市场资讯及洞察

周三的美国通货膨胀数据是本周的核心,但随着石油价格接近七个月高点,比特币(BTC)情绪发生变化,澳元处于三年高位,交易者在未来一周还有很多工作要做。

事实速览

- 美国通货膨胀率(二月)是降息定价和股票方向的关键二元事件。

- 布伦特原油交易价格约为82-84美元/桶,接近七个月高点,伊朗/霍尔木兹紧张局势引发的地缘政治风险溢价为4至10美元。

- 截至3月6日,比特币的交易价格已超过7万美元,如果本周保持不变,则可能出现趋势变化。

美国:通货膨胀是焦点

上个月的美国通胀数据显示,物价同比上涨2.4%,仍远高于美联储2%的目标。

将于周三公布的2月份通货膨胀率将受到审查,看是否有迹象表明关税转嫁或能源成本上涨正在推动价格回升,或者缓慢的下跌趋势是否仍然完好无损。

3月17日至18日的联邦公开市场委员会会议现在估计,削减的可能性仅为4.7%。本周的通胀数据高于预期,可能会进一步推高降息预期。

疲软的解读为新的削减定价和风险资产的潜在救济打开了大门。

重要日期

- 美国通货膨胀率(二月份CPI): 3 月 11 日星期三上午 12:30(澳大利亚东部夏令时间)

监视器

- 核心通货膨胀与总体通货膨胀的差异是商品价格关税转嫁的证据。

- 2年期和10年期美国国债收益率对印刷品的敏感度。

- 在3月18日联邦公开市场委员会做出决定之前,美元走势和联邦观察重新定价。

油:升高且对事件敏感

布伦特原油目前的交易价格约为每桶83-85美元,52周区间为58.40美元至85.12美元,反映了中东冲突引发的戏剧性走势。

分析师估计,石油的地缘政治风险溢价已经从1月份的62.02美元上调至每桶4至10美元,而2026年布伦特原油的平均预测已从1月份的62.02美元上调至63.85美元/桶。

环境影响评估的《短期能源展望》预测,2026年布伦特原油平均价格为58美元/桶,远低于目前的现货价格。

现货和预测基线之间的差距可能成为本周交易者的有用框架:来自中东的任何缓和局势信号都可能迅速缩小这一差距。

监视器

- 霍尔木兹海峡的事态发展以及伊朗核谈判发出的任何外交信号。

- 环境影响评估每周石油库存数据。

- 石油对通货膨胀预期的影响以及它是否改变了央行的态势。

- 能源板块股票相对于大盘的表现。

比特币:情绪观察

在地缘政治紧张局势升级和新的关税担忧的推动下,比特币在过去17周经历了53%的残酷回调,一直试图稳定下来。

然而,昨天上涨了8%,回升至72,000美元以上,加密货币 “恐惧与贪婪指数” 从持续一个多月的20(极度恐惧)下方跃升至29(恐惧),这表明市场情绪可能发生转变。

周三的美国通胀数据低于预期,可能会为突破提供进一步的推动力;热点报告有可能使比特币回落至其刚刚收复的7万美元水平以下。

监视器

- 周三的通货膨胀反应是此举的主要宏观催化剂。

- 在比特币走强之后,任何向山寨币的轮换。

- ETF流入/流出数据作为机构参与的确认。

澳元/美元:鹰派澳大利亚央行遇上地缘政治逆风

澳元的交易价格接近三年多的高点,并将连续第四个月上涨,今年迄今已上涨6%以上,使其成为2026年表现最好的G10货币。

驱动因素是明显的政策分歧。澳洲联储行长米歇尔·布洛克表示,3月的政策会议已经 “上线”,可能的加息,并警告说,伊朗紧张局势带来的油价冲击可能会重新点燃国内通货膨胀压力。

现在,市场定价表明,在即将举行的会议上加息25个基点的可能性约为28%,而在5月之前将全面收紧政策,到年底再次上涨至4.35%的可能性约为75%。

这种鹰派态度与美联储搁置不前并面临鸽派政治压力的对立面,为澳元带来了潜在的结构性利好。

监视器

- 澳元/美元对周三美国通胀数据的反应。

- 澳洲联储本周加息概率重新定价。

- 铁矿石和大宗商品价格是澳元的次要驱动力。

- 鉴于澳大利亚的出口风险,中国的需求信号。

热门话题

就在刚刚,地球上最重要的公司英伟达(NVDA.NAS)最新2025财年Q2财报已出炉,业绩超预期,股价却狂跌。股价表现上,周三美股盘前英伟达涨超1.4%最高$129.1后回落$128.5附近。开盘后收跌超2%报$125.61,美股七姐妹也受影响全部下跌,其中特斯拉、亚马逊、Alphabet(谷歌)跌幅超过1%。周四早盘后业绩公布超预期,但是盘后股价一路下跌,跌幅一度超过8%,盘后报$117,严重拖累AI板块和纳指,下面我们结合最新财报分析下。

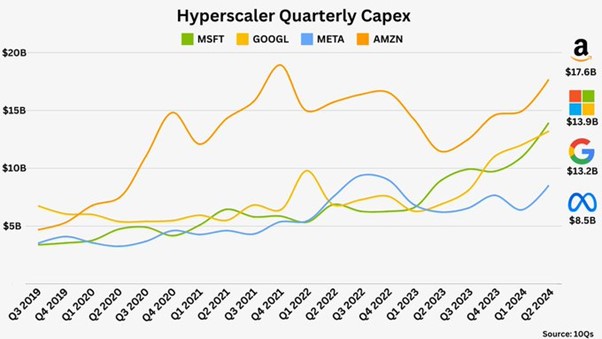

英伟达2025财年Q2业绩:- 总收入:市场预期286.7亿美元,实际304亿美元,同比增长125%;但是2025财年Q3营收指引为325亿美元(+/-2%),增速放缓至80%- 净利润:实际166亿美元,同比增长168%- 毛利率:市场预期调整后75.7%,GAAP调整后毛利率75.1%,非GAAP调整毛利率75%,受Blackwell低产出影响相比第一季度有下滑,当前此数值仍位居7巨头第一位,但是电话会议中暗示70%可能是2025财年中位水平。英伟达给出的Q3指引GAAP调整后毛利润74.4%,非GAAP调整后毛利润75%(+/-0.5%)。- EPS:市场预期非GAAP口径下调整后每股收益$0.64,实际$0.68,同比增长152%业务板块细分方面,数据中心市场预期$250.23,实际263亿美元,同比增长154%;游戏业务营收28.8亿美元,同比增长16%;专业可视化:4.54亿美元,同比增长20%;汽车和自动化业务营收3.46亿美元,同比增长37%。电话会议中提到Blackwell芯片预计四季度实现量产,也就是明年才能看到盈利兑现,尽管会议中黄仁勋多次表示未来对于Hopper芯片和生成式AI需求非常强劲,但是由于大家对公司期望太高和太急切,资本支出和ROI的推迟兑现已经迅速反映在股票波动上。从一季度英伟达的主要客户微软、谷歌、Meta和亚马逊等资本支出来看,后续指引大几率可以兑现,大家不用过于恐慌。

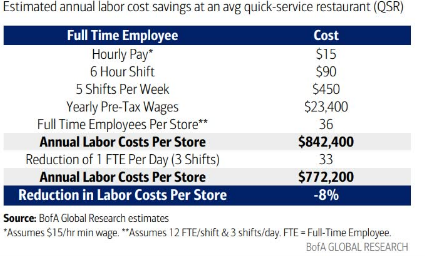

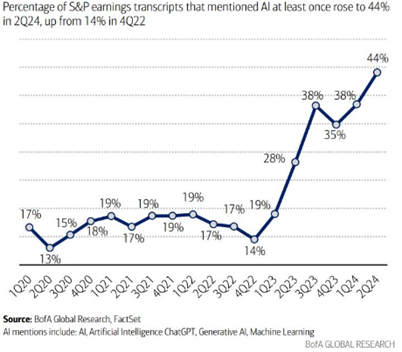

投资者经常高估短期内技术的颠覆性影响,但低估长期影响。美银报告指出,未来几年AI的资本支出可能达到1万亿美元以上,但是对标互联网发展历程我们才刚刚进入1996年。我们都知道AI开发和企业应用推广需要时间,一款芯片通常会在经历过多次流片、寻找工艺缺陷并改进之后才能送入流水线中进行批量生产,甚至调整的过程到此也依旧不会停止,它将会伴随芯片的几乎整个生产周期,预计成本节约和创收潜力将逐渐显现。以快餐店为例,平均工资15美元/小时的全职员工给快餐店带来的全年人力成本达到84万元,仅仅减少1个全职员工将直接节约8%的开支。而标普500中的公司,不论大小,只要2024年Q2业绩陈述/报告中与AI带点关系的公司股价平均至少一次涨近44%。

长期来说,是否交易英伟达取决于投资者对其股性的定位,即周期股还是非周期股,软件相比硬件受周期性影响较小。英伟达GPU受半导体周期性影响非常大,而其软件收入主要来自于与GPU捆绑的软件,以及专业视觉化NVIDIA Omniverse,vWS等,以及数据中心软件产品NVIDIA AI Enterprise,这部分直接收入占比还不够高,所以总体来说英伟达周期性属性还是比较明显的。短期来说,对于风险偏好较低的投资者来说,建议及时止盈获利规避美联储降息窗口带来的不确定性。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:

Christine Li | GO Markets 墨尔本中文部

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pattern is that stocks in long term up trends will pause and consolidate as some holders exit their positions and the stock is accumulated again by buyers in the market. The chart pattern can provide opportunities for powerful break outs and can be used across any time frame.

This allows traders to jump in on potential moves before they explode. Mechanics of the pattern The background of the pattern is relatively simple. The stock has been previously rising in an uptrend and has found some resistance.

It then moves into a period of consolidation categorised by 2-6 retracements with each one being smaller than the previous one. The volume should usually be decreasing as the chart moves to the right. The pattern culminates in a powerful break out that can often be long lasting.

The key for this pattern is that there needs to be a contraction of volatility as the chart moves from the left to the right. This highlights that the volume available is decreasing and becoming scarce. In addition, the more dramatic in volume, the more likely that the move will be explosive.

Below the breakout is accompanied by an increase in the relative volume. In the chart below for Natural Gas, the decrease in volume can be associated with the contracting candlestick pattern. This occurs prior to the break of the long-term resistance.

The breakthrough was also associated with a large amount of buying volume. The VCP can manifest itself in other patterns such as a cup and handle patterns. The key is that the candlesticks must be decreasing volatility.

A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to surpass. Resistance levels are often used in conjunction with support levels, or the point at which traders are unwilling to let an asset's price drop much lower. To understand this fully, it’s important to understand how support and resistance works in general.

A support line is when a price hits a low point (on the selling side) and resistance is when the price hits a high (on the buying side). If the prices rebound back to this price or continue to hit this price without surpassing it, it then starts to become a key resistance or support level. As a rule of thumb when using technical analysis, these tools become very important for some traders.

This is due to those points offering various outcomes. Whether they are a Bounce or a Break, essentially meaning, does the price hit the support/resistance and comes back (Bounce) or does it go through the support/resistance lines (Breaks). It is important to also use other indicators to accompany your technical analysis, as these movements could also easily become reversals or break outs, meaning, instead of them following your prognosis the price does the opposite.

When a price has been rejected various times, it builds an even stronger key resistance. Trading volume and sentiment can help to propel a price past this point and some of the biggest movements come after a price breaks a key resistance. Using a current trend (Fig 1) and a hypothetical trend (Fig 2), let’s take the daily timeframe for BTCUSD as an example (below).

The daily candle has broken through a key resistance of $41,000 as shown on figure 1. If a trader identifies this, they can do one of two things; trade it aggressively and place a trade as it breaks through or trade it conservatively and wait for the former resistance line to become the new support line before placing a trade (so wait for the price to bounce off as outlined on the drawn projection and circled on figure 2). Figure 1.

Figure 2. This technical analysis can be used for any asset you wish to trade: it’s transferrable and key in identifying entry or exit points of trades. By learning to spot the patterns and combining this with knowledge of trading volume and sentiment, you can start to understand the markets better.

Sources: Babypips, Investopedia, @sell9000 Twitter.

热门话题

澳洲限制留学生数量了?为什么?首先,留学生澳洲的一个产业,有多重要呢。国际教育是澳大利亚第四大出口产业!2019年,留学生们为澳洲经济贡献了近376亿澳元,平均每个留学生日常花费每年超过2.1万澳币。而且,这个产业还直接或间接支持了 250,000个工作岗位——无论是教育、住宿,还是餐饮和零售行业,都因为留学生的存在而蓬勃发展。截至2020年,澳大利亚共有超过760,000名 国际学生,遍布各类教育机构,包括高等教育、职业教育与培训(VET)、英语语言课程(ELICOS)(每年大概15万学生创收20亿澳元)、学校教育等。截至2020年,澳大利亚共有超过 760,000名 国际学生,遍布各类教育机构。中国、印度、尼泊尔、越南和马来西亚是留学生的主要来源地。不同国家的学生汇聚于此,不仅促进了文化交流,还为澳洲带来了多元化的社会氛围。澳洲的高等教育在全球享有盛誉。比如,2021年QS世界大学排名中,澳洲有7所大学进入全球前100。留学生们为这些世界一流学府支付的学费,总额超过了85亿澳元。这样的收入,不仅支撑了大学的运行,也为他们提供了更多教育资源。2020年,超过46,000名国际毕业生通过485类毕业生临时签证留在澳洲工作,积累了宝贵的经验。而且,约20%的国际学生在毕业后获得了永久居留权,为澳洲劳动力市场注入了新鲜血液。

虽然,但是。嗯,虽然教育产业很重要,但是从明年起,在澳大利亚大学和职业培训机构开始学习的国际学生数量将受到限制。根据澳洲政府提出的行业改革方案,留学生数量每年上限为 270,000,且每个机构将分别设定限制。教育部长Jason Clare表示,到 2025 年,公立大学的新生人数将限制在145,000人左右,职业院校的新生人数将限制在95,000人左右。过去每年留学生人数如下:2018年,约 288,300 名新国际学生进入澳大利亚各级教育机构。2019年约 300,000 名新国际学生。所以,目前的数据肯定是要下降的。另外,中国留学生占总国际学生的 38%,印度学生占 16%。

为什么限制留学生数量呢?教育部表示:“如今,我们大学的国际学生人数比疫情前增加了约10%,私立职业培训机构的国际学生人数增加了约50%。”最关键的是,“学生们回来了,但骗子也回来了——人们想利用这个行业赚快钱。”很经典的一句话,叫做“中国人不骗中国人”,但是在海外,其实很多刚来的学生,经常因为信息不对称的原因,受到各类损失,而目前有了新媒体和社交媒体之后,这类信息不对称导致的损失被弥补了。但是,骗子或不真诚的人,也会玩转这些新工具,并且根据数据,私立的VET和野鸡学校国际学生增加50%,不乏混迹其中黑在澳洲混签证的情况,对后来的学生或移民造成了很多困扰。所以,限制人数的最关键几点:1. 完善教学系统,主要限制的是因为VET类型或私立学校,也就是野鸡学校太过猖獗,尤其是涉及到学生签和学生最终的教育问题。2. 提升国际留学生门槛,也就相当于提升进入澳洲的留学生综合素质。很多学生不讲英文,或没有为澳洲本土社区做积极地贡献,也并没有促进多元文化交流。3. 政府宣布将限制国际学生人数,作为一项关键机制,将净移民人数从2023年的 520,000人减半至24-25年的260,000人。国际学生已经成为工党削减移民计划的核心。4. 降低因为过多留学生导致的房租市场失衡,劳动市场等各类问题。

对于资本市场的影响,主要在:教育板块直接冲击: 教育行业的上市公司,如提供国际教育服务的大学和教育集团,可能会受到直接冲击。例如,像 IDP Education(ASX: IEL)这样的公司,依赖国际学生招生作为主要收入来源。新生人数上限可能导致这些公司的收入增长放缓,进而影响其股价表现。市场情绪: 市场对教育板块的信心可能会受到影响,因为投资者可能担心这一政策的长期影响,尤其是对于那些严重依赖国际学生收入的教育机构。

房地产市场租赁市场租房需求的下降: 国际学生是澳大利亚租赁市场的重要群体,尤其是在大学校园附近和市中心区域。新生人数的减少可能导致租房需求的下降,特别是对于那些专门针对学生市场的物业。租金价格可能因此受到压制,投资回报率也可能下降。学生公寓市场的压力: 依赖国际学生的学生公寓市场可能面临更大的压力。投资这些物业的房地产信托基金(REITs),如 Vocus Student Living 等,可能会受到直接影响。房地产开发开发项目放缓: 对于正在规划或建设中的学生公寓或与国际学生相关的房地产开发项目,这一政策可能导致开发商重新评估市场需求,并可能推迟或取消部分项目。这将影响房地产开发公司如 Lendlease(ASX: LLC)等的业务增长。Crown Resorts (ASX: CWN): 虽然主要业务是赌场,但Crown的高端住宿和服务对国际学生市场也有一定依赖,特别是在主要城市。国际学生人数的减少可能间接影响该公司部分业务的收入。当然,整体的影响还是有限的,因为留学生限制人数的实际数量,并不是从30万掉到了15万,而是少了10%,相当于比疫情后最夸张的2023年数据少了10%,达到一个平衡状态,我认为这个数字是很合理的,也符合目前澳洲整体的经济和教育结构。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:

Jacky Wang | GO Markets 亚洲投研部主管

热门话题

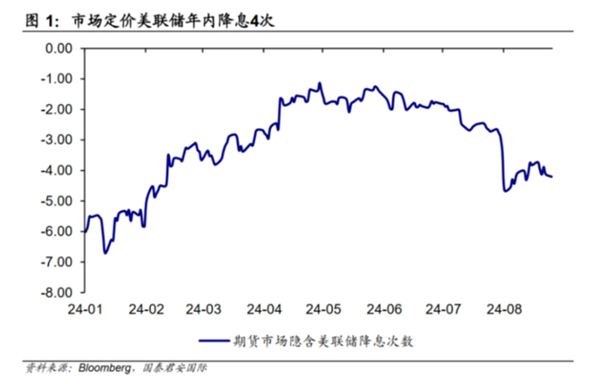

最近几天,熟悉股市和金融市场的朋友们应该都已经收到了风声:美联储在上周结束的全球央行行长聚集的Jackson hole会议上发表了观点明确,几乎属于大白话的讲话。大概说到了以下几点:首先,美国劳动力市场失业率在增加,但是劳动参与度也在增加;第二,稳定通胀预期仍然是美联储的重中之重;第三,美联储的工作重点仍然是实现经济的软着陆。如果我给大家归纳一下,鲍威尔主席的意思就是:我们要准备降息了,但是我们除了降息,还要兼顾好继续控制物价,同时还要刺激经济。而我们知道,要控制物价,就不能降息,或不能轻易降息。但是不降息,经济就得不到刺激。所以,现在鱼与熊掌要兼得,这样的情况下,市场还预计美联储今年要降息100个基点,我个人认为是不是有点逻辑不通了。

但是一直以来,市场或专家的预测都会不断改变的。在24年初,当时市场预计的时美国将会在年内降息6-7次,但是到了5,6月份,这个预期就变成了1-2次。然后又增加到现在预计的4次。可真的是随便说说而已。就是苦了很多散户,把这些专家的话当成了一定会发生的事。但是不论美国今年是要降息3次还是4次。至少有一点大家基本确定的是:基本上,肯定要至少开始降息了。所以我们可以看到,因为美国降息的预期不断在提高,而澳元又因为澳联储明确说短期不会降息,导致了澳元从7月到现在对比美元的汇率价格上涨了最多达到270个基点,大约4%的范围。

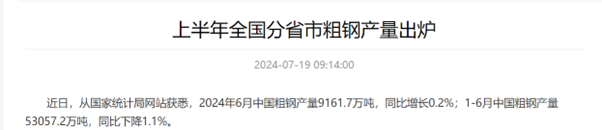

那问题来了,既然美国要不断降息,澳洲暂时又不动,那是不是澳元兑换美元就会不断升值呢?我不管其他专家,大师的看法。至少我本人非常坚定的认为,澳元的长期看跌依然不变。就算时短期和美元有上涨,但是大环境没有改变的情况下,一切都是短暂的浮云。下面说说的我看法,其实就是一句话:铁矿石跌了35%,而且还要跌。首先给大家简单科普一下:我们知道在过去的20年时间里,中国的房价除了中间少数几年下跌以外,大部分时间都是上涨,这也造成了房地产行业的蓬勃发展。而截至到2022年地产最后高峰时期,中国钢铁产量几乎一半是用在房地产和其相关上下游领域。但是我们都知道从2022年到现在,地产价格不要说小城市了,就算是北上广深,都有巨大的回调。也因为价格的变化,最近从买地,到造房,到二手房成交量,都出现了很大的萎缩。换句话说,房地产行业在过去2年里经历了巨大的寒冬,而且这个寒冬似乎现在看来远没有结束。但是,奇怪的事来了。既然房地产占据了用钢量几乎一半,按理说2022年到现在,这钢材产量也应该出现巨大下降啊。并没有。在过去的18个月时间里,全国钢材产量不但没有减少,还有部分增加:

那如果这些数据没有错误,也意味着,有几乎一半的钢材,原本用在地产上的,现在需要去其他地方找买家。纵观现在国内其他领域,就算是新能源车有所增长,但是距离要替代地产行业的用钢量那依然是杯水车薪。那既然国内无法消化产能,就只能找国外买家。虽然大量中国钢铁出海进军国际市场,但是因为其价格有时候太低,导致了很多国家的反弹,像马来西亚和印度已经开始了对中国钢铁的反倾销调查。而于此同时,现在中国国内企业的铁矿石和钢铁的库存都接近爆满。供过于求和全球需求疲软导致全球钢铁价格在2024年到现在已经下跌15%,达到过去10年来的最低点。而于此同时,由于国内目前依然缺乏对于房地产行业的强力刺激,因此很多钢铁厂也扛不住了,他们开始不再预定铁矿石原材料。使得新铁矿石交货的需求也在枯竭。8月的大幅下跌使得铁矿石的价格自年初以来下降了约35%。在中国国内,从中央到地方,其实都已经嗅到了危机:中国工业部已命令所有省级政府暂停新钢铁厂的项目,即使是那 些涉及“产能置换”到新低碳排放技术系统的企业也统统叫停。而中国钢铁行业龙头宝钢的总裁,也在上周公开发言,警告全球矿业和钢铁行业,未来将面临“严冬”。

我们知道,虽然美国率先执行的降息将会帮助降低美元的价值,从而推动美国产品的出口竞争力。相对的,其他货币在这降息周期的初期都会和美元汇率出现上涨。但是从长期来看,一个货币其吸引力不仅仅是短期货币政策导致的,更多则是来自于其国家的核心竞争力和这个货币在全世界的吸引力。那作为澳元,其最大的支撑力其实就来自于澳洲的经济和澳洲矿业的出口情况。所以当中国的钢铁如果卖不出而减少产量后,澳洲的经济也将会收到直接影响。而相应的,澳元的走势在未来也会因为澳洲经济核心竞争力的衰退而出现长期的疲软。每个人都会有自己的判断,我也从不敢说我一定是正确的,但是至少,我一直坚持我们需要有一个明确的观点,千万不要因为害怕判断错误和给出一个模棱两可的结论。在我看来,澳元长期看空在目前依然没有改变,其背后的逻辑就是铁矿石的长期走势,而铁矿石的背后,则是中国国内对于钢材的需求,而钢材需求的背后,就是你自己都可以想得到的原因了。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:

Mike Huang | GO Markets 销售总监

热门话题

刚刚过去的一周股市跌宕起伏,周四的大跌基本回吐了前三天的涨幅,令美股中期回调可能性大大增加,股指也处在技术位能否持续反弹的关键点位。由于非农年下修八百多万岗位,令拜登政府饱受诟病,但一年一度的杰克逊霍尔年会上鲍威尔的讲话短期拯救了股市。杰克逊霍尔年会的报道备受市场关注,作为全球央行盛会,自然能够透漏出国家经济政策的走向。然而我们一般都只关注美联储主席的发言,而无视其他声音,足见美国在一众发达国家中的重要。前几年的年会鲍威尔对整年的经济展望都没有做到及格线,过分乐观估计了通胀导致后来急速加息至今仍未解决通胀问题,后来又迟迟没有政策创新导致高息状态维持良久,经济下行压力巨大。本次年会鲍威尔一改保守作风,表面降息立场,点出目前美国经济问题所在,令市场看到了经济软着陆的可行性。

阅读鲍威尔的演讲稿后,解决通胀压力已经不在被定义为美联储的主要职责,而悄然转为了控制就业数据稳定化。美联储的两大职责就是控制通胀和就业,前几年市场一直聚焦在通胀数据,而目前美国的CPI已经回到了2.9%,今年以来都是稳步回落,距离2%的目标区间已经不远。然而美国的就业数据十分堪忧,最新月非农增幅仅不足12万,结合年下修80万的数据,每月还得剪掉六万多人口,那么实际非农增幅仅不足7万。这样的就业数据显然会对后期实体经济造成极大压力。鲍威尔也表示目前不再担心就业市场过热的问题,疫情后就业岗位的紧缺效应已经过去,但他同时表示之所以美国能够保持历史较低的失业率却控制了通胀上行的主要原因是美国目前的失业率主要是由于空缺职位数量稳步减少导致的,而不是破坏性裁员造成的,这就使得美国目前的经济形式还是较为乐观的,2.8%的GDP增幅也是经济强势的体现。尽管我们看到了美国诸多高科技公司大幅裁员,但美联储主席认为那样的裁员幅度并不是破坏性的。鲍威尔的这点解释有些牵强且有待市场验证,但是在当下却给予市场极大的信心,这也是周五美股普涨的主要原因。

有了以上解读,加上技术面股指测试了十周线的考验,仅周五就从长上影周线转为较平稳的小阳线,兑现了上周对美股走稳上行的预期,也是美股连续第三周上涨,因此新的一周美股大概率还是能够上冲的。出于对新一周几大金融数据可能影响的判断,前半周美股继续反弹的可能性很大,甚至可以大胆预测标普将在前半周上新高。新的一周美国二季度GDP修正值目前给出平修预期继续保持2.8%的增幅,对市场没有负面作用,周五核心PCE物价指数预测值反弹2.7%比前值2.6%增加0.1%对市场小幅利空,但这几年美国核心PCE偶尔有月增幅上行现象,而且只要幅度不大,不至于拖累整体股市。因此对美股的预判是周四GDP修正值落地前美股继续上涨,周四走势需要看GDP是否符合预期,周五核心PCE落地前市场出于消化预期会有些许利空,晚盘具体走向需要等到核心PCE数据做出判断。最为关键的是目前不需要恐慌三季度股指的大跌,这在当前经济大环境分析中找得到答案。资源类股票依然不看好,周末哈萨克斯坦世界第一产铀巨头减产消息将令铀矿股有一波反弹,特别是周一澳铀将集体大涨,持续性有待验证,但基本确立了国际铀价80美元的底。目前可以投资的板块是美股的AI权重股,以低仓位保证灵活度,又不失反弹机会的方式布局较为合理。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:

Xavier Zhang | GO Markets 高级分析师