市场资讯及洞察

周三的美国通货膨胀数据是本周的核心,但随着石油价格接近七个月高点,比特币(BTC)情绪发生变化,澳元处于三年高位,交易者在未来一周还有很多工作要做。

事实速览

- 美国通货膨胀率(二月)是降息定价和股票方向的关键二元事件。

- 布伦特原油交易价格约为82-84美元/桶,接近七个月高点,伊朗/霍尔木兹紧张局势引发的地缘政治风险溢价为4至10美元。

- 截至3月6日,比特币的交易价格已超过7万美元,如果本周保持不变,则可能出现趋势变化。

美国:通货膨胀是焦点

上个月的美国通胀数据显示,物价同比上涨2.4%,仍远高于美联储2%的目标。

将于周三公布的2月份通货膨胀率将受到审查,看是否有迹象表明关税转嫁或能源成本上涨正在推动价格回升,或者缓慢的下跌趋势是否仍然完好无损。

3月17日至18日的联邦公开市场委员会会议现在估计,削减的可能性仅为4.7%。本周的通胀数据高于预期,可能会进一步推高降息预期。

疲软的解读为新的削减定价和风险资产的潜在救济打开了大门。

重要日期

- 美国通货膨胀率(二月份CPI): 3 月 11 日星期三上午 12:30(澳大利亚东部夏令时间)

监视器

- 核心通货膨胀与总体通货膨胀的差异是商品价格关税转嫁的证据。

- 2年期和10年期美国国债收益率对印刷品的敏感度。

- 在3月18日联邦公开市场委员会做出决定之前,美元走势和联邦观察重新定价。

油:升高且对事件敏感

布伦特原油目前的交易价格约为每桶83-85美元,52周区间为58.40美元至85.12美元,反映了中东冲突引发的戏剧性走势。

分析师估计,石油的地缘政治风险溢价已经从1月份的62.02美元上调至每桶4至10美元,而2026年布伦特原油的平均预测已从1月份的62.02美元上调至63.85美元/桶。

环境影响评估的《短期能源展望》预测,2026年布伦特原油平均价格为58美元/桶,远低于目前的现货价格。

现货和预测基线之间的差距可能成为本周交易者的有用框架:来自中东的任何缓和局势信号都可能迅速缩小这一差距。

监视器

- 霍尔木兹海峡的事态发展以及伊朗核谈判发出的任何外交信号。

- 环境影响评估每周石油库存数据。

- 石油对通货膨胀预期的影响以及它是否改变了央行的态势。

- 能源板块股票相对于大盘的表现。

比特币:情绪观察

在地缘政治紧张局势升级和新的关税担忧的推动下,比特币在过去17周经历了53%的残酷回调,一直试图稳定下来。

然而,昨天上涨了8%,回升至72,000美元以上,加密货币 “恐惧与贪婪指数” 从持续一个多月的20(极度恐惧)下方跃升至29(恐惧),这表明市场情绪可能发生转变。

周三的美国通胀数据低于预期,可能会为突破提供进一步的推动力;热点报告有可能使比特币回落至其刚刚收复的7万美元水平以下。

监视器

- 周三的通货膨胀反应是此举的主要宏观催化剂。

- 在比特币走强之后,任何向山寨币的轮换。

- ETF流入/流出数据作为机构参与的确认。

澳元/美元:鹰派澳大利亚央行遇上地缘政治逆风

澳元的交易价格接近三年多的高点,并将连续第四个月上涨,今年迄今已上涨6%以上,使其成为2026年表现最好的G10货币。

驱动因素是明显的政策分歧。澳洲联储行长米歇尔·布洛克表示,3月的政策会议已经 “上线”,可能的加息,并警告说,伊朗紧张局势带来的油价冲击可能会重新点燃国内通货膨胀压力。

现在,市场定价表明,在即将举行的会议上加息25个基点的可能性约为28%,而在5月之前将全面收紧政策,到年底再次上涨至4.35%的可能性约为75%。

这种鹰派态度与美联储搁置不前并面临鸽派政治压力的对立面,为澳元带来了潜在的结构性利好。

监视器

- 澳元/美元对周三美国通胀数据的反应。

- 澳洲联储本周加息概率重新定价。

- 铁矿石和大宗商品价格是澳元的次要驱动力。

- 鉴于澳大利亚的出口风险,中国的需求信号。

China’s recent shift in economic policy and its potential for fiscal stimulus reflect an evolving approach to support economic stability. Following previous monetary easing measures, including a reduction in the Reserve Ratio Requirement and interest rate cuts in late September, China’s National People’s Congress (NPC) Standing Committee has now approved a local government debt restructuring plan. This plan allows for up to RMB 10 trillion (~US$2.54 Trillion) in debt adjustments, including a one-time increase of RMB 6 trillion in the special debt ceiling over 2024-2026, and an additional RMB 800 billion in special bond quotas annually from 2024 to 2028.

These measures align with expectations, the catch – it’s estimated to add just 0.1 per cent to China’s GDP. Naturally this left the market disappointed and saw Chinese equities shredded. But it's more than the lack of direct demand-side stimulus.

It’s the vague guidance on the use of bonds for banking sector recapitalisation as well as poor outlining on housing inventory buy-backs, and idle land. It's all a bit, ‘nothing’. Now we admit market expectations had been high, so price falls were inevitable, but the metals prices post-meeting were telling from both a short- and longer-term perspective.

First support for the housing market may be limited in the near term, given that primary home sales for top developers turned positive up 15 per cent year-on-year from June last year and home prices rose slightly 0.4 per cent in 50 cities September to October. Second is a possible trade war and having some powder dry as it gears up for the next four years of a Trump 2.0 administration. Fiscal Stimulus is clearly going to be part of this.

And already we have seen Finance Minister Lan Foan, in comments to the South China Morning Post discussing this very point. He pointed out that China’s Ministry of Finance has a readiness for fiscal expansion starting in 2025 and that China’s current debt-to-GDP ratio (68%) provides fiscal headroom, especially in comparison to Japan (250%) and the U.S. (119%). So is that suggesting it’s a ‘when’ not an ‘if’?

From a trader and markets perspective the answer may come at the Central Economic Work Conference in December is expected to outline specific fiscal measures for 2025, potentially focusing on reducing housing inventory, boosting infrastructure, and enhancing social welfare and consumption. The market consensus is for between RMB 2-3 trillion in fiscal expansion over the next one to two years, likely with an initial emphasis on infrastructure investment over consumption support. We should point out this could be a “fourth strike and you’re out” territory as expectations for delivery since Gold Week celebrations have been 0-3, a fourth miss might see the markets completely ignoring what has been promised.

However if it does eventuate looking historically, such investment-heavy stimulus cycles have bolstered demand for steel and other raw materials. China’s past stimulus responses, particularly during the 2018-19 U.S. tariff period, included fiscal stimulus and currency depreciation, indicating that fiscal policy could adjust in response to global economic factors. However, China’s approach to fiscal expansion this time may differ slightly from past cycles: Reason 1: Steel Demand: Prior fiscal expansions, such as during 2009-2010 and the 2018-19 tariff period, drove strong steel demand growth.

Investment in steel-intensive infrastructure, for example, boosted annual steel demand by approximately 200 million tons (a 30 per cent increase) between 2016 and 2019, raising the steel intensity of GDP by 7 per cent. Given China’s high cumulative steel stock—estimated at around 8.5 tons per capita (approaching developed-nation averages of 8-12 tons per capita)—the scale of future infrastructure investment may be more limited, as large physical projects are increasingly complete and the need for new largest scale projects is moderating. Reason 2: Shift To Consumption and Social Welfare: Since 2018 China has subtly and gradually shifted fiscal efforts toward consumer support and social welfare to address deflation risks.

This shift is likely to accelerate, as policy moves to an emphasis on stimulating internal demand through social spending. Now historically China has often favoured investment-driven stimulus to support GDP growth targets, which could mean another infrastructure-led, steel-intensive approach if economic conditions demand it, albeit possibly on a smaller scale than in the past, but again 0-3 on promises, there are risks it doesn’t materialise this time around. The next part of the story for commodities and a China stimulus story is the impending trade war.

China is clearly facing headwinds for its exports, given the likely policy changes from the second Trump administration. The biggest issues are the 10 per cent tariff on all imports and up to 60 per cent on Chinese goods. The timing and specifics of the tariffs are uncertain, but using his 2016-2020 timelines as a guide it's likely to be one of the first programs enacted and new tariffs could emerge as early as the first half of 2025.

Currently, more than 20 per cent of China’s steel production is tied to exports—11 per cent directly and 12 per cent indirectly through products like machinery and vehicles—any new tariffs on Chinese goods would likely impact steel output and, subsequently, iron ore demand. During the 2018-19 tariff period, China’s direct steel exports to the U.S. declined, but this was balanced by growth in indirect steel exports via manufactured goods and bolstered by domestic infrastructure demand which is hard to see this time around. 2025 strategies China might deploy to counteract any new tariffs could include currency depreciation, reciprocal tariffs, re-routing exports to new markets, and increased fiscal and monetary stimulus. Interestingly the U.S. comprises only 1 per cent of China’s direct steel export market, it the larger share for indirect exports, particularly machinery ~20 per cent that is the issue.

Since 2018, China has expanded its steel-based goods exports by focusing on emerging markets—a resilience that will likely be tested further if tariffs intensify next year. So where does this leave iron ore? Current iron ore prices, hovering around US$100 per tonne, seem to reflect current market fundamentals pretty accurately.

The substantial net short positions in SGX futures, which were prevalent prior to the late-September stimulus, have notably diminished in the past 6 weeks China’s recent policy adjustments have mitigated the downside risks for steel demand for the remainder of 2024. This is coupled with solidifying demand indicators and restocking activities, which may bolster seasonal price strength as the year concludes. Nevertheless, the potential impact of a seasonal price rally may be constrained by relatively high port stock levels, which presently stand at about 41 days of supply which again underscores why price around US$100 a tonne is accurate.

Looking ahead to 2025, the Ministry of Finance in China signalling forthcoming fiscal expansion suggests a potential upside risk. However, potential new tariffs from the U.S. may pose challenges to steel export volumes, potentially counteracting the positive effects of domestic fiscal measures. China’s response to such tariffs—potentially through currency depreciation, trade redirection, or additional fiscal and monetary stimulus—will be crucial in mitigating these pressures.

But this would be a zero-sum game effect. Thus any upside risks are counted by downside risks – this leads us to conclude that China is not going to be the White Knight of the past. And that 2025 is going to be a tale of two competing forces that sees pricing see-sawing around but finding equilibrium at current prices.

This also leads us to point to equities – iron ore and cyclical plays have benefited strongly over the past 24 months on higher prices and the long COVID tail. 2025 appears to be the year that tail ends and a new phase will begin.

热门话题

特朗普上台后,会做很多颠覆性的创新推进,首当其冲的就是,敢于面对加密技术和去中心化技术对传统中心化货币信用体系的冲击。BTC价格在一周时间内快速上涨30%,最终突破9万美金,市值超过白银,估值1.72万亿美元,成为全球第八大资产。

特朗普8月份表示,JM货币可以“定义未来”,并补充称,他希望JM货币“在美国开采、铸造和制造”。这位当选总统还提议建立类似于美国战略石油储备的国家比特币战略储备,直接购买和投资JM货币作为国家安全措施。并且公开接受任何形式的JM货币捐赠。来自该领域的支持者们为特朗普大选也贡献了可观的真金白银。今年9 月,特朗普和他的子女创办了一家名为 World Liberty Financial 的新JM货币公司,意味着未来的总统亲自加入区块链经济系统中,和他的支持者们,尤其是马斯克,共同支持JM货币市场发展,同时也是受益人。特朗普也说了一句非常激进也有激情的话:“规则将由热爱你的行业的人而不是讨厌你的行业的人制定。”在特朗普赢的大选后,当天美国BTC ETF进入13亿美元新增资金。全球JM货币市场总值达到3万亿美元。

回到过去,看2021年6月,美国证券交易委员会主席加里·根斯勒(Gary Gensler) 在他上任后的首次演讲中表示,JM货币“充斥着欺诈、骗局和滥用”。美国监管机构和美联储共同认为,应该加强JM货币的监管。而目前,美联储理事沃勒表示,稳定币可能为金融系统带来好处。稳定币基本上是一种合成美元。在特朗普胜选后,开始表态支持和认可JM货币在经济系统中的作用。所以,目前美国从政府到监管机构,未来对JM货币的态度,都是开放和支持的。我们不做JM货币本身的价格预测,毕竟美国认可,不代表全世界任何国家都认可。但是,我们从牛市的舆论中,很容易看出来,未来还有更进一步的上涨空间。我之前多次提到,BTC就是JM货币领域的爱马仕。如果我们普通投资者,由于各类问题无法直接参与JM货币市场,或者不了解加密货币世界背后的技术和逻辑,我们可以曲线救国,通过购买与之相关股票进行投资,毕竟,股票各国政府都认可,区块链技术也都认可,股价同样会跟随整个JM世界版块的估值上涨。最推荐的,就是Coinbase。我记得我在2023年左右,公开的墨尔本大型金融讲座活动上,以及多次公开的视频网络研讨会中,都给出推荐,当时价格应该是50-110美金之间波动,而目前价格已经上涨到300美金附近。这家公司是在美国上市的JM货币交易所,只要有交易产生,就有钱赚。该平台持有约9,182枚BTC。所以,BTC价格上涨1万美金,该平台就赚1亿美金。在2024年第三季度,Coinbase报告净收入为7,550万美元,每股收益0.28美元,低于市场预期的0.45美元。收入为12.05亿美元,未达到预期的12.61亿美元。除此之外,GO Markets也给到大家一些区块链技术相关的股票参考:美股上市公司:MicroStrategy Inc. (MSTR):这家商业智能公司是全球持有BTC最多的上市公司之一,持有超过158,000枚BTC。该公司股价进入2024年,也是接近10倍涨幅。

Marathon Digital Holdings, Inc. (MARA):专注于JM货币挖矿,持有约13,286枚BTC。特斯拉公司 (TSLA):这家电动汽车制造商持有约10,500枚BTC。港股上市公司:众安在线 (6060.HK):通过旗下众安银行与多家JM公司合作,提供相关服务。BTC ETF:ARKB.CBOE - ARK 21Shares Bitcoin ETFBITB.NYSE - Bitwise Bitcoin ETP TrustBRRR.NAS - Valkyrie Bitcoin FundBTCO.CBOE - Invesco Galaxy Bitcoin ETFBTCW.CBOE - WisdomTree Bitcoin TrustDEFI.NYSE - Hashdex Bitcoin ETFEZBC.CBOE - Franklin Bitcoin ETFFBTC.CBOE - Fidelity Wise Origin Bitcoin TrustGBTC.NYSE - Grayscale Bitcoin Trust BTCHODL.CBOE - VanEck Bitcoin TrustIBIT.NAS - iShares Bitcoin Trust新的科技时代正在开启,AI和区块链技术在特朗普+马斯克时代,会快速发展。参与进未来财富增长的最便捷方式,就是购买股票成为股东或购买ETF。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管

热门话题

周五美盘继续上冲,三大股指均收下小阳线,从媒体看,美股一旦持续上涨就有唱空声出现,本次大选后的走势直接扭转财报季的持续回调,三大股指创历史新高,是市场对特朗普当选以后的美国经济的肯定,美股牛市框架已经成型,若数据不出意外,很有可能直接对接圣诞元旦行情而不需要过多回调。

AI板块涨跌不一,特斯拉的强势开始持续体现,年初至今净涨幅不到30%,过去两年股价没有其他七巨头的表现,现在特朗普上台,特斯拉持续上涨是合情合理的,$300大关压力已经被突破,股价周五放量大涨8.19%冲上$320,距离前压力$384也不遥远,持有特斯拉中长期都是很有上升空间的选择。核能铀矿继续回调,国际铀价没有反弹迹象,周五澳铀的反弹今天又会回吐,但美国核技术股逢回落就可进场。周末比特币冲上八万美元大关,再次验证美轮减半后会走出大涨波段的规律。本周美国10月CPI年率预期较前值反弹0.2%至2.6%,这也是因大选推迟给出的最新预测,月度数据和核心CPI保持增幅不变,通胀数据依然可控,增速小幅反弹将加剧美联储降息节奏,前半周对美股形成一定压力。周四PPI预期反弹幅度也较大,从前值1.1%反弹至2.3%,但PPI在2%附近依然不差,对股市的影响没有CPI关键。周五鲍威尔将再度在活动上发言,预计其言论也将继续温和中性。目前马斯克已经公然支持特朗普在未来干预美联储,鲍威尔的岗位压力也越来越大,更不可能有激进政策推行了。

美元指数周五继续大涨,再次逼近105大关。近期美元暴涨暴跌的趋势短期难以改变,可能要等到特朗普正式上任才会压制住涨势。金价再度暴跌至2700以下,宽度剧震持续了数日,随着中东局势在特朗普上任过渡期的扑朔迷离,金价接下去几个月也难以稳定。恐慌指数继续回落相对较容易判断,继续兑现大选前预期的下行波段。油价周五扩大跌幅,美油回到$70平台,也符合逢高做空的预期,中期油价会进一步下行。外汇方面,美元的不稳定表现令汇市震荡加剧,澳美再度回到0.66以下,但澳元既有贵金属等原材料和能源价格回落影响,又有澳联储不降息助推,短期陷入大波动也无法避免。美元人民币继续保持在7.2以下。周末中国出台14.3万亿隐形地方债化债政策,有望进一步助推股市并解放地方政府财政困难。因此沪深两市上周的表现基本兑现了人大召开是的“任务”,而A50和HK50的表现明显没有匹配,若本周A股继续稳健上行,以上指数也会反弹匹配A股走势。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Xavier Zhang | GO Markets 高级分析师

热门话题

在全球科技巨头中,高通(QCOM.NAS)凭借强大的多元化战略和技术创新,正一步步走出其手机业务的舒适圈,向着汽车和物联网等高增长领域迈进。让我们来看看,这家芯片巨头如何在新的领域里大展拳脚,并为未来发展铺设强劲轨迹。根据最新2024财年第四季度财报,高通业绩全面超预期,且未来指引也喜人。截至今早美股收盘,股价为$172,相比财报公布前上涨4%。2024财年Q4,高通实现收入102.4亿美元,同比增长18.7%,净利润29.2亿美元,同比增长96%,收入和毛利率双双超预期。虽然本财年有发生小幅裁员,但经营、销售等费用没有实质减少,尤其是研发费用仍然保持21.3%的同比增长。2025财年Q1指引也超出市场预期,预期收入105-113亿美元(市场预期105.5亿美元),调整后EPS为2.89-3.05美元(市场预期2.81美元)。

这一季度的业绩亮点包括:手机、汽车、物联网三大业务的全面回暖。在手机市场逐渐饱和的今天,高通的逆势上扬离不开其多元化战略的成功。手机业务依然是高通的营收“压舱石”,本季度收入占比超过60%。在安卓手机制造商需求回升的推动下,高通手机业务营收增长11.7%,达到了60.96亿美元。特别是VIVO手机出货量增长了22.7%,巩固了高通在手机芯片市场的地位。Snapdragon® 8 Elite芯片在中国手机市场表现优异,未来在三星、华硕等品牌的新机型上继续发光发热也是指日可待。

汽车业务一马当先,是增长的“新引擎”。2024年第四财季,汽车业务收入为8.99亿美元,同比增长高达68%。高通骁龙数字座舱和车联网产品让公司在新车市场获得了大量关注。尽管汽车业务的收入占比目前还不到10%,但增速是各大业务板块中最高的,公司预计下季度汽车业务将继续增长50%。物联网业务(IoT)也迎来了强势反弹。如果说高通的汽车业务是“黑马”,那物联网就是稳扎稳打的老将。第4季度,高通的物联网业务实现了16.83亿美元的营收,同比增长21.7%。在经历了长达6个季度的下滑后,物联网业务终于迎来的明显增长。XR、AI PC等新产品的发布和库存补充的需求推动了这波增长,Quest 3S和Snapdragon® XR2 Gen 2芯片等创新产品也成了IoT业务的新引擎。8月传出的高通收购法国公司Sequans的4G物联网技术,这将帮助高通进一步扩展了低功耗、可靠的物联网解决方案,但是Sequans依旧保留了部分技术的控制权,这限制了高通对该技术的独家使用权,这点可能成为一把“双刃剑”。

AI PC业务备受期待,有望助力高通实现“戴维斯双击”。宏碁、华硕、戴尔、惠普等大厂商已经陆续推出了搭载高通Snapdragon X Plus平台的AI PC设备。可以预见,AI PC将逐步成为高通的“第二曲线”,帮助其走出手机业务的天花板,实现收入和估值的双重提升。下一财季正值节日影响下的电子产品销量旺季,市场对高通的AI PC业务信心满满。在增加业务多元化的同时,高通也并没有忘记回馈股东。本季度,公司批准了150亿美元的股票回购计划。并且,高通还在今年第三季度返还了23亿美元,其中包括13亿美元的股票回购和9.49亿美元的分红。这一举措无疑增强了市场的信心,显示出公司强劲的盈利能力和现金流。长期来说,高通与苹果的关系依旧稳定,尽管苹果有自研调制解调器芯片的打算,但高通成功续约了苹果,未来还将继续为其提供5G芯片。总结来说,高通正通过“第二曲线”的战略转型,逐步从传统的手机芯片领域扩展到物联网、汽车、AI PC等高增长市场。AI PC等新兴业务将为高通带来新一轮的增长,而物联网和汽车的稳定表现则奠定了公司长远发展的基石。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Christine Li | GO Markets 墨尔本中文部

热门话题

10月29日,小米发布了旗下SU7的高性能也是最终版本——SU7 Ultra,吸引了市场的极大关注。这款车不仅在测试表现上优异,还在预售阶段就展示了强劲的市场需求。此外,SU7的发布也为小米股价和市值带来了显著提升。本文将从多方面分析小米SU7 Ultra以及公司的市场潜力。小米SU7 Ultra在纽博格林北环赛道上取得了优异成绩,以6分46秒874的圈速刷新了四门轿车圈速纪录,远超预期,充分展示了升级后的高性能特点。这一成绩使得SU7 Ultra与特斯拉Model S Plaid等高性能电动车齐名,进一步提升了小米品牌的市场竞争力。该车搭载了多项技术创新,包括高性能电池组、高效冷却系统以及精密的底盘调校,都为测试中的卓越性能表现提供了支持。纽北测试成绩展示了小米在电动汽车技术方面卓越的进步,特别是其动力系统和操控性得到了外界的一致认可。业内普遍认为,SU7 Ultra的成功测试不仅巩固了小米在电动汽车市场的技术实力,也为其后续车型的研发奠定了技术基础。在SU7 Ultra发布后的预售阶段,它的市场表现也超出预期。仅预售开启10分钟内就获得了3680台订单,能看出消费者对这款高性能电动轿车的高度认可和浓厚的兴趣,同时也证明了小米的品牌魅力以及在智能科技和移动领域积累的客户信任,进一步巩固了其作为“科技企业+电动汽车制造商”的双重身份。此外,小米的单月交付量已突破2万辆,为其2024年全年10万辆的交付目标提供了坚实保障,若这一增长势头得以延续,SU7 Ultra有望成为小米电动汽车产品线的重要支撑,并加速推动其在高端电动汽车市场的发展。

受SU7 Ultra发布的利好影响,小米集团的股价随之出现显著上涨,发布后的首个交易日,小米股价的涨幅达到14.99%,市值增长了近500亿港元,达到4177亿港元。这一市值接近小米在过去两年内的最高点,显示了投资者和市场对小米电动汽车战略的信心。SU7 Ultra的成功不仅在短期内提振了小米的股价和市值,也为其在未来电动汽车市场的扩展奠定了基础。然而,小米要在激烈的电动汽车市场中长期立足,仍需面临来自特斯拉、比亚迪等行业领先者的竞争压力,尤其是在全球对新能源车需求增加的背景下,小米需要持续创新,在技术和成本方面寻求平衡,以保持其市场地位。在市场机遇方面,电动汽车市场正值快速增长期,全球对清洁能源汽车的需求不断增加。小米依托其智能硬件和AI技术优势,有机会在智能驾驶、车联网和自动驾驶等领域实现突破,形成差异化竞争力。此外,小米广泛的用户基础和良好的品牌形象也为其在高端电动汽车市场的扩展提供了支持。小米进军电动汽车领域的战略布局表明,公司希望通过“科技+出行”生态系统来构建长期竞争优势。SU7 Ultra的推出标志着小米在电动汽车市场迈出了重要一步。未来,小米或将在技术研发、制造供应链以及品牌建设方面加大投入,以进一步提升其在高端电动汽车市场的地位。

对于投资者而言,小米在电动汽车市场的成功有望提升其整体估值,并推动其股价在未来实现增长。然而,由于电动汽车行业竞争激烈,市场的不确定性依然存在,小米能否在这一领域持续创新、吸引消费者,依旧需要经过时间的考验。总而言之,这次的小米SU7 Ultra凭借卓越表现在电动汽车市场中又一次迅速引起关注,作为小米在高档电动汽车领域的首次尝试,SU7 Ultra在性能、市场表现和投资者反映方面都取得了成功,为公司未来在该领域的扩展奠定了坚实基础。然而,在电车市场大家都在不断发展的现状下,小米依旧需要不断的发展创新,以避免被市场淘汰,投资者在投资时还是要避免一时的情绪驱动,理智对待市场,希望大家都能有顺利的投资之路!免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Yoyo Ma | GO Markets 墨尔本中文部

热门话题

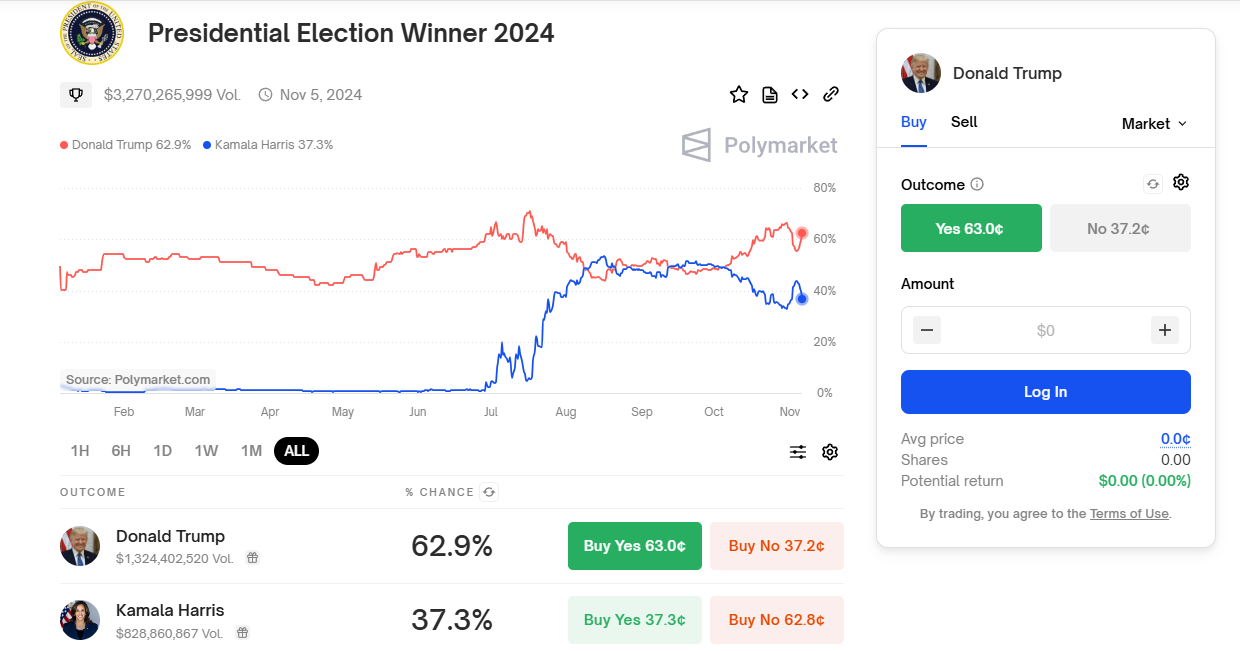

美国大选,最终结果,会影响全球政治和经济格局。美国人让全世界看到了他们的政治影响力,也让全世界看到了,美国人也是普通人,美国政客,也是坏得很。从“萝莉岛”事件,到近期选票造假,投票机器无法选中特朗普等层出不穷的问题,我们也深入了解到,政治到了极端情况下,是无所不用其极的。毕竟,按照特朗普和马斯克所讲,这次输了,可能会面临重大的问题,甚至可能是生命受到威胁。

目前市场还是认为特朗普胜出概率更大,但也不排除后续延迟出结果的可能性。2024年美国总统大选的投票日为11月5日(美国东部时间)。由于美国各州的投票站关闭时间不同,选举结果的公布时间也有所差异。一般情况下,初步结果会在投票日当晚(美国东部时间)陆续公布。考虑到悉尼与美国东部的时差(悉尼时间比美国东部时间早16小时),预计初步结果将在悉尼时间11月6日下午至晚间开始出现。然而,若选情胶着或存在大量邮寄选票,最终结果可能需要数天才能确定。例如,2020年大选由于邮寄选票数量庞大,最终结果在投票日后四天才公布。因此,2024年大选的最终结果可能在悉尼时间11月7日或更晚才能确定。特朗普未来大概率会对中国征收高额关税,因此,中概股不会是很好的投资标的。相比在美国上市的中概股,更好的投资机会会出现在香港。受到政治意识形态不一致导致的冲击波,已经影响到富豪阶层,这些人目前正在积极的向香港涌入。而近期香港股市也给出了积极信号,外部资金进入明显。

特朗普有些比较有趣的政策主张,例如教育改革:特朗普计划建立一个认证机构,确保教师传授爱国价值观,强调美国的历史和西方文明的优越性。很像中国的辅导员,但是有证书。文化政策:他提议创建“自由城市”,并设立一所反对“觉醒文化”的大学,旨在推广传统价值观,抵制被视为过度政治正确的文化潮流。这点马斯克会绝对支持,毕竟儿子的事情是他的痛处。经济上,特朗普偏好减税和减少企业监管,这种政策主张可能刺激公司利润增长,有利于股市,尤其是对金融、能源和传统制造业公司非常友好。支持传统能源和制造业,包括石油、天然气等产业。哈里斯就简单了,继续多性别的政策,继续增加社会福利。所以,特朗普说的很正确,如果这次败了,之后的选举就没有意义了。因为大量的移民涌入摇摆州,导致摇摆州选票会倾向于民主党。哈里斯将继续进行大量的,保护移民的政策,获得新增选票。如果哈里斯获胜,可以参考的投资行业是:清洁能源,NextEra Energ,废品处理,电网现代化和电气设备生产的公司(Eaton)等。另外,对于大部分蓝筹股来说,提高企业税可能会导致股市下跌。因此,民主党的政策,更多的是为了政治正确和稳定性进行的,而共和党更多的,是为了本土经济发展。免责声明:GO Markets 分析师或外部发言人提供的信息基于其独立分析或个人经验。所表达的观点或交易风格仅代表其个人;并不代表 GO Markets 的观点或立场。联系方式:墨尔本 03 8658 0603悉尼 02 9188 0418中国地区(中文) 400 120 8537中国地区(英文) +248 4 671 903作者:Jacky Wang | GO Markets 亚洲投研部主管