市场资讯及洞察

Expected earnings date: Thursday, 29 January 2026 (US, after market close) / early Friday, 30 January 2026 (AEDT)

Key areas in focus

iPhone

The iPhone remains Apple’s largest revenue driver. Markets are likely to focus on unit demand, product mix (including higher-end models), and any signals on upgrade momentum and regional trends.

Services

Investors are likely to focus on growth across areas such as the App Store, iCloud, Apple Music and other subscriptions, alongside any commentary on average revenue per user (ARPU). The size and engagement of Apple’s installed base remain central to overall performance.

Wearables, home and accessories

This segment includes products such as Apple Watch, AirPods, Beats headphones, home-related devices, and accessories. Investors are likely to watch revenue trends in this segment as an indicator of discretionary consumer demand.

Cost and margin framework

Management has flagged tariff and component cost pressures in prior commentary. Markets may remain sensitive to gross margin commentary and any signals of incremental cost pressure or mitigation strategies.

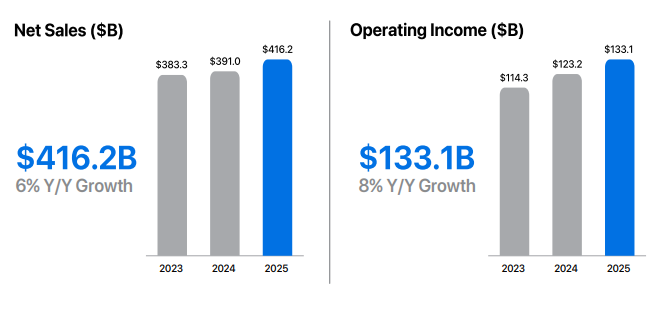

What happened last quarter

Apple’s most recent quarterly update (fiscal Q4 2025) highlighted record September-quarter revenue and EPS, alongside record Services revenue and continued emphasis on installed-base strength.

The prior update also included discussion of holiday-quarter expectations and cost headwinds (including tariffs), which have influenced expected margins and management guidance.

Last earnings key highlights

- Revenue: US$102.5 billion

- Earnings per share (EPS): US$1.85 (diluted)

- iPhone revenue: US$49.03 billion

- Services revenue: US$28.75 billion

- Net income: US$27.5 billion

How the market reacted last time

Apple shares rose in after-hours trading following the release, as investors assessed the results against analyst expectations and management’s holiday-quarter commentary, including tariff-related cost pressures and regional demand considerations.

What’s expected this quarter

Bloomberg consensus points to year-on-year EPS growth, with markets also focused on the revenue outcome and gross margins, given the scale and importance of the holiday quarter for Apple’s earnings profile.

Bloomberg consensus reference points (January 2026):

- EPS: about US$2.65

- Revenue: about US$138 billion

- Full-year FY2026 EPS: about US$8.1

*All above points observed as of 26 January 2026.

Expectations

Sentiment around Apple may be sensitive to any disappointment on holiday-quarter revenue, Services momentum, or margin commentary, given the stock’s large index weight and the importance of this reporting period.

Listed options were implying an indicative move of around ±3% to ±4% based on near-dated, at-the-money options-implied expected move estimates observed on Barchart at 11:00 am AEDT on 25 January 2026. Implied volatility was approximately 29% annualised at that time.

These are market-implied estimates (not a forecast) and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian traders

Apple’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

热门话题

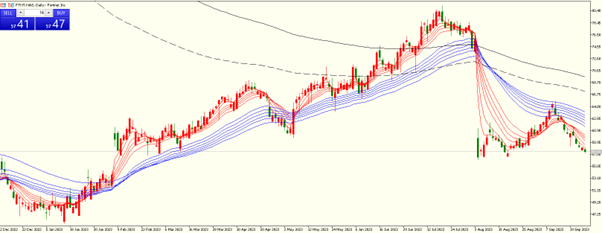

原油与美元是过去几个月,也或是接下来很长一段时间内,金融市场最炙手可热的资产,没有之一。因欧佩克减产,美国原油(WTI)三个月从70美元上涨到了94美元,涨幅35%。美元指数则从100涨到了目前的106.7,我们还无法看到有任何抑制美元这轮涨势的理由。油价破百开始频频出现在头条新闻上,摩根大通CEO说世界还没为美国联邦基准利率到达7%做好准备。原油与美元的共振将使世界经济难以增长,硬着陆、软着陆,还有衰退或将再次是需要关注的事件。在高息美元之下,应对衰退避险的黄金也黯然失色,欧元、英镑将低到尘埃里,全球股市的压力已然显现。真正是,美元升,万物落。如果市场非要有一个王者,那必须是美元。但我们惊奇的发现,油价却不是省油的灯。通常大宗商品与美元是负相关关系的,有意思的是,本轮原油与美元是同步上涨的,背后是有相互作用与影响的效应。表面看起来,就是美元强势,欧佩克不甘示弱,决定联手俄罗斯减产维护油价。其实全球经济前景不佳,该减就减,没有毛病。可是美国哪里受的了这种背刺,辛辛苦苦加息两年,现在物价貌似要全失控了,都是被你这大宗商品之首的原油给搅乱的,是不是?除了原油,目前的食品价格走高是屋漏偏逢连夜雨,也一定引起了官方的担忧。下图可以看到,美国的橙子和牛肉期货价格还在节节攀升,似乎在疫情开始以来就从未中断上涨!橙子与活牛期货周线图:

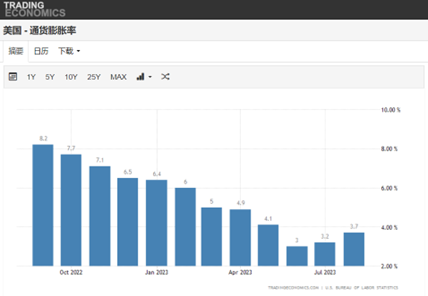

曾几何时,我们以为通胀已经在逐步下降,加息还是很有成效的,该是圆满完工的时候了。确实,回溯过去一年,美国的通胀率也从8.2%稳步回落到了六月最低的3%,然后是略有上升的3.2%(七月)和3.7%(八月)。但是魔鬼在细节里,如果结合原油与一系列食品的不断涨价,我们是可以发现通胀重新抬头的趋势的,这也解释了美元走势越来越强的根本底层逻辑,那就是需要再次抗击通胀。

因为食品栏目众多,其他商品价格比如可可粉、大米、猪肉等也都在上涨,一般我们可以用大宗商品期货指数来预测一篮子商品的走势(Invesco DB Commodity Index Tracking Fund)。周线技术图表看,当前DBC价格已经突破先前短期的下降趋势,转为多头走势,下一目标位将在26.5与30左右。

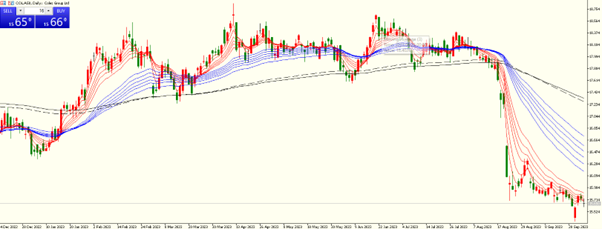

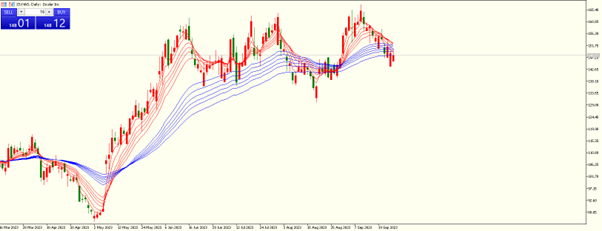

从近期美联储的表态来看,官方对通胀问题是丝毫没有放松。尽管9月美联储没有加息,但是发出了极度鹰派的利率预期管理,目前市场预计今年不会降息,高利率将至少维持到2024年的年中,期间不排除进一步加息的可能。综上所述,笔者认为,今年余下时间或明年上半年,市场的交易机会都还在美元这边,美元指数大概率将回升至109、113或115等位置。实操上,可以做空具有更好流动性的EURUSD和走势更为敏捷流畅的XAUUSD。至于原油,目前已经突破90美元的最后交易密集区,进入了筹码较少区间,预计后市还会有不少的上涨空间。也许一切都是刚刚开始!美元指数周线图:

美国原油期货日线图:

免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jack Lin | GO Markets 新锐分析师

热门话题

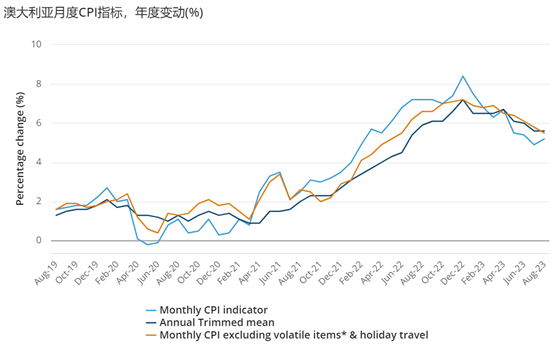

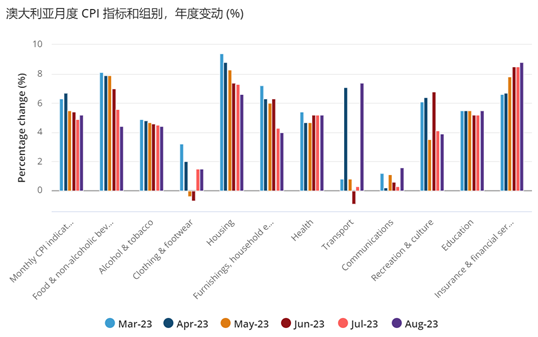

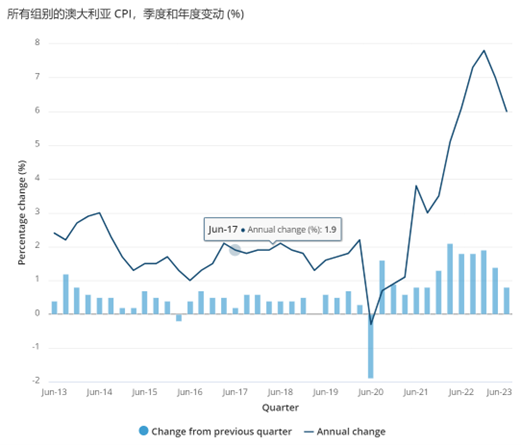

根据澳大利亚统计局(ABS)的最新数据,截至 2023 年 8 月的 12 个月内,月度消费者价格指数(CPI)指标上涨了 5.2%,高于 7 月的 4.9%。月度通货膨胀率已从 12 月 8.4% 的峰值有所放缓。剔除波动性项目和假日旅游的月度消费者物价指数(CPI)的年化变动,8 月份上涨 5.5%,低于 7 月份的 5.8%。8 月份年均通胀率为 5.6%,与 7 月份 5.6% 的涨幅一致。

尽管从月度CPI看,本次公布的8月CPI较7月略高,但数据整体符合市场预期。通胀下降的肯定不会一帆风顺呈直线形下降,目前月度通胀5.2%较澳联储目标通胀区间2-3%仍有距离。因此本次通胀数据传递最明确的信息是:澳联储为了坚决抵御通胀,不枉费本轮加息的4%,一定会将利率在更长的时间内维持高位。

本次公布的8月月度CPI数据,价格上涨最显着的是住房(+6.6%)、交通(+7.4%)、食品和非酒精饮料(+4.4%)以及保险和金融服务(+8.8%)。

住宅与租金截至 8 月份的 12 个月内,新住宅价格上涨 4.8%,反映出劳动力和材料成本高昂。价格增长率继续放缓,反映出材料供应的改善和新需求的抑制。新住宅的年增长率为 2021 年 8 月以来的最低水平。截至 2023 年 8 月的 12 个月中,租金价格上涨 7.8%,高于 7 月份的 7.6%,反映出对租赁物业的强劲需求和租赁市场紧张。

食品食品通胀继续放缓,本次面包和谷物产品以及乳制品的价格上涨了 10% 以上,而好消息是水果和蔬菜的价格比 12 个月前下降了 8.3%,抵消了部分类别上涨带来的通胀。燃油燃油价格较 12 个月前上涨 13.9%。按月计算,8 月份汽车燃料价格上涨 9.1%。汽车燃料的通胀水平仍然存在较多不稳定。原油价格在OPEC+减产的背景下持续上升,我们注意到无论是美国还是澳洲方面,原油价格攀升均引发了市场对于通胀卷土重来的预期。作为经济循环中的重要因素之一,油价的节节攀升与物价稳定下行形成悖论。我们认为,在全球加息维持高利率的背景下,油价可能不会长时间维持在高位。目前美油已经开始在关键阻力位93美元附近盘整,中期可能存在交易机会(GO Markets代码:美油USOUSD 布伦特原油UKOUSD)。

新官上任会给加息添一把火吗?大家都知道即将到来的10月,是新央行行长米歇尔·布洛克任职以来首次公布澳洲利率决议。那么这位新官上任是否会给澳洲加息进程再添一把火呢?我们大胆推测,澳联储10月利率决议不会加息,但是11月之后存在一定可能性加息。理由如下:从目前公布的各经济数据来看,澳大利亚通胀呈现稳定下降,经济增速、人均产出效率、居民可支配收入在加息400基点以来呈现逐步疲软,尽管失业率仍在50年低位,但是谨记澳联储与全球其他央行的不同之处,充分就业与控制通胀始终是澳洲央行双线并行的目标。因此整体并无强烈理由以损失经济与就业为代价,让澳联储在10月激进加息。那么为何又说11月后有一定可能性加息呢?关键的数据将是10月25日公布的季度通胀CPI数据,月度CPI数据尽管具备参考性但是每月的物价波动较大,因此澳联储更倾向于使用季度CPI来作为利率决议的指引核心数据。回顾数据,季度CPI已从2022年12 月7.8%降至最新6%。如果季度CPI超预期顽固,那么11月后澳联储大概率还有一次加息。

澳元 澳股表现整体来看本次月度CPI数据并对对市场形成太大扰动。澳股仍然低迷收ASX200周三下跌0.11%收于7030.3澳元。而澳元对美元仍在0.65之下运行,短期内澳元恐难以得到有效提振。

免责声明:GO Market分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Cecilia Chen | GO Markets 分析师

热门话题咱们澳洲生活的华人,久了都知道,澳洲的治安没那么好。尤其是住在House的朋友,几年前我一个朋友家里被偷了,银行卡都被拿走了,然后马上报警。结果警察录完笔录之后就让他在家等着。然后有趣的事情发生了,偷东西的人在一个加油站用了银行卡加油,我朋友收到刷卡记录马上开车追过去,到达目的地之后马上联系警察。澳洲警察来了之后,说他们没办法调取加油站的监控,并且不允许我朋友再为这件事情私自行动。然后,就没有然后嘞,从此再没有来自警察的任何消息。今年2月,悉尼的一个shopping center遭遇洗劫,包括干洗店、奶茶店等。今年5月,墨尔本发生入室公寓抢劫。6月,火锅店大门被砸开,遭遇洗劫。7月,墨尔本Brighton多辆汽车被砸抢。除此之前,还发生过奢侈品店、苹果店被抢事件。最近12个月,维州警方公布了犯罪数据,当地抢劫案同比上升8.7%,住宅入室盗窃增加了30%,车辆盗窃增加了17.9%,刑事案件增加了5.6%。其中华人中招比例不低,70%被盗的家庭都没锁门。夜不闭户的澳洲生活不再安全了。

新南威尔士更惨,6月份零售店盗窃案同比增加47.5%。连锁店Foodstuffs 的报告显示320家门店犯罪率同比上升了59%。总结来说,澳洲因盗窃犯罪导致的损失超过数十亿美元,约100亿澳币。目前超市盗窃案数量急剧攀升,Coles和Woolworth里面经常看到大家拿了辣椒却选择按照香蕉价格支付。其中受到盗窃影响最大的,是Coles集团,Coles股价财报后大跌,因为超市业务成本增加了9.7%,下半年毛利润下降了3亿澳币,主要原因是盗窃激增。来自水果蔬菜的损失增加了20%。除此之外,Target公布,因为盗窃,年度毛利润损失5亿美元。沃尔玛也面临类似问题,美国全境超市类盗窃导致的损失预计达到1000亿美金每年。根据Coles安全部门调查,当下受到生活所迫的澳洲人比较喜欢把蔬菜水果揣兜里带走。而有团伙的组织则是拿走了价格更高的保健品等。Coles目前增加了摄像头,智能门检测等设备。未来更高级的功能,比如面部识别软件,屋顶传感器等设备相信也会普及到各大零售店铺。

对于零售商来说,除了基本的消费降级,还要面对来自“0”元购的威胁。一次“0”元购,需要10次正常销售才能弥补亏损。有零售代表商说的很卑微:有人把一辆手推车装满,然后若无其事的就推走了。然后就没然后了。让我们看看可怜的Coles集团股价,公布财报后从18掉到了15附近。如果未来澳洲人民生活依旧困难,那么只能说Coles的蔬菜还会继续涨价,毕竟被偷走的货物,成本还是要从其他商品上赚回来,与其股东承受亏损给管理团队带来压力,还不如转嫁给消费者。我们除了面对通胀压力,收入相对降低,还要给偷盗者们买单,好难。

对于安全相关的股票,有三家美国上市公司可以关注:Zscaler、Fortinet、Cisco

Cisco

Fortinet

Zscaler免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题每一个成功的男人,背后都有一个优秀的女人。每一家成功上市的医美公司,背后都有一群优秀的女人。资本市场不缺故事,故事离不开女人,一群女人,就会有一堆讲不完的故事。全球医美市场,以每年两位数的速度增长,在消费降级、全民躺平的时代异军突起。

一向讲究自然风的澳洲华人圈,疫情过后也在扎堆开美容院,是否会出现当年奶茶店的情况?即任何实体店服务的都是区域性人群,需求相对稳定,一旦供给超过需求,经济学中,进入的厂家多了,为了获客商品价格回落,最终美容院的利润空间会趋近于完全竞争市场,即无法获得超额利润。当然,和奶茶店以及餐厅一样,超额利润将来自好的位置和好的医生。所以,开美容院的老板们要有自己的资源,客源和技术,如果觉得这个行业赚钱要挤进来,我觉得独资要慎重,可以考虑合资。想要参与医美市场,但又不想承担更高的风险,却看好医美长期的发展,那么咱们就做投资者,投给那些大团队,大机构,就是上市公司。让这个行业拥有最多资本,最优秀技术的一群人,替我们去在这个行业掘金,我们要有当老板的觉悟,哪怕只有100股。所以,今天还是带大家了解一下医美行业的资本市场。毕竟,10倍的利润增长,是可以造就百倍股价增长。如果加上杠杆,赢了豪宅全款,输了也就少买一个包。当然,大家还是要理性投资。L’Oréal的CEO前几天接受采访说,美容市场将在2023年,达到4000亿欧元的规模,6600万澳币的市场。(广告:目前EURAUD可以在GO Markets自由交易,交叉盘点差低至5,AUDUSD点差低至0)欧莱雅公司也不错,每年花10亿欧元投资在科研上,带动这家114年历史的企业继续前行。要不要买点欧莱雅股票?那么医美是干嘛的?就是动手术和不动手术,分为重医美和轻医美。华人开的店基本都是轻医美。轻医美分为注射类,包括玻尿酸,肉毒素,胶原蛋白等;其次是光电类,包括热玛吉,超声刀,光子嫩肤等;然后是刷酸小气泡等。轻医美的增速远远快于重医美,因为动刀动枪的,还是挺疼的,现在的宝宝们能不疼就不疼。过去5年,轻医美复合增长率25%,重医美为11.5%。那么股票怎么买?上游,去找药品厂商和光电设备厂商。大家去做医美的时候,顺带问问,你家用的什么设备,多少钱。你要是问出来的一个设备,没听过名字,上网查,查都查不到,结果跟你收费5000刀,那真是刀刀扎心呀老妹。或者你一查,中国制造,阿里巴巴进口价2万刀,给你扎四针,那真是谢谢你,完成了资本家的一次性回本。

中游投什么?投医美机构,上市的。没上市的,也没错。看看悉尼墨尔本的火锅市场就知道了,海底捞还是海底捞,你大爷还是你大爷,破产的永远是民营小品牌。为什么美容行业发展越来越快?因为社交变得发达了,网络放大了美的附加价值,即增加了流量。最后是核心,回归自我,专注自己的情绪价值,毕竟我通过外界的努力,变得更好看了。获得了更多关注,更多的资源,形成了一种正向循环。医美市场里,受众群体是家庭收入在25万澳币以上的居多,中国基本平均家庭收入50万以上。年消费基本平均在3万澳币左右。和澳洲贷款broker类似的感觉,只要你服务好,你赚的是3万*30年的钱。一个客户可以贡献100万澳币。当然了,理想总是要有的。医美公司究竟赚不赚钱呢?其实从财报中可以看到,医美50%的费用都贡献给了营销渠道。平均获客成本为1000-3000澳币。竞争也会逐渐激烈,赚钱效应会导致资本持续流入,成本继续上升。当然,在长周期的时间里,美是不变的话题。究竟是投身一家医美店,还是投一家上市公司,逻辑和自己开火锅店,还是买海底捞股票是一样的。没有说哪个更好更坏,只能说哪个更适合你的投资决定。以下是一些相关的上市公司:上海复星医药(600196.SH,2196.HK)股价趋近前期底部

香港医疗集团(2138):香港最大的医疗美容服务提供商,主要从事整形手术、微整形手术及医生操作的能量仪治疗。卓嘎控股(8358):公司提供专业护肤课程及高品质护肤产品,董事局主席兼行政总裁为前TVB著名女星黎姿。昊海生物(6826):整形及伤口护理是四大产品线之一。Sisram med(1696):以色列能源医疗美容设备供应商巨头,香港联交所第一家以色列上市公司,上海复星医药(600196.SH,2196.HK)第一家子公司,以无创微创为主侵入式医学美容产品。利丰控股(1125):自有品牌“雅普利德”进军医疗美容,首家“雅普利德”医疗诊所北京旗舰店于2018年6月正式开业。艾尔建(AGN):全球医学美容领导者,研发、制造和销售医学美容产品的跨国公司,包括肉毒杆菌毒素、丰胸美容产品、飞盘干预产品和其他制药行业。2017年收购上市公司ZELTIQ Aesthetics(ZLTQ),研发及销售非侵入式减脂(减肥)产品,采用专利控温技术选择性减少顽固脂肪隆起,不同于传统吸脂术,不需要手术、注射、麻醉等侵入性手段,并且不影响饮食和运动。Installation Labs Holdings (ESTA):一家全球高科技医疗设备和美容公司,致力于设计、开发、制造和营销创新产品组合,包括先进的硅胶填充乳房和健身植入物。Evolus(EOLS):医疗美容公司,主要市场是自付费医疗。主要候选产品是900 kDa肉毒毒素A复合物的注射制剂。Restoration Robotics(HAIR):毛发移植医疗设备公司,拥有全球唯一的机器人毛发修复系统。Sienna Biopharmaceuticals (SNNA):专注于将生物技术创新引入医学皮肤科和美容领域,为医学皮肤科和美容市场开发和商业化外部产品,例如牛皮癣相关抑制剂。Cutera (CUTR):激光美容设备供应商,用于治疗:色素性病变、皮肤再生和表面修复、纹身去除等。Sientra(SIEN):一家专门提供隆胸和乳房重建产品的医疗美容公司,其隆胸技术得到美国食品和药物管理局的认可和批准。Revance Therapeutics(RVNC):一家处于临床阶段的专业制药公司,专注于新型A型肉毒毒素产品的研发和制造,包括消除鱼尾纹、眉纹等。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

In this climate of phishing and scam websites and messages, we’d like to take this opportunity to remind our clients of the official GO Markets websites. Scammers at times will register similar domains, with minor spelling differences, and copy our website design in an attempt to deceive visitors. These copies can sometimes be very convincing.

GO Markets' genuine websites are www.gomarkets.com, www.gomarkets.eu and www.gomarkets.ltd If in any doubt about a website, simply visit www.gomarkets.com directly. GO Markets is also on a number of Social Media platforms; Facebook, Instagram, LinkedIn, Twitter, WeChat and YouTube. When following links from Social Media pages, please ensure you are directed to one of the legitimate websites above, as scammers may also set up fake Social Media profiles in an attempt to direct users to false websites.

As always, if you have any concerns, please reach out to our Customer Support team or your Account Manager directly.

热门话题最近,油价一直在不断上涨,扰乱了美国应对通胀问题的计划。同时,欧佩克,尤其是沙特和俄罗斯的合作也使美国逐渐失去了对原油市场的控制权。在拜登政府的任期内,美国大幅减少了战略原油储备,这引发了一些共和党人的批评。因此,在即将到来的选举年里,拜登政府可能会小心谨慎,但供应缺口可能不会等待政府的调整。过去两年,高盛作为华尔街最大的能源推手,准确预测了2022年油价的历史性飙升,但今年油价大幅下跌,导致其明星分析师兼首席大宗商品策略师Jeff Currie辞职。然而,油价自年中以来反弹了30%,而摩根大通近期悄然接管了能源市场的领导地位。

摩根大通的能源分析师Christyan Malek在报告中表示,他们的“超级周期”系列报告再次强势回归。鉴于石油行业的投资逐渐减少,绿色能源单独难以满足全球能源需求,Malek预测中期油价可能会升至每桶150美元,比当前布伦特原油价格高出60%。Malek指出,自6月以来油价上涨超过30%,但能源股票一直表现不佳。摩根大通看好全球能源市场,重申每桶80美元以上的长期目标油价。在“超级周期IV”报告中,他们认为短期至中期油价可能会升至每桶150美元,长期保持在每桶80-100美元。支持油价上涨的主要因素包括:1.更长期高息率的前景减缓了资本流入新的供应;2.股权成本上升推动了布伦特原油的现金盈亏平衡点超过每桶75美元,因为公司向股东返还更多现金,从而提高了石油的边际成本;3.体制和政策导向压力推动了向绿色能源的过渡,并引发了对需求见顶的担忧。总之,这是一个在更长期内高油价前景下的能源宏观展望,因为该行业难以证明在2030年之后大规模投资的合理性。摩根大通预测,到2025年,全球石油市场将出现每日110万桶的供需缺口,到2030年,这个缺口将扩大到每日710万桶。这种巨大的短缺将需要油价大幅上涨。那么,全球能源股市还有增长空间吗?摩根大通提到,全球石油市场已从需求驱动的风险转变为供应驱动的风险,即风险从需求端转向供应端。分析显示,满足石油市场供需缺口只能依赖沙特的未利用产能,这将使他们能够在2025-2030年期间满足创纪录的约55%的边际需求增长。相比之下,2005-2018年期间的平均增长仅为18%。OPEC增加产量并用尽其未利用产能(约420-430万桶/日,沙特320万桶/日)可能会导致大约每桶20美元的供应风险溢价。此外,公司的现金收益不仅支持长期每桶80美元以上的油价,而且表明大型能源公司支付资本支出、股利、债务和现金回报所需的油价持续上升。

Malek将全球能源股的评级提升至“增持”,主要原因包括:1.更积极的宏观前景(他们更喜欢石油而不是天然气,因为前者具有结构性利好特征和OPEC减产导致的较低波动性);2.企业的现金实际收支平衡(与远期相比),这意味着2024年的自由现金流收益率约为12%,如果油价达到每桶100美元,自由现金流收益率将升至约15%;3.每股收益(EPS)的上行风险。按照市场预期,2024年的油价高于约10%。此外,这些公司的现金回报率大于30%,支撑了相对于市场的有吸引力估值;4.如果全球库存继续下降,油价上涨到一定程度,OPEC可能在未来12个月增加产量。从历史经验来看,这对能源股有利,因为它通常意味着基本面(需求)正在改善。能源股往往在产量增加时与油价出现正向脱钩。尽管自从沙特在6月启动100万桶/日的减产计划以来,油价上涨了30%,但股票只上涨了约10%,也就是说它们出现了负向脱钩。尽管对油价持乐观态度,Malek仍向基本面投资者发出了一个安全预警。尽管认为该行业处于结构性牛市,油价应该正常化走高,但预计油价和能源股票将在更宽的价格范围内交易,而较高的“加权平均资本成本”(WACC)可能会加剧油价的波动性。未来几年,建立方向性多头头寸的投资者可能需要通过绝对价格修正来在综合能源市场中寻找方向,尤其是对于具有较高石油贝塔系数的股票。在供需基本面仍然紧张的情况下,能源板块应该能够跑赢股市大盘。此外,由于股票估值面临着“更长期高息”带来的风险,当整体股市下跌时,能源行业通常表现优于大盘,因为该行业可作为宏观对冲通胀、利率和地缘政治风险的工具。摩根大通认为全球经济能够承受三位数的名义油价,因为按实际价格计算,油价仍低于2008年和2011年的峰值,也低于“需求破坏区”(即石油在全球GDP中的比重大于5%,而目前仅约为2.5%)。针对电动汽车兴起对化石燃料的威胁引发的石油需求见顶问题,摩根大通则认为这是一种错误的看法。在投资期限内,即到2030年,他们认为石油需求不会见顶,因为需要大量燃料来弥补全球能源赤字。由于供应链、基础设施和关键材料的瓶颈,清洁能源系统在未来十年内还无法足够成熟,捕获技术也不够完善,也无法向终端用户提供足够的“清洁”电力。因此,这对传统燃料施加了更大的压力,以填补缺口并满足新兴市场带动的不断增长的需求。Malek警告称,如果不增加石油和天然气的资本支出,全球将继续面临能源短缺,并可能在未来十年内多次发生石油主导的能源危机,可能比去年欧洲发生的天然气危机严重得多。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师