市場新聞與洞察

透過專家洞察、新聞與技術分析,助你領先市場,制定交易決策。

2026年2月28日,随着美国和以色列联合袭击的开始,屏幕上的数字开始以临床的方式移动,尽管伊朗平民伤亡惨重的实地现实并非如此。正如他们所说,市场没有道德指南,而是有衡量机,而现在,他们正在权衡整个全球经济从 “准时” 模式向 “以防万一” 周期的过渡。

市场发出了什么信号

3月2日,指数盘保持谨慎,而防御力上涨。从历史上看,冲突可以加快补货和订单的速度,但是订单的规模(以及速度)仍然取决于预算、批准和交付瓶颈。

赢家们

1。韩华航空航天 (012450.KS)

韩华是与 “K-Defense” 主题相关的交易比较活跃的公司之一,在全球火炮和弹药周期紧缩的情况下,市场越来越多地将韩华视为可扩展的供应商。能力和交付信誉。

当补货变得紧迫时,大规模生产的能力通常与平台本身一样重要。与K9 Thunder和Chunmoo等系统相关的出口需求强化了持久订单流的说法,即使结果仍然取决于预算、批准和交付时间表。

可以改变情绪的关键因素: 订单簿更新、生产节奏和任何后续出口公告。

2。诺斯罗普·格鲁曼公司 (NOC)

随着投资者对战略现代化和大型长期项目的投资进行了重新定价,诺斯罗普成为人们关注的焦点。通常被视为关键任务的国防市场可以跨周期持续存在。与其说是四分之一,不如说是现代化优先事项保持不变,势头是否保持稳定(以及如果不这样做,时间表是否会发生变化)。

可以影响情绪的关键变量: 采购速度、合同时间和与计划相关的融资语言。

3.RTX 公司 (RTX)

随着投资者对拦截器补给周期和快节奏防空的经济性进行定价,RTX回到了录像带的中心。流失代价高昂,当使用率上升时,政府通常必须补充库存,在许多情况下,还需要为扩产提供资金,这可以延长待办事项并提高收入可见度。

可以影响情绪的关键变量: 补货订单、制造扩张指标和交付吞吐量。

4。洛克希德·马丁公司(LMT)

洛克希德引起了人们的注意,因为市场关注导弹防御需求以及每个采购部门在快节奏的环境中都面临的问题:库存重建的速度有多快?如果利用率保持较高的水平,则赢家往往是最有能力扩大生产和可靠交付的承包商。洛克希德的导弹防御风险使其与补给叙述密切相关。

可以影响情绪的关键变量: 产量增长信号、单位经济和预算驱动的订单节奏。

5。 BAE 系统 (BA.L)

由于积压了836亿英镑,并在AUKUS潜艇计划中发挥了核心作用,随着欧洲部分地区表示有更高的国防开支雄心,BAE成为人们关注的焦点。在 “避险” 轮换中,该股上涨6.11%,至52周高点,交易员正在关注AUKUS的里程碑以及包括 “天盾” 在内的欧洲防空和导弹防御采购。

可以影响情绪的关键变量: 潜在的催化剂是德国支出的任何明显增加,都会提振BAE欧洲各单位的订单,而主要风险包括英国国债收益率急剧上升、英镑再次波动或 “和平威胁” 获利回吐。

输家:并非每个 “战争股票” 都在上涨

6。航空环境 (AVAV)

AeroVironment在开盘时飙升了18%,然后盘中下跌了17%,此前有报道称美国太空部队将重新开放一份14亿美元的合同。此举凸显了采购流程和合同风险如何推动波动,即使在支持性的主题环境中也是如此。

7。克拉托斯国防 (KTOS)

随着中东冲突的加剧,克拉托斯坐落在 “无人机和游荡弹药” 主题中,该主题引起了人们的关注。该股在盈利后仍被抛售,这凸显了国防行业的常见风险。Kratos宣布在12亿美元至14亿美元之间进行大规模后续股票发行,此举加强了资产负债表,可以支持未来的项目投资。

对于专注于短期 “冲突溢价” 叙事的交易者来说,稀释可以迅速改变设置。即使需求条件显得支撑,如果每位股东最终拥有一小部分业务,市场也可能会对股票进行重新定价。

8。直观机器 (LUNR)

一些投机性的太空科技公司落后,因为投资者似乎偏爱国防相关收入更稳定的公司。

9。波音 (BA)

波音在该交易日下跌了约2.5%。尽管其国防部门很有意义,但其商业业务可能对航空需求、空域中断和油价变动更加敏感。

10。Spirit 航空系统 (SPR)

作为主要的航空结构供应商,Spirit AeroSystems仍然与全球飞机生产周期紧密相连。 最近的业绩显示,尽管销售额增加,但亏损仍在扩大,这反映了主要飞机项目的生产成本持续增加。这些压力打压了投资者对短期前景的信心。波音的计划收购最终可能会重塑该公司在供应链中的地位,但执行风险和生产稳定性仍然是市场定价股票的核心。

接下来要看什么

- 升级与降级: 转向外交或停火讨论可以迅速改变围绕国防股的情绪。

- 石油和运输: 能源峰值可能收紧金融状况并给周期性行业带来压力。

- 预算和奖励: 价格变动有时可能先于合同决定,在最终确定奖励时才会明确。

- 生产能力: 具有良好生产和交付记录的公司通常会吸引最多的投资者的注意力。

- 供应链限制: 稀土、推进和电子设备仍然是潜在的瓶颈,可能会限制生产规模的速度。

长期镜头

2026年的伊朗冲突首先是一场人类悲剧。对于市场而言,这也可能代表财政框架中国家安全支出优先顺序的转变。如果国防开支在多年内保持较高水平,那么拥有可扩展制造能力和集成技术堆栈的公司可能会吸引投资者的持续关注。也就是说,市场是周期性的。结构性主题可以持续存在,但也可以在假设发生变化时迅速重新定价。保持分析和风险意识仍然至关重要。

提及特定公司、行业或市场走势仅供一般市场评论之用,并不构成买入或卖出任何金融产品的推荐、要约或邀请。市场对地缘政治或宏观经济事件的反应可能动荡不定且不可预测,结果可能与预期存在重大差异。

The US has entered the Israel-Iran war. However, despite an initial 4 per cent surge on the open, oil has settled where it has been since the conflict began in early June — around US$72 to US$75 a barrel.Trump claims the attacks from the US on Iranian nuclear facilities over the weekend are a very short, very tactical, one-off. This is something his base can get behind — some really big conservative players do not want a long-contracted war that sucks the US into external disputes.Whether this will be the case or not is up for debate, but there is a precedent from Trump's first presidency that we can look to. Iran had attacked several American bases in 2019, as well as attacking Saudi Arabia's most important oil refinery with Iranian drones. There wasn't a huge amount of damage; it was more a symbolic movement and display of capabilities by Iran.Initially, Trump didn't react — it took pressure from Gulf allies like the UAE and Israel for him to respond, which saw him order the assassination of the head of the Iranian Defence Force, Qasem Soleimani. This led to an Iranian response of ‘lots of noise’ and ‘cage rattling’, but minimal real action events, just a few drone attacks. Trump is betting on the same reaction now.If Iran follows the same patterns from the previous engagement, the geopolitical side of this is already at its peak.As of now, Iran is not going after or destroying major Gulf energy capabilities. Nor have there been any disruptions to the shipping traffic through the Strait of Hormuz. In fact, apart from a posturing vote to block the Strait, Iran has not made any indication that it is going to disrupt oil in any way that would lead to price surges.Additionally, despite the U.S. military equipment buildup in the region being its highest since the Iraq war, critical Iranian energy infrastructure is running largely unscathed.This all suggests that the geopolitics and the physical and futures oil markets remain disconnected. Oil will spike on news rumours, but the actual impacts in the physical realm to this point remain low. Of course, this could change in future. But, for now, the risk of seeing oil move to US$100 a barrel is still a minority case rather than the majority.

Position management is one of the most overlooked skills in trading. The shiny new entry setups seem to proliferate our social media channels, while position management receives little airplay.Yet it can be what separates a trader who rides price moves with clarity on when to take action, from one who repeatedly watches their unrealised profits simply vanish.In this article, we break down both sides of position management — scaling in and scaling out — and explore practical ways you can blend these tactics into your existing strategy.

What Are ‘Scaling In’ and ‘Scaling Out’?

Scaling in means opening your full intended position size in planned stages instead of all at once when you first see a potential set-up. This allows you to test your idea with smaller risk first, then add size as the trade proves itself. Done well, it’s like gradually moving with the “market breath” as it shows evidence of a continued move.Scaling out means taking profits off in “chunks” as the price reaches certain levels — locking in some realised profit gains rather than waiting for an all-or-nothing technical exit. Through banking gains progressively, you also reduce risk, leaving less at the mercy of the next Truth Social post or sentiment-changing event.

Why Do This?

At first glance, this may sound unnecessarily messy. Why not just get in and get out — keep it clean?Real markets rarely move in a straight line, even with the strongest of trends. Trends invariably develop in waves, and reversals can often happen quickly, irrespective of instrument or timeframe.

Benefits of Scaling In

- Risk Control: By starting small, you’re not overcommitted too early. If the setup fails, your loss is smaller.

- Confirmation: Adding when a trend continues to be confirmed helps align your exposure with demonstrated market momentum. Price action is king, and this should dictate what we do and when we do it.

- Confidence Booster: Committing in smaller steps feels less intimidating, particularly when combined with a trail or scaling-out strategy.

Benefits of Scaling Out

- Lock in Cash Flow: Taking some profit at logical points locks away real money while giving the rest of your position room to run, helping overcome any feeling of fear of missing out – FOMO — as discussed in a recent article.

- Reduces Pressure: We have all seen a big open position profit swing back. Donating your profit back to the market this way places you in a high-stress situation. Further trading decision-making may be less sharp as a result. Such stress is far less if you’ve already banked part of your profit, and you gain confidence from a good decision.

- Flexibility: You’re not forced to perfectly time the absolute high or low. You capture the ‘meat’ of the move in stages. The time when a trade is most likely not to continue in a desired direction is right at the very start of a trend, where we often see false breakouts, or near the end, where momentum is starting to drop. Why not take advantage of this?

Errors with scaling (how you can mess it up)

The potential benefits of scaling in and out are clear; however, you can still run into issues if you misuse them.Here are three scenarios where many traders may see it fail:

- Averaging Down: Adding more to losing positions, hoping to ‘get back to break-even,’ is a classic but not uncommon trap. Scaling in should always be based on the underlying concept, adding to price move strength, never to weakness.

- Random Additions: Adding size just because a trade is profitable, without clear levels or criteria for action, often backfires. It can lead to scaling at the wrong time or overdoing the next scale in lot size, as overconfidence takes over.

- No Clear Plan: Many traders who believe in the scaling out concept have every intention to do so, but in the absence of clear criteria. Having an unambiguous, specific price action-based approach is vital. Without such guidance, trading logic may be easily replaced by emotional decisions.

Like all parts of your trading, the best results are usually obtained through articulating this part of your strategy within your written plan. Constantly adjusting scale-in or scale-out points mid-trade causes overthinking and inconsistency. The whole point is to reduce second-guessing with what to do and when to do it, not add more.

Examples of ‘Scaling In’ Approaches

Example 1: Break-and-Retest approach

Scenario: A resistance level breaks decisively.Action: Enter 50% of your planned size at the breakout.Confirm: If price pulls back and holds above the broken level, add the remaining 50% on a bullish confirmation candle.Why: You get initial exposure early, but most size goes in once you have more evidence that the breakout is valid.

Example 2: Trend Building approach

Scenario: In a clear trend with identifiable pullbacks.Action: Enter the initial lot size on the setup confirmation. After a retracement pullback, add more on a breach of the recent pre-retracement swing high. Why: Rather than dumping all your capital at the first sign of pause (and there are signals which may indicate this is likely a pause rather than a reversal), you are riding the trend leg by leg, using market structure to guide your positioning.

Examples of ‘Scaling Out’ Approaches

Example 1: Predefined Profit Milestones based on risk

Example: Plan to take off 50% at 1R (one unit of risk) or an ATR multiple and trail the rest over breakevenWhy: You secure a profit cushion while letting the remaining position run for higher returns.

Example 2: Approaching Known Levels

Example: Scaling out just before major resistance levels for longs (or support levels for shorts).Why: Price often reacts to previous price consolidation levels. Taking partial profit nearby locks in gains before potential reversals. Market participants observe these levels, and there may be limit orders that may cap the likelihood of a move through the next key level.

Example 3: Weakening Momentum

Example: If you see a slowing on momentum indicators (e.g., smaller histogram bars or signal line histogram cross) or reversal candle pattern on a smaller timeframe, close a portion rather than the whole trade.Why: If you’re wrong about the trend ending, the remainder might still offer further upside benefit.

Tips for Mastering Scaling

Here are three underpinning principles to help you master scaling:

- Always plan scale points before you enter a trade — not on the fly.

- Never add to losing trades. Scale in only as confirmation builds and criteria are met.

- Journal your trading: Compare the results of trades with and without scaling to see its impact. Make this an ongoing exercise to offer some evidence to refine your initial system.

Final Thoughts

Scaling in and scaling out are not the holy grail, but if acted on well, are sharp tools for traders who want to manage trades that are in tune with the underlying market.Handled with care, they help you ride trends more smoothly, protect open position profit, and reduce the mental anguish every trader can face when the market moves unpredictably in a fully open position.The bottom line is you don’t need to catch every pip or point, just enough to make sure that you give yourself a better chance to grow your account consistently than you may be doing now.

Have you ever stared at your charts, perfectly certain your setup is valid, then right when you are ready to press the entry button, you freeze, tweak the setup, or abandon it altogether?If so, then you have probably experienced what I call the ‘Imposter Trader Syndrome’.Irrespective of trading experience or the evidence-based nature of your trading plan, it can show up as a nagging self-doubt that makes you second-guess your method, ignore your tested plan, or jump in or out of trades for reasons you’d never put in your strategy rules.The outcome is that you move away from what you had planned to do. It eats away at both your consistency and confidence, and consequently impacts negatively on your account balance.

What Is Imposter Trader Syndrome?

Many of you will recognise the term ‘imposter syndrome’ from professional life, which is used to describe a sinking feeling that you are somehow not good enough or that you’ll be “found out” as a fraud — despite all evidence to the contrary.In a trading context, it can show up in two dangerous ways:

- Doubting your analysis and execution in both entry and exit decision-making

- Assuming good results are not attributed to knowledge and skill, but rather luck or the market gods smiling on you for a while.

Carrying these around with you may fuel indecision, constant tweaking, or abandoning your plan altogether, moving you away from consistency and confidence.

Why Does This Happen?

During many coaching hours spent with traders, there are a few common themes considered root causes of imposter trading syndrome:

1. Comparing Yourself to Others:

It is very easy to look at another trader’s highlight reel on social media (read ego-driven rambling) and assume they never hesitate or lose. You don’t see their losing trades because that is not what it is about for them. Rather, the only losing trades you will often see are just your own.

2. Recency Bias

If your last few trades were losers, it is tempting to conclude you have “lost your touch,” ignoring the fact that any system can have drawdowns. Consecutive losses within a profitable year are normal, and challenging market conditions were perhaps contributory to more difficult trading conditions. This focus on the last few rather than the big picture can result in behaviours that move away from established systems.

3. The Chase For Perfection

Many traders want a system that gives zero losses and a 100% win rate. Here is a reality check -- it does NOT exist. It is an impossible standard that can paralyse rational thinking. You may begin to fear making ‘a mistake' (any loss at all) so much that you make no decision at all. Logically, a tested system that produces positive results over time will have losses. The only mistake you can make is to move away from that system. The ability to follow it consistently, irrespective of the outcome of a single trade, should be perceived as a success.

4. Lack of Trust in Your Data

Traders often think they have a solid plan in place, but when it lacks unambiguity, hasn’t been stress-tested properly, or has only traded a handful of times in a live environment, it is difficult to develop trust in it. We know that confidence in your system is probably the number one contributor to the ability to exercise execution discipline. Unless you address this, there is a good chance that doubts will creep into your decisions more and more.

What Imposter Trader Syndrome Looks Like

Closing trades too early: Your trade has gone in your desired direction, but you don’t trust the trade to reach your planned target, so you bank profit “just in case”, only to see it hit your original profit target without you in the market.Skipping valid setups: You see the signal, but the voice says, “I have lost on the last two trades, what if I’m wrong again?” So you let it go without you and watch the price fly exactly to the set-up point you had originally planned for.Over-tweaking your plan: Constantly adding new filters, changing indicators, or modifying rules mid-week, or in the middle of a session, to “fix” something that wasn’t actually broken. I have lost count of the number of times I have seen charts with lines and colours that would look more at home in your local art gallery rather than as part of a well-thought-out trading system. Too many times, many of the things on charts either replicate another indicator, or even worse, there are things on there that the trader does not know what it is telling them at all.Revenge trading: This point is a little more ambiguous than the others, but I feel it is important to include it. Wanting to get your money back to where it was before, or trying to prove that you are a good trader when a couple of trades have gone against you, can also be a sign of imposter trader syndrome. Some suggest it can also be a form of self-sabotage, where one loss feels like proof you aren’t good enough, so you overtrade to prove yourself right.

Why Confidence Matters as Much as Analysis

More often than not, it is a failure in execution rather than a failure in system that is the cause of imposter trading syndrome. Analysis can mean very little without the confidence to follow through on it religiously. Even a flawless system fails if the trader hesitates, exits too soon, or overrides it out of fear.A consistent trading edge only works when you apply it consistently, and that takes trust in yourself as a trader and trust in your system.

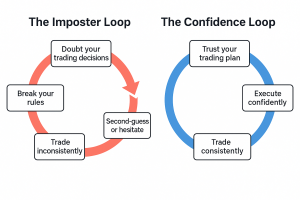

The image below summarises the difference. Which trader would you like to be?

The Imposter vs Confidence Trading loop

Six Ways to Beat Imposter Trader Syndrome

1. Own it!

Until you admit that there is something amiss with what you are doing, you will never do anything to make it better. Move past the excuses and placing blame, and accept that you can do things that are in your control to move to the next level.

2. Prove It to Yourself with Data

Backtest your setup, find someone to help with this if you need to, then forward test with small positions. Keep a journal tracking whether you stuck to the plan you have invested time and effort in creating. Test out “what if” analysis of the trades you know moved away from the plan to see what would have happened if you exercised discipline in the action. Your confidence in your system will grow instantly when you see that following your rules beats not doing so.

3. Focus on Process Over Outcome

Reward yourself mentally for following the plan, not just for winning. Success in trading is usually a result of consistency in action. A well-executed loss is still a win for you in the journey towards becoming a confident, disciplined trader.

4. Use Pre-Trade and Post-Trade Checklists

A simple “Did I follow my entry rules? Did I place my stop and target correctly?” routine keeps you anchored to the process. There are lots of examples of such checklists available online, and it is a common theme covered on the education webinars we run at GO Markets.

5. Trade Smaller When Doubt is High

When moving toward where you need to be, conviction is key. Reducing size while rebuilding your trading self-esteem takes the pressure off. Better small, consistent execution than large emotional missteps in your recovery from perhaps months or even years of not achieving what you can.

6. Limit Noise

Avoid bouncing between ten different trading ‘gurus’ and strategies. Pick the lane that best resonates with your trading style and flexibility, and commit long enough to learning and refining your best-fitting system to give it a chance to see real results.

Summary

Feeling like a ‘trading imposter' is more common than most would care to admit. Unless you begin to own that it could be you, then it is likely to slowly erode your consistency and trading self-esteem. Note the signs and symptoms and commit to doing the things that build confidence in your system as well as yourself. Remember, you are not competing with other traders’ highlights, nor some of the outlandish claims of outrageous results that some may make. You are aiming to become the best trader you can be — build your own sustainable results with a system backed by evidence that fits your trading style, personal trading objectives, and financial situation.

Ignoring corporate actions is a common pitfall many CFD traders fall into. Longing or shorting the underlying share is rooted in technical and fundamental analysis, and simple dividend payouts or buybacks feel unimportant to the trading strategy.However, even though you’re trading an instrument whose value is determined by the movement of an underlying asset, rather than the asset itself, these events can still impact your account balance.It is vital to stay informed of the corporate actions of the underlying share and have a plan for the way you position trades and the length of time you consider holding a position.

Company Dividends

A dividend is the distribution of a portion of a company’s profits to its shareholders. It’s one of the primary ways companies reward investors and signals that the company is in good financial health.

Why Companies Do It:

- To share profits with investors

- To signal stability or maturity

- To attract dividend-focused shareholders

Example:

Woolworths declares a $1 dividend. If you’re long 100 CFDs, you get a $100 credit. If short, you lose $100 on the ex-div date.

CFD Implications:

Long Position: You receive a credit into your account on the ex-dividend date Short Position: Your account is debited the equivalent value.

Market Reaction:

Share prices typically drop by the dividend amount on the ex-div date on open.

Stock Splits and Reverse Splits

A stock split increases the number of shares and reduces the price per share, retaining the existing total market value e.g., your shares may become half the price but you will have double the holding. A reverse split (or consolidation) does the opposite so reducing the number of shares so increasing the price per share.

Why Companies Do It:

- Stock splits make high-priced shares more affordable and attractive to retail investors and increase day-to-day interest.

- Reverse splits are less common but may often be used to lift a stock’s price to improve the perceived positive image of the company.

Example:

Tesla executed a 5-for-1 split in 2020. Holding 100 CFDs became 500 CFDs at 1/5th the original price.

CFD Implications:

Your CFD position is automatically adjusted to reflect the new ratio. Total value remains unchanged.

Market Reaction:

Splits can signal growth confidence and attract traders, often leading to short-term rallies. Reverse splits may be seen as a red flag and lead to selling pressure.

Rights Issue

A rights issue allows current shareholders to buy extra shares, usually at a discount to current share price to raise capital. Market response to a right issue will be dependent on the reason for this action and the overall perception as to whether it will benefit the company in the longer term.

Why Companies Do It:

- To fund growth projects, reduce debt, or raise liquidity

- A sign the company is facing financing pressure

Example:

Qantas may offer a 1-for-5 rights issue at a 20% discount to raise capital to enable the company to buy new aircraft. CFD holders do not get this entitlement.

CFD Implications:

You do not receive rights or participate in the offer. No direct adjustment is made to your CFD position.

Market Reaction:

May result in a price drop due to dilution. However, if the capital raise strengthens the company, prices may recover over time.

Share Buybacks

A company buys back its own shares from the market, reducing the total number in circulation.

Why Companies Do It:

- To return value to shareholders

- To improve metrics like earnings per share (EPS)

- To signal that management believes the stock is undervalued

Example:

BHP announces a $2 billion buyback. As shares are repurchased, the price may gradually rise due to the reduced supply of shares available to trade on the market.

CFD Implications:

There is no action on any CFD holding in the relevant company, so there is no account adjustment.

Market Reaction:

Often seen as mildly bullish, especially for undervalued companies. However, buybacks funded by debt may raise concerns.

Mergers and Acquisitions (M&A)

A merger or acquisition occurs when one company absorbs or combines with another. This may ultimately lead to a change in share structure or ticker symbol if it is approved by the shareholders of the company. There is often a situation where a proposal is presented to the company that results in an elevated share price even before any decision is made.

Why Companies Do It:

- To expand market share, gain assets, or eliminate competition

- Often part of a strategic growth plan

Example:

If Company A merges with Company B and issues 1 new share for every 2 held, your 200 CFDs in A would convert into 100 CFDs in the new entity.

CFD Implications:

Your existing CFD position is converted into the new merged entity (if applicable) using the agreed share ratio.

Market Reaction:

Target companies often rally when takeover bids emerge, while acquirers may see mixed reactions — depending on perceived value or cost of the deal.

Trading Halts

A pause in trading that is imposed by the exchange usually often due to a pending news release from the company about a new, unexpected corporate action or less commonly some regulatory concerns pending investigation.

Why Companies May Be Halted:

- Awaiting a price-sensitive announcement

- Pending merger, legal issue, or earnings release

Example:

If a US biotech stock CFD is halted for an FDA ruling, you’ll remain in your position until the underlying reopens.

CFD Implications:

If the stock is halted, your CFD is also paused. You cannot open or close positions until trading resumes (there will often be a second release informing when the stock is likely to reopen for trading).

Market Reaction:

Trading halts usually precede large price moves — often gaps and reopens — so significant gains or losses may be the result.

Summary

Just because you’re trading Share CFDs doesn’t mean you are insulated from corporate actions. In fact, understanding their timing (although many are unpredictable) and the possible impact of your holding is essential for planning trades and managing actual and potential account value adjustments.It is prudent to have access to an economic calendar as part of your routine and ensure you check out earnings and ex-dividend dates of any stock CFD you hold or are considering for an entry.Whether it’s a dividend or a major structural event like a merger, these changes can and will shift market sentiment towards the underlying stock. Make sure you stay aware of what is happening and what might happen next. The GO Market support team will always be there to assist with any questions you have before or after any corporate action.

Oil has been thrust back into the spotlight as the negative catalyst for markets. The events over the weekend highlight just how fragile the Middle East is and how it will shape global trading in the second half of 2025.Putting Iran in an oil-specific perspective, despite rising geopolitical tensions, the potential for sustained disruptions to energy supply appears limited for now. This is backed by historical data seen in April, June, and October last year, where heightened risk didn't translate into prolonged price surges.There are absolutely geopolitical concerns around Iranian retaliation, coupled with Israeli retaliation, and so on. But the likelihood of strikes on regional energy infrastructure appears low.Iran’s relationships with Gulf nations have improved markedly, reducing the risk of hostile action toward their oil operations. This has been led by Saudi Arabia, which will be strong in ensuring no disruption to global oil supplies. The caveat is if Iran decides to go at it alone and block the Strait of Hormuz, which would severely impact the likes of Bahrain, Qatar, the UAE, Kuwait, and Iraq. This appears unlikely, but a risk we need to be aware of.

Where does diplomacy sit?

Expectations are for tensions to spike in the short term. However, that will likely lead to renewed diplomatic engagement, particularly if the alternatives prove economically or strategically untenable (i.e., long-term war, regime changes, civil unrest). That's the long term; the near-term resolution is the concern. The United States and the greater regions of Europe and Asia will be brought in. We know that the President has a very high preference for low oil prices as a major part of his election campaign. With no signs, demand is likely to collapse. The only way to keep prices down on this escalation is to ramp up supply. The catch is that US producers remain very reluctant to ramp up supply at current prices. OPEC and Saudi Arabia have already moved to increase production to stamp out non-OPEC members on price, and Russia is still a global pariah with its war with Ukraine. So the supply lever is going to be tricky.

So, what about pricing?

Energy price volatility is being closely tied to positioning in the futures market. Historical patterns show a strong correlation between net longs and Brent pricing.If we speculate that short positions were to be fully unwound (from 187k lots to zero), the implied move could be around $14 per barrel. Brent recently hit $65 per barrel before the conflict and spiked to an intraday high of $78.5 per barrel on the news breaking. This reflects the type of technical squeezes we can expect. Sustained gains would then require fresh long positioning.

Summary

The market remains focused on how Iran and Israel might respond further, and whether any escalation might target energy infrastructure directly. Meanwhile, the U.S. continues to signal interest in keeping diplomatic channels open. Unless Iran decides to go against all expectations and independently block the Strait of Hormuz, we can expect heightened volatility in the short term, without any prolonged surge — similar to the patterns we saw during heightened tensions throughout last year.

Fear of Missing Out (FOMO) is a powerful psychological force that can completely derail your trading potential. It can alter meticulously planned trading decisions, right at the time you’re meant to execute.Having spent many years as a trading coach, FOMO is something I have seen far too often. It masquerades as an urgency to be “in the market” or a stated belief by traders claiming to “feel the market.” Unless you take a step back and honestly evaluate your market behaviour, FOMO can drive you into poorly-timed entries, premature exits, and revenge trades that send your account balance into an ever-decreasing spiral.

What Is FOMO in Trading?

FOMO is the emotional pressure that arises from the belief that you are about to miss out on a profitable opportunity. It is the belief that valid opportunities are few and far between, and if you miss out, it matters.This leads traders to ignore their rigorously tested strategies in favour of emotional reactions. The result is that their trades lack any sort of edge, are poorly timed, and carry too much risk.Many traders report feelings of regret, anxiety, and even shame after making FOMO trades. Over time, this can erode self-confidence and lead to even more impulsive behaviour, creating a negative feedback loop and compounding losses.

Why Does FOMO Happen?

Humans are hard-wired to follow the crowd. When you see traders posting big wins or hear about others catching great trades, your brain sees their success and equates this with missed opportunity.This social comparison triggers an immediate emotional response that can override rational decision-making. People never post their losses or the full context behind their winning trades, so you are only seeing a carefully curated highlight reel that creates a distorted view of success.Recency bias is another major factor in FOMO trading. The tendency to place too much importance on recent events, for instance, if a setup worked extremely well yesterday, you may irrationally believe it will work again today, even if conditions have changed.Recency bias and a scarcity mindset also fuel FOMO trading by making us overvalue recent wins and fear missed opportunities. When yesterday's setup delivered profits, we chase similar patterns today, regardless of changed market conditions. And the belief that profitable setups are rare leads to "itchy trigger finger syndrome" — forced entries driven by the fear that this moment might be our only chance.

How FOMO Shows Up in Trading

Chasing Breakouts

Seeing a strong price move and entering deep into a move (often near the top) is common FOMO behaviour. The trader convinces themselves that it’s better to get in late than miss out entirely, rather than simply accepting to leave it and wait for the next set-up opportunity. This mindset often leads to buying into exhaustion, right before the market reverses.

Overleveraging

The feeling of needing to "make up" for missed trades can cause traders to increase position size on the subsequent trades. While this may lead to larger gains on rare occasions, the fact that the mind is in this “revenge” state can lead to increased use of leverage and worse decision-making, significantly increasing the risk of major losses.

Ignoring Plans

When emotion takes over, traders often abandon their entry criteria, position sizing rules, trade confirmation filters and exit management. The result is a strategy that lacks consistency or any statistical edge from careful creation and evaluation over time of that plan.

Impulse News Trading

Another form of FOMO is jumping into trades during high-impact news events without a planned strategy. The fear of missing out on this visibly happening, large and fast move overrides the caution needed to trade volatile conditions.

Ignoring Take-Profit Targets

Even with predefined profit levels, traders may stay in trades longer, thinking the move potentially “has more legs”. This results in giving back unrealised gains, as rather than pushing further in your desired direction, it reverses and moves back from where it came.

Cancelling Trailing Stops

Traders second-guess trailing stops and move them further away, afraid of being stopped out too soon due to perceived market noise. This leads to worse exits than you may have had should you have left your trail stop as it was.

Holding Through Clear Reversal Signs

Emotional attachment to profit potential causes traders to ignore signals that a trend is reversing, hoping the price will resume its direction. Traders may convince themselves this is merely a retracement, ignoring other signs that a reversal is in progress, e.g. increased volume.

Skipping Partial Closes

FOMO can cause traders to avoid scaling out again despite the pre-trade plan of taking some of the table at specified points. This greed-based decision often results in missing the chance to lock in solid profits. We recently posted an article on mastering partial close that dives deeper into the topic.

How to Manage FOMO

The starting point of managing any psychological challenge in your trading, including FOMO, is to take ownership of it. This means acknowledging that FOMO is your responsibility. Accepting that FOMO impulses originate from within and are entirely under your control is the first step to moving from a reactive approach to a strategic one.Once you’ve come to terms with this, there are several structural and psychological tools and tactics you can employ to avoid future FOMO decisions:

- Realign with your Trading Plans: Every trade should have a specific setup, entry condition, risk limit, and exit plan. Relying on predefined rules helps remove emotional interference. Do a comparison of results when your plan was followed versus when it was not. The chance is that the difference will be obvious and add to the belief that your plan is what you MUST execute under all circumstances

- Controlled Position Sizing: Set out-of-trade limits and always adhere to them when tempted to take any trade. Know that you can ultimately scale, but only on a history of positive outcomes and in a measured way.

- Strategies to trade multiple market conditions: Missing out on a trade will seem less acute if you have a strategy to trade a breakout. Knowing you can bank profit now and simply re-enter a new trade when a break is confirmed is logically preferable to a cross your fingers approach.

- Scaling Out Plans: Having a structured scale-out process helps lock in gains and reduces the temptation to hold everything. Use previous trades and do a “what-if” analysis on a partial close to help build the conviction.

- Increase Journaling: Document details about your trades, including why you took them and how you felt before, during, and after. Pay attention to trades driven by urgency or impulse.

- 10-Second Rule: When you feel the urge to take or alter a trade, pause for ten seconds. Ask yourself: “Is this aligned with my plan or driven by FOMO?”

- Pre-Market Routines: Build routines to get into a focused, rational state before trading begins. Again, we recently published an article on pre-market preparation that may be worth a look.

SummaryFOMO may be a regular part of the human condition, but in trading, it can become one of the most dangerous emotional pitfalls. Without vigilance, it can creep into your trading without you realising. You do not need to catch every trade to be successful, another opportunity will be along soon. You should trade with consistency, discipline, and clarity. Mastering FOMO is not about removing emotion, but having the confidence to follow your strategy, not your fear.