กลยุทธ์การเทรดเพื่อสนับสนุนการตัดสินใจของคุณ

สำรวจเทคนิคเชิงปฏิบัติที่จะช่วยให้คุณวางแผน วิเคราะห์ และปรับปรุงการเทรดของคุณ.

ความผันผวนมีวิธีแสดงออกโดยไม่ได้รับเชิญ

วันหนึ่ง ASX กำลังเคลื่อนไหวอย่างเงียบ ๆ... และในวันถัดไป ข้อกำหนดมาร์จิ้นเพิ่มขึ้น การหยุดหยุดไม่เต็มตามที่คาดไว้ และพอร์ตโฟลิโอเปิดด้วยช่องว่างที่ไม่สบายใจในคืนคืน

หากคุณกำลังค้นหาคำตอบคุณไม่ได้อยู่คนเดียวคำถามที่ค้นหามากที่สุดเกี่ยวกับความผันผวนของเทรดเดอร์ชาวออสเตรเลียเกี่ยวข้องกับมาร์จิ้น การสลิปเพจ ช่องว่างข้ามคืน กองทุนที่ซื้อขายด้วยเลเวอเรจ (ETF) และเครื่องมือต่างๆ เช่น ช่วงจริงเฉลี่ย (ATR)

นี่คือสิ่งที่เกิดขึ้น

ทำไมสิ่งนี้จึงมีความสำคัญตอนนี้

ตลาดโลกมีความอ่อนไหวต่ออัตราดอกเบี้ยข้อมูลเงินเฟ้อการเมืองทางภูมิศาสตร์และกระแสที่ขับเคลื่อนด้วยเทคโนโลยีเมื่อสภาพคล่องลดลงและความไม่แน่นอนเพิ่มขึ้น การเปลี่ยนแปลงของราคาจะเพิ่มขึ้นนั่นคือความผันผวน

และความผันผวนไม่เพียงส่งผลกระทบต่อทิศทางราคาเท่านั้น แต่ยังเปลี่ยนวิธีการดำเนินการซื้อขายจำนวนเงินที่ต้องการและพฤติกรรมความเสี่ยงภายใต้พื้นผิวอย่างไร

แปล: ความผันผวนไม่ได้เป็นเพียงการเคลื่อนไหวที่ใหญ่ขึ้นเท่านั้น แต่ยังเกี่ยวกับการเคลื่อนไหวที่เร็วขึ้นและสภาพคล่องที่บางลง นั่นคือเมื่อกลไกของการซื้อขายมีความสำคัญมากที่สุด

ต้องการกรณีศึกษาความผันผวนในโลกแห่งความเป็นจริงหรือไม่?

ทำไมโบรกเกอร์ของฉันจึงเพิ่มข้อกำหนดมาร์จิ้น

หนึ่งในคำถามที่ค้นหามากที่สุดเกี่ยวกับความผันผวนคือเหตุใดข้อกำหนดมาร์จิ้นจึงเพิ่มขึ้นโดยไม่ต้องแจ้งเตือน

เมื่อตลาดไม่เสถียร โบรกเกอร์อาจเพิ่มข้อกำหนดมาร์จิ้นสำหรับสัญญาสำหรับความแตกต่าง (CFD) และผลิตภัณฑ์ที่มีเลเวอเรจอื่น ๆการเปลี่ยนแปลงของราคาที่ใหญ่ขึ้นสามารถเพิ่มความเสี่ยงของบัญชีที่เปลี่ยนไปสู่หุ้นเชิงลบ ดังนั้นการเพิ่มข้อกำหนดมาร์จิ้นจะช่วยลดเลเวอเรจที่มีอยู่และสามารถช่วยจัดการความเสี่ยงในช่วงสภาวะที่รุนแรง

สิ่งนี้อาจหมายถึงอะไรในทางปฏิบัติ

- มาร์จิ้นคอลอาจเกิดขึ้นแม้ว่าราคาจะไม่เคลื่อนไหวอย่างมีนัยสำคัญ

- เลเวอเรจที่มีประสิทธิภาพสามารถลดลงได้อย่างรวดเร็ว

- อาจต้องลดตำแหน่งในเวลาอันสั้น

การปรับมาร์จิ้นมักเป็นการตอบสนองต่อความเสี่ยงของตลาดที่เปลี่ยนแปลงไม่ใช่การตัดสินใจแบบสุ่มในตลาดที่มีความผันผวนสูง ควรสมมติว่าการตั้งค่ามาร์จิ้นสามารถเปลี่ยนแปลงได้อย่างรวดเร็ว ดังนั้นเทรดเดอร์หลายคนจึงเลือกที่จะตรวจสอบขนาดตำแหน่งและบัฟเฟอร์ที่มีอยู่โดยพิจารณาจากความเสี่ยงนั้น

การลื่นไถลคืออะไรและทำไมฉันถึงไม่เติมเงินในราคาของฉัน

หัวข้อที่ค้นหาบ่อยอีกประการหนึ่งคือการลื่นไถล

การลื่นไถลอาจเกิดขึ้นเมื่อคำสั่งหยุดทริกเกอร์และดำเนินการในราคาถัดไปผลลัพธ์อาจขึ้นอยู่กับประเภทคำสั่งซื้อสภาพคล่องของตลาดและช่องว่างในตลาดที่สงบ ความแตกต่างอาจมีขนาดเล็กในขณะที่ในตลาดที่รวดเร็ว ราคาอาจมีช่องว่างเกินระดับหยุด

ไดรเวอร์ทั่วไป ได้แก่

- การเปิดตัวทางเศรษฐกิจหรือรายได้ที่สำคัญ

- สภาพคล่องบาง

- ระดับการหยุดที่แออัด

- เซสชันค้างคืน

คำสั่งหยุดขาดทุนโดยทั่วไปจะให้ความสำคัญกับการดำเนินการมากกว่าความมั่นใจในราคา และในช่วงที่มีความผันผวนสูง ความแตกต่างนี้จะมีความสำคัญการปรับขนาดตำแหน่งและการวางสต็อปโดยอ้างอิงกับการเคลื่อนไหวของราคาทั่วไปอาจมีประสิทธิภาพมากกว่าเพียงแค่กระชับสต็อปในสภาวะที่ไม่เสถียร

ฉันจะจัดการการถ่ายภาพข้ามคืนบน ASX ได้อย่างไร

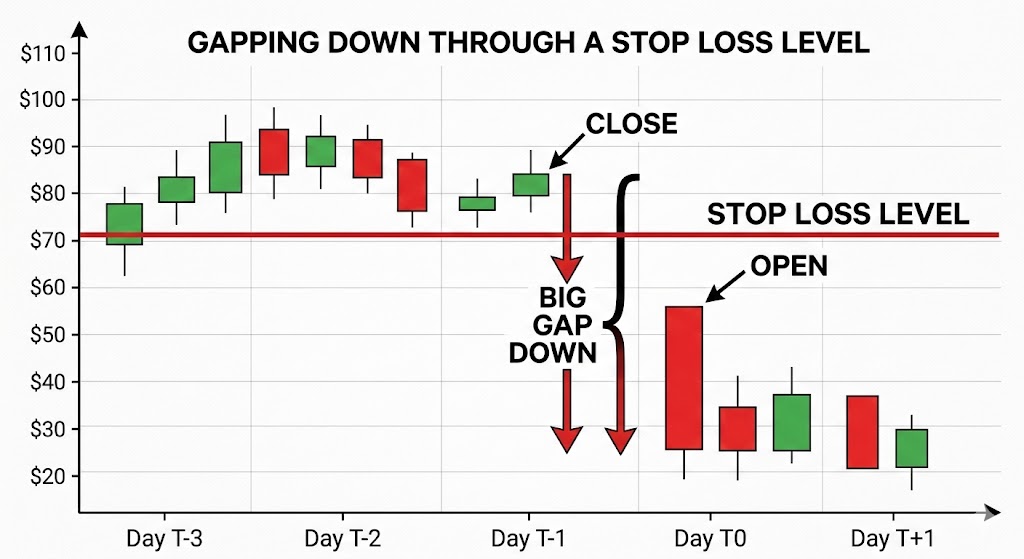

ออสเตรเลียซื้อขายในขณะที่สหรัฐอเมริกานอนหลับและในทางกลับกันน่าเศร้าที่ความแตกต่างของเขตเวลานี้เป็นเหตุผลหนึ่งที่ผู้ค้าออสเตรเลียค้นหาความเสี่ยงจากช่องว่างข้ามคืนหากตลาดสหรัฐลดลงอย่างรวดเร็ว ASX อาจเปิดต่ำสุดในเช้าวันรุ่งขึ้น โดยไม่มีโอกาสที่จะออกระหว่างการปิดและการเปิด

ตัวอย่างวิธีการจัดการความเสี่ยงที่ผู้ค้าตลาดอาจใช้ ได้แก่

- การป้องกันความเสี่ยงดัชนีโดยใช้ฟิวเจอร์ส ASX 200 หรือ CFD*

- การป้องกันความเสี่ยงบางส่วนในช่วงเหตุการณ์ที่มีความเสี่ยงสูง

- ลดการเปิดรับแสงก่อนการประกาศมาโครที่สำคัญ

การป้องกันความเสี่ยงสามารถชดเชยส่วนหนึ่งของการเคลื่อนไหวได้ แต่จะทำให้เกิดความเสี่ยงพื้นฐานเนื่องจากหุ้นแต่ละหุ้นอาจไม่เคลื่อนไหวสอดคล้องกับดัชนีที่กว้างขึ้น

ไม่มีการป้องกันที่สมบูรณ์แบบเพียงการแลกเปลี่ยนระหว่างต้นทุนความซับซ้อนและการลดความเสี่ยง

*CFD เป็นตราสารที่ซับซ้อนและมีความเสี่ยงสูงที่จะสูญเสียเงินเนื่องจากเลเวอเรจ

อะไรคือความเสี่ยงที่สำคัญของ ETF แบบมีเลเวอเรจหรือผกผันในตลาดที่ผันผวนได้?

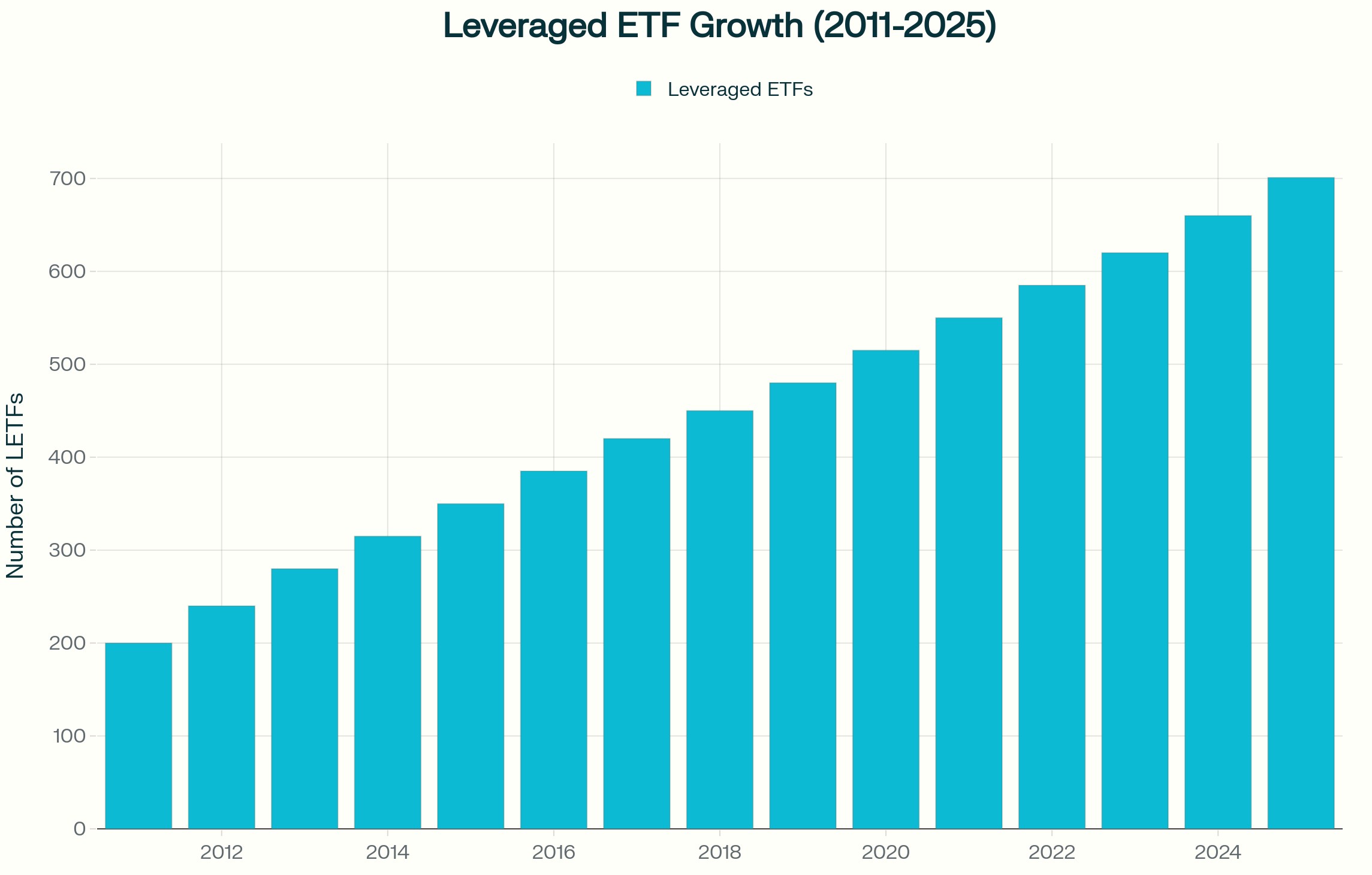

ETF แบบมีเลเวอเรจและผกผันมักจะค้นหาในช่วงที่มีความผันผวนสูงขึ้น

แม้ว่าผลิตภัณฑ์เหล่านี้มักจะรีเซ็ตทุกวัน แต่ก็มีจุดมุ่งหมายที่จะส่งผลตอบแทนรายวันของดัชนีหลายรายการ ไม่ใช่ผลตอบแทนระยะยาวในตลาดด้านข้างที่มีความผันผวน การผสมผสานรายวันสามารถลดมูลค่าได้แม้ว่าดัชนีจะจบใกล้ระดับเริ่มต้นก็ตาม

สิ่งนี้เกิดขึ้นเนื่องจากกำไรและขาดทุนรวมกันอย่างไม่สมมาตรการลดลง 10 เปอร์เซ็นต์ต้องมีการเพิ่มขึ้นมากกว่า 10 เปอร์เซ็นต์ในการฟื้นตัวเมื่อผลนั้นคูณทุกวัน ผลลัพธ์อาจแตกต่างจากดัชนีอ้างอิงอย่างมากเมื่อเวลาผ่านไป

ผู้เข้าร่วมตลาดบางรายอาจใช้อุปกรณ์ดังกล่าวโดยทั่วไปแล้วพวกเขาไม่ได้ถูกออกแบบมาเป็นเครื่องมือป้องกันความเสี่ยงระยะยาวและการทำความเข้าใจโครงสร้างของพวกเขาเป็นสิ่งสำคัญก่อนที่จะใช้ในกลยุทธ์

จะใช้ ATR เพื่อแจ้งตำแหน่งการหยุดได้อย่างไร?

ช่วงจริงเฉลี่ย (ATR) เป็นตัวบ่งชี้ที่ใช้กันทั่วไปสำหรับการวัดความผันผวน

ATR ประมาณจำนวนสินทรัพย์เคลื่อนที่ในช่วงระยะเวลาที่กำหนด รวมถึงช่องว่างแทนที่จะตั้งค่าการหยุดที่เปอร์เซ็นต์โดยพลการ เทรดเดอร์บางรายอ้างอิง ATR และวางจุดหยุดที่หลายครั้ง เช่น ATR สองหรือสามเท่า เพื่อสะท้อนถึงเงื่อนไขที่มีอยู่

เมื่อความผันผวนเพิ่มขึ้น ATR จะขยายตัวและอาจบ่งบอกถึงการหยุดที่กว้างขึ้นหรือขนาดตำแหน่งที่เล็กลงหากความเสี่ยงโดยรวมจะคงที่การเปลี่ยนจากการถามว่า “ฉันเต็มใจที่จะแพ้ไกลแค่ไหน?”เพื่อถามว่า “การเคลื่อนไหวปกติในสภาพปัจจุบันคืออะไร?”

การพิจารณาเชิงปฏิบัติในตลาดที่ผันผวน

ในช่วงที่มีความผันผวนสูงเทรดเดอร์อาจพิจารณา

- อนุญาตให้มีความเป็นไปได้ของการเปลี่ยนแปลงมาร์จิ้น

- ปรับขนาดตำแหน่งอย่างอนุรักษ์นิยมหากความผันผวนเพิ่มขึ้น

- รับทราบว่าคำสั่งหยุดขาดทุนไม่รับประกันราคาขาออกที่เฉพาะเจาะจง

- ทบทวนการเปิดเผยก่อนเหตุการณ์เศรษฐกิจที่สำคัญ

- ทำความเข้าใจกลไกการรีเซ็ตรายวันของ ETF ที่มีเลเวอเรจ

- การใช้มาตรการความผันผวนเช่น ATR เพื่อแจ้งตำแหน่งหยุด

- การรักษาบัฟเฟอร์เงินสดเพียงพอ

ความผันผวนไม่ได้ให้รางวัลการคาดการณ์เพียงอย่างเดียวการเตรียมความพร้อมและการรับรู้ความเสี่ยงอาจช่วยให้เทรดเดอร์เข้าใจความเสี่ยงที่อาจเกิดขึ้น แต่ผลลัพธ์ยังคงคาดเดาไม่ได้

อ่าน: ความผันผวนทั่วโลกและวิธีการซื้อขาย CFD

สิ่งนี้หมายถึงอะไรสำหรับผู้ค้าชาวออสเตรเลีย

ตลาดออสเตรเลียต้องเผชิญกับข้อพิจารณาเชิงโครงสร้างเฉพาะที่เกี่ยวข้องกับตลาดเอเชียและสหรัฐฯความเสี่ยงจากช่องว่างข้ามคืนได้รับอิทธิพลจากชั่วโมงการซื้อขายของสหรัฐฯ และดัชนีที่มีปริมาณทรัพยากร เช่น ASX สามารถตอบสนองต่อการเคลื่อนไหวของราคาสินค้าโภคภัณฑ์และข้อมูลจากประเทศจีนได้อย่างรวดเร็วการเปิดเผยต่อสกุลเงิน รวมถึงการเคลื่อนไหวของ AUD และดอลลาร์สหรัฐ (USD) สามารถเพิ่มความแปรปรวนอีกชั้นได้

ความผันผวนไม่สม่ำเสมอในแต่ละภูมิภาคมีพฤติกรรมแตกต่างกันขึ้นอยู่กับโครงสร้างตลาดและความลึกของสภาพคล่อง

คำถามที่พบบ่อยเกี่ยวกับความผันผวน

อะไรทำให้เกิดความผันผวนของตลาดเพิ่มขึ้นอย่างกะทันหัน?

การตัดสินใจเกี่ยวกับอัตราดอกเบี้ย ข้อมูลอัตราเงินเฟ้อ การพัฒนาภูมิรัฐศาสตร์ ความประหลาดใจในรายได้ และข้อ จำกัด ด้านสภาพคล่องเป็นตัวกระ

ทำไมโบรกเกอร์จึงเพิ่มมาร์จิ้นในช่วงตลาดที่ผันผวน

เพื่อลดโอกาสในการใช้เลเวอเรจและจัดการความเสี่ยงเมื่อการเปลี่ยนแปลงของราคาเพิ่มขึ้น

คำสั่งหยุดขาดทุนสามารถล้มเหลวในช่วงความผันผวนได้หรือไม่?

พวกเขาสามารถสัมผัสกับความลื่นไถ่ถ้ามีช่องว่างของตลาดเกินระดับหยุด ซึ่งหมายความว่าการดำเนินการอาจเกิดขึ้นในราคาที่แย่กว่าที่คาดไว้ในตลาดที่รวดเร็วหรือไม่มีสภาพคล่องความแตกต่างนี้อาจมีนัยสำคัญ

ETF แบบมีเลเวอเรจเหมาะสำหรับการป้องกันความเสี่ยงระยะยาวหรือไม่

โดยทั่วไปจะมีโครงสร้างสำหรับการสัมผัสระยะสั้นเนื่องจากการรีเซ็ตรายวันเหมาะสมหรือไม่ขึ้นอยู่กับวัตถุประสงค์สถานการณ์ทางการเงินและความอดทนต่อความเสี่ยงของคุณ

จะวัดความผันผวนก่อนทำการซื้อขายได้อย่างไร?

เครื่องมือเช่น ATR ตัวบ่งชี้ความผันผวนโดยนัย และการวิเคราะห์ช่วงในอดีตสามารถช่วยหาปริมาณสภาวะที่มีอยู่ได้

คำเตือนความเสี่ยง: ช่วงเวลาของความผันผวนที่สูงขึ้นอาจนำไปสู่การเคลื่อนไหวของราคาอย่างรวดเร็ว การเปลี่ยนแปลงมาร์จิ้น และการดำเนินการในราคาที่แตกต่างจากที่คาดไว้เครื่องมือการจัดการความเสี่ยง เช่น คำสั่งหยุดขาดทุนและตัวบ่งชี้ความผันผวนอาจช่วยในการประเมินสภาพตลาด แต่ไม่สามารถขจัดความเสี่ยงต่อการสูญเสียได้ โดยเฉพาะอย่างยิ่งเมื่อใช้ผลิตภัณฑ์ที่มีเลเวอเรจ

The ability to set up phone notifications for trading activity on your MT5 platform has many advantages including of course the opportunity to “Check-in” on the market whist on the move. It could be argued that this ability goes beyond simple convenience and in the case of “pending orders” could be viewed as an important part of risk management of trades that are opened through this method. Pending orders revisited Pending Orders are advanced entry orders that allow you to place an order onto the system that will be filled at a specific price level.

The key potential advantage is that you don’t have to be watching the market continuously for an order to be filled, and it can be filled at any time if the order is still active on the system. An example could be placing a “Buy Stop” order above an identified resistance level, so if the relevant currency pair or CFD moves to this price point then the order will be filled at your chosen price (You can still place a stop loss and profit target associated with the pending order). Although it a potentially attractive function of your Metatrader platform, one of the potential disadvantages is that without notifications set up you may not be aware that a trade has been entered until you are in a position to look at your trading platform on your PC for example.

Without this awareness of an “open” trade, the implications are: You will not be able to adjust a “trail stop” to lock in potential profit if the trade does go in your direction In the event of imminent economic data, you will not know to adjust such open positions to manage risks associated with this. Setting up phone notifications on your phone, is not only relatively simple but mitigates these potential disadvantages. Setting up notifications We will walk you through the set-up process on MT5 but is similar if you are using MT4.

Download the MT5 app on your mobile phone Allow to send “notifications”. Check in phone settings that it is set up. Open the app and go to messages in settings and find your Metaquote ID at the bottom of the screen.

Make a note of this (See diagram below). Open the MT5 platform on your PC In the tools menu, click on options and then the notifications tab. Enter your MetaquoteID in the pop-up box as shown below.

Click on test You should receive a notification on phone that set up is complete and subsequently with any orders you place and that are filled. Of course, feel free to contact the GO Markets team if you need additional support in setting this up at any time.

When we first start to trade, or subsequently (as a more experienced trader) when we trade a new symbol or system we are often “excited” as we see a “hope” for better results. We often forget that the development of expertise in other areas we have in life (think about what you do in work now for example), you must invest time, effort, learning and making mistakes (providing you acknowledge and learn from them) to develop. This is not an overnight transformation, rather it may take several weeks if not months before you feel confident in your knowledge and skills.

It is bizarre therefore that we should expect anything different with trading development. To be clear, we respect and commend those who take the leap and move from demo to live account. After all, a demo platform ( you can trial a MetaTrader 4 or MT 5 demo account here ) will serve you in learning how the platform works, how to add indicators and get used to how markets move.

However, it is only when you start to have some “skin in the game” and are trading YOUR money, albeit with tiny positions to start with that you learn the most important lessons in trading and develop the appropriate mindset to begin to think about trading larger positions. All that been said, we see time and time again new traders or those trading a new system exhibiting three cardinal sins of the developmental trader, and decide to trade: a. With positions that are too big b.

Short cutting learning and system development c. Strategy skipping (i.e. moving from new system to new system) without meaningful measurement as to what works for you (and what doesn’t) or indeed whether the problem is YOU failing to trade a system religiously. These are all symptoms of impatience, of wanting to get massive returns quickly and without putting the hard yards in at the front end.

Remember this... The purpose of your trading when you start trading a live account should not be huge profit, rather it is to develop the confidence in your system, consistency in action and the measure whether what you are doing could be improved. Although it may seem strange to suggest, it is this and not, in the early stage of trading, the money (and level of profit) is most relevant in your potential lifelong career as a trader.

It is through patience, and adhering to that initial purpose that you can gain sufficient confidence and competence to trade larger positions (after all it is just moving a decimal point to go from 1 mini-lot to a standard lot) and put the right foundations in to move forward. Exercising patience to have the right things in place will serve you well for a potential lifetime of trading, to be impatient may mean your trading lasts but a few weeks or months. It is really that simple.

Position sizing is simply the number of contracts that you choose to enter for any specific trade. It is this, combined with the movement in price (either positively or negatively) from entry to exit in your trade, that determines your final dollar result for any specific trade. As this result impacts on your trading capital, position sizing, along with appropriate exit decisions and actions, are THE two key factors in both risk management and taking profit.

It is good trading practice to have a “tolerable risk level”, i.e. what you are prepared to lose on a single trade. This, as we have covered in First Steps, is usually expressed as a percentage of your total trading capital (somewhere between 1-4% are commonly used). For example, If your chosen risk level is 3% and the capital in your account is $5000, this means that you would be prepared to risk $150 on one trade.

Why use formal position sizing? A formal position sizing system aims to answer the question “how many lots do I enter to keep any loss within my tolerable risk level if my stop loss is triggered?”. As we enter a trade, we ALL position size, but we have a choice as to how we action this.

We can: Guess. Use a dollar level i.e. when it hits this we are out (you can retrospectively modify a stop level on a trade chart on your trading platform). Use a technical level as a stop loss and work out how many contracts we can enter based on the Pip movement between entry and stop.

Logically, “3” would seem the most robust AND this should be calculated BEFORE entering a trade. So how do I position size? Accepting that the third of the options above is theoretically the optimum method, the process is: a.

What is my “tolerable risk level” in dollar terms? b. What is the desired technical entry and stop loss price levels? c. What is the dollar difference between entry and stop loss exit? d.

Divide ”a” (your tolerable risk level) by “c” to get an estimated position size. If your account is in Australian dollars the calculation is easier than trading either many index CFDs (except for the ASX200) or Forex as there is no need to add a further calculation to convert a profit/loss back into your account currency. Other position sizing issues to consider: Position sizing can only make a difference to your risk management if you adhere to your pre-planned exit strategy.

Be aware of gapping on market open from previous close price. This is at its potentially most severe subsequent to a company’s earnings report release and so you may want to consider avoiding this situation as part of your risk management plan. Once you have mastered basic position sizing, consider whether different market conditions or situations would merit a different tolerable risk level on which to base your position sizing calculations. e.g. a major economic news release increased general market volatility.

In such situations it may be that you enter a smaller position initially and then accumulate into the position if it goes in your desired direction. There is a FREE DOWNLOAD of an excel-based “indicative CFD position size calculator” you are welcome to use to assist you in this important part of trading entry. Feel free to use, but please pay attention to the notes.

Click on the link below. CFD position size calculator v2 Please feel free to connect with the team with any questions you have about share CFDs and how you can add this to your trading.

We frequently refer both in the articles we publish and the weekly “Inner Circle” sessions we present, to the benefits of a trading journal. However, the reality is that many traders make the choice not to measure trading despite the logical benefits of doing so. Whether you do or don’t currently, the bottom-line decision you are making is not only whether you do or don’t but how that positions yourself with your trading development.

We would suggest that this overall choice can be broken down into the following three sub-choices. You can make the decisions that are right for you subsequently. Sub-choice 1 - Measuring your system You are either making the choice to: Have certainty on not only whether your trading plan as a whole can create positive outcomes but have evidence to know which component parts of your plan are e.g. indicators you use for entry and exit, comparing strategies you trade, timeframes that work best for you, (and which are not) contributing to such outcomes.

Additionally, it allows you to compare what would happen if you change some of the perimeters on your potential results. OR You have no evidence as to whether your system as a whole and its components parts are working well to serve you in getting the results you desire. Nor do you can test and gather evidence as to what the impact of nay changes you may make to that system, Ask yourself… If I am serious about trading results which choice should I make?

Sub-choice 2 - Measuring you as a trader You are either making the choice to: Know the degree to which you are following your plan or otherwise so you can ultimately make a judgement on: a. Whether your system is working for you (all the points in sub-choice 1 above CANNOT be made unless you are following your plan religiously). b. What you need to work on in terms of tightening your behaviour e.g. on exits or entry c.

Whether there are certain market conditions which you find difficult or are ill-prepared for (so you can fill any knowledge gaps or avoid in the future). OR You can continue to trade as you do, avoiding any self-assessment and growth, and the refinement of your behaviour that may contribute to more positive trading outcomes. Ask yourself… If I am serious about trading results which choice should I make?

Sub-choice 3 - Improving your trading (closing the circle) (let’s assume you are keeping a journal for this one) You are either making the choice to: Measure with purpose that has clear follow through into further development and refinement of your trading plan and subsequently your actions. This facilitates the development of you as a trader based on your individual character and trading style. In practical terms, you ‘close the circle’ with a defined review and develop an action plan based on your review to test and change parts of your plan.

This is evidence-based trading! OR You can measure for measurements sake to on the surface appear to be “doing a right thing” but in reality, failing to unleash the real power of journaling, that is to make an on-going and continuous positive difference to your trading outcomes. Ask yourself… If I am serious about trading results which choice should I make?

In summary, if you have made the choice to read this article to its end you are left with one ultimate choice…to journal or not to journal including the three sub-choices that dependent on which you are making can impact on your trading. So, for one last time, Ask yourself… If I am serious about trading results what should my actions be with what I have read in this article? Our next steps and Share CFD education programme both have indicative trading journal templates to help get you started, and we would be delighted if you could join us.

Drop us a line, click on this link HERE, or give us a call if you want further information on either of these FREE programmes of learning.

A written trading plan, usually comprising of several guiding action statements, serves the following two invaluable purposes: Facilitates consistency in trading action e.g. in the entry and exit of trades, allowing the trader AND Measures the strategy used specified within each statement to make an evidence-based judgement on how well these are serving you and test and amend these statements so you can develop an individual trading plan that may work better for you. Let’s move past the fact that many traders choose not to have a plan at all, an approach that goes against what is one of the key components of giving yourself the chance to become a successful trader, to those who have a plan in place already. This article is targeted a those who have made the logical choice to have some sort of written plan in place.

Great though having a plan is, many traders still have issues with the two purposes outlined above. They still fail to some degree to develop the consistency described and are not really able to measure effectively. A common problem, if we look closely at some of the plan statements used, is that such statement may not be specific enough, have some ambiguity, that means that those purposes may be difficult to achieve.

Let’s provide and work through an example for clarity. Consider the following statement… “I will tighten my stop/trailing stop prior to significant, imminent economic data releases” Firstly, on the positive side again, this does demonstrate an awareness of potential risk and a desire to have something within your plan to manage this risk. However, in terms of being a measurable statement that you can make a judgement as to how well this approach is serving you, there are the following issues: What does ‘tightening’ mean in practical terms in relation to current price point of the pair you are trading?

How close to a data release is ‘imminent’? What constitutes a significant data release (amongst the many that are released daily)? So, to take the previous example consider the following as an alternative: “Prior to imminent economic data releases, I will tighten of a trail stop loss for any open trades, 15 minutes prior to the release and to within 10 Pips of the current price.

This will be actioned for the following data points: Interest rate, CPI, industrial production and jobs data from the country of either currency pair (or Germany, France of across the Eurozone if one of the currency pair is the EURO). US and Chinese PMI manufacturing data, GDP, industrial jobs and interest rate decisions as these may impact all currency majors." So, with THIS amended plan statement the following elements could be measured (if journaled appropriately of course): What would the difference be in your trading outcomes if: No tightening had been actioned. If a different proximity to current price is used e.g. 15 rather than 10 Pips.

If other data releases are added/removed. With this level of measurement, possible with the revised statement, one would now be able to make any changes, backed up with evidence, to your trading plan. Alternatively, of course, you could make the choice to do nothing, retain statements such as the original, and not have the ability to create the richness of evidence to make considered amendments to your plan.

Logically ask yourself the question, "which choice is more likely to serve my trading going forward?"

There are few long-term successful traders that at some stage have not suffered a major capital drawdown on their account at some stage. For whatever the reason the major factor as to whether you continue and get back to “winning ways” or continue to see further drawdowns is what you do next. Unfortunately, there are “traps” that such a set of circumstances can lead to, your aim, if this should happen to you is to avoid these.

This article aims to outline these to assist in developing awareness and assist in your “what happens next” thinking and actions. Trap 1 – Abdicate responsibility It is a natural human response when things go wrong to look for someone/something to blame. This is far easier emotionally to deal with than admitting that you have behaved, through actions, in a way that has contributed to a negative outcome.

Although it may be true that certain market conditions, or “trump tweets”, or economic announcements may all contribute to a significant market price movement, the majority of major capital drawdowns in reality occur over a number of trades and of course you have made the choice to trade and as if not more importantly when to exit any trades you have taken. The reality is of course, that unless you accept 100% that trading action is YOUR choice and that YOU are responsible for your trading results then you are unlikely to move forward and may indeed see further capital drawdowns on your trading account. Accepting this reality, gives you the drive to avoid the other potential traps and put the right things in place to reduce the likelihood of it happening again.

Trap 2 – Fail to explore WHY it happened? Beyond accepting responsibility one of your first tasks is to examine potential and subsequently actual factors that may have contributed. Commonly these can all come under the following: a.

You didn’t know what you were doing due to a knowledge gap b. You didn’t have an evidence-based (i.e. you have tested it and refined accordingly) specific comprehensive trading plan that guided your actions c. You didn’t follow your trading plan d.

Your trading system is comprehensive and sufficiently specific but doesn’t work and needs reviewed i.e. a new set of entry/exit criteria The temptation is, and many traders will go straight to ‘d’ of the above, but again arguably there is an element of “finger pointing” rather than taking responsibility. The reality is that of the four factors above the latter is the most unlikely cause. Being honest in your review is critical.

Such an honest review will give you clear guidance on which factor(s) you should focus on working on. Trap 3 – ‘Revenge’ trading Although this is a term bandied around frequently, let us delve beyond the ‘beermat psychology’ and look a little closer at what this may mean. In essence, the underlying emotional motivation is to get back to where you were before in terms of your account capital.

Commonly this thinking is backed by “desperation”, subsequently influencing actions that often bear little resemblance to good trading practice. In action, you may see: • Taking trades when there is no clear set up • Partial or complete ignoring of any trading plan • Inappropriate actions further trades go against you (e.g. finding reasons to stay in future trades when there is an exit) • Trading higher position sizing that you previously had • Trading each small market move, taking a reverse position even on a trend pause. • Looking to trade tighter and tighter timeframes These of course may significantly contribute to further losses as this emotional rather than system- based trading takes a stronger and stronger hold on your actions. Logically, the following may be more appropriate: • Give yourself some breathing space to properly review …STOP trading while you complete this (As described above) • Although easy to say and not so easy to accept the reality is that your account capital is what it is now, not what it was.

There was, for many in this situation, a time in your trading where whatever your capital level, your aim was to increase whatever that level was and put actions in place to give yourself the best chance of that happening. Ultimately, even if you strayed from this, developing consistency in appropriate trading plan actions and measurement are accepted by most traders as the way to make this happen over time. So, you need to press the “RESET button”, accept it as it is, and have the goal that through returning to that good trading practice consistently, and filling the gaps you need to.

Making this your goal rather than a dollar figure, may give yourself the chance to build capital not just to its previous level but beyond. Let it go! And do the right things from here I guess is the bottom-line message.

Trap 4 – Position size according to your previous rather than current account level This final trap for discussion in this article may seem obvious on the surface, but may either be a symptom of the previous point or something that is overlooked (unless of course inappropriate position sizing was one of the root causes of a major drawdown which you will discover in your review). It is crucial, and hence why we make special reference to it here, that you have a set risk level, usually expressed as a % of your account capital. This will differ from trader to trader but is comply between the 1-3% level as an example.

This determines lot/contract size (dependent on what you are trading) for any individual trade and combined with “stop loss” placement is a critical part of your risk management now and going forward. You need to recalculate what this is for you with reference to your NEW account size and factor this into your decision making, even if this means you are trading smaller amounts for now. In summary, major trading drawdowns are upsetting, and although not common often create additional ‘traps’ which may worsen what has happened to your trading capital.

And finally... Although perhaps of little consolation that many, many traders who now have sustained success, will have gone through this like you, the difference between what happens next and for your trading account in years to come, to your account is likely to be as a result of what you do next. You have choices to make but avoiding the above four traps described may perhaps assist in ultimately getting to where you want to be with your trading going forward.