市场资讯及洞察

.jpg)

2026 年1 月 29日,全球黄金市场经历了“疯狂星期四”。金价在站上 5600 美元 巅峰后,随即上演了时速惊人的“自由落体”,一度跌破 5100 美元。这一波动不仅刷新了单日振幅纪录,更让全市场见证了高位杠杆博弈的残酷性。

一、 5602 到 5097:为何会出现 500美元的“闪崩”?

这场高位跳水并非偶然,而是多重压力瞬间释放的结果:

1. 极度超买后的“技术性多杀多”:

1 月以来金价涨幅已近 30%,RSI 指数一度飙升至 90 以上。在 5600 美元这个极值点,获利盘的离场指令引发了连环踩踏,导致盘面瞬间失去支撑。

2. 流动性“黑洞”与自动止损触发:

当金价从 5600 跌落至 5400 附近时,由于短线资金过于密集,触发了海量高频交易系统的强制平仓单。在缺乏买盘承接的深夜时段,金价出现“真空式”下跌,一路跌向 5100 美元 这个前期重要支撑区。

3. 白银市场的溢出效应:

昨晚现货白银从 120 美元高位一度暴跌 12%,作为联动性极强的贵金属兄弟,白银的剧烈崩盘直接拖累了黄金的信心。

二、 核心驱动逻辑的变化:从“单边狂欢”到“宽幅震荡”

尽管跌幅惊人,但 5100 美元 的迅速企稳也传递了关键信号:

•基本面依然强劲:美联储虽在 1 月 29 日凌晨维持利率不变,但其“鸽派停顿”和对通胀的默许,意味着实际利率的下行趋势未改。

•避险底色仍在:美伊局势及全球关税政策带来的不确定性,使得 5100 美元以下依然有强劲的买盘(如各国央行和长线主权基金)在“接飞刀”。

三、 市场新常态:黄金已进入“超高波动率”时代

昨晚的行情告诉我们,目前的黄金已经不再是那个“慢牛”的避险资产,它表现出了明显的“类数字货币”特征:

•估值锚点模糊:在信用货币受质疑的背景下,市场在5100 与 5600 之间反复寻找新的定价共识。

•散户 FOMO 情绪高涨:国内金饰报价突破 1700 元/克,这种全民抢金的狂热,往往伴随着极高的波动风险。

结语:趋势未死,但“杠杆”已死

昨晚 5600 至 5100 的惊心动魄,是一次教科书式的风险出清。它标志着本轮行情从“共识性上涨”进入了“高波动震荡期”。

•长期看:黄金作为对冲信用风险的地位依然稳固。

•短期看:5100 美元已成为本轮行情的“生命线”。

热门话题

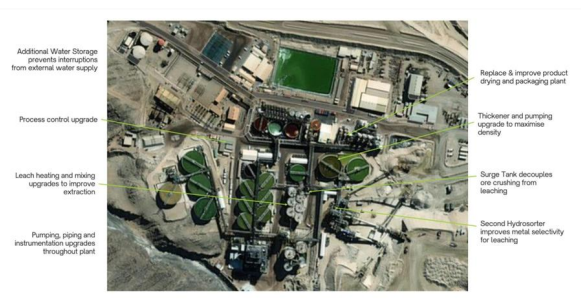

公司简介Paladin Energy Ltd (PDN-AU) 帕拉丁能源公司,从事铀矿的开发和运营。其主要的业务是铀氧化物 U3O8 的销售和贸易。它通过以下部门运营:勘探部门、纳米比亚部门、马拉维部门和澳大利亚部门。勘探部门:其部门主要专注于开发、勘探和评估项目,其中包括地区为澳大利亚和加拿大。在 Michelin 项目上 Paladin 通过其全资子公司 Aurora Energy Ltd (Aurora) 持有52,250 公顷矿产许可的 65% 权益。这个项目主要位于加拿大拉布拉多的中央矿带内。Michelin 项目是在这个矿带的最大矿床。作为该项目的旗舰矿床,米其林总矿产资源量为 12770 万磅铀,其中 90%被列为已测量和指示矿产资源。纳米比亚部门: 纳米比亚部门的的主要业务是对在纳米布亚的铀矿进行生产和销售。纳米比亚部门的运营是借助于帕拉丁能源旗下的 Langer Heinrich Uranium Ltd 去管理和开采 Langer Heinrich 矿。Langer Heinrich 矿是全球核燃料能源循环中经过验证的一级资产。铀市场状况的下滑导致帕拉丁于 2018 年 5 月将 Langer Heinrich 置于护理和维护之中。现在,帕拉丁能源已完成的研究和计划。确认了重启资金(81million)、成本(US$27/lb)和运营绩效(产出 7 年内 590 万磅 U3O8 pa ),以及未来提高运营可靠性和实力的机会。

马拉维部门: 马拉维部门涉及位于马拉维矿区的生产和销售。(马拉维曾被联合国评为世界上最不发达的国家之一,其主要的产业是农业,是非洲主要烟草出口国,烟草出口占国家外汇收入 70%)。澳大利亚部门: 纳米比亚和马拉维部门涉及从位于这些地理区域的矿山生产和销售铀。澳大利亚分部包括其销售和营销、资金、公司和行政管理,还包括为完成销售订单而购买的股票收入。澳大利亚部门持有 Mount Isa 和 Manyingee 项目的权益。其中Mount Isa 的总矿产资源是 14830 万磅,是昆士兰最大的铀矿。

行业分析:目前澳大利亚的铀储存量 167.3 万吨占世界的 31%,但是产量量仅仅占全世界的10%不到。在澳大利亚,铀矿的勘探和开采有着严格的法律约束,这样的情况下,澳洲是不太愿意建立新的油田,不仅不放宽开采限制,甚至还越来越严格。在对于资源的重点保护下,澳洲还有很大份额的铀未见天日。在近五年来,铀的价格波动性较大,造成了收入的不稳定性。

在 2011 年福岛核电站核泄漏之后,核能源环境污染和较高危险性成为世界关注的话题,核电站的安全性再次被质疑。后果就是铀作为核动力能源的关键材料,需求骤降,价格出现暴跌,以至于之后五年铀的价格一直都一蹶不振。在近五年,渐渐地有一些好转。更详细的美联储加息历史复盘,请联系小助手获取。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Neo Yuan | GO Markets 助理分析师

热门话题

加息周期中,美股的表现可以分为两种情况:第一,美股面临盈利上行+货币紧缩的组合。此时美股通常会在加息初期出现 一定幅度的调整,持续时长也通常在 几个月以内。随后盈利上行仍将支撑美股继续走高。直到盈利增速出现下行,或投资者对盈利的预期转弱,美股才会真正开启大级别的下跌行情,而这通常发生在加息周期结束之后。

第二,美股面临盈利下行+货币紧缩的组合。美国经济处于滞胀状态,典型如 20 世纪 70 年代。这段时期,美股通常在货币政策收紧之前就出现调整,因为经济下行压力已经开始显现。当估值达到低位,或滞胀结束时美股就走稳见底。从 1965 年以来,美联储加息一般不会成为美股进入技术性熊市的触发因素。联储加息是为了应对经济增长过热的风险。所以在货币政策刚刚开始收紧时,美股面临着盈利上行和流动性收紧这两股相反的力量,更偏向于震荡。直到投资者对盈利走弱的担忧增强时,美股才会出现调整。典型如 2018 年 9 月、2015 年 8 月、2000 年 3 月、1973 年 1 月等均是如此。较为特殊的情况是,美联储加息期间,美股同时面临其他利空,此时美股的表现不佳。如 1972 年 4月-1974 年 7 月,美国经济处于滞胀阶段,美联储加息以应对通胀问题。再如 1977 年 4 月-1981 年 7 月,美元危机爆发、美元指数下跌、美国国际收支恶化等迫使美联储加息,但同时经济已处于下行期。整体上看,美股在加息期间大跌的概率不高,基本面下行才是核心利空。

目前的实际情况是,美联储加息进入中期阶段,经济停滞增长和高通胀基本表明美国陷入滞涨,美股也从年初已经经历了大幅度的回撤。目前其实企业的盈利都是偏好的,接下去美股进入反弹行情的概率远远大过继续下跌。复盘加息周期 1:伴随着通胀压力的走高,美联储在 1999 年 6 月至 2000 年 5 月持续 6 次加息,累计幅度为 175bp,利率从 4.75%提高到 6.5%。在此之前,美国经济已连续上涨近 10年。在逐步摆脱了储贷危机之后,1992Q1 之后的每个季度美国实际 GDP 增速均保持在 2%以上。加息期间美国经济增速小幅放缓,但 GDP 增速的环比折年率仍维持在 4%以上。在加息初期,美股出现小幅波动。标普 500 指数从 1999 年 7 月 16 日的 1419 点下跌至 1999 年 10 月 15日的 1247 点,跌幅达到 12%,持续时间长达 13 周。从估值与盈利的贡献程度来看,这段时期标普 500 的市盈率从 1999 年 6 月的 29.88 下降至 9 月的 27.03,估值跌幅达到 9.5%,本轮调整大多由估值贡献。在加息中期,盈利支撑美股继续上行。从 1999 年 10 月到 2000 年 4 月,美股迎来了一波反弹,标普 500 指数从 1999 年 10 月 15 日的 1247 点上涨到 2000 年 4 月 7 日的1516 点,涨幅超过 20%。随着初期加息市场担忧情绪的消退,美股迎来了估值和盈利的双双上行。其中估值在 2000 年 3 月回升至 28.94,接近加息前的水平,同期标普 500 指数净资产收益率(ROE) 连续走高,GDP 增速也维持在一个比较稳定的水平。值得关注的是,即使是2000 年 2 月下旬美国国债利差(10y-2y)倒挂也没能阻止美股的上涨行情。在加息末期,市场对美股盈利下行的担忧加剧,互联网泡沫破裂就此开启。标普 500 指数在 4 月 7 号冲至高点后开始回落,随后开始了一波两年之久的下跌行情。美股在 4 月开启调整的触发因素有,微软公司反垄断案引发市场对互联网企业盈利前景的担忧(2000 年 4 月)、国际油价走高加重了市场对美联储加息的担忧。

事后来看,美股盈利的下行才是驱动行情的关键因素,标普 500 指数ROE 在达到 2000 年 5 月的 18%后开始迅速走弱,直到 2002Q2 止跌,由期初的 16.32%下降至9.92%,降幅达到了 6.4%。这个降幅创出了历史新高。美股盈利下行既有宏观经济走弱、911事件冲击的影响,也有上市公司财务造假丑闻暴露、此前虚增的利润回吐的影响。更详细的美联储加息历史复盘,请联系小助手获取。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 专业分析师

Maturity, Yields, Par Values and Coupon payments. These are words that everyone has heard of but not many have a good understanding of what they mean. In this article all these complicated terms will be explained.

Please note that while this information is most relevant for physical bonds, it is still important to understand when dealing with CFD’s as they play an important role in how bond CFD’s are valued. What is a Bond? A bond is an instrument that is used by companies and governments and other entities to raise money through the issuing of debt.

There are different typed of bonds however, the simplest bonds are contracts in which an issuer (Company/Government) receives a payment from the purchaser or bond holder in exchange for the rights to interest plus the principal amount. For example, a government may issue a 10-year bond for $1000 in which they agree to pay 1% interest per annum which will equate to $10 per year. In addition, they will pay back the principal amount once the bond matures.

Key Terms Issuer – The entity that sells the bond initially and must make payments. Holder – The entity who is possession of the bond. Principal – The amount of debt that the government/company has taken that will be paid at maturity.

Par Value – The nominal value of the bond or the price when it was issued. Coupon Payment - The interest payment that is paid to the bond holder. Yield –The coupon payment divided by the Bonds face value.

Maturity – The date when the principal amount of the bond will be paid back. Bond Ratings Generally, Bonds are rated according by agencies, based on how safe the underlying assets are. For instance, government bonds tend to be rated the highest as they are guaranteed by the government, and governments are highly unlikely to default.

In a practical sense, the US government is such a reliable issuer that it should never default on the repayments. This makes Bond’s a great asset to act as a hedge against unsystematic risk. On the other hand, corporate bonds may be given lower ratings depending on their credit risks.

Inverse Relationship between Bond Price and Yield The price and yields for bonds are inversely related. This is important to note as bonds are often charted against their yield and not price which is how derivatives are often charted. Therefore, a trader should be aware of the inverse relationship between price and yield.

This occurs because as the price of a bond changes up or down the interest rate must adjust to ensure that the coupon payment is the same. Assume Bond A is issued at $1000 dollars and 10% interest rate to pay a $100 coupon. 1 Year later that same bond is now priced at $900, however the bond must still pay out a $100 coupon. However, to get a coupon payment of $100, the interest rate must increase.

The formula below shows this: $900 x Interest Rate = 100. Simple Algebra shows that the interest rate = 11.1% Understanding this relationship will make eliminate one of the more confusing elements of trading bonds. Catalysts for Bond Prices The general factors that influence a bond’s price are related to the interest rates and the broader economy.

For instance, if the market interest rate 2% and the bond’s coupon rate is 1%, then the bond will trade at a lower price and vice versa. Subsequently, bonds can be a handy way of tracking the sentiment as they often reflect the feeling in the market. Economic events can impact on the performance of bonds.

When the economy is growing and equities are doing well, bonds tend to perform worse as the return is limited. However, during times of volatility and poor stock market performance, the bond market tends to perform better as the market looks for safety in the guaranteed returns from bonds. Inflationary pressure and low or high interest rates can influence the direction of the way in which bonds are traded.

Generally, in a strong economic market, bonds with longer maturities tend to have higher yields than those in shorter maturity. This is generally due to the thought that the time that is further in the future will has more uncertainty than that in the near-term future. The general exception to this is when the market expects a recession soon.

This causes what is known as an inverted yield curve, in which the shorter-term bond is yielding a higher interest then the long-term bonds. You can trade CFD on the 10 Year US treasury note, 5 Year US treasury Note, UK Gilt, Euro Bund and the JGB Japan Futures on Go Markets Metatrader 5 platform

The AUD has fallen to lows not since the beginning of the Covid 19 pandemic and does not look like stopping anytime soon. With global commodity prices coming down and fears of a recession causing panic sell offs the AUD has been victim to a two-fold attack. The general recession fears push growth assets including the Australian dollar downward as investors look to put their money into safer assets.

In addition, as the USD has increased commodity prices have come down. Going forward, with presumably with recessionary fears only set to get worse globally and inflation in Europe and the UK potentially reaching 20% central banks have had no choice but to be aggressive with their monetary policy. The slowing growth has been a cause for concern as growth assets alongside the AUD have sold off.

Therefore, until there is really a peak in inflation or signs from the Federal Reserve that it intends to back off its hawkish stance, the AUD may very well continue to dive. Technical Analysis On the weekly chart the price currently in a nosedive with no obvious support in sight. The closest support in still $0.04 away at $0.60 which were the GFC lows.

If that level goes, then the next target is $0.55 which was the price during the initial stages of the Pandemic. Just as concerning is the fact that the 50-week moving average is almost ready to cross below the 200 week moving average. This is a lagging indicator that shows that the pair is very much being controlled by the sellers.

In addition, the RSI also still has room to drop further down to reach the level of the Covid 19 levels. The daily price chart confirms the analysis above and if anything shows a more systematic down trend. With both 50 day and 200 day moving averages trending down it does not bode well for a reversal any time soon.IN addition, the price has not been able to breakthrough both averages at for a significant period since June 2021.

Whilst the market can turn quickly, there is still s much fear and panic around that it is hard to see the AUD turning in the short term.

Following the previous Bitcoin analysis ( https://www.gomarkets.com/au/articles/economic-updates/bitcoin-usd-technical-analysis/ ), bitcoin continues to break below pattern after pattern, recently breaking out and re-testing a descending flag pattern on a 4h time frame as seen below: With the next major support sitting around $17,619, it won’t be a surprise if bitcoin comes down to that area. Looking at the correlation between Bitcoin and Ethereum, the last 7 days of price action shows a correlation of.89, which is a positive value that indicates a positive correlation between the two. A positive correlation means that the two moves very similar to one another. [caption id="attachment_273298" align="alignnone" width="602"] (https://cryptowat.ch/correlations)[/caption] [caption id="attachment_273299" align="alignnone" width="527"] (https://cryptowat.ch/correlations)[/caption] For ETHUSD (Ethereum), making similar patterns to BTCUSD, has also recently broken out of a descending flag pattern, signalling a probable continuation of the 4h downtrend, there is a high probability of ETHUSD reaching the next major support around $1012.

热门话题

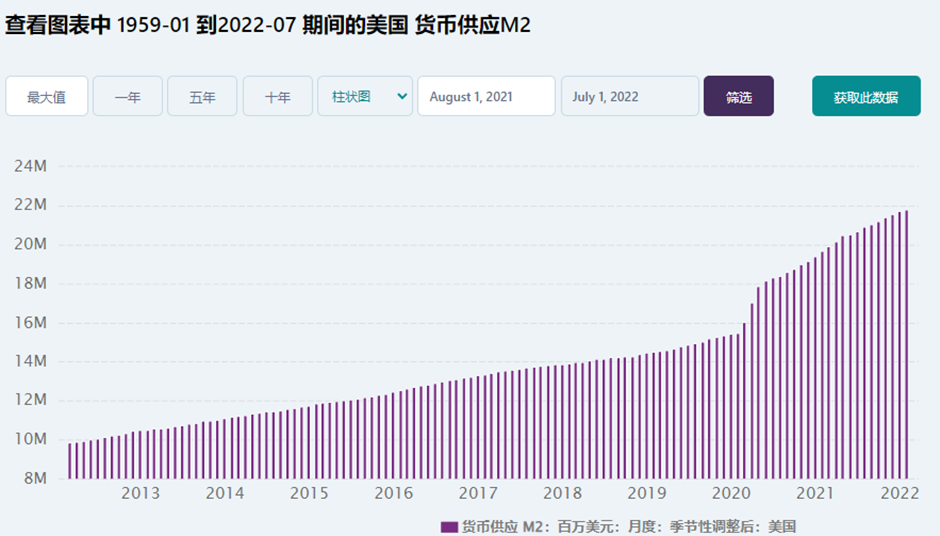

澳大利亚在2022年7月最新数据显示,流通货币M0的数量是550亿澳元。美国2022年7月流通货币M0的数量是55369亿美元。如果美国人口是澳洲人口的16倍左右,那么货币M0的流通量远远超过16倍,已经高达100倍。美元的货币超发严重,这要是放在过去,就好像民国纸币。基本每年都在“稳步增发”,见过“无中生有的”,没见过这么稳定的“无中生有”。当然,不是抨击美国央行印钱不对,只是说,他们超发货币,让我们买单,这我就要替澳洲华人打抱不平了。

美国的货币流通是澳洲的100倍,现在,汇率基本直奔0.60而去,隔壁邻居新西兰都要崩盘了,新西兰纽币到达了0.5的水位。这是什么意思呢?就意味着,美国流通货币是澳洲的100倍,购买力是澳洲的150%,相当于美国人均比澳洲有钱150倍。M0就是流通中的现金,换句话说就是手头里的钞票。当然,大家也可能说,这个太夸张了。但这个就是客观数字。我再说一个数字,美国的M2数字,是22万亿美金,澳大利亚大约2000多亿。又是100倍的差距。M2也就是广义货币,包括了现金和银行活期存款,涵盖了定期存款,居民储蓄存款和其他金融机构的存款,比如证券公司客户保证金,住房公积金中心存款。

超发100倍,然后还能升值??美国人玩金融真的是厉害。空手套白狼。美元再次“征服”世界。美国经济不好,印钱,美股大涨,美国人发钱,美元贬值,刺激出口和国内消费。经济好了,原材料价格上涨了,加息,全世界资金回流美国,资金回流支撑美股,美元升值,美国人股市不跌,购买力上升了,刺激进口,进口原材料成本降低了,收购海外资产容易了,出去旅游方便了。新兴国家我就不说了,多国汇率腰斩,阿根廷央行存款利率高达75%。最惨的,当属欧洲。内忧外患。英国英镑昨天闪崩,直接向美元英镑评价一路飞奔而去。英镑兑美元在亚洲交易时段中一度狂泻4.5%,创1985年以来新低。英国新任财政大臣Kwasi Kwarteng上周末暗示可能将出台更多减税措施。上周五,英国政府宣布了半个世纪以来最激进的一揽子减税措施,价值450亿英镑,市场对英国债务压力和通胀风险产生了担忧。英国10年期国债收益率开盘飙升22基点至4.05%。

澳元跌破0.65,我们的世界在经历一场战争、一场能源危机、一场全球粮食危机、和一场迫在眉睫的经济危机。这个时候,我们需要提前预判央行的预判,预判政府的预判。未来,财富还会经历多次波动和洗牌。看懂了美国金融的操作,就基本能够守得住自己的财富,并且能够在金融周期中,乘风破浪。免责声明:GO Markets分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表GO Markets的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管