市场资讯及洞察

周三的美国通货膨胀数据是本周的核心,但随着石油价格接近七个月高点,比特币(BTC)情绪发生变化,澳元处于三年高位,交易者在未来一周还有很多工作要做。

事实速览

- 美国通货膨胀率(二月)是降息定价和股票方向的关键二元事件。

- 布伦特原油交易价格约为82-84美元/桶,接近七个月高点,伊朗/霍尔木兹紧张局势引发的地缘政治风险溢价为4至10美元。

- 截至3月6日,比特币的交易价格已超过7万美元,如果本周保持不变,则可能出现趋势变化。

美国:通货膨胀是焦点

上个月的美国通胀数据显示,物价同比上涨2.4%,仍远高于美联储2%的目标。

将于周三公布的2月份通货膨胀率将受到审查,看是否有迹象表明关税转嫁或能源成本上涨正在推动价格回升,或者缓慢的下跌趋势是否仍然完好无损。

3月17日至18日的联邦公开市场委员会会议现在估计,削减的可能性仅为4.7%。本周的通胀数据高于预期,可能会进一步推高降息预期。

疲软的解读为新的削减定价和风险资产的潜在救济打开了大门。

重要日期

- 美国通货膨胀率(二月份CPI): 3 月 11 日星期三上午 12:30(澳大利亚东部夏令时间)

监视器

- 核心通货膨胀与总体通货膨胀的差异是商品价格关税转嫁的证据。

- 2年期和10年期美国国债收益率对印刷品的敏感度。

- 在3月18日联邦公开市场委员会做出决定之前,美元走势和联邦观察重新定价。

油:升高且对事件敏感

布伦特原油目前的交易价格约为每桶83-85美元,52周区间为58.40美元至85.12美元,反映了中东冲突引发的戏剧性走势。

分析师估计,石油的地缘政治风险溢价已经从1月份的62.02美元上调至每桶4至10美元,而2026年布伦特原油的平均预测已从1月份的62.02美元上调至63.85美元/桶。

环境影响评估的《短期能源展望》预测,2026年布伦特原油平均价格为58美元/桶,远低于目前的现货价格。

现货和预测基线之间的差距可能成为本周交易者的有用框架:来自中东的任何缓和局势信号都可能迅速缩小这一差距。

监视器

- 霍尔木兹海峡的事态发展以及伊朗核谈判发出的任何外交信号。

- 环境影响评估每周石油库存数据。

- 石油对通货膨胀预期的影响以及它是否改变了央行的态势。

- 能源板块股票相对于大盘的表现。

比特币:情绪观察

在地缘政治紧张局势升级和新的关税担忧的推动下,比特币在过去17周经历了53%的残酷回调,一直试图稳定下来。

然而,昨天上涨了8%,回升至72,000美元以上,加密货币 “恐惧与贪婪指数” 从持续一个多月的20(极度恐惧)下方跃升至29(恐惧),这表明市场情绪可能发生转变。

周三的美国通胀数据低于预期,可能会为突破提供进一步的推动力;热点报告有可能使比特币回落至其刚刚收复的7万美元水平以下。

监视器

- 周三的通货膨胀反应是此举的主要宏观催化剂。

- 在比特币走强之后,任何向山寨币的轮换。

- ETF流入/流出数据作为机构参与的确认。

澳元/美元:鹰派澳大利亚央行遇上地缘政治逆风

澳元的交易价格接近三年多的高点,并将连续第四个月上涨,今年迄今已上涨6%以上,使其成为2026年表现最好的G10货币。

驱动因素是明显的政策分歧。澳洲联储行长米歇尔·布洛克表示,3月的政策会议已经 “上线”,可能的加息,并警告说,伊朗紧张局势带来的油价冲击可能会重新点燃国内通货膨胀压力。

现在,市场定价表明,在即将举行的会议上加息25个基点的可能性约为28%,而在5月之前将全面收紧政策,到年底再次上涨至4.35%的可能性约为75%。

这种鹰派态度与美联储搁置不前并面临鸽派政治压力的对立面,为澳元带来了潜在的结构性利好。

监视器

- 澳元/美元对周三美国通胀数据的反应。

- 澳洲联储本周加息概率重新定价。

- 铁矿石和大宗商品价格是澳元的次要驱动力。

- 鉴于澳大利亚的出口风险,中国的需求信号。

Trading is a skill that requires continuous development, self-assessment, and refinement. For traders aiming to achieve consistent profitability and long-term success, following a structured process can make the difference between stagnation and mastery. In this article, we’ll explore a systemized five-step process for trading development, designed to help you identify gaps, take ownership of your growth, and implement effective strategies.

Additionally we will discuss not only why traders avoid this approach (including a checklist) and what YOU can expect if you follow through on some of the methods used Why This Approach Is Often Overlooked While the systemized approach to trading development is logical and proven, it remains unpopular among many traders. This is largely because it requires introspection, effort, and patience—qualities that often take a backseat to the allure of quick fixes. Many traders fall into the trap of chasing the "next big strategy" or the "magic bullet" that promises instant success without the need for sustained effort.

Reasons Why Traders Avoid This Approach: - Impatience: The desire for immediate results often overshadows the commitment required for gradual improvement. - Overconfidence: Many traders believe they can succeed without addressing fundamental gaps, relying solely on luck or intuition. - Fear of Failure: Self-assessment can be uncomfortable and may reveal mistakes or shortcomings that traders prefer to ignore. - Lack of Awareness: Some traders simply don’t recognise the value of a structured development process or don’t know how to start. - Shiny Object Syndrome: The constant search for new strategies and tools distracts from the need to refine existing skills and processes. - Time Constraints: Trading development requires time and effort, which may seem daunting when balancing other commitments. Checklist: Are You Avoiding This Process? - [ ] Do you often jump to new strategies without fully mastering your current one? - [ ] Do you avoid reviewing your past trades and learning from mistakes? - [ ] Are you more focused on finding a winning indicator or strategy than improving your discipline and execution? - [ ] Do you feel uncomfortable facing your trading weaknesses? - [ ] Have you neglected setting clear goals and benchmarks for your trading? - [ ] Do you feel you lack the time to dedicate to structured development? If you checked any of the above, it’s worth reconsidering your approach.

A systematic process may seem less exciting, but it’s the cornerstone of long-term success. Your FIVE steps to trading development We have identified FIVE key areas of work to help you take your trading to the next level. Within each we have identified actions and suggested potential resources to help in your development journey.

Step 1: Benchmarking Gap Analysis Objective: Evaluate where you currently stand versus where you need to be in three key domains: technical skills, risk management, and psychological discipline. Steps: Assess Your Current Performance: Analyse your trade history, win/loss ratio, average return per trade, and consistency over time. Identify patterns in your trading (e.g., frequent stop-outs, giving too much back to the market on profitable trades, over-leveraging).

Define Your Ideal State: Identify those situations where you shouldn’t trade eg, when unwell, or routines you can put in place that will help you focus as soon as you look at your first chart of the day eg, realign with your trading plan. Specify what consistent profitability looks like for you. This might include metrics such as a 3:1 reward-to-risk ratio, an 80% adherence to your trading plan, or minimising emotional trades.

Conduct a Comparative Analysis: Pinpoint gaps in your knowledge, execution, or mindset. Ask yourself tough questions: Are you trading with discipline? Are your strategies well-tested?

Do you have a proper risk management plan? How to Achieve It: Use tools like trade journaling software, analytics platforms, or even manual spreadsheets to document and evaluate performance. Consider seeking out mentorship or coaching to gain an external perspective on areas for improvement.

Be honest with yourself. Acknowledging and owning areas of weaknesses is the first step toward progress. Step 2: Identification and Prioritization of the Gap Objective: Isolate the most critical gaps and prioritize them based on their impact on your results.

Actions: Categorize Your Gaps: Knowledge Gaps: Lack of understanding of market conditions, indicators, or trading strategies. Execution Gaps: Poor timing, impulsive decisions, or failing to follow your plan. Psychological Gaps: Fear of loss, overconfidence, or inability to manage stress.

Rank Gaps by Priority: Focus on the gaps that directly affect profitability or pose the highest risk to your account. For example, improper risk management may take precedence over optimizing your charting skills. How to Achieve It: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) specific to your trading.

Use performance metrics to quantify the severity of each gap (e.g., how many trades are lost due to poor discipline?). Limit your focus to the top 2-3 gaps to avoid overwhelming yourself. Step 3: Ownership and Plan Clarity Objective: Develop a clear, actionable plan and commit to executing it with accountability.

Action: Create Specific Goals: Example: “Improve adherence to my trading plan from 80% to 90% over the next month.” Break Down the Plan: Define daily, weekly, and monthly tasks. For instance: Daily: Review and refine your watchlist. Weekly: Analyze trade outcomes and adjust strategies.

Monthly: Evaluate progress against set benchmarks. Identify Required Resources: Educational materials (books, courses, webinars). Tools (backtesting software, risk calculators, journaling platforms).

Support systems (accountability groups, mentors, or trading communities). How to Achieve It: Use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) to structure your plan. Establish accountability through regular check-ins with a trading partner or coach.

Create visual reminders (e.g., a whiteboard or app) to keep your plan front and centre. Step 4: Learning and Development in Real-Time Objective: Apply your learning to live or simulated markets to reinforce skills and refine strategies – then take LIVE action. Actions: Using a Demo Account for new approaches: Practice executing trades under realistic market conditions without risking real capital.

Setting up a “ghost account” alongside your LIVE account which can be used to test new strategies or see the impact of scaling before you do it in practice (so you get psychologically ready for those bigger profit and loss numbers) Have set criteria for when you will transition to live trading to reduce the chance of procrastination for taking your next step. Use a Trade Journal: Record every trade with details such as entry/exit points, rationale, outcome, and emotions. Analyse trends over time to uncover recurring mistakes or successful behaviours.

Embrace Feedback: Treat mistakes as learning opportunities. Ask, “What went wrong, and how can I fix it?” Review your trades weekly to identify progress and areas requiring further improvement. How to Achieve It: Simulate market conditions closely aligned with your trading style (e.g., day trading or swing trading).

Join forums or groups where traders share insights and feedback. Commit to a growth mindset: mistakes are inevitable but invaluable for learning. Step 5: Testing, Implementation, and Refinement Objective: Measure your progress, refine your strategies, and ensure a continuous cycle of improvement.

Steps: Test Against Key Metrics: Evaluate progress using your ‘results barometer’ (e.g., profitability, win rate, risk management adherence). Close the measurement circle: Make data-driven decisions to tweak your strategies or execution plans. For instance, if a strategy has a low win rate, analyse whether the issue lies in the strategy itself or its implementation.

Create a Feedback Loop: Revisit Steps 1-4 periodically to ensure continuous alignment with your goals. How to Achieve It: Set milestones (e.g., quarterly reviews of your trading results). Use A/B testing for strategies to compare performance under different conditions.

Celebrate small wins to maintain motivation. So If I Do These Five Stages, What Can I Expect in My Trading Performance? By committing to these five stages, you can logically expect a transformational shift in your trading.

Systematic development not only addresses gaps in your skills but also enhances your confidence and decision-making abilities. Here are the key benefits and reasons why this is the primary driver for action: 1. Improved Consistency: - Following a structured approach reduces impulsive and emotional trading decisions, helping you stick to your plan. - With refined strategies and clear benchmarks, your results will become more predictable over time. 2.

Enhanced Risk Management: - Identifying gaps in your approach allows you to minimise unnecessary risks and protect your capital more effectively. - A systematic process ensures that every trade is backed by sound risk-reward calculations. 3. Data-Driven Decision Making: - Regular review and analysis of your trades ensure that you’re making informed decisions based on evidence rather than guesswork. Commit the principle of “evidence based trading” to everything you do from here, 4.

Increased Confidence: - Knowing that you have addressed weaknesses and built a solid foundation instills greater confidence in your trades. - This confidence helps you remain calm and disciplined, even in volatile markets. 5. Continuous Growth: - The feedback loop ensures that you’re always learning and adapting to changing market conditions. - This adaptability is crucial for staying competitive in the long term. Ultimately, it is an unavoidable fact that the primary driver for taking action lies in the fact that trading success is not about finding shortcuts but about building sustainable habits and systems.

By embracing this process, you’ll not only give yourself a chance to improve your results but also develop the resilience and mindset required to thrive as a trader. Summary Trading is not a one-time skill but a lifelong journey of learning and adaptation. Through following this five-step systemized process, you can take greater control of your development, systematically address your weaknesses, and build on your strengths.

Success in trading doesn’t come from luck but from deliberate effort, discipline, and continuous refinement. Take the first step today, and remember: the best traders are always students of the market. And finally, we are here to help.

Our regular education sessions and videos are there to guide you, offering detailed explanation and clarity about many of the things covered in this article.

热门话题

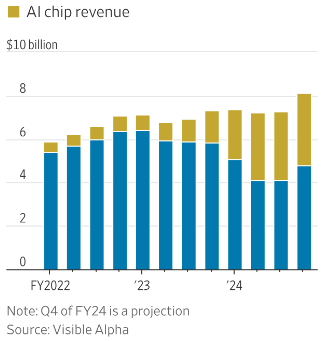

根据12月11日The Information报道,苹果将与博通(AVGO.NAS)将合作研发一款代号为Baltra的AI芯片,交由给台积电制造,预计2026年实现量产。目前各大互联网巨头在布局自研芯片以降低对英伟达等厂商的依赖,继谷歌和Meta之后,博通与苹果的新合作无疑给投资者打了强心针。当天,博通股价涨超6%,台积电股价也微涨1%左右。博通于今早美股盘后发布了Q4业绩报告,不出意料的让投资者满意。截至11月3日的Q4财报基本超预期,营收同比增长50%,Diluted EPS $1.42高于分析师预期的$1.38,AI业务收入暴涨220%,在此带动下,给出2025年业绩指引基本符合市场预期。盘后股价一度暴涨15%,扭转了盘中1.4%跌幅,我们期待今晚美股开盘后的表现。

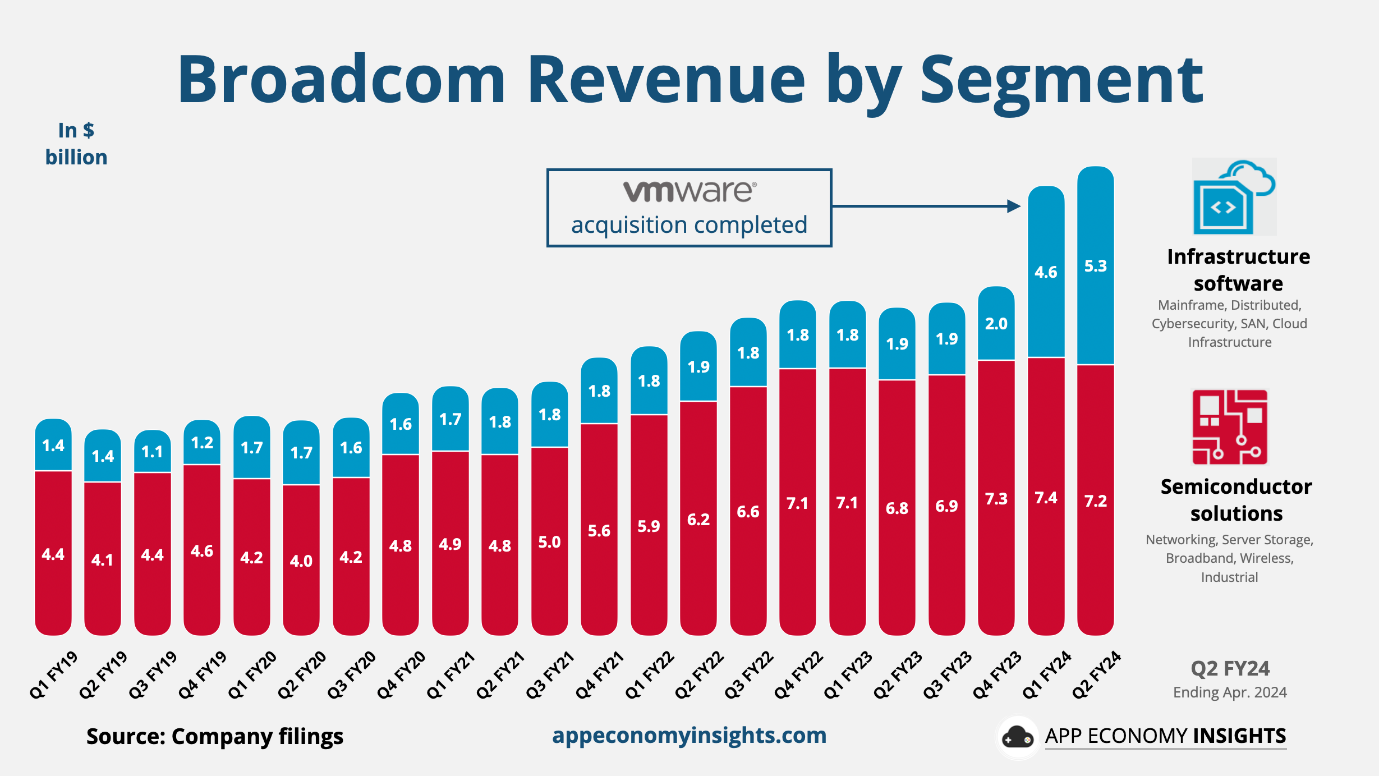

博通是一家以“并购-整合-再并购”策略著称的全球顶级半导体公司,今年以来股价上涨78%,近三年股价上涨426%,目前市值超8000亿美元。通过对博通的业务结构、主要增长点以及未来发展预期的分析,我们可以看出其在半导体和软件服务领域的稳健发展势头。业务板块方面,AI业务和VMware软件业务仍是主心骨。博通的半导体业务覆盖网络、存储连接、宽带、无线通讯等领域,整体板块的增长主要由AI业务引领,而非AI板块增速近两年有所下滑。借助ASIC(特定应用集成电路)技术,博通已经与谷歌和Meta等科技巨头建立了合作关系,其定制芯片已进入量产阶段,只要两家维持相当的资本开支力度增速,博通AI收入增长将有保障。目前,各投行预计2025年科技巨头AI资本支出增速将保持平均20%左右,博通AI的收入增长仍然有望实现20%+。

软件业务方面,博通于2023年完成对VMware的收购,通过外沿收购强化在虚拟化软件市场的领导地位。VMware是虚拟机市场的领军企业,全球用户数超过30万,全球财富TOP50企业超半数使用期服务,2021年VMware在非公有云虚拟化软件市场份额高达92%-97%。博通收购后采取了诸如收费模式转为SaaS订阅模式、精简经销商渠道等变相“涨价”措施。这些调整提高了VMware的收入能力,随着订阅收费模式的全面推广,有分析师预计VMware业务2025年收入将达到170亿美元,同比增长40%。

业绩展望方面,在AI业务和VMware整合的推动下,博通2025财年核心经营利润预计达到336亿美元,同比增长38%。到2026年,预计核心经营利润将达到401亿美元,同比增长19%。机构预计,2025年博通将完成消化收购VMware带来的利润摊销影响,使其2025年整体毛利率有望持续提高。同时,研发和销售费用率有望进一步降低,助力公司实现利润增长,华尔街分析师大多对博通表示继续看好,摩根大通预计EPS将在2025年增长28%达到$6.34,而收入将同比增长17%。当前公司前瞻估值约30倍,比竞争对手英伟达33倍略低。博通通过不断并购实现了“打怪升级”,没有的业务通通买回来整合,目前已成为可以与英伟达打擂台的半导体巨头。伴随着纳指终于在2024年尾声时20000点打卡成功,博通凭借其在核心领域的技术优势,有望在未来数年内保持增长势头并且为投资者带来稳定回报。未来,随着AI和云计算的持续扩展,博通的增长故事仍将延续。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Christine Li | GO Markets 墨尔本中文部

热门话题

近期如果关注全球货币市场的各位可以发现,全球范围内的货币政策逐渐走出了分化的趋势,尤其是美联储的降息步伐更是受到广泛的关注。尽管目前市场大部分的态度依旧是预测十二月份美联储会继续降息,但部分分析师和美联储官员依旧保持观望态度。所以我们今天就来讨论一下,在全球经济增长放缓的今天,美联储和各大经济体的货币政策都会对资本市场产生怎样的深远影响。自2024年中期以来,美联储试图通过多次降息来应对经济增长放缓。然而,随着就业市场逐渐稳健以及对通胀风险的担忧,美联储是否会放缓降息步伐成为市场关注的焦点。

近期数据表明,美国核心通胀率依然高于目标水平,并且华尔街高盛认为一旦特朗普的关税计划得以实施,PCE的核心通胀读数可能会提高近1%。所以尽管市场预计美联储可能在12月再次降息25个基点,但降息步伐放缓的可能性仍在升温。纽约联储主席威廉姆斯此前表示,美国经济为“软着陆”做好准备,支持逐步调整政策工具。但是美联储的政策调整并非孤立事件,全球主要经济体的货币政策路径都开始出现了明显分化:1. 欧洲央行的僵局欧元区通胀依然高企,迫使欧洲央行维持高利率以应对价格压力,但是经济增长疲软的局面又导致政策调整空间受限。从欧元汇率近期持续走弱的趋势可以反映出投资者对欧元区增长前景的担忧。2. 中国央行的宽松政策中国央行近期下调存款准备金率,进一步释放流动性以提振内需和稳住房地产市场。上证综指和港股恒生指数在过去一个月内分别上涨3%和5%,显示政策刺激对市场信心的提振。而人民币对美元汇率小幅下行到达7.29附近,表明市场对中国经济复苏的乐观。

而全球范围内货币政策分化不仅对全球金融市场带来深远影响,也为投资者提供了多元化的机遇:1. 大宗商品市场中国政策宽松带动大宗商品需求回升,铁矿石价格从11月初的115美元上涨至125美元。但美联储降息放缓可能对原油市场形成压力。布伦特原油价格在12月初下跌至每桶72美元,显示出市场对需求增长的谨慎态度。2. 股市表现美国市场:美联储降息放缓的预期对成长型科技股构成压力,但银行、保险等金融股可能受益于高利率环境。欧洲市场:防御性板块(如医疗和消费必需品)表现较强,而周期性板块(如工业和汽车)受到经济疲软的拖累。中国市场:政策刺激驱动消费与科技板块表现亮眼,白酒和新能源股吸引了更多资金。总而言之,目前全球货币政策分化为资本市场带来了新的机遇与挑战。从美联储到欧洲央行,从中国央行到新兴市场,货币政策路径的差异正在塑造未来的投资环境,在此之外,考虑到当前震荡的国际局面,例如亚洲地区的朝韩纠纷,又或者中东地区的动乱以及特朗普当选后中美关系的对立,对于投资者而言,紧跟各国政策调整的动态,并灵活应对市场波动,才是实现稳健收益的关键。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Yoyo Ma | GO Markets 墨尔本中文部

热门话题

2025年世界格局依旧充满较高的不确定性,尤其是特朗普上任后,经济与政治的走向可能难以预测。但比较确定是事情是,降息。在低利率时代,经济政治情况高度不确定的情况下,高股息股票一般会受到机构资金的青睐,因为高股息股票相对于固定收益产品更具吸引力。在贸易战或经济增长缓慢期间,高股息股票可能表现较好,因为它们通常来自于那些具有稳定现金流的成熟公司,能够在经济不确定时期提供收入稳定性。

哪些股票的派息比较稳定,同时又是在某种程度上处于相对垄断地位呢?首先是埃克森美孚公司(Exxon Mobil Corporation),股票代码XOM.NYSE,这个股票推荐的理由是, 根据埃克森美孚2024年发布的《全球展望》,预计到2050年,全球能源需求将增长15%。埃克森美孚正积极推进低碳技术,包括碳捕集与封存、氢能和生物燃料等领域,以应对全球能源转型的挑战。中东局势混乱,石油价格有可能进一步上涨。该公司平均每年分红派息超过5%,非常稳定。其次是Verizon Communications Inc,股票代码VZ.NYSE,(威瑞森通信公司)是美国领先的电信和宽带服务提供商,业务涵盖无线通信、固定宽带和数字媒体等领域。推荐理由很多,首先是不管大家买什么手机,通讯公司就那几家,手机公司很多,经常更新迭代,移动通讯公司就那几家,基本是垄断的。2024年12月,Verizon宣布季度股息为每股67.75美分,年化股息收益率约为6.37%。当然,未来可能面临来自行业内其他几个巨头的竞争。包括AT&T,季度股息为每股0.28美元,年化股息总额为1.12美元。以当前股价计算,股息收益率约为4.77%。AT&T计划在未来三年内通过股息和股票回购向股东返还超过400亿美元。公司预计到2027年自由现金流将超过180亿美元。所以电讯行业,旱涝保收,大家可以关注。

除了公众必备的石油和通讯,还有医疗板块,生病或者日用必备的,比如艾伯维公司(AbbVie Inc.),专注于免疫学、肿瘤学、神经科学等领域的创新疗法。艾伯维在帕金森病治疗领域取得积极进展,其第三项III期试验取得成功,计划于2025年寻求FDA批准。不同于创新类医疗公司,他给分红比较稳定,股息率平均为4%。同样,强生公司(Johnson & Johnson,股票代码:JNJ),大家超市看到的,家用的护肤品等等,很多都是强生集团的,股息收益率约为3.19%。辉瑞大家肯定都听过,打疫苗的时候用到的,辉瑞提供高达5.78%的股息率。

股息率最高的,也是非常稳定的一家公司,离不开这家公司的产品的人群非常稳定,就是烟草公司。奥驰亚集团(Altria Group Inc.,股票代码:MO)股息率约8.4%,股息增长记录 连续54年。在2023年,奥驰亚的净营收为244.8亿美元,支付的股息总额为68亿美元。如果大家想安全的和公司一起成长,这一类现金流稳定的半垄断公司,非常值得在2025年考虑。

免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题

只用了12天,叙利亚反对派武装就转正了。周日,叛军攻入叙利亚首都大马士革,前总统阿萨德及其家人逃至俄罗斯,这标志着阿萨德家族在叙利亚约 50 年的统治结束,也标志着传至第二代的家族王朝终结。也标志着俄罗斯、伊朗在中东地区的影响力进一步被削弱。拜登把地缘政治玩弄的很出色。通过俄乌战争,消耗了俄罗斯的实力,通过以色列,制约阿拉伯国家和叙利亚,并在卸任前夕,影响了叙利亚局势,拜登并表示:我们的做法改变了中东的力量平衡。以色列趁机继续派兵前往占领的叙利亚领土戈兰高地(1967年战略叙利亚领土),并趁机对叙利亚进行轰炸,占领更多领土。

据说叛军在推进的时候,车上有大量的钞票,愿意投降的政府军或者加入叛军阵营的,都可以获得现金奖励。而叙利亚平均一个月的人均收入只有1000人民币一个月。所以,对于饱受战乱的国家和人民,和平进行政府更迭就是众望所归的事情。逃往俄罗斯寻求庇护的前总统巴沙尔是何许人也呢?他是继任父亲留下的总统位置,因为当时全国选举只有他一个名字可以投票。巴沙尔曾经是学医的,在西方留学,太太是一位出生在英国的时尚现代女性。随着政治主导地位的牢固确立,巴沙尔将注意力转向了国民经济。他放宽了进出口管制,允许外国投资者和银行进入该国,并鼓励私营企业的新创业精神。但是,内忧外患的日子一直存在。尤其是他亲近伊朗和俄罗斯,反对美国的态度,让美国和以色列非常不安。2011年的“阿拉伯之春”如野火般席卷整个中东地区。叙利亚也处在民主和专政的思想风暴下。内战由此爆发。而叙利亚政府军的战斗力很堪忧,主要靠盟友支持。普京要求控制叙利亚地中海沿岸的海军和空军基地,以换取战斗机驻扎。伊朗和真主党提供军事顾问、军队和武器,以换取利用叙利亚领土袭击以色列。而随着俄乌战争拉垮了俄罗斯的军事和经济,巴以停火,反政府武装找准时机,迅速出击。该反政府组织最初与伊斯兰国有联系,后来又与基地组织有联系。而在对方战略首都后,发布了中俄双语声明,确保中俄在叙利亚的居民受到保护。很明显,叙利亚的反政府武装,已经做好了长期经营叙利亚的战略。

对美国来说,美国在叙利亚驻军占领着东北部库尔德人控制的石油钻探区。未来可能会趁机推进其民主理念,让新的叙利亚政府尽可能拥抱西方政治体。同时,未来石油价格可能会进一步攀升,尤其是特朗普上台后,中东地区的石油可能会被进一步管制或限制出口,进而刺激美国本土石油开采,利于美国的制造业企业和石油大亨。战争是最可怕的,也是最应该避免的。叙利亚已经有数百万人流离失所,急需各类物资和援助。国内战争结束之后,叙利亚还要面临以色列的虎视眈眈,能否收回本国领土,也会是一个难题。弱国无外交。无论是中国还是澳洲,至少国家主权是完整的,我们珍惜现在美好的生活。在投资领域,石油相应的资产可以关注。中东局势已经出现新的变化,未来地域战争依旧有升级的可能性。特朗普在1月份入驻白宫后,希望能够履行承诺,让世界多一点和平。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题

12月央行周来袭,携手美国最新CPI数据,以及PPI数据集体影响市场走向。上周五的非农数据十分稳健,降低了美联储对就业市场的压力,FedWatch给出12月超过80%的降息概率,基本令下周美联储降息25个基点板上钉钉,也能兑现鲍威尔此前说的今天降息100个点的前瞻。特朗普在接受采访时表示将继续让鲍威尔掌管美联储,并没有替换掉他的打算。本周澳联储利率决议预计继续保持原有利率不变,这也将使得澳大利亚今年无望实现首降,经济下行压力巨大,GDP增速已经不足1%,但澳大利亚CPI数据显示澳大利亚基本已经具备降息条件,今后若突然公布降息也不是意外,只是突然降息的话澳元或许会节节败退了。另外加拿大利率决议预计再降50个基点降利率上限压低至3.25%。瑞士央行利率决议预计再降25个基点调整利率至仅仅0.75%。欧元区存款利率预计下调25个基点至3%。美元指数成分国频频降息在下周美联储降息落地前将形成短暂的美元助推效果。另外国际局势方面依然未有明显好转。黎以停战形同虚设,叙利亚反政府军攻入大马士革推翻政权,令地缘政治风险加剧,也将推高黄金价格。乌克兰总理在同法国总统和未来美国总统特朗普会面后表示愿意开启对俄罗斯的停战谈判。[caption id="attachment_281699" align="alignnone" width="1364"]

周五美国非农数据公布后,纳指稳定上行,标普高开低走但依然收涨,道指小幅收跌,美股整体依旧强势,AI应用层热炒风头依旧,成为带动股指上行的关键。特斯拉再次涨超5%令股价接近$400,也即将兑现本人在特朗普当选后分析的股价短期冲上$400的预测。C3涨超8%终于回到$40美元平台,PLTR继续刷新高。本周甲骨文,Adobe和博通财报来袭,很有希望几句扩大AI应用层股票整体涨幅。预计2025年将会是AI应用股集体爆发的一年。[/caption]能源方面油价因欧佩克两面性政策持续被压低,核电板块分化加剧,国际铀价也再度逼近今年前低,美铀股表现不佳,但跌幅不大。美国核技术股大幅反弹,OKLO涨超9%,SMR和NNE都有明显回暖。特朗普交易继续发酵,特斯拉题材饱受追捧,SpaceX概念股DXYZ未来极度看好,周五股价收涨超过30%,并在盘后继续涨超8%。SpaceX完成首个直连手机卫星星座,并获得了五角大楼合同。比特币重回10万美元,Coinbase涨超7%,MSTR也有小幅上行。高盛,摩根大通以及富国银行等美国本土投行券商股继续稳定上涨。外汇方面澳元持续下行后有所反弹,澳美短期有望重回0.64,澳日跌破96大关,美日重回150平台。本周是央行周也是汇市行情大周,巨震在所难免。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师