Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

Em 28 de fevereiro de 2026, quando o ataque conjunto dos EUA e Israel começou, os números nas telas começaram a se mover de uma forma que parecia clínica, mesmo quando a realidade no terreno, com as trágicas mortes de vítimas civis no Irã, parecia tudo menos isso. Os mercados, como dizem, não têm uma bússola moral, mas sim uma máquina de pesagem e, neste momento, estão avaliando a transição de toda a economia global de um modelo “just-in-time” para um ciclo “just-in-case”.

O que os mercados estavam sinalizando

Em 2 de março, a fita de índice permaneceu cautelosa enquanto a defesa aumentava. Historicamente, os conflitos podem acelerar o reabastecimento e os pedidos, mas o tamanho (e a rapidez) ainda depende de orçamentos, aprovações e gargalos de entrega.

Os vencedores

1. Hanwha Aerospace (012450.KS)

Hanwha é um dos nomes mais negociados vinculados ao tema “K-Defense”, uma empresa cada vez mais vista pelo mercado como fornecedora escalável de um ciclo global cada vez mais apertado de artilharia e munições. Capacidade e credibilidade de entrega.

Quando o reabastecimento se torna urgente, a capacidade de produzir em grande escala geralmente é tão importante quanto a própria plataforma. A demanda de exportação vinculada a sistemas como o K9 Thunder e o Chunmoo reforçou a narrativa de um fluxo de pedidos durável, mesmo quando os resultados ainda dependem de orçamentos, aprovações e prazos de entrega.

Principais coisas que podem mover o sentimento: atualizações do livro de pedidos, ritmo de produção e quaisquer anúncios de exportação subsequentes.

2. Northrop Grumman (NOC)

A Northrop se concentrou à medida que os investidores reavaliaram a exposição à modernização estratégica e a grandes programas de longa duração. Os mercados de defesa, muitas vezes vistos como essenciais, podem persistir em todos os ciclos. É menos sobre um quarto e mais sobre se o ímpeto permanece estável se as prioridades de modernização permanecerem em vigor (e se os cronogramas mudam se não mudarem).

Variáveis-chave que podem mover o sentimento: Ritmo de aquisição, prazo do contrato e linguagem de financiamento relacionada ao programa.

3. Corporação RTX (RTX)

O RTX voltou ao centro da fita quando os investidores avaliaram um ciclo de reabastecimento de interceptores e a economia da defesa aérea de alto ritmo. O desgaste é caro e, quando as taxas de uso aumentam, os governos normalmente precisam reabastecer os estoques e, em muitos casos, financiar a expansão da produção, o que pode aumentar o atraso e aumentar a visibilidade da receita.

Variáveis-chave que podem mover o sentimento: Pedidos de reabastecimento, indicadores de expansão da fabricação e produtividade de entrega.

4. Lockheed Martin (LMT)

A Lockheed chamou a atenção quando os mercados se concentraram na demanda por defesa antimísseis e na questão que cada mesa de compras enfrenta em um ambiente de alto ritmo: com que rapidez os estoques podem ser reconstruídos? Se a utilização permanecer elevada, os vencedores tendem a ser os empreiteiros mais bem posicionados para escalar a produção e entregar de forma confiável. A exposição à defesa antimísseis da Lockheed a mantém intimamente ligada a essa narrativa de reabastecimento.

Variáveis-chave que podem mover o sentimento: sinais de rampa de produção, economia unitária e cadência de pedidos orientada pelo orçamento.

5. Sistemas BAE (BA.L)

Com um acúmulo de 83,6 bilhões de libras e um papel central no programa submarino AUKUS, a BAE entrou em foco quando partes da Europa sinalizaram maiores ambições de gastos com defesa. As ações subiram 6,11% para uma alta de 52 semanas em meio a uma rotação “sem risco”, com os comerciantes observando os marcos do AUKUS e as aquisições europeias de defesa aérea e antimísseis, incluindo o “Sky Shield”.

Variáveis-chave que podem mover o sentimento: Um potencial catalisador é qualquer aumento claro nos gastos alemães que eleve o fluxo de pedidos nas unidades europeias da BAE, enquanto os principais riscos incluem um forte aumento nos rendimentos do ouro do Reino Unido, uma nova volatilidade da libra esterlina ou uma “ameaça de paz” na obtenção de lucros.

Os perdedores: nem todo 'estoque de guerra' sobe

6. Ambiente aeroportuário (AVAV)

A AeroVironment subiu 18% na abertura antes de cair 17% no período intradiário após relatos de que a Força Espacial dos EUA estava reabrindo um contrato de USD 1,4 bilhão. A medida destaca como os processos de aquisição e o risco do contrato podem impulsionar a volatilidade, mesmo em ambientes temáticos favoráveis.

7. Defesa de Kratos (KTOS)

Kratos aborda o tema de drones e munições vadiadoras, que ganhou atenção à medida que o conflito no Oriente Médio se intensificava. As ações ainda foram vendidas após os lucros, destacando um risco comum do setor de defesa. A Kratos anunciou uma grande oferta complementar de ações na faixa de USD 1,2 bilhão a USD 1,4 bilhão. A medida fortalece o balanço patrimonial e pode apoiar futuros investimentos em programas.

Para negociadores focados em narrativas de “prêmio de conflito” de curto prazo, a diluição pode alterar rapidamente a configuração. Mesmo quando as condições de demanda parecem favoráveis, o mercado pode reavaliar as ações se cada acionista finalmente possuir uma parte menor do negócio.

8. Máquinas intuitivas (LUNR)

Alguns nomes especulativos de tecnologia espacial ficaram para trás, pois os investidores pareciam favorecer empresas com receitas mais estabelecidas vinculadas à defesa.

9. Boeing (BA)

A Boeing caiu cerca de 2,5% na sessão. Embora sua divisão de defesa seja significativa, seus negócios comerciais podem ser mais sensíveis à demanda da aviação, às interrupções no espaço aéreo e às mudanças no preço do petróleo.

10. Spirit AeroSystems (SPR)

A Spirit AeroSystems permanece intimamente ligada ao ciclo global de produção de aeronaves como uma importante fornecedora de aeroestruturas. Resultados recentes mostraram perdas crescentes, apesar do aumento das vendas, refletindo os aumentos contínuos dos custos de produção nos principais programas de aeronaves. Essas pressões pesaram sobre a confiança dos investidores nas perspectivas de curto prazo. A aquisição planejada pela Boeing pode, em última análise, remodelar a posição da empresa na cadeia de suprimentos, mas o risco de execução e a estabilidade da produção permanecem fundamentais na forma como o mercado precifica as ações.

O que assistir a seguir

- Escalação versus redução da escalada: Uma mudança em direção à diplomacia ou às discussões sobre o cessar-fogo pode mudar rapidamente o sentimento em relação às ações de defesa.

- Petróleo e transporte marítimo: Os picos de energia podem restringir as condições financeiras e pressionar setores cíclicos.

- Orçamentos e prêmios: Às vezes, os movimentos de preços podem preceder as decisões do contrato, com clareza chegando quando os prêmios são finalizados.

- Capacidade de produção: Empresas com histórico comprovado de produção e entrega geralmente atraem a maior atenção dos investidores.

- Restrições da cadeia de suprimentos: Terras raras, propulsão e eletrônicos continuam sendo possíveis gargalos que podem limitar a rapidez com que a produção cresce.

A lente de longo prazo

O conflito de 2026 no Irã é, antes de tudo, uma tragédia humana. Para os mercados, isso também pode representar uma mudança na forma como os gastos com segurança nacional são priorizados dentro das estruturas fiscais. Se os gastos com defesa permanecerem elevados em um horizonte de vários anos, empresas com capacidade de fabricação escalável e tecnologias integradas poderão atrair a atenção contínua dos investidores. Dito isso, os mercados se movem em ciclos. Os temas estruturais podem persistir, mas também podem ser reavaliados rapidamente quando as suposições mudam. Manter-se analítico e consciente dos riscos continua sendo fundamental.

As referências a empresas, setores ou movimentos de mercado específicos são fornecidas apenas para comentários gerais do mercado e não constituem uma recomendação, oferta ou solicitação para comprar ou vender qualquer produto financeiro. As reações do mercado a eventos geopolíticos ou macroeconômicos podem ser voláteis e imprevisíveis, e os resultados podem diferir materialmente das expectativas.

Introduction: Understanding the Impact of Entry Errors Trade entry is a critical moment that is undoubtedly contributory to the success or failure of a trade (although exits remain an additional key component of course). Whilst many traders focus much energy and effort on entries, the importance of a well-planned and so called ‘high probability entry’ is often underestimated. Poor entries can put traders at an immediate disadvantage, increasing risk exposure, reducing profit potential, and fostering a cycle of emotional and often questionable decision-making at this critical point of any trade.

This article delves into the most common entry mistakes traders make, why these errors occur, and, more importantly, how to avoid them. Many of these are insidious but if remain unchecked can lead to disappointment in trading outcomes, and at worst, may result in significant trading losses if they are not addressed over time. Through developing a greater understanding of the psychological pitfalls, potential technical missteps, and strategic errors made behind poor entries, traders can take actionable steps to enhance their consistency and performance in the markets.

Whether you're a beginner or an experienced trader, mastering your trade entry process can have a profound impact on your long-term trading outcomes and ultimate success or otherwise. The great news is that many of these are not “hard” fixes. Although by no means an exhaustive list, and often connected, these TEN errors in our experience appear to be the most common, Use these areas covered below as a checklist, making notes on any aspect that may resonate you’re your behaviour and of course subsequently take appropriate action as needed. #1.

Chasing Price Implications: Chasing price happens when traders enter impulsively after a sharp price movement in a particular direction. This is often driven by FOMO (Fear of Missing Out), and typically results in buying at overextended levels where a trend is already very established and may have almost run its logical technical course. This often results in a trade reversing or at best price exhaustion and little or no positive outcome over time.

Price reversal will often, even with the appropriate risk management in place result in repeated losses. Solutions: Develop a disciplined approach by waiting for either retracements to logical support levels, with of course evidence either of a bounce upwards, or even a breach of a new key level, or previous swing high (or low if “going short”). Either of these approaches may result in achieving a more favourable entry.

Also many trading platforms, including MT4 and MT% GO Markets platforms can use notification alerts to identify when the price reaches these levels, which is a useful feature that may assist in making sure robust decision-making occurs on a consistent basis. Additionally pending orders may also be used as part of your effective entry toolbox, set with more “cold” logic rather than being driven by emotional excitement of price velocity that may often be short-lived. #2. Ignoring Market Context Implications: Ignoring the broader market environment leads to trades that contradict prevailing trends or key market conditions.

T his oversight often results in entering trades with low probability, increasing the likelihood of stops being triggered. For long-term success, aligning trades with the dominant market forces is not only logical but appears from any research performed to be generally higher probability of at least some period of time where it is more likely that price will move in your desired direction. Failure to do so on a regular basis, can leave traders feeling like they're always on the wrong side of the market.

Example: A trader shorts the S&P 500 during a small pullback, not realising the index is in a strong uptrend on the daily chart. The pullback ends, and the uptrend resumes, quickly hitting the stop-loss. Solutions: Perform a multi-timeframe analysis before entering a trade.

Use higher timeframes (e.g., daily if trading an hourly timeframe) to understand the broader trend and ensure the trade aligns with it. Incorporate trend-following tools like moving averages or trendlines to validate entries is of course a common method to help substantiate this approach. #3. Over-Leveraging Positions Implications: Over-leveraging magnifies both potential profits and losses, but the latter can have devastating consequences.

Even small adverse price movements can wipe out significant portions of an account, leading to margin calls (and so taking “exit control” away from the trader) or even complete account depletion. This often traps traders in a cycle of "chasing losses," further compounding mistakes. Solutions: Implement strict position sizing rules.

For example, risk no more than 1-2% of your account on a single trade by adjusting your position size relative to your stop-loss distance. Your maximum ‘Risk per trade’ should be based on your Tolerable risk % of Account size per trade (e,g, 1%) x Entry price to Stop-loss distance. #4. Entering Without a Stop-Loss Implications: Trading without a stop-loss exposes traders to uncontrolled risk.

It fosters a dangerous mindset of "hoping" the market will work in their favour, often leading to mounting losses. A single large loss can undo months of profitable trading, shaking both confidence and capital and so have longer term psychological implications such as loss aversion, which can further distort good decision-making. Solutions: Use stop-loss orders based on logical technical levels, such as below a recent swing low.

Although less pertinent to entry but equally important through the life of a trade is potential use of trailing stops can also help lock in profits as the price moves favourably, protecting against reversals and of course profit targets based on logical potential technical pause or reversal points. #5. Over-Reliance on Indicators Implications: Indicators are helpful tools but are often misused when relied upon as the sole basis for trade decisions. Many indicators are lagging by nature, meaning they reflect past price movements rather than anticipating future ones.

Blind reliance on indicators can lead to late or false entries, especially in trending or volatile markets. Price action and associated volume should be treated as the primary decision making points with indicators used for confluence, Example: A trader buys a stock because RSI indicates oversold conditions, but the stock continues to decline as the market remains in a strong downtrend. Solutions: Combine indicators with price action and market context.

For example, use RSI or MACD as confirmation for setups rather than primary signals. Always validate indicator signals with chart patterns, price range within a specific candle, and/or key levels of support/resistance. #6. Trading News Events Implications: News events often create sharp volatility, which can lead to slippage, widened spreads, and unexpected losses.

Trading without a structured plan during (and arguably before) such events exposes traders to heightened risk, especially in fast-moving markets. Examples: A trader enters a position before a Federal Reserve announcement, expecting dovish remarks. Instead, hawkish comments cause a rapid market reversal, leading to a significant loss.

It is worth noting that it doesn’t even have to be an adverse announcement to that which was expected to disappoint. If one believes, as is often cited, that everything that is known or expected is already “priced in” then even an expected number or news release can fail to provide a potentially profitable price move. Also of course, equally as dangerous to capital is not to be aware of significant market events at all.

To enter prior to these from a place of ignorance that they are even happening is potentially as damaging to capital.. Solution: Use a trading calendar to track upcoming high-impact news events. If trading news is part of your strategy, place pending orders above and below key levels to capitalise on breakouts while controlling risk. #7.

Trading Impatience Implications: Entering trades prematurely often leads to setups that fail or require larger stop-losses to accommodate unnecessary volatility. This behaviour stems from a need to "be in the market," and this “itchy trigger finger” which is in essence a compromise of discipline arguably can increase the likelihood of losses. Example: A trader buys a stock before confirmation of a breakout, only to see the price reverse and remain in a sideways trend for a prolonged period of time not only failing to see that specific trade do well but also arguably adds opportunity risk as that money invested could be in a trade that has indeed set up to confirm a change of sentiment, Solution: Establish clear entry criteria and wait for confirmation, such as a candle closing above resistance.

Articulate these clearly and unambiguously within your trading plan, #8. Misjudging Risk-Reward Ratios Implications: Poor risk-reward ratios undermine profitability. Even with a high win rate, losses can quickly outweigh gains if the potential reward doesn't justify the risk.

Either a failure to have defined acceptable levels articulated within your plan or ignoring (based on previous price action) potential pause or reversal points are the two main causes. Example: A trader risks $500 to make $200 on a trade. Over several trades, a few losses wipe out multiple winning trades.

Solutions: Ensure a minimum risk-reward ratio is stated for example 2:1 before entering. For instance, if risking $100, target a profit of at least $200 to maintain positive expectancy. #9. Over-Trading Implications: Over-trading leads to increased transaction costs, emotional exhaustion, and reduced focus on high-quality setups.

This is often driven by revenge trading or overconfidence after a winning streak. Example: A trader takes several trades in a single session after a loss, compounding mistakes and ending the day with a larger drawdown. Solutions: Set a daily trade limit and focus on quality over quantity.

Use a trading journal to reflect on your trades and identify patterns of over-trading. #10. Ignoring Correlation Between Assets Implications: Trading multiple correlated assets amplifies risk, as adverse moves in one asset can lead to simultaneous losses across others. Hence, even if say a 2% maximum risk is assigned to a single trade, if trades are highly correlated then that risk is multiplied potentially by the number of trades open.

Example: A trader goes long on EUR/JPY, AUDJPY and GBP/JPY and a sharp JPY rally causes losses in all three positions. Solutions: Use correlation matrices to assess relationships between instruments and diversify by trading uncorrelated assets. For instance, balance a forex position with a commodity trade.

Summary: Trade entry mistakes are often rooted in a combination of emotional decision-making, poor planning or preparation, and over-reliance on tools or strategies without proper context. By identifying these common errors and implementing structured solutions, traders can greatly enhance their ability to execute high-quality trades. The key to success lies in discipline, patience, and a willingness to adapt and learn from mistakes.

Start reviewing your entry process today, be honest with any of the above that may resonate with you (As awareness is always the first step in improvement) and give yourself the chance to potentially transform your trading outcomes over time.

There's been plenty made this year about gold's incredible rise to new record levels. A point that gold bugs love to point out. As we sit here gold is trading at around US$2700oz having reached an all-time high that was just shy of US$2900oz.

Thus the question has to be asked: where is the limit? And where too from here for the inert metal? The movements over the last five years clearly suggest there is a structural change going on inside the very definition of what gold is. 14.7% in the last six months. 29.4% year to date. 34.2% in the last 12 months A staggering 82.3% in the last five years.

That is telling a story that is different to the original fundamentals we were taught at university and then as fundamental traders. Let's look at that theory: gold usually trades closely in line with interest rates, particularly US treasuries. As an asset that doesn't offer any yield it typically becomes less attractive to investors when interest rates are higher and usually more desirable when they fall.

That still technically holds true, However what has changed is how much central banks are interfering with that fundamental. Since 2022 when Russia invaded Ukraine one of the main reactions from the West was to freeze Russian central bank assets. Since that point the Russian central bank particularly has been buying gold as a form of asset store/reserve.

It has also allowed it to avoid the full force of financial sanctions placed on it. But they're not the only ones doing this; emerging market central banks have also stepped up their purchasing of gold since this sanction was put in place and are rapidly increasing their own central bank reserves. Then we look at developed markets central banks.

The likes of the US, France, Germany and Italy have gold holdings that make up to 70% of their reserves are net buyers in the current market. That suggests something else is afoot. Are they concerned about debt sustainability?

Considering the US has $35 trillion of borrowings which is approximately 124% of GDP, do central banks around the world see risk? Considering that many central banks have the bulk of their reserves in US treasuries coupled with the upcoming unconventional administration in the Oval Office this certainly puts gold’s safe haven status in another light. There are truly unknowns with the upcoming trump administration and gold is clear hedging play against potential geopolitical shocks, trade tensions, tariffs, a slowing global economy, deft defaults and even the Federal Reserve subordination risk So what is the outlook for Gold over the coming years and just how high could it go?

Consensus over the next four years is quite divided: by the end of 2024 the consensus is for gold to be at US$2650oz and then easing through 2025 to 2027 to $2475oz. However there are some that are calling for gold to reach the record reached in September this year before surging towards $2900oz the end of 2025 and holding at this level through most of 2026. And right now who could blame this prediction - Gold bugs believe the confidence in gold’s enduring appeal amid a volatile macroeconomic and geopolitical landscape is a bullish bet.

Expectations for sustained diversification and safe-haven flows do appear structural and with central banks and investors seeking to mitigate risks in an environment characterised by persistent uncertainty, geopolitical tensions, and economic volatility. And it's more than just the demand side that's leading the charge. The supply side of the equation further supports our bullish outlook.

Gold mine production is inherently slow to respond to rising prices due to long lead times for exploration, development, and production ramp-up. Furthermore, major producers avoid aggressive hedging strategies, as shareholders typically prefer full exposure to gold’s upside potential. The supportive fundamental backdrop reinforces that demand from both the official sector and consumers will remain robust, while supply-side constraints provide a natural tailwind for price appreciation.

What we as traders need to be aware of is many investors actually believe they've missed the rally and are wary of buying gold at all-time highs. There are some that believe gold is due pull back even a correction as they struggle to make sense of gold in the new world. The divergence away from yields coupled with unknowns out of China and the US has made them nervous to buy this rally.

But we would argue the pullback has probably already happened. If we look at the gold chart, since the US presidential election gold has moved through quite a reasonable downside shift. Dropping from its record all time high to a low $2530oz.

That decline has clearly been cauterised and the momentum now is clearly to the upside. We can see from the chart that spot prices are now testing the September-October consolidation period. Any clean break above these levels would see it going back to testing the head and shoulders pattern at the end of October-November.

This will be the keys to gold for the rest of 2024. But whatever happens in the short term the long-term trend suggests there is more for the gold bugs to delight in.

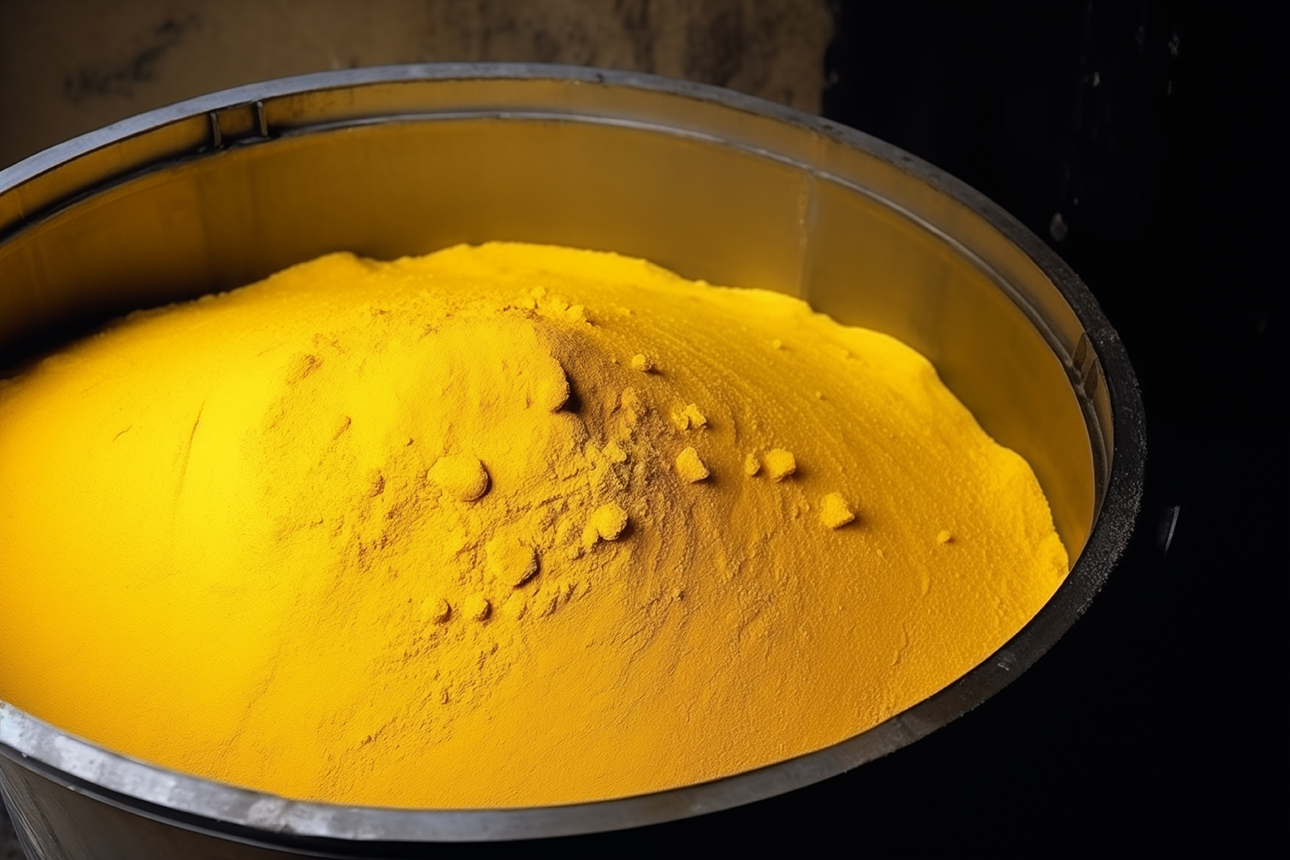

Yellowcake - a commodity that is loved and loathed all in the same breath. The questions we have been asking are - which is right and what’s the outlook? Because as traders and investors that dilemma is key, there is a gap here and that leads to volatility and incorrect pricing in the short and long term some may want to jump on.

Recent developments in the uranium market suggest we may be witnessing the beginning of a significant shift. After a prolonged period of downward pressure on prices, two key events over the past two weeks have kicked yellowcake back into the minds of traders. First is the geopolitical supply shock, the second are signals of increased long-term demand.

That is music to us in economics as this is a pure supply and demand thematic and suggests a potential reversal. Together, they could usher in a new phase of steady price appreciation, reminiscent of the market's bullish run in 2023. Point 1: Demand Side: U.S.

Energy Policy Could Lay the Foundation for Long-Term Growth The first major factor influencing uranium demand stems from the U.S. political landscape. The election of President-elect Donald Trump introduces a new energy agenda, one that could reshape the trajectory of nuclear power in the United States. While Trump's campaign rhetoric and early post-election messaging have heavily emphasised fossil fuel expansion - check last week’s piece on the "drill, baby, drill" thematic - it’s clear that nuclear power also holds a significant place in his vision for America’s energy future.

Trump has repeatedly voiced support for nuclear energy, particularly for small modular reactors (SMRs). These advanced nuclear technologies are seen as the next generation of clean energy solutions, offering modular, scalable power generation with enhanced safety and efficiency. In recent speeches and interviews, Trump has highlighted (in his view) nuclear energy is part of the solution needed in achieving sustainability, lower carbon emissions, and enhancing U.S. energy independence.

That last point is actually his biggest driver here being an America First ideal. This policy focus could mark a critical inflection point for uranium demand globally. While nuclear infrastructure projects are long-term endeavours and won’t generate immediate demand for uranium, the signals are clear: the U.S. government may soon prioritise nuclear energy investments in ways we haven’t seen in decades.

It also comes at a time when the likes of France and to some extent greater Europe moves in this direction. Either way as these plans materialise, uranium’s importance as a strategic resource will only grow. Moreover, Asia is also shifting its focus to this energy source as well.

Asian countries are increasing their reliance on nuclear energy to meet ambitious carbon neutrality targets. This international momentum could compound the effects of U.S. policy changes, creating a robust foundation for sustained uranium demand over the next decade. Point 2 Supply Side: Part 1 Russia’s Export Restrictions Tighten the Market The second major development is far more immediate and impactful.

That changes on the supply side of the equation. Last week, Russia announced new restrictions on the export of enriched uranium to the United States, escalating geopolitical tensions and significantly disrupting global supply chains. This move mirrors the U.S.’s earlier ban on Russian uranium imports, imposed in May 2023 as part of broader sanctions against Russia.

Historically, Russia has been a critical player in the global uranium market, supplying enriched uranium to numerous countries, including the United States. In 2023 alone, Russia accounted for 28 per cent of U.S. enriched uranium imports, a substantial share of the market. Although U.S. sanctions effectively ended these imports by August 2023, waivers remain in place for select companies, allowing limited purchases from Russian suppliers until 2028 such as Centrus Energy and Constellation Energy.

What isn’t clear is whether any imports have actually taken place under this exemption since the sanctions were tightened. Either way Russia’s new export restrictions will exacerbate existing supply chain constraints and are likely to push U.S. utilities to seek alternative sources of enriched uranium. This, in turn, should drive increased activity in both spot and futures markets as energy providers scramble to secure long-term supply agreements.

The ripple effects of these restrictions may also spill over into global markets, further tightening the balance of supply and demand. Part 2 Wider Supply Challenges: A Tighter Market Ahead The second part of the supply side equation is that Russia isn’t the only player and recent production reports, and other geopolitical issues are also driving shortages in uranium For example: Niger’s Production Halt: Orano, a major uranium producer, recently placed Niger’s only operational mine into “care and maintenance” code for moth balling due to logistical challenges. The catch with putting mines into care and maintenance is that once its down it takes months (sometimes years) to return to full capacity.

So it’s not just a here and now story. Be aware this mine, which has an annual capacity of 2,000 tonnes of uranium (tU), accounts for approximately 3 per cent of global supply. The halt underscores the fragility of the uranium supply chain in politically unstable regions.

Junior Miners Struggling: Smaller uranium miners are cutting their production targets for 2024 and 2025 due to a combination of slower-than-expected ramp-ups, lower ore grades, and resistance from local communities. Collectively, these issues have removed an estimated 2,600 tU from projected global supply—roughly 4 per cent of the market. Offsetting Gains Insufficient: While Cameco has announced a 1-million-pound (365 tU) increase in its 2024 production guidance thanks to improved performance at its McArthur River mine, these gains are insufficient to offset broader supply losses.

With supply tightening, producers struggling to meet commitments in the spot market, the pressure is building on the supply that is in circulation – and that is a price enhancer. Where does this leave Uranium? These developments create a powerful pinch point in the uranium market.

There is a promising long-term demand story evolving driven by potential shifts in U.S. energy policy and global momentum toward nuclear energy. On the flip-side, immediate supply constraints, driven by geopolitical tensions and production challenges, are tightening the market. The convergence of these factors could mark the start of a new cycle characterised by sustained price increases.

While it’s too early to definitively declare a bull market, the conditions are becoming increasingly favourable. For investors, this shifting landscape presents an opportunity. If supply disruptions persist, the uranium market could experience a strong rebound in the coming months.

Prices in both the spot and term markets are likely to reflect this tightening balance, creating a more attractive risk-reward dynamic for those positioned to take advantage of the trend. Big caveat - the uranium market is notoriously volatile and can see +/- 20 per cent moves in days or weeks. But the current setup suggests a potential turning point that could define the market's trajectory for years to come.

There has been plenty of conjecture about where oil is going to go in 2025 and we would suggest that the recent climb in Brent crude oil prices above $80 per barrel reflects an intensifying mix of geopolitical uncertainty. The main 3 uncertainties driving oil have been the impact of the U.S. presidential election, the escalation of the Middle East tensions and anticipation surrounding the OPEC+ meeting on December 1. These factors are clearly shaping short-term oil price dynamics, although some uncertainties have begun to ease, namely the election and the Middle East, but they still hold sway.

Thus let’s explore revised demand and supply projections as the industry anticipates a potential surplus in 2025 and the enactment of the Trump administrations Drill. Drill. Drill policy. 1.

Middle East Tensions Geopolitical tensions in the Middle East have posed a notable risk to the global oil supply particularly the conflicts involving Israel and Iran and the potential disruptions it would cause to OPEC’s 5 largest producers. However, so far, oil infrastructure in the region has largely remained intact, and oil flows are expected to continue without significant interruptions. While exchanges between regional powers remain a potential flashpoint, there is a general consensus that the two countries have stepped back from the worst.

The base case for this point is to assume stability in oil transportation routes and infrastructure. However, as we have seen during periods of unrest this year the consequences of a flare up for global oil prices can be considerable, underscoring the market's sensitivity to even minor shifts in Middle Eastern stability. 2. U.S.

Presidential Election – Drill Baby Drill The U.S. presidential election outcome has had a muted effect on oil prices – so far. This is likely due to President-elect Trump's policies regarding the energy being ‘speculative’. But there are several parts of his election platform that will directly and indirectly hit oil over the coming 4 years.

First as foremost – its platform was built on ‘turning the taps back on’ and ‘drill, drill, drill’. Under the current administration US shale gas and new oil exploration programs have come under higher levels of scrutiny and/or outright rejections. The new administration wants to reverse this and enhance the US’ output.

This is despite consensus showing these projects may return below cost-effective rates of return if oil prices remain low and the cost of production above competitors. Second, although President-Elect’s proposed tariff policies—ranging from 10-20 per cent on all imports, with higher rates on Chinese goods—could slow global trade, the net effect on the oil market is uncertain. Consensus estimates have the 10 per cent blanket tariff reducing U.S.

GDP growth by 1.4 per cent annually, potentially cutting oil demand by several hundred thousand barrels per day. If enacted, this bearish influence could counterbalance any potential bullish effects on prices. The third issue is geopolitics again – this time the possible reinstatement of the "maximum pressure" campaign on Iran that was enacted in the first Trump administration.

If the Trump administration imposes secondary sanctions on Iranian oil buyers, Iran’s exports could drop as they did during the 2018-2019 period, when sanctions sharply curtailed oil shipments. Such a development would likely tighten global supply and drive prices higher. These three issues illustrate possible impacts U.S. policy could have in 2025 and illustrate how contrasting economic and geopolitical factors could sway oil prices in unpredictable ways.

It again also explains why reactions in oil to Trump’s victory are still in a holding pattern. 3. What about OPEC? This brings us to the third part of the oil dynamic, OPEC and its upcoming Vienna convention on December 1.

The OPEC+ meeting presents another key variable, currently the consensus issue that member countries face - the risk of oversupply in 2025 and what to do about it. Despite Brent crude hovering above $70 per barrel, a price point that has normally seen production cut reactions, consensus has OPEC+ maintain its production targets for 2025, at least for the near term. We feel this is open for a significant market surprise as there is a growing minority view that OPEC+ could cut production by as much as 1.4 million barrels.

With Brent prices projected to stabilise around the low $70s, how effectively OPEC+ navigates this delicate balance between production and demand remains anyone’s guess and it's not out of the question that the bloc pulls a swift change that leads to price change shocks. December 1 is a key risk to markets. Where does this leave 2025?

According to world oil sites global supply and demand projections for 2025 suggest a surplus of approximately 1.3 million barrels a day, and that accounts for the recent adjustments to both demand and OPEC supply which basically offset each other. With this in mind and all variables remaining constant the base case for Brent is for pricing to sag through 2025 with forecasts ranging from as low as $58 a barrel to $69 a barrel However, as we well know the variables in the oil markets are vast and are currently more unknown than at any time in the past 4 years. For example: Non-OPEC supply growth underperformed in 2024, which is atypical; over the past 15 years, non-OPEC supply has generally exceeded expectations.

With Trump sworn in in late-January will the ‘Drill, Drill, Drill policy be enacted quickly and reverse this trend? This may prompt a supply war with OPEC, who may respond to market conditions by revising its output plans downward, which would tighten supply and support prices. In short its going to be complex So consensus has an oil market under pressure in 2025 with a projected surplus that could bring Brent prices into the mid-$60s range by the year’s end.

But that is clearly not a linear call and the global oil market faces an intricate array of challenges, and ongoing monitoring of these trends will be essential to refine forecasts and gauge the future direction of prices, something we will be watching closely.

Why you need to understand this market concept to improve your trading: Market Correlation For new traders and experienced traders, it can be daunting trying to find the best assets to trade. Whether it be equities, foreign exchange or indices, traders should be trying to have as many factors pointing in their favour as possible when entering a trade. These factors can include, the general trend of the individual asset, the price action at the time of entering the trade, candlestick patterns, use of technical indicators, among many others.

However, one thing that all traders should know about and understand is correlation. What is Correlation? Correlation is the pattern or relationship of how one asset performs relative to another asset.

In statistics, there are mathematical measures of correlation including covariance, correlation coefficients and other terms to describe the relationship of one asset to another. These methods can also be used to quantify asset correlations. A correlation between assets can be positive negative or uncorrelated.

Understanding which relationship between different assets can help provide some indication of the way in which an assets price will go. Below is a diagram that shows how the return of assets can be plotted against each other and the potential relationship. For example, imagine that there are two gold companies Gold company A Gold company B Assume that the price of their shares is perfectly, positively, correlated.

This means that when gold company A’s share price rises by 1% company B’s share price will also rise by 1%. This same price action will occur in reverse if the price of company A falls by 1%. Now in practice no two assets are perfectly correlated.

However, two or more assets may be very strongly correlated. Therefore, identifying how correlated certain assets are and how the price of one impact on the other can be a powerful tool. What creates correlation?

Strong correlation between assets usually occurs because the price of the different assets is material impacted by very similar factors. For instance, two companies in Australia may be more correlated than one company in Australia and one company in the USA. This is because geographically the Australian companies will be affected the local economic conditions.

This may include things such as inflation, taxation policies and other geographical specific conditions. Other factors that can influence the correlation include similarity of the assets or a company’s business operations, being in the same sector or a range of other factors. For example, see the correlation between the ‘Big 4’ banks in Australia below.

It can be seen due to how similar the businesses are and the conditions of which they operate in the pattern on returns are almost identical. Index correlation An important phenomenon to understand is the law of averages and big numbers. Essentially, if large companies are grouped together then they act as a good proxy for the overall market or a specific sector.

This essentially is what an ETF or and Index is. Therefore, as it represents how most individual companies are performing, most companies will be to a degree correlated to the overall market index or relevant sector index or ETF. Size matters Another important thing to understand about how correlation works is that smaller assets or companies will tend to correlate towards the performance of the major players within the sector.

For instance, in the technology sector, smaller technology company’s such as zoom will likely be correlated to larger companies such as Apple and Microsoft by virtue of being in the same sector. Correlations do not just occur in equities and are prevalent in FOREX and commodities. Correlation can be found between growth assets such as the Nasdaq Index which is a technology heavy Index and growth currencies such as the AUD or NZD.

Similarly, more stable assets such as the Dow Jones will likely be more correlated to commodities such as oil, they represent more stable industry and manufacturing sectors. How does it improve your trading? By simply being aware of the direction of the correlated assets, a trader is better able to trade with underlying trend and momentum.

This is vital when trying to optimise edge and improve trading accuracy. It can also equally show when a stock is underperforming or overperforming. For instance, if the general trend of a sector leader is trading 5% higher over a certain period, and a smaller company in the sector is trading at 10% higher it is outperforming the ‘sector’ and understanding why this occurs is an important step into deciphering what is driving price action.

Having a good understanding of how assets correlate can also help find potential trading opportunities earlier than others. This is because by following a sector it becomes easier to see which assets still may have room to shift their price. Ultimately, if a trader can develop their identification of patterns of correlation and the reasons for the relationships between different assets it can provide a trader with a much stronger and accurate edge.

China’s recent shift in economic policy and its potential for fiscal stimulus reflect an evolving approach to support economic stability. Following previous monetary easing measures, including a reduction in the Reserve Ratio Requirement and interest rate cuts in late September, China’s National People’s Congress (NPC) Standing Committee has now approved a local government debt restructuring plan. This plan allows for up to RMB 10 trillion (~US$2.54 Trillion) in debt adjustments, including a one-time increase of RMB 6 trillion in the special debt ceiling over 2024-2026, and an additional RMB 800 billion in special bond quotas annually from 2024 to 2028.

These measures align with expectations, the catch – it’s estimated to add just 0.1 per cent to China’s GDP. Naturally this left the market disappointed and saw Chinese equities shredded. But it's more than the lack of direct demand-side stimulus.

It’s the vague guidance on the use of bonds for banking sector recapitalisation as well as poor outlining on housing inventory buy-backs, and idle land. It's all a bit, ‘nothing’. Now we admit market expectations had been high, so price falls were inevitable, but the metals prices post-meeting were telling from both a short- and longer-term perspective.

First support for the housing market may be limited in the near term, given that primary home sales for top developers turned positive up 15 per cent year-on-year from June last year and home prices rose slightly 0.4 per cent in 50 cities September to October. Second is a possible trade war and having some powder dry as it gears up for the next four years of a Trump 2.0 administration. Fiscal Stimulus is clearly going to be part of this.

And already we have seen Finance Minister Lan Foan, in comments to the South China Morning Post discussing this very point. He pointed out that China’s Ministry of Finance has a readiness for fiscal expansion starting in 2025 and that China’s current debt-to-GDP ratio (68%) provides fiscal headroom, especially in comparison to Japan (250%) and the U.S. (119%). So is that suggesting it’s a ‘when’ not an ‘if’?

From a trader and markets perspective the answer may come at the Central Economic Work Conference in December is expected to outline specific fiscal measures for 2025, potentially focusing on reducing housing inventory, boosting infrastructure, and enhancing social welfare and consumption. The market consensus is for between RMB 2-3 trillion in fiscal expansion over the next one to two years, likely with an initial emphasis on infrastructure investment over consumption support. We should point out this could be a “fourth strike and you’re out” territory as expectations for delivery since Gold Week celebrations have been 0-3, a fourth miss might see the markets completely ignoring what has been promised.

However if it does eventuate looking historically, such investment-heavy stimulus cycles have bolstered demand for steel and other raw materials. China’s past stimulus responses, particularly during the 2018-19 U.S. tariff period, included fiscal stimulus and currency depreciation, indicating that fiscal policy could adjust in response to global economic factors. However, China’s approach to fiscal expansion this time may differ slightly from past cycles: Reason 1: Steel Demand: Prior fiscal expansions, such as during 2009-2010 and the 2018-19 tariff period, drove strong steel demand growth.

Investment in steel-intensive infrastructure, for example, boosted annual steel demand by approximately 200 million tons (a 30 per cent increase) between 2016 and 2019, raising the steel intensity of GDP by 7 per cent. Given China’s high cumulative steel stock—estimated at around 8.5 tons per capita (approaching developed-nation averages of 8-12 tons per capita)—the scale of future infrastructure investment may be more limited, as large physical projects are increasingly complete and the need for new largest scale projects is moderating. Reason 2: Shift To Consumption and Social Welfare: Since 2018 China has subtly and gradually shifted fiscal efforts toward consumer support and social welfare to address deflation risks.

This shift is likely to accelerate, as policy moves to an emphasis on stimulating internal demand through social spending. Now historically China has often favoured investment-driven stimulus to support GDP growth targets, which could mean another infrastructure-led, steel-intensive approach if economic conditions demand it, albeit possibly on a smaller scale than in the past, but again 0-3 on promises, there are risks it doesn’t materialise this time around. The next part of the story for commodities and a China stimulus story is the impending trade war.

China is clearly facing headwinds for its exports, given the likely policy changes from the second Trump administration. The biggest issues are the 10 per cent tariff on all imports and up to 60 per cent on Chinese goods. The timing and specifics of the tariffs are uncertain, but using his 2016-2020 timelines as a guide it's likely to be one of the first programs enacted and new tariffs could emerge as early as the first half of 2025.

Currently, more than 20 per cent of China’s steel production is tied to exports—11 per cent directly and 12 per cent indirectly through products like machinery and vehicles—any new tariffs on Chinese goods would likely impact steel output and, subsequently, iron ore demand. During the 2018-19 tariff period, China’s direct steel exports to the U.S. declined, but this was balanced by growth in indirect steel exports via manufactured goods and bolstered by domestic infrastructure demand which is hard to see this time around. 2025 strategies China might deploy to counteract any new tariffs could include currency depreciation, reciprocal tariffs, re-routing exports to new markets, and increased fiscal and monetary stimulus. Interestingly the U.S. comprises only 1 per cent of China’s direct steel export market, it the larger share for indirect exports, particularly machinery ~20 per cent that is the issue.

Since 2018, China has expanded its steel-based goods exports by focusing on emerging markets—a resilience that will likely be tested further if tariffs intensify next year. So where does this leave iron ore? Current iron ore prices, hovering around US$100 per tonne, seem to reflect current market fundamentals pretty accurately.

The substantial net short positions in SGX futures, which were prevalent prior to the late-September stimulus, have notably diminished in the past 6 weeks China’s recent policy adjustments have mitigated the downside risks for steel demand for the remainder of 2024. This is coupled with solidifying demand indicators and restocking activities, which may bolster seasonal price strength as the year concludes. Nevertheless, the potential impact of a seasonal price rally may be constrained by relatively high port stock levels, which presently stand at about 41 days of supply which again underscores why price around US$100 a tonne is accurate.

Looking ahead to 2025, the Ministry of Finance in China signalling forthcoming fiscal expansion suggests a potential upside risk. However, potential new tariffs from the U.S. may pose challenges to steel export volumes, potentially counteracting the positive effects of domestic fiscal measures. China’s response to such tariffs—potentially through currency depreciation, trade redirection, or additional fiscal and monetary stimulus—will be crucial in mitigating these pressures.

But this would be a zero-sum game effect. Thus any upside risks are counted by downside risks – this leads us to conclude that China is not going to be the White Knight of the past. And that 2025 is going to be a tale of two competing forces that sees pricing see-sawing around but finding equilibrium at current prices.

This also leads us to point to equities – iron ore and cyclical plays have benefited strongly over the past 24 months on higher prices and the long COVID tail. 2025 appears to be the year that tail ends and a new phase will begin.