市場新聞與洞察

透過專家洞察、新聞與技術分析,助你領先市場,制定交易決策。

预计收益日期: 2026 年 2 月 25 日星期三(美国,收盘后)/~ 2026 年 2 月 26 日星期四上午 8:00(澳大利亚东部夏令时间)

NVIDIA即将发布的财报预计将围绕数据中心收入增长、人工智能相关需求的可持续性、毛利率轨迹以及2027财年(FY2027)的前瞻性指导。

市场可能会关注资本支出趋势、供应能力和管理层的人工智能基础设施前景。

一些市场参与者也可能将NVIDIA的业绩视为表达更广泛的人工智能相关投资情绪的有用信号,尽管结果仍可能受到公司特定因素和更广泛的市场条件的影响。

重点领域

数据中心(人工智能芯片)

数据中心领域仍然是NVIDIA的主要增长动力。市场可能会监控收入增长率、毛利率和有关人工智能加速器需求的指导。

博彩

NVIDIA 还销售游戏电脑显卡。市场将关注这部分业务是否保持稳定和盈利,尤其是更广泛的消费者和个人电脑周期趋势。

汽车和专业可视化

这些是与人工智能开发、设计软件和自动驾驶相关的较小部门。它们通常不是短期业绩的主要驱动力,但可以关注评论以寻找长期增长和产品势头的迹象。

利润率和成本

市场将评估NVIDIA的盈利能力,尤其是在人工智能相关投资和供应规模持续扩大的情况下。利润率是与收入增长、指导和更广泛的风险情绪一起受到密切关注的一个因素。

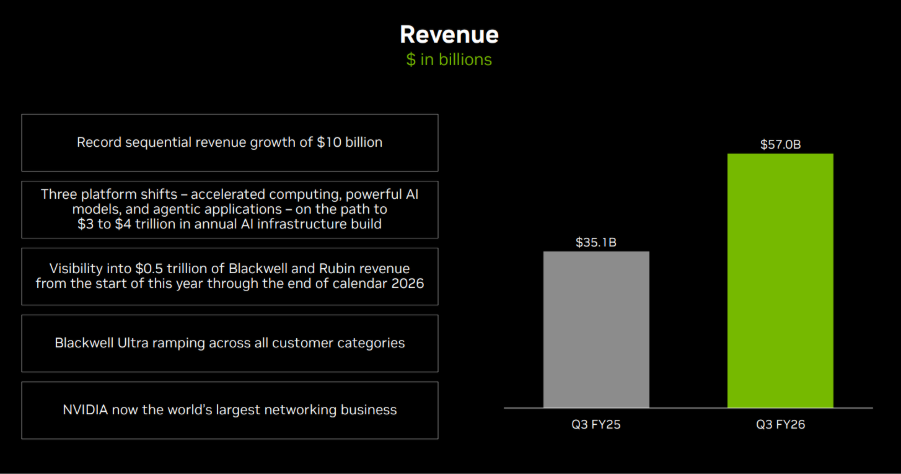

上个季度发生了什么

在最新的季度更新中,NVIDIA报告了强劲的同比收入增长,这主要是由数据中心需求带动的。

管理层的评论和随后的报告提到了人工智能加速器需求的持续强劲,并提到了持续的供应规模举措。

最新财报主要亮点

- 收入: 57.0 亿美元

- 每股收益(EPS): 1.30 美元(摊薄)

- 数据中心收入: 512 亿美元

- 毛利率: 73.4%

- 营业收入: 360 亿美元

分析师对本季度的期望

彭博社的共识估计表明,在即将发布的报告中,收入将持续同比增长,市场重点关注数据中心性能和 FY2027 的前瞻性指导。

彭博共识参考点:

- 每股收益: 大约 1.52 美元

- 收入: 约655亿美元

- FY2027 全年每股收益: 大约 7.66 美元

*截至2026年2月16日观察到的所有上述观点。

分析师普遍预计,与人工智能相关的需求将持续下去,而注意力仍集中在供应动态和任何需求正常化的速度上。

市场隐含的预期

上市期权的定价指示性变动约为 ± 7% 到 ± 8% 围绕财报发布,基于近期的现价(ATM)期权隐含的预期走势估计。隐含波动率约为 年化率为 48%。

这对澳大利亚投资者意味着什么

NVIDIA的收益可能会影响包括纳斯达克100指数在内的美国主要股票指数的短期情绪和波动性,并有可能在发布后溢出到亚洲时段。

它还可能影响人们对澳大利亚证券交易所上市的科技风险敞口公司和在美国大盘股成长板块敞口的ETF的情绪,尽管相关性可能会在重大事件中迅速发生变化。

澳大利亚投资者可能也希望考虑在内 澳元/美元货币走势,这可能会影响离岸股票和交易所买卖基金的当地货币兑换。

重要风险说明

在美国收盘并进入亚洲早盘后,纳斯达克100(NDX)期货和相关的差价合约定价可以立即反映出流动性减弱、利差扩大,以及围绕新信息的更大幅度重新定价。

相对于正常工作时间条件,这样的环境会增加差距风险和执行不确定性。

从2月16日开始的一周内,市场将出现大量经济数据和持续的盈利势头,这将为更广泛的增长前景提供依据。

- 采购经理人指数快报(星期五):美国、欧元区、英国和日本的商业调查为2月份的增长势头提供了早期解读。

- 科技之外的人工智能:尽管行业变动可以反映多种驱动因素,但评论越来越关注人工智能如何影响各行各业的商业模式。

- 股权周转:最近的科技表现好坏参半,更广泛的参与似乎不如已确认的轮换那么稳定。

- 收益:随着大多数美国巨型股的上报,本周零售和消费类股是焦点,澳大利亚的报告季仍然很繁忙。

- 比特币(BTC): 在尝试反弹后回落,对情绪变化仍然高度敏感。

闪存采购经理人指数

周五公布的主要经济体的采购经理人指数快速读数可以及时了解商业状况和需求趋势。

如果服务业保持弹性,而制造业保持疲软,市场可能会将其解释为稳定但不均衡的增长。如果两者都减弱,增长担忧可能会更快地卷土重来。

本周早些时候,日本国内生产总值、英国劳动力数据、英国消费者价格指数、澳大利亚就业和美国贸易数据帮助在周五多个国家发布采购经理人指数快报之前定下了基调。

关键日期

- 初步采购经理人指数(美国、欧元区和英国): 2月20日星期五

监视器

- 采购经理人指数发布前后的货币波动。

- 债券收益率对增长意外或失望的反应。

- 行业和大宗商品表现的变化可能与需求预期的变化有关。

人工智能颠覆

一些市场评论强调了人工智能对各行各业的潜在长期竞争影响,尽管宏观状况、利率和收益预期仍可能推动公司和行业的业绩。

- 金融:尽管股价变动可以反映多种影响,但一些讨论的重点是人工智能工具是否会随着时间的推移改变财富管理和建议交付的某些部分。

- 物流和货运:一些市场讨论集中在提高自动化程度是否会随着时间的推移影响成本和定价动态以及其他周期性驱动因素上。

- 软件:反应仍然参差不齐,一些公司受益于人工智能集成,而另一些公司则面临差异化和定价能力的问题。

这种转变意味着人工智能主题可以越来越多地通过相对的性能和分散性来表达,而不是广泛的 “冒险” 出价。

监视器

- 参考自动化、人工智能投资或人工智能相关竞争压力的收益指导。

- 增加部门之间和部门内部的分散。

- 对前瞻性评论的反应更大,而不是头条新闻的胜负或失误。

股权周转

上周早些时候科技股的反弹势头减弱。市场没有明确的避险条件,反而表现出喜忧参半的参与度。

金融、工业和防御性板块有时会吸引资金流入,但还不够稳定,不足以确认持续的转动。

参与率仍然不均衡,现阶段资金流动模式更加稳定的证据仍然有限。

监视器

- 非科技行业持续相对强劲。

- 收益率变动及其对增长敏感型股票的影响

- 更广泛的行业参与与狭隘的科技领导地位

聚焦收益

作为 美国财报季 本周的注意力转向了后端,注意力转向了零售公司。

零售业绩可以提供有关消费者实力、全权支出趋势和利润弹性的信号,尤其是在人们对经济状况看法不一的情况下。

在澳大利亚,报告季仍在继续,支撑了整个股票的波动 ASX。

监视器

- 零售利润率评论和折扣趋势

- 消费者需求展望声明和指导基调

- 即使指数走势平淡,个股仍会出现大幅波动

比特币情绪敏感

比特币 最近几个交易日交易价格走低,并且仍然高度波动。有可能回到2月5日的低点,但价格可能会在两个方向上迅速变化。

一些市场参与者将比特币视为投机情绪的指标之一,尽管任何更广泛的 “风险偏好” 解读都是不确定的,并且可能受到加密市场多种驱动因素的影响。

关键经济事件

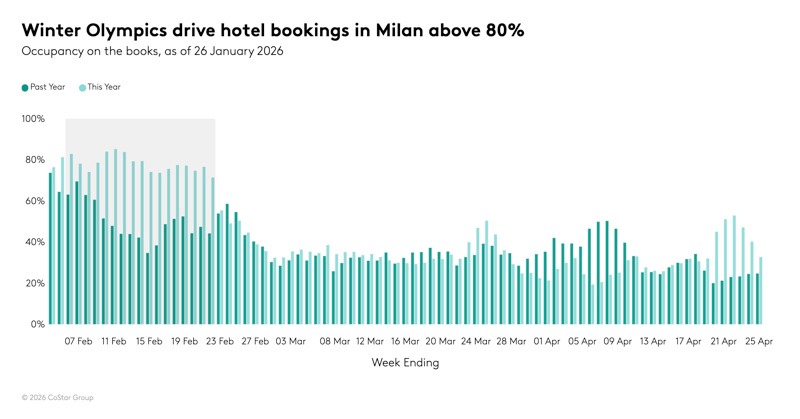

大型全球活动,例如 奥运会 可以将注意力从市场上移开,转移参与度,并减少口袋里的交易量。

当这种情况发生时,流动性可能会显得较轻,利差可能不太稳定,短期价格走势可能会变得更加噪音,即使更广泛的指数水平波动没有实质性变化。

因此,与其问 “奥运会会造成波动吗?”,更实用的视角是问 “哪些波动事件 可以 在奥运会期间露面?”

事实速览

- 普遍没有证据表明奥运会本身是市场波动的持续直接驱动力。

- 奥运会窗口期间发生的波动率飙升通常与更大的波动率激增同时发生 力量已经在行动,包括宏观压力、政策意外和地缘政治。

- 与奥运会相关的更可重复的影响往往在于执行条件,而不是新的基本市场制度。

奥运会 “波动性宾果游戏”,它是如何运作的

可以把它看作是常见的波动触发因素的清单,这些触发因素可能会在全世界的关注下出现。

一些 “波动率宾果游戏” 方块是永恒的,例如中央银行和地缘政治。其他则更为现代,例如网络干扰风险、气候行动主义和围绕东道城市物流的社会热点。

宏观与政策

央行冲击

当政策预期发生变化时,无论日历如何,市场都可能波动。

2012年伦敦奥运会提醒人们,这个故事不是体育运动。那是欧元区。2012年7月下旬,欧洲央行行长马里奥·德拉吉在伦敦发表了 “不惜一切代价” 的讲话,当时主权压力是主要的波动性主题。

宏观压力已经来临

2008年北京奥运会是在全球金融危机所决定的一年里举行的,波动与信用压力和风险偏好的重新定价有关,而不是事件本身。奥运会从 2008 年 8 月 8 日持续到 2008 年 8 月 24 日。

地缘政治与安全

地区冲突时机

在2008年北京会议期间,俄罗斯与格鲁吉亚的冲突在2008年8月初升级,与奥运会时期重叠。市场教训是,主要广播的地缘政治重新定价不会暂停。

“闭幕式之后” 的风险

2022年北京奥运会于2022年2月20日结束。仅几天后,俄罗斯对乌克兰的全面入侵始于2022年2月24日。

这是经典的 “宾果方块”,因为它强化了相同的原理。地缘政治升级可能发生在全球事件窗口附近,而不一定是由其造成的。

安全事件头条震惊

奥运会也直接受到安全事件的影响,尽管这些赛事本身不是 “市场驱动力”。

塑造重大事件更广泛安全背景的两个历史例子是:

- 1972 年夏季奥运会期间的慕尼黑大屠杀。

- 1996 年亚特兰大奥运会百年奥林匹克公园爆炸案。

现代东道城市气候

环境和反奥运抗议活动

主办城市的行动主义并不是什么新鲜事物,但主题已变得更加注重气候和基础设施。

2024年巴黎奥运会举行了有组织的抗议活动和 “反开放” 活动。巴黎各地的报道还提到了气候组织的环境抗议活动。

当前 2026 年冬季奥运会 在米兰的反奥运抗议活动中开幕,报道包括涉嫌的铁路破坏和示威活动,部分侧重于奥林匹克基础设施对环境的影响。

通过风险情绪、交通中断、政策应对和更广泛的 “不稳定” 框架,这些类型的头条新闻可能间接地影响市场。

网络中断风险

网络 “宾果广场” 在现代游戏中变得越来越突出。

法国国家网络安全机构ANSSI报告了2024年5月8日至2024年9月8日期间向ANSSI报告的548起影响奥运会相关实体的网络安全事件。

即使事件得到控制,网络事件仍然会增加头条新闻的噪音和信心。

物流和 “赛事能否举行” 的争议

有时,波动率的联系不在于奥运会,而是围绕交付的争议。

2024年巴黎奥运会围绕塞纳河和活动准备情况进行了备受瞩目的审查,同时还有大量公共支出用于清理河流,关于水质风险的辩论仍在继续。

健康与颠覆叙事

公共卫生问题

2016年里约奥运会提醒人们,即使市场影响是间接的,健康风险叙述也可能成为奥运会背景的一部分。

在奥运会之前,人们广泛讨论了寨卡病毒的担忧,包括关于全球传播风险和旅行相关传播的辩论。

“延期时代” 的记忆

由于 COVID-19,2020年东京奥运会被推迟到2021年,这突显了全球冲击事件可能主导其他一切,包括主要体育赛程。

交易者的实用要点

奥运时代最可重复的转变通常不是 “更大的波动性”,而是不同的执行条件。

在全球重大事件中,一些交易者选择关注点差和深度,以寻找流动性减弱的迹象,在条件波动时减少交易,并注意地缘政治、网络和抗议头条随时可能出现。

在规模庞大的全球市场中,体育通常不是催化剂。宾果游戏方块是.

奥运会和冬季奥运会吸引了数周的全球关注,吸引了数百万观众,成为头条新闻。对于交易者来说,这种关注通常就像催化剂,但真正的市场驱动因素保持不变:宏观经济、政策和全球风险情绪,而不是体育日历。

那么,为什么一些交易员说在重大体育赛事期间业绩疲软呢?

这通常归结为未能适应利润率可能发生变化的条件,尤其是流动性和参与度。

1。预期 “事件波动”

一个重大的全球事件可以假设市场 应该 多移动。即使条件不支持,一些交易者也认为会出现更大的波动,因此设定了突破或增加风险的立场。

关键驱动因素

- 在某些市场和交易日中,参与度的减少会削弱趋势的跟进度

- 情绪可能会夸大预期,超出价格走势的水平

示例:交易者预计奥运会开幕式期间会出现突破,但低区域参与度限制了价格变动,导致开局不合理。

2。在平静的交易时段强行交易

当价格走势较慢且区间压缩时,一些交易者会感到压力,要求他们保持活跃并接受较低质量的入场机会。

关键驱动因素

- 狭窄的盘中区间会增加虚假信号

- 较低的信念可能有利于盘整而不是趋势,从而增加虚假突破的风险

- “保持参与” 会降低选择性

要点:使用更安静的会话来完善设置或查看数据,而不是强制进行边际交易。

3.忽略较少的流动性

在重大全球事件期间,参与度可能会略有缓解,而且在较短的时间范围内,这种影响通常更为明显。日线图可能看起来很正常,而盘中价格走势随着走势的增加而变得更加波动。

关键驱动因素

- 在深度较低的条件下,价格更容易上涨,灯芯尺寸可能会增加

- 在某些工具和交易时段中,流动性变弱可能伴随着更大的点差和更大的执行变动(因市场、场地和经纪商条件而异)

时间框架对较薄条件的敏感度

上表仅供参考(因市场而异):日线图可能看起来正常。五分钟的图表可能会让人感觉更不稳定。

低音量大灯芯示例

4。在异常情况下使用正常尺寸

即使整体波动率看起来稳定,当流动性减少时,执行风险也会增加,尤其是对于短期或超短线交易式的方法而言。

关键驱动因素

- 滑点可能会增加,止损可能会 “过冲”

- 薄弱的条件可以更容易地在噪音中触发停机

- 与正常情况相比,更大的利差可以改变进入/退出结果

调整:保持固定尺寸可能会失真 有效 风险。一些交易者在设置止损/限额等风险参数时,特别是在较短的交易时段中,会审查交易成本,包括点差和执行条件。

5。跟进度低的交易突破

当参与度下降时,趋势跟踪策略可能会步履蹒跚。动量可能会迅速消散,虚假的中断变得更加普遍。

关键驱动因素

- 流量减少会限制持续的定向移动

- 一些低流动性机制可能倾向于均值回归而不是动量

示例:经典的区间突破似乎在盘中有效,但由于后续交易量未能实现,该突破会迅速消失。

突围失败示例

6。忽视时机和分散注意力的风险

没有可靠的证据表明奥运会日历可以预见地推动地缘政治事件。但是,当紧张局势已经加剧时,重大的全球事件有时可能与注意力转移到其他地方同时发生,有点类似于节日、选举或重大峰会。

交易者应确定条件何时变慢或变弱,并进行相应的调整,调整策略以降低跟进风险,并根据执行现实调整头寸规模。最重要的是,在这段时间内,当优势有限时,避免强行交易。

即将发生的经济事件

火炬在米兰点燃,公众的注意力已经从开幕式的戏剧转移到了滑雪场上的比赛。

但是对于外汇(FX)交易者来说,目光仍然集中在欧元(EUR)图表上。由于意大利处于体育界的中心,欧元区经济正面临着一年中最受关注的时刻之一。

1。主场优势(意大利经济)

一些估计表明,奥运会可能为意大利经济带来约53亿欧元的提振,这要归因于直接支出和火焰熄灭后旅游业的延长。实际上,这可能意味着前期的 “直接支出” 阶段。据估计,米兰和多洛米蒂山脉之间有250万名观众流动,酒店、零售和交通需求可能达到峰值。

清单任务:观察意大利的工业生产(2026年2月11日星期三)。尽管奥运会可能会支持服务活动,但值得关注的是,更广泛的生产数据是否跟上了步伐,或者奥运会的影响是否仅局限于与旅游业相关的行业。

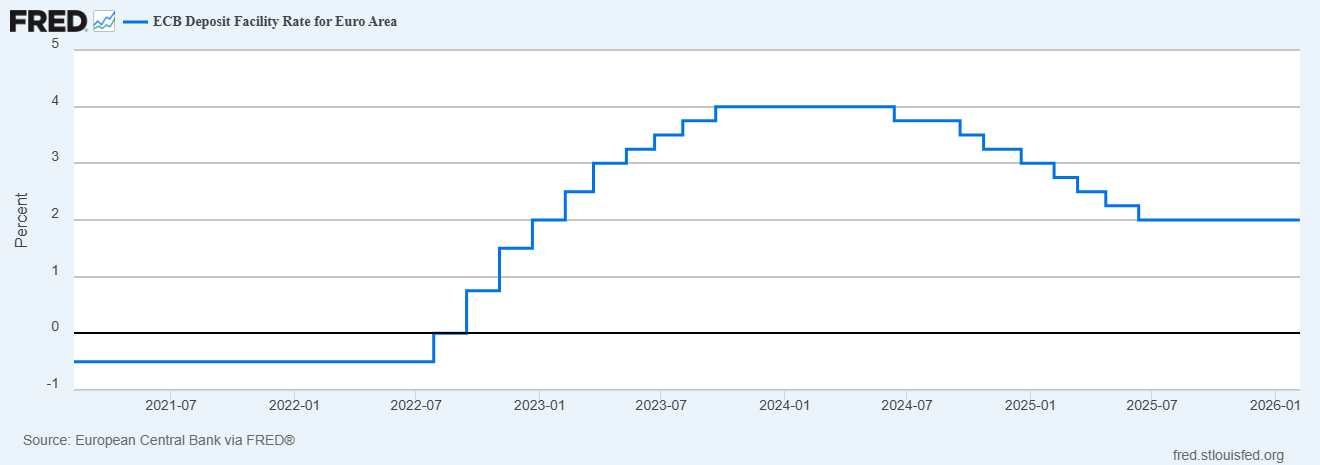

2。欧洲央行发出信号

在2月5日的会议上,欧洲央行(ECB)将政策设定稳定在2.15%,存款额度稳定在2.00%。行长克里斯蒂娜·拉加德表示,尽管通货膨胀似乎在稳定,但欧洲央行仍处于 “观望” 模式。

清单任务:关注本周欧洲央行成员的讲话。任何基调的转变,包括表明利率可能在更长时间内保持较高水平的更为鹰派的倾向,都可能成为欧元/美元的潜在顺风,特别是如果它与更为谨慎的美联储基调形成鲜明对比的话。

3.探索伦敦与纽约的重叠之处

最负盛名的奥运会决赛通常在欧洲晚间举行。对于交易者而言,这与伦敦至纽约的时段重叠(通常是格林威治标准时间 14:00 至 17:00)相吻合。那时欧元交叉盘的流动性最强,头寸可以围绕数据和头条新闻。

清单任务: 预计在这段时间内可能出现的流动性峰值以及 “虚假突破” 的可能性。如果美国的主要数据点(例如周二的零售销售或周五的消费者价格指数)在欧洲市场仍处于开放状态时出现,则欧元对的波动率可能会回升。

GO市场本周展望

4。避风港斜坡

尽管欧元是该节目的明星,但更广泛的地缘政治噪音仍可能给奥运会蒙上阴影。例如,受央行买盘、对美元疲软的预期以及年终预测上调的推动,黄金在2月初短暂突破5,000美元大关后,已经交易价格在5,000美元大关附近。

清单任务:如果情绪转而避险,请关注瑞士法郎(CHF)和黄金等传统避险资产。黄金最近出现了大幅波动,目前正在测试5,000美元附近的阻力。如果奥运会期间地缘政治头条加剧,欧元/瑞郎也可能会出现更大的波动性。

5。国内生产总值最终排名

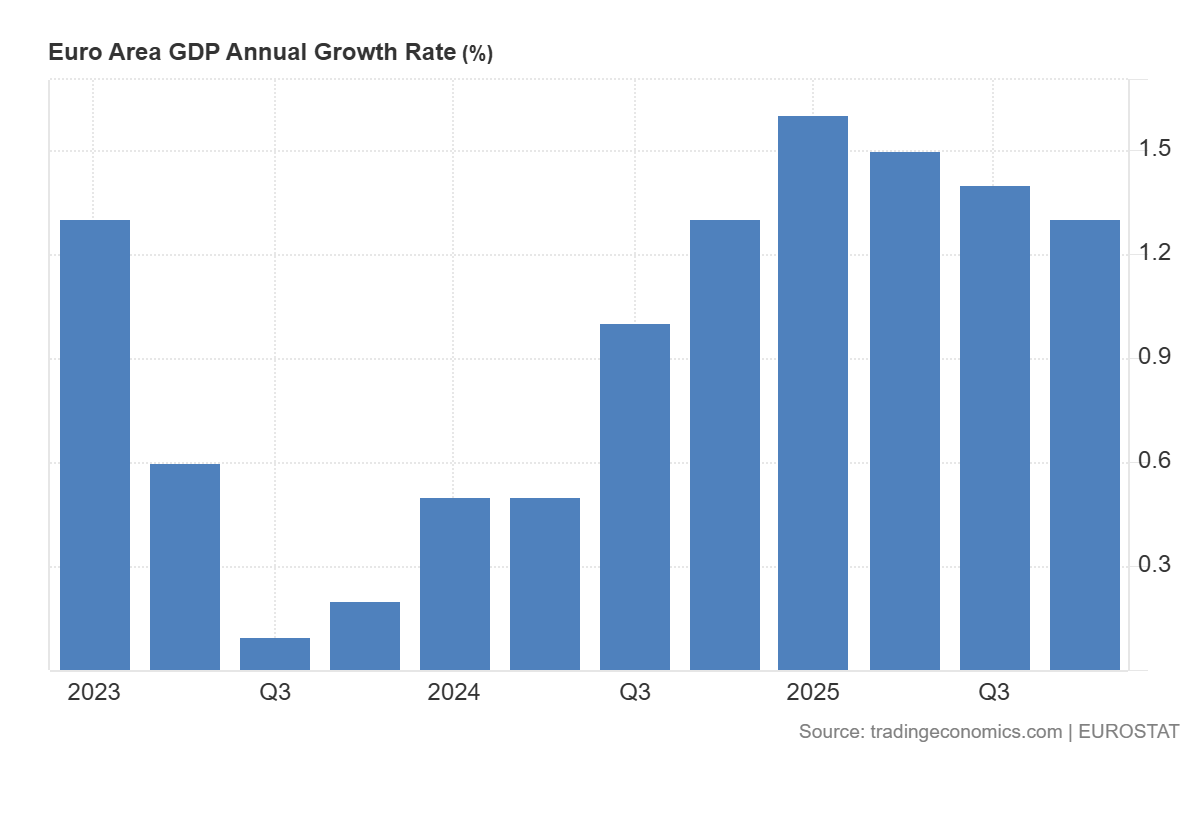

本周以2026年2月13日星期五的欧元区第四季度国内生产总值(第二次估计)结束。

清单任务:初步估计显示增长0.3%。如果该数字向上修正,可能会增强欧元区的弹性,并可能支持欧元周末的出价。

底线

尽管 “奥运提振” 可能为意大利提供情绪缓冲,但欧元的走势仍可能取决于欧洲央行的 “观望” 立场是否受到周五国内生产总值更新或周三工业生产数据的挑战。

随着黄金价格徘徊在5,000美元附近,美国面临着受重新安排数据影响的日历,在黄金时段事件发生之际,波动性可能会在关键的重叠时段内保持较高水平。

关于米兰科尔蒂纳冬奥会期间澳大利亚获得奖牌的机会和市场波动时刻的完整每日指南。

事实速览

- 开幕式: 澳大利亚东部夏令时间2月7日上午6点(米兰2月6日晚上 8:00)。

- 主要观景窗口: 澳大利亚东部夏令时间每天凌晨 4:00 至下午 2:00 与盘前和澳大利亚证券交易所的交易时间一致。

- 颁奖典礼: 通常从澳大利亚东部夏令时间上午 6:00 至上午 7:00 运行。非常适合盘前头寸调整。

- 53 名澳大利亚运动员 竞争: 澳大利亚有史以来第二大冬奥代表队,有10名真正的奖牌争夺者。

GO Markets 奥运赛程

开幕式 + 首枚奖牌-2 月 7 日星期六

早餐时间举行开幕式,然后是周六黄金时段颁发的第一枚金牌。

哈里·莱德劳代表澳大利亚参加男子速降比赛,这是奥运会的首个金牌赛事,而越野滑雪运动员罗西·福特汉姆和菲比·克里德兰则在周六深夜参加比赛。

颁奖典礼和第一枚奖牌在同一天的配对创造了最大的媒体饱和度,在周一的澳大利亚证券交易所开盘之前,将进行整个周末的新闻周期处理。

关键事件

- 开幕式: 澳大利亚东部夏令时间上午 6:00

- 男子速降决赛(奥运会第一枚金牌): 澳大利亚东部夏令时间晚上 9:30

- 女子 10 公里 + 10 公里滑雪三项: 澳大利亚东部夏令时间晚上 11:00

对于交易者来说

- NEC(九号娱乐): 双收视率活动。开幕式周六上午 6:00,为早间电视观众排队等候。晚上 9:30 的第一枚奖牌是周六晚上的黄金时段。

- 意大利股票(富时MIB): 历史上在国内奥运会期间表现不佳。2006年都灵奥运会期间的跌幅为-2.1%。

- STLA(Stellantis): 如果环保组织将仪式作为目标,则ESG将面临头条风险。

- 服装赞助商套利: 如果非热门选手赢得男子速降比赛,他们的赞助商预计平均胜出率为+2.3%(2018年平昌冬奥会,2022年北京奥运会数据)。

首批奖牌仍在继续-2 月 8 日星期日

奖牌热潮将在周日继续,19岁的瓦伦蒂诺·古塞利在男子单板滑雪大跳台上起飞,这使澳大利亚有机会在奥运会视觉效果最为壮观的赛事之一中提前登上领奖台。

由于颁奖典礼仍然焕然一新,古塞利的表现为澳大利亚的滑雪板运动定下了基调,并可能影响周一澳大利亚证券交易所极限运动股票的开盘头寸。

关键事件

- 男子单板滑雪大跳台决赛 (瓦伦蒂诺·古塞利): 澳大利亚东部夏令时间上午 5:30

- 女子普通山地个人决赛: 澳大利亚夏令时间上午 5:57

对于交易者来说

- MNST(怪物饮料): 极限运动赞助商,受益于多项运动员的奥运会。

- 佛罗里达州(Foot Locker)、ZUMZ(Zumiez): 青少年零售极限运动曝光率。古塞利黄金可能会暂时引起轰动。

2 月 9 日星期一

这是澳大利亚奥运日历上罕见的平静日子。澳大利亚没有安排奖牌活动,因此对于交易者来说,这是一个纯粹的观察日。

监控周一澳大利亚证券交易所开盘前如何处理古塞利的周末业绩,以及周二Coady摊牌前的头寸。

2 月 10 日,星期二

苔丝·科迪试图将自己2022年的铜牌升级为女子单板滑雪大跳台的金牌。周二上午的时机为交易者提供了一个潜在的盘前定位窗口,尽管与第二天的大亨明星相比,Coady温和的主流形象限制了风险敞口。

关键事件

- 女子单板滑雪大跳台决赛: 澳大利亚东部夏令时间上午 5:30

对于交易者来说

- 佛罗里达州(Foot Locker)、ZUMZ(Zumiez): 青年零售。Coady gold 可能会暂时引起轰动。

- MNST(怪物饮料): 波动性较小,一般极限运动赞助商。

2 月 11 日,星期三

雅卡拉·安东尼面前的平静。周三没有澳大利亚赛事意味着交易员们花了一天时间为奥运会最重要的时刻做准备:午夜刚过的安东尼大亨决赛。

Moguls 总决赛-2 月 12 日星期四

澳大利亚奥运会最重要的时刻将在周三午夜过后到来,雅卡拉·安东尼将在女子雪橇决赛中捍卫自己的奥运冠军。

作为拥有26次世界杯胜利的全美最光明的金牌希望,安东尼上午12点15分的表现是整个奥运会两周内NEC和VFC股票影响力最大的潜在事件。

周四晚上 10:15,马特·格雷厄姆也在追逐自己的第一枚奥运金牌。这两个事件都具有很高的NEC和VFC波动潜力。

关键事件

- 女子雪上摩托车决赛(贾卡拉·安东尼): 澳大利亚东部夏令时间上午 12:15

- 男子雪上摩托车决赛(马特·格雷厄姆): 澳大利亚东部夏令时间晚上 10:15

对于交易者来说

- NEC(九号娱乐): 监控周四开盘方向的隔夜业绩和收视率。

- VFC(VF Corp/North Face): 赞助两位运动员。双枚奖牌可能会带来更大的影响。

- 卫冕冠军波动率: 安东尼的失利可能会造成更大的情绪波动。

- 社交情绪: 周四上午追踪推特/谷歌趋势,以评估安东尼的表现规模。

2 月 13 日星期五

单板滑雪越野滑雪占据中心位置,两次获得澳大利亚奖牌的机会预示着周五的交易日。

亚当·兰伯特的隔夜决赛开启了上午的开局,而乔西·巴夫的晚间对决则占据了澳大利亚的黄金时段。

关键事件

- 男子单板滑雪越野决赛: 澳大利亚东部夏令时间上午 12:56

- 女子单板滑雪越野决赛: 澳大利亚东部夏令时间晚上 7:30

对于交易者来说

- NEC 情绪指标: 如果兰伯特在周五上午获得奖牌,格雷厄姆在周四晚上获得奖牌,那可能会创造积极的势头。

Jakara Anthony 参加比赛——2 月 14 日星期六

贾卡拉·安东尼将在周六晚上的女子双打决赛中获得双打冠军。

如果她在周四再次在这里夺得黄金,那么 “双金 Jakara” 的叙述不言自明,提供的是几何而不是线性的媒体价值。

关键事件

- 女子双雪上摩托车决赛(贾卡拉·安东尼): 澳大利亚东部夏令时间晚上 9:46

对于交易者来说

- NEC 的叙事力量: “双金Jakara” 可以吸引更多的休闲观众。

- 如果是安东尼银牌/铜牌星期四: 救赎故事的潜力。

- 周末时间: 周六晚上的业绩=周一澳大利亚证券交易所的差距。

- 格式风险: 监控预选赛;如果利润大于 1 秒(井喷式爆发),参与度可能会下降。

2 月 15 日星期日

一个安静的星期天提供兑换弧线和低影响力的行动。布伦丹·科里上午的短道比赛与股票的相关性微乎其微,而马特·格雷厄姆深夜的双冠决赛提供了继周五传统赛事之后的第二次奖牌机会。

关键事件

- 短道速滑 1500 米决赛: 澳大利亚东部夏令时间上午 8:42

- 男子双雪大师决赛: 澳大利亚东部夏令时间晚上 9:46

对于交易者来说

- VFC 第二次机会: 如果格雷厄姆错过了周五的大亨,那么双重大亨的救赎是可能的。

2 月 16 日,星期一

周一深夜,哈里·莱德劳重返滑雪场参加激流回旋比赛,但高山滑雪对澳大利亚观众的影响微乎其微。

这是交易日历中的占位日,市场更专注于消化周末大亨的业绩和为周二的单体决赛做准备。

关键事件

- 男子激流回旋: 澳大利亚东部夏令时间晚上 11:00

Bree Walker 参加比赛——2 月 17 日星期二

布雷·沃克有望创造奥运会历史,她将参加女子单人雪车决赛,追逐澳大利亚有史以来的第一枚雪橇奖牌。

尽管说法很有说服力,但商业现实是,雪橇没有零售赞助商的足迹,限制了股票的直接交易。

关键事件

- 双人花样滑冰决赛: 澳大利亚东部夏令时间上午 6:00

- 女子单宝宝决赛: 澳大利亚东部夏令时间上午 7:06

对于交易者来说

- NEC: 历史上,有舵雪橇的收视率很低,但沃克金牌可以提供澳大利亚人首创的价值。

2 月 18 日,星期三

周三晚上,老将劳拉·皮尔和丹妮尔·斯科特在澳大利亚历史上引以为豪的赛事中占据中心位置(自2002年以来共获得2枚金牌)。但是,航拍的利基吸引力和深夜时机可能会限制市场的影响。

关键事件

- 女子空中技巧决赛: 澳大利亚东部夏令时间晚上 9:30

- 女子回转决赛: 澳大利亚东部夏令时间晚上 11:30

对于交易者来说

- NEC: 如果两者都获得奖牌,则有可能稍微提振情绪。

- VFC 曝光度: 由于空中飞行运动员的商业化程度较低,因此潜力有限。

2 月 19 日,星期四

周四晚上的空中航拍是一场影响较小的压轴赛事,澳大利亚人赖利·弗拉纳根获得奖牌的期望微乎其微,市场相关性甚至更低。

随着比赛的结束,斯科蒂·詹姆斯周六的半管对决才是真正的话题,尽管弗拉纳根获得奖牌可能会造成弱者的叙事。

关键事件

- 男子空中技巧决赛l:澳大利亚东部夏令时间晚上 9:30

2 月 20 日星期五

这是斯科蒂·詹姆斯决定性遗产的周六之前的最后平静。为詹姆斯周六凌晨 5:30 的U型场地技巧决赛做准备,这是澳大利亚运动员最后一次重大潜在波动事件。

斯科蒂·詹姆斯参加比赛——2 月 21 日星期六

斯科蒂·詹姆斯的遗产时刻将于周六早上到来。他代表澳大利亚参加了五届奥运会,获得两枚奖牌和零枚金牌。这是他最后的机会,也是奥运会最激动人心的赛事,也是周一闭幕式前的最后一个主要交易催化剂。

关键事件

- 男子单板滑雪U型场地技巧决赛(斯科蒂·詹姆斯): 澳大利亚东部夏令时间上午 5:30

- SkiMo 混合接力赛: 澳大利亚东部夏令时间晚上 11:30

对于交易者来说

- NEC: 周末价格发现可能会延迟。如果詹姆斯在星期六获得金牌。

- NKE(耐克): 通过极限运动升降机,金牌可能会产生光环效应。

- Guseli 通配符: 华伦天奴也在参加比赛(他继Big Air之后的第二场比赛,2月8日)。双重奖章可以放大叙事效果。

2 月 22 日星期日

十六岁的因德拉·布朗在周日上午的女子自由滑半管比赛中成为人们关注的焦点,与最受欢迎的顾艾琳(中国)对决,这可能会成为Z世代品牌的转折点。

关键事件

- 女子自由式滑雪半管决赛 (因德拉·布朗): 澳大利亚东部夏令时间上午 5:30

- 女子双人雪车决赛: 上午 7:05

对于交易者来说

- 周一至周二手表: 监控哪些品牌宣布与布朗签约。

- MILN(Global X 千禧一代ETF): 极限运动零售商,Z世代社交平台曝光率

闭幕式-2月23日星期一

周一上午的闭幕式为2026年的米兰科尔蒂纳大幕落下了帷幕,历史表明,欣快感就是在这里消失的。

- 男子冰球决赛(NHL 超级巨星): 澳大利亚东部夏令时间上午 12:10

- 闭幕式: 澳大利亚东部夏令时间上午 6:00

值得关注的市场:

- 法国阿尔卑斯山 2030 年旋转: 闭幕式以移交给法国为特色。

- 澳大利亚奖牌数量: 如果超过4枚奖牌(北京总计),政府可能会增加2030年冬季运动的资助。

- 冰上曲棍球决赛: 自2014年以来,NHL球员首次参加比赛。美国/加拿大的主要收视率意味着CMCSA的潜在提升。

全球市场将迎来许多潜在的高冲击催化剂,进入新的一周。日本大选首先在周日举行,其次是美国的通货膨胀和劳动力市场数据,这些数据继续影响着利率预期。

- 日本大选: 政策连续性和政治稳定被普遍视为对区域市场的支持。

- 美国通货膨胀和劳动力市场: 消费者价格指数(CPI)和就业状况报告(非农就业人数,NFP)是本周的直接宏观焦点。

- 比特币风险指标: 比特币回到了2024年底的最后一次水平,并且仍远低于2025年10月的峰值。

- 行业旋转观察: 科技行业最近表现不佳,而价值和防御板块则趋于稳定,财报季继续影响资金流量。

日本大选

日本的大选主要是从政策确定性的角度来看待的。市场通常倾向于财政和货币环境的明确结果和连续性。

意想不到的结果或联盟的不确定性可能会增加本周初日元和区域指数的短期波动。

关键日期

- 大选(日本): 2月8日,星期日

- 周一亚洲交易的业绩

市场影响

- 日元可能对结果、不确定性或政策方向的潜在变化敏感

- 在业绩明确之前,亚洲股市可能会在周初出现波动

美国通货膨胀和劳动力市场

通货膨胀仍然是利率预期的最直接投入,而NFP月度报告则对就业条件和工资压力进行了广泛的解读。

美国国债收益率和美元通常会对这些数据做出快速反应,对股票、黄金和成长型资产产生连锁反应。

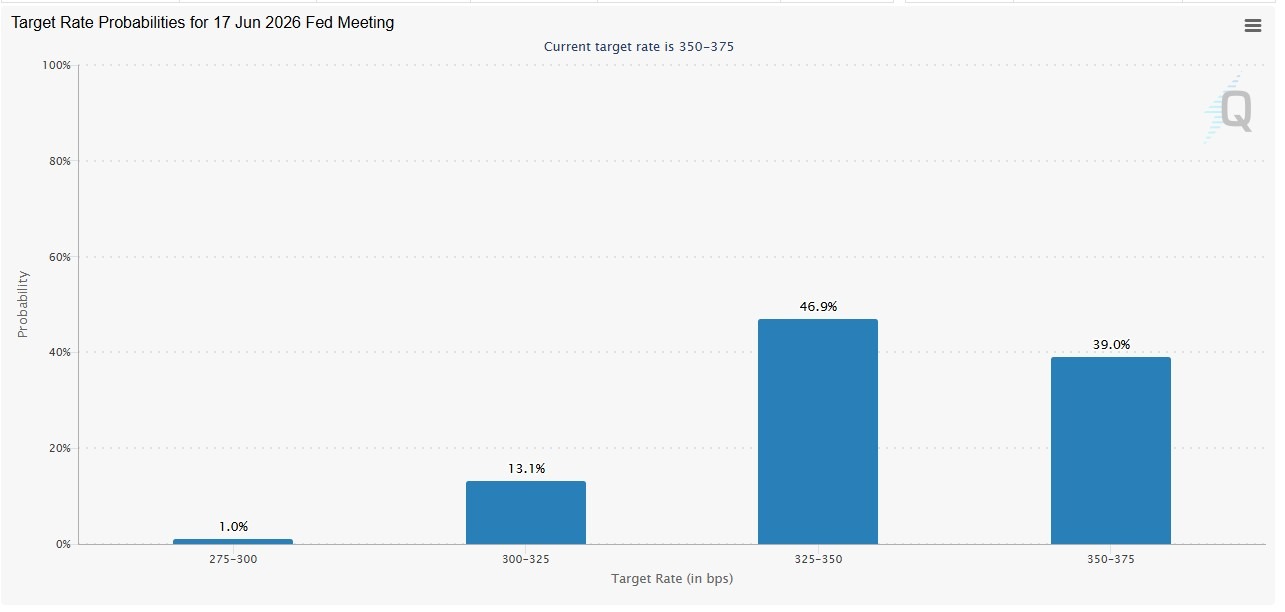

目前的定价表明,在4月会议之前,市场认为降息的可能性不到30%,而6月的会议加息概率超过50%。

关键日期

- 就业情况: 2月11日星期三 08:30(美国东部时间)| 2月12日星期四 00:30(澳大利亚东部夏令时间)

- 消费者价格指数(2026年1月): 2月13日星期五 08:30(美国东部时间)2月14日星期六 00:30(澳大利亚东部夏令时间)

市场影响

- 收益率通常首先变动,其次是美元,然后是风险资产

- 对降息时机的预期可能会迅速调整

- 增长和科技股对利率仍然更加敏感

比特币

比特币已跌至2024年11月美国大选前的最后一次水平,比2025年10月的峰值低了近50%。

虽然不是传统的宏观指标,但可以将加密市场视为投资者风险承受能力的实时读数。持续疲软可能与对包括科技股在内的贝塔值较高的资产采取更加谨慎的立场相吻合。

市场影响

- 加密情绪疲软可能与投机流减少相吻合

- 风险偏好可能仍更具选择性

行业轮换

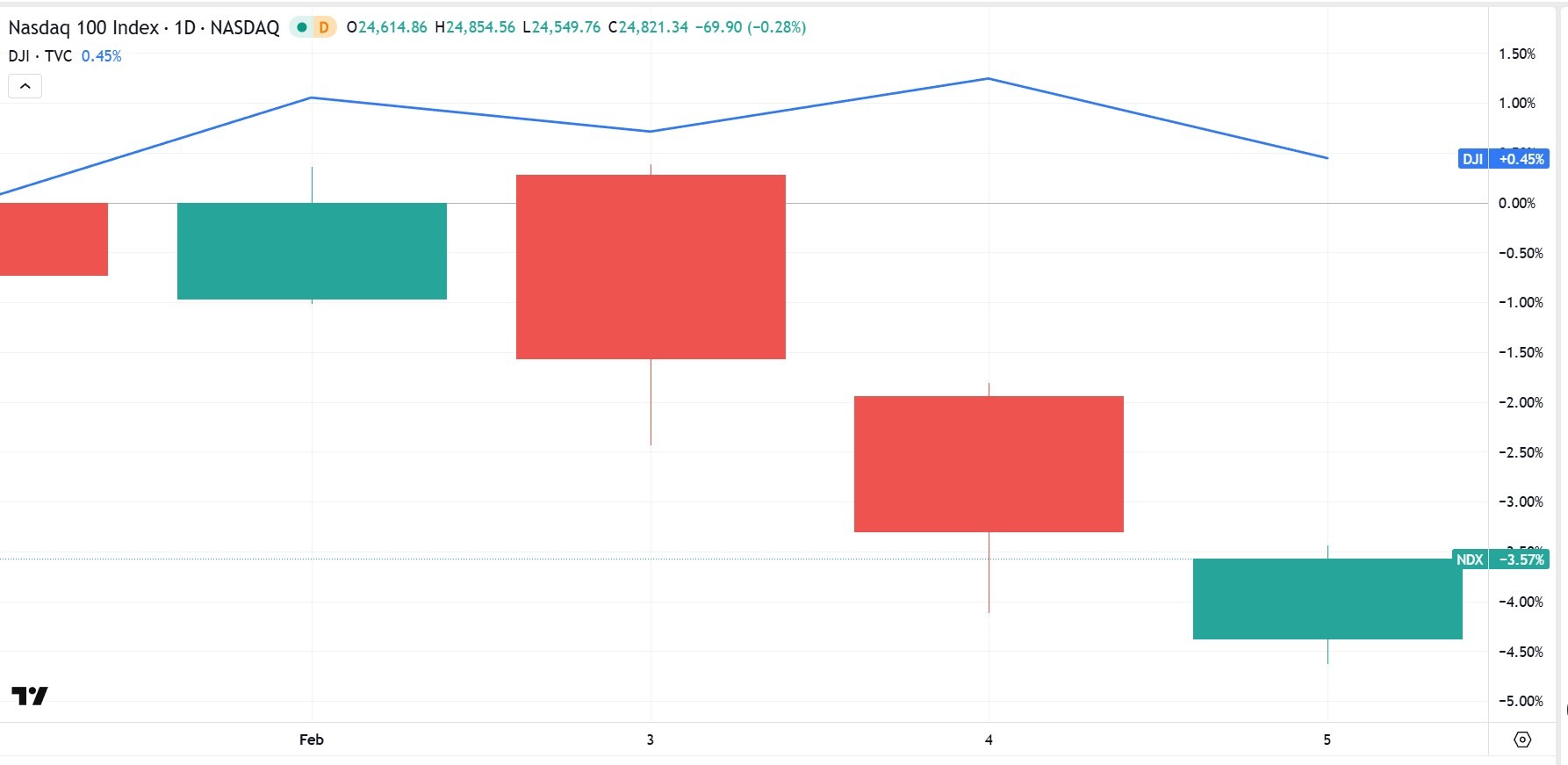

在过去的一周中,道琼斯工业平均指数跑赢大盘,交易价格略低于中性,而纳斯达克100指数下跌了4%以上,这反映了大盘股对收益率走强的敏感性。

此举可能反映出什么

- 利率驱动的增长股承受压力

- 科技表现强劲后的获利回吐

- 财报季有利于更广泛的行业参与

- 对于贝塔值较高的资产,总体上采取更为谨慎的态度

在将这种转变描述为结构性轮动之前,市场通常会寻找金融、工业或国防板块持续多周的跑赢大盘。

市场影响

- 科技股对收益率变动仍然更加敏感

- 价值板块和防御板块可能会获得相对支撑

- 收益指引继续影响领导力