市場新聞與洞察

透過專家洞察、新聞與技術分析,助你領先市場,制定交易決策。

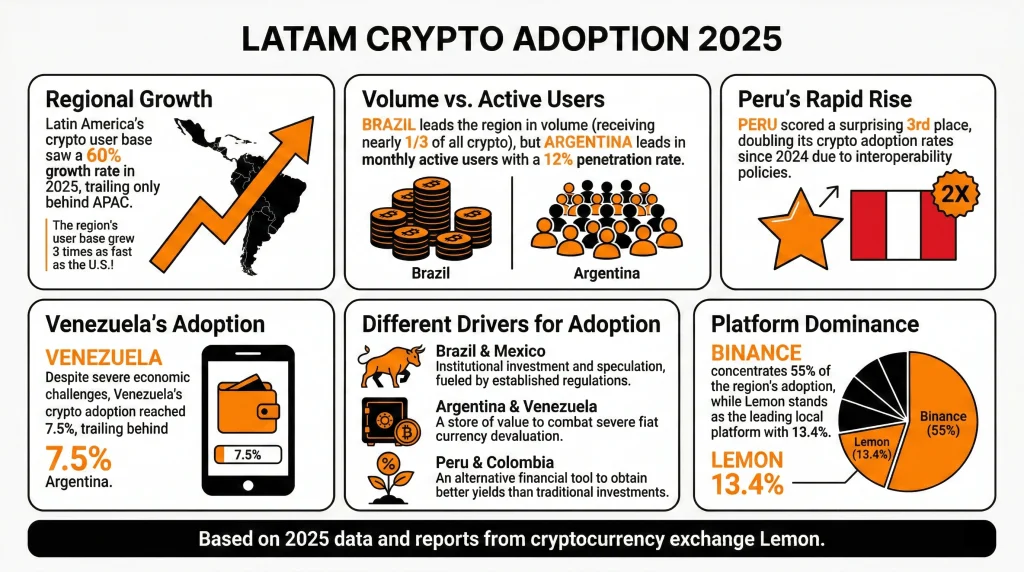

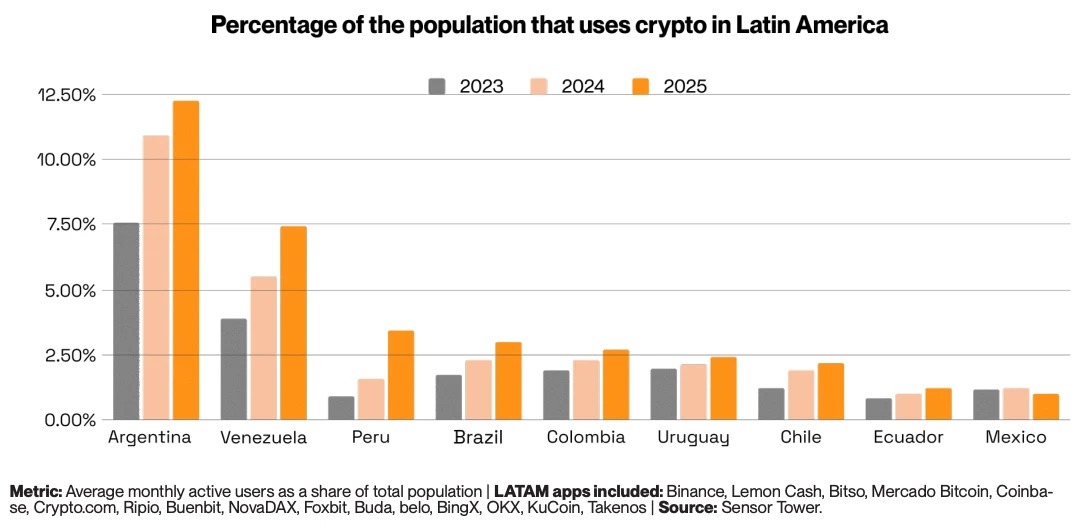

2025年,拉丁美洲(LATAM)的加密货币交易量超过7300亿美元,同比增长60%,这使该地区约占全球加密活动的10%。

2026年,机构参与者开始认真对待该地区,监管正在具体化,2025年以来的结构性驱动因素没有减弱的迹象。但是该地区不是一个单一的故事,2026年将考验当前的势头是建立在坚实的基本面还是投机乐观情绪之上。

事实速览

- 拉丁美洲每月活跃的加密用户同比增长18%,是美国的三倍。

- 阿根廷的月活跃用户渗透率达到12%,占该地区加密活动的四分之一以上。

- 现在,超过90%的巴西加密货币流量与稳定币有关。

- 三个拉美国家进入全球前20名:巴西(第5位)、委内瑞拉(第18位)、阿根廷(第20位)。

- 秘鲁的加密应用程序下载量在2025年增长了50%,下载量为290万次。

从生存工具到金融基础设施

由于投机,拉丁美洲没有接受加密货币。它之所以接受它,是因为传统的金融体系一再让普通百姓失望。在过去的15年中,该地区五个最大经济体的平均年通货膨胀率为13%,而同期美国的平均年通货膨胀率仅为2.3%。

在委内瑞拉,这一比例在一年内达到了65,000%。在阿根廷,这一比例在2024年超过了220%。对于数百万人来说,以当地货币持有储蓄是一种缓慢的自我毁灭行为。稳定币成为了自然的反应。与美元挂钩的数字资产提供了可靠的价值储存、无国界的转移性以及无需银行账户即可访问。

与西方不同,在西方,加密货币更多地被视为一种投机工具,而在拉丁美洲,它已成为一种必要的金融工具。但是,该地区的采用驱动因素并不完全统一。巴西和墨西哥是机构故事,受监管的市场参与和成熟的金融参与者的推动。

阿根廷和委内瑞拉仍然是保值游戏,加密货币是抵御法币崩盘的直接对冲工具。秘鲁和哥伦比亚是更追求收益的市场,加密货币提供的回报是传统储蓄账户无法比拟的。

拉美采用加密货币的速度有多快?

2025年,拉美的链上加密货币交易量同比增长了60%。自2022年年中以来,该地区的累计交易量已达到近1.5万亿美元,在2024年12月达到创纪录的单月877亿美元的峰值。

2025年,拉丁美洲的月活跃加密用户也增长了18%,是美国的三倍。

稳定币是推动这种采用的主要工具。在2025年收到的7,300亿美元中,有3,240亿美元是通过稳定币交易转移的,同比增长89%。在巴西,超过90%的加密货币流量与稳定币相关,而在阿根廷,稳定币占活动的60%以上。

展望未来,根据IMARC集团的数据,到2033年,拉丁美洲的加密货币市场预计将达到4426亿美元,从2025年起将以10.93%的复合年增长率增长。

对于交易者而言,采用速度与其说是头条新闻,不如说是推动采用速度的原因:该地区有6.5亿人以稳定币为基础,实时建设平行金融基础设施。

机构转向

在拉美的大部分加密历史中,采用率是自下而上的。没有银行账户或银行账户不足的零售用户通过本地交易所推动了交易量。现在,高端市场的这种情况正在发生变化。

2026年2月,全球领先交易所运营商德意志交易所集团旗下的Crypto Finance集团宣布向拉丁美洲扩张,目标是寻求机构级托管和交易基础设施的银行、资产管理公司和金融中介机构。

传统银行和金融科技公司纷纷效仿。Nubank现在奖励持有USDC的客户。巴西的B3交易所于2025年批准了世界上第一只现货XRP和SOL ETF,领先于美国。自2024年初以来,包括梅尔卡多比特币、NovaDAX和币安在内的中心化交易所共上市了200多个新的以巴西雷亚尔计价的交易对。

2025年3月,巴西金融科技公司Meliuz成为该国第一家推出比特币增持策略的上市公司,目前持有320比特币。

“拉丁美洲已经在全球范围内采用加密货币。市场现在需要的是机构级治理,这正是我们来到这里的原因,” ——加密金融集团首席执行官Stijn Vander Straeten

加密汇款用例

拉丁美洲每年从海外工人那里获得数千亿美元,这使汇款成为该地区最具体、最可衡量的加密用例之一。传统的转账服务平均每笔交易收取6.2%的费用。对于300美元的转账,大约相当于20美元的费用。

基于区块链的基础设施可以更广泛地降低费用。比特币使每转账100美元的成本约为3.12美元。而像XRP或以太坊第二层基础设施这样更便宜的替代方案可以将其降低到0.01美元以下。

对于向秘鲁汇款1,500美元的移民工人来说,仅从传统银行转账就能节省的费用超过秘鲁每周平均工资。

LATAM 的加密监管环境

最能决定LATAM是否发挥其2026年潜力的变量是加密监管。在这里,情况确实好坏参半。

巴西的《虚拟资产法》在该地区处于领先地位,该法涵盖资产隔离、VASP 许可、AML/KYC 要求和资本标准。它还实施了国内 VASP 转账旅行规则,该规则于 2026 年 2 月生效。但是,一些更具争议的提案,包括对跨境稳定币交易设定10万美元的上限以及禁止自托管钱包转账,仍在积极磋商中。

墨西哥的2018年金融科技法仍然是世界上最早正式承认虚拟资产的法规之一。智利的2023年金融科技法为交易所、钱包和稳定币发行人设立了许可证,正式承认数字资产为 “数字货币”。

玻利维亚于2024年6月批准了受监管的数字资产交易,撤销了长达十年的加密禁令。阿根廷于2025年引入了强制性交易所登记。尽管取消了比特币的法定货币地位,但萨尔瓦多仍在继续扩大代币化经济举措。

该地区的十个国家现在拥有某种正式的加密框架。但是对于交易者来说,监管分歧仍然是一种现实风险,鉴于巴西获得的拉美加密货币交易量占拉美所有加密货币交易量的近三分之一,任何重大的政策逆转都可能产生巨大的后果。

交易者应该注意什么

巴西的制度势头是最重要的结构性趋势。到2025年,巴西的链上交易量为3188亿美元,实际上是拉丁美洲市场。

巴西稳定币磋商的结果可能会产生很大的影响。限制在国内支付中使用外国稳定币将直接影响该地区主导市场中交易量最大的资产类别。

阿根廷是波动率的玩家。2025年,月活跃用户渗透率为12%,加密应用程序下载量为540万次,这表明零售参与度不断提高。

哥伦比亚是一个值得关注的预警市场。2025年比索贬值5.3%,财政危机的加深正在推动稳定币流入,其模式反映了阿根廷早年的发展轨迹。如果哥伦比亚的宏观形势进一步恶化,加密货币的采用可能会加速。

交易所集中风险也在起作用。币安加密货币交易所是超过50%的拉丁美洲加密用户的主要交易所。如果交易所面临任何监管行动、运营中断或竞争冲击,可能会对市场产生巨大的影响。

底线

拉丁美洲的加密市场进入了一个新阶段。导致该地区最初出现加密需求的结构性驱动因素尚未消失:通货膨胀、汇款、金融排斥和货币不稳定都仍在起作用。

所发生的变化是建立在它们之上的图层。机构基础设施、监管框架、企业资金的采用以及流入直到最近还基本自给自足的地区的全球交易所资本。

巴西在2025年将近-250%的交易量增长及其占拉美所有加密货币的近三分之一的地位是决定性的市场发展。其监管轨迹、稳定币政策决策和ETF渠道将有效地为该地区在2026年定下基调。

对于交易者而言,总体增长数据是真实的,但其背后的集中风险、监管不确定性以及国家层面的分歧也是真实的。

Artificial Intelligence (AI) is no longer a futuristic concept; it is a rapidly evolving reality reshaping industries, including financial markets. For traders, understanding how AI impacts price action and adopting strategies to adapt to these changes are critical to staying competitive. This article aims to explore AI's current capabilities, its profound influence on price action, but also offer some thoughts on how traders can potentially thrive during current and future changes that may impact markets.

What is Artificial Intelligence? Artificial Intelligence refers to the ability of machines to simulate human intelligence and perform tasks such as learning, reasoning, problem-solving, and planning. AI can be broadly categorized into three types: Artificial Narrow Intelligence (ANI): Specialized AI systems designed to perform specific tasks (e.g., chatbots, fraud detection, and algorithmic trading).

Artificial General Intelligence (AGI): A hypothetical stage where AI matches human cognitive abilities, capable of learning and reasoning across diverse tasks. Artificial Superintelligence (ASI): An even more speculative stage where AI surpasses human intelligence in every way. Currently, ANI dominates the landscape and drives innovations across industries.

For financial markets, ANI forms the foundation for tools and algorithms that enhance trading efficiency, accuracy, and decision-making. What is Machine Learning? Machine learning (ML) is one of the most important technologies underpinning AI and its potential applications in the trading world and so is worth just a little more explanation.

In simple terms, it may enable machines to learn from data, identify patterns, and make predictions or decisions without requiring explicit programming for each scenario. Let’s look briefly at the key elements, types and applications of ML that may have trading relevance. Key Elements of Machine Learning Data: Machine learning relies on large datasets, such as historical market prices, trading volumes, and economic indicators.

Algorithms: These are mathematical rules and calculations used to analyse data and make predictions. They range from simple regressions to complex deep learning models. Feedback Loops: Feedback allows ML models to learn from successes and failures, continually improving their accuracy over time.

Types of Machine Learning Supervised Learning: Machines are trained using labeled datasets, such as identifying bullish or bearish patterns in historical data. Unsupervised Learning: Machines find hidden patterns or anomalies in unlabeled data, such as clustering similar market behaviors. Reinforcement Learning: Machines learn through interaction with an environment, receiving rewards or penalties for actions, making it particularly useful for dynamic trading environments.

Applications in Trading Machine learning drives key advancements in trading, including: Predicting price movements using historical and real-time data. Optimizing portfolio allocations. Detecting anomalies or potential fraud.

Automating decision-making processes based on market conditions. Understanding machine learning is essential because it forms the backbone of many AI-driven trading tools that are reshaping financial markets. Concepts like enhanced trend identification, predictive analytics, and scenario planning all stem from machine learning’s ability to process vast datasets and adapt to changing market conditions.

AI’s Current and Future Capabilities in Trading As the evolution of AI expands into most areas that impact on our world, trading is no exception, AI applications in the financial world span a wide spectrum of uses but most fall into three main categories. This comprise: Fraud Detection: Identifying irregularities in financial transactions. Predictive Analytics: Anticipating price movements based on historical patterns and real-time inputs.

Advanced Decision Support: Assisting traders by analyzing complex datasets and suggesting optimal actions. As ANI technology advances, it is expected to refine these capabilities further, enabling: Enhanced sales forecasting for financial products. Real-time risk management tools.

The development of more personalized trading recommendations. In the long term, these advancements are likely to create a trading environment driven by increasingly sophisticated AI systems. AI’s Impact on Price Action Price action—the study of historical price movements to predict future trends—is foundational to many trading strategies.

AI's integration into trading may begin reshaping this traditional paradigm in several potential ways: Enhanced Trend Identification AI’s speed and accuracy in identifying trends far outpace traditional methods: Faster Recognition: Algorithms can process vast datasets in real-time, detecting emerging trends before they are visible to manual analysis. Greater Accuracy: AI can filter out noise and focus on genuine market movements, providing more reliable insights. Predictive Analytics AI’s predictive capabilities extend traditional market forecasting: Forecasting: Using historical data and complex algorithms, AI predicts market shifts with varying confidence levels.

Scenario Analysis: Simulating multiple market conditions, AI helps traders prepare for diverse outcomes. Changing Trend Lifecycles AI-driven strategies could alter the nature and duration of market trends: Accelerated Trends: Rapid AI-driven trades may shorten the lifecycle of trends, making them more volatile and less predictable. Increased Volatility: High-speed trades based on AI predictions can lead to significant price swings in short timeframes.

Behavioural Impacts AI is likely to influence trader behaviour and market dynamics: Herding Behavior: Similar AI-driven insights can lead to collective actions, amplifying price movements. Strategy Diversification: To remain competitive, traders must develop diverse and creative strategies. Challenges and Risks While AI offers tremendous potential, it also introduces challenges traders must navigate: Increased Market Volatility AI’s speed and efficiency can exacerbate short-term market volatility.

Sudden price movements may trigger stop-losses more frequently, disrupting traditional risk management strategies. Flash Crashes Algorithmic trading can lead to flash crashes—sudden, sharp price declines caused by cascading AI-driven trades. These events create liquidity risks and potential financial losses.

Over-Reliance on AI Dependence on AI systems could lead traders to overlook market fundamentals, exposing them to algorithmic biases and failures. Reduced Effectiveness of Traditional Tools As AI reshapes market behaviour, traditional tools like moving averages may lose reliability, forcing traders to adopt more dynamic approaches. Ethical and Regulatory Concerns AI introduces challenges around transparency, data bias, and compliance with evolving regulations, requiring constant vigilance.

How to Adapt and Thrive To improve the chances of potential better outcomes in a new more AI-driven market, traders must adopt proactive strategies that embrace rather than push away likely changes in the traditional ways of looking at markets. These may include: Review and Refine Your Strategies Evaluate how AI might impact your existing methods, particularly those reliant on lagging indicators. Incorporate real-time data analysis tools to complement traditional approaches.

Action: Conduct stress tests on your strategies under simulated high-volatility scenarios to ensure resilience. Leverage AI for Competitive Advantage Explore AI-powered platforms for market analysis, trade recommendations, and risk management. Develop custom AI models tailored to your trading style.

Example: Use machine learning to identify unusual trading volumes across multiple markets, providing actionable insights into potential opportunities. Strengthen Risk Management Practices Adapt stop-loss levels dynamically based on real-time volatility metrics. Diversify portfolios to reduce exposure to single-market risks.

Action: Incorporate scenario analysis tools to prepare for unexpected market conditions, such as flash crashes or sudden policy changes. Stay Informed and Educated Keep up with advancements in AI and its applications in trading by attending webinars, reading industry reports, and engaging with experts. Experiment with AI tools in demo accounts to understand their capabilities and limitations.

Example: Test AI-based predictive analytics platforms to evaluate their effectiveness in your trading strategies. Harness Human Creativity and Judgment Combine AI-driven insights with personal market knowledge to develop hybrid strategies. Focus on areas where human intuition, creativity, and adaptability can complement AI’s analytical power.

Action: Use AI as a decision-support tool, relying on your judgment for execution and fine-tuning strategies. Conclusion AI is transforming financial markets, presenting both opportunities and challenges for traders. While its speed, accuracy, and predictive power can disrupt traditional methods, those who adapt their strategies and leverage AI’s potential stand to thrive.

By refining approaches, strengthening risk management, and staying informed, traders can navigate the complexities of AI-driven markets and position themselves for success. The future of trading is here. Embrace the change, adapt your strategies, and unlock the potential of AI to gain an edge in an increasingly competitive market.

Introduction: Understanding the Impact of Entry Errors Trade entry is a critical moment that is undoubtedly contributory to the success or failure of a trade (although exits remain an additional key component of course). Whilst many traders focus much energy and effort on entries, the importance of a well-planned and so called ‘high probability entry’ is often underestimated. Poor entries can put traders at an immediate disadvantage, increasing risk exposure, reducing profit potential, and fostering a cycle of emotional and often questionable decision-making at this critical point of any trade.

This article delves into the most common entry mistakes traders make, why these errors occur, and, more importantly, how to avoid them. Many of these are insidious but if remain unchecked can lead to disappointment in trading outcomes, and at worst, may result in significant trading losses if they are not addressed over time. Through developing a greater understanding of the psychological pitfalls, potential technical missteps, and strategic errors made behind poor entries, traders can take actionable steps to enhance their consistency and performance in the markets.

Whether you're a beginner or an experienced trader, mastering your trade entry process can have a profound impact on your long-term trading outcomes and ultimate success or otherwise. The great news is that many of these are not “hard” fixes. Although by no means an exhaustive list, and often connected, these TEN errors in our experience appear to be the most common, Use these areas covered below as a checklist, making notes on any aspect that may resonate you’re your behaviour and of course subsequently take appropriate action as needed. #1.

Chasing Price Implications: Chasing price happens when traders enter impulsively after a sharp price movement in a particular direction. This is often driven by FOMO (Fear of Missing Out), and typically results in buying at overextended levels where a trend is already very established and may have almost run its logical technical course. This often results in a trade reversing or at best price exhaustion and little or no positive outcome over time.

Price reversal will often, even with the appropriate risk management in place result in repeated losses. Solutions: Develop a disciplined approach by waiting for either retracements to logical support levels, with of course evidence either of a bounce upwards, or even a breach of a new key level, or previous swing high (or low if “going short”). Either of these approaches may result in achieving a more favourable entry.

Also many trading platforms, including MT4 and MT% GO Markets platforms can use notification alerts to identify when the price reaches these levels, which is a useful feature that may assist in making sure robust decision-making occurs on a consistent basis. Additionally pending orders may also be used as part of your effective entry toolbox, set with more “cold” logic rather than being driven by emotional excitement of price velocity that may often be short-lived. #2. Ignoring Market Context Implications: Ignoring the broader market environment leads to trades that contradict prevailing trends or key market conditions.

T his oversight often results in entering trades with low probability, increasing the likelihood of stops being triggered. For long-term success, aligning trades with the dominant market forces is not only logical but appears from any research performed to be generally higher probability of at least some period of time where it is more likely that price will move in your desired direction. Failure to do so on a regular basis, can leave traders feeling like they're always on the wrong side of the market.

Example: A trader shorts the S&P 500 during a small pullback, not realising the index is in a strong uptrend on the daily chart. The pullback ends, and the uptrend resumes, quickly hitting the stop-loss. Solutions: Perform a multi-timeframe analysis before entering a trade.

Use higher timeframes (e.g., daily if trading an hourly timeframe) to understand the broader trend and ensure the trade aligns with it. Incorporate trend-following tools like moving averages or trendlines to validate entries is of course a common method to help substantiate this approach. #3. Over-Leveraging Positions Implications: Over-leveraging magnifies both potential profits and losses, but the latter can have devastating consequences.

Even small adverse price movements can wipe out significant portions of an account, leading to margin calls (and so taking “exit control” away from the trader) or even complete account depletion. This often traps traders in a cycle of "chasing losses," further compounding mistakes. Solutions: Implement strict position sizing rules.

For example, risk no more than 1-2% of your account on a single trade by adjusting your position size relative to your stop-loss distance. Your maximum ‘Risk per trade’ should be based on your Tolerable risk % of Account size per trade (e,g, 1%) x Entry price to Stop-loss distance. #4. Entering Without a Stop-Loss Implications: Trading without a stop-loss exposes traders to uncontrolled risk.

It fosters a dangerous mindset of "hoping" the market will work in their favour, often leading to mounting losses. A single large loss can undo months of profitable trading, shaking both confidence and capital and so have longer term psychological implications such as loss aversion, which can further distort good decision-making. Solutions: Use stop-loss orders based on logical technical levels, such as below a recent swing low.

Although less pertinent to entry but equally important through the life of a trade is potential use of trailing stops can also help lock in profits as the price moves favourably, protecting against reversals and of course profit targets based on logical potential technical pause or reversal points. #5. Over-Reliance on Indicators Implications: Indicators are helpful tools but are often misused when relied upon as the sole basis for trade decisions. Many indicators are lagging by nature, meaning they reflect past price movements rather than anticipating future ones.

Blind reliance on indicators can lead to late or false entries, especially in trending or volatile markets. Price action and associated volume should be treated as the primary decision making points with indicators used for confluence, Example: A trader buys a stock because RSI indicates oversold conditions, but the stock continues to decline as the market remains in a strong downtrend. Solutions: Combine indicators with price action and market context.

For example, use RSI or MACD as confirmation for setups rather than primary signals. Always validate indicator signals with chart patterns, price range within a specific candle, and/or key levels of support/resistance. #6. Trading News Events Implications: News events often create sharp volatility, which can lead to slippage, widened spreads, and unexpected losses.

Trading without a structured plan during (and arguably before) such events exposes traders to heightened risk, especially in fast-moving markets. Examples: A trader enters a position before a Federal Reserve announcement, expecting dovish remarks. Instead, hawkish comments cause a rapid market reversal, leading to a significant loss.

It is worth noting that it doesn’t even have to be an adverse announcement to that which was expected to disappoint. If one believes, as is often cited, that everything that is known or expected is already “priced in” then even an expected number or news release can fail to provide a potentially profitable price move. Also of course, equally as dangerous to capital is not to be aware of significant market events at all.

To enter prior to these from a place of ignorance that they are even happening is potentially as damaging to capital.. Solution: Use a trading calendar to track upcoming high-impact news events. If trading news is part of your strategy, place pending orders above and below key levels to capitalise on breakouts while controlling risk. #7.

Trading Impatience Implications: Entering trades prematurely often leads to setups that fail or require larger stop-losses to accommodate unnecessary volatility. This behaviour stems from a need to "be in the market," and this “itchy trigger finger” which is in essence a compromise of discipline arguably can increase the likelihood of losses. Example: A trader buys a stock before confirmation of a breakout, only to see the price reverse and remain in a sideways trend for a prolonged period of time not only failing to see that specific trade do well but also arguably adds opportunity risk as that money invested could be in a trade that has indeed set up to confirm a change of sentiment, Solution: Establish clear entry criteria and wait for confirmation, such as a candle closing above resistance.

Articulate these clearly and unambiguously within your trading plan, #8. Misjudging Risk-Reward Ratios Implications: Poor risk-reward ratios undermine profitability. Even with a high win rate, losses can quickly outweigh gains if the potential reward doesn't justify the risk.

Either a failure to have defined acceptable levels articulated within your plan or ignoring (based on previous price action) potential pause or reversal points are the two main causes. Example: A trader risks $500 to make $200 on a trade. Over several trades, a few losses wipe out multiple winning trades.

Solutions: Ensure a minimum risk-reward ratio is stated for example 2:1 before entering. For instance, if risking $100, target a profit of at least $200 to maintain positive expectancy. #9. Over-Trading Implications: Over-trading leads to increased transaction costs, emotional exhaustion, and reduced focus on high-quality setups.

This is often driven by revenge trading or overconfidence after a winning streak. Example: A trader takes several trades in a single session after a loss, compounding mistakes and ending the day with a larger drawdown. Solutions: Set a daily trade limit and focus on quality over quantity.

Use a trading journal to reflect on your trades and identify patterns of over-trading. #10. Ignoring Correlation Between Assets Implications: Trading multiple correlated assets amplifies risk, as adverse moves in one asset can lead to simultaneous losses across others. Hence, even if say a 2% maximum risk is assigned to a single trade, if trades are highly correlated then that risk is multiplied potentially by the number of trades open.

Example: A trader goes long on EUR/JPY, AUDJPY and GBP/JPY and a sharp JPY rally causes losses in all three positions. Solutions: Use correlation matrices to assess relationships between instruments and diversify by trading uncorrelated assets. For instance, balance a forex position with a commodity trade.

Summary: Trade entry mistakes are often rooted in a combination of emotional decision-making, poor planning or preparation, and over-reliance on tools or strategies without proper context. By identifying these common errors and implementing structured solutions, traders can greatly enhance their ability to execute high-quality trades. The key to success lies in discipline, patience, and a willingness to adapt and learn from mistakes.

Start reviewing your entry process today, be honest with any of the above that may resonate with you (As awareness is always the first step in improvement) and give yourself the chance to potentially transform your trading outcomes over time.

There's been plenty made this year about gold's incredible rise to new record levels. A point that gold bugs love to point out. As we sit here gold is trading at around US$2700oz having reached an all-time high that was just shy of US$2900oz.

Thus the question has to be asked: where is the limit? And where too from here for the inert metal? The movements over the last five years clearly suggest there is a structural change going on inside the very definition of what gold is. 14.7% in the last six months. 29.4% year to date. 34.2% in the last 12 months A staggering 82.3% in the last five years.

That is telling a story that is different to the original fundamentals we were taught at university and then as fundamental traders. Let's look at that theory: gold usually trades closely in line with interest rates, particularly US treasuries. As an asset that doesn't offer any yield it typically becomes less attractive to investors when interest rates are higher and usually more desirable when they fall.

That still technically holds true, However what has changed is how much central banks are interfering with that fundamental. Since 2022 when Russia invaded Ukraine one of the main reactions from the West was to freeze Russian central bank assets. Since that point the Russian central bank particularly has been buying gold as a form of asset store/reserve.

It has also allowed it to avoid the full force of financial sanctions placed on it. But they're not the only ones doing this; emerging market central banks have also stepped up their purchasing of gold since this sanction was put in place and are rapidly increasing their own central bank reserves. Then we look at developed markets central banks.

The likes of the US, France, Germany and Italy have gold holdings that make up to 70% of their reserves are net buyers in the current market. That suggests something else is afoot. Are they concerned about debt sustainability?

Considering the US has $35 trillion of borrowings which is approximately 124% of GDP, do central banks around the world see risk? Considering that many central banks have the bulk of their reserves in US treasuries coupled with the upcoming unconventional administration in the Oval Office this certainly puts gold’s safe haven status in another light. There are truly unknowns with the upcoming trump administration and gold is clear hedging play against potential geopolitical shocks, trade tensions, tariffs, a slowing global economy, deft defaults and even the Federal Reserve subordination risk So what is the outlook for Gold over the coming years and just how high could it go?

Consensus over the next four years is quite divided: by the end of 2024 the consensus is for gold to be at US$2650oz and then easing through 2025 to 2027 to $2475oz. However there are some that are calling for gold to reach the record reached in September this year before surging towards $2900oz the end of 2025 and holding at this level through most of 2026. And right now who could blame this prediction - Gold bugs believe the confidence in gold’s enduring appeal amid a volatile macroeconomic and geopolitical landscape is a bullish bet.

Expectations for sustained diversification and safe-haven flows do appear structural and with central banks and investors seeking to mitigate risks in an environment characterised by persistent uncertainty, geopolitical tensions, and economic volatility. And it's more than just the demand side that's leading the charge. The supply side of the equation further supports our bullish outlook.

Gold mine production is inherently slow to respond to rising prices due to long lead times for exploration, development, and production ramp-up. Furthermore, major producers avoid aggressive hedging strategies, as shareholders typically prefer full exposure to gold’s upside potential. The supportive fundamental backdrop reinforces that demand from both the official sector and consumers will remain robust, while supply-side constraints provide a natural tailwind for price appreciation.

What we as traders need to be aware of is many investors actually believe they've missed the rally and are wary of buying gold at all-time highs. There are some that believe gold is due pull back even a correction as they struggle to make sense of gold in the new world. The divergence away from yields coupled with unknowns out of China and the US has made them nervous to buy this rally.

But we would argue the pullback has probably already happened. If we look at the gold chart, since the US presidential election gold has moved through quite a reasonable downside shift. Dropping from its record all time high to a low $2530oz.

That decline has clearly been cauterised and the momentum now is clearly to the upside. We can see from the chart that spot prices are now testing the September-October consolidation period. Any clean break above these levels would see it going back to testing the head and shoulders pattern at the end of October-November.

This will be the keys to gold for the rest of 2024. But whatever happens in the short term the long-term trend suggests there is more for the gold bugs to delight in.

Yellowcake - a commodity that is loved and loathed all in the same breath. The questions we have been asking are - which is right and what’s the outlook? Because as traders and investors that dilemma is key, there is a gap here and that leads to volatility and incorrect pricing in the short and long term some may want to jump on.

Recent developments in the uranium market suggest we may be witnessing the beginning of a significant shift. After a prolonged period of downward pressure on prices, two key events over the past two weeks have kicked yellowcake back into the minds of traders. First is the geopolitical supply shock, the second are signals of increased long-term demand.

That is music to us in economics as this is a pure supply and demand thematic and suggests a potential reversal. Together, they could usher in a new phase of steady price appreciation, reminiscent of the market's bullish run in 2023. Point 1: Demand Side: U.S.

Energy Policy Could Lay the Foundation for Long-Term Growth The first major factor influencing uranium demand stems from the U.S. political landscape. The election of President-elect Donald Trump introduces a new energy agenda, one that could reshape the trajectory of nuclear power in the United States. While Trump's campaign rhetoric and early post-election messaging have heavily emphasised fossil fuel expansion - check last week’s piece on the "drill, baby, drill" thematic - it’s clear that nuclear power also holds a significant place in his vision for America’s energy future.

Trump has repeatedly voiced support for nuclear energy, particularly for small modular reactors (SMRs). These advanced nuclear technologies are seen as the next generation of clean energy solutions, offering modular, scalable power generation with enhanced safety and efficiency. In recent speeches and interviews, Trump has highlighted (in his view) nuclear energy is part of the solution needed in achieving sustainability, lower carbon emissions, and enhancing U.S. energy independence.

That last point is actually his biggest driver here being an America First ideal. This policy focus could mark a critical inflection point for uranium demand globally. While nuclear infrastructure projects are long-term endeavours and won’t generate immediate demand for uranium, the signals are clear: the U.S. government may soon prioritise nuclear energy investments in ways we haven’t seen in decades.

It also comes at a time when the likes of France and to some extent greater Europe moves in this direction. Either way as these plans materialise, uranium’s importance as a strategic resource will only grow. Moreover, Asia is also shifting its focus to this energy source as well.

Asian countries are increasing their reliance on nuclear energy to meet ambitious carbon neutrality targets. This international momentum could compound the effects of U.S. policy changes, creating a robust foundation for sustained uranium demand over the next decade. Point 2 Supply Side: Part 1 Russia’s Export Restrictions Tighten the Market The second major development is far more immediate and impactful.

That changes on the supply side of the equation. Last week, Russia announced new restrictions on the export of enriched uranium to the United States, escalating geopolitical tensions and significantly disrupting global supply chains. This move mirrors the U.S.’s earlier ban on Russian uranium imports, imposed in May 2023 as part of broader sanctions against Russia.

Historically, Russia has been a critical player in the global uranium market, supplying enriched uranium to numerous countries, including the United States. In 2023 alone, Russia accounted for 28 per cent of U.S. enriched uranium imports, a substantial share of the market. Although U.S. sanctions effectively ended these imports by August 2023, waivers remain in place for select companies, allowing limited purchases from Russian suppliers until 2028 such as Centrus Energy and Constellation Energy.

What isn’t clear is whether any imports have actually taken place under this exemption since the sanctions were tightened. Either way Russia’s new export restrictions will exacerbate existing supply chain constraints and are likely to push U.S. utilities to seek alternative sources of enriched uranium. This, in turn, should drive increased activity in both spot and futures markets as energy providers scramble to secure long-term supply agreements.

The ripple effects of these restrictions may also spill over into global markets, further tightening the balance of supply and demand. Part 2 Wider Supply Challenges: A Tighter Market Ahead The second part of the supply side equation is that Russia isn’t the only player and recent production reports, and other geopolitical issues are also driving shortages in uranium For example: Niger’s Production Halt: Orano, a major uranium producer, recently placed Niger’s only operational mine into “care and maintenance” code for moth balling due to logistical challenges. The catch with putting mines into care and maintenance is that once its down it takes months (sometimes years) to return to full capacity.

So it’s not just a here and now story. Be aware this mine, which has an annual capacity of 2,000 tonnes of uranium (tU), accounts for approximately 3 per cent of global supply. The halt underscores the fragility of the uranium supply chain in politically unstable regions.

Junior Miners Struggling: Smaller uranium miners are cutting their production targets for 2024 and 2025 due to a combination of slower-than-expected ramp-ups, lower ore grades, and resistance from local communities. Collectively, these issues have removed an estimated 2,600 tU from projected global supply—roughly 4 per cent of the market. Offsetting Gains Insufficient: While Cameco has announced a 1-million-pound (365 tU) increase in its 2024 production guidance thanks to improved performance at its McArthur River mine, these gains are insufficient to offset broader supply losses.

With supply tightening, producers struggling to meet commitments in the spot market, the pressure is building on the supply that is in circulation – and that is a price enhancer. Where does this leave Uranium? These developments create a powerful pinch point in the uranium market.

There is a promising long-term demand story evolving driven by potential shifts in U.S. energy policy and global momentum toward nuclear energy. On the flip-side, immediate supply constraints, driven by geopolitical tensions and production challenges, are tightening the market. The convergence of these factors could mark the start of a new cycle characterised by sustained price increases.

While it’s too early to definitively declare a bull market, the conditions are becoming increasingly favourable. For investors, this shifting landscape presents an opportunity. If supply disruptions persist, the uranium market could experience a strong rebound in the coming months.

Prices in both the spot and term markets are likely to reflect this tightening balance, creating a more attractive risk-reward dynamic for those positioned to take advantage of the trend. Big caveat - the uranium market is notoriously volatile and can see +/- 20 per cent moves in days or weeks. But the current setup suggests a potential turning point that could define the market's trajectory for years to come.

There has been plenty of conjecture about where oil is going to go in 2025 and we would suggest that the recent climb in Brent crude oil prices above $80 per barrel reflects an intensifying mix of geopolitical uncertainty. The main 3 uncertainties driving oil have been the impact of the U.S. presidential election, the escalation of the Middle East tensions and anticipation surrounding the OPEC+ meeting on December 1. These factors are clearly shaping short-term oil price dynamics, although some uncertainties have begun to ease, namely the election and the Middle East, but they still hold sway.

Thus let’s explore revised demand and supply projections as the industry anticipates a potential surplus in 2025 and the enactment of the Trump administrations Drill. Drill. Drill policy. 1.

Middle East Tensions Geopolitical tensions in the Middle East have posed a notable risk to the global oil supply particularly the conflicts involving Israel and Iran and the potential disruptions it would cause to OPEC’s 5 largest producers. However, so far, oil infrastructure in the region has largely remained intact, and oil flows are expected to continue without significant interruptions. While exchanges between regional powers remain a potential flashpoint, there is a general consensus that the two countries have stepped back from the worst.

The base case for this point is to assume stability in oil transportation routes and infrastructure. However, as we have seen during periods of unrest this year the consequences of a flare up for global oil prices can be considerable, underscoring the market's sensitivity to even minor shifts in Middle Eastern stability. 2. U.S.

Presidential Election – Drill Baby Drill The U.S. presidential election outcome has had a muted effect on oil prices – so far. This is likely due to President-elect Trump's policies regarding the energy being ‘speculative’. But there are several parts of his election platform that will directly and indirectly hit oil over the coming 4 years.

First as foremost – its platform was built on ‘turning the taps back on’ and ‘drill, drill, drill’. Under the current administration US shale gas and new oil exploration programs have come under higher levels of scrutiny and/or outright rejections. The new administration wants to reverse this and enhance the US’ output.

This is despite consensus showing these projects may return below cost-effective rates of return if oil prices remain low and the cost of production above competitors. Second, although President-Elect’s proposed tariff policies—ranging from 10-20 per cent on all imports, with higher rates on Chinese goods—could slow global trade, the net effect on the oil market is uncertain. Consensus estimates have the 10 per cent blanket tariff reducing U.S.

GDP growth by 1.4 per cent annually, potentially cutting oil demand by several hundred thousand barrels per day. If enacted, this bearish influence could counterbalance any potential bullish effects on prices. The third issue is geopolitics again – this time the possible reinstatement of the "maximum pressure" campaign on Iran that was enacted in the first Trump administration.

If the Trump administration imposes secondary sanctions on Iranian oil buyers, Iran’s exports could drop as they did during the 2018-2019 period, when sanctions sharply curtailed oil shipments. Such a development would likely tighten global supply and drive prices higher. These three issues illustrate possible impacts U.S. policy could have in 2025 and illustrate how contrasting economic and geopolitical factors could sway oil prices in unpredictable ways.

It again also explains why reactions in oil to Trump’s victory are still in a holding pattern. 3. What about OPEC? This brings us to the third part of the oil dynamic, OPEC and its upcoming Vienna convention on December 1.

The OPEC+ meeting presents another key variable, currently the consensus issue that member countries face - the risk of oversupply in 2025 and what to do about it. Despite Brent crude hovering above $70 per barrel, a price point that has normally seen production cut reactions, consensus has OPEC+ maintain its production targets for 2025, at least for the near term. We feel this is open for a significant market surprise as there is a growing minority view that OPEC+ could cut production by as much as 1.4 million barrels.

With Brent prices projected to stabilise around the low $70s, how effectively OPEC+ navigates this delicate balance between production and demand remains anyone’s guess and it's not out of the question that the bloc pulls a swift change that leads to price change shocks. December 1 is a key risk to markets. Where does this leave 2025?

According to world oil sites global supply and demand projections for 2025 suggest a surplus of approximately 1.3 million barrels a day, and that accounts for the recent adjustments to both demand and OPEC supply which basically offset each other. With this in mind and all variables remaining constant the base case for Brent is for pricing to sag through 2025 with forecasts ranging from as low as $58 a barrel to $69 a barrel However, as we well know the variables in the oil markets are vast and are currently more unknown than at any time in the past 4 years. For example: Non-OPEC supply growth underperformed in 2024, which is atypical; over the past 15 years, non-OPEC supply has generally exceeded expectations.

With Trump sworn in in late-January will the ‘Drill, Drill, Drill policy be enacted quickly and reverse this trend? This may prompt a supply war with OPEC, who may respond to market conditions by revising its output plans downward, which would tighten supply and support prices. In short its going to be complex So consensus has an oil market under pressure in 2025 with a projected surplus that could bring Brent prices into the mid-$60s range by the year’s end.

But that is clearly not a linear call and the global oil market faces an intricate array of challenges, and ongoing monitoring of these trends will be essential to refine forecasts and gauge the future direction of prices, something we will be watching closely.

Why you need to understand this market concept to improve your trading: Market Correlation For new traders and experienced traders, it can be daunting trying to find the best assets to trade. Whether it be equities, foreign exchange or indices, traders should be trying to have as many factors pointing in their favour as possible when entering a trade. These factors can include, the general trend of the individual asset, the price action at the time of entering the trade, candlestick patterns, use of technical indicators, among many others.

However, one thing that all traders should know about and understand is correlation. What is Correlation? Correlation is the pattern or relationship of how one asset performs relative to another asset.

In statistics, there are mathematical measures of correlation including covariance, correlation coefficients and other terms to describe the relationship of one asset to another. These methods can also be used to quantify asset correlations. A correlation between assets can be positive negative or uncorrelated.

Understanding which relationship between different assets can help provide some indication of the way in which an assets price will go. Below is a diagram that shows how the return of assets can be plotted against each other and the potential relationship. For example, imagine that there are two gold companies Gold company A Gold company B Assume that the price of their shares is perfectly, positively, correlated.

This means that when gold company A’s share price rises by 1% company B’s share price will also rise by 1%. This same price action will occur in reverse if the price of company A falls by 1%. Now in practice no two assets are perfectly correlated.

However, two or more assets may be very strongly correlated. Therefore, identifying how correlated certain assets are and how the price of one impact on the other can be a powerful tool. What creates correlation?

Strong correlation between assets usually occurs because the price of the different assets is material impacted by very similar factors. For instance, two companies in Australia may be more correlated than one company in Australia and one company in the USA. This is because geographically the Australian companies will be affected the local economic conditions.

This may include things such as inflation, taxation policies and other geographical specific conditions. Other factors that can influence the correlation include similarity of the assets or a company’s business operations, being in the same sector or a range of other factors. For example, see the correlation between the ‘Big 4’ banks in Australia below.

It can be seen due to how similar the businesses are and the conditions of which they operate in the pattern on returns are almost identical. Index correlation An important phenomenon to understand is the law of averages and big numbers. Essentially, if large companies are grouped together then they act as a good proxy for the overall market or a specific sector.

This essentially is what an ETF or and Index is. Therefore, as it represents how most individual companies are performing, most companies will be to a degree correlated to the overall market index or relevant sector index or ETF. Size matters Another important thing to understand about how correlation works is that smaller assets or companies will tend to correlate towards the performance of the major players within the sector.

For instance, in the technology sector, smaller technology company’s such as zoom will likely be correlated to larger companies such as Apple and Microsoft by virtue of being in the same sector. Correlations do not just occur in equities and are prevalent in FOREX and commodities. Correlation can be found between growth assets such as the Nasdaq Index which is a technology heavy Index and growth currencies such as the AUD or NZD.

Similarly, more stable assets such as the Dow Jones will likely be more correlated to commodities such as oil, they represent more stable industry and manufacturing sectors. How does it improve your trading? By simply being aware of the direction of the correlated assets, a trader is better able to trade with underlying trend and momentum.

This is vital when trying to optimise edge and improve trading accuracy. It can also equally show when a stock is underperforming or overperforming. For instance, if the general trend of a sector leader is trading 5% higher over a certain period, and a smaller company in the sector is trading at 10% higher it is outperforming the ‘sector’ and understanding why this occurs is an important step into deciphering what is driving price action.

Having a good understanding of how assets correlate can also help find potential trading opportunities earlier than others. This is because by following a sector it becomes easier to see which assets still may have room to shift their price. Ultimately, if a trader can develop their identification of patterns of correlation and the reasons for the relationships between different assets it can provide a trader with a much stronger and accurate edge.