with conviction as evidenced by the candle formation and volume. Now it’s testing the prior support zone…”

Do this each day, and you’ll build the ability to trade based on understanding of what market psychology is telling you rather than just guesswork.

When to Use Indicators — and When to Walk Away

As stated before, indicators aren't useless but can play an important part in confirming or disputing your market story. They work well when they confirm what price action already suggests, smooth out trends or help define zones, and help filter conditions (e.g., only trade long above 200 EMA).If you find yourself staring at indicator crossovers or waiting for an RSI line to tick over 30 without looking at price, you are reading the footnotes, not the full plot.Use indicators in the background, not the foreground of your decision-making.

Summary

Price is not just data, it’s market dialogue. It’s the collective voice of every trading participant in the market NOW. It demonstrates emotion, logic, and intention. When you learn to read the price like a story, you start anticipating rather than reacting. You reduce overtrading with a focus on price action that is compelling, not just suggestive. And arguably, your interaction with the market becomes clearer, simpler, and potentially far more powerful.

上周美股三大指数再度刷新历史高位,投资者情绪整体乐观,但市场的基本面支撑依然有限,数据表现与政策预期成为关键影响因素。近期多方观点认为,当前美国利率若能维持在1%-2%区间,或将有利于中短期经济运行,引发市场对于利率前景的更多猜测。备受关注的一项财政刺激法案正在推进过程中,尽管在部分立法程序中取得阶段性进展,但相关内容仍存在一定分歧。市场调查显示,该法案在部分群体中支持度较低,舆论对此有不少讨论。有观点指出,相关法案或将加大传统产业投入,并对债务结构产生一定影响,市场正在关注其对就业和财政的实际效果。同时,贸易谈判的不确定性也对市场构成扰动。多方沟通仍在持续推进中,而此前设定的90天关税宽限期临近尾声,投资者密切关注后续进展,特别是在欧美及亚洲多方的沟通节奏上。本周最重要的宏观数据来自即将公布的美国非农就业数据,市场预测新增就业人数或将继续放缓,失业率或有回升。如果数据进一步走弱,可能强化市场对于货币政策宽松预期的判断。板块方面,美股科技巨头普遍收涨,除个别权重股轻微调整外,整体走势强劲。芯片龙头继续领涨,市场对AI及新一代技术板块的关注度居高不下。稳定币相关概念股则出现波动,其中CRCL跌破$180,技术面关注反弹信号;比特币则一度突破108,000美元,维持强势区间运行。核能及原材料板块维持强势,受国际价格支撑,澳洲铀矿股今日或继续获得市场关注。黄金价格略有下行,避险情绪相对平稳;原油小幅回调,市场整体风险情绪尚可。汇市方面,美元指数延续偏弱走势,市场正等待更多实质性政策与经济信号。澳元兑美元维持在0.65上方,美元兑日元窄幅震荡,美元兑人民币保持在7.16附近水平。稳定币立法进展仍是后续市场观察重点,或将在年中迎来关键窗口。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师

昨晚美国一季度GDP意外下修,加上特朗普的“影子主席”提案影响,美元指数继续跌破98.00,创下2022年2月以来新低。这已是美元指数连续第4周运行在100关口下方,累计贬值幅度达4%。周四,特朗普放言将提前8个月提名下任美联储主席,意图打造“影子美联储”施压现任主席鲍威尔。白宫考虑最早9月宣布人选,提前了8-10个月,远超传统3-4个月交接期。这将创造近一年的“双头统治期”,候任主席可通过言论引导市场预期,形成对现任决策层的“影子压力”。这种安排直接挑战美联储的独立性根基。鲍威尔在国会听证时直言:“美联储的任务是确保美国经济状况良好,其他都是干扰”。当被问及独立性受威胁的后果,他警告:“失去价格稳定信誉将推高长期利率,重建信誉代价高昂”。市场热度较高的候选人名单包括:1. 沃什(Kevin Warsh):2006年2月到2011年4月曾任美联储理事,2024年11月特朗普考虑提名其担任财政部长。他曾协助时任美联储主席伯南克处理过08年金融危机,可以帮助投资者稳定对于市场的信心。货币政策方面,沃什重视美联储政策独立性,总体偏鹰派,可能与特朗普主张冲突。2. 贝森特(Scott Bessent):现任财政部部长,曾经的对冲基金经理,曾在索罗斯手下工作。非常认可特朗普“美国优先”主张,偏向于宽松货币政策,马斯特离场后,贝森特现在俨然已成为trump团队里的二号人物,特朗普眼中忠诚度是比较高的一位人选。但是作为曾经的基金经理,他把50亿的基金规模管理成了5亿,市场可能会质疑其专业性和经验度。3. 沃勒(Christopher Waller):现任美联储理事,特朗普第一任期内受到提任,货币政策态度比较灵活。沃勒近期表态支持7月降息,与特朗普诉求形成微妙呼应。如果他成为美联储主席,市场可能认为美联储政策得到一定的延续,不确定性较低。4. 鲍曼(Michelle Bowman):现任美联储理事,特朗普第一任期内受到提任。2025年3月12日,特朗普的顾问表示,鲍曼已确认接任下一任副主席,取代迈克尔,成为美联储的最高监管官员。GDP再次出现负值,美元可能面临新一轮抛压。2025年第一季度GDP环比年化萎缩0.5%,这是自2022年以来的最差季度表现。哈佛大学经济学教授萨默斯毫不留情地评价:“一个世纪以来,这可能是美国总统任期前一百天内经济表现最差的一次”,,显示经济动能正在全面减弱,当前10年期美债实际收益率已跌破1.8%萎缩的核心原因是进口激增与政府支出收缩,以及影子美联储催动交易。企业因恐慌性囤货导致进口暴增——货物进口量在1月至3月间飙升50.9%,贸易逆差扩大至1620亿美元。这种“透支式进口”不仅未能提振经济,反而挤压未来消费空间。技术破位也表明美元的下行通道。从技术图形观察,美元指数已形成清晰空头格局:周线三连阴击穿99.30颈线位,确认头肩顶形态,量度目标指向94区域;MACD指标呈现2023年11月以来最强看跌信号,日线RSI触及28.6超卖;关键支撑带98.20-98.50正接受考验,此处汇聚长期趋势线与斐波那契138.2%扩展位。中期来讲,欧洲央行放缓降息加上日本央行加息预期,可尝试做多欧元/日元交叉盘,而因铁矿石价格收到中国经济复苏疲软牵连,可尝试做空澳元/美元:“去美元化”正从概念变为现实。全球贸易中以美元计价比例降至46%(2015年为55%),各国央行黄金储备持续增加。美元作为避险资产的光环,正被“美国制造的不确定性”侵蚀。技术性反弹或许可期——美元净空头占比达历史峰值的92%,市场过度拥挤可能引发短期逆转。但若98关口确认失守,美元或将滑向更深贬值。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Christine Li | GO Markets 墨尔本中文部

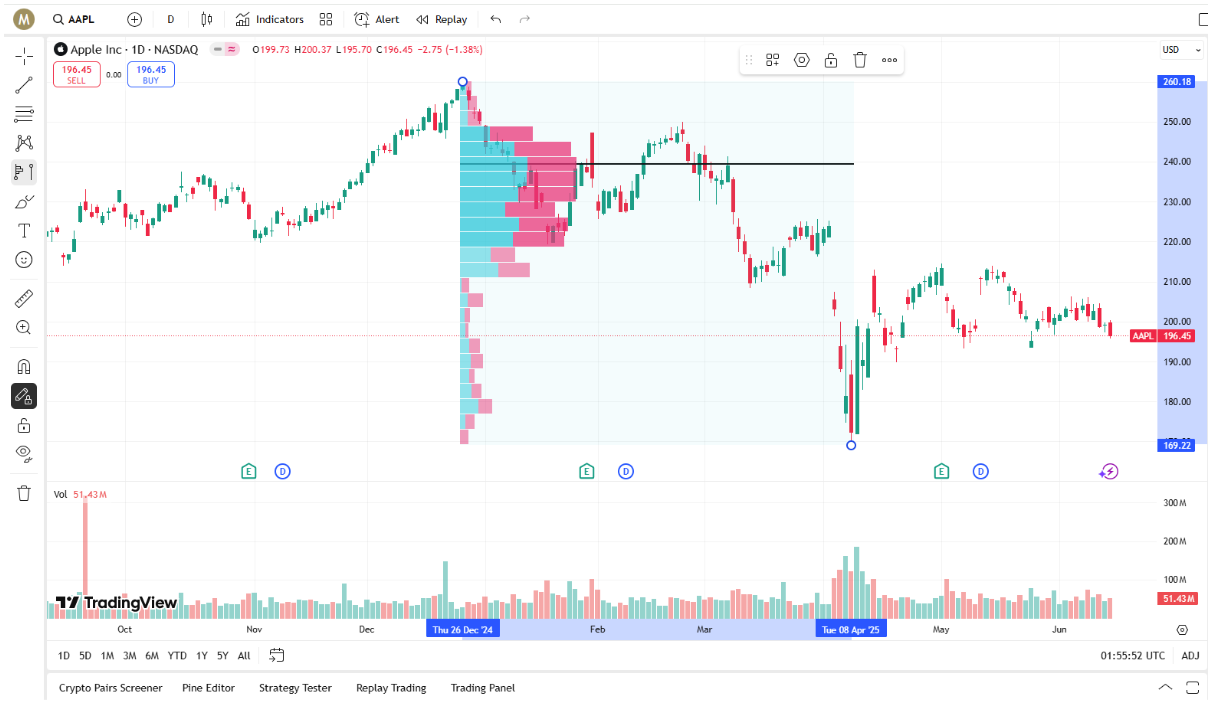

2002年,一位名叫陈浩的作者出版了《筹码分布》一书。该书以筹码研究为切入点,开创了技术分析的一个全新分支,书中的诸多观点在之后广为流传,并对市场分析方法产生了深远影响。如今,许多国内主流交易软件中都配有筹码分布功能,其概念正是源自这本书的核心内容。然而,各大软件中的筹码分布功能并不尽完善。它们背后的模型在时间维度上存在一定缺陷,无法精确追溯每笔成交对应的建仓时点,只能依赖时间推移进行自然衰减的估算。这种方式虽然简单直观,却容易导致偏差,尤其是在剧烈波动的市场环境中。基于这一局限,TradingView在原有理念基础上进行了改进。用户可以自定义时间区间或价格区间,系统将基于该区间内的实际成交数据生成成交量分布图谱。值得注意的是,TradingView所呈现的是成交量分布,而非直接定义的筹码分布。这种方式更为客观,给予用户更高的分析自由度,交易者可以根据成交量的堆积情况,结合自身判断推导出可能的筹码分布情况,而不是被动接受软件直接给出的、可能存在误差的结果。令人欣喜的是,GO Markets平台近期已正式接入 TradingView,用户现可在同一平台上实现行情分析与交易操作的一体化,大幅提升交易效率。只需注册我们的交易账户,并开通相应的TradingView使用权限,即可开始使用成交量分布这一强大功能。接下来,我们将为您演示这一功能的具体使用方法。首先,打开我们在TradingView中的图表窗口,并选择想要分析的标的,这里以苹果公司(Apple)的股票为例。在左侧工具栏中,可以找到一个名为 “Forecasting and Measurement Tools” 的图标。点击图标右侧的展开按钮后,会出现一组相关工具。

在其中的Volume Based分栏下,可以看到两个关键选项:Fixed Range Volume Profile和Anchored Volume Profile。这两个工具分别对应两种不同类型的成交量分布展示方式:Fixed Range Volume Profile:用于分析指定价格区间内的成交量分布。Anchored Volume Profile:用于分析自某一特定时间点以来的成交量分布。我们先来看一下Fixed Range Volume Profile的展示效果。点击该工具后,在图表中选择一个起点和终点,例如,如果我们想研究苹果股票在2024年4 月份从高点回落这段时间内的成交量分布,只需选中相应区间,即可生成分析结果,如下图所示:

可以看到,该工具清晰地展示了该时间区间内不同价格水平的成交量分布。与传统的下方成交量柱状图不同,这里是按价格维度来分布成交量,而非按时间。这种展示方式有助于我们识别出市场中多空力量的集中区域,即哪些价格区间吸引了大量交易,从而辅助判断潜在的支撑位和压力位。如果我们改用Anchored Volume Profile工具,则展示的是自选定时间点至今这一期间内的成交量分布,更适合用于趋势跟踪或关键事件后的交易结构分析。

总的来说,TradingView提供的成交量分布工具,为我们进行筹码分析和市场结构判断提供了更加直观和灵活的方式。无论是通过 Fixed Range Volume Profile 分析特定区间内的成交量堆积,还是借助 Anchored Volume Profile跟踪某一关键时点以来的交易情况,都能有效帮助我们识别主力建仓区域、判断支撑压力位,提升交易决策的准确性。相比传统交易软件中固化的筹码分布模型,TradingView更强调分析自主性。建议有一定交易经验的投资者深入学习并运用这一工具,为自己的技术分析体系增添一项强有力的辅助手段。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Michael Miao | GO Markets 悉尼中文部

1. Inflation Uncertainty

While recent data has shown core inflation moderating, core PCE is on track to average below target at just 1.6% annualised over the past three months.Federal Reserve Chair Jerome Powell made clear that concerns about future inflation, especially from tariffs, remain top of mind.“If you just look backwards at the data, that’s what you would say… but we have to be forward-looking,” Powell said. “We expect a meaningful amount of inflation to arrive in the coming months, and we have to take that into account.”While the economy remains strong enough to buy time, policymakers are closely monitoring how tariff-related costs evolve before shifting policy. Powell also stated that without these forward-looking risks, rates would likely already be closer to the neutral rate, which is a full 100 basis points from current levels.

2. The Unemployment Rate anchor

Powell repeatedly cited the 4.2% unemployment rate during the press conference, mentioning it six times as the primary reason for keeping rates in restrictive territory. At this level, employment is ahead of the neutral rate.“The U.S. economy is in solid shape… job creation is at a healthy level,” Powell added that real wages are rising and participation remains relatively strong. He did, however, acknowledge that uncertainty around tariffs remains a constraint on future employment intentions.If not for a decline in labour force participation in May, the unemployment rate would already be closer to 4.6%. Couple this with the continuing jobless claims ticking up and hiring rates subdued, risks are building around labour market softening.

3. Autumn Meetings are Live

While avoiding firm forward guidance, Powell hinted at a timeline:“It could come quickly. It could not come quickly… We feel like the right thing to do is to be where we are… and just learn more.”This suggests the Fed will remain on hold through the July meeting, using the summer to assess incoming data, particularly whether tariffs meaningfully push inflation higher. If those effects prove limited and unemployment begins to rise, the stage could be set for a rate cut in September.

The US has entered the Israel-Iran war. However, despite an initial 4 per cent surge on the open, oil has settled where it has been since the conflict began in early June — around US$72 to US$75 a barrel.Trump claims the attacks from the US on Iranian nuclear facilities over the weekend are a very short, very tactical, one-off. This is something his base can get behind — some really big conservative players do not want a long-contracted war that sucks the US into external disputes.Whether this will be the case or not is up for debate, but there is a precedent from Trump's first presidency that we can look to. Iran had attacked several American bases in 2019, as well as attacking Saudi Arabia's most important oil refinery with Iranian drones. There wasn't a huge amount of damage; it was more a symbolic movement and display of capabilities by Iran.Initially, Trump didn't react — it took pressure from Gulf allies like the UAE and Israel for him to respond, which saw him order the assassination of the head of the Iranian Defence Force, Qasem Soleimani. This led to an Iranian response of ‘lots of noise’ and ‘cage rattling’, but minimal real action events, just a few drone attacks. Trump is betting on the same reaction now.If Iran follows the same patterns from the previous engagement, the geopolitical side of this is already at its peak.As of now, Iran is not going after or destroying major Gulf energy capabilities. Nor have there been any disruptions to the shipping traffic through the Strait of Hormuz. In fact, apart from a posturing vote to block the Strait, Iran has not made any indication that it is going to disrupt oil in any way that would lead to price surges.Additionally, despite the U.S. military equipment buildup in the region being its highest since the Iraq war, critical Iranian energy infrastructure is running largely unscathed.This all suggests that the geopolitics and the physical and futures oil markets remain disconnected. Oil will spike on news rumours, but the actual impacts in the physical realm to this point remain low. Of course, this could change in future. But, for now, the risk of seeing oil move to US$100 a barrel is still a minority case rather than the majority.