กลยุทธ์การเทรดเพื่อสนับสนุนการตัดสินใจของคุณ

สำรวจเทคนิคเชิงปฏิบัติที่จะช่วยให้คุณวางแผน วิเคราะห์ และปรับปรุงการเทรดของคุณ.

ความผันผวนมีวิธีแสดงออกโดยไม่ได้รับเชิญ

วันหนึ่ง ASX กำลังเคลื่อนไหวอย่างเงียบ ๆ... และในวันถัดไป ข้อกำหนดมาร์จิ้นเพิ่มขึ้น การหยุดหยุดไม่เต็มตามที่คาดไว้ และพอร์ตโฟลิโอเปิดด้วยช่องว่างที่ไม่สบายใจในคืนคืน

หากคุณกำลังค้นหาคำตอบคุณไม่ได้อยู่คนเดียวคำถามที่ค้นหามากที่สุดเกี่ยวกับความผันผวนของเทรดเดอร์ชาวออสเตรเลียเกี่ยวข้องกับมาร์จิ้น การสลิปเพจ ช่องว่างข้ามคืน กองทุนที่ซื้อขายด้วยเลเวอเรจ (ETF) และเครื่องมือต่างๆ เช่น ช่วงจริงเฉลี่ย (ATR)

นี่คือสิ่งที่เกิดขึ้น

ทำไมสิ่งนี้จึงมีความสำคัญตอนนี้

ตลาดโลกมีความอ่อนไหวต่ออัตราดอกเบี้ยข้อมูลเงินเฟ้อการเมืองทางภูมิศาสตร์และกระแสที่ขับเคลื่อนด้วยเทคโนโลยีเมื่อสภาพคล่องลดลงและความไม่แน่นอนเพิ่มขึ้น การเปลี่ยนแปลงของราคาจะเพิ่มขึ้นนั่นคือความผันผวน

และความผันผวนไม่เพียงส่งผลกระทบต่อทิศทางราคาเท่านั้น แต่ยังเปลี่ยนวิธีการดำเนินการซื้อขายจำนวนเงินที่ต้องการและพฤติกรรมความเสี่ยงภายใต้พื้นผิวอย่างไร

แปล: ความผันผวนไม่ได้เป็นเพียงการเคลื่อนไหวที่ใหญ่ขึ้นเท่านั้น แต่ยังเกี่ยวกับการเคลื่อนไหวที่เร็วขึ้นและสภาพคล่องที่บางลง นั่นคือเมื่อกลไกของการซื้อขายมีความสำคัญมากที่สุด

ต้องการกรณีศึกษาความผันผวนในโลกแห่งความเป็นจริงหรือไม่?

ทำไมโบรกเกอร์ของฉันจึงเพิ่มข้อกำหนดมาร์จิ้น

หนึ่งในคำถามที่ค้นหามากที่สุดเกี่ยวกับความผันผวนคือเหตุใดข้อกำหนดมาร์จิ้นจึงเพิ่มขึ้นโดยไม่ต้องแจ้งเตือน

เมื่อตลาดไม่เสถียร โบรกเกอร์อาจเพิ่มข้อกำหนดมาร์จิ้นสำหรับสัญญาสำหรับความแตกต่าง (CFD) และผลิตภัณฑ์ที่มีเลเวอเรจอื่น ๆการเปลี่ยนแปลงของราคาที่ใหญ่ขึ้นสามารถเพิ่มความเสี่ยงของบัญชีที่เปลี่ยนไปสู่หุ้นเชิงลบ ดังนั้นการเพิ่มข้อกำหนดมาร์จิ้นจะช่วยลดเลเวอเรจที่มีอยู่และสามารถช่วยจัดการความเสี่ยงในช่วงสภาวะที่รุนแรง

สิ่งนี้อาจหมายถึงอะไรในทางปฏิบัติ

- มาร์จิ้นคอลอาจเกิดขึ้นแม้ว่าราคาจะไม่เคลื่อนไหวอย่างมีนัยสำคัญ

- เลเวอเรจที่มีประสิทธิภาพสามารถลดลงได้อย่างรวดเร็ว

- อาจต้องลดตำแหน่งในเวลาอันสั้น

การปรับมาร์จิ้นมักเป็นการตอบสนองต่อความเสี่ยงของตลาดที่เปลี่ยนแปลงไม่ใช่การตัดสินใจแบบสุ่มในตลาดที่มีความผันผวนสูง ควรสมมติว่าการตั้งค่ามาร์จิ้นสามารถเปลี่ยนแปลงได้อย่างรวดเร็ว ดังนั้นเทรดเดอร์หลายคนจึงเลือกที่จะตรวจสอบขนาดตำแหน่งและบัฟเฟอร์ที่มีอยู่โดยพิจารณาจากความเสี่ยงนั้น

การลื่นไถลคืออะไรและทำไมฉันถึงไม่เติมเงินในราคาของฉัน

หัวข้อที่ค้นหาบ่อยอีกประการหนึ่งคือการลื่นไถล

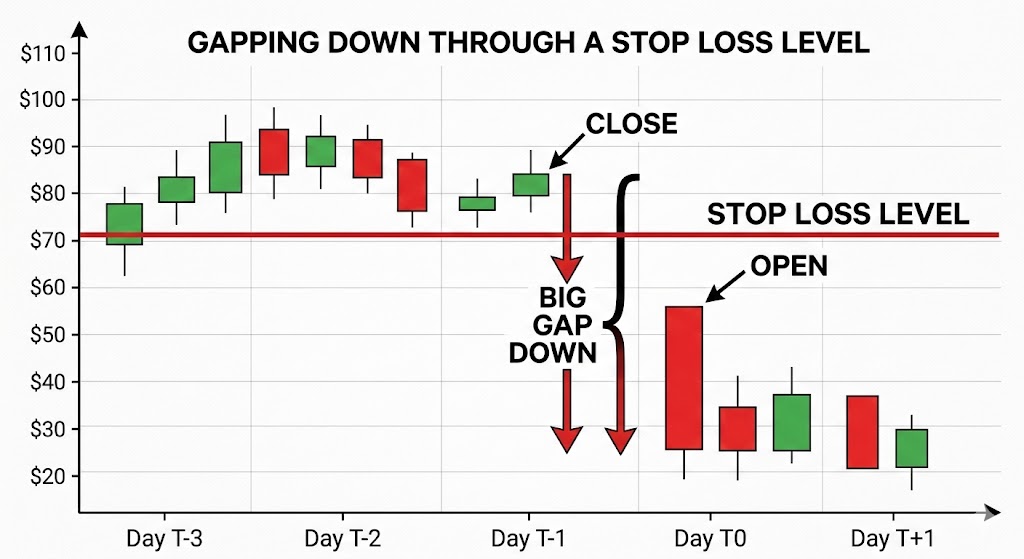

การลื่นไถลอาจเกิดขึ้นเมื่อคำสั่งหยุดทริกเกอร์และดำเนินการในราคาถัดไปผลลัพธ์อาจขึ้นอยู่กับประเภทคำสั่งซื้อสภาพคล่องของตลาดและช่องว่างในตลาดที่สงบ ความแตกต่างอาจมีขนาดเล็กในขณะที่ในตลาดที่รวดเร็ว ราคาอาจมีช่องว่างเกินระดับหยุด

ไดรเวอร์ทั่วไป ได้แก่

- การเปิดตัวทางเศรษฐกิจหรือรายได้ที่สำคัญ

- สภาพคล่องบาง

- ระดับการหยุดที่แออัด

- เซสชันค้างคืน

คำสั่งหยุดขาดทุนโดยทั่วไปจะให้ความสำคัญกับการดำเนินการมากกว่าความมั่นใจในราคา และในช่วงที่มีความผันผวนสูง ความแตกต่างนี้จะมีความสำคัญการปรับขนาดตำแหน่งและการวางสต็อปโดยอ้างอิงกับการเคลื่อนไหวของราคาทั่วไปอาจมีประสิทธิภาพมากกว่าเพียงแค่กระชับสต็อปในสภาวะที่ไม่เสถียร

ฉันจะจัดการการถ่ายภาพข้ามคืนบน ASX ได้อย่างไร

ออสเตรเลียซื้อขายในขณะที่สหรัฐอเมริกานอนหลับและในทางกลับกันน่าเศร้าที่ความแตกต่างของเขตเวลานี้เป็นเหตุผลหนึ่งที่ผู้ค้าออสเตรเลียค้นหาความเสี่ยงจากช่องว่างข้ามคืนหากตลาดสหรัฐลดลงอย่างรวดเร็ว ASX อาจเปิดต่ำสุดในเช้าวันรุ่งขึ้น โดยไม่มีโอกาสที่จะออกระหว่างการปิดและการเปิด

ตัวอย่างวิธีการจัดการความเสี่ยงที่ผู้ค้าตลาดอาจใช้ ได้แก่

- การป้องกันความเสี่ยงดัชนีโดยใช้ฟิวเจอร์ส ASX 200 หรือ CFD*

- การป้องกันความเสี่ยงบางส่วนในช่วงเหตุการณ์ที่มีความเสี่ยงสูง

- ลดการเปิดรับแสงก่อนการประกาศมาโครที่สำคัญ

การป้องกันความเสี่ยงสามารถชดเชยส่วนหนึ่งของการเคลื่อนไหวได้ แต่จะทำให้เกิดความเสี่ยงพื้นฐานเนื่องจากหุ้นแต่ละหุ้นอาจไม่เคลื่อนไหวสอดคล้องกับดัชนีที่กว้างขึ้น

ไม่มีการป้องกันที่สมบูรณ์แบบเพียงการแลกเปลี่ยนระหว่างต้นทุนความซับซ้อนและการลดความเสี่ยง

*CFD เป็นตราสารที่ซับซ้อนและมีความเสี่ยงสูงที่จะสูญเสียเงินเนื่องจากเลเวอเรจ

อะไรคือความเสี่ยงที่สำคัญของ ETF แบบมีเลเวอเรจหรือผกผันในตลาดที่ผันผวนได้?

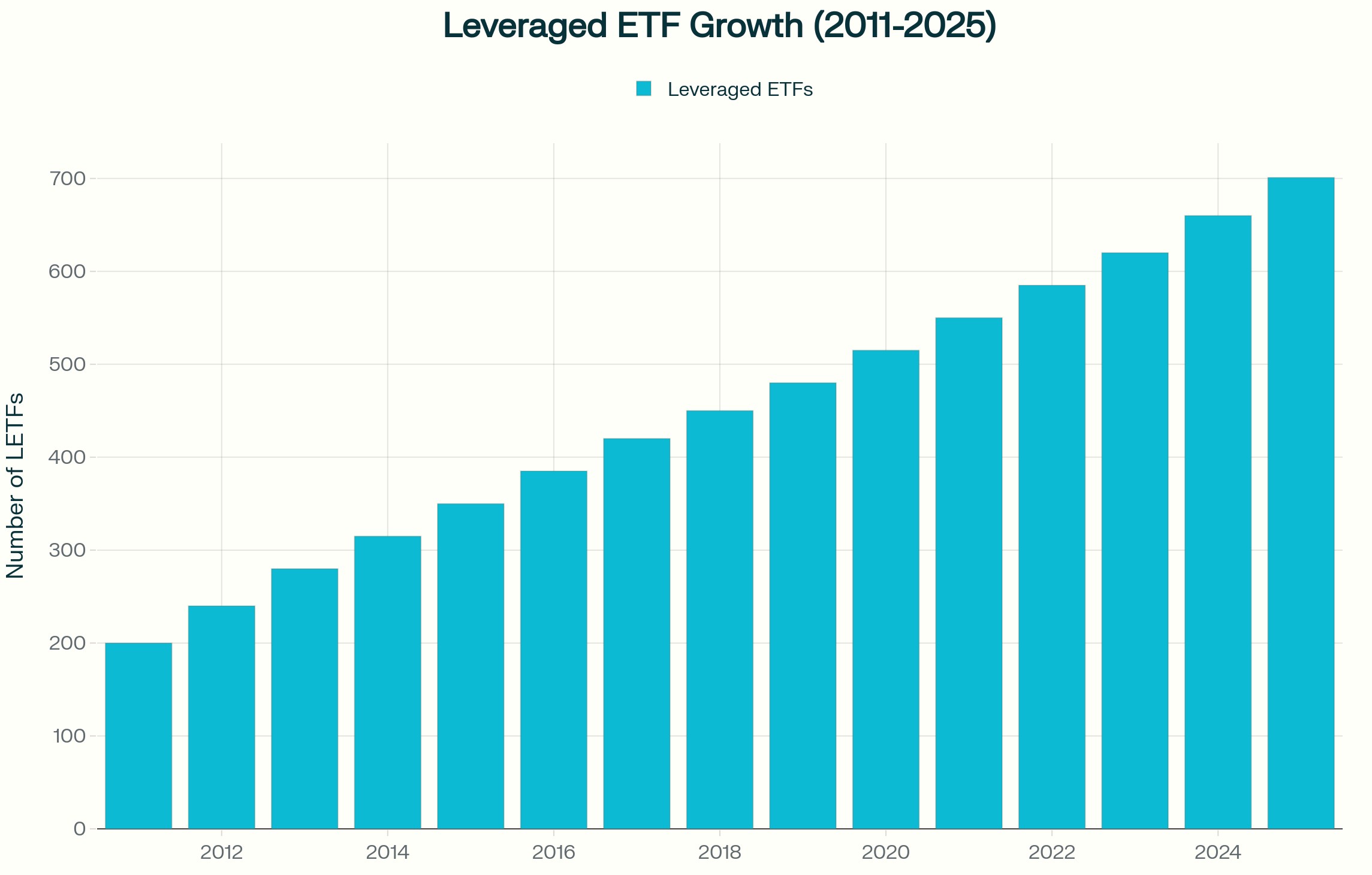

ETF แบบมีเลเวอเรจและผกผันมักจะค้นหาในช่วงที่มีความผันผวนสูงขึ้น

แม้ว่าผลิตภัณฑ์เหล่านี้มักจะรีเซ็ตทุกวัน แต่ก็มีจุดมุ่งหมายที่จะส่งผลตอบแทนรายวันของดัชนีหลายรายการ ไม่ใช่ผลตอบแทนระยะยาวในตลาดด้านข้างที่มีความผันผวน การผสมผสานรายวันสามารถลดมูลค่าได้แม้ว่าดัชนีจะจบใกล้ระดับเริ่มต้นก็ตาม

สิ่งนี้เกิดขึ้นเนื่องจากกำไรและขาดทุนรวมกันอย่างไม่สมมาตรการลดลง 10 เปอร์เซ็นต์ต้องมีการเพิ่มขึ้นมากกว่า 10 เปอร์เซ็นต์ในการฟื้นตัวเมื่อผลนั้นคูณทุกวัน ผลลัพธ์อาจแตกต่างจากดัชนีอ้างอิงอย่างมากเมื่อเวลาผ่านไป

ผู้เข้าร่วมตลาดบางรายอาจใช้อุปกรณ์ดังกล่าวโดยทั่วไปแล้วพวกเขาไม่ได้ถูกออกแบบมาเป็นเครื่องมือป้องกันความเสี่ยงระยะยาวและการทำความเข้าใจโครงสร้างของพวกเขาเป็นสิ่งสำคัญก่อนที่จะใช้ในกลยุทธ์

จะใช้ ATR เพื่อแจ้งตำแหน่งการหยุดได้อย่างไร?

ช่วงจริงเฉลี่ย (ATR) เป็นตัวบ่งชี้ที่ใช้กันทั่วไปสำหรับการวัดความผันผวน

ATR ประมาณจำนวนสินทรัพย์เคลื่อนที่ในช่วงระยะเวลาที่กำหนด รวมถึงช่องว่างแทนที่จะตั้งค่าการหยุดที่เปอร์เซ็นต์โดยพลการ เทรดเดอร์บางรายอ้างอิง ATR และวางจุดหยุดที่หลายครั้ง เช่น ATR สองหรือสามเท่า เพื่อสะท้อนถึงเงื่อนไขที่มีอยู่

เมื่อความผันผวนเพิ่มขึ้น ATR จะขยายตัวและอาจบ่งบอกถึงการหยุดที่กว้างขึ้นหรือขนาดตำแหน่งที่เล็กลงหากความเสี่ยงโดยรวมจะคงที่การเปลี่ยนจากการถามว่า “ฉันเต็มใจที่จะแพ้ไกลแค่ไหน?”เพื่อถามว่า “การเคลื่อนไหวปกติในสภาพปัจจุบันคืออะไร?”

การพิจารณาเชิงปฏิบัติในตลาดที่ผันผวน

ในช่วงที่มีความผันผวนสูงเทรดเดอร์อาจพิจารณา

- อนุญาตให้มีความเป็นไปได้ของการเปลี่ยนแปลงมาร์จิ้น

- ปรับขนาดตำแหน่งอย่างอนุรักษ์นิยมหากความผันผวนเพิ่มขึ้น

- รับทราบว่าคำสั่งหยุดขาดทุนไม่รับประกันราคาขาออกที่เฉพาะเจาะจง

- ทบทวนการเปิดเผยก่อนเหตุการณ์เศรษฐกิจที่สำคัญ

- ทำความเข้าใจกลไกการรีเซ็ตรายวันของ ETF ที่มีเลเวอเรจ

- การใช้มาตรการความผันผวนเช่น ATR เพื่อแจ้งตำแหน่งหยุด

- การรักษาบัฟเฟอร์เงินสดเพียงพอ

ความผันผวนไม่ได้ให้รางวัลการคาดการณ์เพียงอย่างเดียวการเตรียมความพร้อมและการรับรู้ความเสี่ยงอาจช่วยให้เทรดเดอร์เข้าใจความเสี่ยงที่อาจเกิดขึ้น แต่ผลลัพธ์ยังคงคาดเดาไม่ได้

อ่าน: ความผันผวนทั่วโลกและวิธีการซื้อขาย CFD

สิ่งนี้หมายถึงอะไรสำหรับผู้ค้าชาวออสเตรเลีย

ตลาดออสเตรเลียต้องเผชิญกับข้อพิจารณาเชิงโครงสร้างเฉพาะที่เกี่ยวข้องกับตลาดเอเชียและสหรัฐฯความเสี่ยงจากช่องว่างข้ามคืนได้รับอิทธิพลจากชั่วโมงการซื้อขายของสหรัฐฯ และดัชนีที่มีปริมาณทรัพยากร เช่น ASX สามารถตอบสนองต่อการเคลื่อนไหวของราคาสินค้าโภคภัณฑ์และข้อมูลจากประเทศจีนได้อย่างรวดเร็วการเปิดเผยต่อสกุลเงิน รวมถึงการเคลื่อนไหวของ AUD และดอลลาร์สหรัฐ (USD) สามารถเพิ่มความแปรปรวนอีกชั้นได้

ความผันผวนไม่สม่ำเสมอในแต่ละภูมิภาคมีพฤติกรรมแตกต่างกันขึ้นอยู่กับโครงสร้างตลาดและความลึกของสภาพคล่อง

คำถามที่พบบ่อยเกี่ยวกับความผันผวน

อะไรทำให้เกิดความผันผวนของตลาดเพิ่มขึ้นอย่างกะทันหัน?

การตัดสินใจเกี่ยวกับอัตราดอกเบี้ย ข้อมูลอัตราเงินเฟ้อ การพัฒนาภูมิรัฐศาสตร์ ความประหลาดใจในรายได้ และข้อ จำกัด ด้านสภาพคล่องเป็นตัวกระ

ทำไมโบรกเกอร์จึงเพิ่มมาร์จิ้นในช่วงตลาดที่ผันผวน

เพื่อลดโอกาสในการใช้เลเวอเรจและจัดการความเสี่ยงเมื่อการเปลี่ยนแปลงของราคาเพิ่มขึ้น

คำสั่งหยุดขาดทุนสามารถล้มเหลวในช่วงความผันผวนได้หรือไม่?

พวกเขาสามารถสัมผัสกับความลื่นไถ่ถ้ามีช่องว่างของตลาดเกินระดับหยุด ซึ่งหมายความว่าการดำเนินการอาจเกิดขึ้นในราคาที่แย่กว่าที่คาดไว้ในตลาดที่รวดเร็วหรือไม่มีสภาพคล่องความแตกต่างนี้อาจมีนัยสำคัญ

ETF แบบมีเลเวอเรจเหมาะสำหรับการป้องกันความเสี่ยงระยะยาวหรือไม่

โดยทั่วไปจะมีโครงสร้างสำหรับการสัมผัสระยะสั้นเนื่องจากการรีเซ็ตรายวันเหมาะสมหรือไม่ขึ้นอยู่กับวัตถุประสงค์สถานการณ์ทางการเงินและความอดทนต่อความเสี่ยงของคุณ

จะวัดความผันผวนก่อนทำการซื้อขายได้อย่างไร?

เครื่องมือเช่น ATR ตัวบ่งชี้ความผันผวนโดยนัย และการวิเคราะห์ช่วงในอดีตสามารถช่วยหาปริมาณสภาวะที่มีอยู่ได้

คำเตือนความเสี่ยง: ช่วงเวลาของความผันผวนที่สูงขึ้นอาจนำไปสู่การเคลื่อนไหวของราคาอย่างรวดเร็ว การเปลี่ยนแปลงมาร์จิ้น และการดำเนินการในราคาที่แตกต่างจากที่คาดไว้เครื่องมือการจัดการความเสี่ยง เช่น คำสั่งหยุดขาดทุนและตัวบ่งชี้ความผันผวนอาจช่วยในการประเมินสภาพตลาด แต่ไม่สามารถขจัดความเสี่ยงต่อการสูญเสียได้ โดยเฉพาะอย่างยิ่งเมื่อใช้ผลิตภัณฑ์ที่มีเลเวอเรจ

Entries for longer-term stock investment approaches can be based on either long-term technical trends or more commonly, fundamental data related to a company’s current and projected performance. Despite the plethora of such suggestions, there is often a lack of clear guidance, or even a complete absence, of instructions on determining the timing of an exit from a long-term position. Logically, whether it’s a short-term technical entry or long-term fundamental entry, many of the “rules of the game” are similar, including the need for clear and unambiguous exit strategies seems paramount for consistently positive investment outcomes.

The approach originally used to make an entry decision can serve as a good starting point but there are other considerations that can potentially benefit outcomes. This article aims to briefly describe six potential exit approaches you could consider, providing some detail and examples as to how to action your chosen approach. Target Price Exit Strategy Setting Targets: Determine a fair value (and thus exit price target) by conducting in-depth fundamental analysis, utilizing metrics like Price-to-Earnings ratio (P/E), Cash flow, debt levels, book value, or longer-term technical levels.

On-going monitoring: Regularly track the price against this target. For example, if you calculate a fair value for a stock at $50, and it’s currently trading at $45, you might decide to sell once it reaches or exceeds $50. Other Considerations: Regularly review and adjust the target price, taking into account changes in fundamental factors impacting the relevant sector or market as a whole.

Ongoing Fundamental Awareness Ongoing Analysis: Continuously evaluate underlying fundamentals, such as earnings, balance sheets, cash flow, and management quality. Be vigilant not only when next company reporting dates are due but also for the often-unpredictable release of operational updates or changes in guidance. Trigger Points: Identify specific company indicators or information that would prompt an exit.

An example of this may be a sustained decline in revenue or mounting debt levels, particularly when beyond what was originally expected. Other Considerations: Implementing this strategy requires consistent research and a nuanced understanding of the particular business and industry factors influencing the investment. Having the optimum resources in place to be able to do this is vital and identifying these should be a primary goal of any fundamental investor.

Economic & Sector Changes On-going Analysis: Regularly review broader economic indicators like GDP growth, inflation, interest rates, or industry trends. Understand how such changes in these key data points may correlate with the asset price and establish exit criteria accordingly.For example, you may reconsider a position in a technology stock if there’s a widespread shift away from tech spending or growth concerns or regulatory changes that detrimentally affect the sector. Other Considerations: This strategy necessitates a broad understanding of economic cycles, industry dynamics, and how these elements interact with your particular investment holdings.

Additionally, it’s worth noting that appropriate resources should be in place to ascertain this as proactively as possible, or at worst in a timely manner. This may assist in preventing excess depreciation in asset price to the point where action is delayed and major capital damage has occurred. Dividend Targeted Approaches On-going Analysis: If part of your entry criteria and anticipated return from fundamental analysis-oriented trades is based on dividend yield to some degree, it is worthwhile to not only look at what is current but also perform ongoing evaluation of the reliability and/or growth of dividends.

Exit Criteria: Having established an expected return, it logically makes sense to have criteria in place to help decision making. For example a decrease in dividend yield below a certain threshold or a cut in dividends could be part of your potential exit plan for a specific investment. Other Considerations: As well as vigilance for the timing of company announcements where dividend changes are often announced, awareness of the yield of your current investment compared to others, and industry trends is required, as they could influence the sector and the market as a whole.

Time-Based Exits On-going Analysis: Often with time-based exits, there is alignment with a particular impending event. Examples of this type of event include a shift to EVs from petrol-fuelled cars or the impact on assets in the lead-up to an election. Either way, your investment time horizon needs to be reviewed should there be a change in circumstances and the rationale behind your initial thinking on entry.

Other Considerations: There is a discipline involved in exiting from a stock position that remains strong even after an event, or the impact of such, has passed. With a systematic approach to fundamental entries in place, it is legitimate to review whether other fundamental approach criteria are met and perhaps consider continuing to hold. Without this in place, or if no match with other approaches exists, logic would dictate that a planned exit is an exit, and you should action it as such, no matter how well this specific position has served you to date.

Portfolio Rebalancing On-going Analysis: Although not based on a specific entry approach, periodically evaluate your overall portfolio asset allocation is prudent. Reviewing whether the current holdings are still a fit with long-term investment aims and risk tolerance in current and ongoing market circumstances are appropriate rebalancing considerations. Rebalancing Exit Approach: Criteria for rebalancing should be pre-planned and clearly defined.

These may require consideration of multiple factors, such as an asset becoming an excessive portion of the portfolio on good performance, or changes in market or economic circumstances that threaten specific portions of the portfolio. Other Considerations: Continuous monitoring of the portfolio is required, and checking continuing congruence with desired asset allocation and your risk profile is vital. Rather than based on a specific entry approach, just to reinforce that the concept of rebalancing is one that is important across all of the approaches described above.

Summary Although they receive little “airplay” in comparison to technical approaches and exits, the exit strategies within a portfolio based on fundamental analysis entries are multifaceted, frequently interconnected, and equally important to master. Crafting a proficient exit system demands a comprehensive knowledge of each specific investment holding, and wider market and economic dynamics, in the context of your personal investment objectives, and risk tolerance. The need for a set of written system criteria for all actions, regular monitoring, thorough analysis, and disciplined adherence to predetermined exit criteria are essential.

Ideally, as traders, our aim is often to identify potential entries at the start of a new trend (so “first in the queue”) and exit at the end of that trend. Of course, we often will identify a price move where a trend may already be established and are therefore faced with the decision as to “join in” mid-trend (we hope) with the aim of catching the rest of a trend move. The concern of this approach is of course the fear of potentially entering just prior to that trend changing.

There are “clues” we can use, such as candle body/wick size and volume which may help, but also there is a group of indicators termed ‘oscillators’ which work on the idea that there are points in a price move which the underlying asset (be it a Forex pair or CFD) may be overbought (and hence a long trade could be deemed riskier), and oversold (where a short trade may be termed riskier). Although the Relative Strength Index (RSI) which we covered previous in an article (review "Adding the RSI to your entry or exit trading plan? "), is possibly a more commonly used oscillator for determining oversold and overbought situations, the stochastic although possibly seen as being slightly more complex, does appear to be frequently used by more experienced traders. This article aims to shed some light on how this indicator is used and what it may be showing you relative to price movement.

What is the stochastic trying to tell us? As with the RSI the Stochastic is an oscillator (whose value can theoretically lie between 0-100) which has identified key levels which may indicate whether a particular asset is overbought or oversold. A move into either of these two “zones” may suggest a trend change is more likely to be imminent.

The key levels are below 20 (oversold) and above 80 (overbought). See below a 30-minute chart for GBP/USD with the stochastic added using the default system settings (we have added horizontal lines from the drawing tools to make the key levels clearer. We will discuss settings later and the additional line but at a simple level, taking the blue line on the stochastic if it moves below 20, then you would be cautious and perhaps avoid entering a short trade (examples A and B), and perhaps avoid entering a long trade if it moves above 80 (see example C).

And the other dotted line? There are two lines that form the stochastic namely: %K (usually a solid line) – In this case blue as previously referenced above. %D (usually a dotted line) and is a moving average of %K (often set as an exponential) Slowing periods may also be set (default is 3). As a rule, the slower (bigger number the less “noisy” i.e. you will see less overbought and oversold conditions).

And how can it be used? a. As an additional entry criteria “tick” As referenced earlier, for entry, traders may use this as an additional tick (when other indicators may suggest entry) to make sure they do not enter a long trade on an overbought currency pair/CFD, or short trade on an oversold currency pair/CFD. b. As a warning to prepare for exit action in an open trade Though less commonly discussed, it would appear logical that if in a long trade for example and the Stochastic moves into an over-bought position this could be a warning to consider exit (more commonly used as a signal to tighten a trailing stop loss) c.

As a primary reversal signal Additionally, some traders may look to buy when moving out of an oversold situation when the EMA dotted line crosses the solid blue line. (and of course, the reverse when overbought). It would be rare to use this in isolation with no other indicators, using increasing volume, and candle change recognition would often be used also. The relatively fast default settings (5,3,3) may merit some review anyway but particularly in this case.

Which settings? As with any indicator you are in control of the settings and what you use for you is of course your choice. With the chart below, we have used the default 5,3,3 and added a 21,7, 7 to illustrate the difference of a less noisy set of perimeters.

In Summary Ultimately, and to finish, it is of course your choice as to which criteria you use for entry and exit. Remember, whatever these are for you, the key lessons of: a. specifically identifying how you are to use the criteria within your plan, b. the importance of forward-testing (as well as back-testing) of any system change, c. and of course, the discipline of following through are ALL critical whether you use the Stochastic, RSI or neither.

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pattern is that stocks in long term up trends will pause and consolidate as some holders exit their positions and the stock is accumulated again by buyers in the market. The chart pattern can provide opportunities for powerful break outs and can be used across any time frame.

This allows traders to jump in on potential moves before they explode. Mechanics of the pattern The background of the pattern is relatively simple. The stock has been previously rising in an uptrend and has found some resistance.

It then moves into a period of consolidation categorised by 2-6 retracements with each one being smaller than the previous one. The volume should usually be decreasing as the chart moves to the right. The pattern culminates in a powerful break out that can often be long lasting.

The key for this pattern is that there needs to be a contraction of volatility as the chart moves from the left to the right. This highlights that the volume available is decreasing and becoming scarce. In addition, the more dramatic in volume, the more likely that the move will be explosive.

Below the breakout is accompanied by an increase in the relative volume. In the chart below for Natural Gas, the decrease in volume can be associated with the contracting candlestick pattern. This occurs prior to the break of the long-term resistance.

The breakthrough was also associated with a large amount of buying volume. The VCP can manifest itself in other patterns such as a cup and handle patterns. The key is that the candlesticks must be decreasing volatility.

A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to surpass. Resistance levels are often used in conjunction with support levels, or the point at which traders are unwilling to let an asset's price drop much lower. To understand this fully, it’s important to understand how support and resistance works in general.

A support line is when a price hits a low point (on the selling side) and resistance is when the price hits a high (on the buying side). If the prices rebound back to this price or continue to hit this price without surpassing it, it then starts to become a key resistance or support level. As a rule of thumb when using technical analysis, these tools become very important for some traders.

This is due to those points offering various outcomes. Whether they are a Bounce or a Break, essentially meaning, does the price hit the support/resistance and comes back (Bounce) or does it go through the support/resistance lines (Breaks). It is important to also use other indicators to accompany your technical analysis, as these movements could also easily become reversals or break outs, meaning, instead of them following your prognosis the price does the opposite.

When a price has been rejected various times, it builds an even stronger key resistance. Trading volume and sentiment can help to propel a price past this point and some of the biggest movements come after a price breaks a key resistance. Using a current trend (Fig 1) and a hypothetical trend (Fig 2), let’s take the daily timeframe for BTCUSD as an example (below).

The daily candle has broken through a key resistance of $41,000 as shown on figure 1. If a trader identifies this, they can do one of two things; trade it aggressively and place a trade as it breaks through or trade it conservatively and wait for the former resistance line to become the new support line before placing a trade (so wait for the price to bounce off as outlined on the drawn projection and circled on figure 2). Figure 1.

Figure 2. This technical analysis can be used for any asset you wish to trade: it’s transferrable and key in identifying entry or exit points of trades. By learning to spot the patterns and combining this with knowledge of trading volume and sentiment, you can start to understand the markets better.

Sources: Babypips, Investopedia, @sell9000 Twitter.

The U.S. Dollar Index (USDX, DXY, DX, or, informally termed “the Dixie") is a measure of the value of the United States dollar relative to a basket of foreign currencies. It is often used as an indicator of the overall strength or weakness of the U.S. dollar in the foreign exchange market.

Changes in the index value reflect shifts in the relative strength of the U.S. dollar compared to the other currencies in the basket. If the index rises, it suggests that the U.S. dollar is strengthening against the other currencies, and if it falls, it indicates a weakening dollar. The index is calculated using a geometric mean of the exchange rates between the U.S. dollar and a selected specific group of six major currencies.

A common misconception is the component currencies reflect what are commonly thought of as including the currencies that comprise the so called “majors”. However, the currencies that make up this basket are, the Euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK), and Swiss franc (CHF) ONLY. These currencies are then weighted based on their importance in international trade and financial markets to create a quoted overall numerical value, and changes in this value may plotted on a chart as with any other tradable asset class over a set period of time.

Here are the weightings of currencies that make up the USD index currently: Euro (EUR) - Weight: 57.6% Japanese Yen (JPY) - Weight: 13.6% British Pound (GBP) - Weight: 11.9% Canadian Dollar (CAD) - Weight: 9.1% Swedish Krona (SEK) - Weight: 4.2% Swiss Franc (CHF) - Weight: 3.6% Please keep in mind that these weightings are subject to change, albeit infrequently, and it's recommended to refer to reliable financial sources for the most up-to-date information on the U.S. Dollar Index components and their respective weightings. The impact of the USD on other asset classes The U.S.

Dollar Index (USDX) can have a significant impact on various asset classes, as changes in the value of the U.S. dollar relative to other major currencies can influence global financial markets and economic conditions. Here's how the USDX can affect different asset classes: Foreign Exchange (Forex) Market: Currency Pairs: The most direct impact of the USDX is on currency pairs. When the USDX strengthens, the U.S. dollar is gaining relative to other currencies in the basket.

Bear in mind that this strength may neither be uniform against individual currencies nor in the degree of price move in specific USD crosses nor even, on occasion, in the same direction. Commodities: Commodity Prices: A stronger U.S. dollar can put downward pressure on commodity prices. Commodities like gold, oil, and copper are often priced in U.S. dollars globally.

A stronger dollar can make these commodities more expensive for holders of other currencies, hence often there is an inverse relationship to some degree on how these move versus the USD. Gold is often seen as a hedge against a weakening U.S. dollar. When the dollar strengthens, gold can become relatively less attractive to investors seeking safe-haven assets, potentially leading to lower gold prices.

Equity Markets: U.S. Stocks: A stronger dollar can impact multinational companies' earnings negatively. When the dollar appreciates, the overseas profits of U.S. companies become worth less when converted back to dollars, potentially leading to lower corporate earnings.

Emerging Markets: Many emerging market economies borrow in U.S. dollars. If the U.S. dollar strengthens, the debt servicing costs for these economies can rise, leading to economic challenges. As a result, some emerging market stocks can experience increased volatility or even significant economic pressure over time.

Bonds: U.S. Treasuries: The value of U.S. Treasury bonds can be influenced by the USDX.

A stronger dollar can attract foreign investors seeking higher yields, potentially driving up demand for U.S. Treasuries and affecting bond prices. Interest Rates and Central Banks: US Federal Reserve Policy: The strength of the U.S. dollar can influence the decisions of the U.S.

Federal Reserve regarding interest rates. A stronger dollar might give the Fed room to consider tighter monetary policy, while a weaker dollar might lead to more accommodative policies. It's important to note that market dynamics are complex and influenced by a multitude of factors only one of which may be the USD.

Other factors such as economic data, geopolitical events, and central bank actions also have significant impacts on various asset classes, often more so than the USD itself, and indeed may in turn influence the USD. Trading the USD index There are a few ways you can trade the USDX: Futures Contracts: The most direct way to trade the USDX is through futures contracts. These contracts are traded on exchanges like the Intercontinental Exchange (ICE).

They allow you to speculate on the future value of the USDX without actually owning the underlying currencies. The UDX futures trade on the ICE (Intercontinental Exchange, Inc.) for 21 hours a day. Exchange-Traded Funds (ETFs): Some ETFs track the performance of the USDX.

These ETFs attempt to replicate the movements of the index and can be bought and sold on stock exchanges like regular stocks. The most liquid of these is UUP. Options: Contracts allow you to buy or sell options on the USDX at a specified price before or on a certain date.

Contracts for Difference (CFDs): CFDs are derivative instruments that allow you to speculate on price movements without owning the underlying asset. We offer CFDs on the USDX futures contract, which can enable you to go long or short the asset. As part of the extensive product suite offered by GO Markets you have the opportunity to trade both the ETF referenced above, and the USD index (ticker code USDOLLAR). (Keywords: Forex, USD, US dollar, US dollar index, USDX, DXY, Futures contract)

The Purchasing Managers' Index (PMI) is an economic indicator used to measure the health and activity level of a specific sector of an economy, namely the manufacturing or services sectors. PMI data is published on a monthly basis and is of three types: Manufacturing PMI: This is the most well-known type of PMI. It measures the health of the manufacturing sector within an economy.

The index is derived from surveys of purchasing managers at manufacturing companies and covers aspects like production, new orders, employment, supplier deliveries, and inventories. Services PMI: This measures the performance of the services sector, which includes industries like finance, healthcare, retail, education, and more. The services PMI considers factors such as business activity, new orders, employment, and business expectations.

Composite PMI: The composite PMI combines both the manufacturing and services PMI data to provide a broader picture of the overall economic activity in a country. This can be particularly useful for assessing the overall health of the economy. It provides insight into whether a sector is expanding or contracting by examining various business activity components.

PMI is a widely recognised and followed indicator that helps analysts, policymakers, and investors assess the overall economic conditions. The PMI can be viewed as a timely and forward-looking indicator, reflecting overall current economic conditions and provides insights into potential future trends. Here's how the PMI works: Data Collection: Surveys are conducted among purchasing managers from a representative sample of companies in the chosen sector.

These managers are responsible for making procurement decisions, which often provides insight into the current state of economic activity. Components: The PMI survey typically includes questions about various aspects of business activity, such as new orders, production output, employment, supplier deliveries, and inventory levels. Respondents indicate whether these components are expanding, contracting, or staying the same.

Scoring System: Each component of the survey is assigned a score. A score above 50 generally indicates expansion or growth in that component, while a score below 50 indicates contraction. A score of exactly 50 suggests no change.

Calculation of the final PMI: The scores of various components are aggregated to calculate the overall PMI. If the majority of components show expansion, the PMI will be above 50; if the majority show contraction, the PMI will be below 50. Sub-Indices: In addition to the overall PMI, sub-indices might provide insights into specific components like new orders, production, employment, and more.

PMI – The Market Response The market response to PMI (Purchasing Managers' Index) data can be quite significant and can impact various financial asset classes. As with any economic data, the market response to PMI releases will be largely dependent on the consensus estimates of each of the numbers (with are theoretically priced into markets to some degree) against the actual numbers released, and how close this is to estimates. A figure that is wide of the mark compared to expectations is likely to produce a more severe market response.

The response depends on several factors, including the direction of the PMI reading, the sector being measured, the overall economic context, the global significance of the country relevant country (e.g. US PMI may have more global market impact) and underlying market sentiment. Although the exact impact will be dependent on the PMI in the overall economic context, generally speaking the following may be some of the common responses.

General asset classes Equity Markets: A PMI reading above 50 is generally seen as a sign of economic expansion and growth. In the event of a better than expected number, this can lead to increased investor confidence in the market's overall health, potentially driving stock prices higher. A number less than expected and/or below 50 is likely as with this and those assets classes below to have the reverse impact, Currency Markets: In the foreign exchange market, a strong PMI reading can strengthen the currency of the country due to increased confidence in its economic outlook, and in interest sensitive environments may encourage central bank action potentially.

Commodity Markets: A positive PMI may signal increased demand for raw materials and resources, potentially boosting commodity prices, notably base metals and oil. Again, the country for which the PMI is released is relevant with a global impact on commodity prices only with the major manufacturing economies e.g. US and China.

Impact on Interest Rates: Central banks often closely monitor PMI data as part of their decision-making process regarding interest rates. A strong PMI might suggest an economy is heating up, potentially leading to discussions of tightening monetary policy (raising interest rates) to reduce the likelihood of increasing inflation. Conversely, a weak PMI might indicate the need for loosening policy (lowering interest rates) to stimulate growth.

Sector-Specific Responses: Different sectors can have varying sensitivities to PMI data. For example, manufacturing-focused indices and stocks may have a more pronounced response to PMI data related to manufacturing, while service sector indices may react more strongly to service sector PMI data. PMI data is a valuable tool for economists, investors, and policymakers to assess economic trends, make informed decisions, and understand the performance of various sectors within an economy.

As traders, our responsibilities are not only to keep abreast of not only when key data such as the PMI is released but to potentially take this into account with reference to potential risks, in our trading decision-making. (Keywords: PMI, Purchasing Managers Index, market data)