市場新聞與洞察

透過專家洞察、新聞與技術分析,助你領先市場,制定交易決策。

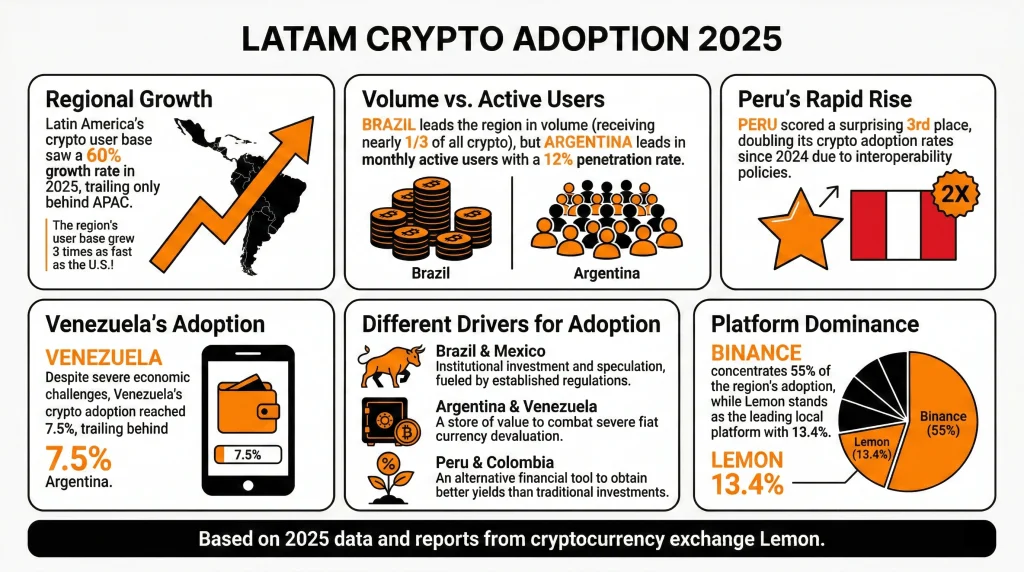

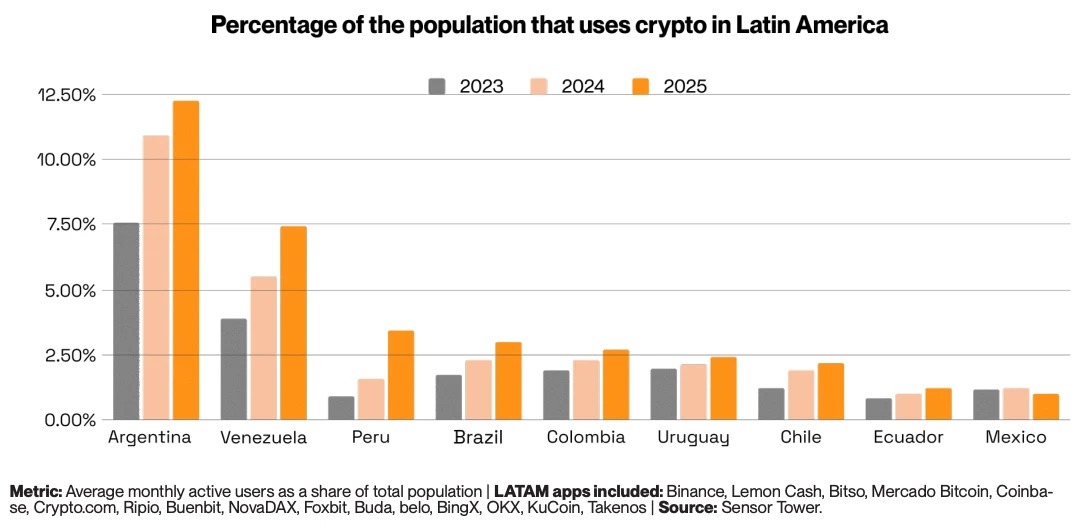

2025年,拉丁美洲(LATAM)的加密货币交易量超过7300亿美元,同比增长60%,这使该地区约占全球加密活动的10%。

2026年,机构参与者开始认真对待该地区,监管正在具体化,2025年以来的结构性驱动因素没有减弱的迹象。但是该地区不是一个单一的故事,2026年将考验当前的势头是建立在坚实的基本面还是投机乐观情绪之上。

事实速览

- 拉丁美洲每月活跃的加密用户同比增长18%,是美国的三倍。

- 阿根廷的月活跃用户渗透率达到12%,占该地区加密活动的四分之一以上。

- 现在,超过90%的巴西加密货币流量与稳定币有关。

- 三个拉美国家进入全球前20名:巴西(第5位)、委内瑞拉(第18位)、阿根廷(第20位)。

- 秘鲁的加密应用程序下载量在2025年增长了50%,下载量为290万次。

从生存工具到金融基础设施

由于投机,拉丁美洲没有接受加密货币。它之所以接受它,是因为传统的金融体系一再让普通百姓失望。在过去的15年中,该地区五个最大经济体的平均年通货膨胀率为13%,而同期美国的平均年通货膨胀率仅为2.3%。

在委内瑞拉,这一比例在一年内达到了65,000%。在阿根廷,这一比例在2024年超过了220%。对于数百万人来说,以当地货币持有储蓄是一种缓慢的自我毁灭行为。稳定币成为了自然的反应。与美元挂钩的数字资产提供了可靠的价值储存、无国界的转移性以及无需银行账户即可访问。

与西方不同,在西方,加密货币更多地被视为一种投机工具,而在拉丁美洲,它已成为一种必要的金融工具。但是,该地区的采用驱动因素并不完全统一。巴西和墨西哥是机构故事,受监管的市场参与和成熟的金融参与者的推动。

阿根廷和委内瑞拉仍然是保值游戏,加密货币是抵御法币崩盘的直接对冲工具。秘鲁和哥伦比亚是更追求收益的市场,加密货币提供的回报是传统储蓄账户无法比拟的。

拉美采用加密货币的速度有多快?

2025年,拉美的链上加密货币交易量同比增长了60%。自2022年年中以来,该地区的累计交易量已达到近1.5万亿美元,在2024年12月达到创纪录的单月877亿美元的峰值。

2025年,拉丁美洲的月活跃加密用户也增长了18%,是美国的三倍。

稳定币是推动这种采用的主要工具。在2025年收到的7,300亿美元中,有3,240亿美元是通过稳定币交易转移的,同比增长89%。在巴西,超过90%的加密货币流量与稳定币相关,而在阿根廷,稳定币占活动的60%以上。

展望未来,根据IMARC集团的数据,到2033年,拉丁美洲的加密货币市场预计将达到4426亿美元,从2025年起将以10.93%的复合年增长率增长。

对于交易者而言,采用速度与其说是头条新闻,不如说是推动采用速度的原因:该地区有6.5亿人以稳定币为基础,实时建设平行金融基础设施。

机构转向

在拉美的大部分加密历史中,采用率是自下而上的。没有银行账户或银行账户不足的零售用户通过本地交易所推动了交易量。现在,高端市场的这种情况正在发生变化。

2026年2月,全球领先交易所运营商德意志交易所集团旗下的Crypto Finance集团宣布向拉丁美洲扩张,目标是寻求机构级托管和交易基础设施的银行、资产管理公司和金融中介机构。

传统银行和金融科技公司纷纷效仿。Nubank现在奖励持有USDC的客户。巴西的B3交易所于2025年批准了世界上第一只现货XRP和SOL ETF,领先于美国。自2024年初以来,包括梅尔卡多比特币、NovaDAX和币安在内的中心化交易所共上市了200多个新的以巴西雷亚尔计价的交易对。

2025年3月,巴西金融科技公司Meliuz成为该国第一家推出比特币增持策略的上市公司,目前持有320比特币。

“拉丁美洲已经在全球范围内采用加密货币。市场现在需要的是机构级治理,这正是我们来到这里的原因,” ——加密金融集团首席执行官Stijn Vander Straeten

加密汇款用例

拉丁美洲每年从海外工人那里获得数千亿美元,这使汇款成为该地区最具体、最可衡量的加密用例之一。传统的转账服务平均每笔交易收取6.2%的费用。对于300美元的转账,大约相当于20美元的费用。

基于区块链的基础设施可以更广泛地降低费用。比特币使每转账100美元的成本约为3.12美元。而像XRP或以太坊第二层基础设施这样更便宜的替代方案可以将其降低到0.01美元以下。

对于向秘鲁汇款1,500美元的移民工人来说,仅从传统银行转账就能节省的费用超过秘鲁每周平均工资。

LATAM 的加密监管环境

最能决定LATAM是否发挥其2026年潜力的变量是加密监管。在这里,情况确实好坏参半。

巴西的《虚拟资产法》在该地区处于领先地位,该法涵盖资产隔离、VASP 许可、AML/KYC 要求和资本标准。它还实施了国内 VASP 转账旅行规则,该规则于 2026 年 2 月生效。但是,一些更具争议的提案,包括对跨境稳定币交易设定10万美元的上限以及禁止自托管钱包转账,仍在积极磋商中。

墨西哥的2018年金融科技法仍然是世界上最早正式承认虚拟资产的法规之一。智利的2023年金融科技法为交易所、钱包和稳定币发行人设立了许可证,正式承认数字资产为 “数字货币”。

玻利维亚于2024年6月批准了受监管的数字资产交易,撤销了长达十年的加密禁令。阿根廷于2025年引入了强制性交易所登记。尽管取消了比特币的法定货币地位,但萨尔瓦多仍在继续扩大代币化经济举措。

该地区的十个国家现在拥有某种正式的加密框架。但是对于交易者来说,监管分歧仍然是一种现实风险,鉴于巴西获得的拉美加密货币交易量占拉美所有加密货币交易量的近三分之一,任何重大的政策逆转都可能产生巨大的后果。

交易者应该注意什么

巴西的制度势头是最重要的结构性趋势。到2025年,巴西的链上交易量为3188亿美元,实际上是拉丁美洲市场。

巴西稳定币磋商的结果可能会产生很大的影响。限制在国内支付中使用外国稳定币将直接影响该地区主导市场中交易量最大的资产类别。

阿根廷是波动率的玩家。2025年,月活跃用户渗透率为12%,加密应用程序下载量为540万次,这表明零售参与度不断提高。

哥伦比亚是一个值得关注的预警市场。2025年比索贬值5.3%,财政危机的加深正在推动稳定币流入,其模式反映了阿根廷早年的发展轨迹。如果哥伦比亚的宏观形势进一步恶化,加密货币的采用可能会加速。

交易所集中风险也在起作用。币安加密货币交易所是超过50%的拉丁美洲加密用户的主要交易所。如果交易所面临任何监管行动、运营中断或竞争冲击,可能会对市场产生巨大的影响。

底线

拉丁美洲的加密市场进入了一个新阶段。导致该地区最初出现加密需求的结构性驱动因素尚未消失:通货膨胀、汇款、金融排斥和货币不稳定都仍在起作用。

所发生的变化是建立在它们之上的图层。机构基础设施、监管框架、企业资金的采用以及流入直到最近还基本自给自足的地区的全球交易所资本。

巴西在2025年将近-250%的交易量增长及其占拉美所有加密货币的近三分之一的地位是决定性的市场发展。其监管轨迹、稳定币政策决策和ETF渠道将有效地为该地区在2026年定下基调。

对于交易者而言,总体增长数据是真实的,但其背后的集中风险、监管不确定性以及国家层面的分歧也是真实的。

Where’s the Federal Reserve at? Slowing Growth and Potential Rate Cuts: Recent economic data suggests a slowdown in growth, contrary to earlier expectations of reaccelerating growth and inflation. Federal Reserve Chairman Jerome Powell's statements and recent economic indicators point towards the possibility of lower policy rates in the near future.

Key indicators, such as the softening in job markets and overall economic activity, indicate that growth is decelerating rather than accelerating. Core inflation remains above the Fed's target but is showing signs of a gradual decline, with core CPI at 0.29% month-over-month (MoM) in April. This trend could build the Fed's confidence that inflation is on a downward trajectory, potentially leading to rate cuts starting in July.

These data trends have filtered into in the market itself. The divergence between the S&P and US 2-year has been come very apparent as yields unwind from their hawkish bets that ramped up on Q1 data. That spread is becoming an interesting trade – it could close as fast as it has opened if data misses.

On the data – what is core to the Fed’s view? Inflation Trends: Core inflation remains elevated but shows signs of slowing. The April core CPI increase of 0.29% MoM aligns with the Fed's expectations of gradual inflation decline.

The slow but steady decrease in shelter prices, particularly the owner’s equivalent rent (OER), is a positive sign. However, the "supercore" non-shelter services sector's inflation is unlikely to slow significantly without a loosening of the labour market and that remains a headwind. That brings us to the next question what is the official views of the Fed?

Federal Reserve Outlook: The recent Federal Open Market Committee (FOMC) minutes and statements from Fed officials suggest it still holds a cautious approach. While there is no major shift towards a hawkish stance, the rhetoric indicates a readiness to cut rates if inflation data supports a premise it’s on a path to a more sustainable level. Yet the view from members is rather mixed, illustrated by the mixed views from members over the past week.

Key Statements Vice Chair Philip Jefferson: Jefferson noted that while April's data is encouraging, it is too early to determine if the slowdown in inflation is sustainable. He emphasized the current restrictive monetary policy and refrained from predicting when rate cuts might begin, stressing the importance of assessing incoming economic data and the balance of risks. Vice Chair of Supervision Michael Barr: Barr expressed disappointment with Q1 inflation readings, which did not increase his confidence in easing monetary policy.

He reinforced the message that rate cuts are on hold until there's clear evidence that inflation will return to the 2% target. Cleveland Fed President Loretta Mester: Mester anticipates a gradual decline in inflation this year but acknowledges that it will be slower than expected. She no longer expects three rate cuts this year and mentioned that the Fed is prepared to hold rates steady or raise them if inflation does not improve as anticipated.

San Francisco Fed President Mary Daly: Daly sees no need for rate hikes but also lacks confidence that inflation is decreasing towards 2%. She sees no urgency to cut rates, echoing the broader sentiment of caution among Fed officials. The conclusion from all this is that the Fed is still giving itself time.

It’s of the view that the restrictive policy will need more time to work, suggesting a prolonged period of higher interest rates to combat inflation effectively and despite the movements in the bond market and USD. Traders in the fed fund futures are still trading a full 50 basis points higher as of now compared to their bets at the March meeting. (Black v Blue line) Other data that matters: GDP and Consumer Spending: Despite strong GDP growth in the latter half of 2023, real GDP growth slowed significantly to 1.6% annualized in Q1 2024. Final private domestic demand was sustained primarily by consumer services spending, even as real goods spending declined.

The weakening consumer spending on goods is beginning to spill over into the services sector, indicating broader consumer weakness. Manufacturing and Investment: Data on manufacturing and business investment remains weak. Manufacturing production has stagnated, and orders for durable goods have not shown significant improvement.

Residential fixed investment is also slowing, with housing starts and building permits both declining in April. Housing Market: Existing home sales data, to be released soon, is expected to show a modest rebound from the previous month. However, ongoing weakness in the housing market, influenced by higher mortgage rates, remains a concern.

Hot Copper – Too hot? Copper has experienced significant price movements, with several key factors contributing to the recent trends in copper prices, spreads, and inventory levels. The following points provide an in-depth analysis of the forces at play: Tighter Physical Copper Market: Last week's record highs in COMEX and SHFE copper prices, alongside the COMEX-LME copper spreads indicate a very tight physical copper market.

This saw the LME copper price smash a new record all-time high (above US$11,000 a tonne). The dislocation in copper price benchmarks, such as the COMEX-LME spread, typically leads to adjustments in physical flows. However, current conditions are proving challenging, with generally low copper inventories and logistical issues.

For example, traders in China are facing tight shipping schedules, making it difficult to move copper to the US. Suggesting the price will hold in the interim De-commoditisation of Commodities: Deliverable Metal Scarcity: The elevated COMEX copper prices relative to other benchmarks can be partly attributed to the lack of deliverable metal. Only 17% of the metal in LME warehouses originates from countries with COMEX-approved brands.

This scarcity of deliverable inventory means that most of the available copper cannot be used to satisfy COMEX contracts, driving up the COMEX copper premium. RIO, BHP and the like all benefit from this. Influence of Financial Flows: Naturally this kind of move brings highten investor and trader interest.

COMEX copper futures are experiencing all-time highs in long positioning and record open interest in copper options. This surge in financial flows has pushed COMEX copper prices higher compared to other benchmarks and has been more resistant to reversal. What next?

The tight inventory situation is likely to persist, especially if logistical challenges and shipping delays continue. This will maintain upward pressure on prices and could lead to further dislocations between different copper price benchmarks. Efforts to alleviate bottlenecks will be crucial in normalizing price spreads and stabilizing the market.

Any improvement in shipping schedules or inventory replenishment could ease some of the current tensions, but we do not hold our breathe for this to occur any time soon. Conclusion The recent record highs in copper prices and spreads underscore a complex interplay of tight physical markets, and significant financial flows. Traders should closely monitor these dynamics and adapt their positions to capitalise on potential switches and further squeezes.

But in the main Dr. Copper is hot and likely to remain so until supply catches up.

What is going on with Taiwan? Taiwan is back in the news after US speaker of the house Nancy Pelosi visited the country causing a fiery reaction from the mainland of China. Historical background In order to understand the causes of the China/Taiwan tension, some historical perspective is needed.

The current tension stems from the Chinese civil war 1927 – 1949 where Mao Zedong’s Communist army and Chiang Kai- Shek’s Republic of China army fought in a series of intermittent battles to secure control of mainland China. As the Communist army began to gain ascendancy, Chiang Kai–Shek and the Republic of China movement was forced into exile to Taiwan. Since this exile and lasting until today, a long-standing military and political standoff has been in place between the two countries with each claiming to be the rightful controller of China.

In recent years, China has attempted to expand its influence and places such as Hong Kong have seen Beijing challenge its sovereignty the pressure has been building on Taiwan. At times of increased tension, China has conducted military exercises in the Taiwan Strait to act as a ‘warning’ to Taiwan and the West that it may be treading too close to China’s political interests. Current Day Events Nancy Pelosi became the first US speaker of the House to visit Taiwan in more than 25 years.

The visit by Pelosi, whilst not necessarily threatening is an act that supports the legitimacy of Taiwan as a democratic, sovereign government. Pelosi challenged the essence of China’s communist regime and stated, “Today the world faces a choice between democracy and autocracy.” However, the speaker did not go as far as to offer any specific military support to protect against an aggressive response from the CCP.. Any act of economic or military support has the potential to draw an aggressive response from the CCP.

Why does this matter? Traders and investors do not have to look too far to see what can happen to the market if geopolitical conflict breaks out. It is still only a few months on since the Russia and Ukraine conflict broke out.

After the initial invasions, commodity prices soared as sanctions were placed on Russia and supply chains were placed under pressure. The market is still trying to adjust to these consequences today. In addition, the Ruble took a huge hit and Moscow Exchange had to be closed as countries placed sanctions on Russia and its monetary system.

If China was to invade Taiwan it is reasonable to expect economic sanctions will follow. With China being such a huge player in the global supply chain, it may have a larger effect on commodity prices. The Ukraine conflict showed the world how fragile global supply chains can be when conflict strikes.

Specifically, Gas, Grain, Oil rocketed in price. Regarding Taiwan and China, a large portion of the world semi- conductors are produced in Taiwan which means that there could be disastrous consequences that may ensure should war breakout. A more detailed discussion on the impact that a shortage of semiconductors may have can be found below. https://www.gomarkets.com/au/articles/economic-updates/semi-conductor-supply-crunch/ Similarly, the Yuan may take a hit with any kind of escalation in conflict.

Therefore, traders should be aware of the conflict and ongoing tensions as trading opportunities may eventuate. The USDCNH can be traded on Go Markets platforms.

The Society for Worldwide Interbank Financial Telecommunication, legally S.W.I.F.T. SC, is a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide. Its principal function is to serve as the main messaging network through which international payments are initiated.

It also sells software and services to financial institutions, mostly for use on its proprietary "SWIFTNet". Its important to understand that money is not moved through the SWIFT system but most importantly is the data attributed to the money that is moved through this medium. In other words, without SWIFT the institutions wouldn’t know who and for what reason is a transaction is being made.

For example; if you are sending money from country to country, SWIFT would inform the recipient bank that is getting the money, to expect a certain sum, from a certain bank. So its an extremely important step that will be taken away from Russia. If you do not have that information flow; you simply cannot do any international transactions.

SWIFT welcomes the public launch of the New Payments Platform (NPP) in Australia, which is set to revolutionise the way payments are made domestically. SWIFT has helped to design, build, test and deliver the NPP and will play a key role in operating the infrastructure for the NPP. The NPP’s paradigm-shifting financial architecture has been designed and constructed to fundamentally improve how consumers, businesses and governments transact with one another.

The key features of the NPP include: 24/7 instant payments and real-time line-by-line settlement via the Reserve Bank of Australia’s Fast Settlement Service PayID, the new and easy way to link a financial account with an easy-to-remember identifier such as a mobile phone number, email address or ABN for businesses Open access platform that truly empowers innovation through competition Overlay services framework that will provide new value services to Australian consumers, businesses and government Russia’s SWIFT Sanction Since the invasion of Russia, many countries have joined forces in order to impose heavy sanctions on Russia. Some of these actions are to limit, deter and coerce Russia or Vladimir Putin into changing his strong stance in the war against Ukraine. These sanctions would be felt throughout all classes of Russia’s community and its corporate arm.

One popular sanction has been to remove Russia from the SWIFT messaging system, with the intention to stop any Russian companies from doing international business, which in turn would hurt Russia’s economy and potentially turn Russian loyalists against Mr. Putin and force him into an unlikely reversal of the war. Although this is somewhat looked upon as a key destabilizing strategy by the West, there are some that feel the move is mostly symbolic.

EU bars 7 Russian banks from SWIFT, but spares those in Energy (Reuters). The European Union said on Wednesday (2 nd march) it was excluding seven Russian banks from the SWIFT messaging system, but stopped short of including those handling energy payments, in the latest sanctions imposed on Russia over its invasion of Ukraine. VTB Bank PJSC and Bank Rossiya are among the banks that face a ban from the messaging system.

The other institutions included on the EU list are Bank Otkritie, Novikombank, Promsvyazbank PJSC, Sovcombank PJSC and VEB.RF, said the officials, who asked not to be identified because the decision was private. European Union ambassadors agreed to spared the nation’s biggest lender Sberbank PJSC and a bank part-owned by Russian gas giant Gazprom PJSC. Would it work: Professor of Financial Economics at the University of Loughborough University, Alistair Milne, explains why he is sceptical of the sanction. “Russia’s exclusion from the international payments messaging system Swift, is presented as a powerful means of undermining its economy.

But for a payment’s expert such as myself, this is something of a myth.” He continues, “The reality, however, is that limiting access to Swift is less practically effective than most media coverage supposes. It is an important symbol of global repudiation of Russia’s exercise of military force, but not much more. It is other measures, such as blocking the central bank of the Russian Federation from transacting internationally, which is undermining confidence in the Rouble.” “There is no fundamental problem with transferring funds using some other secure messaging systems.

Russian banks might, for example, instead arrange payments using the SPFS system, which was established after the 2014 invasion of Crimea by the Russian central bank. This is currently used by a handful of international banks in Germany and Switzerland linked to Russian banks.” “Or they could use the CIPS network, which was created by the People’s Bank of China for the purpose of cross-border payments with indirect participants in many countries. They could even use WhatsApp to instruct the necessary transactions.” Leaving room for negotiation?

The EU has avoided the sanctioning of all Russia banks, specially those that use SWIFT in the energy industry. This might be crucial as they seem to be trying to limit Russia, but at the same time keep the door ajar to be able to negotitate energy deals, which, the West are hugely dependednt on. Another thing to note is payments for Russian energy exports, for example to Gazprom, are even less Swift-dependent.

When operators buy oil or gas from Gazprom, they make payments in either euro or US dollars into bank accounts held by the Russian energy company. So if the intention of sanctions is to block payments for Russian gas, the tool is not Swift; it is sanctions on Gazprom and its banking facilities. Perhaps this could be something that is visited in the future.

The absence of Sberbank PJSC and Gazprombank shows the continuing level of concern over the consequences for Europe from a financial isolation of Russia spilling over into the global economy, especially when it comes to energy supplies. The bloc is also worried Russia could retaliate by cutting deliveries. Sources: Reuters, Wikipedia, Loughborugh University, Bloomberg, swift.com

Walmart tops expectations for Q2 – the stock is up Walmart Inc. (WMT) announced its Q2 financial results before the market open on Wall Street on Tuesday. World’s largest supermarket chain reported results that exceeded analyst expectations, sending the stock price higher. The company reported revenue of $152.859 billion (up by 8.4% year-over-year) vs. $150.994 billion expected.

Earnings per share reported at $1.77 per share for the quarter vs. $1.62 per share estimate. Doug McMillon, President and CEO of Walmart commented on the latest results: ''We’re pleased to see more customers choosing Walmart during this inflationary period, and we’re working hard to support them as they prioritize their spending. The actions we’ve taken to improve inventory levels in the U.S., along with a heavier mix of sales in grocery put pressure on profit margin for Q2 and our outlook for the year.

We made good progress throughout the quarter operationally to improve costs in our supply chain, and that work is ongoing. We continue to build on our strategy to expand our digital businesses, including the continued strength we see in our international markets.'' Walmart Inc. (WMT) chart The stock was up by over 6% on Tuesday, trading at $140.233 a share. Here is how the stock has performed in the past year: 1 Month +8.62% 3 Month +7.14% Year-to-date -2.74% 1 Year -6.62% Walmart price targets Deutsche Bank $142 Raymond James $140 BMO Capital $160 Cowen & Co. $150 Morgan Stanley $145 UBS $152 Credit Suisse $133 Wells Fargo $130 Walmart is the 14 th largest company in the world with a market cap of $383.98 billion.

You can trade Walmart Inc. (WMT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Sources: Walmart Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The USDJPY has been in an extremely strong upward trend since September 2021. This pair's recent price action has also been charactarised by relatively weak retracements as it has trended higher. Inflationary pressures have acted as a strong catalyst for the USD against most other currencies further aided by the Federal Reserve taking a strong stance against inflation with a series of aggressive interest rate hikes.

At the same time, the JPY has remained weak as the Central Bank of Japan has refused to intervene and shift from its dovish stance. The most recent retracement shows the potential for a good risk/reward Long trade. On the chart, it can be seen that the price has pulled back to the 23.60% Fibonacci level, which is at 132/133JPY.

This area also doubles as a support zone with the prior resistance level becoming a level of support which is another sign that the trend may continue. On the weekly chart, the characteristics of the candlesticks near the support zone also support the premise that the price may bounce. The candles have long wicks touching the support area indicating that the buyers are soaking up the supply.

They have also closed near their opening price again showing how buyers are soaking up the supply. The 4-hour chart shows a consolidation of the price forming a triangle, with the potential to break out to the upside. This may provide an alternative entry signal for the same overall strategy.

An important aspect to remember when trading this strategy is to ensure that price occurs with relatively high volume. Large volume indicates that buyers are regaining control over the price, and that sellers have become exhausted. Potential risks There are some risks with this trade.

Firstly, the pair is already quite overextended with the price at multi-decade highs. In addition, with US inflation fears potentially easing and interest rate hikes priced in already, the current price may be near its peak.

USDJPY ready to bounce or retrace further. The USDJPY has been recently provided great buying opportunities for traders. However, in recent days it has posted its largest drop since beginning the current upward at the beginning of January 2021.

The question remains, is this just a standard retracement or is it a symbol of a much bigger reversal. In the last few months, the USD has risen sharply as the market has responded to inflation fears and geopolitical events. With inflation levels at record levels across much of the developed world many Central Banks have shifted to a hawkish stance regarding their monetary policy with the USA being a prime example of this.

On the contrary, the Central Bank of Japan has remained dovish almost acting as a lone solider compared to other countries in this regard. Despite this, as bond yields have begun to settle down and the market has begun to price in recession fears and inflation, the YEN has become attractive again. Technical Analysis Looking at the technical elements of the chart, the price is down from the multi decade highs of 139 that it reached in the middle of July.

Importantly the price has also dropped below the most recent support level. In addition, the price has also breached the 50-day moving average. The question that remains is whether this is a simple retracement or the signs of a reversal occurring.

There are two characteristics of this price action that support the potential bounce back to the upside for this currency pair. Firstly, on the daily, chart, although the price did break through the initial first level of support it is currently holding the next stronger level down at 131/132. In addition, looking at the weekly chart, the price is showing a relatively strong bounce off the same 131/132 zone.

This multi timeframe analysis, further supports the continuation of the upward trend of the pair. The midterm buy target may be a retest of the 140 level. There is a large risk with this trade.

If the ‘Top’ is indeed ‘in’ and the pair does start to falter, then there is risk of massive selling. This is because the pair is already so overextended to the buy side. In addition, a rush to close Yen short positions may further accelerate the move back downward.

If this does occur and the 130 level breaks it may see the price fall to the 125 level. The short-term future of the pair will still likely be determined by short term economic news and activity within both Japan and the USA.