ข่าวสารตลาด & มุมมองเชิงลึก

ก้าวนำตลาดด้วยมุมมองเชิงลึกจากผู้เชี่ยวชาญ ข่าวสาร และการวิเคราะห์ทางเทคนิค เพื่อเป็นแนวทางในการตัดสินใจซื้อขายของคุณ.

การเคลื่อนไหวล่าสุดของน้ำมันทำให้ชื่อพลังงานกลับมาโฟกัสอีกครั้งในช่วงหกเดือนที่ผ่านมา Exxon Mobil และ Baker Hughes มีประสิทธิภาพเหนือกว่าน้ำมันดิบ Brent ในระดับปกติ Chevron ยังคงสร้างสรรค์อย่างกว้างขวาง SLB ยังคงล้าไปด้านสินค้าโภคภัณฑ์ และฉันทามติของโบรกเกอร์ของ Woodside ได้รับการวัดมากขึ้น

เมื่อน้ำมันดิบเคลื่อนไหว ผลกระทบจะไม่ค่อยถูกครอบคลุมกับสินค้าโภคภัณฑ์ราคาน้ำมันที่สูงขึ้นอาจส่งผลต่อความคาดหวังของเงินเฟ้อ ต้นทุนการจัดส่งและอัตรากำไรขององค์กรทั่วเศรษฐกิจโลก

การเคลื่อนไหวล่าสุดแสดงอะไร

บริษัทมีสามวิธีที่กว้างขวางสามารถรับประโยชน์จากราคาน้ำมันที่แน่นขึ้น:

- ผลิตน้ำมันและก๊าซโดยการขายสินค้าในราคาที่สูงขึ้น

- การให้บริการและอุปกรณ์แก่ผู้ผลิต

- การขนส่งน้ำมันทั่วโลก

แต่ละชื่อด้านล่างแสดงถึงประเภทหนึ่งของความเสี่ยงเหล่านั้น โดยมีโปรไฟล์ความเสี่ยงที่แตกต่างกันเมื่อน้ำมันดิบเพิ่มขึ้น

1.เอ็กซอนโมบิล (NYSE: XOM)

ในช่วงหกเดือนที่ผ่านมา Exxon Mobil มีประสิทธิภาพเหนือกว่าน้ำมันดิบ Brent โดยราคาหุ้นเพิ่มขึ้นเกือบ 35% เมื่อเทียบกับประมาณ 30% สำหรับ Brentณ วันที่ 11 มีนาคม 2026 ทั้งคู่ซื้อขายต่ำกว่าระดับสูงสุดตลอดเวลาเพียง 3% ในขณะที่ Exxon ยังคงใกล้ระดับสูงสุดในรอบ 52 สัปดาห์

Exxon Mobil เป็นหนึ่งในบริษัทน้ำมันแบบบูรณาการที่ใหญ่ที่สุดในโลก โดยมีการเปิดเผยแพร่ครอบคลุมการสำรวจ การผลิต การกลั่น และสารเคมีเมื่อราคาน้ำมันสูงขึ้น ธุรกิจอัพสตรีมอาจได้รับประโยชน์จากอัตรากำไรที่กว้างขึ้น ในขณะที่ขนาดและการกระจายความเสี่ยงสามารถช่วยยับยั้งส่วนที่อ่อนแอของวงจรได้

เอ็กซอน โมบิล (XOM) เทียบกับน้ำมันดิบเบรนต์ 6 เดือน

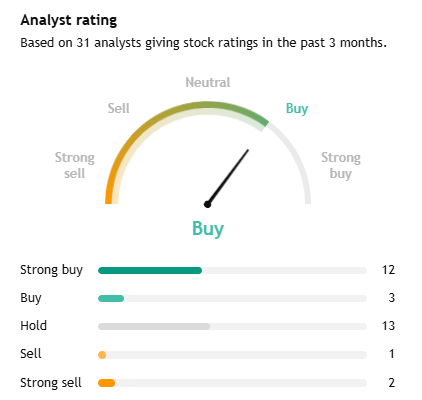

ฉันทามตินักวิเคราะห์: ซื้อ

จากข้อมูลของ TradingView ความเชื่อมั่นของนักวิเคราะห์ที่มีต่อเอ็กซอนมีความเป็นบวกอย่างกว้างขวางจากนักวิเคราะห์จำนวน 31 คนที่ติดตาม 15 คนให้คะแนนการซื้อหรือซื้อหุ้นที่แข็งแกร่ง 13 อัตรา Hold, 1 อัตรา ขาย และ 2 อัตรา ขายที่แข็งแกร่ง

มุมมองเชิงบวกนั้นเชื่อมโยงกับความแข็งแกร่งของงบดุลของ Exxon และการผลิตมาร์จิ้นที่สูงขึ้นนักวิเคราะห์ในแง่ดีที่สุดคาดการณ์เป้าหมายราคา 1 ปีสูงถึง 183.00 เหรียญสหรัฐเป้าหมายราคาเฉลี่ยอยู่ที่ 145.00 เหรียญสหรัฐ ซึ่งต่ำกว่าราคาซื้อขายปัจจุบันประมาณ 3.6%

2.เชฟรอน (NYSE: CVX)

Chevron เป็นรายใหญ่รวมระดับโลกอีกหนึ่งที่ได้รับประโยชน์จากการเคลื่อนไหวของน้ำมันดิบที่เพิ่มขึ้นเมื่อเร็ว ๆ นี้ โดยหุ้นซื้อขายใกล้ระดับสูงสุดในรอบ 52 สัปดาห์เช่นเดียวกับ Exxon Chevron ดำเนินงานทั่วห่วงโซ่คุณค่า รวมถึงการผลิตอัปสตรีมการกลั่นและการตลาด

การเข้าซื้อกิจการ Hess ที่เสร็จสมบูรณ์ของ Chevron เพิ่มกายอานาและสินทรัพย์อัปสตรีมอื่น ๆ ซึ่งนักวิเคราะห์บางคนเห็นว่าสนับสนุนเมื่อเวลาผ่านไปอย่างไรก็ตามผลกระทบของรายได้ยังคงอยู่ภายใต้การบูรณาการการดำเนินการโครงการและความเสี่ยงด้านราคาสินค้าโภคภัณฑ์

ผลการดำเนินงานของ Exxon Mobil vs เชฟรอน แผนภูมิ 6 เดือน

ฉันทามตินักวิเคราะห์: ซื้อ

Chevron ถูกมองเหมือนกับ Exxon โดยความเชื่อมั่นของโบรกเกอร์ยังคงสร้างสรรค์อย่างกว้างขวางผลรวมล่าสุดของ TradingView แสดงให้เห็นว่านักวิเคราะห์จำนวน 30 คนที่ครอบคลุมหุ้นในช่วงสามเดือนที่ผ่านมา โดยมี 17 อันดับ คือ ซื้อหรือซื้อที่แข็งแกร่ง 11 รายการ ขายที่ 1 และ 1 ที่ ขายที่แข็งแกร่ง

นักวิเคราะห์ได้เน้นพอร์ตการลงทุนที่หลากหลายของ Chevron และการมีส่วนร่วมที่อาจเกิดขึ้นจาก Hess แม้ว่าความผันผวนของราคาสินค้าโภคภัณฑ์และความเสี่ยงในการดำเนินการอาจทำให้ระมัดระวังมากขึ้น

3.SLB (NYSE: SLB)

SLB ซึ่งก่อนหน้านี้รู้จักกันในชื่อ Schlumberger เป็นหนึ่งในผู้ให้บริการด้านน้ำมันและเทคโนโลยีที่ใหญ่ที่สุดในโลกจัดหาเครื่องมืออุปกรณ์และซอฟต์แวร์ที่ช่วยให้ผู้ผลิตค้นหา เจาะและทำบ่อให้สมบูรณ์ได้อย่างมีประสิทธิภาพมากขึ้น

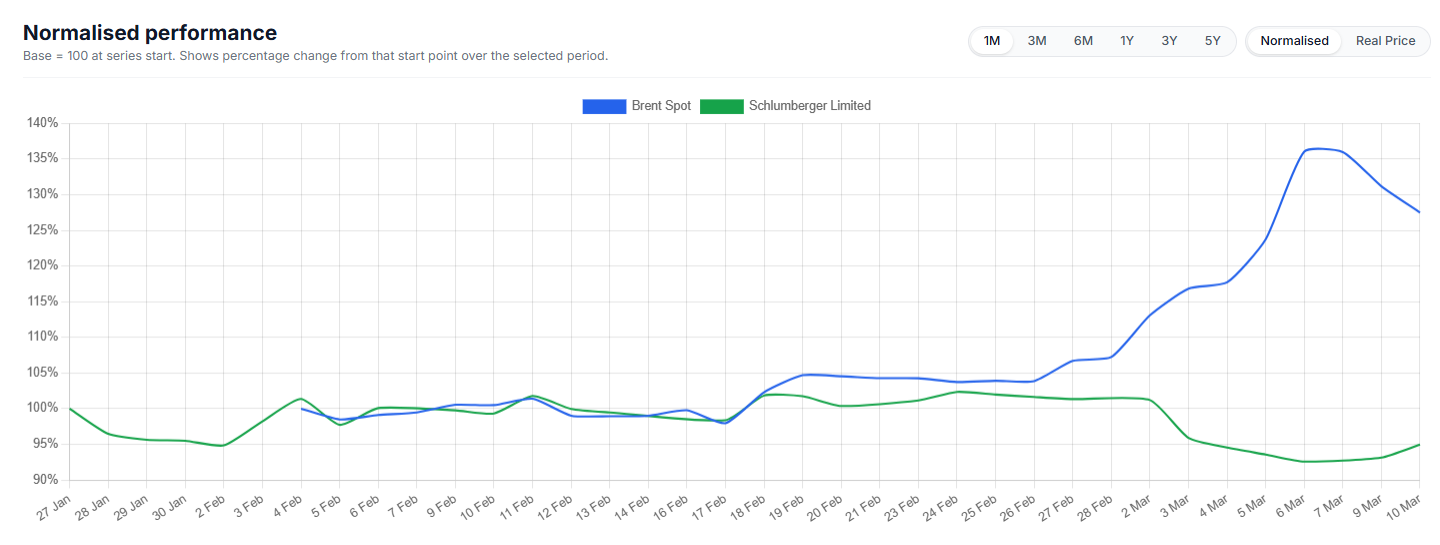

ในช่วงหกเดือนที่ผ่านมา SLB ล้าไปจากน้ำมันดิบ Brent โดยมีการซื้อขายราคาหุ้นอยู่ในช่วงชิปปิ้งและยังคงอยู่ต่ำกว่าจุดสูงสุดเมื่อเร็ว ๆ นี้นั่นแสดงให้เห็นว่าพื้นหลังน้ำมันที่แข็งแกร่งขึ้นยังไม่สะท้อนให้เห็นอย่างเต็มที่ในราคาหุ้น

รูปแบบดังกล่าวไม่ผิดปกติสำหรับ บริษัท บริการในทุ่งน้ำมัน ซึ่งการตัดสินใจใช้จ่ายของลูกค้ามักเป็นไปตามการเคลื่อนไหวในสินค้าโภคภัณฑ์อ้างอิงมากกว่าที่จะเคลื่อนที่ตามล็อคกับพวกเขาการจัดอันดับใหม่ในอนาคตจะขึ้นอยู่กับปัจจัยต่างๆ รวมถึงการใช้จ่ายเงินทุนของผู้ผลิต ระยะเวลาสัญญา การกำหนดราคาบริการ กิจกรรมนอกชายฝั่ง และเงื่อนไขของตลาดที่กว้างขึ้นไม่ควรสันนิษฐานว่าราคาน้ำมันที่มั่นคงจะแปลเป็นราคาหุ้น SLB ที่แน่นขึ้นโดยอัตโนมัติ

SLB เทียบกับน้ำมันดิบ Brent ประสิทธิภาพปกติ 6 เดือน

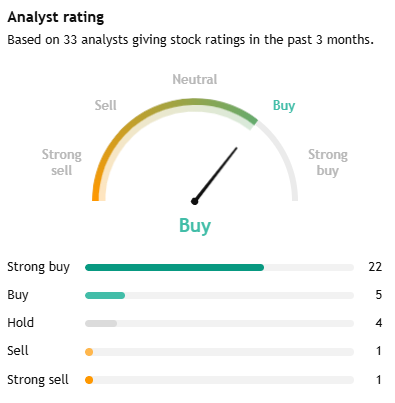

ฉันทามติ: ซื้อ

จากข้อมูลของ TradingView เห็นด้วยกันของนักวิเคราะห์บุคคลที่สามเกี่ยวกับ SLB คือ Buyจากนักวิเคราะห์จำนวน 33 คนที่ครอบคลุมหุ้น 27 คนให้คะแนนการซื้อหรือซื้อที่แข็งแกร่ง 4 อัตรา Hold และ 2 อัตรา ขายหรือขายที่แข็งแกร่ง

นั่นบ่งบอกถึงความเชื่อมั่นของโบรกเกอร์ที่สร้างสรรค์ แม้ว่าช่องว่างระหว่างราคาน้ำมันและผลการดำเนินงานราคาหุ้นล่าสุดของ SLB แสดงให้เห็นว่านักลงทุนอาจต้องการหลักฐานที่ชัดเจนในการปรับปรุงความต้องการบริการและราคาก่อนที่หุ้นจะสะท้อนให้เห็นถึงฉากหลังสินค้าโภคภัณฑ์ที่แข็งแกร่งขึ้นอย่างเต็มที่

4.เบเกอร์ ฮิวจ์ (NASDAQ: BKR)

Baker Hughes เป็นผู้ให้บริการและอุปกรณ์ในทุ่งน้ำมันรายใหญ่อีกรายหนึ่ง โดยมีการสัมผัสกับส่วนอุตสาหกรรมเพิ่มเติม เช่น LNG และโครงสร้างพื้นฐานด้านพลังงานแม้ว่าราคาน้ำมันจะไม่สูงสุดอย่างมาก แต่ความก้าวหน้าของเทคโนโลยีการขุดเจาะและต้นทุนที่ลดลงก็ช่วยให้การเล่นหินจำนวนมากทำกำไรได้ ซึ่งสนับสนุนความต้องการบริการ

บริษัทยังได้รับการอธิบายว่ามีตำแหน่งที่ดีเนื่องจากงบดุลและการเปิดเผยต่อกิจกรรมการสำรวจและการผลิตอย่างต่อเนื่องในช่วงที่ราคาน้ำมันสูงขึ้นหรือแม้แต่มีเสถียรภาพต่อบริษัท การผสมผสานระหว่างบริการและเทคโนโลยีพลังงานอาจสร้างแรงผลักดันรายได้หลายประการ

ในช่วงหกเดือนที่ผ่านมา Baker Hughes มีประสิทธิภาพเหนือกว่าน้ำมันดิบ Brent อย่างมีนัยสำคัญตามมาตรฐานBrent ซื้อขายในช่วงที่เข้มงวดกว่ามากในช่วงส่วนใหญ่ก่อนที่จะปรับตัวสูงขึ้นในช่วงปลายปี ในขณะที่ BKR เพิ่มขึ้นอย่างต่อเนื่องและได้กำไรสะสมที่แข็งแกร่งขึ้นอย่างมีนัยสำคัญนั่นชี้ให้เห็นว่าราคาหุ้นของ BKR ไม่เพียง แต่ได้รับประโยชน์จากฉากหลังของน้ำมันเท่านั้น แต่ยังรวมถึงการมองโลกในแง่ดีเฉพาะของบริษัทและการสนับสนุนในวงกว้างสำหรับบริการในแหล่งน้ำมันและชื่อเทคโนโลยีพลังงานอีกด้วย

BKR เทียบกับน้ำมันดิบ Brent ประสิทธิภาพปกติ 6 เดือน

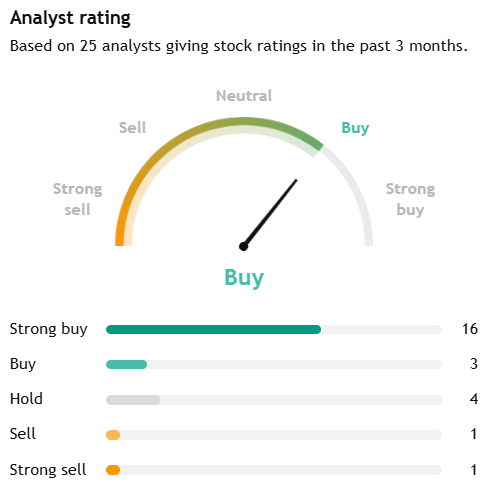

ฉันทามตินักวิเคราะห์: ซื้อ

จากข้อมูลของ TradingView Baker Hughes ได้รับการจัดประเภทเป็น Strong Buyจากนักวิเคราะห์ 25 คนที่ให้คะแนนในช่วงสามเดือนที่ผ่านมา 16 คนให้คะแนนการซื้อหุ้น Strong Buy, 3 คนให้คะแนนการซื้อสินค้า 4 คนให้คะแนนการถือหุ้น 1 ให้คะแนนขายและ1 อันดับให้คะแนนขายที่แข็งแกร่ง

โดยรวมแล้วความเชื่อมั่นของโบรกเกอร์ที่มีต่อ Baker Hughes นั้นเป็นไปในเชิงบวก โดยนักวิเคราะห์ครอบคลุมมากกว่าสามในสี่ให้คะแนนหุ้นทั้งStrong Buy หรือ Buy ในขณะที่ส่วนที่เหลือส่วนใหญ่อยู่ที่ Holdมุมมองของนักวิเคราะห์ที่สนับสนุนดังกล่าวดูเหมือนจะสะท้อนให้เห็นถึงความเสี่ยงของ BKR ต่อทั้งบริการสนามน้ำมันแบบดั้งเดิมและตลาดพลังงานและเทคโนโลยีอุตสาหกรรมที่กว้างขวาง รวมถึงโครงสร้างพื้นฐาน LNG

5.วูดไซด์เอ็นเนอร์ยี่ (ASX: WDS)

Woodside Energy ให้รายชื่อผู้ผลิตในออสเตรเลียที่มีการสัมผัสกับตลาดLNG และน้ำมันอย่างมีนัยสำคัญรายได้ของบริษัทมีความเชื่อมโยงอย่างใกล้ชิดกับราคาสินค้าโภคภัณฑ์ที่เกิดขึ้นจริง ซึ่งทำให้หุ้นมีความอ่อนไหวต่อการเปลี่ยนแปลงของราคาน้ำมันดิบและก๊าซ ตลอดจนความต้องการพลังงานทั่วโลกกว้างขึ้น

เมื่อเทียบกับชื่อพลังงานที่ใหญ่กว่าในสหรัฐอเมริกาบางชนิด ความเชื่อมั่นของโบรกเกอร์ที่มีต่อ Woodside ดูเหมือนจะวัดได้มากขึ้นนักลงทุนกำลังปรับสมดุลความเสี่ยงและเลเวอเรจของ LNG ทั่วโลกของบริษัทไปยังราคาพลังงานที่แข็งแกร่งขึ้นกับราคาที่เกิดขึ้นล่าสุดที่อ่อนลง ความเสี่ยงโครงการและการดำเนินการ และความกดดันด้านกฎระเบียบและการลดคาร์บอนในระยะยาว

ฉันทามตินักวิเคราะห์: จะ

จากข้อมูลของ TradingView วูดไซด์ได้รับการจัดอันดับเป็นNeutral/Holdจากนักวิเคราะห์ 15 คน 2 ประเมินให้คะแนนการซื้อที่แข็งแกร่ง 4 อัตรา ซื้อ 7 อัตรา Hold, 1 อัตรา ขาย และ 1 อัตรา ขายที่แข็งแกร่ง

เป้าหมายราคาเฉลี่ย 12 เดือนคือ 29.20 เหรียญสหรัฐเทียบกับราคาปัจจุบันประมาณ 30.28 เหรียญ ซึ่งหมายถึงการลดลงประมาณ 3.6%เมื่อเทียบกับชื่อพลังงานของสหรัฐอเมริกาที่ใหญ่กว่าในรายการนี้ นั่นชี้ไปที่มุมมองของโบรกเกอร์ที่ระมัดระวังมากขึ้น

6.ผู้ประกอบการเรือบรรทุกน้ำมันทั่วโลก

บริษัทเรือบรรทุกน้ำมันจะได้รับประโยชน์เมื่อราคาน้ำมันแข็งแกร่ง การเปลี่ยนแปลงนโยบายของ OPEC+ และความตึงเครียดทางภูมิศาสตร์เพิ่มการขนส่งทางระยะไกลและขัดขวางเส้นทางการค้าตามปกติเมื่อปริมาณน้ำมันเคลื่อนไหวต่อไป อุปสงค์ 'ตันไมล์' สามารถสนับสนุนอัตราค่าเรือบรรทุกวันและผลกำไรได้แม้ว่าตลาดพลังงานที่กว้างขวางจะผันผวนก็ตาม

ฉันทามติของนักวิเคราะห์: N/A

นี่เป็นหมวดหมู่อุตสาหกรรมที่กว้างกว่าหุ้นที่ซื้อขายต่อสาธารณะเดียว ดังนั้นจึงไม่มีฉันทามติของโบรกเกอร์คนเดียวที่จะอ้างถึงความคิดเห็นของนักวิเคราะห์จะต้องได้รับการประเมินในระดับบริษัท เช่น Frontline plc (FRO), Euronav (EURN) หรือ Scorpio Tankers (STNG)

ในวงกว้างกว่าภาคส่วนนี้เป็นวัฏจักรประโยชน์ใด ๆ จากตลาดขนส่งที่เข้มงวดสามารถย้อนกลับได้หากเส้นทางเป็นปกติ อัตราค่าขนส่งลดลง หรืออุปทานเพิ่มขึ้น

ความเสี่ยงและข้อ จำกัด

ราคาน้ำมันที่สูงขึ้นไม่ขจัดความเสี่ยงสำหรับชื่อเหล่านี้

- หากราคาสูงขึ้นเร็วเกินไป การทำลายอุปสงค์และการตอบสนองของนโยบายอาจส่งผลต่อรายได้ในอนาคตได้

- การตัดสินใจทางการเมืองจาก OPEC+ หรือผู้ผลิตรายใหญ่อื่น ๆ สามารถย้อนกลับการเพิ่มขึ้นโดยการเพิ่มอุปทาน

- บริษัทบริการและเรือบรรทุกมีวงจรสูงเมื่อวงจรเปลี่ยนไป พลังการกำหนดราคาอาจจางหายไปอย่างรวดเร็ว

- ปัญหาเฉพาะของ บริษัท รวมถึงการดำเนินการโครงการ การกำหนดราคาที่เกิดขึ้นและการใช้จ่ายเงินทุน ยังคงมีความสำคัญ

เมื่อรวมกันชื่อเหล่านี้อาจได้รับประโยชน์จากราคาน้ำมันที่มั่นคงขึ้น แต่ยังมีความเสี่ยงเฉพาะภาคภูมิศาสตร์และระดับบริษัท ที่สมควรได้รับความสนใจอย่างใกล้ชิด

ข้อสังเกตตลาดที่สำคัญ

- Woodside ให้การเปิดเผย LNG และน้ำมัน แม้ว่าความเชื่อมั่นของโบรกเกอร์ในปัจจุบันจะเป็นกลางมากกว่าชื่อที่ใหญ่กว่าในสหรัฐฯ

- ผู้ประกอบการเรือบรรทุกอาจได้รับประโยชน์เมื่อตลาดขนส่งสินค้าเข้มงวด แม้ว่าการค้านั้นยังคงเป็นวงจรสูงและขึ้นอยู่กับเส้นทาง

- SLB และ Baker Hughes อาจได้รับประโยชน์หากราคาน้ำมันที่มั่นคงจะส่งผลให้เกิดกิจกรรมการขุดเจาะและการเสร็จสิ้นมากขึ้น แต่การตอบสนองต่อราคาหุ้นมีความหลากหลาย

- Exxon Mobil และ Chevron เสนอการเปิดเผยโดยตรงกับอัพสตรีมอัพสตรีมที่แข็งแกร่งขึ้น ซึ่งได้รับการสนับสนุนจากการดำเนินงานที่หลากหลาย

การอ้างอิงในบทความนี้เกี่ยวกับ Exxon Mobil, Chevron, SLB, Baker Hughes, Woodside, ผู้ประกอบการเรือบรรทุก, การจัดอันดับความเห็นชอบของนักวิเคราะห์ และเป้าหมายราคาจะรวมไว้สำหรับความคิดเห็นของตลาดทั่วไปเท่านั้น และไม่ถือเป็นคำแนะนำหรือข้อเสนอที่เกี่ยวข้องกับผลิตภัณฑ์ทางการเงินหรือความปลอดภัยใด ๆข้อมูลของบุคคลที่สาม รวมถึงการจัดอันดับที่เป็นเอกฉันท์และราคาเป้าหมายอาจเปลี่ยนแปลงโดยไม่ต้องแจ้งให้ทราบล่วงหน้า และไม่ควรพึ่งพาแยกกันการเปิดเผยพลังงานและการขนส่งเป็นวงจรและอาจได้รับผลกระทบอย่างมีนัยสำคัญจากความผันผวนของราคาสินค้าโภคภัณฑ์ การกำหนดราคาที่เกิดขึ้นจริง การเปลี่ยนแปลงการผลิต การดำเนินการโครงการ การหยุดชะงักทางภูมิรัฐศาสตร์ สภาพตลาดการขนส่ง การพัฒนากฎระเบียบ และการเปลี่ยนแปลงความเชื่อมั่นของนักลงทุนมุมมองใด ๆ เกี่ยวกับผู้รับผลประโยชน์ที่อาจเกิดขึ้นจากราคาน้ำมันที่สูงขึ้นอาจมีความไม่แน่นอนอย่างมีนัยสำคัญ

Global central banks have been a crucial part in providing aid and support to the global economy during the coronavirus pandemic. Faced with an unprecedented crisis, central bankers have rapidly deployed various monetary tools to keep credit flowing and support businesses and households. Given that interest rates were somewhat already at record-lows in many major countries, asset purchase schemes were widely used to put downward pressure on long-term rates.

Monetary policies were also accompanied by huge fiscal intervention. Also, in a coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank have even agreed to lower their rates on currency swaps. What's Next?

The two-day Federal Open Market Committee meeting which will end on Wednesday with a statement followed by a press conference will be heavily eyed. Markets will likely look for clues on how the Fed’s is viewing the health of the economy after easing lockdown measures. Even though Friday’s jobs report came much better-than-expected and there was a decline in the unemployment rate from 14.7% to 13.3% in May, it is widely expected that the FOMC will keep rates steady near zero.

The scenario of negative interest rates is also highly unlikely. As the pandemic continues to create havoc on the global economy, it is also reshaping the political dynamics: Quarterly Forecasts Much attention will, therefore, be on the economic and interest rate forecasts. The Fed refrained from providing any forecasts during the pandemic given the tremendous uncertainties about the economic outlook.

This Fed’s meeting has, therefore, the potential to move markets if much details are revealed about future plans and expectations for inflation, GDP and unemployment. The projections are expected to be much worse than the favourable outlook seen in the last forecasts back in December. Dot Plots High unemployment and weak inflation have been the key factors forcing central banks to keep rates at record low levels.

The recent jobs reports came as a surprise and have raised expectations that the labour market may be rebounding at a quicker pace than expected. Investors would, therefore, look for explicit guidance from the Fed on how long they will likely keep rates near zero. Even though the economic outlook remains highly uncertain, the so-called dot plot which shows the entries of the FOMC officials regarding the interest rate forecasts will be scrutinized for guidance.

Latest dot plots – December 2019 Yield Curve Control As short-term interest rates approach zero, there have been recent speculations of the possibility that the Federal Reserve may control the yield curve and cap specific yields to cushion the impact of a downturn. Stock Market Global stocks have rallied significantly since March lows on the back of massive economic stimulus packages from central banks and governments which will likely stay in place for a while. In an extremely low-interest rate environment, quantitative easing and large fiscal policy measures have absorbed the pandemic-induced shocks and camouflaged the stark reality of the impact of the coronavirus.

On Monday, investors drove the S&P500 to a 15-week high, erasing its 2020 losses– lifted by heightened expectations of a quicker recovery and a supportive Federal Reserve. After a great run to the upside, investors appear to be taking a pause and booked profits ahead of the Fed’s decision. Equity traders would want to hear that the Fed will stay accommodative, keep interest rates unchanged and remains committed to supporting the economy while still striking some optimistic tones on the recovery of the economy.

US Dollar The US dollar was mostly weaker against major currencies as risk sentiment has improved lifted by heightened expectations of a quicker recovery following the reopening of economies earlier than initially expected. The surprising nonfarm payrolls have fueled those expectations and kept the greenback on the downside. If the Fed is set to look into the yield curve control as per the speculations, the US dollar may come under more pressure.

Source: Bloomberg Gold Amid the reopening of economies, geopolitical risks and a weaker US dollar, the precious metal has been trading sideways within a $70 range as traders wait for the next biggest catalyst. As of writing, gold has firmed higher above the $1,700. Gold traders will eye the outcome of the Fed’s two-day policy meeting.

XAUUSD (Daily Chart) Source: GO MT4

EU Recovery Fund After a standoff between the EU and Germany, following a critical ruling on ECB’s quantitative easing program by Germany’s constitutional court, the gradual reopening of economies of member states within the Eurozone has brought some optimism. The downside risks for the Eurozone and its shared currency have somewhat eased on the fact that Europe, which was the epicentre of COVID-19 after China, might have gone through the worst phase of the pandemic. The sentiment for the Euro was also buoyed by the EU Recovery fund proposed by Chancellor Angela Merkel and President Emmanuel Macron to help Europe’s mostly hit countries.

Unfortunately, the optimism over the coronavirus fund proposal, which aims to show unity in overcoming the crisis and to achieve quicker economic recovery, was short-lived. Europe’s Frugal Four Amid an unprecedented crisis, the Franco-German proposal was to provide support and reinforce EU financial relations and show that Europe is standing together. Austria, Denmark, the Netherlands and Sweden, dumbed as the “ frugal four ” put forward a counter-proposal that highlights the diversion of opinions in helping the Southern members states.

Grants or Loans The Franco-German proposal is about “overcoming the crisis united and emerging from it stronger ”. Both leaders proposed to make outright grants to help countries in need. They want to launch a temporary fund of 500 billion euro for EU budget expenditure: “This would not provide loans, but rather budget funding for the sectors and regions hit hardest by the crisis.

We firmly believe that it is both justified and necessary to now provide funding for this from the European side that we will gradually deploy across several European budgets in the future.” In contrast, the frugal four wishes to provide loans rather than grants to southern European countries and expect the recipients of loans to comply with the fundamental principles of the EU and commit to strong reforms in repaying the loans. Their two-year and “one-off” proposal appears to also outline how those countries should use the funds and target sectors that are mostly hit based on an assessment. The coronavirus pandemic is testing the solidarity of European members and is threatening to reawaken a euro crisis.

Southern countries like Greece, Italy and Spain lacked the fiscal space they need to put forward an economic stimulus package to support their economies, compared to Northern countries. Disparity? Compromise?

Both proposals are saying “ yes ” to emergency aids to assist with recovery, but the disparity lies on how the funds will be financed to respond to the economic wreckage. The size of the emergency fund, the conditions of the funds or whether it will be grants or loans will be a compromise the markets are expecting to see. However, the type of compromise might be a key factor in determining the relationships of EU members.

Unprecedented times probably need unprecedented Unity. Euro – The Shared Currency The fact that Europe may have gone through the worst phase of the coronavirus has somewhat eased the downside risks of the shared currency. But the current geopolitical tensions with China and uncertainties on the EU Recovery plan are putting a lid on the upside momentum of the Euro.

After the sharp plunge in March, the EURUSD pair has been trading within the 1.08 to 1.09 range. Yesterday, the better-than-expected IFO Surveys in Germany has helped the pair to hold ground and hover around the 1.09 level. The recovery plan could mitigate the selling pressure and allow a probable move above 1.10 level if there is a compromise that satisfies the frugal four.

EURUSD Source: Bloomberg Terminal The immediate attention turns to the European Commission which is supposed to unveil a draft recovery plan on May 27 th, 2020. About GO Markets GO Markets was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider.

The Logistics Company has reported a 27% decline in net profit (after tax) for the six months ended 31 December. The drop in profit is mainly due to higher costs on: Fuel Transport Brexit-proofing costs. The company was also deprived of the one-off tax benefit of US$130 million from a year ago.

Below is a summary of key metrics: Source: www.brambles.com With respect to the IFCO reusable plastic container business, the Chief Executive, Mr Chipchase did not provide any concrete information and said that the process “is not sufficiently” advanced, further adding that the company has not yet made any decisions on whether they will “sell” or “de-merge” it. Its share price dropped to a low of $10.85 which is a drop above 3% before rebounding slightly. As of writing, it is trading at $11.04:

Central banks of major economies like the US, UK and Japan turned to quantitative easing (QE) at a time where they were unable to push interest rates any lower. The European Central Bank (ECB) launched its first large scale of asset purchases in 2015 and was among the latest central bank to join the QE bandwagon. How QE works The ECB adopted the QE program to address the risks of a prolonged period of low inflation and help the Eurozone to return to the desired inflation level.

The QE, also known as the Asset Purchase Program (APP), consists of: Corporate Sector Purchase Programme (CSPP) Public Sector Purchase Programme (PSPP) Asset-backed Securities Purchase Programme (ABSPP) Third Covered Bond Purchase Programme (CBPP3) On 13 December 2018, the ECB decided to end the net purchases under the APP and announced that it would keep reinvesting cash from maturing bonds for a long time after its first interest rate hike. Market Expectations As the economic sentiment in the eurozone is worsening rapidly, investors are expecting the central bank to announce a robust stimulus package at its next meeting on Thursday: An Interest Rate Cut and Resuming Quantitative Easing. However, we saw divergent opinions on whether the central bank should resume asset purchases.

An Interest Rate Cut An interest rate policy by itself might not be enough, as cutting rates that are already negative will bring little help to the markets. If the central bank resume bond purchases, it could boost monetary and financing conditions. However, we are seeing divergent opinions on whether the central bank should resume asset purchases.

QE2 – The Second Round of Quantitative Easing In the height of the eurozone crisis from 2011-2014, such policies were probably justified. The current weakness in the euro- area might not be weak enough to warrant such a step, and there is now much skepticism on recommencing such non-standard and controversial monetary policies. The ECB policymakers have also dampened expectations of the resumption of bond purchases lately.

Market participants were initially expecting Mario Draghi to end its term with a significant package of monetary stimulus before Christine Lagarde takes over. It was are largely priced-in and now that the expectations eased ahead of the meeting, we are seeing European bond yields bouncing off record lows. Money markets and the foreign exchange markets are still expecting a traditional monetary policy intervention – at least a 10-basis point rate cut.

The Euro received a boost on Monday on hopes of German fiscal stimulus, though some expectations of monetary easing have limited the gains. EURUSD (H4 Chart) Source: GO MT4 If the central bank failed to satisfy dovish expectations already instilled in the markets, the shared currency may get a boost. The EURUSD pair may be trading sideways around the 1.10 level ahead of the ECB meeting on Thursday.

The pair could pick up a strong bid if the central bank falls short of expectations.

The week kicked off with a series of ECB speeches, and markets participants were gearing up to have more updates on the Eurozone economy, interest rate and Italy. Investors were keen to see whether the ECB downplays the slowdown in the German economy and the Italian Budget risks. We bring you a summary of the main headlines following the speeches: ECB’s Praet Speech: Peter Praet is a member of the ECB’s Executive Board since 2011.

The most captivating headlines from the latter are probably: “ The eurozone has lost some growth momentum, and headwinds are becoming increasingly noticeable.” He also argued that there is limited spillover from Italy so far. Praet acknowledged how the factors related to protectionism, financial market volatility and vulnerabilities in emerging markets are creating headwinds. He reiterated that the ECB policy will remain predictable and will proceed at a gradual pace.

He mentioned that it would need a big change in scenarios not to abide by rate guidance. ECB’s Nowotny Speech: Ewald Nowotny is the governor of the National Bank of Austria and member of the European Central Bank (ECB)’s governing council. Nowotny discussed the quantitative easing program and that the ending process poses little risk to financial stability.

He believes that “ a well-communicated exit may benefit financial health and very low rates for a long time may impair stability ”. ECB’s Coeuré Speech: Benoît Cœuré is a member of the ECB's Executive Board. The speech was mainly focused on Growth, Europe and Togetherness.

His speech captures how to reap the benefits of the Single Market. He highlighted how Europe’s East is not catching up which might question the value of the EU. “There have been some notable improvements in certain countries over time, but in others the process of gradually catching up with their EU peers appears to have stalled, or even to have backtracked, in recent years.” “And if there is no credible prospect of lower-income countries catching up soon, there is a risk that people living in those countries begin questioning the very benefits of membership of the EU or the currency union.” ECB’s President Draghi’s Speech: The President provided further insights into the euro area outlook and the ECB’s monetary policy. “The data that have become available since my last visit in September have been somewhat weaker than expected.” “A gradual slowdown is normal as expansions mature and growth converges towards its long-run potential…. Some of the slowdowns may also be temporary.” “Underlying drivers of domestic demand remain in place.” Overall, he expressed that the ECB maintained their view that the economy was still in line with expectations.

However, inflationary pressures were lower than expected which means that while bond purchases are set to end in December, the ECB will maintain significant monetary stimulus due to the moderation in recent data.

Dissecting the FOMC Statement The US Federal Reserve cut interest rates overnight by 25 basis points, taking the US Federal Funds rate to 2.25%. The rate cut was mostly seen as a hawkish one. In the press conference, Chair Powell said that the central bank’s rate cut was a “mid-cycle adjustment to policy ” rather than “the beginning of a long series of rate cuts.” We have dissected the July FOMC statement in comparison with the June statement to highlight the changes for ease of reference.