市場新聞與洞察

透過專家洞察、新聞與技術分析,助你領先市場,制定交易決策。

2026年2月28日,随着美国和以色列联合袭击的开始,屏幕上的数字开始以临床的方式移动,尽管伊朗平民伤亡惨重的实地现实并非如此。正如他们所说,市场没有道德指南,而是有衡量机,而现在,他们正在权衡整个全球经济从 “准时” 模式向 “以防万一” 周期的过渡。

市场发出了什么信号

3月2日,指数盘保持谨慎,而防御力上涨。从历史上看,冲突可以加快补货和订单的速度,但是订单的规模(以及速度)仍然取决于预算、批准和交付瓶颈。

赢家们

1。韩华航空航天 (012450.KS)

韩华是与 “K-Defense” 主题相关的交易比较活跃的公司之一,在全球火炮和弹药周期紧缩的情况下,市场越来越多地将韩华视为可扩展的供应商。能力和交付信誉。

当补货变得紧迫时,大规模生产的能力通常与平台本身一样重要。与K9 Thunder和Chunmoo等系统相关的出口需求强化了持久订单流的说法,即使结果仍然取决于预算、批准和交付时间表。

可以改变情绪的关键因素: 订单簿更新、生产节奏和任何后续出口公告。

2。诺斯罗普·格鲁曼公司 (NOC)

随着投资者对战略现代化和大型长期项目的投资进行了重新定价,诺斯罗普成为人们关注的焦点。通常被视为关键任务的国防市场可以跨周期持续存在。与其说是四分之一,不如说是现代化优先事项保持不变,势头是否保持稳定(以及如果不这样做,时间表是否会发生变化)。

可以影响情绪的关键变量: 采购速度、合同时间和与计划相关的融资语言。

3.RTX 公司 (RTX)

随着投资者对拦截器补给周期和快节奏防空的经济性进行定价,RTX回到了录像带的中心。流失代价高昂,当使用率上升时,政府通常必须补充库存,在许多情况下,还需要为扩产提供资金,这可以延长待办事项并提高收入可见度。

可以影响情绪的关键变量: 补货订单、制造扩张指标和交付吞吐量。

4。洛克希德·马丁公司(LMT)

洛克希德引起了人们的注意,因为市场关注导弹防御需求以及每个采购部门在快节奏的环境中都面临的问题:库存重建的速度有多快?如果利用率保持较高的水平,则赢家往往是最有能力扩大生产和可靠交付的承包商。洛克希德的导弹防御风险使其与补给叙述密切相关。

可以影响情绪的关键变量: 产量增长信号、单位经济和预算驱动的订单节奏。

5。 BAE 系统 (BA.L)

由于积压了836亿英镑,并在AUKUS潜艇计划中发挥了核心作用,随着欧洲部分地区表示有更高的国防开支雄心,BAE成为人们关注的焦点。在 “避险” 轮换中,该股上涨6.11%,至52周高点,交易员正在关注AUKUS的里程碑以及包括 “天盾” 在内的欧洲防空和导弹防御采购。

可以影响情绪的关键变量: 潜在的催化剂是德国支出的任何明显增加,都会提振BAE欧洲各单位的订单,而主要风险包括英国国债收益率急剧上升、英镑再次波动或 “和平威胁” 获利回吐。

输家:并非每个 “战争股票” 都在上涨

6。航空环境 (AVAV)

AeroVironment在开盘时飙升了18%,然后盘中下跌了17%,此前有报道称美国太空部队将重新开放一份14亿美元的合同。此举凸显了采购流程和合同风险如何推动波动,即使在支持性的主题环境中也是如此。

7。克拉托斯国防 (KTOS)

随着中东冲突的加剧,克拉托斯坐落在 “无人机和游荡弹药” 主题中,该主题引起了人们的关注。该股在盈利后仍被抛售,这凸显了国防行业的常见风险。Kratos宣布在12亿美元至14亿美元之间进行大规模后续股票发行,此举加强了资产负债表,可以支持未来的项目投资。

对于专注于短期 “冲突溢价” 叙事的交易者来说,稀释可以迅速改变设置。即使需求条件显得支撑,如果每位股东最终拥有一小部分业务,市场也可能会对股票进行重新定价。

8。直观机器 (LUNR)

一些投机性的太空科技公司落后,因为投资者似乎偏爱国防相关收入更稳定的公司。

9。波音 (BA)

波音在该交易日下跌了约2.5%。尽管其国防部门很有意义,但其商业业务可能对航空需求、空域中断和油价变动更加敏感。

10。Spirit 航空系统 (SPR)

作为主要的航空结构供应商,Spirit AeroSystems仍然与全球飞机生产周期紧密相连。 最近的业绩显示,尽管销售额增加,但亏损仍在扩大,这反映了主要飞机项目的生产成本持续增加。这些压力打压了投资者对短期前景的信心。波音的计划收购最终可能会重塑该公司在供应链中的地位,但执行风险和生产稳定性仍然是市场定价股票的核心。

接下来要看什么

- 升级与降级: 转向外交或停火讨论可以迅速改变围绕国防股的情绪。

- 石油和运输: 能源峰值可能收紧金融状况并给周期性行业带来压力。

- 预算和奖励: 价格变动有时可能先于合同决定,在最终确定奖励时才会明确。

- 生产能力: 具有良好生产和交付记录的公司通常会吸引最多的投资者的注意力。

- 供应链限制: 稀土、推进和电子设备仍然是潜在的瓶颈,可能会限制生产规模的速度。

长期镜头

2026年的伊朗冲突首先是一场人类悲剧。对于市场而言,这也可能代表财政框架中国家安全支出优先顺序的转变。如果国防开支在多年内保持较高水平,那么拥有可扩展制造能力和集成技术堆栈的公司可能会吸引投资者的持续关注。也就是说,市场是周期性的。结构性主题可以持续存在,但也可以在假设发生变化时迅速重新定价。保持分析和风险意识仍然至关重要。

提及特定公司、行业或市场走势仅供一般市场评论之用,并不构成买入或卖出任何金融产品的推荐、要约或邀请。市场对地缘政治或宏观经济事件的反应可能动荡不定且不可预测,结果可能与预期存在重大差异。

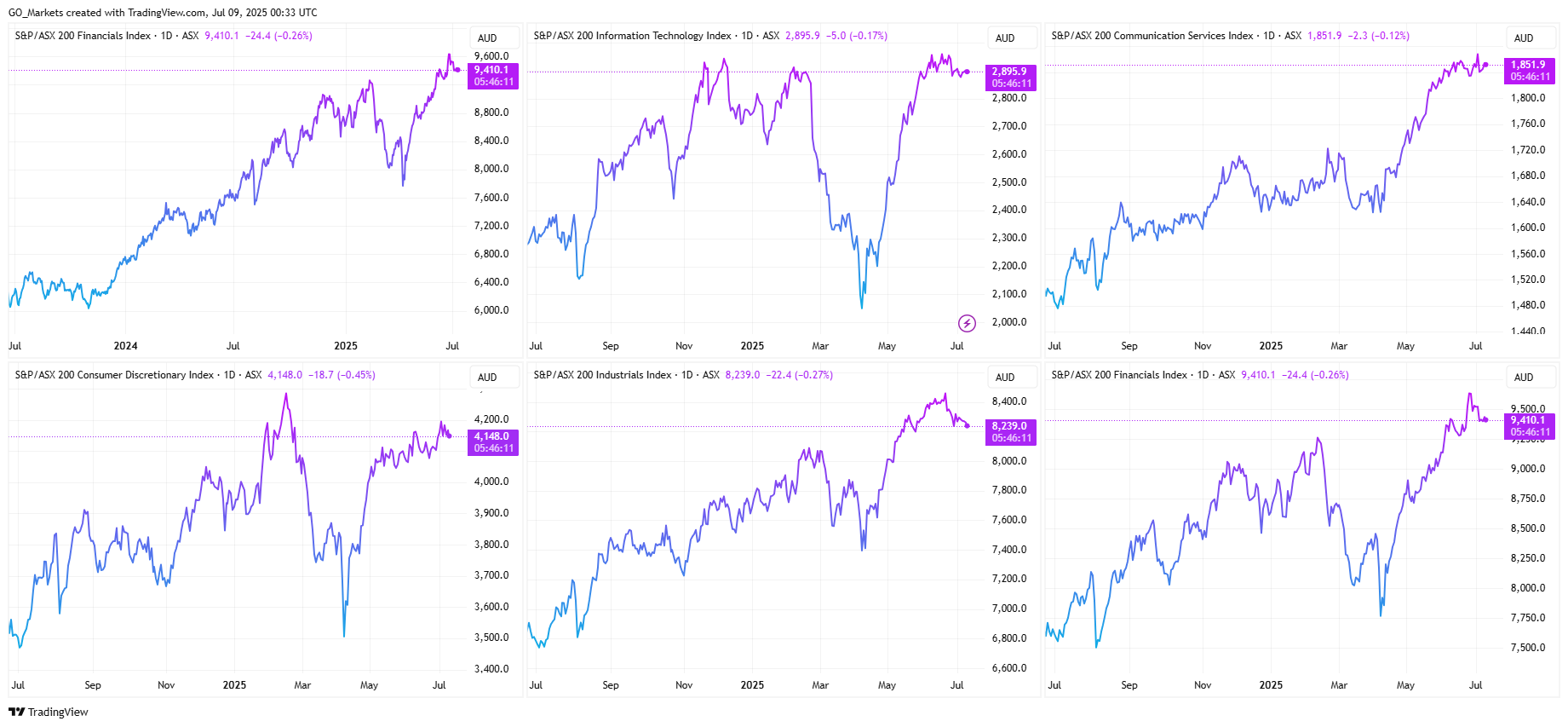

Despite living through one of the most chaotic political and trade environments in recent history, the ASX 200 delivered its strongest performance since the pandemic rally.The S&P/ASX 200 Index gained 9.97% in capital growth and 13.81% in total returns, hitting a record high of 8,639.1 points in June.While Trump's tariff announcements caused dramatic market swings — including the ASX plunging nearly 500 points on "Liberation Day" — Australian markets weathered the storm and managed to rally before the financial year end.The rally was driven primarily by heavyweight banks like Commonwealth Bank and Westpac, with CBA alone responsible for nearly half the index's gains.However, the performance was not uniform across all sectors — five of the 11 ASX market sectors actually lost value during the financial year.

Sector Performance Rankings

Financials

The ASX 200 financials sector was the top-performing market sector of FY25, with the Financials Index rising by 24.45% and delivering total returns including dividends of 29.39%.Sector Champion: Despite Commonwealth Bank's headline-grabbing 45% rise that captured most investor attention, it was retirement and general investment solutions provider, Generation Development Group (ASX: GDG), that led the sector with a rise of 114% in FY25.

Technology - AI Boom Continues

The Information Technology Index rose by 23.89% and provided a total return of 24.19%.Sector Champion: TechnologyOne outperformed both its FY24 and 1H25 earnings expectations — 9.8% and 11.3% on each result respectively. ASX:TNE rose 121% during FY25 to close at $41.01.

Communications

The Communications Index gained 23.4% for the year.Sector Champion:EVT topped the communication leaderboard in FY25. The stock has largely traded nowhere since 2015, but found some momentum thanks to a bump in earnings from its cinema business, with the stock rising 41%.

Industrials

The Industrials Index gained 22% during FY25.Sector Champion: Qantas Airways (ASX:QAN) shares rose 84% to close at $10.74. Lower jet fuel prices, strong international and domestic pricing, and capacity growth gave investors renewed confidence in the leading Australian airline.

Consumer Discretionary

The Consumer Discretionary Index rose 18% for the year.Sector Champion: Temple & Webster Group (ASX:TPW) dominated the sector with a 127% gain to $21.32. Improved consumer sentiment and strong sales saw the e-commerce furniture company capitalise on momentum, especially in its home improvement and B2B categories.

Real Estate & REITs

The Real Estate Index gained 10% despite volatile bond yields throughout the year.Sector Champion: Charter Hall Group (ASX:CHC) was the sector leader — closing the financial year 72% higher at $19.19 per share.[caption id="attachment_712086" align="alignnone" width="1101"]

Top-performing sectors in FY25[/caption]

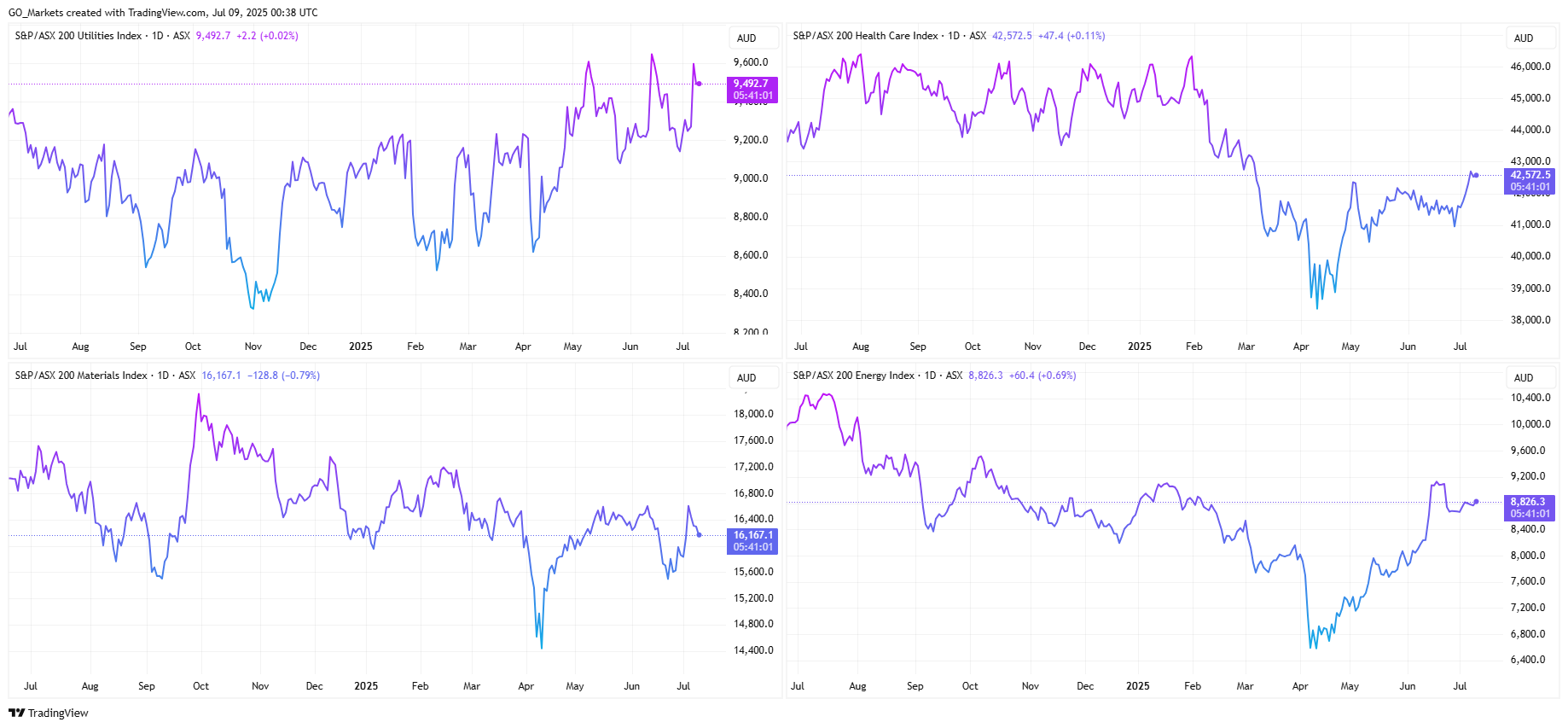

Utilities

The Utilities Index fell 1.6%.Sector Champion: APA Group (ASX:APA) managed a modest 2.3% gain in FY25, but managed to come out above its peers as the sector's best performer.

Consumer Staples

The Consumer Staples Index declined 2.1%.Sector Champion: Bega Cheese (ASX:BGA) led the sector with a 28% gain, backing up its strong FY24 results.

Healthcare

The Healthcare Index fell 5.99% despite some individual standouts.Sector Champion: Sigma Healthcare's merger with Chemist Warehouse created one of the biggest rallies of the year. As the merger gained clarity, the stock's potential inclusion in the S&P/ASX 200 drove strong buying from investors. Sigma (ASX:SIG) gained 135% to close at $2.99.

Materials

The second-worst sector was materials, with the Materials Index dropping 6.04%. Sector Champion: Despite sector struggles, gold miner Regis Resources (ASX:RRL) ascended 150% to close at $4.39, benefiting from rising gold prices.

Energy - The Year's Biggest Loser

The worst-performing ASX sector was energy, with the Energy Index falling 13.52%. Influences largely by the sector's largest stock — Woodside Energy Group — crumbling by 16%, closing at $23.66. Sector Champion: Uranium explorer Deep Yellow (ASX:DYL) stood out in the struggling sector with a 25% gain.[caption id="attachment_712087" align="alignleft" width="1051"]

Worst-performing sectors in FY25[/caption]

Looking Ahead

The results of FY25 tell a simple story: execution matters more than sector. Technology and financials thrived because the best companies in these sectors did what they said they would do. Energy and materials struggled because many companies in these sectors are fighting structural headwinds, not just cyclical ones. The market is becoming more about which companies to back, rather than which sectors to back. Looking forward to FY26, this pattern could become even more pronounced as geopolitical tensions and trade wars see market uncertainty become the norm rather than the exception.

The ASX 200 closed out the 2025 financial year on a high, reaching a new intra-month peak of 8,592 in June and within touching distance of the all-time record. The index delivered a 1.4% total return for the month, rounding off a strong final quarter with a 9.5% return and locking in a full-year gain of 13.8% — its best performance since 2021.This strong finish all came down to the postponement of the Liberation Day tariffs. From the April 7 lows through to the end of the financial year, the ASX followed the rest of the world. Mid-cap stocks were the standout performers, beating both large and small caps as investors sought growth opportunities away from the extremes of the market. Among the sectors, Industrials outperformed Resources, benefiting from more stable earnings and supportive macroeconomic trends tied to infrastructure and logistics.But the clear winner was Financials, which contributed an incredible 921 basis points to the overall index return. CBA was clearly the leader here, dominating everything with 457 basis points on its own. Westpac, NAB, and others also played a role, but nothing even remotely close to CBA. The Industrials and Consumer Discretionary sectors made meaningful contributions, adding 176 and 153 basis points, respectively. While Materials, Healthcare, and Energy all lagged, each detracting around 45 to 49 basis points. Looking at the final quarter of the financial year, Financials were by far the biggest player again, adding 524 basis points — more than half the quarter’s total return of 9.5%. Apart from a slight drag from the Materials sector, all other parts of the market made positive contributions. Real Estate, Technology, and Consumer Discretionary followed behind as key drivers. Once again, CBA was the largest individual contributor, adding 243 basis points in the quarter, while NAB, WBC, and Macquarie Group added a combined 384 basis points. On the other side of the ledger, key underperformers included BHP, CSL, Rio Tinto, Treasury Wine Estates, and IDP Education, which all weighed on quarterly performance.One of the most defining features of the 2025 financial year was the dominance of price momentum as a market driver — something we as traders must be aware of. Momentum strategies far outpaced more traditional, fundamental-based approaches such as Growth, Value, and Quality. The most effective signal was a nine-month momentum measure (less the most recent month), which delivered a 31.2% long-short return. The more commonly used 12-month price momentum factor was also highly effective, returning 23.6%. By contrast, short-term reversals buying last month’s losers and selling last month’s winners was the worst-performing approach, with a negative 16.4% return. Compared to the rest of the world, the Australian market was one of the strongest trades for momentum globally, well ahead of both the US and Europe, despite its relatively slow overall performance.Note: these strategies are prone to reversal, and in the early days of the new financial year, there has been a notable shift away from momentum-based trading to other areas. Now is probably too early to say whether this marks a sustained change, but it cannot be ignored, and caution is always advised.The second big story of FY26 will be CBA. CBA’s growing influence was a key story of FY25. Its weight in the index rose by an average of 2.1 percentage points across the year, reaching an average of 11.5% by June. That helped push the spread between the Financials and Resources sectors to 15.8 percentage points — the widest gap since 2018. Despite the strong cash returns, market valuations are eye-watering; at one point during June, CBA became the world’s most expensive bank on price metrics. The forward price-to-earnings multiple now sits at 18.9 times. This is well above the long-term average of 14.7 and higher than the 10-year benchmark of 16.1. Meanwhile, the dividend yield has slipped to 3.4%, down from the historical average of 4.4%. Earnings momentum remains soft, with FY25 growth estimates still tracking at 1.4%, and FY26 forecast at a moderate 5.4%. This suggests that recent gains have come more from expanding valuation multiples than from actual earnings upgrades, making the August reporting date a catalyst day for it and, by its size, the market as a whole.On the macro front, attention now turns to the Reserve Bank of Australia. The central bank cut the cash rate by 25 basis points to 3.6% at its July meeting. Recent commentary from the RBA has taken on a more dovish tone, with benign inflation data and ongoing global uncertainty expected to outweigh the strength of the labour market. The RBA appears to be steering toward a neutral policy stance, and markets will be watching for further signals on how that shift will be managed. Recent economic data has been mixed. May retail sales were weaker than expected, while broader household spending indicators held up slightly better. Building approvals saw a smaller-than-hoped-for bounce, employment remains strong, but productivity is low. Inflation is now at a 3-year low and falling; all this points to underlying support from the RBA’s easing bias both now and into the first half of FY26.As we move into FY26, the key questions are:

- Can fundamentals wrestle back control over momentum?

- Will earnings growth catch up to price to justify valuations?

- How will policy decisions from the RBA and other central banks shape investor sentiment in an ever-volatile world?

While the early signs suggest a possible rotation, the jury is still out on whether this marks a new phase for the Australian market or just a brief pause in the rally that defined FY25.

In the world of trading, few stories are as famous as the one behind the Turtle Traders. The Turtle experiment was simple in concept — could absolute beginners, given nothing but a set of rules and two weeks of training, beat the markets?The results of the experiment were extraordinary. Even today, four decades later, many of their principles still echo through our algorithm-dominated trading world.In this article, we’ll revisit the original Turtle strategy, examine how it worked, and explore how this legendary approach could be reimagined for modern traders.

Who Were the Turtles?

The Turtle Traders were the product of a famous bet between trading legend Richard Dennis and his partner William Eckhardt. Dennis believed that trading could be taught; Eckhardt thought that the ability to trade was a set of skills that you are born with. To settle the debate, Dennis placed an ad in the newspaper and selected a group of everyday individuals, none of whom had any prior trading experience.These recruits underwent a two-week crash course in trading, during which they were taught a complete, mechanical system. It was based on trend-following logic, relying on breakouts, strict entry and exit rules, and position sizing based on market volatility. The idea was simple — eliminate emotion, follow the rules, and let the trends do the work.The experiment was a runaway success. As a group, the Turtles reportedly achieved an average annual return of 80%, managing millions in capital and building one of the most talked-about trading systems in history.

Turtle Trading Rules and Instruments

Entry Rules:

The Turtles followed mechanical entry rules based on the concept of trading with the trend. The initial entry criteria were:

- Enter a long position if the price breaks above the 20-day high.

- Enter a short position if the price falls below the 20-day low.

- For a more conservative approach, a second strategy of a 55-day breakout was used as an alternative.

- Orders were placed using buy/sell stop orders triggered by the breakout.

Markets Traded:

The system was applied across a wide range of liquid futures markets:

- Currency Futures: EUR/USD, JPY/USD, GBP/USD, CHF/USD, CAD/USD

- Commodity Futures: Gold, Silver, Crude Oil, Heating Oil, Corn, Wheat, Soybeans, Sugar, Cocoa, Cotton

- Stock Index Futures: S&P 500, Nikkei 225, Dow Jones (DJIA)

- Interest Rate Futures: U.S. Treasury Bonds, Eurodollars

The Importance of Volatility:

They used the Average True Range (ATR) of a 20-days, termed “N”, in many of their calculations to account for the impact of volatility.

Pyramiding (accumulation): Adding to Winning Trades:

The Turtles were also taught to scale into winning trades. This method, known as pyramiding or accumulation, involved adding to a trade if the price moved in their favour. If N (ATR) was 40 points, they would add 0.5 × the Average True Range to the trade. For example, accumulation of a new position would be actioned at 20 and then again at another 20, adding up to a maximum of four positions: the original trade plus three additional entries.

Exits and Risk Management

Initial Stop Loss:

Each trade was initiated with a stop loss placed 2N away from the entry price. This ensured that no single trade risked more than 2% of the account balance.

Trailing Stop:

As the trade progressed and additional units were added, the stop loss was dynamically adjusted using the most recent entry as a reference.The trailing stop for all positions was 2N on the latest (most recent) added position. If the stop was hit, all positions in that trade were closed simultaneously, locking in gains and controlling downside risk.

How Have Markets Changed Since the 1980s?

- Algorithmic and high-frequency trading (HFT) now dominate markets, often resulting in faster and more erratic price movements.

- Trading costs (commissions, spreads) have significantly decreased, enabling more frequent entries and tighter stops.

- Trend persistence has diminished. Markets often reverse more quickly, making it harder for long-trend strategies to succeed without adaptation.

- Forex and futures markets are more liquid, making it easier to execute large positions with less slippage.

- Futures markets have seen changes in volume and type, enabling a greater selection of asset choices.

- Stock indices tend to exhibit more mean reversion, demanding smarter trend filters.

- Breakouts from common levels are less reliable, often resulting in quick reversals due to stop hunting and market manipulation.

- A greater need for confirmation signals before acting on a breakout.

- ATR-based sizing remains relevant but may benefit from more dynamic scaling.

- Rigid stop-loss rules (like 2× ATR) are more likely to be hit due to shorter trend durations.

How Could the Turtle System Be Used Today?

Although the principles underpinning the turtle systems remain valid for trading today, some tweaking of the original criteria and parameter levels would be worth exploring.

Entry Modifications:

Requiring confirmation from trend filters, such as price being above the 200 EMA or RSI values above 55, or perhaps looking for confirmation on larger timeframes, could reduce false signals and improve win rates.Additional volume filters, including relative volume, OBV, and average volume, may add value to decision-makingIncorporating indicators developed since the turtle experiment, such as other variations of the ATR and RSI, Bollinger bands, and Keltner channels, may be worth consideration for the confluence of the basic trend following structure.

Exit and Risk Enhancements:

In the turtles experiment, the ATR was static once the initial trade was entered; the N value remained fixed for that position and all subsequent accumulated positions. Arguably a dynamic ATR instead of a fixed level may be worth consideration to adjust to changing volatility over time.This especially makes sense if you are considering adding additional confluence from other indicators for the initial position.

Trade Like a Turtle

Using the original Turtle approach could be considered a checklist for good practice. Especially when it comes to rule-based system designs, risk management, emotional discipline in execution, and equal attention to entry, accumulation, and exit.Consider testing a “Turtle-inspired” strategy using current instruments and enhanced filters before taking it live. The spirit of the Turtle experiment lives on not just in its rules, but in the key message that trading can be taught. You can learn it, but success depends on sticking to a well-thought-out plan and adhering to the golden rules of trading that still apply today.

Most traders obsess over entries, indicators, and setups, but often overlook a simple factor — the time of day that you trade.Time of day affects volatility, liquidity, and when new information enters the market. Ignoring it can turn good setups into frustrating inactivity, or even losses, while embracing it can help you trade with the market, not just the setup.

Why Time of Day Is Important

Markets are not equally active during the whole period they are open. Price action is driven by human behaviour, either on an individual or organisational level. Behaviour commonly follows routines:

- Economic data is released at scheduled times

- Institutions trading during business hours

- Retail traders are more active during specific sessions — in terms of volume and location.

This invariably creates rhythms in the market. By learning to trade with these rhythms, your trades will often require less confirmation, you improve stop placement, and have cleaner follow-through on trading ideas.

The Global Trading Clock

The trading day is broadly broken into three main sessions: Asia, Europe, and the US. Each has its own “character,” and benefits vary based on which time zone best aligns with your strategy.

1. Asia (Tokyo)

10pm –7am GMT: Markets are generally quieter except JPY and AUD FX pairs and index CFDs. Common characteristics include:

- Lower liquidity

- Range-bound behaviour

- Risk of false breakouts

Reversion strategies may do well in such market conditions as well as setting up highs and lows, which may be useful references for sessions later in the day.

2. Europe (London)

7am–4pm GMT: Increased volatility and volume are seen during the European session across many asset classes. The opening of the LME can influence metals prices, and US futures may respond accordingly to increased volatility. Common characteristics include:

- Large institutional flows

- Strong trends can begin

- Overlaps with NY for 2 hours

Breakout strategies using Asian session highs or lows as reference (or previous days' US session) may outperform. And trend continuation and reversal approaches on the back of new data coming out of Europe may also be common. The two-hour crossover with the subsequent US session can also be an important change in market conditions.

3. US (New York)

12pm–9pm GMT: Volatility spikes may occur at US equity market open and significant data releases with global asset class impact are often released at 8.30am US Eastern time. Common characteristics include:

- Major economic releases

- US equity open creates short-term momentum

- Slower into the late session

Fast moves might be prevalent early in the day, suggesting short-term momentum-supported new trend set-ups may outperform. Reversals around the middle of the day are also not uncommon.The Federal Reserve interest rate decisions are always in the early afternoon in the US, which can flip market sentiment.

The Intra-Session Rhythm

It is not only session-to-session changes that can often be seen on price charts. Within each session, price often has a tendency to move in waves. So, as a general rule, you may see:

- Early session: bursts of volatility and institutional positioning

- Mid-session: consolidation or retracements

- Late session: thinning liquidity, profit-taking, fakeouts

Why Most Traders Miss This

During strategy development, many strategies are tested on charts without considering what time the setup occurred.A 15-minute candle during the London open isn’t the same as one during the Australian lunch break.So, if you start taking breakouts in low-volume periods, trading reversals just before news, or entering trends during midday doldrums, these may have less chance of meeting the goals for that particular trade.

How to Use Time of Day as a Filter Practically

1. Mark Your Session Windows

On your chart, visually block out the London open, NY open, and overlap. Use vertical lines or shading — this will help you historically see what happens at these key times.*Note: We are developing a free indicator for this that you can place on a chart. Email [email protected] if you are interested.

2. Backtest by Session

You can split potential trades by session ‘time blocks’ that look back over time. Strategy types often work better during specific hours:

- Breakouts work 7am–10am GMT

- Mean reversion thrives 2am–5am GMT

- Reversals occur more often post-3pm GMT

Using your existing setups (or even previous trades), look at a sample to see what may have happened. 3. Add Time as a Trade FilterOnce you have some evidence from, test out simple rules like:

- “Only take trend trades between 7am–11am GMT”

- “No breakout entries after 3pm NY”

If you can code (or have access to someone who can), then you can backtest this quickly to see the impact of these filters.

4. Know the News Calendar

Most high-impact data is released at predictable times — make knowing what is happening and when part of your daily trending agenda. These contribute to the characteristics of a session, but also may flip what is standard on its head. Reference in your plan the major data points and how you are going to manage potential entry setups.

Trade With the Market — Not Just the Setup

The best trades don’t just have good structure; they also happen at the right time.Logically, if you want cleaner trade setups, high-probability entries, and improved consistency, then aligning your trading strategies with the market clock makes sense.It’s a simple shift that most traders ignore — perhaps to their detriment. Finding the best time of day to trade for your trading strategy could be one of the things that helps develop your trading edge.

There is an apparent enthusiasm among traders nowadays to add indicators to charts that resemble modern art more than market analysis. RSI, MACD, moving averages, stochastic oscillators, Bollinger Bands, volume profiles, and so many more. While these tools do have their place in some strategies, many traders forget the fundamental truth: price is the source, everything else is a reaction.Learning to read price as a narrative, showing a sequence of events that reveals the intentions and psychology of both buyers and sellers, can offer the trader a level of understanding that no single or even multiple indicators can give.

Indicators Are the Supporting Act — Not the Main Show

Don’t take from the opening that I think for one moment that Indicators are inherently bad. They can be helpful when used correctly as a way to offer some confluence to what the current price may be suggesting.But by design, most indicators are lagging. They take price and/or volume data and apply mathematical formulas to summarise or smooth the past.Moving Averages tell you where the price has been over the period of the MA setting. RSI shows whether the recent move has been relatively strong, even if it doesn’t tell you why. MACD illustrates the relationship between two moving averages and whether it's changing, but not necessarily market intent.Indicators are descriptive, not predictive. They are great at confirming bias but may not produce desired outcomes when used as your primary decision-making tool.

Price Action is a Language

Every candlestick is a snapshot of a battle occurring between buyers and sellers over a fixed point in current time. The shape and size of each bar contain a message.A large bullish candle (close near the high) indicates strong buyer control during that bar.A long wick above the body shows attempted movement upward but failure to hold — in other words, a rejection at higher prices.A doji (small body, long wicks) suggests indecision — neither side in control.And of course, the reverse is the case for a bearish candle.These are not random. They reflect the psychology of where market participants are now and can imply a degree of confidence, hesitation, exhaustion, or even reversal pressure.

Key takeaway:

There could be merit in starting each trading session by scanning the last 5–10 candles on your timeframe and asking: Who was in control? Are they still in control? And is there evidence that this may continue or be changing on THIS candle?”These simple questions can dramatically shift your perspective from reaction to anticipation.

What is Market Structure?

While individual candles can show immediate intent, structure reveals progression.A trend is never a continued straight line; market structure is the pattern of swing highs and swing lows that form the underlying skeleton of a trend.An uptrend forms higher highs (HH) and higher lows (HL).A downtrend forms lower highs (LH) and lower lows (LL).A range is where highs and lows are roughly equal, showing balance between buyers and sellers.Structure tells you where traders are likely to place orders and whether a trend may continue.There may be stops placed below swing lows, creating potential support. There may be profit targets at prior highs, creating potential resistance.Breakout or breakdown movement may be triggered if there is a break of these structural key levels, e.g., a break of a previous swing high may suggest continuation.

Key takeaway:

Try to map out the most recent swing highs/lows on your chart. Ask the question: Are we building a structure to continue, or is there a potential pause point where the market may decide to shift direction? And how should this impact my decision to enter a trade or stay in an open trade?This framing, based on current market structure, helps you align with momentum rather than chase it.

Volume: The Emotion in the Story

While price tells you what is happening, volume gives a sense of how much conviction is behind it. Volume adds depth and credibility to the story of price. Although there are those who would be reluctant to use tick volume with Forex and CFD trading, there is still potential legitimacy in testing this in your trading. As it is leading, not lagging, volume with price (arguably) acts as an important market gauge. High volume on a breakout = genuine interest with evidence of market convictionLow volume breakout = potential trap. Lack of participation means the move may fail.Effort vs. Result = if price moves very little despite high volume, it suggests absorption — large opposing orders are sitting there.

Volume as a Visual Lie Detector?

Sometimes price action looks bullish, but volume says otherwise. For example, A bullish engulfing candle that forms with lower-than-average volume is often a false signal. A reversal candle that forms with a volume spike often suggests a strong shift in sentiment.To use this practically, consider a volume average line to highlight when it may be time to act (or time not to).

How to Practice Your Trading Story Creation

Through the key fundamental principles covered above, you can start training how to create a market story.

Daily Market Story Exercise:

- Strip off all indicators apart from volume!

- Look at the last 10–20 candles.

- Say out loud or write the story you see in front of you — e.g., “Price was rising but slowed near resistance. After a rejection candle, sellers stepped in with conviction as evidenced by the candle formation and volume. Now it’s testing the prior support zone…”

Do this each day, and you’ll build the ability to trade based on understanding of what market psychology is telling you rather than just guesswork.

When to Use Indicators — and When to Walk Away

As stated before, indicators aren't useless but can play an important part in confirming or disputing your market story. They work well when they confirm what price action already suggests, smooth out trends or help define zones, and help filter conditions (e.g., only trade long above 200 EMA).If you find yourself staring at indicator crossovers or waiting for an RSI line to tick over 30 without looking at price, you are reading the footnotes, not the full plot.Use indicators in the background, not the foreground of your decision-making.

Summary

Price is not just data, it’s market dialogue. It’s the collective voice of every trading participant in the market NOW. It demonstrates emotion, logic, and intention. When you learn to read the price like a story, you start anticipating rather than reacting. You reduce overtrading with a focus on price action that is compelling, not just suggestive. And arguably, your interaction with the market becomes clearer, simpler, and potentially far more powerful.

1. Inflation Uncertainty

While recent data has shown core inflation moderating, core PCE is on track to average below target at just 1.6% annualised over the past three months.Federal Reserve Chair Jerome Powell made clear that concerns about future inflation, especially from tariffs, remain top of mind.“If you just look backwards at the data, that’s what you would say… but we have to be forward-looking,” Powell said. “We expect a meaningful amount of inflation to arrive in the coming months, and we have to take that into account.”While the economy remains strong enough to buy time, policymakers are closely monitoring how tariff-related costs evolve before shifting policy. Powell also stated that without these forward-looking risks, rates would likely already be closer to the neutral rate, which is a full 100 basis points from current levels.

2. The Unemployment Rate anchor

Powell repeatedly cited the 4.2% unemployment rate during the press conference, mentioning it six times as the primary reason for keeping rates in restrictive territory. At this level, employment is ahead of the neutral rate.“The U.S. economy is in solid shape… job creation is at a healthy level,” Powell added that real wages are rising and participation remains relatively strong. He did, however, acknowledge that uncertainty around tariffs remains a constraint on future employment intentions.If not for a decline in labour force participation in May, the unemployment rate would already be closer to 4.6%. Couple this with the continuing jobless claims ticking up and hiring rates subdued, risks are building around labour market softening.

3. Autumn Meetings are Live

While avoiding firm forward guidance, Powell hinted at a timeline:“It could come quickly. It could not come quickly… We feel like the right thing to do is to be where we are… and just learn more.”This suggests the Fed will remain on hold through the July meeting, using the summer to assess incoming data, particularly whether tariffs meaningfully push inflation higher. If those effects prove limited and unemployment begins to rise, the stage could be set for a rate cut in September.