Notícias de mercado & insights

Mantenha-se à frente dos mercados com insights de especialistas, notícias e análise técnica para orientar suas decisões de negociação.

A América Latina registrou 730 bilhões de dólares em volume de criptomoedas em 2025. Em toda a região, 57,7 milhões de pessoas agora possuem alguma forma de classificação de moeda digital (latam), uma base que está crescendo mais rápido do que em qualquer outro lugar do mundo.

À medida que o capital institucional chega e a regulamentação amadurece, esses são os nomes negociados publicamente que os investidores estão observando mais de perto.

Por que a LATAM é uma potência criptográfica no momento

As melhores ações criptográficas da LATAM para observar

1. Nu Holdings (NYSE: NU)

Banco digital · 127 milhões de usuários no Brasil, México e Colômbia

O Nubank pode ser um dos proxies mais diretos listados para o boom de fintech e criptografia da LATAM. A empresa integrou o comércio de criptomoedas diretamente em seu aplicativo Nu e fez uma parceria com a Lightspark para incorporar o Bitcoin Lightning Network para transações de Bitcoin mais rápidas e econômicas.

No terceiro trimestre de 2025, a receita aumentou 42% em relação ao ano anterior para $4,17 bilhões, os depósitos de clientes aumentaram 37% para $38,8 bilhões e o lucro bruto aumentou 35% para $1,81 bilhão.

As ações retornaram cerca de 36% no ano passado e triplicaram os retornos do S&P 500 nos últimos três anos. A empresa domina o Brasil, com mais de 60% da população adulta usando o Nubank.

A Nu Holdings também obteve recentemente a aprovação condicional para lançar o Nubank N.A., um banco digital nacional dos EUA. No entanto, o anúncio provocou uma retração, com os investidores cautelosos quanto aos prazos de implantação de capital e aos custos de expansão.

O UBS baixou sua meta de preço para $17,20, citando alguns cuidados com o mercado, apesar das mudanças operacionais positivas.

O que assistir

- Tendências de qualidade de crédito no Brasil e no México.

- Ritmo de adoção do USDC por meio de recompensas do Nubank.

- Cronograma de fretamento bancário dos EUA e divulgações antecipadas de custos.

2. Mercado Livre (NASDAQ: MELI)

E-Commerce/Fintech · 18 países na América Latina

O MercadoLibre não é um jogo de criptomoedas puro, mas o Mercado Pago (seu braço de fintech) se tornou um dos trilhos financeiros mais importantes da América Latina. A empresa detém cerca de 570 BTC em seu balanço patrimonial como proteção contra a inflação regional e emitiu sua própria stablecoin indexada ao dólar americano, a Meli Dólar.

A receita líquida do Mercado Pago para o ano inteiro de 2025 atingiu $12,6 bilhões, um aumento de 46% em relação ao ano anterior, enquanto o volume total de pagamentos atingiu $278 bilhões, um aumento de 41%. Os usuários ativos mensais da Fintech cresceram cerca de 30% por dez trimestres consecutivos, e a carteira de crédito quase dobrou para $12,5 bilhões ano a ano.

O problema do MercadoLivre é a lucratividade. A compressão geral da margem de 5 a 6% é atribuída a investimentos persistentes em frete grátis, expansão do cartão de crédito, comércio primário e comércio internacional.

As ações caíram cerca de 14,5% nos últimos seis meses, com o mercado reavaliando as ações em torno do que a administração classificou como uma fase deliberada de investimento até 2026.

O caso de longo prazo continua convincente. O Mercado Pago introduziu produtos de seguro e gerenciamento de ativos criptográficos em seus principais mercados, posicionando-o menos como uma empresa de comércio eletrônico e mais como um banco digital em grande escala com infraestrutura criptográfica incorporada.

O que assistir

- Tendências de perda de empréstimos do Mercado Pago e qualidade da carteira de crédito.

- Integração com Stablecoin e volume de criptomoedas por meio de sua rede de pagamento.

- Se o lançamento do cartão de crédito na Argentina pode alcançar lucratividade.

3. Meliuz (B3: CASH3.SA)

Tesouraria Fintech/Bitcoin · Primeira empresa de tesouraria de Bitcoin listada no Brasil

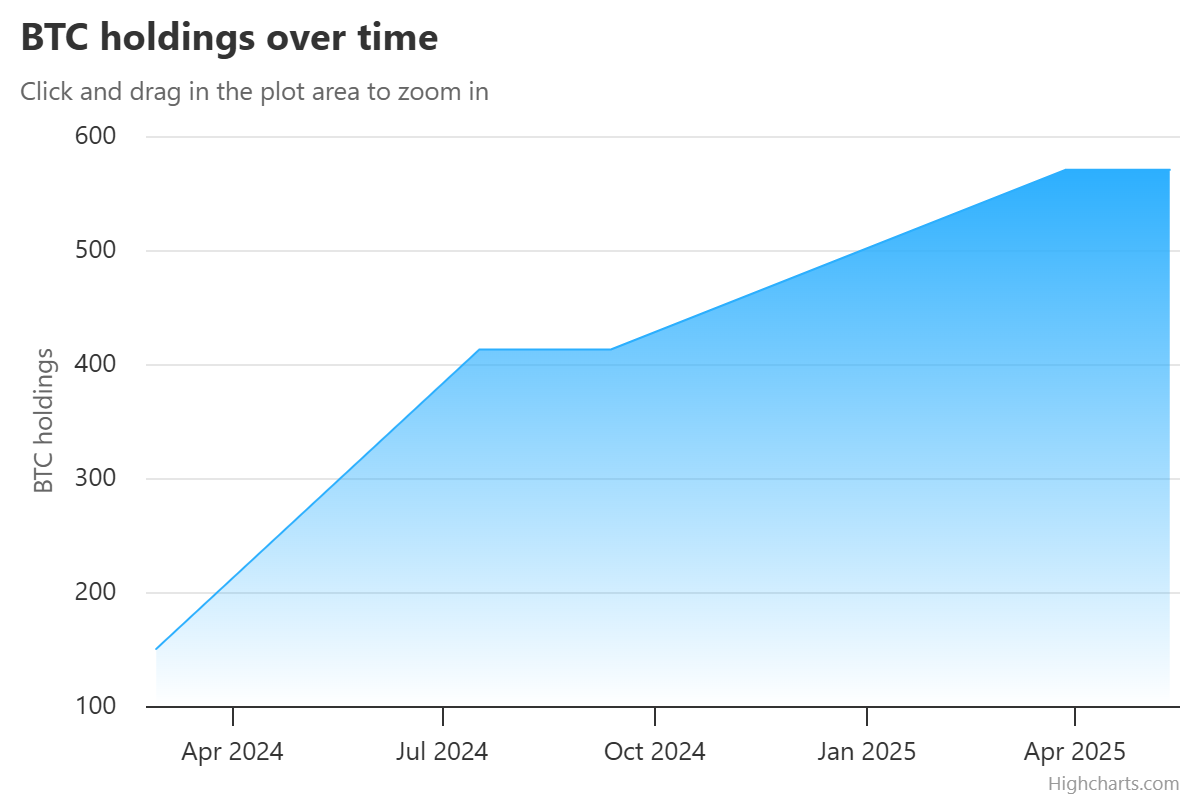

Méliuz é a expressão patrimonial mais direta da tendência corporativa de tesouraria de Bitcoin na América Latina. No início de 2025, a Méliuz se tornou a primeira empresa de capital aberto na América Latina a adotar formalmente uma estratégia de tesouraria de Bitcoin, recebendo aprovação dos acionistas para alocar reservas de caixa para a acumulação de Bitcoin.

Em vez de emitir dívidas baratas denominadas em dólares para comprar BTC, a Méliuz usa a emissão de ações e o fluxo de caixa operacional. A empresa também vende opções de venda garantidas em dinheiro em Bitcoin para gerar rendimento, um manual emprestado da empresa japonesa de tesouraria de Bitcoin Metaplanet, mantendo 80% das participações em BTC em câmaras frigoríficas

O CASH3 atua essencialmente como um veículo alavancado para a exposição ao BTC, capturando intensamente a vantagem nos ciclos de alta, mas gerando maior volatilidade na queda, especialmente quando há dívida envolvida.

As ações subiram aproximadamente 170% em maio de 2025 após o anúncio da estratégia Bitcoin. No entanto, desde então, voltou aos níveis de abril de 2025, acompanhando amplamente a ação do preço do Bitcoin e destacando a volatilidade das ações.

O que assistir

- Direção do preço do Bitcoin.

- Métrica BTC por ação.

- Expansão das estratégias de geração de rendimento

- Qualquer movimento para listar ações internacionalmente.

4. BTC laranja (B3: OBTC3.SA)

Tesouro de Bitcoin puro · O maior detentor corporativo de bitcoins da América Latina

Onde a Méliuz é uma empresa fintech que também detém Bitcoin, a OranjeBTC é o oposto: uma empresa cujo objetivo principal é a acumulação de Bitcoin.

A empresa foi listada na B3 em outubro de 2025 por meio de uma fusão reversa com a empresa de educação Intergraus, marcando a primeira estreia pública no Brasil de uma empresa cujo modelo de negócios se concentra inteiramente no acúmulo de Bitcoin.

Atualmente, a OranjeBTC detém mais de 3.650 BTC e arrecadou quase $385 milhões em Bitcoin, com o apoio de investidores notáveis, incluindo os irmãos Winklevoss, Adam Back, FalconX e Ricardo Salinas.

Sua rodada de financiamento de 210 milhões de dólares foi liderada pelo Itaú BBA, o braço de investimentos do maior banco do Brasil, em um voto significativo de confiança institucional.

Em 2026, a OBTC3 caiu cerca de 32% no acumulado do ano, tornando-a a mais atingida das duas ações do tesouro brasileiro de Bitcoin. A ação atingiu uma alta histórica de 29,00 BRL no dia da listagem (7 de outubro de 2025) e uma baixa histórica de 6,06 BRL em fevereiro de 2026.

Atualmente, ele é negociado em torno de BRL 7,06, um grande desconto em relação à sua estreia, mas que reflete de perto a retração do Bitcoin em relação aos níveis máximos.

OranjeBTC é o nome mais volátil desta lista e deve ser tratado como um veículo Bitcoin de alta beta. A liquidez é menor do que os nomes estabelecidos.

O que assistir

- Trajetória do Bitcoin por ação.

- Qualquer aumento de capital ou novas compras de BTC.

- Possíveis ambições internacionais de listagem.

- Como o desconto/prêmio do valor patrimonial líquido do valor de mercado (MNaV) evolui em relação ao preço do Bitcoin.

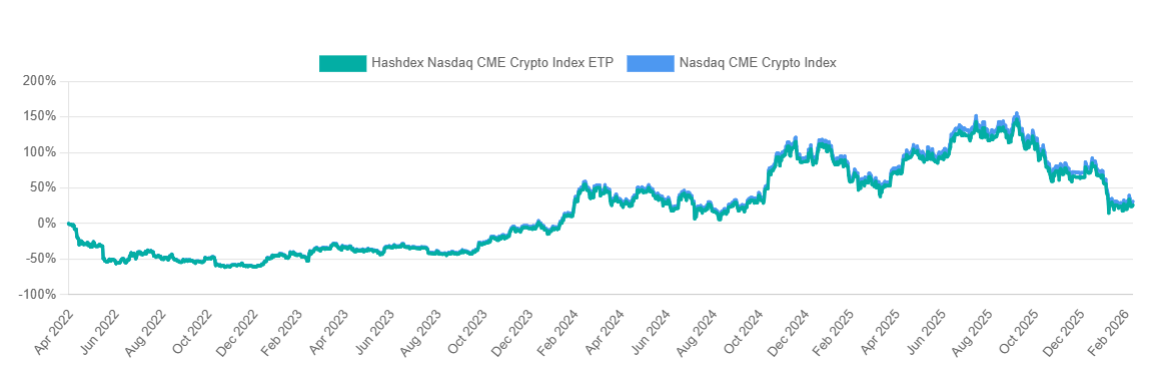

5. Hashdex — HASH11 (B3: HASH11)

Crypto Asset Management · Principal emissor de ETFs criptográficos do Brasil

O Hashdex oferece um tipo diferente de exposição à criptografia. Em vez de um balanço patrimonial ou estratégia de negócios de uma única empresa, o HASH11 é uma cesta diversificada de ativos criptográficos envolta na familiaridade de uma estrutura regulada de ETF brasileira.

O Brasil hospeda 22 ETFs que oferecem exposição total ou parcial a ativos criptográficos, com os fundos da Hashdex atraindo 180.000 investidores e volumes diários de transações em média de R$50 milhões.

A Hashdex lançou o primeiro ETF XRP à vista do mundo (XRPH11) na B3 do Brasil em abril de 2025, acompanhando o Índice de Preços de Referência Nasdaq XRP e alocando pelo menos 95% dos ativos líquidos para o XRP.

A empresa também opera ETFs de ativo único para Bitcoin (BITH11), Ethereum (ETHE11) e Solana (SOLH11), juntamente com seu principal fundo de índice de ativos múltiplos HASH11.

Em meados de 2025, a Hashdex lançou um ETF híbrido Bitcoin/Gold (GBTC11) que ajusta dinamicamente as alocações entre os dois ativos.

Para investidores que desejam uma exposição diversificada ao mercado de criptomoedas em vez do risco de um único ativo, o HASH11 é a rampa de acesso mais acessível por meio da infraestrutura regulada de ações do Brasil.

No entanto, como um índice criptográfico de vários ativos, o HASH11 ainda está sujeito ao amplo desempenho dos mercados de ativos digitais. E, diferentemente dos nomes de ações nesta lista, não há nenhum negócio operacional que crie valor independente.

O que assistir

- Sentimento geral do mercado de criptomoedas.

- Expansão potencial dos produtos Hashdex no mercado dos EUA.

- Crescimento da AUM à medida que a adoção institucional acelera no Brasil.

- Desempenho relativo do HASH11 versus alternativas de ativo único.

O que assistir a seguir

A infraestrutura institucional ainda está no início — o Crypto Finance Group da Deutsche Börse entrou na LATAM no início de 2026 e as bolsas locais abriram mais de 200 pares de negócios denominados em BRL desde 2024. O ritmo dessa construção definirá o tom para todos os cinco nomes.

O progresso regulatório no Brasil, México e Chile é o principal facilitador para a próxima onda de capital. Qualquer contratempo afetaria mais fortemente os nomes em beta mais alto, como OBTC3 e CASH3.

O volume de Stablecoin é o sinal em tempo real mais confiável da região. Apesar de uma desaceleração global no início de 2025, a LATAM ainda registrou 16,2 bilhões de dólares em volume de negócios entre janeiro e maio, um aumento de 42% em relação ao ano anterior. Veja se esse impulso se mantém — uma reaceleração eleva todos os cinco; uma reversão os pressiona igualmente.

The Kroger Company (KR) released its latest financial results for Q2 on Friday. The American grocery supermarket chain reported revenue of $34.638 billion for the quarter vs. $34.461 billion estimate. Earnings per share also beat analyst estimates at $0.90 per share vs. $0.82 per share expected. "Kroger delivered strong second quarter results propelled by our Leading with Fresh and Accelerating with Digital strategy.

We are incredibly thankful for our dedicated associates who continue to deliver a full, fresh and friendly customer experience," CEO of Kroger, Rodney McMullen said in a press release. "Our consistent performance underscores the resiliency and flexibility of our business model, which enables Kroger to thrive in many different operating environments. We are applying technology and innovation to improve freshness, grow Our Brands, and create a seamless shopping experience so our customers can get what they want, when and how they want it, with zero compromise on quality, selection and affordability." We will continue to focus on providing affordable, fresh food to our customers, investing in wages and the associate experience, and creating zero hunger, zero waste communities because when we do those things well, we deliver attractive and sustainable shareholder returns," McMullen added. The Kroger Company (KR) chart The stock price of Kroger rose by around 5% on Friday, trading at $51.07 a share.

Here is how the stock has performed in the past year: 1 month +8.20% 3 months -0.02% Year-to-date +12.86% 1 year +19.71% Kroger price targets Credit Suisse $55 Oppenheimer $51 Guggenheim $57 Morgan Stanley $41 Deutsche Bank $53 BNP Paribas $60 The Kroger Company is the 450 th largest company in the world with a market cap of $36.27 billion. You can trade The Kroger Company (KR) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Sources: The Kroger Company, TradingView, MetaTrader 5, MarketBeat, CompaniesMarketCap

The United States used 30.28 trillion cubic feet of natural gas in 2021, making them the world’s largest consumer of natural gas. Natural gas consumption in the United States has two seasonal peaks, largely reflecting weather-related fluctuations in energy demand. One of the biggest consumptions of gas is industrial, residential and commercial cooling and heating systems (eia, 2022).

As the world’s largest user of natural gas transitions out of summer, will this change indicate a decrease of their natural gas consumption? Could the decrease in demand for cooling be reflected on the technical charts? On a daily timeframe, natural gas has been on a steady upward trend since the end of June, in tandem with the beginning of summer in the US (seen on the chart below).

A trendline from the beginning of that trend until now can be drawn, and we can see recently that line has been broken by a daily candlestick, closing below the trendline which can indicate a change in trend for natural gas. After the strong break below of the trendline followed by multiple bearish daily candlesticks, we can consequently expect further downside movement for natural gas, after breaking through a strong support at $8.4, in all probability with natural gas currently sitting at $7.895 we could see natural gas come down to the next support level around $7.57.

NIO Q2 results have arrived NIO Inc. (NIO) reported its unaudited second quarter financial results on Wednesday. The Chinese electric vehicle maker reported revenue of $1.538 billion for the quarter, beating analyst estimate of $1.458 billion. Loss per share reported at -$0.20 per share vs. -$0.16 loss per share expected.

William Bin Li, founder, chairman and CEO of the EV company commented on NIO’s performance in Q2: ''We delivered 25,059 vehicles in the second quarter of 2022, representing a growth of 14.4% year-over-year despite the COVID-19 related challenges. With the teams’ concerted efforts, our deliveries started to recover and achieved 10,052 and 10,677 units in July and August, respectively." "The second half of 2022 is a critical period for NIO to scale up the production and delivery of multiple new products. The ES7, our first mid-large five-seater smart electric SUV based on NIO Technology 2.0 (NT2.0), has become a new favorite of the market with its superior performance, comfort and digital experience.

We witnessed a robust order inflow for the ES7 and started its deliveries at scale in August. We also look forward to starting the mass production and delivery of the ET5 in late September. With the compelling product portfolio and well-established brand awareness, NIO will attract a broader user base and embrace robust growth in the coming quarters," Li concluded.

NIO has delivered a total of 238,626 vehicles as of August 31, 2022. The company expects deliveries of between 31,000 to 33,000 in Q3 and revenue of between $1.913 billion and $2.030 billion. NIO Inc. (NIO) chart The stock was up by around 3% at the market open in the US on Wednesday, trading at $17.88 a share.

Here is how the stock has performed in the past year: 1 month -14.66% 3 months -16.05% Year-to-date -45.99% 1 year -55.14% NIO price targets B of A Securities $26 UBS $32 Mizuho $60 Morgan Stanley $34 Barclays $34 Deutsche Bank $70 Goldman Sachs $56 NIO Inc. is the 15 th largest automaker in the world with a market cap of $28.62 billion. You can trade NIO Inc. (NIO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Sources: NIO Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Brent Crude and West Texas Intermediate Oil both fell to their lowest levels since January as fresh recession fears swept the market. Brent dropped to $87 a barrel and WTI to $81. The prices dropped following OPEC’s decision to cut the production by 100,000 barrels a day of supply from October.

In recent months with the Russian and Ukraine conflict raging, OPEC had to lift production as supply dipped. However, with the decreasing health of the global economy and a incredibly strong US dollar demand for overseas oil has dipped. Poor economic data from China and its Covid zero strategy has also pushed concerns of weaker demand.

In fact, China’s crude oil important dropped by 9.4% from a year earlier signalling the slowdown in demand. Furthermore, with the US federal reserve expected to remain hawkish until inflation is back to a sustainable level, in the short term there is little resistance in the way of the US dollar continuing to grind its way higher, further pressuring the price of oil. Whilst the current dip may provide some relief for consumers, with uncertainty from the Kremlin and Putin potentially capping their energy exports, the short term volatility will likely continue.

As it can be seen from the charts below, both WTI and Brent have broken down through their key support levels. The price may struggle to fall lower in the immediate short term and may need to consolidate in the short term before pushing lower again.

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer to gauge is the Fear and Greed index, emotions trigger actions, there is a reason why there are sellers and buyers in the market at the same time, yes it can be attributed to the way people take in information or understand the data, in a normal day, there are always winners, as there are always losers. So, with that in mind you might understand that this information or data is truly important to traders as it impacts heavily on the markets, as such that, as a trader it would be irresponsible for you to focus solely on the Technical Analysis and disregard the Fundamentals.

However, you could be able to trade Fundamentals without the Technical Analysis. What is Fundamental News? The best way to answer this, is by acknowledging that the performance of an economy is a direct result of different political, social and economic outcomes.

These could differ from the release of figures of the unemployment rate to interest rates, from elections to the GDP, to geopolitical events such as the invasion of Ukraine to a countries coup or BREXIT. All of these have profound effects on the price of commodities, currencies, bonds, or securities, as it would either make the asset easily accessible or as in recent times with COVID it makes is harder to supply it when there is huge demands. Investors are always on the lookout for small details that would help them decipher if their investments are in sound condition or if they need to do something to avoid losing their positions.

Typically, if you are trading CFDs you would look to an Economic Calendar – It’s just like a standard calendar, which provides timelines of specific reports and/or meetings which will take place in the future, from various countries around the world. You could see one here at Forex Factory. A great tool which will aid traders to set up their trades in advance or allow them to make a decision to see if it would be wise to keep a trade open during the event, or open a trade before or wait until the fact to enter the market.

As you begin to follow economic announcements, you may understand why some events—like the consumer price index—may cause markets to move. But you may wonder why it’s important to follow lesser events, like the food price index. Usually, a major event provides an indication of the state of the economy.

But traders follow lesser events because they provide an indication of upcoming major announcements. For example, a jump in food prices may mean the consumer price index will jump as well. An example of an economic calendar is below.

Fundamental Analysis consists of the trader keeping track of all these factors within the reports and how they have affected the market. Fundamental analysis can also cover broader aspects of trading depending on the asset in question. The various fundamental factors can be grouped into two categories: quantitative and qualitative.

The financial meaning of these terms isn't much different from their standard definitions. Here is how a dictionary defines the terms: Quantitative – "related to information that can be shown in numbers and amounts." Qualitative – "relating to the nature or standard of something, rather than to its quantity." In this context, quantitative fundamentals are hard numbers. They are the measurable characteristics of a business.

That's why the biggest source of quantitative data is financial statements. Revenue, profit, cash flow, assets, wages and more can be measured with great precision. Fundamental Trading can be done in various ways depending on your availability – some reports are released late in the night or early morning depending on your perspective, which mean, you may be asleep so trading these may require a level of organisation from your part in terms of understanding how to set up pending orders, with the right risk management in place to take you out of the trade whether it has reached your desired profit limit or the amount you’d be happy to risk losing or trade the action live as you see the reaction of the price movement.

All In all Fundamental news, analysis and trading are a major facet of trading, it is also right to mention, that some fundamental traders would incorporate technical analysis from time to time to create stronger affirmations in their research. Sources: babypips.com, https://www.contracts-for-difference.com/, https://www.investopedia.com/, www.forexfactory.com

With central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The country is Japan, and the consequence of the Central Bank of Japan’s ultra-dovish policy has been a massive weakening of its currency. Against almost all other currencies the JPY has been depreciating aggressively.

Specifically, the USD/JPY and the NZD/JPY are shaping as potentially trading opportunities. Both trading opportunities are largely based on a technical breakout as opposed to a pure fundamental breakout. NZD/JPY This currency pair is forming into a symmetrical triangle pattern.

Importantly the price has been contracting and the range getting smaller. This shows that the price is reaching an equilibrium point between buyers and sellers. However, at some point and the price will not be able to contract further and will have to break out either to the upside or the downside.

The general rule of a symmetrical triangle is to wait until the price breaks before taking a position because the price has not indicated if it will break upward or downward. In addition, the RSI indicates a similar pattern showing consolidation in the same type of triangle. Therefore, a break of this RSI triangle may correlate and support a break out on the actual price.

USD/JPY This pair has seen an even more extreme move upward. After pulling back to the recent support at the 23.6% Fibonacci retracement level, the price has risen again and is looking to test the highs at 139.5 JPY. In order to find a new target the chat needs to be zoomed out to the monthly in order to see the next resistance point which is at 145JPY.

This would also take the price to almost 25 year highs. With more economic data to come out of the USA later this week.